Impacts of the Inflation Reduction Act on Rare Earth Elements

The recently passed Inflation Reduction Act has set the stage for the U.S. to make a significant contribution to the production of minerals for the energy transition. But the legislation does not solve all the barriers to increased domestic mining and manufacturing.

The recently passed Inflation Reduction Act (IRA), takes bold steps toward promoting domestic production of critical minerals for the energy transition. These provisions are intended not only to support a rapid energy transition, but also to lessen U.S. reliance on China and Russia, where geopolitical tensions are high.

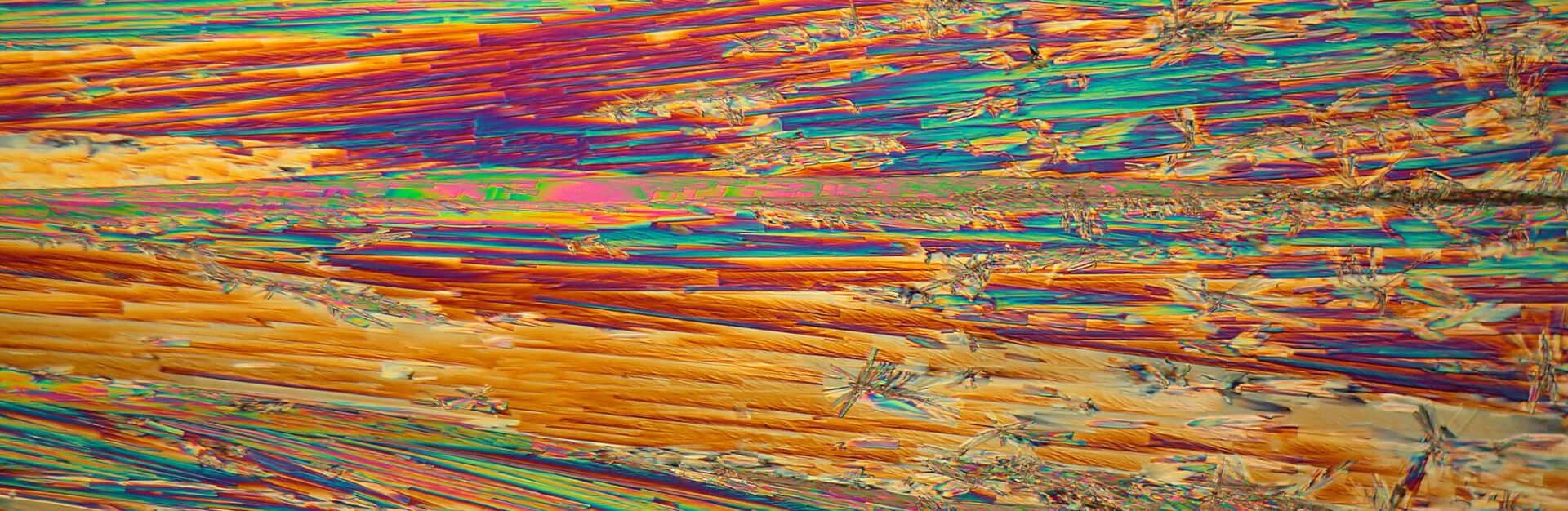

The Kleinman Center recently published two digests on the global production and future demand for one group of critical minerals known as rare earth elements (REE’s). These elements—namely neodymium, dysprosium, and praseodymium—have become essential resources of the energy transition because of their essential inclusion in permanent magnets used by wind turbines and electric vehicles.

It is clear that the IRA puts us on a course that brings production of these critical minerals closer to home, in order to fulfill domestic security and energy transition goals. But as we dive into the details of the IRA, it’s important to understand the context. The most critical minerals to the energy transition—REE’s and lithium, especially—are typically found in relatively low concentrations compared to other metals. This means that the mining and processing of these materials produces a very high waste-to-yield ratio, resulting in adverse environmental effects that have been felt for decades in China and other producing countries. The IRA’s success therefore must rely on nimble and informed policies that not only speed up the energy transition, but also reduce environmental impacts.

The IRA includes a new tax credit for domestic manufacturers of “eligible components,” which in this case includes critical minerals including key rare earth elements: neodymium, dysprosium, and praseodymium. This tax credit covers up to 10% of the manufacturer’s cost of production and represents a considerable incentive to begin or continue producing critical minerals domestically.

Similar to this incentive, the IRA also includes $500 million of additional funding under the Defense Production Act (DPA), which grants the President authority to direct economic incentives to secure domestic production of critical resources. This spring, the administration invoked its authority under the DPA to increase support for domestic mining and processing of minerals critical to “the production of large-scale batteries.” With this focus only on battery materials, the risks of REE dependence have not yet been addressed.

The IRA also authorizes DOE to offer an additional $40 million in loan guarantees using title XVII of the Energy Policy Act. As of 2021, these loans can go to projects that “increase the domestically produced supply of critical minerals,” likely including efforts to increase domestic manufacturing of rare earth elements.

One of the most discussed provisions of the IRA is the revision of electric vehicle tax credits. With these revisions, EV’s from major manufacturers will continue to be eligible for the full $7,500 tax credit only if they meet stringent new manufacturing standards. Specifically, final assembly of the vehicle must occur in North America, 40% of the value of critical minerals in vehicle’s battery must be produced in a country covered by a U.S. free-trade agreement, and 50% of the components of the vehicle’s battery must be manufactured or assembled in North America. These percentages are scheduled to increase and become even more stringent over time.

While these new limits to the EV tax credit will likely have a profound effect on global production patterns for elements such as lithium, nickel, cobalt, and manganese that are essential components of EV batteries, the new rule is unlikely to impact REE production. REE’s are critical components of EV motors but are not typically used in batteries. Despite the considerable economic risks of China’s domination in REE production, as explained in our digests, the IRA fails to include motor components as a consideration for ongoing EV tax credits.

As these provisions demonstrate, the IRA sets the stage for the U.S. and its trade partners to make a much more significant contribution to the global production of essential minerals for the energy transition, including the mining and processing of rare earth elements for permanent magnet production.

However, the IRA does not resolve all of the barriers to increased domestic mining and manufacturing. Without nimble and informed environmental policy innovation, one of two bad futures looks likely: either federal and state environmental regulations impede new projects despite the incentives contained in the IRA, or increased production of these critical minerals fulfills domestic security and energy transition goals but threatens ecosystems and communities with widespread environmental pollution as seen abroad.

Take a deeper dive into these critical resource issues in the following policy digests:

The Not-So-Rare Earth Elements: A Question of Supply and Demand

by Hyong-Min Kim and Deep Jariwala

Rare Earth Elements: A Resource Constraint of the Energy Transition

by Oscar Serpell, Wan-Yi “Amy” Chu, and Benjamin Paren

Oscar Serpell

Deputy DirectorOscar Serpell oversees all student programming, alumni engagement, faculty and student grants, and visiting scholars. He is also a researcher, writer, and policy analyst working on research initiatives with students and Center partners.