Plugging Carbon Leaks with the European Union’s New Policy

On the road to carbon neutrality in 2050, the European Union (EU) has recently adopted a Carbon Border Adjustment Mechanism (CBAM) to address carbon leakage from international trade. The CBAM raises new challenges. It should be appropriately designed to level the playing field within and outside the EU, and it has the potential to export decarbonization outside the EU’s borders.

At a Glance

Key Challenge

Policy Insight

On the road to carbon neutrality in 2050, the European Union (EU) has recently adopted a Carbon Border Adjustment Mechanism (CBAM) to address carbon leakage from international trade. The CBAM raises new challenges. It should be appropriately designed to level the playing field within and outside the EU, and it has the potential to export decarbonization outside the EU’s borders.

Carbon Leakage

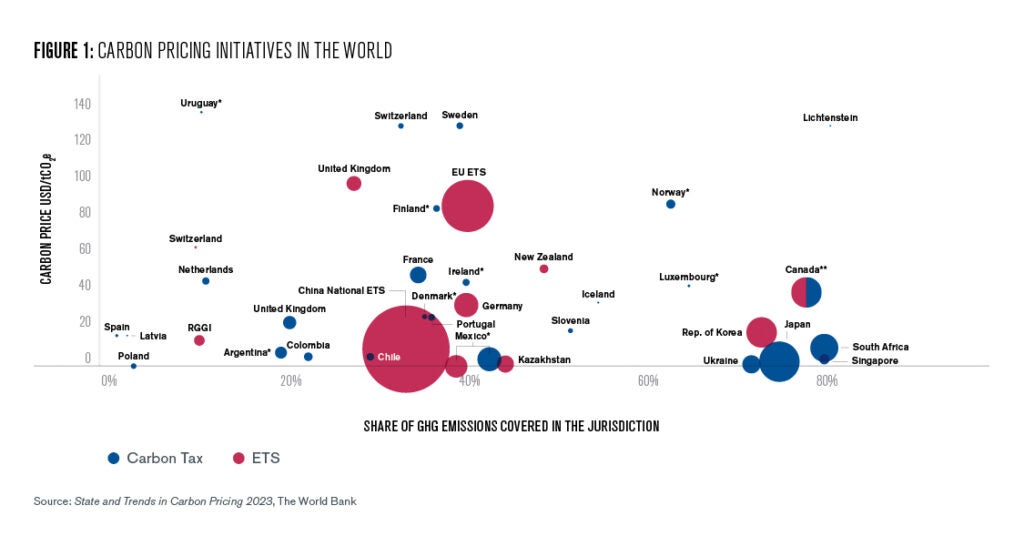

In the last decade, initiatives to price carbon have flourished. Carbon taxes and emission trading systems have been implemented in many parts of the world: in the EU; some parts of the U.S. (California and New England) and Canada (British Columbia, Quebec); as well asChina, South Korea, and New Zealand (see Figure 1 below).

Unilateral carbon pricing does not align well with globalization. Energy-intensive manufacturing firms operating in regulated jurisdictions must pay for their carbon dioxide and other greenhouse gas (GHG) emissions. Such regulation burden increases their cost, making them less competitive. These firms lose market share to competitors located in regions without carbon pricing. They export less and sell less domestically, as imported products become cheaper in comparison because they are not subject to the carbon price.

Some firms are tempted to relocate their production plants abroad to avoid paying for their carbon emissions. As a result, the domestic reduction in GHG emissions is partly offset by increased production in countries where emissions are unregulated — a phenomenon known as emissions leakage. Even though empirical evidence of actual carbon emission leakage is quite limited, it could become substantial with higher carbon prices and more industries involved in the future. According to Fowlie and Reguant (2022), if the U.S. priced carbon at $25 per ton, for every ton of CO2 reduced domestically, half a ton would leak through international trade, offsetting the effects and increasing emissions abroad.

Addressing Carbon Leakage in Europe

The EU’s Emission Trading System (EU ETS) has been a powerful tool in reducing European carbon emissions. Since 2005, the EU ETS has capped GHG emitted by the most polluting industries within the EU territory. Eligible firms buy allowances through an auction system and trade them on the EU ETS market. To address carbon leakage, the EU ETS has provided a certain number of emission allowances for free to industrial manufacturers exposed to international competition.

In 2026, the Carbon Border Adjustment Mechanism (CBAM) will begin to replace the free allowance policy for sectors such as cement, iron and steel, aluminum, fertilizers, electricity, and hydrogen. The transition from the free allowances system to CBAM will occur gradually over ten years. The CBAM charges a tariff on imports based on the carbon footprint of the products (also referred to as emission factor or emission intensity). Importers must purchase CBAM credits for each ton of the product’s carbon footprint at the weekly average price of an EU ETS allowance.

A preliminary CBAM transition period began last year. During this phase, importers have been required to report the carbon footprint of their products, known as the embedded emissions. The European Commission provides the methodology for reporting and default values for the emissions embedded in all eligible products. Reporting does not imply paying the carbon tariff so far, as this transition phase is a pilot and learning period. Starting in 2026, importers will be required to buy the CBAM certificates based on the embedded emissions they have reported.

The EU’s CBAM is essentially a border charge on imports that replaces free allowances. As Fischer and Fox (2012) mention, carbon leakage can be addressed with a border rebate on exports. Firms are exempted from paying the carbon price on the share of production they export in carbon-free jurisdictions. Export rebates could be implemented in the EU ETS by keeping free allowances on exported production.

Moving From Free Allowances to a CBAM

In Ambec, Esposito, and Pacelli (2024), we investigate how free allowances and the CBAM impact competitiveness, international trade, and carbon leakage. In our framework, firms invest in decarbonization, and they compete with foreign firms in both domestic and international markets. Our analysis is calibrated on the EU’s cement, iron, and steel industries.

When firms receive allowances for free, they do not bear the total cost of their GHG emissions. While this approach is bad for the climate, it helps competitiveness. This means that free allowances reduce the regulatory burden put on EU firms. Their production costs are more comparable to those of their foreign competitors, promoting a fairer competition. Thus, free allowances level the playing field within and outside the EU.

In contrast, with the CBAM, firms are charged the full cost of their GHG emissions. The CBAM aligns with the “polluter pays principle,” which mandates that polluters bear the harmful impacts of the pollutants they emit. Under the CBAM, foreign firms are subjected to the same emission costs but only for their production sold in the EU. This ensures that EU and foreign firms face fair, equivalent regulatory costs when serving the EU market.

However, their regulation costs diverge for their production sold outside the EU. Although EU firms must pay for their GHG emissions when serving foreign markets, firms operating outside the EU do not. Therefore, the CBAM levels the playing field within the EU but not beyond its borders.

Replacing free allowances with a border charge in a CBAM dampens international trade: raising the cost of foreign products reduces imports within the EU. However, unlike free allowances, the border charge does not boost EU exports.

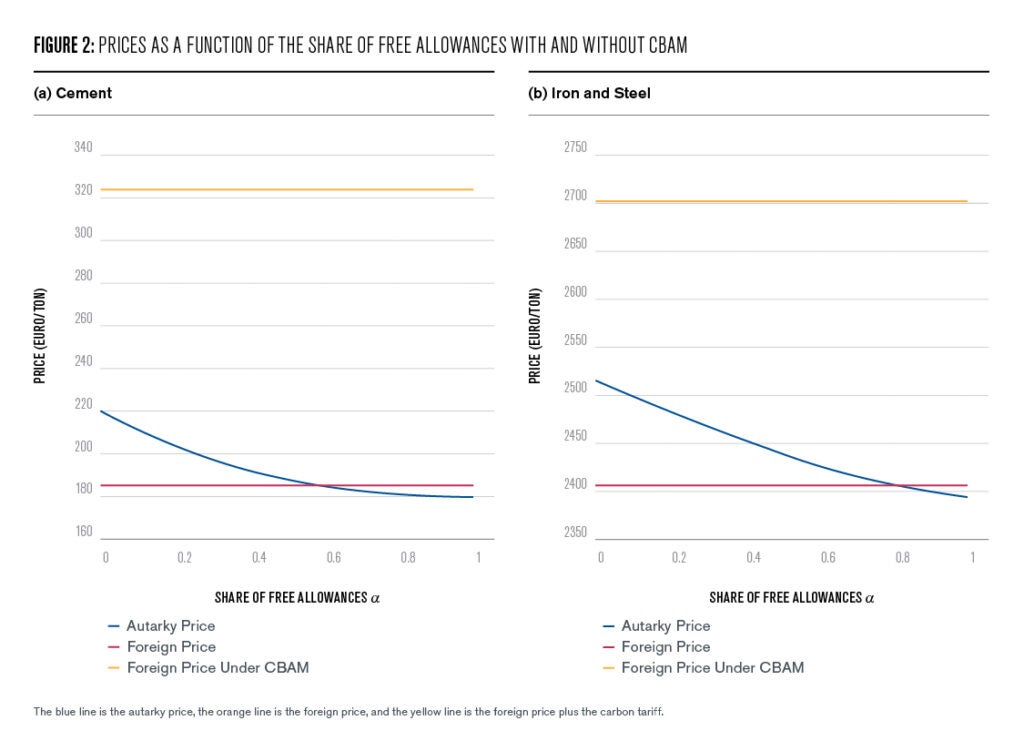

Our calibration compares the economic outcome of both free allowances and the CBAM by analyzing the cost of products on both sides of the EU’s border. These findings are illustrated in Figure 2 below with a carbon price of €162 for cement (left) and steel (right), with the x-axis representing the share of free allowances.

The blue line in Figure 2 represents our estimation of the price of the product in the EU without international trade, known as the autarky price. The orange line is the price of foreign products imported from Turkey or Russia into the EU. Without CBAM or free allowances, the orange line is below the blue line (left-hand side of both graphs), meaning foreign products are cheaper than the autarky price.

In this scenario, domestic production is not competitive, and the EU relies more on imports. As the share of free allowances increases (i.e., moving right in the graphs), EU products become more competitive. With nearly 100% free allowances, EU products become cheaper than foreign products, shifting the economic outcome from imports to exports.

The introduction of the border charge shifts the price of foreign products when imported into the EU from the orange to the yellow line, with the difference being the carbon tariff. Consequently, foreign products are not any more competitive within the EU and are no longer imported. The CBAM moves the equilibrium outcome from import to no trade without free allowances.

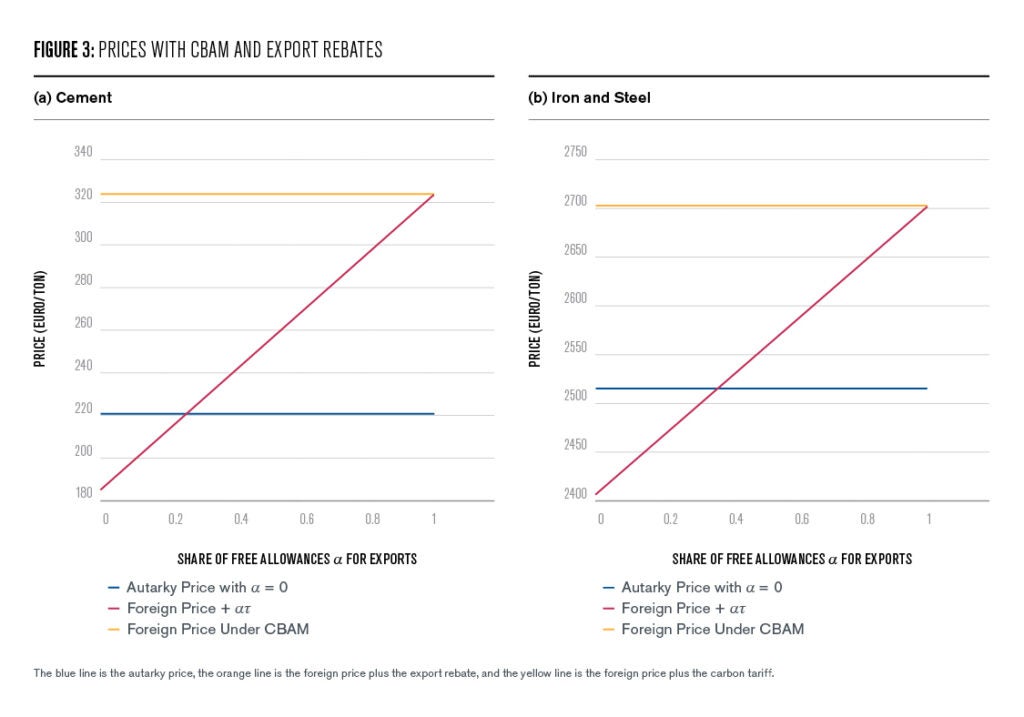

In the paper, we also analyze another policy that should complement the border charge in the CBAM to foster exports: an export rebate. This rebate would exempt EU firms from paying the total cost of the GHG emitted by their production process only on exported output. The export rebate would restore fair competition in international markets by alleviating the regulation burden for exported products. In other words, it would level the playing field outside the EU. To illustrate how export rebates modify the economic outcome, we present Figure 3 below, which reproduces Figure 2 by adding the export rebate applied to the foreign.

When EU producers sell in the international market, they receive not only the foreign price but also an export rebate, such as free allowances for exported production. The orange line in Figure 3 represents the return per exported output. This return exceeds the autarky price when the export rebate is high enough: over 25% of free allowances on exported production for cement or 40% for steel. As a result, EU firms benefit then from exporting their production.

The export rebate was on the table during the negotiation phase between the European Commission, the European Parliament, and the European Council. In June 2022, the European Parliament adopted an amendment favoring the continuation of “free allowances except on the production that is exported” (Ambec 2022). That would have boosted exports, benefiting not only the EU economy but also the climate because foreign products have generally higher embedded emissions than EU products. Replacing foreign products with EU ones would reduce global GHG emissions. Unfortunately, the amendment was not included in the final CBAM project.

Carbon Leakage Along the Supply Chain

The EU has decided to implement the carbon tariff only in a few sectors, including aluminum, cement, electricity, fertilizers, hydrogen, iron, and steel. These sectors are raw materials and energy sources used mostly as inputs upstream of the supply chain, making their carbon footprint easier to compute. The European Parliament had advocated extending the CBAM to plastic and organic chemicals. However, these products were excluded from the final decision, due to the challenges associated to the calculation of their carbon footprint.

While targeting a subset of sectors rather than the whole economy seems better for administrative feasibility, it can also lead to undesirable effects. First, products from targeted sectors might be replaced by close substitutes not covered by the CBAM, such as replacing cement and steel with wood or glass in the construction industry. The emission leakage mitigated for the targeted sectors can be more than offset by an increased import of raw materials exempted from the carbon tariff.

Second, by increasing the cost of inputs within the EU but not outside, the CBAM incentivizes firms to relocate their manufacturing plants outside the EU. Plugging carbon leaks only in some sectors upstream might create bigger leaks in other sectors downstream of the supply chain of manufactured products. For instance, automotive and aviation manufacturers might relocate their production abroad because they have access to cheaper steel, electricity, or aluminum, and they can import vehicles and planes into the EU without being subject to a CBAM.

This supply chain leakage effect could be avoided by covering more products downstream of the supply chain, for example, by including the weight of basic raw materials covered in the CBAM, which are embodied in the imported products. However, that approach would introduce another layer of complexity as the carbon intensity of steel, aluminum, or power embedded in, following the earlier example, vehicles and planes are difficult to track and measure.

Comparing Carbon Prices

When importing from countries with carbon pricing, importers will be charged only the carbon price difference between the EU and the country of origin. This partial exemption from paying the full carbon tariff sounds appealing for two reasons. First, it makes the EU CBAM more compatible with the World Trade Organization’s rules by ensuring that domestic and foreign products are treated similarly by paying the same price for their carbon footprint. Otherwise, foreign producers would be charged twice for their emissions and pay more for the same carbon footprint as EU producers due to the EU CBAM. Second, it encourages other countries to adopt their own carbon pricing for exports, allowing them to collect revenue from carbon pricing instead of leaving it to the EU.

Firms would pay the same carbon price when exporting to the EU, but part of it would be collected by the country of origin rather than by the EU. Charging the carbon price difference encourages policy spillovers on carbon pricing. This policy spillover effect promotes convergence towards a uniform carbon price, the one of the EU ETS. It increases the efficiency of decarbonization investments as costs are minimized when polluters pay the same price for their emissions, making decarbonization more cost-effective.

Nevertheless, adjusting for the price difference does not necessarily fully restore fair competition between EU and foreign products since the carbon price does not fully capture the regulatory burden. Other considerations, such as the emission scope, the sectors covered, or the allocation of allowances in emission trading schemes, matter.

For instance, the first ETS implemented in the U.S. in 2009, the Regional Greenhouse Gas Initiative (RGGI), covers only the emissions from electricity generation. Power plants pass through the cost of pollution allowances at least partially to their clients, including energy-intensive manufacturing plants. However, unlike in the EU, these energy-intensive facilities are not paying for what they emit by burning fossil fuel.

In the same vein, in many ETSs, most of the allowances are free. In China, firms receive allowances for 70% of their 2021 emissions for free (ICAP 2024), and therefore, only 30% of their emissions are charged, or even less if they reduce them. Moreover, they do not bear the carbon price if their emissions per output are lower than the threshold. They might benefit from carbon pricing if they are the net seller of allowances by cashing out their allowance surplus.

In contrast, in the EU, power plants must buy all their allowances and free allowances will be phased out in other sectors by 2036. The price paid per unit of CO2 equivalent emissions is a poor statistic of the regulatory burden when ETS rules differ.

The IRA and the U.S. CBAM

In the U.S., federal-level carbon pricing is unlikely. Instead, the Biden administration passed the Inflation Reduction Act (IRA) to foster decarbonization in the U.S. economy. The IRA includes some emission pricing, but only on methane emitted by oil and gas facilities. Thus, not all emissions are charged, only those exceeding a threshold, so the more performing facilities will likely be exempted.

The IRA offers massive subsidies to low-carbon technologies, such as renewable energy sources, nuclear power, electric vehicles, batteries, carbon sequestration and storage, and energy efficiency. Estimates of the total bill range from $300 to $700 billion over ten years (Bistline et al., 2023). With the IRA, decarbonization is financed by public funds, and firms pay only part of the cost of abating carbon emissions.

Nevertheless, U.S. companies can still compete with foreign firms using cheap fossil fuel energy and low-cost dirty technologies. As with carbon pricing, carbon emissions can leak with decarbonization subsidies: For each dollar invested in low-carbon technologies, the reduction of CO2 in the U.S. might be partially offset by an increase in emissions outside the U.S. Anti-leakage policies can thus be justified to make the IRA’s subsidies more effective in reducing GHG emissions in the U.S.

Along this line, the U.S. Senate discussed introducing a carbon border mechanism in the Clean Competition Act (Clausing and Wolfram, 2023). It would charge a tariff on carbon emissions above a threshold corresponding to the U.S. average emission intensity. It could be an alternative to the high tariffs implemented during the Trump administration’s mandate to protect the U.S. steel and aluminum industries. Additionally, a carbon tariff protects domestic production against competition with carbon-intensive exports. It also encourages emission reductions beyond U.S. borders, incentivizing foreign firms to reduce their carbon intensity below the U.S. average to be exempted from the carbon tariff.

Each dollar spent reducing the carbon intensity of U.S. products could potentially create spillovers with American trading partners. The carbon tariff would then amplify the emission reduction driven by the IRA through a snowball effect: Each reduction in the emission intensity of American products is eventually matched by foreign firms to lower their carbon bill when trading with the U.S.

Concluding Comments

Climate change is a global issue addressed with local policies, such as carbon pricing and subsidies for low-carbon technologies. International trade can undermine the effectiveness of these local policies by increasing imports from countries with unregulated or lax climate policies, where firms produce with cheap and dirty technologies. Carbon leakage must be addressed through complementary trade policies like the EU’s CBAM.

Despite its complexity, the CBAM has several properties that make it a good candidate to complement the EU ETS. Unlike the practice of giving away free allowances, which exempts EU firms from paying the total cost of their carbon emissions, the CBAM is consistent with the polluter-pays principle. By charging the EU ETS price per carbon emission embedded in imported goods, the CBAM levels the playing field within the EU. However, it does not level the playing field beyond the EU. To do so, it should be complemented with export rebates, such as free allowances on the production sold in international markets.

The EU’s CBAM incentivizes firms importing within the EU to reduce carbon emissions and encourages trading country partners with the EU to launch their carbon pricing. However, its implementation will be challenging. It started with the reporting of the embedded emissions during a pilot phase. Some features raise concerns, such as its partial coverage (only a few sectors upstream of the supply chain) or the adjustment to foreign carbon prices. Nevertheless, the EU’s CBAM is a first step in better coordination between climate and trade policies, and it could become an inspiration for other countries investing in decarbonization, such as the U.S.

Stefan Ambec

INRAE Research Professor, Toulouse School of EconomicsStefan Ambec is INRAE Research Professor at Toulouse School of Economics where he leads the TSE Energy and Climate Center. Ambec is a 2023-2024 Kleinman Center Visiting Scholar.

Ambec, S. 2022. “The European Union’s Carbon Border Adjustment Mechanism: Challenges and perspectives,” TSE Working Paper, n. 22-1365. https://www.tse-fr.eu/sites/default/files/TSE/documents/doc/wp/2022/wp_tse_1365.pdf

Ambec, S., F. Esposito and A. Pacelli. 2024. “The Economics of Carbon Leakage Mitigation Policies.” Journal of Environmental Economics and Management, 2024, 175: 102973.

Bistline, J., N. Mehrotra and C. Wolfram. 2023. “Economic Implication of the Climate Provisions of the Inflation Reduction Act.” NBER working paper 31267, http://www.nber.org/papers/w31267

Clausing, K.A. and C. Wolfram. 2023. “Carbon Border Adjustments, Climate Clubs, and Subsidy Races When Climate Policy Vary.” Journal of Economic Perspectives, 37(3): 137-162.

Fischer, C. and A. K. Fox. 2012. “Comparing Policies to Combat Emissions Leakage: Border Carbon Adjustments Versus Rebates.” Journal of Environmental Economics and Management 64(2): 199–216.

Fowlie, M. L. and Reguant, M. 2022. “Mitigating Emissions Leakage in Incomplete Carbon Markets.” Journal of the Association of Environmental and Resource Economists, 9(2): 307–343.

ICAP, 2024. “Emission Trading Worldwide: Status Report 2024. Berlin: International Carbon Action Partnership.”