The Carbon Shock: Investor Response to the British Columbia Carbon Tax

Over the past decade, governments have finally started to combat climate change through policy interventions, but a constant fear has been how the economy and the markets will react to any new legislation. To what degree are such concerns warranted?

At a Glance

Key Challenge

In 2008, British Columbia passed a carbon tax. But in many other places, a carbon tax has not been politically viable—with much concern over whether markets can bear it.

Policy Insight

Following British Columbia’s carbon tax announcement, one might expect to see better portfolio performance from firms with lower carbon intensity. But there appears to be no statistically significant relationship. Perhaps markets can thrive with a carefully designed carbon tax.

Introduction

In recent years, it has been of great interest in the literature to understand the increasingly important risk factor of climate in the context of financial and economic risk. After the former Bank of England governor Mark Carney coined the term “stranded assets” to highlight the long-term risk to firms in carbon-intensive industries, academics in a variety of fields not only limited to finance and economics have been paying new attention to how these systematic risk factors will affect economic variables, and additionally, investor behavior. Particularly, with greater awareness around the world regarding the magnitude of the risk posed by climate change to the well-being of our civilization, governments have started to take action, but these moves have major economic consequences.

In this policy digest, we focus on investor reactions to the carbon tax. In recent decades, governments across the world have attempted to combat climate change through numerous policies designed to reduce carbon emissions, but the most prominent and quite possibly the most effective has been the carbon tax.

Despite numerous attempts to replicate this policy across different governments, however, only a few such taxes have been implemented, most heavily in European nations. One of the primary arguments against the implementation of the carbon taxes in regions around the world is that they will hinder economic growth. And while it’s difficult to measure economic growth changes over short time periods and link the causality specifically to a certain event, we can use financial market reactions as a proxy for investor sentiment regarding future economic conditions, which play a large part in stock valuation.

Since many of the largest opponents of the carbon tax are investors, it is interesting to see to what degree their actions match their words. More specifically, we are interested in answering a couple of major questions in this study. First, following the announcement of a carbon tax, how do investors rebalance their portfolios with regard to carbon-intensive firms and carbon-light companies? In other words, do economic sectors associated with one group tend to expand while the others contract?

In addition, does the market as a whole take a hit, or is the response simply a reallocation of assets? The second question is especially interesting because if after a carbon tax the market valuation does not take a systematic hit, then it follows that the market as a whole was not affected, possibly implying that general economic conditions might not be as impacted as much as investors tend to say. These questions should be of particular interest not only to investors but also to policymakers who are in positions to consider implementing such policies in their locales.

In order to address these questions, we apply an event study methodology, which is commonly used in this literature to ascertain the impact of specific events on financial returns. The event of interest is the announcement on February 19, 2008 of the carbon tax in British Columbia. One specific attribute of this government intervention is that it was designed to be revenue-neutral, which entails that every dollar taken in via taxation is returned to the economy by some form of government spending or revenue reduction. This detail is quite important because it implies that overall spending capital did not suddenly decrease as a result of this policy, so we can analyze this issue by organically controlling for a variable that is known to affect economic consequences.

For the purposes of this digest, we focus on an empirical analysis of investor reactions in the Canadian market following the announcement of this tax. We use stock returns and firm accounting data from Compustat, much of which is gathered through annual reports and 10-K’s, for companies listed in the Toronto Stock Exchange who are members of the TSX Index and supplement that with firm-level emissions data from the Carbon Disclosure Project (CDP).

Using this, we rank firms by a carbon intensity measure, which we define as the level of their carbon emissions relative to their size, which is measured by market capitalization. We then aggregate the top quartile and bottom quartile into portfolios to see if there is a performance difference over our period of interest. Since it came as a complete surprise to the markets, we can establish identification and obtain robust estimates by using an event study approach.

Background

Much of the interest in this field stems from the recognition of climate risk and the threat of stranded assets. By definition, stranded assets represent assets that have historically generated cash flow for a firm but suddenly lose value due to an exogenous shock. All of a sudden, certain assets become less valuable because firms can no longer produce as much value with them, or in extreme cases, can’t utilize them at all.

In most cases that use this terminology, and particularly our case, this exogenous shock comes in the form of a macro-policy intervention by a governmental institution. Such an intervention can come in many forms, most popularly a carbon tax or a cap-and-trade system, but regardless, it will almost certainly affect the operations of firms that operate in the affected region.

With such intervention there is a shock effect on a company’s financials in two primary ways. First, we see a cash flow shock that plays out relatively quickly over the short term because certain assets suddenly become significantly less valuable.

More concretely, consider the following example: Assume we have an automaker firm General Autos that runs a major factory in a region that has historically had little emissions-related legislation. This factory has a post-tax profit margin of 5%. Suddenly, however, a carbon tax is announced and passed, and now a large variable expense directly proportional to carbon emissions, and by extension, production quantity, is introduced.

All of a sudden, the profit margin declines heavily to the point that it is no longer profitable to run the factory, so it’s closed down, and the cash flow of the company takes an immediate hit. In a less extreme case, the factory can still run, but the new optimal production level falls, so extra tools and machines are suddenly devalued.

The other effect is the discount rate effect, and this represents a change in the long-run risk of the company. Continuing the previous example, aside from the direct effect of the legislation, there could now be an additional long-run risk that more legislation limiting productivity and potentially leading to stranded assets will be introduced. This means that investors now face a greater risk of investing in this company, so the firm’s cost of capital increases, thus affecting its valuation.

On the other hand, there could be less long run risk all of a sudden because the government action was a lot more measured than previously expected, in which case a firm’s valuation would be affected in the opposite direction. While both risks are important, we focus in this paper primarily on the short-run cash flow implications of such shocks.

In order to conduct this empirical study, we consider the effects of the 2008 British Columbia carbon tax announcement. We focus on investor sentiment following this event in order to obtain deeper insight into how they react to such shocks. We can judge based on the market movements in the days following the event. We can see how investors respond with portfolio reallocation, but the challenge of such an economic study lies in establishing causality.

As a result, we use an event study approach as our identification strategy. We need to show that this event was truly a surprise to investors and to account for confounding variables so we can attribute the remainder of the fluctuation in stock prices to the legislation.

Surprise Analysis

Since our question revolves around public markets, we need to establish that the announcement of the tax was a surprise to the public in general. This is important so that we can attribute the reaction of the investors to this event in particular; otherwise, the case could be made that since people anticipated the announcement, their reactions in terms of changing portfolio holdings occurred in the few days leading up to it, which would significantly complicate the analysis.

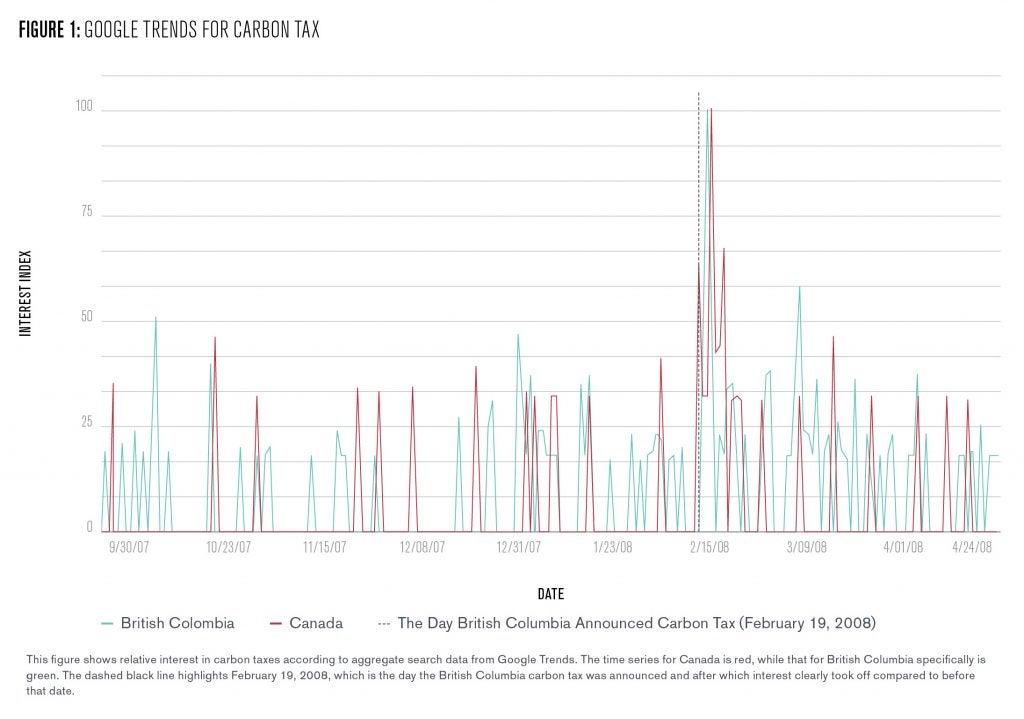

While the fact that the announcement was a surprise is generally established in some of the literature surrounding the tax mentioned earlier, we use some external data to highlight this as well. We begin with results from Google Trends to show the search popularity of the term “carbon tax” in both Canada and British Columbia for the period ranging from the end of September 2007 to the end of April 2008, and the graph can be found in Figure 1.

Clearly, the time series shows an approximately similar pattern throughout, except for the few days just after the announcement during which the index spikes rapidly. Of course, had the event not been a complete surprise to the public, especially if there were leaks or hints that it could happen, we would expect to see either a smaller spike before the big spike after the announcement or a gradual run-up to the date. We see neither of these patterns in the data.

In addition, we looked for evidence in other papers and Internet archives, particularly historical news sources and blogs, and confirmed that this event was indeed a surprise to the relevant parties.

Brief Study Overview

Here is a general overview of the study. The details of the methodology are excluded from this digest but can be found in the complete paper. We matched the CDP firm-level emissions data to the returns of each firm, but still we only had emissions values for a small subset of companies, specifically 70, which is about 6% of TSX firms.

So, we supplemented this data with emissions data for 279 American firms, which we have no reason to believe should have had generally different emission patterns after accounting for basic differences. Then, we used machine learning techniques, particularly random forest and boosting, to create and train a predictive model in order to obtain estimates for other companies in our sample.

With these, we ranked the firms in terms of carbon intensity and created portfolios based on their relative levels. So, the bottom quartile of carbon intensity became the LOW portfolio, while the top quartile became the HIGH portfolio. With these, we conducted an event study analysis, whose details are excluded.

Results

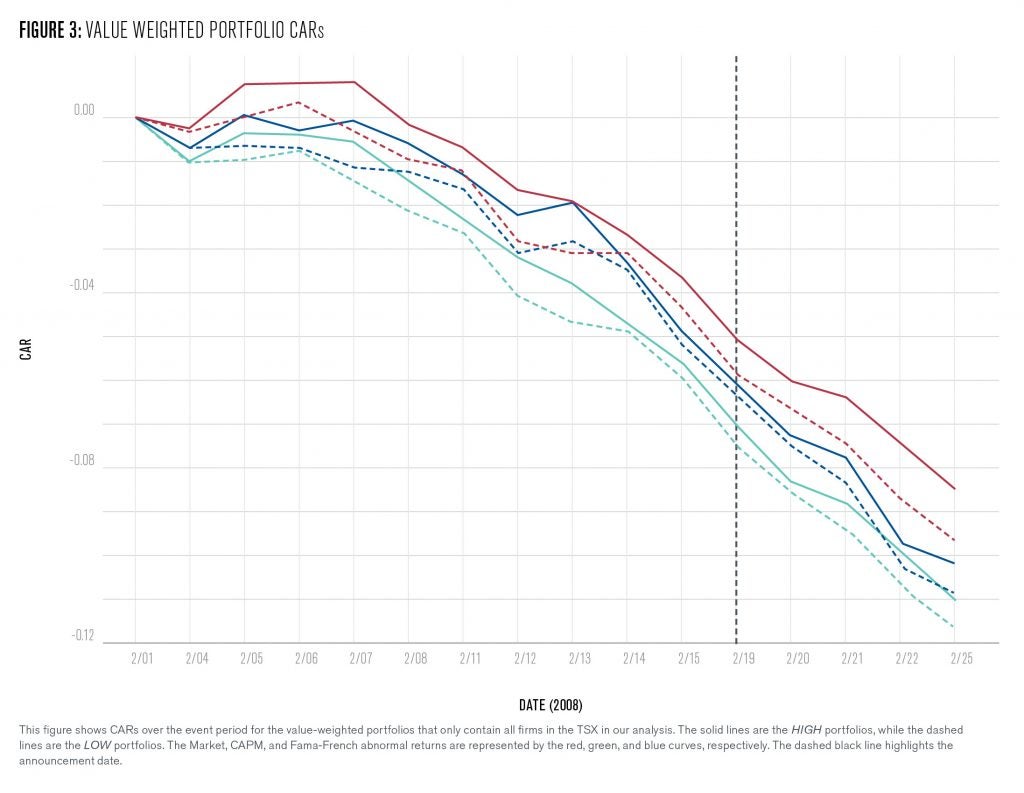

In this section, we present the main result for firms based in the British Columbia province. The following figure shows Cumulative Abnormal Returns (CARs) based on the announcement. These portfolio returns are adjusted for systematic risk factors according to various popular asset pricing models: The Market Model, Capital Asset Pricing Model (CAPM), and Fama-French Three Factor Model.

Each of the curves in the figure above represents portfolios based on firms’ carbon intensity levels. While one would expect to see the portfolio of firms with lower carbon intensity, and consequently less exposure to this newly announced carbon tax, to perform better, there appears to be no statistically significant relationship. If that were the case, the gap between the dashed and solid lines would close almost immediately following the announcement date, or perhaps even reverse, but this is not at all apparent in the two or three days following it.

Additionally, from a visual perspective, we would also generally expect a difference in slopes following the announcement. Further statistical analysis confirms that we can see little statistical effect in the data.

Similar results hold when we consider the entire TSX, which is assumed to be representative of the entire Canadian market. Again, we do not observe a statistically significant change, and our tests confirm that.

Possible Explanations

Interestingly, we have not found strong evidence of a relation between a firm’s carbon intensity and its stock price effect following the announcement of the British Columbia carbon tax. This is an interesting effect. With the announcement of a new tax, one would expect equity prices to decrease since this has a direct impact on cash flows.

Even though the design is revenue-neutral, the taxes are not returned to the companies directly; rather, they are spread out among the population and corporations through other tax cuts. So, one possibility is that investors expected many companies to enjoy a tax cut rather than a tax burden with this policy, so the effects balanced out.

This is possible, but it’s unlikely given that most of the revenues were to be returned to the population, meaning that a potential corporate tax benefit was likely to be quite small. So, it’s hard to consider this to be a response to cash flow changes.

This raises the other possibility that it is a reaction to changes in long-term risk. It’s possible that some investors viewed climate legislation as inevitable in the long run and that they expected the burden to be much worse. So, when a low initial tax rate and a very gradual plan of increasing it over the next few years was introduced, maybe investors were relieved and responded positively to a reduction in long-term risk and a subsequent decrease in the implied discount rate since the market had already priced in an even higher expected carbon tax. The effects were again balanced out.

Either way, however, the important relationship here is the lack of a correlation between a firm’s carbon intensity and the effect on its stock price. In other words, highly carbon-intensive firms were surprisingly not punished by investors after this announcement, and similarly, carbon-light companies were not rewarded. One possibility is that since this event occurred during the initial downfall of the Great Recession of 2008, the effect was largely ignored due to the effects of other more important events. But again, we don’t directly see evidence of this effect.

From a policymaker’s perspective, we can obtain an interesting lesson: There appears to be a disconnect between what investors say regarding climate legislation and how they actually act. In the worst case, one could argue that there isn’t a disconnect but rather the tax was too small to have a measurable impact on firms’ businesses.

However, this itself has huge implications for policy. It means that legislators can start responding to climate change gradually without worrying about drastic reactions by the markets, as some investors warn could happen with even the slightest change in policy. We can see that with a careful design and a clear plan that is publicly outlined, governments can start addressing this great challenge.

Conclusion & Takeaways

In this analysis, we have conducted an event study of the 2008 British Columbia carbon tax announcement and analyzed the impact of a firm’s carbon intensity on its stock price following this event. Interestingly, we found little relation between the two and argue as a result of this finding that governments around the world can start addressing climate change through carefully designed policy interventions without fear of economic catastrophe.

There are a number of interesting future directions for this work. One interesting question to address is to what degree the size of a carbon tax effects market prices. It would be interesting to see whether these effects hold or change in regions that have introduced higher carbon taxes, such as in Europe. However, some studies that have attempted to estimate the proper price of carbon emissions through measuring the effects of market externalities have concluded that almost no government has a rate anywhere near that value.

So, some simulation analysis that explores this question could be interesting. Another equally intriguing topic is how actual economic growth is affected by these climate policies. While some work has been done to observe changes in macroeconomic variables like unemployment, a comparison of economic growth under different carbon tax regimes could be both interesting for academics and informative for policymakers.

Regardless, it appears that governments can dare to act more strongly without serious economic repercussions. A carbon tax itself is not equivalent to a massive carbon tax. With proper design and planning, carbon taxes and other climate policies could effectively address one of humanity’s greatest challenges.

Akshay Malhotra

Doctoral Student, Stanford UniversityAkshay Malhotra is a Ph.D. student in finance at Stanford School of Business. He is a recent graduate of Penn, with a bachelor’s in finance from The Wharton School, a bachelor’s in computer science from the School of Engineering and Applied Science (SEAS), and a master’s in data science from SEAS.

Azevedo, Deven and Hendrik L. Wolff. 2017. “Do Carbon Taxes Kill Jobs? Evidence of Heterogeneous Impacts from British Columbia.”

Bansal, Ravi, Marcelo Ochoa, and Dana Kiku. 2019. “Climate Change Risk.”

Barnett, Michael. 2019. “A Run on Oil: Climate Policy, Stranded Assets, and Asset Prices.”

Bolton, Patrick and Marcin T. Kacperczyk. 2020. “Do Investors Care about Carbon Risk?”

Columbia Business School research paper forthcoming.

Bushnell, James B., Howard Chong, and Erin T. Mansur. 2013. “Profiting from Regulation: Evidence from the European Carbon Market.” American Economic Journal: Economic Policy, 5 (4), 78-106.

Carattini, Stefano and Suphi Sen. 2019. “Carbon Taxes and Stranded Assets: Evidence from Washington State,” Economics Working Paper Series 1909, University of St. Gallen, School of Economics and Political Science.

Duff, David G. 2008. “Carbon Taxation in British Columbia.” Vermont Journal of International Law, Vol. 10, 87-107.

Gorgen, Maximilian and Andrea Jacob, Martin Nerlinger, Ryan Riordan, Martin Rohleder, and Marco Wilkens. 2019. “Carbon Risk.”

Han, J., M. K. Linnenluecke, Z. T. Pan, and T. Smith. 2019. “The Wealth Effects of the Announcement of the Australian Carbon Pricing Scheme.” Pacific-Basin Finance Journal, 53, 399-409.

MacKinlay, A. 1997. “Event Studies in Economics and Finance.” Journal of Economic Literature. 35(1), 13-39.

Murray, Brian and Nicholas Rivers (2015). British Columbia’s Revenue-Neutral Carbon Tax: A Review of the Latest “Grand Experiment” in Environmental Policy. Energy Policy, Vol. 86, 674-683.

Pastor, Lubos, Robert Stambaugh, and Lucian Taylor (2020). “Sustainable Investing in Equilibrium.”

Pretis, Felix (2019). “Does a Carbon Tax Reduce CO2 Emissions? Evidence from British Columbia.”