Spark Magazine 2023

An Anthology of Student Work

SPARK stands for Student-Published Anthology of Research at Kleinman. It serves as a platform to highlight the exceptional energy research conducted by students throughout the campus during the academic year. SPARK represents a vital aspect of our continuous endeavors to enhance student programming and foster community engagement in the years ahead. The magazine’s concept was established through collaboration with our newly formed student advisory council, a group of Kleinman fellows, researchers, and certificate students who voluntarily convene at regular intervals to provide guidance on how we can better address the needs of the Penn student community.

2023 Articles

The hope for this magazine is that it not only celebrates the featured authors for their insightful research contributions but also challenges the reader to think critically about their own relationship to energy. The articles in this magazine explore a wide range of ambitious technical and policy solutions to some of the biggest challenges facing the future of energy. The authors delve into cutting-edge technical solutions such as green hydrogen, solar fuels, and distributed carbon ledgers, alongside policy strategies that question fundamental assumptions about money and finance.

The first volume of this magazine comprises seven submissions. Each underwent a thorough review and editing process by the editorial sub-committee of the student council. Special thanks to the student editors Caroline Magdolen, Ha-nam Yoon, and Angela Sun.

By: Jean Andre Petit P.

Green hydrogen has become an important part of government efforts to reduce emissions and accelerate the energy transition. However, developing this technology to be more efficient and attractive to investors has been difficult. In this article I will explain some key elements of green hydrogen, discuss some challenges its development has faced, and provide an update on its status.

Hydrogen is an energy source that can be used in a wide variety of applications, from fuel for vehicles and machinery to energy storage systems. It does not emit greenhouse gasses when burned, however, most of the processes currently used to produce it do, as they are mainly based on fossil fuels.

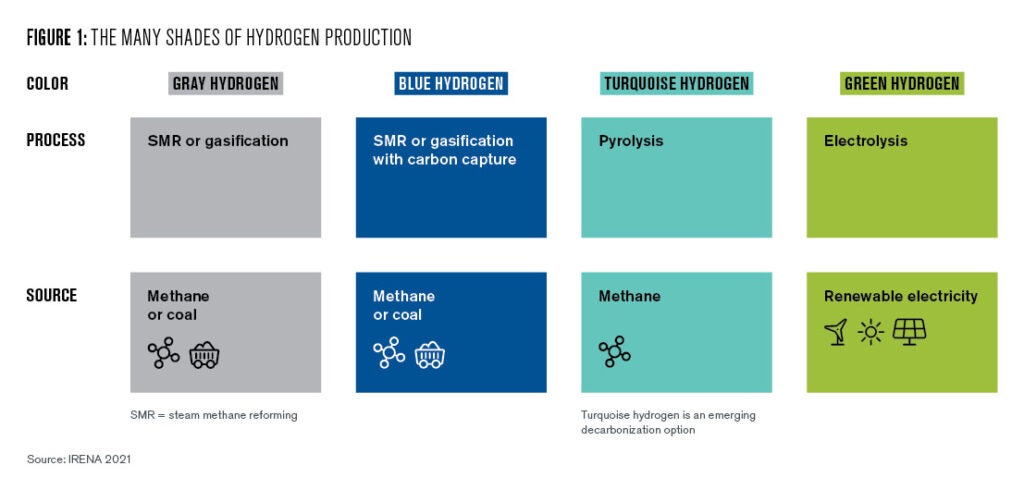

It is classified in colors depending on how polluting the hydrogen production process is. On the one hand, if the hydrogen production process uses clean energy sources, such as solar and wind energy, we speak of green hydrogen. The most efficient process to produce green hydrogen is electrolysis, by which the water’s elements are separated using electricity from renewable sources to obtain hydrogen. On the other hand, gray and blue hydrogen are produced by using fossil fuels, but in the case of blue hydrogen carbon capture processes are applied.

Challenges

Despite the potential of green hydrogen to play an important role in the energy transition, it has faced several difficulties in developing as a viable energy alternative.

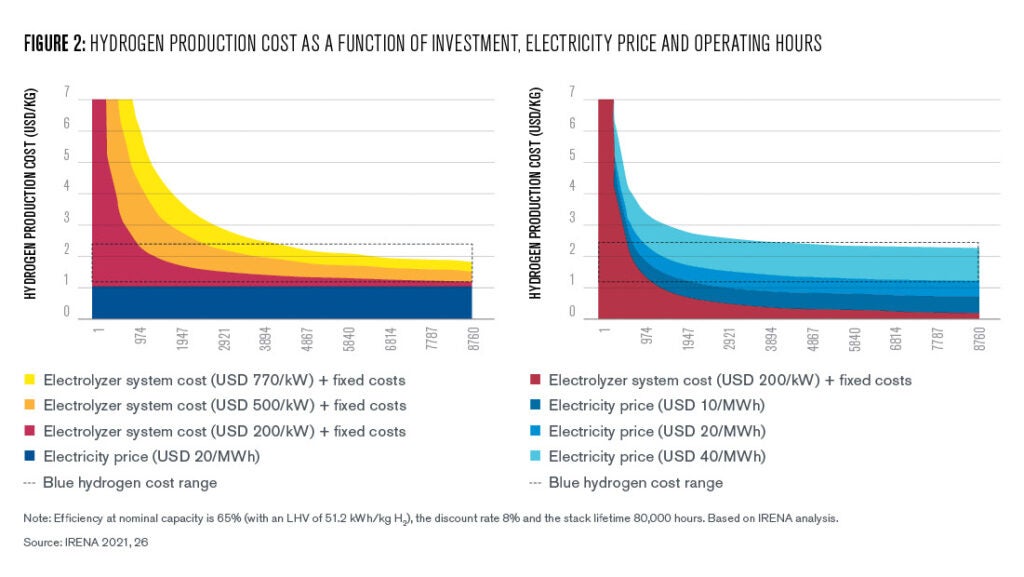

High production costs: The cost of green hydrogen production is two or three times higher than gray and blue hydrogen (IRENA 2021, 7). For this reason, hydrogen is currently produced primarily using fossil fuels such as coal, oil, or natural gas, generating more than 900Mt of CO2 emissions per year (IEA 2022a).

Two key reasons for this price gap are the price of renewable electricity and electrolysers. In accordance with the International Energy Agency (IEA), renewable electricity costs can make up 50-90% of green hydrogen total production expenses (IEA 2021). Additionally, the current production of electrolyzers is very expensive, so there is a need for reducing their procurement and construction cost, and enhancing their performance and durability in order to bridge the gap with hydrogen produced by non-renewable sources.

Low efficiency: Green hydrogen undergoes substantial energy losses throughout its value chain stages and additional energy inputs are required. About 30-35% of the energy used to produce hydrogen by electrolysis is lost. Transporting it requires additional energy, usually around 10-12% of the energy contained in the hydrogen (IRENA 2020). Furthermore, the low density of hydrogen compared to natural gas means that storing it requires much larger storage spaces and the implementation of additional processes to compress it.

To make green hydrogen more viable it is necessary to improve the efficiency of its production process and explore more efficient storage alternatives. This could involve developing better compression capacities or finding ways to lower the costs of storing it in a liquid form, which is currently energy-intensive and expensive as it requires keeping the hydrogen at very low temperatures.

Fresh water dependency: The production of hydrogen through electrolysis requires the availability of freshwater, an increasingly scarce resource. According to the United Nations, two thirds of the world population could face water-stressed conditions by 2025 (2016). This sets the challenge of finding a way to produce hydrogen through sea water or looking for alternative sources of freshwater, such as desalinated seawater.

War in Ukraine

The conflict in Ukraine and the severing of economic relations with Russia, one of the world’s largest producers of oil and gas, have resulted in higher energy and raw material prices. As a result, some economies have increased their production of fossil fuels to cover the deficit created by this situation. However, this conflict has also triggered an acceleration in the policies to reduce the dependency on fossil fuels, opting in the medium and long term for clean energies.

As a consequence of the Russian’s invasion in Ukraine, the President of the United States announced in a joint press statement with European Commission President Ursula von der Leyen that they are going to “accelerate widespread adoption of energy-efficient technologies and equipment, […] invest in innovative solutions and technologies to make the switch from fossil fuels. And together […] advance the use of clean and renewable hydrogen to reduce our carbon emissions” (The White House 2022). These statements were followed by significant announcements from both the European Commission and the United States.

The European Commission presented the RePowerEU plan, which aims to completely end dependency on Russia’s imported fossil fuels by 2030 through a series of measures, including the production of 10 million tons of domestic renewable hydrogen production and the importation of 10 million tons of renewable hydrogen by 2030 (European Commission 2022).

In the same line, the United States launched two initiatives that can promote the development of low-emission hydrogen. The first one is the Infrastructure Investment and Jobs Act´s $8 billion program to fund the development of regional clean hydrogen hubs across America. The purpose of this plan is to speed up the adoption of hydrogen as a clean energy carrier by creating networks that connect hydrogen producers, consumers, and local connective infrastructure. The second one is the Inflation Reduction Act, which contains certain provisions that may incentivize clean hydrogen production, such as a new tax credit and an increase in the value of the existing tax credit for carbon sequestration.

Current Landscape and Future Opportunities

The development of green hydrogen requires advances in various areas to make it more competitive. The good news is that these advances are progressing rapidly. This is reflected in the downward trend of the prices of solar photovoltaic and wind power, which have already declined 80% and 40%, respectively, in the last decade (IRENA 2021, 7). Also, the production costs of electrolysers have fallen 60% since 2010 and could fall another 40% in the short term and 80% in the longer term (IRENA 2021, 7). Furthermore, scientific developments to produce hydrogen from seawater have been reported (Stanford News 2019), and there is a growing interest in the construction of seawater desalination plants around the world.

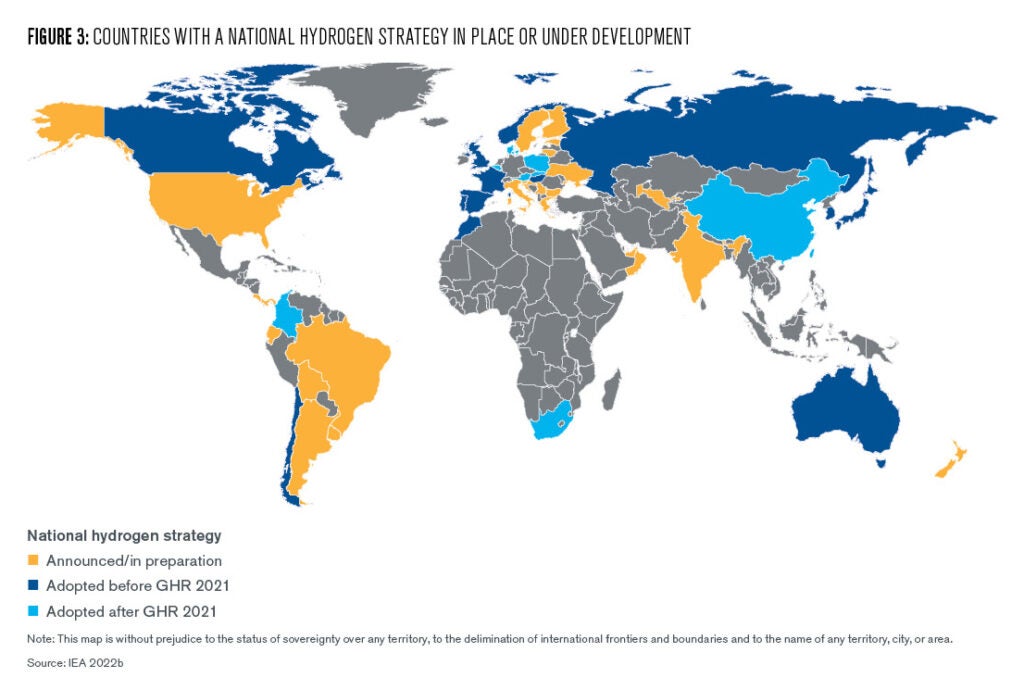

To date, 25 countries have adopted national strategies for green and low-emission hydrogen development and several other nations have announced that they are working on preparing their own plans. These strategies are focused on increasing electrolysis capacities and production targets, promoting research and development in technology, and supporting demand creation for low-emission hydrogen in key sectors, especially those in which emissions are hard to abate (IEA 2022b).

It is highly relevant to keep aligning the interests of countries, investors, and users. The governments have the important task of identifying the opportunities for the development and widespread implementation of hydrogen, as well as, connecting their decarbonization commitments, the potential of the countries and specific industries, with the needs of the users (Hydrogen Council 2020)1.

In this way, it is possible to target incentives and support mechanisms efficiently and effectively, and make it feasible to establish long-term supply contracts with competitive prices, predictable returns, and attractive bankability conditions for all market participants.

Despite the obstacles to the massive adoption of this technology, there is a strong interest in having green hydrogen play a central role in the energy transition. Important efforts have been deployed to accelerate its development, which have been further enhanced by the war in Ukraine. We will soon see how these announcements, the technological advances, and the adoption of strategies for the development of green hydrogen will impact the competitiveness of this technology and in the energy transition process towards carbon neutrality.

Jean Andre Petit P.

LL.M. and WBLC GraduateJean Andre is a 2022 LL.M. and Wharton Business and Law Certificate graduate of the University of Pennsylvania. He has worked as a lawyer in Chile and Colombia, focusing his career on the development of energy and infrastructure projects.

Department of Energy. 2022. “DOE Launches Bipartisan Infrastructure Law’s $8 Billion Program for Clean Hydrogen Hubs Across U.S.” Available at: https://www.energy.gov/articles/doe-launches-bipartisan-infrastructure-laws-8-billion-program-clean-hydrogen-hubs-across

European Commission. 2022. “REPowerEU Plan.” Available at: https://eur-lex.europa.eu/legal-content/EN/TXT/PDF/?uri=CELEX:52022SC0230&from=EN

Hydrogen Council. 2020. “Path to hydrogen ompetitiveness: A cost perspective.” p. 69. Available at: https://hydrogencouncil.com/en/path-to-hydrogen-competitiveness-a-cost-perspective/

IEA. 2021. “Global Hydrogen Review.” p. 113. Available at: https://iea.blob.core.windows.net/assets/5bd46d7b-906a-4429-abda-e9c507a62341/GlobalHydrogenReview2021.pdf

IEA. 2022a. “Hydrogen. Energy system overview. Tracking report.” September 2022. Available at: https://www.iea.org/reports/hydrogen

IEA. 2022b. “Global Hydrogen Review.” p. 184. Available at: https://iea.blob.core.windows.net/assets/c5bc75b1-9e4d-460d-9056-6e8e626a11c4/GlobalHydrogenReview2022.pdf

IRENA. 2020. “Green Hydrogen: A Guide to Policy Making”. p. 13. Available at: https://www.irena.org/-/media/Files/IRENA/Agency/Publication/2020/Nov/

IRENA_Green_hydrogen_policy_2020.pdf

IRENA. 2021. “Making the Breakthrough: Green Hydrogen Policies and Technology Costs.” Available at: https://www.irena.org/-/media/Files/IRENA/Agency/Publication/2020/Nov/

IRENA_Green_Hydrogen_breakthrough_2021.pdf?la=en&hash=40FA5B8AD7AB1666EECBDE30EF458C45EE5A0AA6

Stanford News. 2019. “Stanford researchers create hydrogen fuel from seawater.” Available at: https://news.stanford.edu/2019/03/18/new-way-generate-hydrogen-fuel-seawater/#:~:text=Stanford%20researchers%20create%20hydrogen%20fuel,

abundant%20source%20%E2%80%93%20for%20chemical%20energy.

The White House. 2022. “Remarks by President Biden and European Commission President Ursula von der Leyen in Joint Press Statement.” Available at: https://www.whitehouse.gov/briefing-room/speeches-remarks/2022/03/25/remarks-by-president-biden-and-european-commission-president-ursula-von-der-leyen-in-joint-press-statement/

United Nations. 2016. “Secretary-General Warns Two Thirds of Global Population Could Face Water-Stressed Conditions within Next Decade, in Message for International Forests Day.” Available at: https://www.un.org/press/en/2016/sgsm17610.doc.htm

US Congress. 2021. “H.R.5376 – Inflation Reduction Act of 202”. Available at: https://www.congress.gov/bill/117th-congress/house-bill/5376

By: Zhao Liu

Pennsylvania’s heavy reliance on fossil fuels poses a significant challenge to the sustainable development of the power generation sector. Although Pennsylvania has joined the Regional Greenhouse Gas Initiative (RGGI) to reduce carbon emissions, ongoing legal disputes may compel Pennsylvania to withdraw from the RGGI, resulting in significant environmental, health, and economic consequences. To mitigate these possible losses, remedial actions should tackle air pollution and environmental justice issues while introducing supplementary policies to RGGI to encourage rapid decarbonization.

Pennsylvania Power Generation Overview

Pennsylvania possesses abundant fossil fuel resources and holds a prominent position in energy production in the United States. It is the second-largest producer of energy, the second-largest producer of natural gas, and the third-largest producer of coal. In terms of electricity production, Pennsylvania ranks third in the country and is responsible for significant carbon dioxide emissions, placing it fourth among all states (U.S. EIA 2022b). The power generation sector has been a major contributor to Pennsylvania’s overall greenhouse gas (GHG) emissions, accounting for more than 30% of total emissions for many years (PA DEP 2022).

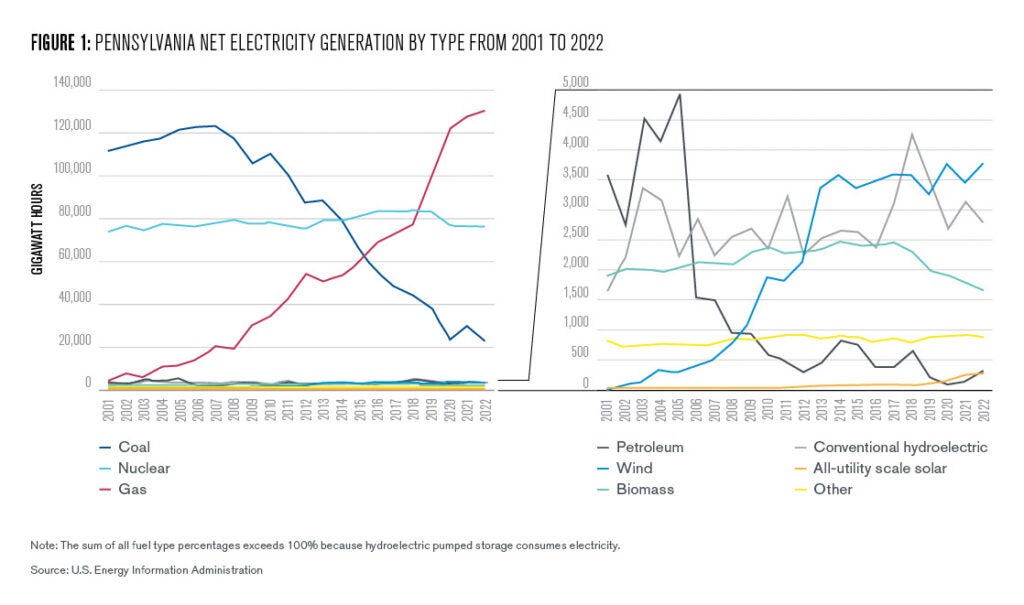

The power generation in Pennsylvania relies primarily on three sources: coal, gas, and nuclear power generation. Over the past two decades, the capacity for gas-fired power generation has substantially increased and has largely replaced coal-fired and petroleum-fired power generation. However, this shift has also led to an overall increase in fossil fuel power generation from 60.6% in 2001 to 64.4% in 2022. By contrast, the proportion of fossil fuel power generation across the United States has decreased from 71.6% to 60.2% over the same period (U.S. EIA 2023).

The Regional Greenhouse Gas Initiative (RGGI)

RGGI is an innovative market-based program, aimed at reducing carbon dioxide emissions in the power generation sector, and is the first of its kind in the United States. The program has been adopted by eleven states in New England and the Mid-Atlantic. RGGI applies to power plants generating 25 megawatts of electricity or more, and involves a cap-and-trade system that limits carbon emissions and allows for trading of emission credits.

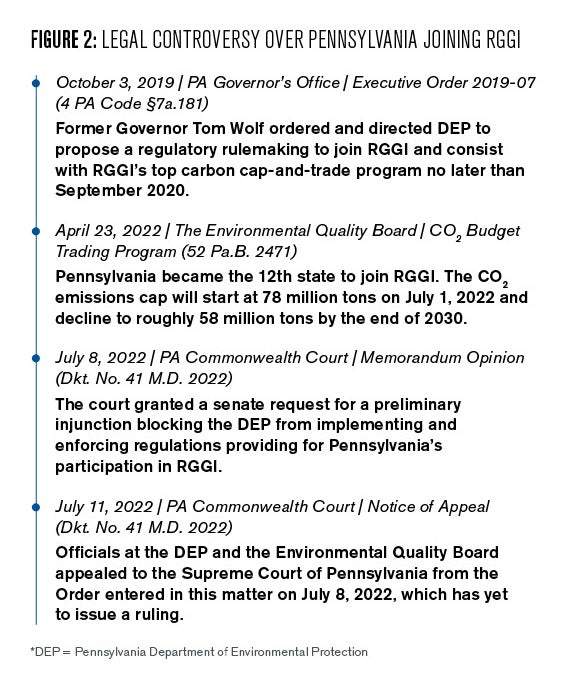

The implementation of RGGI in Pennsylvania was temporarily halted by a preliminary injunction issued by the Commonwealth Court. This ruling was challenged by officials at the state Department of Environmental Protection (DEP) and Environmental Quality Board, and the final decision is still pending.

In Pennsylvania, greenhouse gas (GHG) reduction goals have been established with the aim of reducing emissions by 26% by 2025 and 80% by 2050 from 2005 levels. Joining the RGGI program from 2022-2023 would enable Pennsylvania to reduce CO2 emissions by 97- 225 million tons by 2030, which is equivalent to 2.5-5.9 times the carbon emissions from coal-fired power generation in Pennsylvania in 2019.

Joining RGGI is also expected to result in an increase in Gross State Product of nearly $2 billion and a net increase of over 30,000 jobs, while the number of workers in the power generation industry in Pennsylvania in 2021 is only about 20,000. Lastly, it would create public health benefits valued at around $6.3 billion (PA DEP 2023). This article will explore how Pennsylvania could respond to either of two scenarios; one where PA stays committed to RGGI, and one in which the state decides to leave the program.

Scenario 1: Pennsylvania Joins RGGI

Pennsylvania’s adoption of the RGGI program can bring about significant environmental, health, and economic benefits. However, historical data suggests that participation in the RGGI program has limited impact on transitioning from coal to natural gas or renewable energy sources. Moreover, it can result in reduced efficiency of coal-fired and gas-fired power generation, leading to an increase in carbon emissions (Yan 2021). Therefore, Pennsylvania should undertake more incentives and disincentives to phase out fossil fuel power generation capacity in the long term.

- Reduce GHG Emissions of gas-fired power plants: Pennsylvania should prepare for the phasing out of fossil fuel power plants, by focusing on gas-fired power plants. Only six conventional coal-fired power plants remain in Pennsylvania, and all but one have plans to retire or transition to a cleaner energy source within the next decade (Legere 2022). In contrast, Pennsylvania plans to have 1.9 gigawatts of gas-fired generation capacity online by 2025 (Max Ober 2021).

Given the dominant role of gas-fired power generation in Pennsylvania, it is more feasible to first reduce greenhouse gas emissions from these plants rather than phase them out directly. The state can use financial incentives or regulatory methods to encourage gas-fired power plants to control GHG emissions. One approach is to offer tax credits to gas-fired power plants that invest in renewable energy projects, purchase renewable energy credits (RECs), and utilize Carbon Capture and Storage (CCS) or low-carbon technologies like combined heat and power (CHP) systems.

Another regulatory option is to set a performance standard for gas-fired power plants, such as a maximum limit on GHG emissions per megawatt-hour of electricity produced. The state could also incorporate gas-fired power turbines into the carbon cap-and-trade system of the RGGI program or establish a new program to control GHG emissions. - Update AEPS and set a new renewable energy goal: Pennsylvania’s Alternative Energy Portfolio Standards Act (AEPS) of 2004 set a state-level renewable energy goal of 8% of “Tier I”2 energy sources by 2021. As of the end of 2021, Pennsylvania has made significant progress toward meeting its renewable energy goals, with all electric distribution companies and all but two electric generation suppliers having met their requirements by acquiring and retiring sufficient Alternative Energy Credits (PA PUC 2022).

However, Pennsylvania’s current sustainable energy usage goal remains at 8% of “Tier I” energy sources as established by the AEPS of 2004, and no long-term goals have been established. This is in contrast to 23 other states and Puerto Rico, which have announced 100% clean energy, carbon-free electricity or net-zero GHG emissions goals by 2050 at the latest (Leon and Ziai 2023).

As of 2022, renewable energy accounted for only 3.54% of total power generation in Pennsylvania, ranking the state 45th in the country, which is significantly lower than the national average of 21.5% (U.S. EIA 2023). In light of this, it is imperative that Pennsylvania not only set renewable energy goals for the next decade, as Governor Shapiro promised during his campaign, but also consider setting long-term, ambitious 100% carbon-free electricity or 100% renewable energy goals. - Tap into solar energy: Pennsylvania has significant potential for clean energy investment, ranging from $16.22 billion to $20.31 billion, with approximately $7 to $9 billion allocated for clean energy projects (Coalition for Green Capital 2017). Among renewable energy sources, solar energy appears to have several advantages. First, solar energy is strongly endorsed by both federal and state governments, as evidenced by the Federal PV Tax Credit and Pennsylvania Solar Renewable Energy Certificate (SREC). Second, a recent opinion survey conducted by Embold Research found that solar energy is the most popular form of renewable energy in Pennsylvania (Embold Research 2022); Third, Google Project Sunroof has identified that a significant percentage (75%) of buildings in Pennsylvania are viable for solar energy (Google Project Sunroof 2019). Finally, the levelized cost of electricity and payback periods for solar energy in Pennsylvania are relatively short compared to other states (U.S. EIA 2022a). Given these promising factors, it is recommended that Pennsylvania reduce barriers to customer and utility participation in solar energy.

Scenario 2: Pennsylvania Does Not Join RGGI

If Pennsylvania decides to withdraw the RGGI program, it is recommended that Pennsylvania not only adopt supplementary policies as discussed in Scenario 1, but also take remedial actions to address existing environmental justice and health problems.

Pennsylvania is the largest electricity exporter in the U.S., exporting 85.5 million megawatt hours in 2021, which was 79.9 percent higher than the second-largest exporter of energy, Alabama (U.S. EIA 2023). Failure to join the RGGI program will result in Pennsylvania continuing to suffer the pollution effects of emission leakage from surrounding RGGI states. These states have been choosing to shift power generation to non-RGGI states as it is cheaper for them than decarbonizing themselves. 43.11% to 85.65% of carbon reduction in RGGI states was leaked to non-RGGI states between 2009 to 2017 (Zhou and Huang 2021), which is one of the reasons that Pennsylvania’s electricity carbon emissions increased by 9.6% between 2020 and 2021, reaching the highest levels since 2016.

The Environmental Protection Agency (EPA) has identified fossil fuel power plants as the largest source of deadly pollutants. If Pennsylvania does not join the RGGI program, several counties, such as Beaver, Indiana, Armstrong, York, and Montour will continue to bear health damages caused by sulfur dioxide emissions, nitrogen oxides and particulate matter 2.5 (PM2.5) emissions (Yang et al. 2021).

Conclusion

Pennsylvania has reaped significant economic benefits from power generation and fuel production as a result of its natural resources. However, its heavy reliance on fossil fuels has become a barrier to achieving a sustainable transformation. Pennsylvania must recognize that sustainable transformation is inevitable, and federal decarbonization regulations will eventually be issued.

At present, Pennsylvania is considerably behind other states in the process of sustainable transformation. Consequently, Pennsylvania must take a more proactive and early approach to decarbonizing the power generation sector, particularly since there is a possibility that the final ruling may reject RGGI legislation.

Zhao Liu

Master Candidate, University of PennsylvaniaZhao Liu is a Master of Environmental Studies Candidate and a Master of Laws Candidate at the University of Pennsylvania.

Coalition for Green Capital. 7/6/2017 2017. Pennsylvania Energy Investment Partnership Report. https://www.nature.org/content/dam/tnc/nature/en/documents/energy-investment-partnership-report-2.pdf.

Embold Research. 2022. ” Vote Solar Poll Results.” Last Modified March 2022. Accessed 3/15/2023. https://votesolar.org/wp-content/uploads/2022/02/PA-Poll-Results-Web-Final-2.pdf.

Google Project Sunroof. 2019. “Estimated rooftop solar potential of Pennsylvania.” Last Modified Jun 2019. Accessed 3/15/2023. https://sunroof.withgoogle.com/data-explorer/place/ChIJieUyHiaALYgRPbQiUEchRsI/.

Legere, Laura. 2022. “Carbon pollution from Pa. power plants is rising – and it’s not just a pandemic bounce.” Post-Gazette, 02/24/202, 2022. Accessed 3/15/2023. https://www.post-gazette.com/business/powersource/2022/02/24/Pennsylvania-carbon-dioxide-emissions-increase-power-plants-coal-gas-RGGI-climate/stories/202202240077.

Leon, Warren, and Anna Ziai. 2023. “Table of 100% Clean Energy States.” Clean Energy States Alliance. Last Modified Feb 2023. Accessed 3/15/2023. https://www.cesa.org/projects/100-clean-energy-collaborative/guide/table-of-100-clean-energy-states/.

Max Ober, Scott Jell. 2021. “Most planned U.S. natural gas-fired plants are near Appalachia and in Florida and Texas.” US EIA. Last Modified 11/22/2021. Accessed 3/15/2023. https://www.eia.gov/todayinenergy/detail.php?id=50436.

PA DEP. 10/6/2022 2022. Pennsylvania Greenhouse Gas Inventory Report 2022. https://files.dep.state.pa.us/Energy/Office%20of%20Energy%20and%20Technology/

OETDPortalFiles/ClimateChange/PennsylvaniaGreenhouseGasInventory2022.pdf.

—. 2023. “Regional Greenhouse Gas Initiative.” Accessed 3/15/2023. https://www.dep.pa.gov/Citizens/climate/Pages/RGGI.aspx.

PA PUC. March 2022 2022. Alternative Energy Portfolio Standards Act of 2004. PA PUC, (PA PUC). https://www.puc.pa.gov/media/1843/aeps-2021-report-030822.pdf.

US EIA. March 2022 2022a. Levelized Costs of New Generation Resources in the Annual Energy Outlook 2022. https://www.eia.gov/outlooks/aeo/pdf/electricity_generation.pdf.

—. 2023. “Electricity Data Browser.” Accessed 3/15/2023. https://www.eia.gov/electricity/data/browser/.

US EIA, tir. 2022b. “Pennsylvania State Profile and Energy Estimates.” Last Modified 11/17/2022. Accessed 3/15/2023. https://www.eia.gov/state/analysis.php?sid=PA#1.

Yan, Jingchi. 2021. “The impact of climate policy on fossil fuel consumption: Evidence from the Regional Greenhouse Gas Initiative (RGGI).” Energy Economics 100: 105333.

Yang, Hui, An Thu Pham, Joel Reid Landry, Seth Adam Blumsack, and Wei Peng. 2021. “Emissions and health implications of Pennsylvania’s entry into the regional greenhouse gas initiative.” Environmental Science & Technology 55 (18): 12153-12161.

Zhou, Yishu, and Ling Huang. 2021. “How regional policies reduce carbon emissions in electricity markets: Fuel switching or emission leakage.” Energy Economics 97: 105209.

By: Walter Johnsen

As a society, we are at the cusp of a historic infrastructure transition to replace our fossil-fuel derived energy ecosystem with one centered on renewable energy. Recent disasters such as the 2020 fires in eastern Australia, ongoing droughts in Northern Africa, or unprecedented flooding of urban centers in Gyeongju City, South Korea dictate the need to accelerate transition away from fossil fuels and limit climate change to 1.9 ˚C of warming (Cappucci, 2021; Kim & Lee, 2022; Mahmoud, Gan, Allan, Li, & Funk, 2022). Excitingly, projections by IEA show that energy from renewable sources will overtake coal by as soon as 2025.

The large-scale replacement of fossil-fuel energy infrastructure with renewables will pose a new challenge: how do you store energy between when it is produced and when it is used? Renewables generate electricity, which if not immediately used, must be stored. Currently, the dominant methods to store electricity in the US are pumped hydroelectric (94%), batteries (2.7%), and thermal energy (2.5%) (DOE Office of Science 2022).

However, the status quo technologies are not amenable to the scale and duration demanded for a fully electrified society. In the US, most geological areas suitable for pumped hydroelectric systems already have the technology installed, preventing it from being further scaled (Pumped Storage Hydropower, 2022). Batteries require large amounts of rare metals, have a low energy storage per unit mass, and degrade over time, making them infeasible for grid level energy storage (Huang & Li, 2022; Masias, Marcicki, & Paxton, 2021).

In the context of these existing energy storage technologies, additional strategies should be considered that contain a high energy per unit mass, have a long duration of storage, and require few rare metals. One such avenue is solar fuels.

“Solar fuels” is an umbrella term to describe energy-dense chemicals produced using energy from the sun. Catalysts powered by solar energy transform abundant chemicals such as water (H2O), nitrogen gas (N2), or carbon dioxide (CO2) into high energy chemicals such as hydrogen gas (H2), ammonia (NH3), or ethanol (C2H5OH), respectively (DOE Explains… Solar Fuels, 2022).

The chemical processes require trace amounts of precious metals as catalysts. The formed chemical fuels can be stored for long durations, and the energy contained in them can later be accessed upon either combustion or electrochemical processes as seen in fuel cells. The advantages of solar fuels for long duration and grid level storage warrants a deeper look into avenues that will accelerate the technology’s use.

Many different chemicals are being pursued as solar fuels including hydrogen, hydrazine, ammonia, formic acid, carbon monoxide, methanol, ethanol, and ethylene. Each proposed fuel differs in its fundamental physical properties including energy per mass, energy per volume, and physical state at atmospheric pressure and temperature, allowing for a context-specific deployment of solar fuels. For example, the high energy per mass intrinsic to hydrogen lends it applicable to contexts where weight must be limited, such as air transportation and shipping (Furchgott, 2021). In fact, last January, Kawasaki Heavy Industries began sea trials of the world’s first hydrogen cargo ship (Murtaugh, 2019). Conversely, a fuel with a high energy per volume ratio such as ethanol could find use for seasonal energy storage in cities, where space is limited.

Harnessing the sun’s energy to synthesize chemical fuels is a technology still in its infancy. The state-of-the-art catalysts used to create solar fuels through incorporating solar energy into high energy bonds are inefficient and often make a variety of byproducts. The scale up of such catalysts beyond research scale poses additional challenges of sourcing chemical precursors, designing reactors that evenly distribute solar energy, and effectively separating desired products from catalysts (Mustafa, Lougou, Shuai, Wang, & Tan, 2020). In parallel, modular systems that decouple the solar harvesting step from the high energy bond formation step meet inefficiencies each time energy is transferred and transformed between systems (De Luna et al., 2019).

But through public-funded research, private sector engagement, and proactive policy at the federal and state levels, solar fuels could reasonably attain wide-scale deployment in a decarbonized future. Specifically, federally funded research can be leveraged to overcome current shortcomings of solar fuel technology. Early engagement of the private sector will lead to advances in scaling solar fuel technology from beyond research scale. Finally, federal and state policy in the form of subsidies and taxes can accelerate when solar fuels achieve market viability.

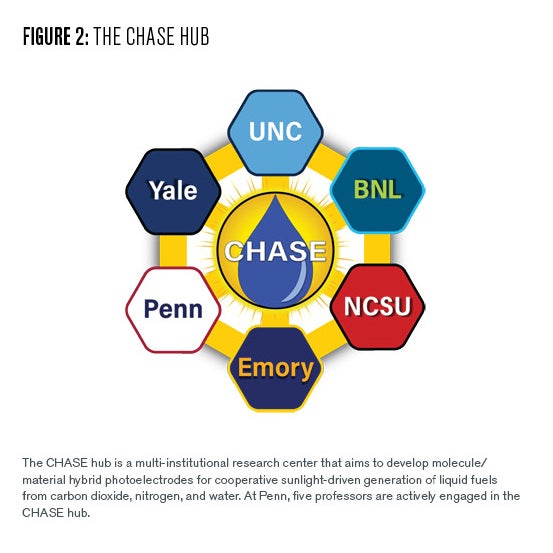

Fundamental research at public institutions and universities is one avenue to achieve major advancements in solar fuel technology. Here at the University of Pennsylvania, researchers are actively engaged in a $40-million Department of Energy (DOE) multi-institution research center, the Center for Hybrid Approaches in Solar Energy to Liquid Fuels (CHASE), to design new solar-fuel forming systems. Through fostering collaboration among researchers at Penn, Brookhaven National Lab, UNC, Yale, Emory, and NC State University, the CHASE hub aims to develop three brand new solar fuel forming systems. Additional funding opportunities for solar fuel technology and increased opportunities for collaboration between researchers will enable further progress on solar fuel technology.

In conjunction with fundamental academic research, early recruitment of the private sector is vital to accelerate deployment of solar fuel technology. Private sector companies can identify early markets, and through deploying the technology, discover innovations that further drive down costs.

One company, AIR Company, is already using solar fuel forming systems to synthesize lubricants, soaps, aviation fuel, and vodka from carbon dioxide, water, and sunlight. Initially, AIR Company used its patented technology to synthesize ethanol which was subsequently used to make vodka. AIR Company chose vodka as an initial market because its vodka made from sunlight and carbon dioxide was cost competitive with premium vodkas (Kang, 2020).

Since launching, AIR Company has continued to innovate their trademark systems, subsequently decreasing their manufacturing costs. As a result, AIR Company has been able to expand into the soap, lubricant, and aviation fuel market (Bettenhausen, 2022). Competition between additional private companies will further accelerate innovation toward market-viable solar fuel technologies.

Federal and state policies will have a profound impact on whether solar fuels will be used as an energy storage technology. Federal policy can facilitate their adoption by subsidizing fuels and chemicals formed from sunlight and taxing fossil-fuel derived chemicals. By driving down the costs of solar fuels and increasing the costs of fossil fuels, policy would expedite solar fuels’ path to market viability. In parallel, infrastructure needed for solar fuel deployment can be proactively built. This can include gradually changing shipping fleets from gas-based to hydrogen-based, building pipelines capable of carrying proposed solar fuels, and expanding existing solar farms. States can accelerate solar fuel adoption by incentivizing solar farm development on private and state land, pledging to decarbonize, and funding solar fuel research at their home research institutions.

Solar fuels are an exciting technology for energy storage in a decarbonized future. Chemical fuels have a plethora of advantages over batteries, including long duration of energy storage. However, the synthesis of energy-dense fuels from abundant chemicals – such as water, nitrogen gas, and carbon dioxide – and sunlight is expensive due to inefficient catalytic systems. With active participation from research institutions, the private sector, and policymakers, solar fuel technology will become cost-viable and deployed.

Walter Johnsen

Student Advisory Council MemberWalter Johnsen is a Ph.D. candidate in the department of chemistry and he was the 2022 Kleinman Philadelphia Energy Authority Fellow. He is also a member of the Kleinman Center’s Student Advisory Council.

Bettenhausen, C. (2022, September 27, 2022). Air Company launches sustainable aviation fuel. Retrieved from https://cen.acs.org/energy/Air-Company-launches-sustainable-aviation/100/web/2022/09

Cappucci, M. (2021, July 27, 2021). Australian fires had bigger impact on climate than covid-19 lockdowns in 2020. Washington Post. Retrieved from https://www.washingtonpost.com/weather/2021/07/27/australian-bushfires-smoke-climate-covid/

De Luna, P., Hahn, C., Higgins, D., Jaffer, S. A., Jaramillo, T. F., & Sargent, E. H. (2019). What would it take for renewably powered electrosynthesis to displace petrochemical processes? Science, 364(6438), eaav3506. doi:doi:10.1126/science.aav3506

DOE Explains… Solar Fuels. (2022). Retrieved from https://www.energy.gov/science/doe-explainssolar-fuels

Electricity Storage. (2022). Retrieved from https://www.epa.gov/energy/electricity-storage

Furchgott, R. (2021, November 15, 2021). Can Hydrogen Save Aviation’s Fuel Challenges? It’s Got a Way to Go. The New York Times. Retrieved from https://www.nytimes.com/2021/11/15/business/airplanes-hydrogen-fuel-travel.html

Huang, Y., & Li, J. (2022). Key Challenges for Grid-Scale Lithium-Ion Battery Energy Storage. Advanced Energy Materials, 12(48), 2202197. doi: https://doi.org/10.1002/aenm.202202197

Kang, A. (2020, August 31, 2020). From CO2 To Vodka: Air Company Launches World’s First Carbon-Negative Spirit. Forbes. Retrieved from https://www.forbes.com/sites/annakang/2020/08/31/from-co2-to-vodka-air-company-launches-worlds-first-carbon-negative-spirit/?sh=32fe44b14f5a

Kim, V., & Lee, C. W. (2022, September 6, 2022). Scenes From the Aftermath of Typhoon Hinnamnor. New York Times. Retrieved from https://www.nytimes.com/2022/09/06/world/asia/scenes-aftermath-typhoon-hinnamnor.html

Mahmoud, S. H., Gan, T. Y., Allan, R. P., Li, J., & Funk, C. (2022). Worsening drought of Nile basin under shift in atmospheric circulation, stronger ENSO and Indian Ocean dipole. Scientific Reports, 12(1), 8049. doi:10.1038/s41598-022-12008-8

Masias, A., Marcicki, J., & Paxton, W. A. (2021). Opportunities and Challenges of Lithium Ion Batteries in Automotive Applications. ACS Energy Letters, 6(2), 621-630. doi:10.1021/acsenergylett.0c02584

Murtaugh, D. (2019, December 11, 2019). World’s First Liquid Hydrogen Ship Debuts in Green Economy Boost. Bloomberg. Retrieved from https://www.bloomberg.com/news/articles/2019-12-12/world-s-first-liquid-hydrogen-ship-debuts-in-green-economy-boost?leadSource=uverify%20wall

Mustafa, A., Lougou, B. G., Shuai, Y., Wang, Z., & Tan, H. (2020). Current technology development for CO2 utilization into solar fuels and chemicals: A review. Journal of Energy Chemistry, 49, 96-123. doi: https://doi.org/10.1016/j.jechem.2020.01.023

Pumped Storage Hydropower. (2022). Retrieved from https://www.energy.gov/eere/water/pumped-storage-hydropower

By: Zakaria Hsain

As the possibility of limiting warming to 1.5oC vanishes out of reach (UNEP 2019), accelerating the transition to net-zero emissions has become an ever more urgent concern. In the U.S., achieving net-zero emissions by 2050 would require at least $2.6 trillion of energy supply-side capital before 2030, and at least $10 trillion by 2050, in addition to comparable demand-side investments (Larson et al. 2020). Thus, removing barriers to the timely and efficient deployment of capital to critical decarbonization and adaptation projects is of paramount importance.

However, U.S. policymakers and multilateral development banks have, domestically and in international climate talks, repeatedly pushed a climate strategy that prioritizes for-profit private capital and restricts public financing of climate projects (Carney 2021; Aronoff 2021; Hook 2022). Under this strategy, governments would merely encourage action from private investors through fiscal incentives, regulatory reforms, and early-stage risk-mitigating investments.

This would limit financing to important projects that either face significant risks to profitability or cannot be monetized, such as many infrastructure and resiliency projects in developing nations, and the plugging of inactive oil and gas wells in the U.S. (Kaminker, Stewart, and Upton 2012; Tall et al. 2021).

A case in point is the “Billions to Trillions” plan: the World Bank tried to attract reticent private capital towards infrastructure and development projects in developing nations but failed, attracting a measly $0.37 of private capital for every $1 of deployed public capital (Attridge and Engen 2019; Gabor 2021).

Underpinning this strategy is the belief that money is finite and public financial capacity constrained. U.S. Climate Envoy John Kerry echoed this belief in recent remarks: “No government in the world has enough money to solve the climate crisis […] There is only one place you find the money we need in the trillions of dollars. That’s the private sector” (Hook 2022). But to what extent is this statement true? Is our collective financial capacity constrained in the face of climate change?

Currency Issuers and Financial Constraints

Mainstream macroeconomics textbooks tell us that governments finance their spending either through taxes or borrowing from the private sector (Jones 2010). This theory underpins the notion, held by Kerry and other policymakers, that public finance cannot provide the trillions needed for climate investment, which necessitates the reliance on private capital.

In reality, nations, such as the U.S. (L. R. Wray 2015), the U.K. (Berkeley et al. 2022), and Japan (Mitchell 2022), that issue their own currencies, maintain flexible exchange rates, and hold little foreign currency-denominated debt can pursue their policy goals with no financial constraint. With its immense foreign exchange reserves (over $3 trillion), China could be considered part of this group of nations despite retaining tight control of its exchange rate (L. R. Wray and Liu 2014).

When a currency-issuing national government spends, it creates its own currency, through digital entries in the banking system, and can purchase labor, technology, natural resources, or anything else offered for sale in its own currency, no matter the price (L. R. Wray 2015; Mosler 2010; Kelton 2020). In other words, the U.S. government can purchase anything offered for sale in U.S. dollars, and the U.K. government can purchase anything offered for sale in British pounds.

Unlike a household, firm, or local government, a currency-issuing national government does not need to first collect taxes or issue debt instruments to spend (Bell 1998). In the U.S., this fact was recognized as early as the 1940s by Federal Reserve officials (Ruml 1946; Kaiser-Schatzlein 2020). Yet, taxes and public debt still serve important purposes. Taxes, which can only be paid using the government’s own currency, create and regulate demand for this otherwise worthless currency, while public debt instruments, such as Treasury bonds, are primarily intended to regulate interest rates (L. R. Wray 1998; Tymoigne and Wray 2013; L. R. Wray 2015).

The Inflation Constraint

Though facing no financial constraints, nations such as the U.S. must contend with real economic constraints imposed by the productive capacity of the economy and the availability of underutilized labor, commodities, and machinery. Running up against these constraints without preemptive policy measures may lead to excessive inflation (L. R. Wray 2015; Kelton 2020).

Inflation can be defined as an increase in the level of prices across the economy. Fundamentally, the price level is dictated, first, by the prices that the national government, as the monopoly issuer of the currency, pays when it spends, and, second, by all other prices derived from markets through the interaction of supply and demand, the relative power of buyers and sellers, and the influence of government policy and institutions (Levey 2021; Mosler 2023).

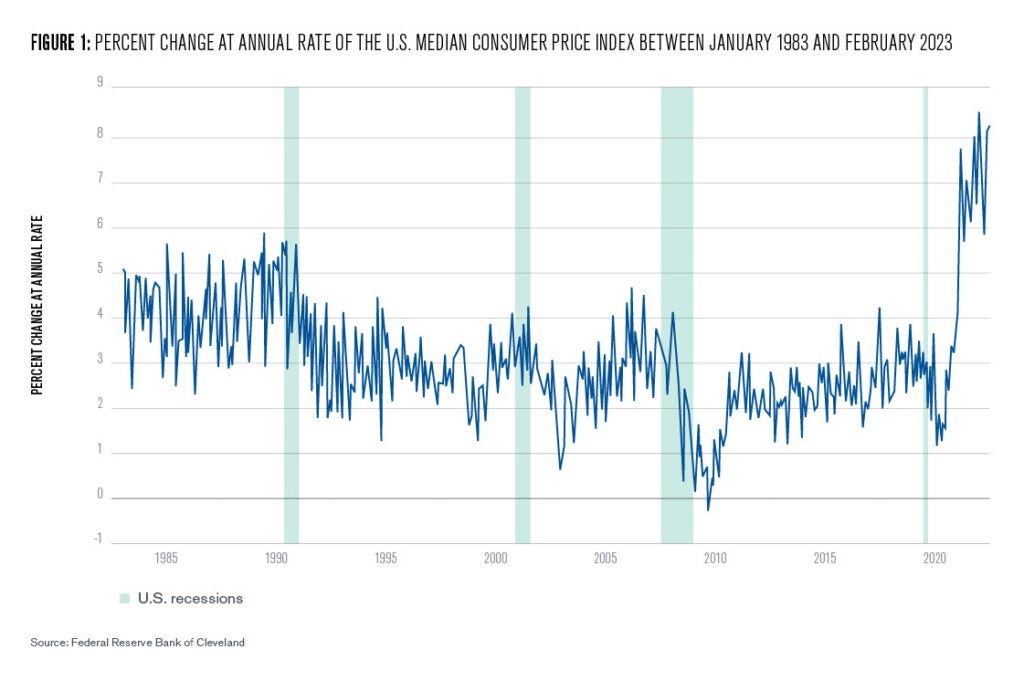

In practical terms, inflation may arise when the government outbids the private sector for fully utilized resources but could also be due to bottlenecks in supply chains or in specific sectors, abusive price setting by monopolies or oligopolies, supply-constraining regulations, or geopolitical shocks (Kim et al. 2022; Konczal and Lusiani 2022; Fullwiler et al. 2019). While it is difficult to empirically quantify the price level, the U.S. Consumer Price Index, a weighted average of the prices of a sample of consumer goods and services, is considered to be a useful approximation (Fig. 1).

In the context of the U.S. transition to net-zero emissions, pressures on the price level can arise from delaying or blocking the buildout of critical infrastructure. Case in point: high-voltage transmission lines, which would bring cheap renewable electricity to high-demand population centers, but can take over 15 years to complete, largely due to a complicated and poorly coordinated regulatory environment, lengthy permitting processes, and conflicts over cost allocation and land use (Klump and Behr 2021).

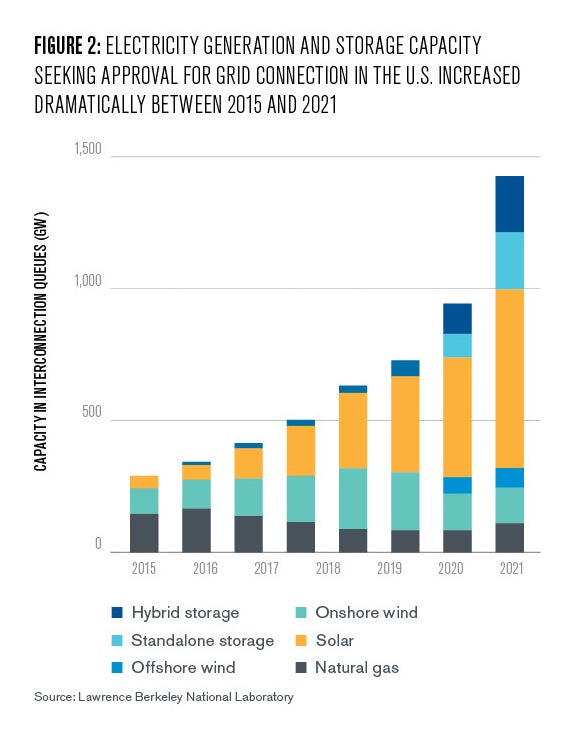

These transmission lines would ease a ballooning nationwide backlog of renewable generation and storage projects waiting to be approved for grid connection (Rand et al. 2022; Bruggers 2022) (Fig. 2), thus accelerating the transition to a 100% emissions-free grid (Jenkins et al. 2022). Without them, electricity prices in sparsely populated regions with abundant wind and solar resources can drop into negative territory, while population centers in the Northeast and California pay high prices for electricity from high-marginal-cost fossil fuel plants (Malik 2022; Lazard 2021).

Pressures on the price level can also arise from excessive costs and consistent budget overruns in the planning and execution of climate projects. In this regard, the U.S. is notorious for the excessively high cost of building high-density housing, public transit, and energy and industrial infrastructure, which has been attributed to a range of factors from shortcomings in project management and institutional structures (Goldwyn et al. 2023; Eash-Gates et al. 2020), to the intensification of “Not In My Backyard” citizen opposition empowered by local, state, and federal regulations (Zullo 2023; Potter, Datta, and Stapp 2022; Brooks and Liscow 2021). High project costs not only diminish the impact of capital investments, but also inflate the prices of the goods and services that these investments enable.

Mobilizing Trillions without Inflation

The U.S. transition to net-zero emissions is projected to only cost 1–5 % of GDP annually (Nersisyan and Wray 2019; Larson et al. 2020). Maintaining price stability is crucial to maximize the impact of every dollar invested and to, more importantly, preserve and grow the political support needed for the transition to succeed.

Historically, the main tool used to restore price stability in the event of an inflationary shock has been interest rate management by the Federal Reserve (Fed), but this tool has proven over decades of trial and error to be ineffective at best, and counterproductive at worst (Papadimitriou and Wray 2021; Spross 2018; Sharpe and Suarez 2015). Price stability can be more effectively preserved through a set of targeted and preemptive policy interventions, which are listed below from the most benign to the most coercive:

Targeted Capital Allocation

Projects in communities and economic sectors with the highest rates of underutilized labor and resources, such high-unemployment communities, would benefit from priority capital allocation (Hockett 2020). These projects would have the greatest economic impact and the lowest inflationary risk.

Targeted investments that increase productive capacity or lead to a short-term deflationary impact, could also be prioritized to enable planned inflationary investments. For instance, investing in the domestic capacity for mining and processing critical minerals may reduce the costs of producing electric vehicles and other clean energy technologies (Serpell et al. 2020).

Open Market Operations

The Fed regulates the price of money (i.e., interest rate) by trading Treasury securities. Yet, equally, if not more, important are the prices of labor (wages), energy, and agricultural and mineral commodities. The Fed and its regional banks could engage in trading in commodity markets to mitigate volatility and counteract speculative activity (Hockett 2022). Federal agencies with relevant jurisdiction could also maintain buffer stock programs similar to the Strategic Petroleum Reserve (U.S. Department of Energy 2022).

In the case of labor, open market operations would take the form of a job guarantee program that would continuously develop lists of useful projects in coordination with local governments and nonprofits and hire anyone willing to work in return for a predefined living wage and benefit package (Tcherneva 2020; Hockett 2019). If designed well, it could eliminate involuntary unemployment, set the minimum standard for labor remuneration, and act as a powerful countercyclical economic stabilizer. Versions of this program were implemented in Argentina and India with largely positive outcomes (Azam 2011; Kostzer 2008).

Targeted Bond Sales

Treasury bonds with attractive returns could be offered for sale in localities at risk of inflationary pressures. These bonds would drain private savings, thus reducing consumer demand for the goods and services needed for climate projects. To streamline these bond sales, Congress could allow all U.S. residents, firms, and local governments to hold deposit accounts directly at the Fed (Omarova 2021; Hockett 2020). This reform would foster financial inclusion, greatly streamline transactions, and support the development of digital ledger technologies (Hockett 2020).

Corporate and Financial Regulation

A broad financial regulatory toolkit, that goes beyond interest rate management, could be employed to constrain credit growth and reduce speculation, both in the aggregate and in discrete sectors (Tankus 2022). Additionally, effective enforcement of corporate regulations, especially antitrust laws, would mitigate price collusion and the undue price-setting power of large market players, which can be significant drivers of inflation (Greeley 2019; Konczal and Lusiani 2022).

Regulatory and Institutional Reform

To enable the completion of climate projects at lower cost and in shorter time frames, the U.S. has to engage in a politically fraught reform of permitting and zoning regulations at the local, state, and federal levels. An important potential target for reform is the environmental review process mandated by the National Environmental Policy Act of 1969 (NEPA) and equivalent state laws, which have consistently inflated the timelines and costs of projects through drawn-out litigation and administrative procedure Potter et al. 2022).

Two components of a NEPA reform might be to, first, constrain the scope and time limit of lawsuits that a proposed project may face, and second, designate, through a broad time-limited consultative process, geographic areas that allow streamlined litigation-proof permitting for specific categories of projects that meet a set of pre-defined specifications.

Another approach to reduce project costs is to improve institutional coordination and project management practices. This may include setting up a federal-level agency that coordinates large projects across state and local jurisdictions (Hockett 2020), and strengthens in-house technical, legal, and management expertise within public agencies to improve the oversight of contractors and minimize the use of expensive consultants (Goldwyn et al. 2023).

Price Controls

During World War II, the U.S. introduced a system of rationing and price controls overseen by the Office of Price Administration to manage the prices of resources needed for the war effort (Jacobs 1997). To mobilize resources for rapid decarbonization and adaptation, price control systems may be established not only to prevent price gouging in critical sectors, but also to release resources from private use while protecting living standards.

One such system, arguably “the most powerful anti-inflationary tool the government has” (Galbraith 2022), is a publicly-funded single-payer health insurance program such as Medicare for All. It would not only yield widespread social and health benefits, but would also have a deflationary impact equivalent to 2.6–3.7 % of GDP (Nersisyan and Wray 2019), thus wresting many thousands of workers and immense resources from the current multi-payer system, so they can be shifted to productive climate projects.

Targeted Taxation

Taxes drive demand for the sovereign currency, and can, thus, be used as a potent, albeit coercive and unpopular, tool to decrease purchasing power in targeted localities or sectors of the economy. Taxes could also be used to discourage polluting activities (e.g., carbon tax) or speculation in financial markets (e.g., financial transaction tax) (Hockett 2020).

Conclusion

Transitioning to a net-zero emissions economy will require the timely deployment of trillions of dollars to transform our carbon-intensive modes of production and consumption. Nations, such as the U.S., that issue their own free-floating currencies face no financial constraint, but must contend with a binding price stability constraint which can be managed through targeted policy interventions such as open market operations, price controls, regulatory and institutional reform, and taxation. Though our collective financial capacity may be unlimited, we are limited by the availability of labor, land, commodities, and technology, as well as by our ability to regulate and coordinate their deployment in a manner that preserves price stability while matching the urgency of the transition.

Zakaria Hsain

Ph.D. Mechanical Engineering and Applied MechanicsZakaria Hsain holds a Ph.D. in mechanical engineering and applied mechanics from Penn and is a former Kleinman Center research assistant. He is a fellow at the Hydrogen and Fuel Cell Technologies Office at the U.S. DOE.

Aronoff, Kate. 2021. “The White House’s New Climate Strategy: Let Businesses Solve It.” The New Republic, November 2021. https://newrepublic.com/article/164279/white-house-climate-business-cop26.

Attridge, Samantha, and Lars Engen. 2019. “Blended Finance in the Poorest Countries: The Need for a Better Approach.” London. https://odi.org/en/publications/blended-finance-in-the-poorest-countries-the-need-for-a-better-approach/.

Azam, Mehtabul. 2011. “The Impact of Indian Job Guarantee Scheme on Labor Market Outcomes: Evidence from a Natural Experiment.” SSRN Electronic Journal. https://doi.org/10.2139/ssrn.2062747.

Bell, Stephanie. 1998. “Can Taxes and Bonds Finance Government Spending?” 244. Annandale-on-Hudson, NY.

Berkeley, Andrew, Josh Ryan-collins, Richard Tye, and Neil Wilson. 2022. “The Self-Financing State: An Institutional Analysis of Government Expenditure, Revenue Collection and Debt Issuance Operations in the United Kingdom.” WP 2022/08. London. https://www.ucl.ac.uk/bartlett/public-purpose/sites/bartlett_public_purpose/files/the_self-financing_state_an_institutional_analysis_of_government_

expenditure_revenue_collection_and_debt_issuance_operations_in_the_united_kingdom.pdf.

Bertrand, Savannah. 2021. “Plugging Orphaned Oil and Gas Wells Provides Climate and Jobs Benefits.” Environmental and Energy Study Institute. 2021. https://www.eesi.org/articles/view/plugging-orphaned-oil-and-gas-wells-provides-climate-and-jobs-benefits.

Brooks, Leah, and Zachary Liscow. 2021. “Can America Reduce Highway Spending? Evidence from the States.” In Economic Analysis and Infrastructure Investment, edited by Edward L. Glaeser and James M. Poterba, 107–50. University of Chicago Press. https://www.nber.org/system/files/chapters/c14356/c14356.pdf.

Bruggers, James. 2022. “Overwhelmed by Solar Projects, the Nation’s Largest Grid Operator Seeks a Two-Year Pause on Approvals.” Inside Climate News, February 2022. https://insideclimatenews.org/news/02022022/pjm-solar-backlog-eastern-power-grid/.

Carney, Mark. 2021. “Building a Private Finance System for Net-Zero: Priorities for Private Finance for COP26.” Glasgow. https://ukcop26.org/wp-content/uploads/2020/11/COP26-Private-Finance-Hub-Strategy_Nov-2020v4.1.pdf.

Cruz-hidalgo, Esteban, Dirk H Ehnts, and Pavlina R Tcherneva. 2019. “Completing the Euro: The Euro Treasury and the Job Guarantee.” Revista de Economía Crítica 27: 100–111.

Eash-Gates, Philip, Magdalena M. Klemun, Goksin Kavlak, James McNerney, Jacopo Buongiorno, and Jessika E. Trancik. 2020. “Sources of Cost Overrun in Nuclear Power Plant Construction Call for a New Approach to Engineering Design.” Joule 4 (11): 2348–73. https://doi.org/10.1016/j.joule.2020.10.001.

Fullwiler, Scott, Rohan Grey, and Nathan Tankus. 2019. “An MMT Response on What Causes Inflation.” Financial Times, March 1, 2019. https://www.ft.com/content/539618f8-b88c-3125-8031-cf46ca197c64.

Gabor, Daniela. 2021. “The Wall Street Consensus.” Development and Change 52 (3): 429–59. https://doi.org/10.1111/dech.12645.

Galbraith, James K. 2022. “How the Left Should Think About Inflation.” The Nation, February 2022. https://www.thenation.com/article/economy/inflation-federal-reserve/.

Goldwyn, Eric, Alon Levy, Elif Ensari, and Marco Chitti. 2023. “Transit Costs Project: Understanding Transit Infrastructure Costs in American Cities.” New York. https://transitcosts.com/final-report/.

Greeley, Brendan. 2019. “When DOJ and the FCC Slowed Inflation.” Financial Times, March 28, 2019. https://www.ft.com/content/2e30057e-b0d2-357a-8a9b-9052308918f8.

Hart, Nina M., and Linda Tsang. 2021. “National Environmental Policy Act: Judicial Review and Remedies.” https://crsreports.congress.gov/product/pdf/IF/IF11932.

Ho, Jacqueline S., Jhih Shyang Shih, Lucija A. Muehlenbachs, Clayton Munnings, and Alan J. Krupnick. 2018. “Managing Environmental Liability: An Evaluation of Bonding Requirements for Oil and Gas Wells in the United States.” Environmental Science and Technology 52 (7): 3908–16. https://doi.org/10.1021/acs.est.7b06609.

Hockett, Robert C. 2019. “Open Labor Market Operations.” Challenge 62 (2): 113–27. https://doi.org/10.1080/05775132.2019.1583418.

———. 2020. Financing the Green New Deal: A Plan for Action and Renewal. Palgrave Macmillan. https://doi.org/10.1007/978-3-030-48450-7.

———. 2022. “Central Banks Can, Must, And Will Collar Commodity Prices.” Forbes, March 2022. https://www.forbes.com/sites/rhockett/2022/03/23/central-banks-can-must-and-will-collar-commodity-prices/.

Hook, Leslie. 2022. “US Climate Envoy John Kerry Warns World against Turning Back to Coal.” Financial Times, May 12, 2022. https://www.ft.com/content/29ac22a8-b12d-4234-8ef7-e680cf44e731.

Jacobs, Meg. 1997. “‘How about Some Meat?’: The Office of Price Administration, Consumption Politics, and State Building from the Bottom up, 1941-1946.” Journal of American History 84 (3): 910–41. https://doi.org/10.2307/2953088.

Jenkins, Jesse D, Jamil Farbes, Ryan Jones, Neha Patankar, and Greg Schivley. 2022. “Electricity Transmission Is Key to Unlock the Full Potential of the Inflation Reduction Act.” Princeton, NJ. https://doi.org/10.5281/zenodo.7106176.

Jones, Charles I. 2010. Macroeconomics. 2nd ed. W. W. Norton & Company.

Kaboub, Fadhel. 2006. “A Roadmap to Full Employment and Price Stability for Developing Countries: The Case of Tunisia.” University Of Missouri – Kansas City.

Kaiser-Schatzlein, Robin. 2020. “The Government Can Afford Anything It Wants.” The New Republic, June 2020. https://newrepublic.com/article/158221/government-can-afford-anythi-wants.

Kaminker, Christopher, Fiona Stewart, and Simon Upton. 2012. “The Role of Institutional Investors in Financing Clean Energy.” Paris. http://www.oecd.org/sd-roundtable/papersandpublications/50363886.pdf.

Kelton, Stephanie. 2020. The Deficit Myth: Modern Monetary Theory and the Birth of the People’s Economy. PublicAffairs.

Kim, Kenneth, George Rao, and Meagan Martin. 2022. “Economic Analysis: Russia-Ukraine War Impact on Supply Chains and Inflation.” https://www.kpmg.us/insights/2022/russia-ukraine-war-impact-supply-chains-inflation.html.

Klump, Edward, and Peter Behr. 2021. “What a $2B Texas Project Says about U.S. Quest for CO2-Free Grid.” E&E News. 2021. https://www.eenews.net/articles/what-a-2b-texas-project-says-about-u-s-quest-for-co2-free-grid/.

Konczal, Mike, and Niko Lusiani. 2022. “Prices, Profits, and Power : An Analysis of 2021 Firm-Level Markups.” https://rooseveltinstitute.org/wp-content/uploads/2022/06/RI_PricesProfitsPower_202206.pdf.

Kostzer, Daniel. 2008. “Argentina: A Case Study on the Plan Jefes y Jefas de Hogar Desocupados, or the Employment Road to Economic Recovery.” 534. Annandale-on-Hudson, NY. https://doi.org/10.2139/ssrn.1132772.

Larson, Eric, Chris Greig, Jesse Jenkins, Erin Mayfield, Andrew Pascale, Chuan Zhang, Joshua Drossman, et al. 2020. “Net-Zero America: Potential Pathways, Infrastructure, and Impacts.” https://netzeroamerica.princeton.edu/the-report.

Lazard. 2021. “Lazard’s Levelized Cost of Energy Analysis – Version 15.0.” https://www.lazard.com/media/451881/lazards-levelized-cost-of-energy-version-150-vf.pdf.

Levey, Samuel. 2021. “Modeling Monopoly Money: Government as the Source of the Price Level and Unemployment.” 992. Annandale-on-Hudson, NY. https://doi.org/10.2139/ssrn.3914919.

Malik, Naureen S. 2022. “Negative Power Prices? Blame the US Grid for Stranding Renewable Energy.” Bloomberg. 2022. https://www.bloomberg.com/news/articles/2022-08-30/trapped-renewable-energy-sends-us-power-prices-below-zero.

Mitchell, Bill. 2022. “The Japanese Denial Story – Part 1.” 2022. http://bilbo.economicoutlook.net/blog/?p=48952.

Mosler, Warren. 2010. Seven Deadly Innocent Frauds of Economic Policy. Valance Co. http://moslereconomics.com/wp-content/powerpoints/7DIF.pdf%5Cnpapers2://publication/uuid/1D7CE85A-EB40-4F2F-B208-820076A37385.

———. 2023. “A Framework for the Analysis of the Price Level and Inflation.” In Modern Monetary Theory, edited by L. Wray, Phil Armstrong, Sara Holland, Claire Jackson-Prior, Prue Plumridge, and Neil Wilson, 87–93. Edward Elgar Publishing.

Nersisyan, Yeva, and L. Randall Wray. 2019. “How to Pay for the Green New Deal.” 931. https://www.levyinstitute.org/pubs/wp_931.pdf.

Omarova, Saule. 2021. “The People’s Ledger: How to Democratize Money and Finance the Economy.” Vanderbilt Law Review 74 (5). https://doi.org/10.2139/ssrn.3715735.

Papadimitriou, Dimitri B., and L. Randall Wray. 2021. “Still Flying Blind After All These Years: The Federal Reserve’s Continuing Experiments With Unobservables.” https://www.levyinstitute.org/pubs/ppb_156.pdf.

Potter, Brian, Arnab Datta, and Alec Stapp. 2022. “How to Stop Environmental Review from Harming the Environment Permitting Reform Is an Opportunity to Accelerate Decarbonization.” Washington, DC. https://progress.institute/environmental-review/.

Raimi, Daniel, Alan J. Krupnick, Jhih Shyang Shah, and Alexandra Thompson. 2021. “Decommissioning Orphaned and Abandoned Oil and Gas Wells: New Estimates and Cost Drivers.” Environmental Science and Technology 55 (15): 10224–30. https://doi.org/10.1021/acs.est.1c02234.

Raimi, Daniel, Neelesh Nerurkar, and Jason Bordoff. 2020. “Green Stimulus for Oil and Gas Workers : Considering a Major Federal Effort To Plug Orphaned and Abandoned Wells.” https://www.energypolicy.columbia.edu/sites/default/files/file-uploads/OrphanWells_CGEP-Report_071620.pdf.

Rand, Joseph, Ryan Wiser, Will Gorman, Dev Millstein, Joachim Seel, Seongeun Jeong, and Dana Robson. 2022. “Queued Up: Characteristics of Power Plants Seeking Transmission Interconnection As of the End of 2021.” https://emp.lbl.gov/queues.

Ruml, Beardsley. 1946. “Taxes for Revenue Are Obsolete.” American Affairs 8 (1).

Serpell, Oscar, Wan-Yi “Amy” Chu, Benjamin Paren, and Giridhar Sankar. 2020. “Feasibility of Seasonal Storage for a Fully Electrified Economy.”

Sharpe, Steve A, and Gustavo A Suarez. 2015. “Why Isn’t Investment More Sensitive to Interest Rates: Evidence from Surveys.” 2014–002. Finance and Economics Discussion Series. Washington, DC. https://www.federalreserve.gov/econresdata/feds/2014/files/201402r.pdf.

Spross, Jeff. 2018. “Everyone Loves Paul Volcker. Everyone Is Wrong.” The Week, December 2018. https://theweek.com/articles/810196/everyone-loves-paul-volcker-everyone-wrong.

Tall, Arame, Sarah Lynagh, Candela Blanco Vecchi, Pepukaye Bardouille, Felipe Montoya Pino, Elham Shabahat, Vladimir Stenek, et al. 2021. “Enabling Private Investment in Climate Adaptation and Resilience.” Washington, DC. https://doi.org/10.1596/35203.

Tankus, Nathan. 2022. “The New Monetary Policy: Reimagining Demand Management and Price Stability in the 21st Century.” https://files.modernmoney.network/M3F000001.pdf.

Tcherneva, Pavlina R. 2020. The Case for a Job Guarantee. Polity Press.

Tymoigne, Éric, and L Randall Wray. 2013. “Modern Monetary Theory 101: A Reply to Critics.” 778. Annandale-on-Hudson, NY. http://www.levyinstitute.org/pubs/wp_778.pdf.

U.S. Department of Energy. 2022. “Strategic Petroleum Reserve.” 2022. https://www.energy.gov/fecm/strategic-petroleum-reserve-9.

UNEP. 2019. “Emissions Gap Report 2019.” Nairobi. https://wedocs.unep.org/bitstream/handle/20.500.11822/30797/EGR2019.pdf?sequence=1&isAllowed=y.

Wray, L. Randall. 1998. “Money and Taxes: The Chartalist Approach.” 222. https://papers.ssrn.com/sol3/papers.cfm?abstract_id=69409.

———. 2015. Modern Money Theory: A Primer on Macroeconomics for Sovereign Monetary Systems. 2nd ed. Palgrave McMillan.

Wray, L Randall, and Xinhua Liu. 2014. “Options for China in a Dollar Standard World: A Sovereign Currency Approach.” 783. https://www.levyinstitute.org/pubs/wp_783.pdf.

Zullo, Robert. 2023. “Across the Country, a Big Backlash to New Renewables Is Mounting.” Idaho Capital Sun, February 16, 2023. https://idahocapitalsun.com/2023/02/16/across-the-country-a-big-backlash-to-new-renewables-is-mounting/.

By: Derek Jones

Introduction

High up-front costs have created an EV market where, in general, ownership is limited to upper-middle-class, white communities. As a result, the associated EV charge infrastructure has been placed geographically where EV adoption and/or charger demand are relatively high. This makes logical sense: Why place an EV charger where it is unlikely to be utilized?

However, several issues related to social and technological inclusion arise from the uneven distribution of EV charge infrastructure. Furthermore, current policies in heavily urbanized environments make it challenging—oftentimes impossible—to own a personal EV charger, especially if you are a renter. An equity issue related to charging access is forming in the city of Richmond. A continuation of this trend would exclude disadvantaged communities from feasibly participating in what many would argue is a foregone conclusion in America, the electrification of our automobile fleet.

Beyond this, refusing to take an active role in the EV transition would unnecessarily hinder Richmond’s 2050 climate goals. RVAGreen 2050 set the achievable target of a “45% reduction in greenhouse gas emissions by 2030, below 2008 levels, and net-zero emissions by 2050.” Of Richmond’s greenhouse gas emissions, roughly 30% comes from transportation (RVAGreen 2050 2022). Therefore, Richmond should take steps to foster equitable EV charger distribution as a means to contribute to the decarbonization efforts stated in RVAGreen 2050.

Challenges and Solutions

Technology Challenges: Charger Type

The main types of chargers used today are Level 1, Level 2, and Direct Current Fast Chargers (DCFC) (Moloughney 2021). DCFCs are by far the most attractive for consumers due to their fast charge times. However, they are currently the most expensive and can cost up to $40,000 per unit (Moloughney 2021). On the other hand, Level 2 chargers present a cost-effective option that is viable for Richmond and palatable for consumers.

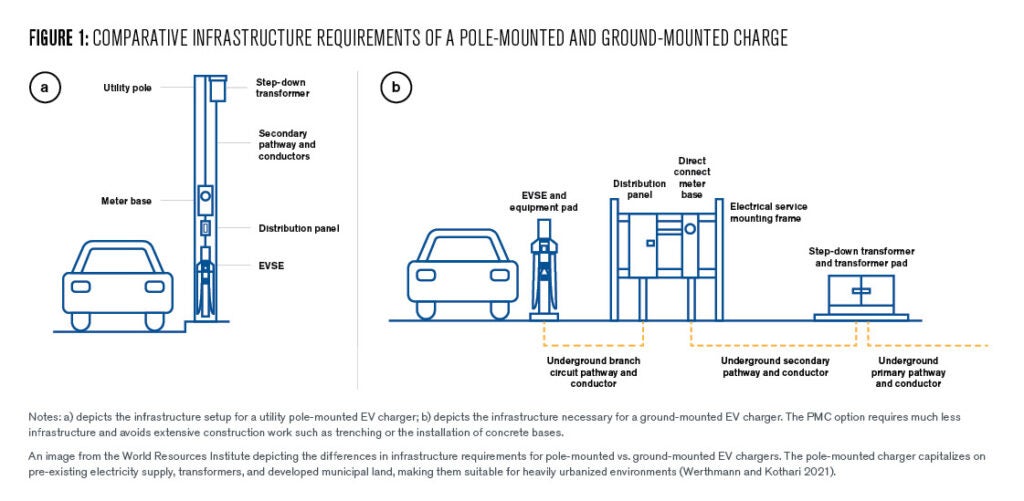

An elegant solution that offers maximum utility and cost savings is the pole-mounted charger, which is simply an EV charger mounted to a utility pole or streetlight. Pole-mounted chargers offer several unique benefits over traditional ground-mount chargers in urban environments. Most notably, they require far less infrastructure and investment to install. The World Resources Institute estimates a 55–70% installation cost savings on average when compared to ground-mounted systems (Werthmann and Kothari 2021)

Policy Challenges:

Zoning Ordinance

The first policy challenges that many urban EV owners encounter are zoning ordinances, which prohibit running an electrical cord across the sidewalk onto the street, since this would obstruct the public right of way as well as create obvious safety concerns. Rather than amend this policy, one solution that is proposed would be to implement adequate public, pole-mounted charging access. Just as gas car drivers are not required to invest in private fuel reserves, EV owners should not be required to own charging infrastructure.

Renters Are Being Left Behind

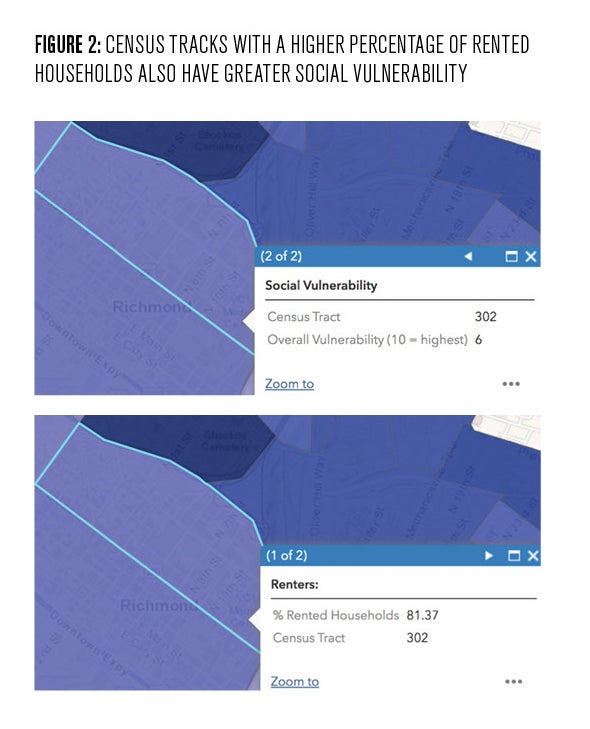

However, the fact of the matter is charger ownership is still necessary due to a lack of robust, public charging networks. This excludes renters, who are unable to make any upgrades or modifications to their unit without a landlord’s approval. In disadvantaged communities, landlords are often not willing to upgrade their units for fear of increasing property values, thus increasing rents. This relates to equity in Richmond, as in any neighborhood that rates above a 5/10 in overall social vulnerability using RVAGreen 2050’s climate equity screening tool, a greater than 50% renter population can be observed (RVA Climate Equity Index 2022).

In the current situation, renters would almost entirely rely on their landlord to install some sort of charging solution, which is a proposition that is neither required by law nor incentivized heavily enough to be a reasonable expectation. This decreased capability for renters to invest in private charging discourages EV adoption and further emphasizes the need for adequate public charging.

Public Charging

An issue immediately encountered when discussing public charging is who owns the actual charger. The operation and maintenance of the charger itself for the years after installation is one reason why utility ownership may be optimal. Dominion Energy (Virginia’s largest utility) already has a workforce that can be deployed to maintain chargers. An average 2–3 million person Utility stands to gain $1.3-2.9 billion of increased value as a direct result of EV deployment (Baker et al. 2019). This means in theory Dominion, a utility with as many as 9 million customers, likely already possesses the means to expand their EV-related workforce.

The efficacy of this model has already been demonstrated. For example, nearby in Charlotte, NC, a public-private effort between UNC Charlotte, the city of Charlotte, Centralina Regional Council, and Duke Energy recently installed the city’s first pole-mounted charger. The project, titled PoleVolt™, is funded through the U.S. Department of Energy’s Vehicle Technology Office. Duke Energy owns most of the streetlight poles in the state, which are further managed by internal committees. These committees must approve the use of the pole for a charger. Additionally, PoleVolt used equipment and a cloud-based smartphone app which were both developed at the University of North Carolina-Charlotte’s EPIC lab. More deployments across the city are being planned currently (Duke Energy News Center 2022).

General Recommendations

In general, the first step in promoting EV charger distributional equity should be to incorporate Equity factors into any EV charger site planning conducted by the City of Richmond. A recent Argonne national laboratory study (Kuiper er al. 2022) compared equity factors such as education level and income with transportation factors and highway corridor location in order to determine where in a disadvantaged community a charger should be placed to maximize usage.

While the equity site modeling literature is in its infancy, studies that correlate equity factors with existing transportation data represent a step forward in local government thought processes. Rather than waiting for the perfect solution, Richmond should adopt and build upon a site planning strategy that incorporates equity considerations at the earliest possible stage of planning.

Beyond site modeling, EV-friendly policies need to be passed in Richmond. An optimal starting point would be amending current building codes. Examples of existing policies are Portland’s “EV Ready Code Project” and Boston’s “EV Readiness Policy.” These policies require EV chargers and/or charge readiness in a minimum percentage of parking spots for all new, multi-unit dwelling (MUD) builds. Richmond should adopt a similar policy that prepares the city for the eventual mass deployment of chargers.

While the above policy suggestion presents a necessary step for EV adoption as a whole within Richmond, it would only apply to new buildings. This type of policy alone could further exclude disadvantaged communities, where new builds are less prevalent. Because of this, Richmond should heavily incentivize charger installations on existing MUDs as well. These could take the form of tax incentives or direct compensation for installation and could be funded entirely with federal dollars. These benefits could be synergized with the existing Dominion “Smart Charging Infrastructure Program” in order to cover the majority of costs for EV charger installation on existing MUDs.

Finally, Richmond should develop a 3–8 charger pilot of pole-mounted, public chargers in disadvantaged communities where there is a lack of current charge infrastructure. An interdisciplinary implementation team (similar to the Charlotte, NC example) should be created to ensure this project is conducted thoroughly. Federal funding from the American Rescue Plan, Infrastructure Investment and Jobs act, and the Inflation Reduction Act should be leveraged, as they are intended specifically for projects such as this.

Conclusion

While the up-front cost of EVs is anticipated by many to drop as a result of plummeting battery prices, the lack of a robust charging network will remain a barrier to EV adoption, especially in disadvantaged communities. Because the current EV landscape is not conducive to distributional equity of chargers, EV feasibility among disadvantaged communities and renters is being limited. Because of this, the city of Richmond must actively pursue EV charger distributional equity through creative policy design. Unlike so many infrastructure projects of the past, equity should be factored in at the very outset in order to ensure equal opportunity and the overall feasibility of EV adoption for all Richmonders.

Derek Jones

Masters of Environmental Studies CandidateDerek Jones is a Master of Environmental Studies Candidate at the University of Pennsylvania.

Baker, T., S. Aibino, E. Belsito, and A. Sahoo. 2019. “Electric Vehicles are a Multibillion-Dollar Opportunity for Utilities.” Boston Consulting Group. April 23, 2019. Retrieved from: https://www.bcg.com/publications/2019/electric-vehicles-multibillion-dollar-opportunity-utilities

City of Richmond Climate Equity Action Plan 2030. 2022. City of Richmond; RVAGreen 2050. Retrieved from: https://richmond.konveio.com/rvagreen-2050-climate-equity-action-plan-2030-spring-community-review-period-comment-period-closed

Electric Vehicle (EV) Ready Code Project. 2022. The City of Portland. Retrieved from: https://www.portland.gov/bps/planning/ev-ready

Kuiper, J.A., X. Wu, Y. Zhou, and M.A. Rood. 2022. “Modeling Electric Vehicle Charging Station Siting Suitability with a Focus on Equity.” United States Department of Energy Argonne National Lab. June 6, 2022. Retrieved From: https://doi.org/10.2172/1887567

Map of EV Charging Stations in Richmond. 2022. Chargefinder. Retrieved from: https://chargefinder.com/us/richmond/charging-station/g7xj7d

Moloughney, T. 2021. “What Are the Different Levels of Electric Vehicle Charging?” Forbes, October 4, 2021. Retrieved from: https://www.forbes.com/wheels/advice/ev-charging-levels/

RVA Climate Equity Index. 2022. City of Richmond Sustainability Office. Retrieved from: https://cor.maps.arcgis.com/apps/webappviewer/index.html?id=e4d732f225fe457d83df11fe9bf71daf

UNC Charlotte, City of Charlotte, Centralina Regional Council. 2022. “UNC Charlotte, City of Charlotte, Centralina Regional Council, Duke Energy Win the Prestigious Diversity, Equity, and Inclusion in Cleantech Award for Curbside Electric Vehicle Charging Technology.” Duke Energy News Center. November 10, 2022. Retrieved from: https://news.duke-energy.com/releases/unc-charlotte-city-of-charlotte-centralina-regional-council-duke-energy-win-prestigious-diversity-equity-and-inclusion-in-cleantech-award-for-curbside-electric-vehicle-charging-technology

Walsh, M.J. 2020. “Electric Vehicle Readiness Policy for New Developments.” City of Boston. Retrieved from: https://www.boston.gov/sites/default/files/file/2020/03/EV%20Readiness%20Policy%20For%20New%20Developments%20%287%29.pdf

Werthmann, E., and V. Kothari. 2021. “Pole-Mounted Electric Vehicle Charging: Preliminary Guidance for a Low-Cost and More Accessible Public Charging Solution for U.S. Cities.” World Resources Institute. November 2021. Retrieved from: https://wrirosscities.org/sites/default/files/pole-mounted-electric-vehicle-charging-preliminary-guidance.pdf

By: Zachary Vlessing

Introduction

There is little doubt that China has world-leading aspirations when it comes to combating climate change and leading the world’s energy transition. Its investment in renewable energy has more than doubled the United States or any of its competitors in the past decade and Xi’s commitment to peaking emissions by 2030 and net-zero by 2060 represents the most ambitious national climate change commitment to date (Wu 2021). Yet, although the Chinese Communist Party (CCP) has a clear vision to lead their country into a new energy frontier, businesses within China still have a lot of catching up to do in aligning their goals with these national and societal aspirations.

China continues to lag much of the world, particularly their western counterparts, in adopting best practices in non-financial accounting of crucial metrics in sustainability and social impact. These environmental, social, and governance (ESG) metrics are important because they offer one of the few market-oriented solutions available for “socially conscious” investors to direct capital toward firms with better sustainability records.

Engineered as a financial tool, ESG scores disclose societal measures such as emissions intensity, labor practice, wages, and other societal impacts. In many cases, these ESG scores can be synthesized into large exchange-traded funds or mutual funds that include ESG screens that remove poorly rated ESG companies from the index and overweight high ESG preformers3.

The explosion of interest in environmental, social, governance (ESG) investing and the need for company level disclosure have spurred increased development from governments to guide corporations on how to measure these metrics. While Western companies and governments are racing to develop better reporting of this crucial data, China has lagged behind in both developing the frameworks and performance on ESG metrics. It continues to place near the bottom of MSCI’s All Country World Index, where it ranks 47th out of 50 countries on ESG performance in 2021 (Zhang 2021).

Yet the standardization of these metrics across the world is still in its early stages. In the coming decade, China has a unique opportunity to translate its climate leadership position and strong regulatory apparatus to implement some of the strongest ESG requirements in the world in pursuit of their 2030 and 2060 goals.

History of Chinese ESG Practices