Introduction

In almost 25 years of climate talks, equity between developed and developing countries has been one of the most important and difficult goals to achieve. Today’s developed countries grew and prospered from carbon-intense economies. Recognizing that this path is not sustainable, the world community is asking developing countries to follow a different path—to reduce overall fossil fuel use. Yet strict mitigation policies and the cost of adaptation may jeopardize economic development for developing countries.

At the center of the “equity” issue lays a key resource: coal. Coal has been a major factor in the industrialization of developed nations. In the absence of “universal” carbon pricing mechanisms, coal remains an inexpensive and reliable way to produce electricity for countries with fast-growing energy demand. Coal is also the worst source of energy for greenhouse gas emissions, with dangerous climate implications, given the lack of carbon storage technologies. With international pressure to fight climate change mounting, coal producing countries, especially developing ones are faced with a dilemma when it comes to coal use.

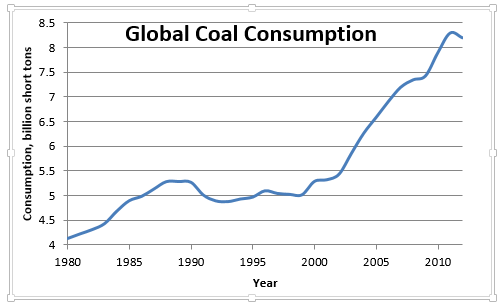

While global coal consumption has decreased in the last years (see figure 1), it is uncertain whether this trend will continue.

This digest explores the current state of coal markets, as well as supply and consumption prospects for countries with significant impact on the global coal industry. It also provides an insight on how key coal players are resolving the “coal dilemma.”

Demand Growth and Usage

Unlike oil, where exports and imports are spread around a large number of countries, coal exports come from just a few major producing nations. The top five coal exporters—Indonesia, Australia, Russia, the United States, and Colombia—together accounted for 81% of total coal outflows in 2012. The top five importing countries—China, Japan, South Korea, India, and Taiwan—accounted for 61% of total imported coal.

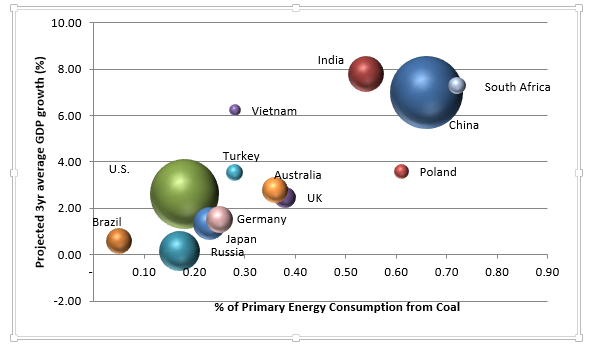

Figure 2 shows several of the largest producers and consumers around the globe. The horizontal axis is the current percentage of primary energy that a country gets from coal. The vertical axis shows the projected three-year average GDP growth from 2015 to 2017, as forecast by the IMF and World Bank. The size of a country’s “bubble” indicates the current size of the country’s energy consumption. Countries in the top right corner, in particular, are expected to have large increases in demand as coal-heavy economies grow rapidly.

United States Coal Demand Falls

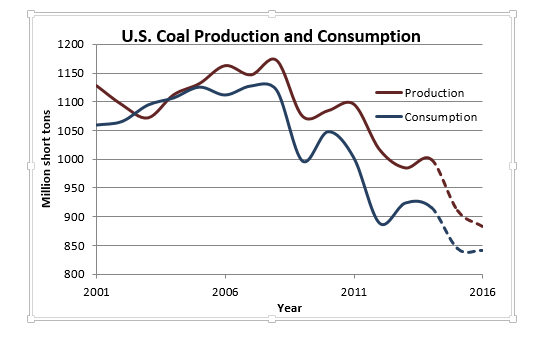

The United States coal industry is almost certainly on an extended downward path. Though the United States has been a top coal consumer for more than a century, coal consumption has declined since a 2008 peak (see Figure 1). The EPA’s Clean Power plan makes it unlikely costly new generation capacity will be built anywhere in the United States. Furthermore, the natural gas industry has provided a lower-cost alternative with half the greenhouse gas emissions. In April 2016, natural gas briefly passed coal as the main source for electricity generation in the United States, and will likely take the lead again soon1.

U.S. based companies have started to show signs of financial distress. On June 27th, 2008, Peabody Energy stocks closed at an all-time high price of $1,260.75 per share. Today, stocks in the world’s largest private coal company are sold at $14 a share. A combination of global recession, cheap and abundant U.S. natural gas from hydraulic fracturing, and environmental regulation have resulted in great challenges for many major coal companies.

Given declining domestic consumption, coal producers are looking to export their product to other nations. In 2012, U.S. coal exports totaled nearly 126 million short tons, a recent peak and a 213% increase since the beginning of the natural gas boom in 2007. However, since that 2012 peak, coal exports have decreased by 23%. This is in large part due to a slowdown in demand from China. Decreased exports to China account for a third of total U.S. export losses from 2012 to 20142. Though producers have sought to reach other foreign markets, domestic opposition to coal exports has also been growing. In Oregon, Ambre Energy ran into regulatory trouble while attempting to build export terminals in the state, and most of the Pacific coast has proved hostile to coal export terminals3. This opposition has been led by environmentalists. However, some academics have argued that U.S. coal is cleaner than much of the coal burned in Asia, and thus, shipping it abroad to replace coal produced elsewhere could reduce global emissions4.

India’s Big Challenge

India stands out as a particular country of interest, as it is projected to soon become the world’s second largest coal market3. India’s toughest challenge is a lack of generation capacity. In 2012, the country experienced massive blackouts in major cities that left hundreds of millions without electricity. Meanwhile, more than a fifth of its population continues to live without regular access to electric power56. This gap between supply and demand will need to be met quickly, but doing it cleanly will be a challenge for the country. Even with emissions pledges made in October (to increase renewables and reduce carbon), India’s coal use is expected to double between 2012 and 20407.

Prime Minister Narenda Modi has proposed this problem can be solved with renewable energy in rural areas, but the majority of electric capacity growth will almost certainly come from thermal coal8.

Most coal in the sub-continent is produced by the country’s state-controlled Coal India Limited, which, according to The Times of India newspaper, aims to produce 1 billion metric tons of coal by 20209. Coal India has made it a mission to reduce or eliminate the need for coal imports, even as India’s primary energy source is projected to skyrocket over the next few decades. While unlikely to eliminate the need for imports, the country’s reserves—an estimated 66.8 billion tons of recoverable coal—would sustain a significant share of local demand. The IEA’s 2015 World Energy Outlook predicts India will be the world’s largest importer of coal by 2040 and notes imports are likely to come primarily from Indonesia.10

Burning all this coal will come with a high environmental cost. Indian coal releases particularly large and dangerous amounts of particulate matter. From an air quality standpoint, India’s cities are now the most polluted in the world. The country has the three worst cities for air quality in the world, and 13 of the 20 worst cities11.

EIA notes the country’s industry remains “relatively closed to private and foreign investment”6. This lack of private and foreign investment could certainly limit the penetration of emission-efficient technologies required to mitigate environmental costs.

Pacific Coal

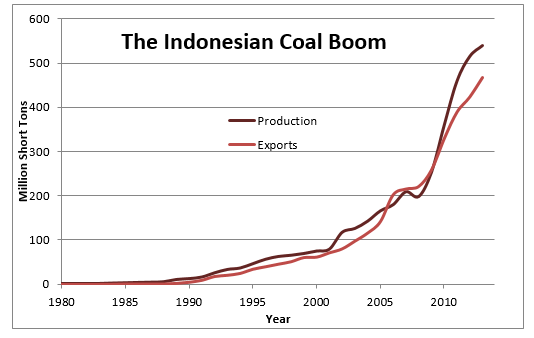

Just twenty years ago, the idea that Indonesia could meet India’s growing demand for coal was hardly a foregone conclusion. Figure 3 demonstrates how rapidly Indonesia has ramped up production from almost nothing in 1980, to become one of the world’s top coal producers today.

Unlike in China or India, where domestic production rose in order to meet a rising demand for coal at home, Indonesia dug its mines to feed the growing furnaces of countries abroad. It exports over 80% of production, with half of that going to China and India12. Indonesia’s location near the world’s largest coal consumers has allowed it to quickly find markets for its own coal and made it the top world exporter of the fossil fuel.

In becoming the top exporter, Indonesia unseated another Pacific neighbor: Australia. Until 2011, Australia led the world in coal exports and in 2013, exported nearly 90% of production. Like Indonesia, Australia exports much of its coal to China and India, though Japan is its largest customer—with approximately one third of all coal exports13. This trend is unlikely to shift dramatically as Japan is notoriously short of domestic fuel resources and, after Fukushima, has been cautious about implementing new nuclear power.

China’s Policy Shift

And what about the world’s current largest coal market? China’s coal consumption has been prolific, accounting for over half of total world consumption in 2012. However, as outlined in a previous Kleinman Center Digest, the People’s Republic of China has recently committed to a shift towards cleaner and less carbon intensive energy sources. This will put pressure on coal, which is the most polluting and emission-intensive fossil fuel.

As shown in Figure 2, China still has a massive market for coal. With economic growth expected to continue at high levels (though not quite as high as those in the past) for the next few years, China’s coal demand will grow even as renewable and clean sources begin to take a larger share of the overall energy mix.

Furthermore, China began importing coal in 2009 when demand outstripped the domestic supply11. Since 2009, these imports have provided a convenient endpoint for coal exports from Indonesia and Australia. But the quantity of imports are not likely to grow at the levels seen since 2009, as China’s economy is slowing and transitioning away from coal-intensive industries like steel production14.

China’s interest in coal-to-gas facilities is another area that poses air quality concerns. Sinopec has signed on to a $10 billion project to produce 8 billion cubic feet of synthetic gas each year in China, according to Reuters15. While this holds promise for burning coal without releasing dangerous particulate matter, there are concerns regarding the economic viability of a largely untested technology, not to mention that such a process emits even more greenhouse gases than burning the coal directly16.

Much like in India, China’s fuel choices will have important implications for the future of the coal industry and the climate.

Coal and Development

As other countries begin to exhibit the economic catch-up effect demonstrated best by China’s dramatic rise, striking a balance between sustainable or emission-free electricity and cheap, easily accessible coal power will prove difficult. This balance could be altered if the international community agrees and complies with climate mitigation pledges in Paris. As it stands, however, the world’s capacity for coal production, combined with a weakening demand from current large consumers like the United States will almost certainly allow coal to retain its place as the low-cost fuel option. This means developing or underdeveloped nations may form a significant future bloc of coal consumers.

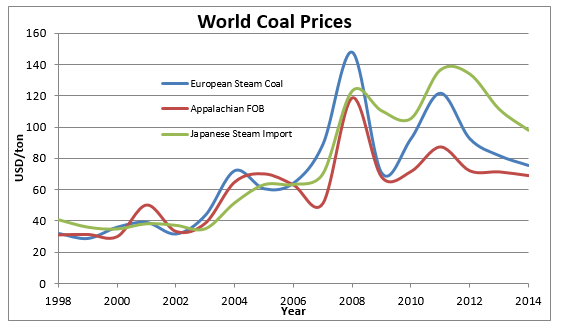

As developed nations turn away from coal and natural gas pushes it out of the market, the price for coal will continue to fall (see figure 4). Already since 2011 prices have fallen 40% in some markets across the globe. This makes policy decisions to move away from coal all the more difficult for developing economies and may reverse the economics of the natural gas-to-coal switch occurring in the United States. The IEA notes that although there are a variety of different markets and types of coal, all prices are down due to global oversupply17.

Several solutions have been proposed to aid developing countries in climate mitigation without undue burden. The Green Climate Fund, which would provide funding to developing nations for mitigation efforts, could subsidize renewable energy sources to the point of making them competitive with coal. Furthermore, technology transfer and export could allow the most efficient thermal coal plants, such as those built in Japan, to make up the majority of new plants. This would ensure that, if coal is to be burned, it is done in the most efficient and clean way possible.

Substituting coal with natural gas consumption is also an option available to developing countries with important natural gas reserves like China or Indonesia. But in the absence of natural gas reserves, this is not an economic option given the cost of LNG import terminals.

These and other options require agreement and support from developed economies. When submitting Intended Nationally Determined Contributions, some developing economies have made a business-as-usual plan as well as one which is dependent on international support and funding. Coal may still be a major fuel source in 2050 or 2100, but to reach climate targets, the share of coal usage cannot increase to meet future energy demand.

Angela Pachon

Special AdvisorAngela Pachon is a special advisor to the Kleinman Center, in charge of designing and overseeing international programs and teaching. She was previously the Center’s research director.

Dillon Weber

Research AssistantDillon Weber was a research fellow at the Kleinman Center and a graduate of the University of Pennsylvania majoring in chemical and biomolecular engineering and economics.

- Monthly Energy Review, October 2015. Washington, DC: United States Energy Information Administration, 2015. [↩]

- Quarterly Coal Report, October 2015: United States Energy Information Administration, 2015. [↩]

- Davis, Rob. “Ambre Energy Selling Oregon, Washington Coal Export Terminals Amid Coal Price Slump.” The Oregonian (Nov 26, 2014). [↩] [↩]

- Golden, Mark. “Reduce Greenhouse Gases by Exporting Coal, Says Frank Wolak.” Stanford Precourt Institute for Energy [↩]

- Badkar, Mamta. “Why India has the Massive Power Blackout Problems.” Business Insider (July 31, 2012). [↩]

- World Bank, Sustainable Energy for All (SE4ALL) database from World Bank, Global Electrification database. [↩] [↩]

- Nussbaum, Alex and Anindya Uphadyay. “India Pledges Clean Energy Push in UN Climate Submission.” Bloombergbusiness (October 1, 2015). [↩]

- Froome, Craig. “Power-Deficient India Chooses Electricity and Economics Over Emissions Goals.” Quartz India (Oct 12, 2015). [↩]

- “Coal India Will Surpass 550 MT Target.” The Times of India (Nov 2, 2015). [↩]

- IEA. World Energy Outlook 2015 Organisation for Economic Co-operation and Development, 2015. [↩]

- Vorrath, Sophie and Giles Parkinson. “India’s Dirty Coal Problem.” Reneweconomy (April 15, 2014). [↩] [↩]

- International Energy Data and Analysis; Indonesia: U.S. Energy Information Administration, 2015. [↩]

- International Energy Data and Analysis; Australia: United States Energy Information Administration, 2014. [↩]

- International Energy Data and Analysis; China: U.S. Energy Information Administration, 2015. [↩]

- Rose, Adam. “China’s Sinopec Gets Approval for $20 Billion Coal-to-Gas Pipeline.” Reuters (Oct 14, 2015). [↩]

- Liu, Coco. “Can China’s Bid to Turn Coal to Gas be Stopped?” Scientific American (Oct 29, 2014). [↩]

- OECD. Medium-Term Coal Market Report 2014 Organisation for Economic Co-operation and Development, 2014. [↩]