When Canada committed to reducing total GHG emissions by 30%, Alberta stepped up its game. How Canada's largest carbon emitting province moved from climate laggard to climate leader.

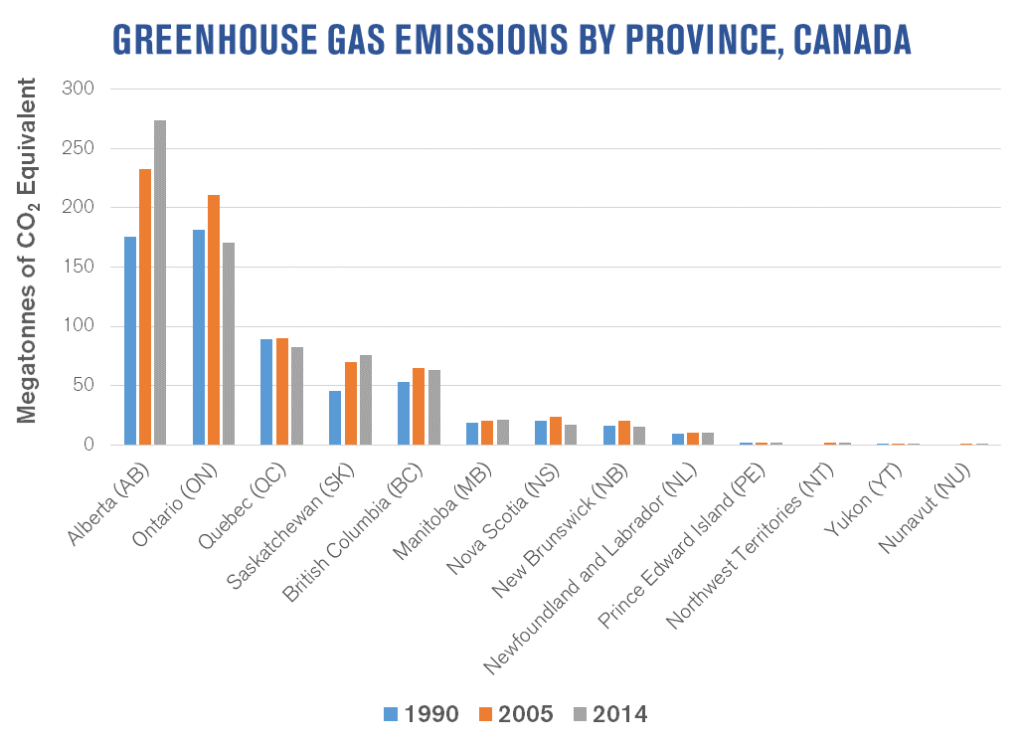

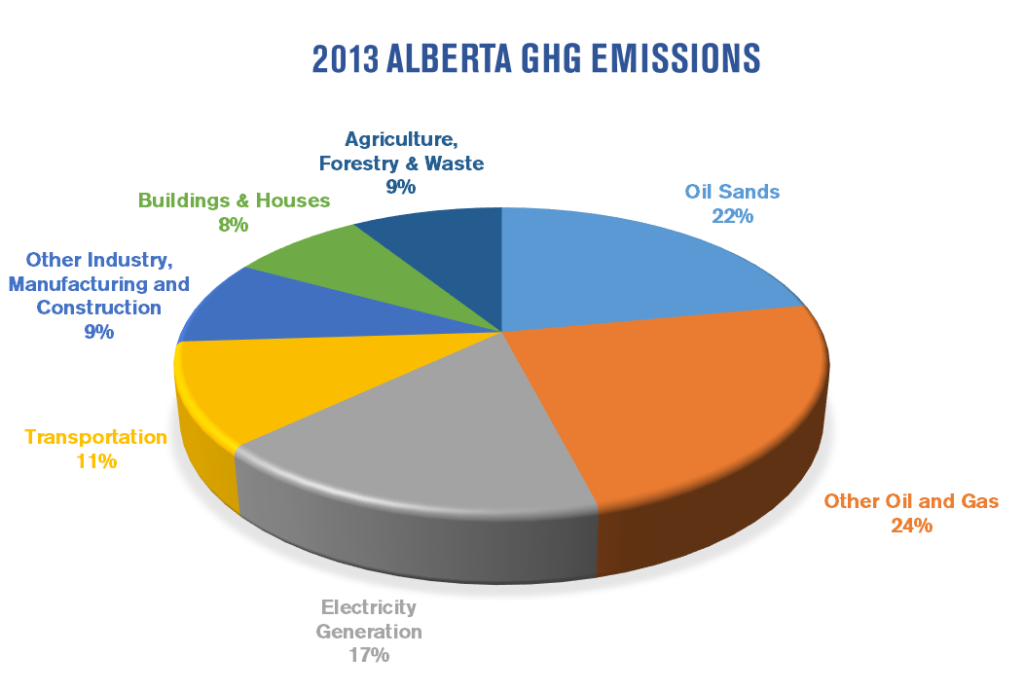

The province of Alberta holds the world’s third largest oil reserve, putting Canada among the top five oil producers in the world [1]. Oil and gas extraction has been a main driver of economic growth for the Alberta province and for the Canadian economy. At the same time, this sector has been a large source of emissions of greenhouse gases (GHGs). Alberta is the largest carbon emitter in Canada and almost 50% of Albertan carbon emissions—which have grown steadily in the last 25 years—are attributable to this sector (Figure 1).

The Climate ‘Laggard’

The growing oil and gas extraction business in Alberta was an important factor in Canada’s failure to meet Kyoto targets to reduce GHG emissions by 17% from 2005 levels by 2020. This failure resulted in the withdrawal of Canada from the Kyoto protocol in 2010 and its consequent reputation as a “climate laggard,” even though some major emitters like the United States never even ratified the Kyoto protocol.

A year ago, in preparation for the COP21 meeting in Paris, Canada committed to reducing total GHG emissions by 30% of 2005 levels by 2030 in its Intended Nationally Determined Contribution (INDC) to the United Nations. This pledge was rated inadequate by the Climate Action Tracker (CAT), an independent scientific analysis produced by four research organizations tracking climate action pledges. For CAT, the 2°C goal was unlikely to be met because of the tar sands operations. They estimated emissions from tar sands could reach 14% of Canada’s total emissions by 2020 and expressed doubt about Canada’s ability to meet its targets [2].

Scientific estimates and ratings aside, the perception of the tar sands as a major obstacle fighting climate change is negatively affecting Alberta and Canada’s business and trade opportunities. The years-long review and eventual denial by the U.S. of the Keystone XL pipeline expansion was justified by the U.S. State Department in part by the poor economics of the projects, but also by the potential damage the production and use of the tar sands would have on efforts to combat global climate change and GHG emissions [3].

From Laggard to Leader?

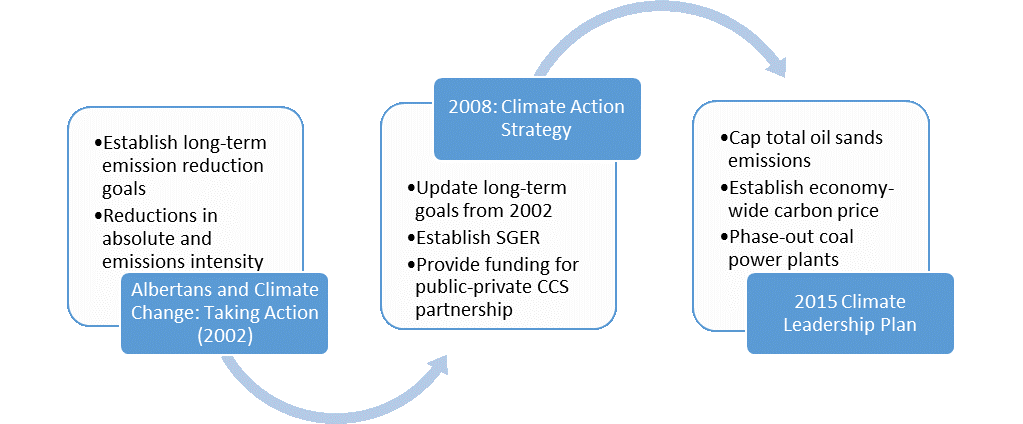

New governments at the provincial and federal levels seem determined to reverse this reputation. In November 2015, the newly elected Premier of Alberta, Rachel Notley, announced a Climate Leadership Plan for the province. Surprisingly, and despite the alleged inaction of previous governments, this is not Alberta’s first climate plan.

In 2002 and again in 2008, the province established overall goals of both absolute GHG emissions reductions and emission intensity reductions relative to GDP (Figure 2).

These goals, and the process by which they would be achieved, were laid out in the province’s report “Albertans and Climate Change: Taking Action,” produced in 2002. This document was followed by another, “Alberta’s 2008 Climate Change Strategy.” The 2008 Strategy was based on three key themes to achieve the desired reductions: energy conservation and efficiency, carbon-capture and storage (CCS), and green energy production.

Pricing Carbon: A Not-So-New Story

Notably, the 2008 reform established a carbon fee and a carbon offset system [4]. Through the Specific Gas Emitters Regulation (SGER), the largest GHG emitters with emissions greater than 100,000 tonnes (metric tons) of carbon per year had to comply with emission intensity limits. In other words, SGER established a cap on the ratio of CO2 emissions per unit of production. There were 106 facilities covered by SGER in 2014 in the sectors of oil sands, natural gas processing, electricity generation, chemical manufacturing, forestry products, and mineral mining and processing. SGER established the limit as 88% of an emission intensity baseline. This baseline was defined as the average emission intensity over the years 2003, 2004, and 2005.

Facilities were given four options to comply with this target. These four options included:

- Improve facilities by making the necessary investments to reduce emissions

- Purchase emission performance credits generated at facilities that achieve more than the SGER required reductions

- Purchase carbon offset credits from other facilities not regulated by SGER that have voluntary reduced emissions and have been approved by the Alberta Emission Offset Registry

- Pay a fee of $15/ tonne of CO2 for emissions above the limits

- Note: Revenue collected from this fee goes to the Climate Change and Emissions Management Fund (CCEMF). The fund aims to assist in the development of projects in the areas of energy efficiency carbon capture and storage and green energy production.

The design of the SGER had some flaws and results were modest. According to Dobson and Winter (2015) SGER regulations achieved a mere 3% reduction in total emissions between 2007 and 2014 relative to a non-regulated scenario [5]. One of the main problems identified by Dobson and Winter in the SGER design was the definition of large emitters (over 100,000 tonnes of carbon each year). This meant the fee was confined almost exclusively to oil sands developers and utilities, while leaving large areas of the carbon-emitting economy, such as transportation, exempt. Other issues concerning the SGER design were the generous limit and the low fee. Although emitters had incentives to reduce emissions above the 88% baseline limit, they did not have incentives to reduce emissions below the limit. Moreover, the $15/tonne fee created a cost ceiling for any investment required to reduce emissions. Projects above this ceiling were not likely to be pursued [6].

Even with significant gaps in emissions coverage pre-2016, the $15/tonne fee raised $425 million according to reporting by the Climate Change and Emission Management Corporation (CCEMC), the entity in charge of CCEMF.

Carbon Pricing 2.0

Seeking to improve upon the 2008 framework, the Albertan government formally passed a new, far-reaching carbon tax: Bill 20, the Climate Leadership Implementation Act last June. The Act establishes a carbon levy for all fuel consumption—including gasoline and natural gas—beginning in January 2017. The levy will be based on a carbon price of $20/tonne in 2017 and $30/tonne in 2018. It will cover 78% to 90% of provincial emissions, since certain exemptions were included, like fuel used on sites of emitters covered by the SGER, fuel used as raw material in an industrial process, biofuels, fuel used for farming purposes, and several other exemptions. [7]

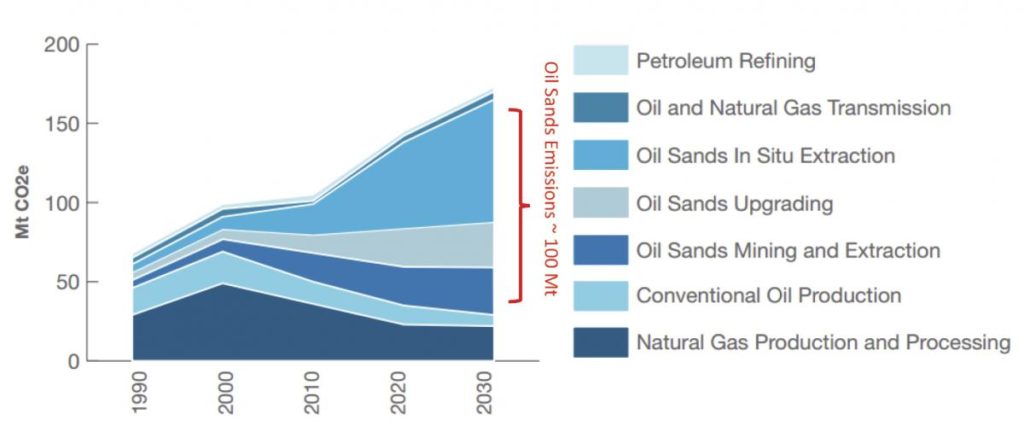

Though not yet codified into law, the new climate strategy aims to put a hard cap on total emissions from the oil sands sector of 100 Megatonnes (Mt) annually [8]. Currently, emissions are approximately 70 Mt, so while this cap will allow some growth, perpetual development of the oil sands will require improvements in development methods or implementation of Carbon Capture and Storage technologies.

For large emitters, the SGER will remain in place through the end of 2017. New regulations are in the process of being discussed, although the government has expressed the intention to transition to a system of performance standards specific to product and sectors. In 2015, the SGER was modified to reduce the limits to 85% and 80% of the same baseline in 2016 and 2017 respectively. The four options to comply remain, but the fee to CCEMC has increased to $20/tonne in 2017.

The Albertan government has estimated the new carbon price will raise $3.2 billion in revenue by the end of the 2018-2019 fiscal year.

The tax will primarily hit consumers at the pump and in their heating bills. For a family of four, the government expects the tax will add $338 to household spending in 2017 and $508 in 2018. When initially proposing the change in November, Premier Notley had promised citizens the tax would be completely revenue neutral. In an effort to maintain her promise, a rebate schedule has been established based on the government’s estimates of the total cost for household sizes. Households below a specific income threshold (estimated to cover 60% of Albertans) will be eligible for the full rebate.

Crucially, the rebate money is distributed at a flat rate, regardless of actual cost to any given consumer. This ensures the incentive to reduce use of carbon-emitting fuels remains properly aligned with the price signal. The max rebate for a household with two children stands at $360, with households making over $101,500 annually not eligible for the rebate.

In addition to this direct rebate to households, disbursed on an established quarterly pay schedule, Alberta will drop the small-business tax rate from its current 3% down to 2%, saving small businesses an estimated $185 million.

Adding up the individual rebates and estimated costs for lowering the small business tax rates, the government has promised between $600 million and $750 million [*] in rebates and tax reductions each year. However, this leaves the tax a long way off from being truly revenue neutral if Alberta expects to add $1 billion to its treasury annually. From the time the legislation was initially proposed in November to its final passage last month, in tacit recognition of this discrepancy, the language used by the Premier changed from “revenue neutral” to a promise to “fully reinvest” the funds from the tax. In accordance with the language change, the new bill has promised to invest funds raised from the tax in various projects designed to help Alberta and Canada meet its climate goals, including funding for renewable energy technology.

Given the majority of the NDP party, the bill passed without significant amendments in less than 20 days. This was a “painless” process compared to the 22 months that U.S. senate and house members have spent in discussing the North American Energy Security and Infrastructure Act, which is far from proposing a carbon tax.

Complementary Policies

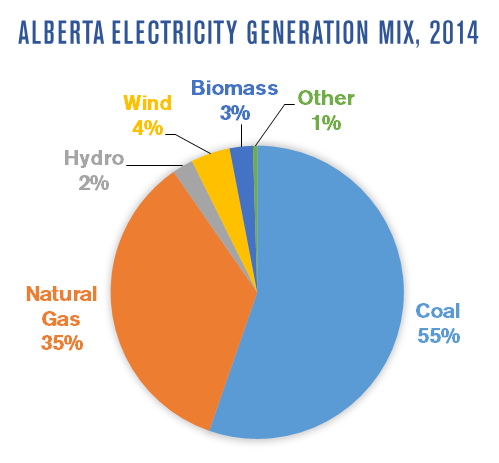

This funding will be needed to achieve another key part of Alberta’s energy plan: the elimination of pollution from thermal coal power plants by 2030. Alberta’s current power generation is primarily from coal (55% of generation) with natural gas (35%) making up much of the rest (Figure 4). Thus, transitioning to a more carbon-free province is not a given. Furthermore, the province has only installed 347 MW of new renewable capacity since 2014, a mere 2% of total generation capacity [9]. The government has, however, listed that as of August 2015 another 2,480 MW of renewable generation capacity is scheduled to be completed in the province. The government has stated it hopes to achieve 30% renewable generation by the time of the coal phase-out, leaving much of the lost capacity to be filled with natural gas fired plants.

While burning natural gas produces less CO2 than coal, methane emissions have begun to attract more interest as recent studies have shown they can make a significant contribution to overall emissions, particularly considering methane is (conservatively) at least 25 times more potent a greenhouse gas than CO2. As Alberta trends toward more natural gas consumption, it will need to ensure it does not suffer from a rebound effect of more warming through methane leaks and vents. To avoid this, the government has pledged to reduce oil and gas sector methane emissions by 45% in 2025.

Much as it did with the carbon price and CCS initiatives, the regulators plan to partner with multiple stakeholders through the Joint Initiative on Methane Reduction and Verification, which will run to 2020 and develop regulation to ensure the 2025 goal is met. Rather than put a price on emissions of methane, however, the government plans to develop new efficiency standards that will put limits on the quantity of methane emissions permitted for processes and equipment. Industry participation in the initiative will be essential—the measuring and monitoring required to effectively track emissions (particularly in extraction) will almost certainly fall to those actually doing the emitting. It is worth to note that conventional oil and gas producers were given an exemption of the levy for natural gas produced and consumed on site until Jan 1, 2023 while they undertake Methane Reduction measures.

Conclusion

The benefits of a carbon price for emissions reductions have been widely touted by industry experts, economists, and even major industrial players such as Shell, Exxon, and BP. Setting a price on carbon is the most cost-efficient policy among the broad menu of climate policies.

Alberta may have set an example for fossil fuel intensive jurisdictions, but the success of the carbon tax will be linked to various factors. Just as with the SGER legislation from 2008, the tax must pass muster as expensive enough to motivate behavior change without compromising the competitiveness of the Alberta economy.

While in comparison to the EU benchmark (currently around $6/tonne) Alberta’s new levy is expensive, it is not clear whether it is high enough to achieve emissions reductions. Estimates for the cost of carbon capture and storage, for example, range from $36/tonne to over $150/tonne and major industrial players use internal shadow carbon prices at $40 or more [10]. The expected reform to SGER—still to be completed—is going to be decisive.

A revenue-neutral carbon tax in neighboring British Columbia has been effective at a rate that has increased over the years and is now at $30/tonne and covers over 70% of the province’s carbon pollution. Theory suggests that the tax on marginal carbon emissions should be the same in both provinces, because the tax should be equivalent to the marginal damage (costs) caused by emissions of a ton of carbon and this damage is the same in both provinces. Thus a $30/tonne tax in Alberta should be efficient. But this efficiency does not necessarily ensure the reduction of emissions. If the cost of reducing emissions is higher in Alberta than in BC, then it is more efficient that emissions are reduced where it is cheaper to do so.

Furthermore, the state of Alberta’s economy will play a role in the perception of the carbon tax as a success or failure. Fuel exports from Alberta may become more expensive due to the regulation. This can certainly affect competitiveness, but also may unlock possibilities to reduce costs for the industry. A better reputation when it comes to the environment and global climate change might ease the approval for pipeline building, an important cost factor in the tar sands. The carbon tax may also attract new investors to clean energy sectors. If Alberta’s industries are able to flourish under the new tax regime, and if consumers respond to the price signal by reducing fuel consumption or switching fuels, the tax will have worked and Alberta will have achieved a dramatic transformation, from an ostracized climate laggard to a strong climate policy leader in coordination and cooperation with industry and stakeholders.

The authors wish to acknowledge helpful comments from a reviewer of an earlier draft. Any remaining errors are the responsibility of the author alone.

* 4.145 million people in Alberta, 66% covered with max rebate of $200/individual = $547 million in rebates + $185 million in reduced taxes = $732 million in returned or negated revenue (estimate is high because rebates for multiple individuals in a household are dramatically reduced).

Angela Pachon

Special AdvisorAngela Pachon is a special advisor to the Kleinman Center, in charge of designing and overseeing international programs and teaching. She was previously the Center’s research director.

Dillon Weber

Research AssistantDillon Weber was a research fellow at the Kleinman Center and a graduate of the University of Pennsylvania majoring in chemical and biomolecular engineering and economics.

[1] International Energy Statistics: Energy Information Administration, 2015.

[2] “Climate Action Tracker: Canada Assessment” last updated May 2015, http://climateactiontracker.org/countries/developed/canada.html

[3] “The White House Statement by the President on the Keystone XL Pipeline”, November 2015, https://www.whitehouse.gov/the-press-office/2015/11/06/statement-preside…

[4] Specific Gas Emitters Regulation, Alberta Regulation 139/2007

[5] Dobson, Sarah and Jennifer Winter. “The Case for a Carbon Tax in Alberta.” University of Calgary School of Public Policy Research Papers 8, no. 40 (Nov 2015, 2015).

[6] Read, Andrew. “Backgrounder: Climate Policy in Alberta” Pembina Institute, July 2014

[7] Climate Leadership Implementation Act (SA 2016, cC16.9)

[8] Leach, Andrew et al. Climate Leadership Report to the Minister: Alberta Government, 2015.

[9] Annual Electricity Data Collection: Total Generation: Alberta Utilities Commission, 2015.

[10] Use of Internal Carbon Price by Companies: Carbon Disclosure Project, 2013.