Part 2: Evaluating PGW’s LNG Proposal

Part two of this series provides further insights into PGW's proposed LNG project.

My first blog explained the very basics of PGW’s LNG proposal. Here, I’ll provide further project insights and pose some recommendations based on my observations.

Questions from the Gas Commission Hearing: On October 29, 2018, the Philadelphia Gas Commission hosted a public hearing to explore PGW’s LNG proposal. A copy of the testimonies and the hearing transcript is available. In general, some of the critical questions surrounded the lack of detail on specific contract language (the petition includes a term sheet rather than draft contracts) and questions about adequacy of risk protection for PGW (e.g. in the instance of PEC default). The public advocate also expressed skepticism that the project would generate enough revenue to garner profit sharing benefits for PGW, therefore limiting financial benefit to the services agreement (≤ $1.35 million per year).

Here are a few issues the hearing didn’t seem to cover that are important to more fully explore.

Safety: A 2015 feasibility study PGW commissioned from CH-IV expressed concern that a new 35 MMcfd liquefier (which would have also required a new storage tank) at Passyunk could have the potential to create vapor dispersion extending beyond PGW’s property line. Primarily, this is a concern because of flammability, and therefore, would prevent compliance with federal regulations. PGW verbally stated to me that these concerns no longer exist given the liquefier has been scaled back to 10 MMcfd and no new tankage is required. Public assurance of this would be beneficial.

The Business Model: The most profitable opportunity for PEC is to utilize the Passyunk plant as a peak shaving facility during the winter months. In other words, PEC would purchase and liquefy gas when it is cheap then vaporize and sell stored gas via pipeline when prices are high (i.e. during the peak season spanning November through April).

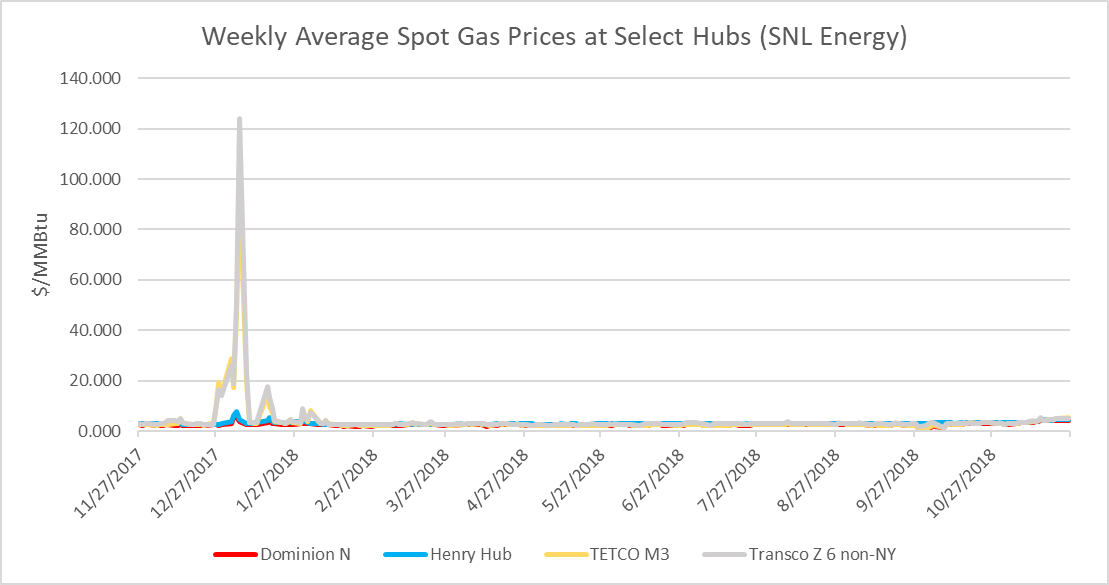

The Philly region provides a significant peak shaving business opportunity given most large-volume gas users in the area likely buy gas priced at the TETCO M3 or Transco Z6 Non-NY hubs. Pricing at these hubs has become extremely volatile in the peak season, given these hubs feed into northeast natural gas markets (e.g. via the Algonquin pipeline) that are generally both supply and pipeline constrained. See the graph to the right for a better sense of winter price spikes at these hubs.

PEC’s ability to capitalize on this opportunity will be limited by the relatively small size of the Passyunk tank, which when combined with the call option from Richmond, would enable about 44 MMcfd of vaporized flowing gas for about 10-12 days.

PGW’s testimony indicates that of the 2.75 Bcf per year of LNG, approximately 900 MMcf would be sold as flowing gas via pipeline, and the remainder (1,800 MMcf) would be delivered as LNG via truck.

Firm Transportation. During peak times, both gas supply and pipeline capacity to deliver the gas can be limited. Capitalizing on flowing gas peak shaving opportunities depends on PEC’s use of both the LNG facilities and PGW’s firm interstate pipeline capacity (via “exchange services”). However, the petition term sheet does not seem to charge PEC for use of PGW’s firm transportation capacity. Only intra-city, on-system transportation is priced, at $0.20/dekatherm. Incorporating service fees for optimizing firm capacity may increase the revenue generation potential of this project for PGW, or could lower the purchased gas cost rate paid by PGW customers.

Environmental Impacts: PGW commissioned a study looking at the environmental impacts associated with operation of the new facilities. The study documented relatively insignificant impacts (e.g. minor increases in NOx and CO emissions).

Broader environmental impacts (positive or negative) are more likely to relate to the end use of the gas. Reducing harmful diesel and fuel oil emissions through increased use of natural gas may provide environmental and health benefits. However, the liquid LNG market is less developed than the peak shaving opportunities discussed above. Securing large volume gas use clients for peak shaving will come easily for PEC. Yet, for these likely uses, there would be modest environmental benefit (e.g. perhaps avoiding on-site petroleum use for dual-fuel generators).**

Liberty mentioned three key diesel displacement opportunities it intends to pursue: oil-fired generation, emergency generation, and heavy transportation (specifically locomotives, but bunker fuel replacement is an opportunity too). However, these markets may take considerable time to develop, and therefore the environmental benefits are theoretical until realized. For example, LNG for locomotive transport is essentially still in pilot phase. Displacing diesel through LNG for backup generation requires a big upfront investment, because you can’t use gas in an existing diesel genset and you need LNG storage and vaporization on-site. Accelerating the retirement of rarely used oil-fired peak generation capacity could occur, provided gas-fired units invest in on-site LNG storage and vaporization assets.

Recommendations: Based on the observations above, implementing the following recommendations would better inform the public and policymakers as they consider this project.

- Safety Check – Provide public information and education on safety-related issues, and how these issues have been addressed in order to ensure regulatory compliance.

- Value PGW’s Firm Capacity – Explore the need to reimburse ratepayers for PEC’s use of PGW’s firm interstate pipeline capacity by incorporating an applicable service fee, and associated updates to revenue projections.

- Market and Environmental Benefits Test – Host and provide outcomes of a non-binding open season for PEC services to better assess likely clients and inform claims of environmental harms or benefits.

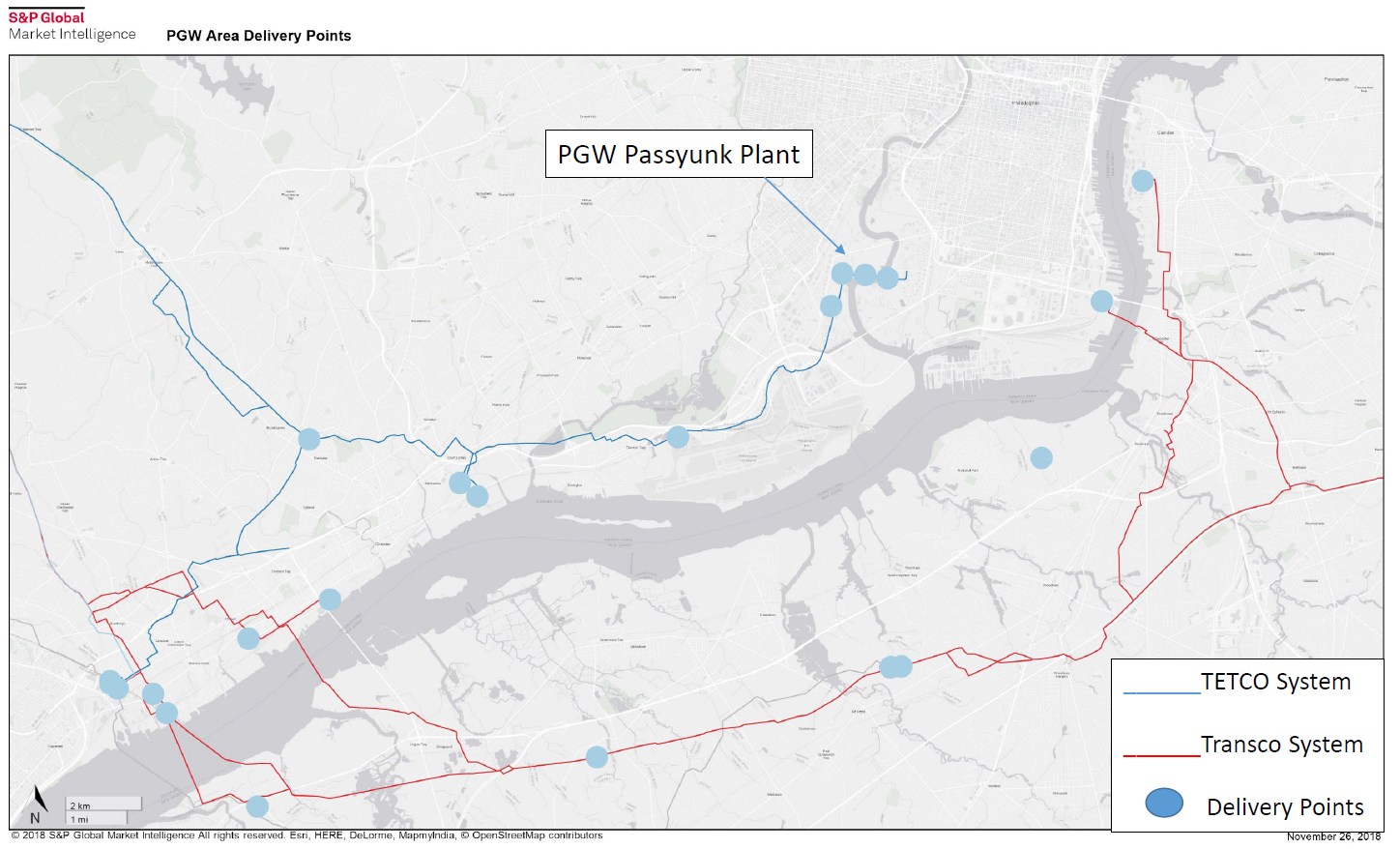

** Given the pending regulatory approval of the project, PEC has not yet executed binding agreements. PGW receives firm gas supply via the Texas Eastern (Tetco) and Transcontinental (Transco) pipelines. Therefore, other gas users on these lines may be good candidates for PEC’s peak shaving services. Nearby customers on the Tetco Line include the Philadelphia Energy Solutions Refinery, the Paulsboro Refinery, Liberty Electric power plant, Delmarva Power and Light, and PECO gas distribution. Nearby customers on the Transco line include: a cement plant near Camden, Marcus Hook refinery/terminal, PECO gas distribution, a Power Plant (connected at Post Road M6317), and Delmarva Power and Light. In addition, large volume gas users behind the citygate may also be attractive clients for PEC.

Christina Simeone

Kleinman Center Senior FellowChristina Simeone is a senior fellow at the Kleinman Center for Energy Policy and a doctoral student in advanced energy systems at the Colorado School of Mines and the National Renewable Energy Laboratory, a joint program.