Today's electric grid is developing within the confines of a century-old regulatory system. This article provides an overview of power sector regulation and offers a legal path forward for the regulation of distributed energy resources.

Regulation of the U.S. electricity industry is split primarily between state public utility commissions (PUCs) and the Federal Energy Regulatory Commission (FERC) along jurisdictional lines established by Congress nearly a century ago. The division of authority outlined in the Federal Power Act (FPA) accords with the industry’s structure and technology that existed at the time.

This anachronistic governance framework shapes the industry’s ongoing development. Our twenty-first century electric grid is developing within the confines of an early twentieth century regulatory system.

This article briefly summarizes the evolution of the electricity industry with a focus on the jurisdictional framework and on how the relative influence of FERC and PUCs has shifted over time. It then examines outstanding legal questions and quandaries about distributed energy resources.

These technologies upend a long-standing industry assumption that power flows only from utilities to consumers. Bidirectional power flows enable new transactions that do not align with traditional PUC or FERC jurisdiction and expose a set of unresolved jurisdictional issues.

Recapping a Century of Regulatory History

When Congress passed the FPA, most states had already developed a comprehensive scheme for electric utility regulation. By declaring power companies “public utilities,” states shielded established companies from competition to motivate investment in the nascent industry. State-regulated rates reimbursed the utility for the costs of providing service and provided it with a sufficient profit to attract investors.

This model reduced the utility’s risk exposure, allowing it to raise inexpensive capital that financed infrastructure expansion. In fostering continual growth, states aligned the public interest with private profit. Utilities were incentivized to meet society’s growing energy demand, and consumers were protected from monopoly abuses by a comprehensive regulatory system.

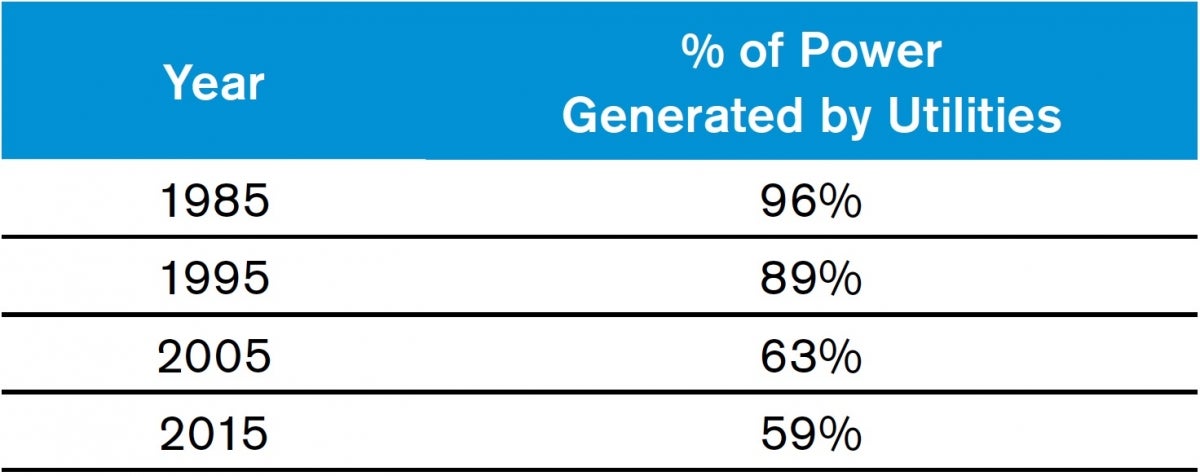

In 1935, Congress provided FERC with jurisdiction over electric transmission rates and wholesale power sales “in interstate commerce.” At the time, wholesale sales between utilities facilitated over long-distance transmission lines were a relatively small part of the business. The vast majority of electricity was sold by utilities directly to their ratepayers.

Each utility built its own generation and distribution infrastructure primarily to meet local consumer demand. Utilities financed construction of those assets almost exclusively with state-regulated retail rates and securities. The FPA left these transactions and facilities under state control, thereby maintaining states’ regulatory primacy over the industry.

Over the ensuing decades, the industry regionalized. Across the country, utilities formed joint ventures to construct new power plants, particularly nuclear-powered facilities, that were sized to meet regional demand rather than the needs a single utility’s consumers.

Meanwhile, utilities formed nearly two dozen “power pools,” contractual arrangements that enabled trades of electricity during emergencies and maintenance, seasonal exchanges of energy, sharing of reserve capacity, and grid optimization. The interstate high-voltage utility-owned transmission lines that made these joint ventures and agreements possible were closed to competing companies. Utilities operated these grids as cartels, using their market power over transmission to restrict competition and maintain their dominance over power generation.

Through a series of orders issued in the 1990s, and without any mandate from Congress, FERC required utilities to provide non-discriminatory access to their transmission lines. Opening the transmission system to non-utility companies allowed them to sell power and enabled the creation of competitive wholesale power markets.

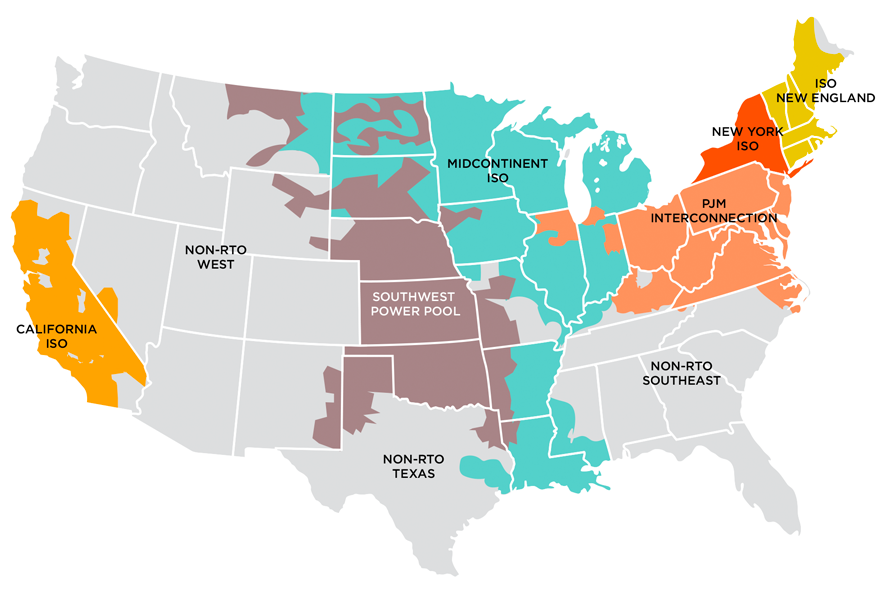

FERC also outlined the functions of regional transmission operators (RTO), private organizations that manage the regional grid, plan transmission expansion, allocate the costs of new projects among market participants, and operate wholesale energy markets. With the exception of Texas, FERC approves all RTO rules and adjudicates disputes about rules and their implementation.

At the state level, industry restructuring laws passed by approximately a dozen states in the late 1990s required or incentivized utilities to sell their power plants to corporate affiliates or independent companies. Without their own generation, utilities had to procure power through wholesale markets to meet the demand of their ratepayers. State restructuring thus seeded the new RTO markets with consumer demand and non-utility power suppliers.

In other states, vertically integrated utilities remain the dominant industry players. In the Midwest and Great Plains regions, vertically integrated utilities participate in RTOs where they sell power from their own facilities and purchase power sold by other utilities and non-utility generators. In non-RTO regions (see Figure 1), many vertically integrated utilities continue to construct generation but also contract with independent power producers for some portion of the power they distribute and sell to their ratepayers.

FERC’s Expanding Influence

Today, most new power plants sell at wholesale to RTOs or utilities. Under either transaction model, FERC has exclusive jurisdiction over the rates, terms, and conditions of the plant’s sales and thus has considerable influence over the price of power.

As the power generation market has shifted from utility-owned plants serving retail ratepayers to FERC-regulated wholesale sales, states lost considerable leverage over power plant investment. Nonetheless, states maintain influence through their regulation of plant siting and, critically, utility portfolios. By requiring a utility to utilize specified types of generation, states motivate investment in preferred sources of generation.

State policies that promote particular types of generation, particularly wind and solar, highlight a legal gap exposed by restructuring’s separation of power generation from its delivery. Because states are prohibited by the FPA from setting a wholesale rate, policies target the purchasing utility, which is subject to extensive state regulation, rather than the generator that is generally unregulated by the PUC.

State utility procurement mandates have the effect of subsidizing FERC-regulated wholesale sales. For example, more than half of states require utilities to procure certificates (or credits) that represent the environmental attributes of clean energy. Generators earn revenue by selling these credits, which increases the value of the energy that they sell at wholesale.

Opponents of state clean energy policies argue that state mandates to utilities intrude on FERC’s exclusive jurisdiction over wholesale power sales. The legal ambiguity around state subsidies may be resolved in 2018 by two federal courts. New York and Illinois require utilities to purchase zero emission credits from specified nuclear plants that represent the benefits of their emission-free power. Competing generators argue that state-mandated payments for these credits amount to impermissible state regulation of wholesale rates. If the courts agree, the balance of power over power generation would tilt further towards FERC.

Restructuring also led to an increased role for FERC over transmission development. Utilities historically built transmission to move power from their power plants to their distribution facilities. As the industry regionalized through joint ventures and power pools, utilities expanded the interstate transmission system, but each utility continued to focus on the needs of its own ratepayers. FERC’s regulation of RTOs institutionalized regional planning and cost allocation. Through these processes, utilities must necessarily consider and pay for regional transmission needs.

FERC rules also require RTOs to allow non-utility companies to compete in the transmission development market. Like independent power producers, merchant transmission companies are largely unregulated by PUCs and subject only to FERC’s market rules. FERC’s relative influence over the sector increases as these merchant transmission developers gain market share. However, institutional barriers at RTOs and state laws that favor utility transmission owners have restrained the development of a competitive transmission market.

As with generation, each state retains authority over siting transmission lines. Many states permit construction only if the applicant demonstrates a proposed project’s in-state benefits. The mismatch between the regional and local needs may hamper the development of the interstate grid. Projects that meet FERC’s goal of improving regional reliability and efficiency may fail to satisfy a state’s parochial concerns. The reverse is also possible—a proposed project that achieves a state’s goal, such as importing renewable energy into the state, may fail to obtain financial approval from FERC.

Utilities continue to enjoy monopoly control over distribution infrastructure under state regulation. Distribution rates paid by consumers are set by PUCs. Government and cooperatively owned utilities are largely excluded from the regulatory regime described in this article. In total, these entities provide distribution service to approximately twenty percent of U.S. homes.

The remainder of this article explores outstanding legal questions about the regulation of distributed energy resources (DERs), with a focus on jurisdictional ambiguities and complications. Key legal questions center on the scope of FERC’s jurisdiction over “wholesale sales in interstate commerce.”

Legal Uncertainties around DER Regulation

Distributed Energy Resources (DERs) include small-scale generation and storage technologies as well as demand response services that reduce consumption in response to price signals or instructions from the grid operator. DERs can provide energy as well as services that ensure the grid’s reliability and safe operation. They may be associated with a utility ratepayer’s account and located “behind-the-meter” or may be connected to the distribution system in front of the meter and owned by the local utility or an independent company.

Sales of energy and services by DERs are generally regulated by PUCs. DERs have historically accounted for a relatively small portion of the total power market, and wholesale markets could ignore their impact. Recent growth and the prospect of continued technological improvements are leading FERC to rethink its role. Whether FERC seeks to displace or complement state DER programs is an outstanding question.

Any move by FERC will be controversial. FERC’s jurisdiction over wholesale sales in interstate commerce has covered energy sales from large-scale plants that transfer power through the interstate transmission system to utilities that distribute that power to consumers. Under this top-down model, FERC’s authority did not reach down into utility distribution systems that were regulated exclusively by PUCs. FERC’s regulation of demand response starting in the early 2000s breached this bygone bright line and provides a model for how FERC is approaching expanding its regulation of DERs.

In 2008, FERC ordered RTO markets to allow demand response aggregators to sell in wholesale markets. These companies contract with consumers willing to reduce their consumption when energy prices are high and sell those demand savings to RTOs. Two years later, FERC ordered RTOs to pay demand response aggregators (and large consumers providing demand response service) the same rate that they pay generators because both energy savings and generation can balance supply and demand and ensure the power system’s reliability.

In response to FERC’s rule, generation companies filed suit, arguing that FERC’s jurisdiction over wholesale sales in interstate commerce did not provide it with authority to regulate demand response. The Supreme Court rejected their argument that demand response entails reductions in retail sales and is therefore beyond the reach of FERC’s wholesale sales jurisdiction. Instead, the Court concluded that FERC’s regulations aimed to improve the reliability and efficiency of wholesale markets and did not usurp state authority.

Splitting DER Oversight between FERC and States

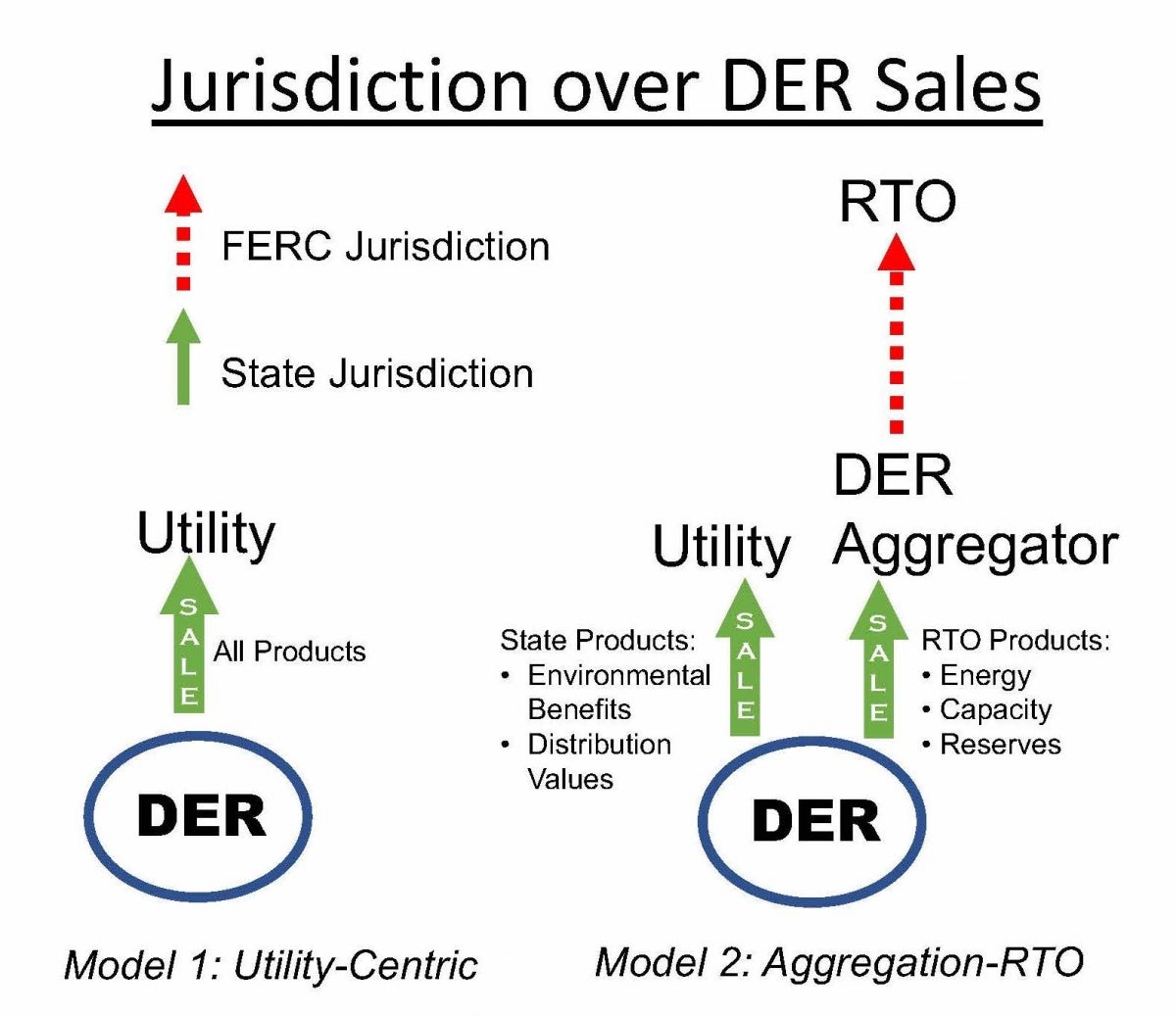

Shortly after the Court affirmed FERC’s jurisdiction over demand response, FERC proposed to require RTOs to allow DER aggregators to participate in the markets. Aggregators contract with multiple DER owners or own several DER systems across a region. They bid the accumulated energy and grid services from their DER fleet into an RTO market as if the DERs were a single resource. As with demand response, states would retain jurisdiction over sales from individual DERs to an aggregator, and FERC would have exclusive authority over sales from an aggregator to an RTO.

This model allows DERs to participate in RTO markets and avoid the expense and complexities of doing so directly. The model also provides an opportunity for continued state-regulated payments to DERs. DERs can provide value that is not compensable in RTO markets, including avoided pollution and operational benefits to the distribution grid. As illustrated in Figure 2, DERs would sell energy and other RTO products to aggregators and would sell state-regulated products to the local utility.

This aggregation model can co-exist with the current utility-centric model for DER sales. Today, most ratepayers with rooftop solar get credit on their utility bills for their energy production by paying the utility the difference between their total monthly consumption and solar production.

FERC has concluded that this billing convention, known as net metering, is merely a method of measuring retail sales, and its jurisdiction is not implicated so long as there is no net sale over the billing period from the ratepayer to the utility. When FERC revisits this issue (as it inevitably will), it should clarify that it will not assert jurisdiction over any DER sales, regardless of whether there is a net sale between the DER owner and utility.

This renouncement will ensure that FERC never has the burden of regulating DER sales. If FERC were to assert jurisdiction, the FPA would compel FERC to determine the “just and reasonable” rate for sales by DERs. As discussed, FERC relies on markets to set power prices, and it deems those prices just and reasonable based on its presumption that they are the result of fair competition.

That presumption is predicated on FERC’s rule that transmission owners open their networks to rival suppliers. It is unlikely that FERC has jurisdiction to impose a similar open-access requirement at the distribution level. Without this pre-requisite for competition, FERC’s market-based rate approach to ratemaking may not be extendible to DERs and it is not clear how FERC would regulate rates.

Apart from this rate-setting challenge, FERC’s assertion of jurisdiction would prematurely quash state efforts to foster DERs. Small-scale resources have the potential to transform the power sector, but their scalability and numerosity present an array of operational and economic challenges. FERC jurisdiction would preempt state experimentation and impose a nationally uniform approach to DER regulation.

FERC’s legal justification for disclaiming jurisdiction over DER sales would hinge on its interpretation of “wholesale sales in interstate commerce.” While an energy transfer from a DER to a local utility may be a “wholesale sale,” defined in the FPA as a sale for resale, FERC could conclude that it is not “in interstate commerce.” Instead, the transfer is beyond FERC’s reach, because the transaction is entirely local.

This determination would not rely on a demonstration that DER energy is actually consumed locally. Rather, FERC’s legal conclusion would be premised on a practical reading of the FPA, including its explicit reservation of authority to states over local transactions and facilities (Harvard EPI 2017).

While a contrary legal conclusion is plausible, it is within FERC’s discretion to decline to adopt it. When FERC’s landmark open-access transmission order was challenged in court, some parties argued that FERC had not gone far enough and that it was compelled by the FPA to pry open the so-called “retail transmission” market.

The Court recognized that this broader assertion of authority would have significant implications for state regulation and concluded that FERC had “discretion to decline to assert such jurisdiction . . . in part because of the complicated nature of the jurisdictional issues.” FERC could take the same approach with DERs by concluding that even if it could assert jurisdiction over DER sales, it is making a “statutorily permissible policy choice” to leave states in charge and only assert jurisdiction over aggregators’ wholesale sales to RTOs (New York v. FERC 2002).

If FERC does disclaim jurisdiction over DER sales, it nonetheless has important roles to play in developing DER markets. First, FERC should finalize its proposed DER aggregation rule. Enabling these resources to participate in RTO markets will spur innovation and enhance competition. Second, FERC should use its convening power to facilitate coordination between RTOs, utilities, and aggregators. Any jurisdictional approach will require that these entities share information and establish communications and operational protocols.

Proper coordination will allow the utility-centric and aggregation regulatory models to co-exist. For example, a DER owner could contract with an aggregator to sell energy and other RTO products under specified market conditions and sell those products to the utility at other times. So long as the utility and aggregator are both aware of the arrangement and have proper protocols in place, the DER owner would not be paid twice for the same service.

A sustainable regulatory framework for DERs should allow owners, utilities, and RTOs to capture the full value of these resources. DERs can deliver services across the entire electric system and reduce ratepayer-owners’ utility bills. Unlocking DERs’ full value will require coordination across the FERC-PUC jurisdictional line. FERC can facilitate this coordination while allowing states to continue administering DER programs

Conclusion

The FPA’s division of authority aligned regulation of the electric industry with the technological and economic realities of the 1930s. Regionalization of the industry and restructuring altered the balance of power between PUCs and FERCs. Today, DERs enable transactions that do not fit neatly within the FPA’s jurisdictional boundaries. FERC’s DER aggregation rule would be an important step in resolving regulatory ambiguities and unleashing DERs’ full potential.

The author wishes to acknowledge the helpful comments of Dr. James R. Hines. Any remaining errors are the responsibility of the author alone.

Ari Peskoe

Director, Electricity Law Initiative at Harvard UniversityAri Peskoe is the director of the Electricity Law Initiative at Harvard Law School’s Environmental and Energy Law Program. In 2017-2018 Peskoe was a visiting scholar at the Kleinman Center.

Comments of the Harvard Environmental Policy Initiative, FERC Docket RM18-9 (Apr. 17, 2017).

“ISO RTO Operating Regions,” Sustainable FERC, accessed April 10, 2018. http://sustainableferc.org/iso-rto-operating-regions/

New York v. FERC, 535 U.S. 1, 28 (2002).