Tracking Gasoline Price Impacts in California: Part 1

Recent data indicate that consumer price impacts from the Low Carbon Fuel Standard have been substantially smaller than worst-case outcomes, but costs are poised to grow in the years ahead.

Last fall, I published a report for the Kleinman Center on California’s Low Carbon Fuel Standard (LCFS), a market-based policy that seeks to curb the carbon intensity of transportation fuels sold in the state. My report reviewed substantial evidence indicating that the biofuels it subsidizes—which have earned about 80% of the program’s credits to date, worth billions of dollars a year—don’t cut greenhouse gas emissions much, if at all.

Concerns that the program exacerbates climate change, air and water pollution, and global food insecurity are reason enough to be concerned with the state’s decision to double down on the status quo. But the issue that got the most public attention was the LCFS program’s impact on gasoline prices.

The debate over fuel prices has since taken on a life of its own. Although I took care to identify the full range of uncertainty in my report and clarified my views about the most likely outcomes in an oped, many observers seized on my worst-case scenario without addressing the range of results I reported. Congressional Republicans cited my work to predict an imminent spike in gasoline prices, while California Governor Gavin Newsom responded that historical program costs have been low and implied those costs won’t rise further.

So, who was right? Let’s look at the data.

Under Senate Bill 1322, refiners are required to report the cost of the LCFS program to the California Energy Commission, which publishes summary data showing the program’s total impact on retail prices for branded and unbranded gasoline.

Figure 1 shows that, in the run-up to the adoption of the LCFS program amendments, refiners reported gasoline price impacts of about 10¢ per gallon. Those impacts jumped to almost 20¢ per gallon in January 2025 before declining steadily through May, the latest month for which data are available as of this writing.

Notably, all of these data are well below the projections considered in the regulator’s own cost-benefit analysis (about 47¢ per gallon) or the worst-case scenario from my report (about 65¢ per gallon)—one of many scenarios I included, and for which I assumed, but did not predict, that LCFS credit prices would reach their maximum allowed levels of nearly $270 a credit in 2025.

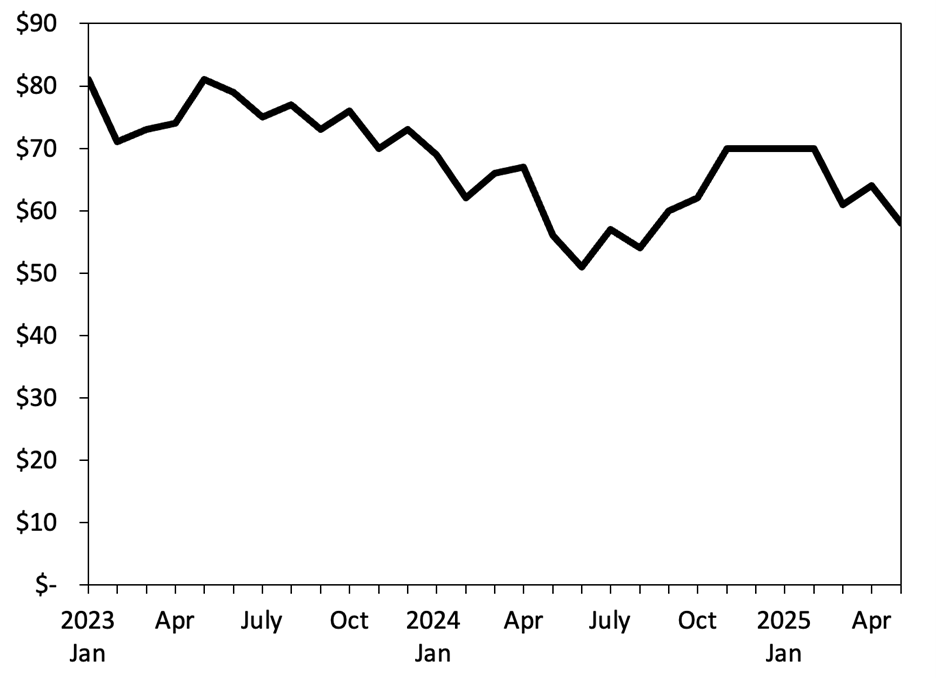

The primary reason actual gasoline price impacts were relatively low is a steady decline in LCFS credit prices, which were flat at about $70 a credit through this winter but fell to about $50 a credit by the summer (see Figure 2). Notably, this trend is the opposite of what regulators expected—after all, the program reforms were explicitly designed to increase credit prices—and it appears to have surprised some expert observers who have been sanguine about gasoline price impacts.

But if LCFS credit prices were flat from November through February, then why did retail price impacts jump in January 2025?

The answer, as I’ll explain in my next post, is that refiners appear to have started passing along the higher costs of complying with the LCFS program’s lower carbon intensity targets—an outcome that portends growing price impacts in the years ahead.

Danny Cullenward

Senior FellowDanny Cullenward is a senior fellow at the Kleinman Center. He is a climate economist and lawyer, a Research Fellow with the Institute for Carbon Removal Law and Policy, and the Vice Chair of California’s Independent Emissions Market Advisory Committee.