Computing the Right Price Signal for the Social Cost of Carbon

Introduction

As explained in the first digest of this series, the solution to restore efficiency in the face of a global externality such as climate change is to expose all emitters of CO2 to the same carbon price. This price should be equal to the marginal damage or cost that is generated by these emissions over time.

Little Concensus

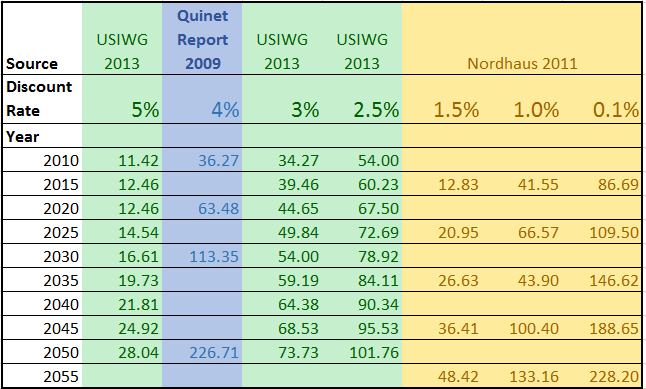

For the past two decades, governments have commissioned estimates of the social cost of carbon (SCC). This cost can vary significantly. Although the fifth report of the Intergovernmental Panel on Climate Change (IPCC 2014) does not contain much information about it, there is now a sizeable literature about the social cost of carbon. The problem is that there is no consensus among experts about how to value the marginal climate damages generated by CO2. To illustrate this uncertainty, Table 1 shows different estimations of the costs of carbon with different discount rates.

Sources: US Interagency Working Group (2013)1 , Quinet Report (2009)2 , and Nordhaus (2011)3 , for price conversions Bureau of Labor Statistics CPI index and OECD Purchasing Power Parities for GDP.4 For Nordhaus estimates tons of CO2 equal 1/3 of tons of CO.

OECD Purchasing Power Parities for GDP. F

Three reasons explain the differences presented above.

- Damages are often non-monetary. There is no agreed-upon methodology to value non-tradable assets like natural capital, biodiversity, etc.

- Damages are uncertain. Climatologists are still debating about several aspects of their models: How much will average temperature increase if we double the concentration of GHG in the atmosphere? What is the tipping point? How important are the stabilizing and destabilizing mechanisms of the earth’s climate?

- Damages are in the distant future. This reality raises the question of our responsibility towards future generations.

The key economic parameter that determines arbitrage over immediate sacrifices and future benefits is the discount rate. The discount rate translates future costs into present costs. However, economists disagree about what rate should be used to discount the distant future. In a growing economy, investing for the future—for example by fighting climate change—raises intergenerational inequalities. Future generations are typically wealthier than previous generations. Therefore, a global increase in investment forces the relatively poor current generation to reduce consumption for the benefit of increasing the wealth of future generations. Keep in mind for example that, with a 2% annual growth rate of consumption, people living two centuries from now will consume 50 times more goods and services. We, on the other hand, consume 50 times more goods and services than our ancestors who lived two centuries ago. If we are inequality-averse, investing for the future is socially desirable only if the return on these investments is large enough to compensate the costs. This justifies using a positive discount rate. This argument is implicit in all discussions that economists have had over the last two decades. However, long-term growth is uncertain, and this justifies taking this intergenerational inequality argument with a pinch of salt.

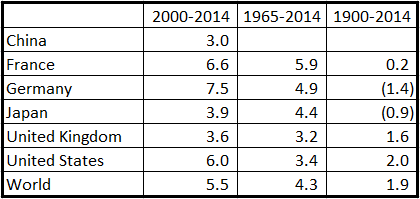

The modern asset pricing theory provides a useful benchmark to examine in a comparative way this valuation problem.5 In financial practice, this argument also translates to a positive interest rate. A simple arbitrage argument justifies using the interest rate to discount the safe (or low-risk) benefit flow of any investment project. Indeed, there are myriad ways to improve the future, and it is crucial to prioritize them. Rather than fighting climate change, one could invest in the safe productive capital of the economy that will be used by future generations to increase their wealth. Fighting climate change is desirable only if the “return” of required investments is larger than the return obtained by investing in the safe physical capital of the economy, which is measured by the interest rate. This explains why the interest rate could be a good candidate for the discount rate, at least for risk-free investment projects. Table 2, provides some information about the interest rates observed over the last 100 years.

Source: Dimson, Marsh, and Staunton.6

From this table, assuming that future economic growth will be similar to the past, a relatively low real discount rate between 0-2% should be used to discount these damages to the present (if future climate damages were certain). This discount rate is in the order of magnitude of what has been used by Stern to estimate the SCC. He obtained an estimation of 100 or more per ton of CO2.7

Most of the models that have been used to calculate SCC (like the standard integrated assessment model, such as DICE) however, positively link climate damages to consumption growth, as demonstrated by Dietz, Gollier, and Kessler.8 For example, Nordhaus used the RICE-2011 model with 16 sources of uncertainty to conclude that “those states in which the global temperature increase is particularly high are also ones in which we are on average richer in the future.”3

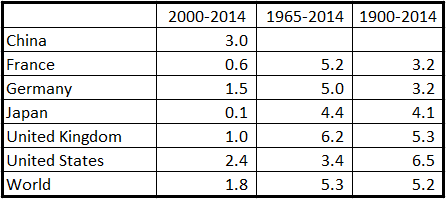

This positive relationship between climate damages and consumption justifies the use of a relatively high rate to discount expected climate damages. Thus, the relevant climate discount rate should be closer to the average return of equity than to the risk-free rate (like the return on long-term government bonds presented in Table 2). Table 3 provides information about the average return of equity during the last 100 years. A discount rate for SCC around 3-5% seems to be the more appropriate.

Notice, however, that the positive relationship between climate benefits and consumption also means that in a fast growing world economy, climate damages will be much larger too. This implies a larger discount rate (as explained before) and also a larger expected benefit of fighting climate change. Dietz, Gollier, and Kessler show that the net effect of this positive relation argument is to raise—not to reduce—the price of carbon. In net, this justifies a SCC around $40/tCO2.8

Source: Dimson, Marsh, and Staunton.6

Investor Expectations

Economists strongly recommend using carbon pricing to globally coordinate the fight against climate change in an efficient way. This recommendation has been endorsed by a wide range of companies around the world, such as Shell, ENGIE, and Microsoft.

Unfortunately, the Paris Accord failed to introduce a universal carbon price. The Accord is extremely weak, with no formal commitment and no verification mechanism. The negotiators worked hard to ensure that this agreement contained no such coercive procedure, so national pledges could be removed on short notice.

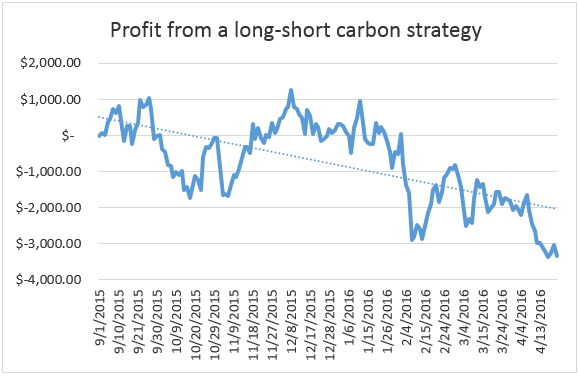

As a result, investors and households don’t believe that the Paris Accord will ever penalize high emitters of GHG. Otherwise, they would have massively disinvested from the least responsible companies around the planet to reinvest in the more virtuous ones. This activity would have been reflected in asset prices. MSCI is an international company that has built various portfolios specializing in different sectors or regions. One of their indices tracks the value of a portfolio called ACWI LOW CARBON, which in each sector/country, biases its composition towards companies that emit less CO2. In Figure 1, we have drawn the evolution of the profit of an investor who gambled on the success of the COP21. On Sept 1, 2015, this investor would have invested one million dollars on the ACWI LOW CARBON portfolio (taking a long position on the ACWI LOW CARBON portfolio, and short on the ACWI benchmark). If she would have sold or liquidated her position right during the Paris Conference, she could have netted a low profit of $1000. But as we write this note, on April 22, 2016, this profit as been turned into a net loss of $3,331!

This means that the possibility to put in place an efficient carbon pricing policy remains a remote and somewhat unrealistic expectation. It is important to also think about what responsible actors can do. As explained above, a social cost of carbon, i.e. a carbon price, around $40/tCO2 makes sense. This means that responsible investors should implement any action to reduce emission of CO2 that costs them less than $40/tCO2. No more, no less.

Conclusion

How much should be invested today to fight climate change depends upon how high the price of carbon should be. Determining the SCC strongly relies on our appreciation of our responsibility toward future generations. This is an ethical question that transcends climate change, as it influences the way we think about protecting biodiversity and non-renewable resources, investing in infrastructure and education, or reducing public debt. This ethical question translates into the choice of discount rate, which also depends upon the risk profile of climate damages. A discount rate around 3-5% (similar to the average return on equity) and an SCC of $40/tCO2 should be adequate benchmarks for responsible investors.

Christian Gollier

Director, Toulouse School of EconomicsChristian Gollier is the director of the Toulouse School of Economics and the Wesley Clair Mitchell Visiting Research Professor at Columbia University. In 2015-2016 he was a visiting scholar at the Kleinman Center.

Angela Pachon

Special AdvisorAngela Pachon is a special advisor the Kleinman Center and was previously the Center’s research director. She advises on the research agenda, research grants and the visitor scholar programs, as well as developing scholarship and research collaborations.

- U.S. Interagency Working Group, (2013), Technical Update of the Social Cost of Carbon for Regulatory Impact Analysis under Executive Order 128666. [↩]

- Quinet, A., (2009), La valeur tutélaire du carbone, La Documentation Française, Rapports et Documents 16, Paris. [↩]

- Nordhaus, W.D., (2011), Estimates of the Social Cost of Carbon: Background and Results of the RICE-2011 Model, Cowles Foundation Discussion Paper, October 2011. [↩] [↩]

- OECD, (2013), Climate and Carbon: Aligning Prices and Policies, OECD Environment Policy Paper 1, OECD Publishing, Paris. [↩]

- Gollier, C., (2012), Pricing the Planet’s Future: The Economics of Discounting in an Uncertain World, Princeton University Press. [↩]

- Dimson, E., P. Marsh and M. Staunton, (2015), Credit Suisse Global Investment Returns Sourcebook 2015, Zurich. [↩]

- Stern Review. 2007. The Economics of Climate Change: The Stern Review, Cambridge [↩]

- Dietz, S, Gollier C., Kessler, L (2015), The climate beta, Centre for Climate Change Economics and Policy, Working Paper No. 215, Grantham Research Institute on Climate Change and the Environment Working Paper No. 190. [↩] [↩]