The 2016 election granted Republicans control of the House, Senate, and the White House and an opportunity to craft a broad policy agenda. Having failed to pass a repeal and replacement of Obamacare, consensus now seems to land on tax policy as a new focus for the administration’s priorities. President Trump has alluded to the need to cut taxes and encourage economic growth, a message supported by conservatives in Congress.

Concerning such goals, the Washington Post reported on April 4th that the administration may have been entertaining a carbon tax as part of a large package tax deal. Such a proposal has seen recent advocacy among prominent Republicans—including former Secretary of State James Baker and former Treasury Secretary Hank Paulson—who made the case for a $40/ton carbon tax to Trump’s chief economic advisor Gary Cohn at the White House recently (Hess 2017). Only hours after the Post’s story was released, however, the administration responded by refuting that a carbon tax was not currently under consideration (Paletta 2017).

This is unfortunate—the administration is missing a golden opportunity to reduce the size of the federal government, enact a pro-growth economic policy, and in doing so also take a bold step toward combatting global climate change.

As is, Republican lawmakers have no expressed interest in implementing a carbon tax, even going so far as to specifically condemn the idea in a House vote in 2016 (Cama 2016). The proposal is hardly more palatable to Democrats; there is little appetite in Washington today for new taxes. However, properly framed, a carbon tax could satisfy both Republicans and Democrats by discouraging profligate carbon emissions while using the revenue to lower individual income taxes.

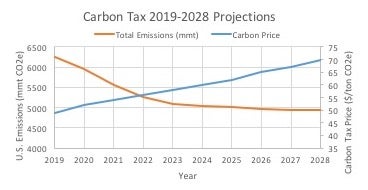

According to the United States Environmental Protection Agency (EPA) Inventory of U.S. Greenhouse Gas Emissions and Sinks, the U.S. emitted 6.87 billion metric tons of CO2 equivalent (CO2e) greenhouse gases in 2014 (2016). The federal government, furthermore, collected $1.4 trillion in individual income taxes, a full 46 percent of government revenue (2015). A carbon tax could mitigate the loss of revenues of the tax reforms that President Trump proposed during his campaign. For example, a single scenario analyzed by the U.S. Treasury in January 2017 with a carbon price of $49/ton beginning in 2019 and increasing each year to 2028 would raise an estimated $2.2 trillion in the 10-year period. The estimated corresponding emissions levels are shown in Figure 1.

Macroeconomic Effects

The impact of any carbon tax on the overall economy in the short and long term depend heavily on the level of the carbon price, as well as the way the revenue generated from the tax is spent. The scenario described above would have significant impacts on the prices of fuel and other consumer goods. The Treasury estimates that a carbon price of $49/ton added in 2019 would increase the cost of gas by approximately 44 cents/gallon. Thus, a carbon tax alone—as with any new tax—would be expected to have an overall negative impact on the economy. However, using the revenue productively by reducing other tax rates or the federal budget deficit could offset or perhaps reverse the negative impact.

The Price is Right

Rather than set the price of carbon arbitrarily, economic theory indicates the tax should be set equal to the cost of the externality incurred by the emitting society, in other words, the social cost of carbon. There have been many estimations of this cost, which depends on the discount rate of future costs and benefits of emitting carbon. In a previous Kleinman Center Digest, Gollier and Pachon (2016) reviewed those estimations and concluded that a social cost of carbon close to $40/ton of CO2 was an appropriate price signal. If a carbon tax were to be set at this level for all greenhouse house gas emissions across the U.S., it would generate nearly $275 billion. This additional revenue could pay for cuts to the headline rates of the individual income tax brackets.

How much of an economic boost such a shift would provide is hard to calculate due to the complex nature of the economy and the near ubiquity of fossil-fuel use in modern society. A paper from the Brookings Institute notes that while tax reform (i.e. revenue neutral changes to the tax code which reduce headline rates) is rare in U.S. policy, it can have the beneficial effect of more efficient allocation of economic resources which results in a boost in the size of the economy (Gale and Samwick 2014).

Shrinking Returns

While the carbon tax could replace portions of the income tax, it would also reduce the overall amount of greenhouse gas emissions from the economy. This creates a problem for a taxation system based on emissions. Namely, if the tax is successful in achieving its goal of reducing greenhouse gas emissions, federal revenue will decrease in the absence of unacceptably sharp increases in the price/ton of the tax.

Once emissions are reduced, rather than increasing income taxes again or implementing a replacement tax—an unlikely prospect given the political difficulty of passing new taxes or raising current taxes—there is opportunity for Republicans to pursue another treasured policy: shrinking overall federal spending. The gradual decline in revenues from the carbon tax makes an ideal scenario for a gradual reduction in federal outlays.

In writing the carbon tax law, Congress could identify future spending cuts that would be gradually introduced as carbon tax revenues fell. This approach allows programs and expenditures to be responsibly reduced over long time periods (and allows political cover for those implementing the cuts) while providing a clear incentive and trigger to do so. Taken together, such a policy would achieve two of the Republican party’s most dearly held policy directives: lowering headline tax rates and shrinking the size of the federal government.

If all this is not enough, further spending cuts sure to encourage Republicans to rally behind a carbon tax could come from a reduction in federal subsidies for carbon-free energy. According to the Energy Information Administration (EIA), subsidy support for renewable energy totaled approximately $15 billion for FY2013 (2015). Under a carbon tax, such spending would be redundant—the most efficient carbon mitigation technologies would be economically desirable thanks to the carbon price signal. Democrats may be loath to part with subsidies for specialized industries, but given that a carbon tax corrects the market failure that is indirectly solved by green energy subsidies, maintaining the subsidies after correcting the market failure would be inefficient and distortionary.

Rebating

A carbon tax’s distributional impacts make such a system highly regressive. Lower income individuals pay lower taxes (or none at all in the case of those who qualify for the Earned Income Tax Credit (EITC) already while spending disproportionate amounts of income on goods and services that would now have additional taxes. In Alberta, a fossil-fuel intensive economy which recently implemented a province-wide carbon tax, this regressive impact was mitigated through direct rebates to low- and middle-income citizens. This option may also be attractive to lawmakers as it is likely to have the least direct effects on consumers and prevents a carbon tax from becoming overly regressive. It also gives the not insignificant political boost of millions of Americans getting a check in the mail. However, using revenue to rebate directly reduces the available revenue which can be reduced from the income taxes.

Dinan (2012) notes that many government programs aimed at low-income earners, such as the Supplemental Nutrition Assistance Program (SNAP), have disbursements which are pegged to either inflation or the price of goods they are used to fund. In the case of SNAP, the value of benefit received is pegged to food prices, so an increase in food prices due to a carbon tax would be fully compensated by an increase in SNAP benefits for lower income households. An expansion of the EITC could then be used to compensate for any additional regressive effects of the tax.

While rebating remains an option for carbon tax implementation in the United States, a declining revenue stream set to match targeted budget cuts in addition to an expansion of the EITC is likely to have more appeal to budget hawks in Congress. This approach also puts the country on a better fiscal path while not posing undue costs on the nation’s most vulnerable.

Combatting Emissions

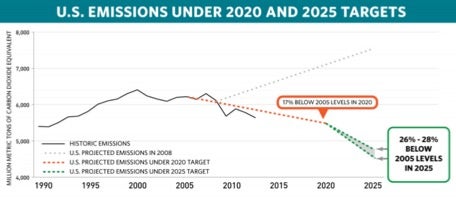

Economic impacts are only half the consideration when setting carbon tax policy. How much of an impact might such a tax have on the greenhouse gas emissions of the United States? Though the current administration is unlikely to feel bound by the Paris Climate Agreement, it is worth noting that a $40/ton carbon price would likely put the U.S. well in compliance with its Intended Nationally Determined Contribution (INDC) submitted to the UN. The INDC aimed for a 26-28 percent decrease in emissions over 2005 levels to 2025. As part of the 2014 Annual Energy Outlook, the EIA investigated expected impacts of a $25/ton carbon tax implemented in 2015 and increasing in price by 5 percent each year. In that scenario the United States just misses its promises in the INDC. Given that a higher price on carbon is certain to provide further downward pressure on overall greenhouse gas emissions, it is a fair assumption that under a $40/ton carbon price, the United States would meet or exceed its promises to the world from the Paris agreement. This is the same conclusion the Climate Leadership Council reaches, specifically advocating for a $40/ton carbon price (Bailey and Bookbinder, 2017).

Of course, how effective the carbon price is at reducing overall greenhouse gas emissions will be significantly impacted by how the tax is implemented. Failure to fully account for society’s varied and ubiquitous uses of emission-intensive products and services would lead to a less-than-optimal reduction of emissions. According to Bruvoll and Larsen (2002), who studied Norway’s first-ever implementation of a carbon tax in 1991, the country’s policy was largely rendered ineffective due to a number of crucial exemptions. The same argument has been made regarding Alberta’s initial carbon price on large-emitters, the Specific Gas Emitters Regulation, which covered only point sources of emissions over 100,000 tons of emissions/year. In contrast, British Columbia’s broad-based carbon tax brought about a 16 percent drop in fuel use per capita in the province, while also lowering tax rates as revenue is recycled into corporate tax rates (The Economist 2014).

The clearest lesson from the above examples is that, to be effective, any implemented carbon price should be applicable to the broadest possible base. The price signal must be applied across the full economy, otherwise it will push consumers toward exempted or protected industries not subject to the tax and ultimately distort the market.

However, exclusions are almost certain to be included in any carbon tax bill. Industry leaders would certainly push for so-called “border adjustment” policies—like those implemented in Alberta. Border adjustments allow exporters of goods and services to be rebated the cost of the carbon price on any exported goods to countries which do not have an equivalent carbon price. Similarly, any imported goods from countries which do not charge a carbon tax would be assessed an equivalent tariff. This has the impact of making the carbon tax a tax on consumption rather than production, even if the tax is implemented at the point of production.

However, exclusions are almost certain to be included in any carbon tax bill. Industry leaders would certainly push for so-called “border adjustment” policies—like those implemented in Alberta. Border adjustments allow exporters of goods and services to be rebated the cost of the carbon price on any exported goods to countries which do not have an equivalent carbon price. Similarly, any imported goods from countries which do not charge a carbon tax would be assessed an equivalent tariff. This has the impact of making the carbon tax a tax on consumption rather than production, even if the tax is implemented at the point of production.

In addition to ensuring the tax is focused on consumption rather than production, the border adjustment also has the impact of protecting domestic industry. In the absence of global or near-global carbon tax policies, firms based or producing in those countries which charge a carbon tax would be at a natural disadvantage to firms producing in countries which lack such a tax. While it pushes back against the broad application principle above, this exemption is likely a necessary component of any legislation in the absence of a global carbon price. Border adjustments have typically been considered “protectionist” as they amount to tariffs aimed at maintaining domestic industry competitiveness; however, the current administration’s protectionist bent would align with border adjustment.

In terms of distortion, one potential flashpoint for controversy could be the natural gas industry. While natural gas emits less carbon per unit of energy than either coal or oil, it is still a major source of carbon emissions. Currently, the global export market for natural gas is relatively small, but thanks to the hydraulic fracturing boom in shale gas, there is the potential for that to change in the coming decades. The U.S. appears poised to become a major exporter of natural gas and an exemption on the carbon tax for exported natural gas would be a huge source of emission leakage in the carbon plan. Again, however, the Trump administration’s insistence on improving U.S. trade deficits with other countries could make border adjustment policies a selling point rather than a barrier in Congress and to the public.

Bringing Stakeholders to the Table

Regardless of its structure, a grand bargain on carbon tax remains a remote possibility. Climate change and energy use were rarely discussed during the 2016 campaign that propelled Republicans and President Trump to power. At the state level, Trump’s avowed dislike of the clean power plan is spurring some Democrats to push for state carbon taxes in tacit acknowledgement that federal action is unlikely (Storrow 2017).

The most recent carbon tax implemented in North America in the province of Alberta holds lessons here as well. The Albertan carbon tax initiative garned input and support from major interest groups and stakeholders, including the fossil-fuel industry. This potential exists in the United States as well. Though it may come as a surprise to many, the largest oil companies have endorsed a carbon tax as the best way to fight climate change, including ExxonMobil under now Secretary of State Rex Tillerson’s tutelage. Major oil producers see a carbon tax in two ways, as a vehicle to allow them to pursue various low-carbon R&D policies and a way for them to demonstrate their commitment to the environment.

Achieving buy-in from major oil companies, who collectively spend millions in lobbying for and against legislation, could be a decisive factor in passing carbon tax legislation. ExxonMobil, Chevron, and ConocoPhillips all incorporate an internal carbon price into financial decisions and European companies with large U.S. presences such as BP, Shell, and StatOil have also openly stated their preference for a global carbon tax. Any policy should include representatives from these oil majors as part of the development process to ensure their support in selling the legislation to the American public and to lawmakers.

In addition to major oil companies, efforts should be made to reach out to the electric power sector. Here would lie both the most ardent supporters and most vociferous detractors of an economy-wide carbon tax.

For nuclear, wind, and solar electricity producers, a carbon tax would be a major boon—crediting these technologies for their production of electricity without the additional externality costs of greenhouse gas emissions. Nuclear power in particular, which has suffered in recent years due to the expansion of inexpensive natural gas, would find a savior in an appropriately set carbon price that allowed it to keep plants running against lower-priced natural gas plants.

Coal and natural gas producers, on the other hand, would find a carbon tax squeezing margins. Natural gas might be redeemed by further fuel switching away from coal, which emits two to four times as much CO2 per unit of energy produced. With natural gas already beating coal out in price competiveness, it is hard to imagine coal remaining particularly profitable under a carbon tax regime, but taking care of coal communities would necessarily be a vital part of any proposed plan (see Manley and Simeone 2017).

On the other side of the aisle, efforts should also be made to achieve endorsement from major environmental groups. Washington state’s I-732 referendum, which proposed a state carbon tax in exchange for tax cuts to businesses and rebates to low income families, failed to pass in large part due to resistance by environmental groups. These groups felt the revenue should be spent on green initiatives rather than on reducing taxes. The policy failed to achieve buy-in from major stakeholders and fought strong uphill resistance from the left, a typically pro-environment constituency.

Should all the pieces fall into place, however, a grand coalition of oil companies, nuclear power and renewable energy companies, and environmental NGOs supporting a bill that gives both parties major policy victories could be the perfect recipe to bring both Republicans and Democrats to the center aisle. President Trump has frequently claimed he makes great deals; this could be the best of his career.

Dillon Weber

Research AssistantDillon Weber was a research fellow at the Kleinman Center and a graduate of the University of Pennsylvania majoring in chemical and biomolecular engineering and economics.

Bailey, David, and David Bookbinder. A Winning Trade. Report. February 2017. Accessed April 8, 2017. https://www.clcouncil.org/wp-content/uploads/2017/02/A_Winning_Trade.pdf.

Bruvoll, Annegrete, and Bodil Merethe Larson. Greenhouse gas emissions – do carbon taxes work? Report. Accessed March 15, 2017. http://econweb.ucsd.edu/~carsonvs/papers/632.pdf.

Cama, Timothy. “House votes to condemn carbon tax.” TheHill. June 10, 2016. Accessed April 8, 2017. http://thehill.com/policy/energy-environment/283029-house-condemns-carbo….

“The Evidence Mounts: British Columbia’s Carbon Tax.” The Economist, July 31, 2014. Accessed April 24, 2017. http://www.economist.com/blogs/americasview/2014/07/british-columbias-ca….

Hess, Hannah. “GOP statesmen launch ‘uphill slog’ for carbon tax.” Greenwire, February 8, 2017. Accessed April 4, 2017. https://www.eenews.net/greenwire/2017/02/08/stories/1060049753.

Gale, William G., and Andrew A. Samwick. Effects of Income Tax Changes on Economic Growth. Report. September 2014. Accessed April 3, 2017. https://www.brookings.edu/wp-content/uploads/2016/06/09_Effects_Income_T….

Pachon, Angela, and Christian Gollier. Computing the Right Price Signal for the Social Cost of Carbon. Publication. Kleinman Center for Energy Policy, University of Pennsylvania. April 28, 2016. Accessed April 10, 2017. http://kleinmanenergy.upenn.edu/policy-digests/computing-right-price-sig….

Paletta, Damian, and Max Ehrenfreund. “White House Disavows Tax-Overhaul Options in Quick Reversal of Stance.” The Washington Post, April 5, 2017. Accessed April 8, 2017. http://www.highbeam.com/doc/1P4-1883922430.html?refid=easy_hf.

Simeone, Christina, and Adija Manley. Revitalizing Coal Communities. Report. Kleinman Center for Energy Policy, University of Pennsylvania. December 20, 2016. Accessed April 10, 2017. http://kleinmanenergy.upenn.edu/paper/revitalizing-coal-communities.

Storrow, Benjamin. “Lawmakers use threat of Trump to pitch carbon taxes.” ClimateWire, February 22, 2017. Accessed March 15, 2017. https://www.eenews.net/climatewire/2017/02/22/stories/1060050383.

United States. Congressional Budget Office. Offsetting a Carbon Tax’s Costs on Low-Income Households. By Terry Dinan. November 2012. Accessed April 3, 2017. https://www.cbo.gov/sites/default/files/112th-congress-2011-2012/working….

United States. Department of the Treasury. Office of Tax Analysis. Working Paper 115. By John Horowitz, Julie-Anne Cronin, Hannah Hawkins, Laura Konda, and Alex Yuskavage. January 2017. Accessed April 3, 2017. https://www.treasury.gov/resource-center/tax-policy/tax-analysis/Documen….

United States. Energy Information Administration. Direct Federal Financial Interventions and Subsidies in Energy in Fiscal Year 2013. By Fred Mayes and Michelle Bowman. Washington, DC: U.S. Department of Energy, 2015.

United States. Environmental Protection Agency. Inventory of U.S. Greenhouse Gas Emissions and Sinks. Accessed April 8 2017. https://www.epa.gov/sites/production/files/2016-08/documents/print_us-gh….

United States. Treasury. Receipts by Source. Accessed April 8, 2017. https://www.treasury.gov/press-center/press-releases/Documents/2014%20Re….