EVs Mean Growth for These Businesses

In October, cumulative sales of plug-in electric vehicles in the U.S. hit the one million mark. That is good for the environment, and these businesses, too!

In October, cumulative sales (since 2011) of plug-in electric vehicles (EVs) in the United States hit the one million mark. Though impressive, this makes up only 1% of U.S. vehicle fleet.

As scientists increase the urgency of calls for reducing greenhouse gas emissions—and the transportation sector is the top energy-related source of this pollution in the U.S.—accelerating deployment of lower-emissions transportation solutions (via electrification) becomes more environmentally important.

But, it is not all about the environment. No. It turns out EVs are good for business too. Here are a few examples of businesses that see EVs as a growth opportunity.

Electricity Generators and Utilities

In general, electric generation companies support EVs because they increase demand for the firm’s product: electricity. For example, a report by DOE’s NREL found electricity demand could jump 20% to 38% above reference scenarios by 2050 through electrification initiatives primarily lead by the transportation sector.

For electric distribution utilities, the more lucrative opportunity occurs by increasing the utility’s rate base. These are the regulator-approved capital investments that qualify for a ratepayer-backed rate of return. By contrast, utility expenses are typically pass-through costs to the ratepayer that do not generate additional returns. So, for utilities, deploying capital to support EVs is much more attractive than just racking up expenses.

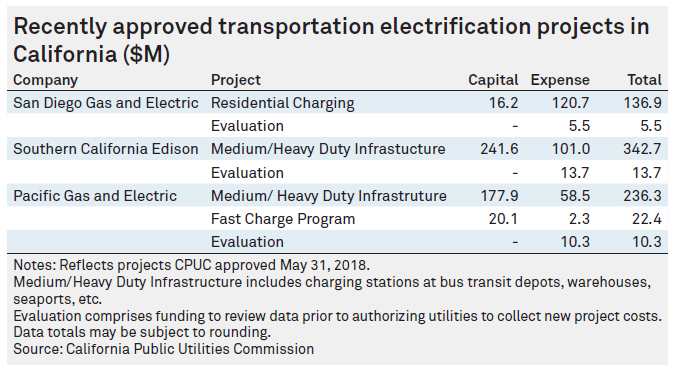

A terrific report from S&P Global Market Intelligence (Penn readers can access this with a PennKey) details the rate treatment of electric utility EV deployment investments in California. The graphic to the right shows how recently approved EV infrastructure investments have been treated by California regulators. Turns out that in the sunshine state “make ready” infrastructure investments to accommodate medium and heavy duty vehicles (fleets of buses and trucks, port vehicles) are being treated as the more attractive capital investments. On the other hand, utility outlays to support residential charging (like rebates or customer-owned charging infrastructure) are largely considered as expenses that do not qualify for a rate of return. California has largely rejected the idea of utility-owned, customer-sited residential charging infrastructure. In so far as other states follow California, there is a big incentive for utilities to focus on serving the medium and heavy duty vehicle sector. And, since many of these vehicles are currently diesel-fueled, the environmental and public health benefits may also be greatest in this sector.

Automakers (General Motors, Tesla)

Back in August, the Trump Administration moved to revoke California’s authority to limit greenhouse gas emissions from vehicles, and freeze fuel economy standards at 37 miles per gallon starting in 2020—rather than allow an increase to 47 mpg by 2025. These fuel economy and emissions standards have pushed automakers to make cleaner cars, with EVs being a key strategy for compliance.

So, General Motors may have surprised the Trump Administration in October when the automaker called for a nationwide EV mandate (modelled on California’s Zero emissions Vehicle or ZEV program) that would result in 7 million EVs on the road by 2030 (about 25% of the new vehicle fleet). Globally, GM plans to offer 20 EV models by 2023, and sees Europe and Asia moving towards EVs too.

And, of course, there is Tesla. The pioneering and (finally) profitable company that is just killing the competition in the EV space. I mean, just check out this graph.

Raw Materials, Substitutes, and Alternative Battery Technology

Lithium, nickel, and cobalt are key raw materials needed to manufacture electric vehicle batteries. These metals are primarily supplied outside the U.S., and there are concerns that supplies will significantly tighten as EV markets accelerate, especially after 2025. As Wood Mackenzie states, “Without sustained lithium, nickel, and cobalt supply, there will be no EV revolution.” Moody’s and many others have warned of the impending supply crunch too.

And, there are signs the private sector sees the forecasted surge in demand as a big opportunity. For example, in October, FMC Corp., headquartered in Philly, spun off its lithium business into a new IPO called Livent Corporation (NYSE:LTHM). The idea is the lithium portion of FMC’s business could be more valuable on its own, especially as demand for lithium is set to skyrocket. Other companies will benefit from rising prices as the supply of these metals tightens and demand rises.

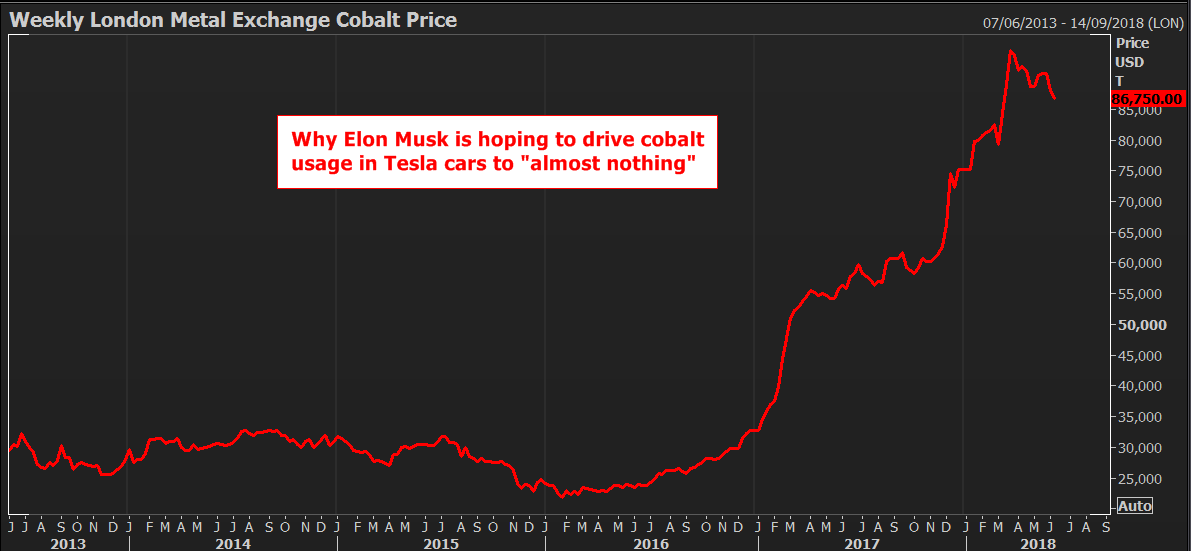

This great line graph from Reuters shows how cobalt prices have skyrocketed over the past few years, prompting battery makers (led by Tesla) to look for ways to decrease use of the rare metal. So, there will also be opportunities for companies that can develop alternative technologies or material substitutes.

Unfortunately, as is typical in the energy space, zero sum games are everywhere. Here, oil and refining industries will lose out as EV deployment accelerates. The International Energy Agency forecasts the global growth of EVs will displace 2.5 million barrels per day of oil by 2030. So, businesses targetting EVs for growth should expect some push back!

Christina Simeone

Kleinman Center Senior FellowChristina Simeone is a senior fellow at the Kleinman Center for Energy Policy and a doctoral student in advanced energy systems at the Colorado School of Mines and the National Renewable Energy Laboratory, a joint program.