Should California Subsidize Out-of-State Biofuels or In-State Electric Vehicles?

California Governor Gavin Newsom wants the state to backfill federal EV tax credits that the Trump administration is threatening to cut, but his plan needs a funding source. The state could divert the billions spent every year on imported biofuels toward EVs and EV infrastructure.

California Governor Gavin Newsom announced that the state might backfill federal electric vehicle (EV) tax credits, which the incoming Trump administration is threatening to cut. But details about how the state would fund this move are scarce.

The specific funding source Governor Newsom identified comes from the state’s cap-and-trade program for greenhouse gases, which brings in $4–5 billion a year but likely requires a challenging reauthorization to continue raising funds after 2030 (see Chapter 4). Even if that vote were to come together, the program’s revenues are fully subscribed today—so big cuts are likely needed to accommodate a major new spending program.

But there’s always money in the banana stand. California climate policy is already mobilizing billions of dollars a year via the state’s Low Carbon Fuel Standard (LCFS), which requires sellers of fossil gasoline and diesel fuels to buy credits from approved low-carbon fuels. In a recent report for the Kleinman Center, I reviewed the ongoing controversy over program regulations that were finalized in early November, including whether the fuels earning valuable LCFS credits actually deliver the climate benefits they promise and how much the program will increase retail fuel prices.

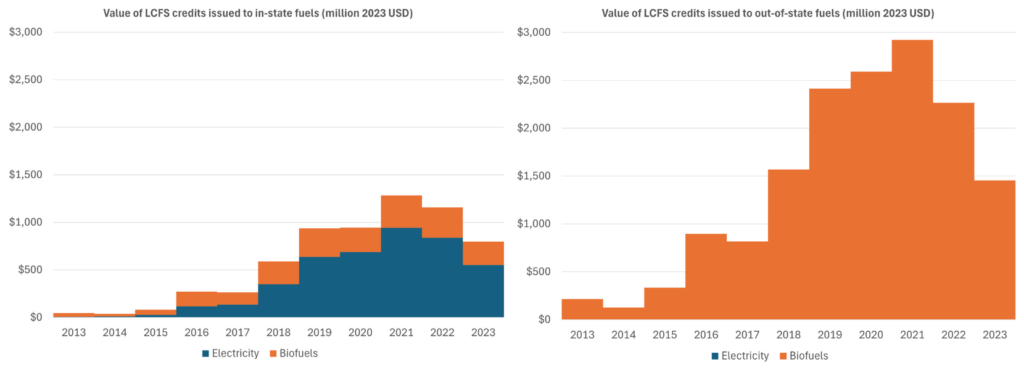

One of the most striking things about the LCFS program is that it operates as a tax on domestic fuel consumption that primarily subsidizes out-of-state biofuel producers. Political science 101 suggests that these kinds of policies should balance concerns about local cost impacts by channeling program benefits to local stakeholders. But California’s program does the opposite: not only does the regulator deny the potential for significant price impacts that could exceed $1 per gallon of gasoline by the early 2030s, it also sends the majority of the program’s financial benefits to out-of-state companies.

For example, the regulator issued about $4.2 billion worth of credits in 2021. Local investments in EV charging infrastructure and related applications earned credits worth $940 million. But nearly 78% of the program’s credits went to biofuels—worth almost $3.3 billion—and most of those biofuels were made by out-of-state firms (all units 2023 USD).

All told, California drivers paid about $2.9 billion for out-of-state biofuels. With that money, California drivers could have funded 390,000 rebates for electric vehicles at $7,500 each—just in 2021 alone. (About 375,000 EVs were sold in California in 2023.)

To be fair, EV subsidies aren’t a panacea. Some subsidies go to people who were already planning to purchase an EV; some subsidies go to purchasers of luxury EV models; and many EV models in the U.S. market are trending toward heavier, more dangerous vehicles that create safety risks for everyone else. There’s a strong case to be made for prioritizing subsidies for e-bikes and transit, and to focus EV rebates on lower-income households (as the state did toward the end of its most recent program).

But whatever your preferred incentives, it’s time to face facts: under the LCFS program, California is sending a lot of money to out-of-state biofuel producers and relatively little to in-state EV infrastructure. Those costs are paid for by California drivers and will grow substantially under the newly approved program rules.

Thanks to the LCFS, California now consumes 95% of national renewable diesel production, much of which is mandated under the federal Renewable Fuel Standard. Rather than promote innovation, the LCFS causes existing production to be diverted to serve California’s market, along with substantial international imports from Singapore and other biofuel producers.

California could continue to spend billions to pay for imported biofuels with questionable climate benefits. Or it could spend that money on rebates for EVs and e-bikes, EV charging infrastructure, and public transit. Either way, it’s a choice.

Danny Cullenward

Senior FellowDanny Cullenward is a senior fellow at the Kleinman Center. He is an economist and lawyer focused on the scientific integrity of climate policy with additional appointments at the Institute for Responsible Carbon Removal at American University and Google.