Barriers to Energy Efficiency Adoption in Low-Income Communities

Energy efficient technologies could spur sustainable development by generating financial savings while also lowering carbon emissions. Subsidies or access to credit could help the poor adopt these technologies.

At a Glance

Key Challenge

The up-front investment often required for energy efficiency adoption can be prohibitively expensive for low-income households, especially when financial market frictions—common in lower-income countries—limit their access to loans.

Policy Insight

Policymakers can support sustainable development by providing subsidies or financing for energy efficient technologies among low-income households.

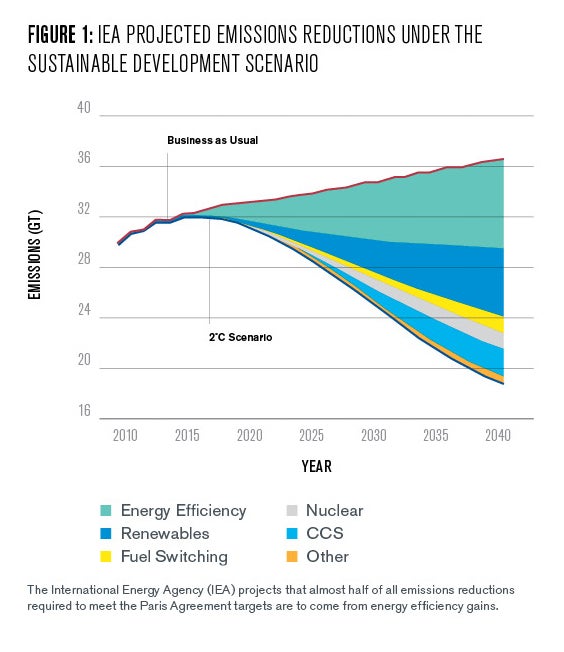

To meet the Paris Agreement targets cost-effectively, the International Energy Agency calls for increases in energy efficiency to drive half of targeted emissions reductions (Image 1; IEA 2018), with renewables and carbon capture and storage driving much of the remainder. Existing research shows that the uptake of energy efficiency investments—such as electric vehicles or more energy efficient refrigerators— remains inefficiently low, and that two of the most effective policies to increase adoption in higher income countries are: 1) carbon taxes that internalize negative externalities, and 2) nudges that increase the salience of energy savings (Gerarden, Newell, and Stavins 2017).

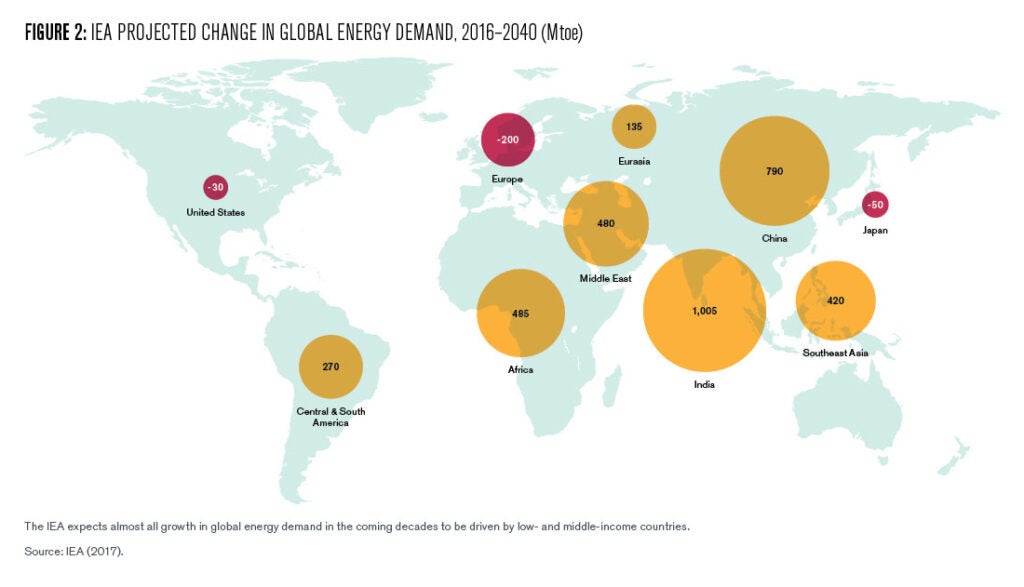

But these policies may not be as effective in lower income settings, for two reasons. First, credit market frictions are more prevalent in low-income settings. This may prevent the adoption of technologies that already generate large private benefits, limiting the impact of internalizing externalities. Second, because energy is a larger portion of household budgets, attention to savings may already be high. Identifying the optimal policies to promote the adoption of energy efficiency in lower income contexts is important because almost all growth in global energy demand in the next several decades is expected to come from these countries:

In a recent working paper, we estimate the financial and environmental benefits to adopting an energy efficient charcoal cookstove (Berkouwer and Dean 2021). We then identify an important barrier to adoption and explore the implications of these results for climate policies such as energy efficiency subsidies and carbon taxes.

Energy Efficiency for the Poor

Energy efficiency adoption can have large benefits for the poor. The United Nations Sustainable Development Goal 7 is to “Ensure access to affordable, reliable, sustainable and modern energy for all” (UN 2015). The share of household income spent on energy costs, also known as the energy burden, tends to be largest among the poor. Humans have a basic set of needs (including heating, cooking, and lighting), which low-income families must prioritize, and which tend to grow only slightly when incomes rise. Energy spending comprises 3.5% of household income for the median American household but exceeds 7% for the poorest Americans (Drehobl and Ross 2016). The share in low-income countries is often even higher: the energy burden for the median household in our study sample is 20% of household income. Household adoption of energy efficient appliances has the potential to reduce these expenditures meaningfully.

In Kenya, more than two-thirds of households still use traditional wood and charcoal stoves as their primary cooking technology (Kenya 2019 Census). These have significant negative health consequences. They produce indoor air pollution that contributes to millions of deaths each year and contribute to growing deforestation and climate change (WHO 2017; Pattanayak et al. 2019; Bailis et al. 2015). More than 4 billion people still do not have access to modern cooking methods (World Bank 2020b).

By 2030, half of Africa’s population is expected to be living in cities, where more than 80% of households rely on charcoal for daily cooking and heating needs (FAO 2017). Total spending on firewood and charcoal in Sub-Saharan Africa in 2012 was 12 billion USD (Bailis et al. 2015), and Kenyan households consumed 680 million USD worth of charcoal in 2019 (Kenya Ministry of Energy 2019). Charcoal usage is expected to continue growing in coming decades due to rising incomes and rapid urbanization, as households that currently gather firewood for cooking climb up the energy ladder and switch to charcoal (Hanna and Oliva 2015).

While middle-income Kenyans are increasingly adopting modern cooking technologies, adoption among lower-income households remains low. We focus on low-income households living in informal settlement areas around Nairobi, where charcoal is widely available and many households cook with traditional charcoal stoves such as the Kenyan ceramic jiko (KCJ). For these households, the most salient feature of modern cookstoves is the financial savings—and the amount saved depends on energy prices.

In Kenya, the price of charcoal has fluctuated in recent years due to the off-and-on implementation of government bans on deforestation for environmental reasons (Iiyama et al. 2014). Charcoal is usually sold in small metal or plastic tins (mkebe or kasuku), which contain between 1–4 kilograms of charcoal and retail for between $0.50–$1.50, although respondents report that the price of charcoal can sometimes fluctuate by 20%–30% of the average price on a monthly basis.

Despite the benefits of energy efficiency technologies, adoption remains low. The IEA (2018) estimates that cost-effective energy efficiency opportunities in the household appliance and vehicle sectors that are available today to households globally have the potential to save $201 billion in avoided energy expenditures and $365 billion in transportation costs per year by 2040.

The Energy Efficient Jikokoa Cookstove

We study one such technology: the Jikokoa, an energy efficient charcoal cookstove produced by Burn Manufacturing, which is for sale for $40 in stores and supermarkets across East Africa. The Jikokoa is very similar to the KCJ: respondents report no change in the taste or smell of food, they can continue buying the same charcoal from their preferred vendor, and effectively no learning is required to switch from the KCJ to the Jikokoa.

Burn has sold more than 1 million stoves in the past five years, but adoption so far has been concentrated among higher- and middle-income Kenyan families. This is not because people have not heard of the stove: more than 98% of respondents had heard of the stove, primarily via television (66%); a friend, neighbor, or family member (30%); the radio (20%), or a billboard, newspaper, or bus advertisement (10%). So then why is adoption still low among the lowest income families? Is it that the savings do not justify the high cost? Or do households face barriers that prevent them from adopting?

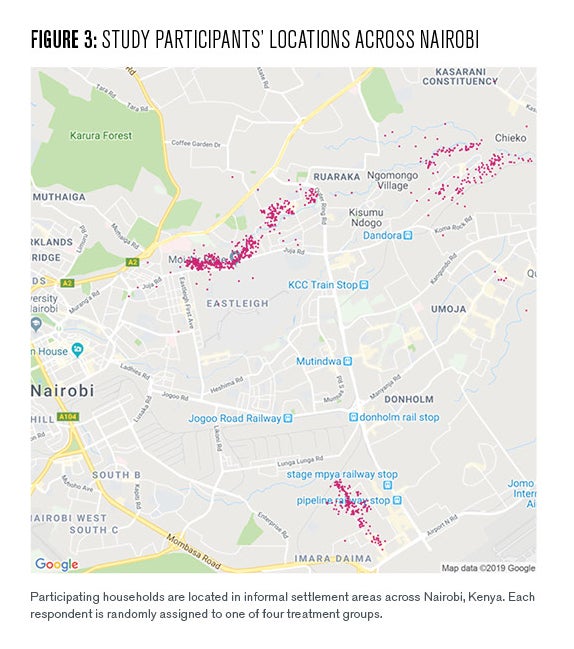

To answer these questions, we enroll 1,000 participants in Nairobi, Kenya, who use a traditional charcoal cookstove as their primary energy durable.

Most households purchase a small amount of charcoal every day, usually between $0.50 and $1, with which to cook their daily meals. We offer participating households the opportunity to buy the Jikokoa at a subsidized price. By randomly varying the subsidy we can accurately estimate the impacts of adopting the stoves on families’ charcoal usage. Each household was invited to participate in four surveys over a 14-month period.

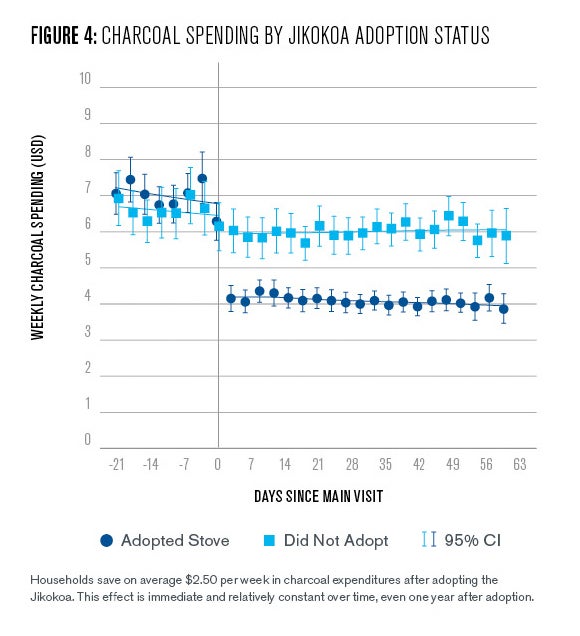

We find that the Jikokoa reduces household charcoal consumption by 40% relative to a control group. This corresponds to large private financial savings: the average household saves $236 over the two-year lifespan of the stove. This is a significant sum of money, especially considering that monthly income for households is around $120 per month.

Given the $40 cost of the stove, this represents a 300% annual rate of return on investment. This is likely significantly higher than alternative investments to which respondents may have access.

Previous studies of efficient cookstoves found declines in usage and benefits over time due to technology breakdown, poor maintenance, or user tastes (Pillarisetti et al. 2014; Hanna, Duflo, Greenstone 2016). To test this, we re-survey respondents and conduct a charcoal SMS survey one year after the main experiment. Out of the more than 500 stove adopters re-surveyed one year later, 98% still had the Jikokoa. Among the 2% who no longer had the stove, reasons for loss include theft, fire, non-payment repossession, and giving the stove away voluntarily.

Twelve months after adoption, the stove continues to cause a reduction in charcoal spending of almost $2.50 per week, corresponding to a 42% reduction relative to the control group. Savings appear constant over the long term. This improvement on previous cookstove technologies may be attributable to the Jikokoa’s ease of use and similarity to traditional jikos. It is also more durable, and adopters can access free repair services provided in Nairobi if needed.

The industrial process of charcoal production, transport, and consumption has a large carbon footprint. The average household in our sample consumes around 850 KG of charcoal per year, and when factoring in the production, transport, and burning of charcoal, each KG of charcoal emits around 8.1 KG of CO2e (FAO 2017). The stove’s 40% reduction then corresponds to 6.9 metric tons of CO2e in avoided emissions over the two-year lifetime of the stove. Using the EPA (2016) estimate for the 2020 social cost of CO2 of $42, adoption of a stove generates almost $300 in CO2e emission reductions over two years of usage. Focusing on only the environmental benefits, investing in a Jikokoa reduces greenhouse gas emissions at a cost of $5.76 per ton of CO2e.

This is cheaper than many abatement technologies available in the United States: recent estimates put CAFE standards at between $48 and $310 per ton of CO2e, advanced nuclear at $59 per ton, coal retrofit with carbon capture and storage at $85 per ton, and the weatherization assistance program at $350 per ton (Gillingham and Stock 2018). It is more in line with estimates in other low-income countries: For example, Jayachandran et al. (2017) estimate $2.60 per ton abated through payments for ecosystem services in Uganda. Still, it is worth noting the Jikokoa’s large private financial and health benefits: factoring those in, the Jikokoa would have a negative abatement cost, since abating CO2e generates financial savings rather than costing money.

Finally, the stove also generates significant time savings and health benefits. In ongoing research, we are working to quantify these additional benefits.

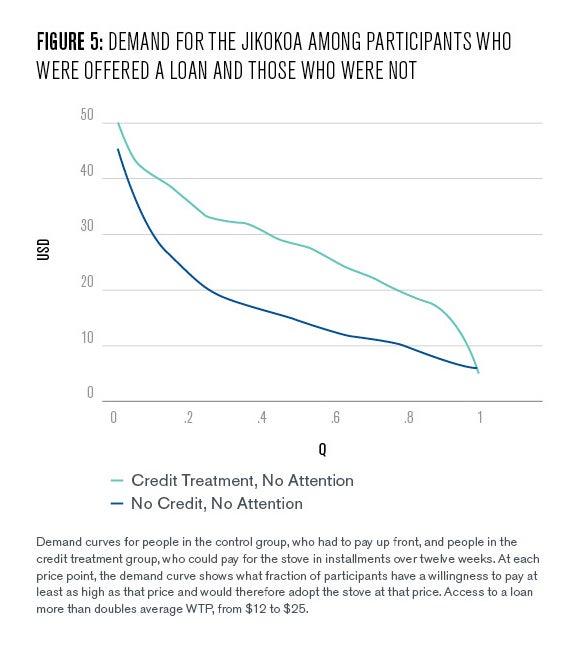

Credit Doubles Adoption

If the returns to adoption are so high, why was adoption still low among this population? We investigate whether a lack of access to credit might constrain adoption by eliciting households’ willingness to pay (WTP) for the item: the maximum they would be willing to pay to buy the good.

Households who had to pay for the cost of the stove up front were on average willing to pay at most $12 to buy the stove. However, when we offered a random set of respondents the opportunity to pay for the stove in instalments over a twelve-week period, WTP doubled. Respondents with access to credit were willing to pay $25 to buy the stove.

Is the optimal policy response to expand credit markets? The answer to this question is complicated. First, repayment was not perfect. Across all respondents who adopted the stove in the credit treatment groups, on average 72% of the loan was repaid. The loans offered in this experiment charged an interest rate of 1.16% per month or 3.5% over the three months. In practice, lenders could charge higher interest to recover losses from these high default rates, however this would increase default rates, since default is higher among people with higher costs. A recalibration exercise reveals that there is no interest rate at which a lender could break even for any price above $15.

Second, the three-month loan increases willingness to pay to $25, but this is still below the stove’s market price of $40. One potential solution would be to extend the period of the loan to six or even twelve months. While we were unable to test this in our experiment, this might increase adoption further. Alternatively, policy makers may need to supplement access to credit with additional policies that increase the stove’s affordability.

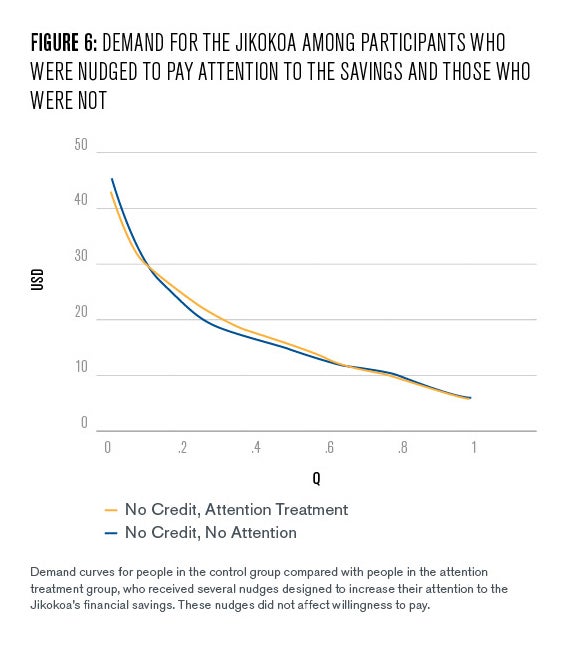

Increased Attention Doesn’t Affect Adoption

In high-income contexts, inattention has been found to be an important determinant of energy efficiency adoption (Allcott and Taubinsky 2015; Gillingham, Houde, and van Benthem 2021; Jessoe and Rapson 2014; and De Groote and Verboven 2019).

The effectiveness of attention nudges as a policy lever may be higher or lower in low-income contexts. Energy is a much larger portion of the household budget (20% in our sample), so households may attend to these savings more carefully and make optimal trade-offs (Shah, Shafir, and Mullainathan 2015; Fehr, Fink, and Jack 2019; Goldin and Homonoff 2013). Other work suggests the cognitive stress of being poor can impair households’ decision-making capabilities (Haushofer and Fehr 2014; Schilbach, Schofield, and Mullainathan 2016; Kremer, Rao, and Schilbach 2019).

To measure the impact of inattention, some participants in our study receive nudges that are designed to increase their attention to the stove’s financial benefits. They first receive text messages every three days for one month asking about their charcoal spending. Immediately before stating how much they are willing to pay, they complete an accounting exercise estimating their yearly savings and what they could spend it on.

This heavy-handed intervention did not affect participants’ willingness to pay for the stove, suggesting individuals are already attentive to the savings potential. Given the lack of response to an intense intervention designed to increase attention, nudges to make salient potential savings may be an ineffective policy.

This may be due to the decision’s high financial consequences: the median respondent saves one month of income per year. There is modest evidence in the literature that when stakes are higher, cognitive performance among the poor improves. It may also be that energy expenditures are easier to track when inputs and outputs are strongly correlated—charcoal usage is relatively easy to track when its sole usage is for charcoal cookstoves. This is analogous to gasoline usage to power a vehicle and may explain why our findings align with some evidence showing households correctly evaluate costs against future gas prices when deciding whether to purchase a more energy efficient vehicle (Allcott and Wozny 2014; Busse et al. 2013).

Carbon Taxes

The energy efficient technology in this paper is privately profitable, and households attend to these savings, but credit constraints prohibit adoption for most agents. What do these results mean for environmental policy in contexts where financial market frictions are common?

Economists do not often achieve unanimous agreement, but one policy with remarkably high support (including 27 Nobel Laureate economists and four Federal Reserve chairs) is Pigovian taxation to correct negative externalities: in a first-best setting, the efficient solution to negative externalities is a Pigovian tax on the emitting good (Pigou 1920).

There is broad support amongst economists in favor of a carbon tax as a tool to incentivize greenhouse gas emissions reductions in order to slow climate change. Low- and middle-income country governments are increasingly implementing carbon taxes to reduce emissions of greenhouse gases and local environmental pollutants. For example, South Africa, Chile, and Mexico have all enacted a carbon tax since 2014, each covering at least 40% of domestic greenhouse gas emissions (World Bank 2020a).

However, the credit constraints we observe suggest we are not in a “first-best setting.” A carbon tax is unlikely to achieve optimal abatement and may not be the optimal policy in low-income settings where households face credit constraints. An agent facing binding credit constraints cannot respond optimally to the incentives set by the tax.

Worse, a carbon tax would have important equity implications by increasing energy prices, especially for those with the tightest credit constraints, who are often the poorest and therefore also have the highest energy burden. Most likely, a carbon tax would be regressive.

Instead, our results suggest policy makers wanting to increase the adoption of energy efficient technologies in these contexts should focus on increasing affordability through subsidies or targeted financing, particularly when the private benefits are large and inefficiencies due to imperfect targeting are minimal. Factoring in private savings and avoided environmental damages, a subsidy for the energy efficient cookstove would generate $19 of welfare gains for every $1 of government expenditure.

Authors’ note: We thank Burn Manufacturing for supporting this independent research, and we thank the Busara Center for Behavioral Economics for expertly implementing field activities.

Susanna Berkouwer

Assistant Professor of Business Economics & Public PolicySusanna Berkouwer is an assistant professor of Business Economics & Public Policy at the Wharton School.

Joshua Dean

Assistant Professor, University of ChicagoJoshua Dean is an assistant professor of behavioral science and economics at the University of Chicago Booth School of Business.

Allcott, Hunt, and Dmitry Taubinsky. 2015. “Evaluating Behaviorally Motivated Policy: Experimental Evidence from the Lightbulb Market.” American Economic Review 105 (8): 2501–2538.

Allcott, Hunt, and Nathan Wozny. 2014. “Gasoline Prices, Fuel Economy, and the Energy Paradox.” The Review of Economics and Statistics 96 (5): 779–795.

Bailis, Robert, Rudi Drigo, Adrian Ghilardi, and Omar Masera. 2015. “The Carbon Footprint of Traditional Woodfuels.” Nature Climate Change 5:266–272.

Berkouwer, Susanna, and Joshua Dean. 2021. “Credit, Attention, and Externalities in the Adoption of Energy Efficient Technologies by Low-Income Households.” Working paper.

Busse, Meghan, Christopher Knittel, and Florian Zettelmeyer. 2013. “Are Consumers Myopic? Evidence from New and Used Car Purchases.” American Economic Review 103 (1): 220-256

De Groote, Olivier, and Frank Verboven. 2019. “Subsidies and Time Discounting in New Technology Adoption: Evidence from Solar Photovoltaic Systems.” American Economic Review 109 (6): 2137–2172

Drehobl, Ariel, and Lauren Ross. 2016. Lifting the High Energy Burden in America’s Largest Cities: How Energy Efficiency Can Improve Low Income and Underserved Communities. Report by Energy Efficiency for All and the American Council for an Energy-Efficient Economy.

Fehr, Dietmar, Gunther Fink, and B. Kelsey Jack. 2019. “Poverty, Seasonal Scarcity and Exchange Asymmetries.” NBER Working Paper #26357.

Food and Agricultural Organization of the United Nations. 2017. The Charcoal Transition.

Gerarden, Todd D., Richard G. Newell, and Robert N. Stavins. 2017. “Assessing the Energy-Efficiency Gap.” Journal of Economic Literature (55), no. 4: 1486–1525

Gillingham, Kenneth, Sebastien Houde, and Arthur van Benthem. 2021. “Consumer Myopia in Vehicle Purchases: Evidence from a Natural Experiment.” Forthcoming, American Economic Journal: Economic Policy.

Gillingham, Kenneth and James H. Stock. 2018. “The Cost of Reducing Greenhouse Gas Emissions.” Journal of Economic Perspectives 32(4): 53-72.

Goldin, Jacob, and Tatiana Homonoff. 2013. “Smoke Gets in Your Eyes: Cigarette Tax Salience and Regressivity.” American Economic Journal: Economic Policy 1 (5): 302–236.

Hanna, Rema, Esther Duflo, and Michael Greenstone. 2016. “Up in Smoke: The Influence of Household Behavior on the Long-Run Impact of Improved Cooking Stoves.” American Economic Journal: Economic Policy 8 (1): 80–114.

Hanna, Rema, and Paulina Oliva. 2015. “Moving Up the Energy Ladder: The Effect of an Increase in Economic Well-Being on the Fuel Consumption Choices of the Poor in India.” American Economic Review Papers and Proceedings 105 (5): 242–246.

Haushofer, Johannes, and Ernst Fehr. 2014. “On the Psychology of Poverty.” Science 344 (6186): 862–867.

Iiyama, Miyuki, Audrey Chenevoy, Erick Otieno, Teddy Kinyanjui, Geoffrey Ndegwa, Jan Vandenabeele, Mary Njenga, and Oliver Johnson. 2014. “Achieving Sustainable Charcoal in Kenya: Harnessing the Opportunities for Cross-Sectoral Integration.” World Agroforestry Center and Stockholm Environment Institute.

International Energy Agency. 2017. World Energy Outlook 2017.

International Energy Agency. 2018. Market Report Series: Energy Efficiency 2018.

Jayachandran, Seema, Joost de Laat, Eric F. Lambin, Charlotte Y. Stanton, Robin Audy, and Nancy E. Thomas. 2017. “Cash for Carbon: A Randomized Trial of Payments for Ecosystem Services to Reduce Deforestation.” Science 357 (6348): 267-273.

Jessoe, Katrina, and David Rapson. 2014. “Knowledge Is (Less) Power: Experimental Evidence from Residential Energy Use.” American Economic Review 104 (4): 1417–1438.

Kremer, Michael, Gautam Rao, and Frank Schilbach. 2019. “Behavioral Development Economics.” Handbook of Behavioral Economics 2:345–458.

Pattanayak, S. K., M. Jeuland, J. J. Lewis, F. Usmani, N. Brooks, V. Bhojvaid, A. Kar, L. Lipinski, L. Morrison, O. Patange, N. Ramanathan, I. H. Rehman, R. Thadani, M. Vora, and V. Ramanathan. 2019. “Experimental Evidence on Promotion of Electric and Improved Biomass Cookstoves.” Proceedings of the National Academy of Science of the United States of America 116 (27): 13282–13287.

Pigou, Arthur Cecil. 1920. The Economics of Welfare. London: Macmillan.

Pillarisetti, Ajay, Mayur Vaswani, Darby Jack, Kalpana Balakrishnan, Michael N. Bates, Narendra Arora, and Kirk R. Smith. 2014. “Patterns of Stove Usage after Introduction of an Advanced Cookstove: The Long-Term Application of Household Sensors.” Environmental Science and Technology 48 (24): 14525–14533.

Republic of Kenya, Ministry of Energy. 2019. “Kenya Cooking Sector Study: Assessment of the Supply and Demand of Cooking Solutions at the Household Level.”

Schilbach, Frank, Heather Schofield, and Sendhil Mullainathan. 2016. “The Psychological Lives of the Poor.” American Economic Review: Papers and Proceedings 106 (5): 435–440.

Shah, Anuj K., Eldar Shafir, and Sendhil Mullainathan. 2015. “Scarcity Frames Value.” Psychological Science 26 (4): 402–412.

United Nations. 2015. Transforming our World: The 2030 Agenda for Sustainable Development. (A/RES/70/1)

U.S. Environmental Protection Agency. 2016. “Technical Update of the Social Cost of Carbon for Regulatory Impact Analysis Under Executive Order 12866.”

World Bank Group. 2020a. State and Trends of Carbon Pricing 2020.

— 2020b. The State of Access to Modern Energy Cooking Services.

World Health Organization. 2017. The Global Impact of Respiratory Disease.