PA Future Utility Part II: Electric Utility Challenges and Opportunities

This second digest in the Pennsylvania Future Utility policy series examines challenges and opportunities facing electric utilities across the nation. This information is presented as a general overview, specific circumstances may change in each state or jurisdiction.

Introduction

Today, electric distribution companies are faced with a number of challenges impacting the way they do business and raising questions about the ongoing viability of the traditional regulatory approach (for more on the traditional regulatory approach, please review the “Part I – Background on Electric Utility Regulation” digest in the PA Future Utility policy series). There are also opportunities utilities are exploring to addressing these challenges.

Two large-scale, industry-based surveys are used as proxies for the perspectives of the modern day utility:

- Utility Dive’s 2015 State of the Electric Utility survey provides an excellent resource to understand the contemporary electric utility perspective, both from vertically integrated (where both power generation and distribution is regulated) and deregulated (where there are competitive wholesale generation markets) states. The 2015 Utility Dive survey included perspectives from 433 electric utility executives, mostly consisting of investor-owned and municipal utilities, from across the country.1

- Black and Veatch’s 2014 Strategic Directions: U.S. Electric Industry report surveyed 576 “qualified electric industry participants” from the U.S. and Canada & Mexico (7.9%), representing mostly public and investor-owned utilities. The majority of the participants represented electric distribution, regulated generation or vertically integrated utilities.2

Challenges

This list provides just a sample of the issues that electric utilities across the country are facing. The list tends to focus on issues most relevant in deregulated states. For states where generation is regulated, this list of challenges may be longer and more complex.

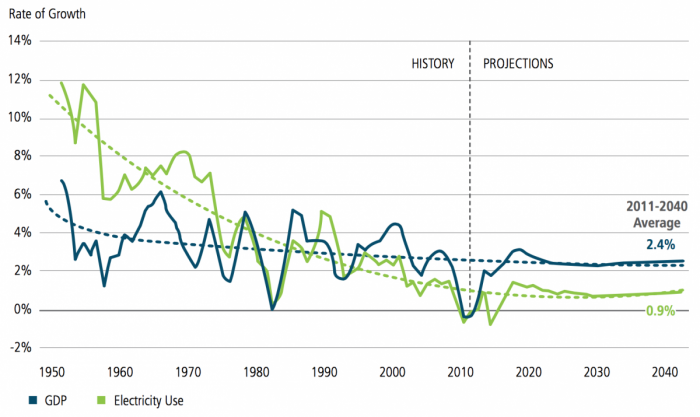

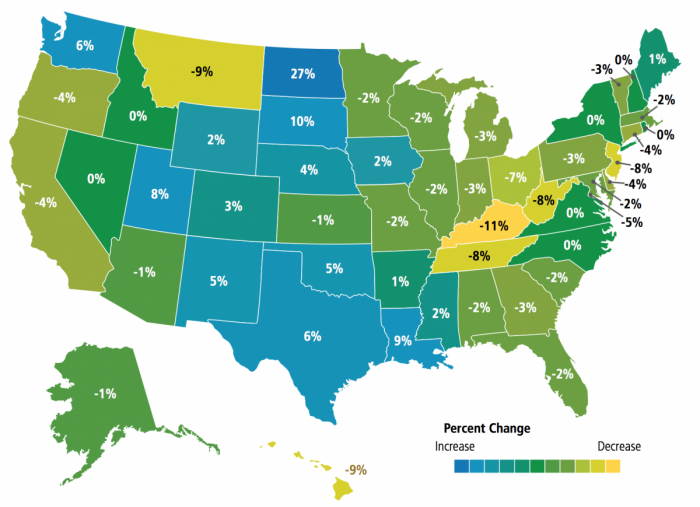

- Low Load Growth: Sales of electricity (or load) help support revenues to keep utilities profitable, fund new infrastructure investments, offset rising costs, etc. However, national data shows that load growth has steadily decreased over time, reducing the ability for utilities make capital investments and negatively impacting profitability. This phenomenon has the potential to reduce credit worthiness, which in turn could impact a company’s capital structure and costs (and therefore consumer costs). According to the Quadrennial Energy Review (QER), “U.S. electrical demand is at its lowest levels in decades, driven most significantly by policies that promote energy efficiency, supply/demand balance, and the shift in the economy to less energy intensive industry.”3 There is significant regional variation in load growth trends, as evidenced by Figure 2 below.

- Aging Infrastructure: When Utility Dive asked “what are the three most pressing challenges for their utility”, approximately 47 percent of the executives surveyed indicated that old infrastructure, followed by aging force (39%), the current regulatory model (38%), and stagnant load growth (28%).4 The American Society of Civil Engineers gave U.S. energy infrastructure a grade of D+, citing challenges with the electric grid that includes reliability concerns associated with aging equipment, intermittent power disruptions and increased vulnerability to cyber attacks.5 A study performed by the Brattle Group for the Edison Electrical Institute, a trade association representing investor-owned electric utilities, estimated that from 2010 – 2030, the entire U.S. electric utility industry could require investments of $1.5 – $2 trillion dollars, of which $298 billion is for transmission and $582 billion is for distribution infrastructure.6

- Grid Modernization and Cyber Security: Grid modernization efforts and investments, to make distribution systems more responsive (e.g. through advanced metering), capable of supporting greater distributed energy resource (DER) penetration, and to enhance resiliency are underway. Grid management challenges associated with increased DER penetration, such as accommodating two-way power flows and intermittent generation, can arise. Greater realization and deployment of microgrids may cause interconnection challenges between the microgrids and the utility system. In addition to these interoperability issues, as distribution system technologies advance, cybersecurity vulnerabilities also increase. A cybersecurity vulnerability is a weakness in a computing system that can result in problems if exploited by an attacker or is present in conjunction with a disruptive event. According to the Idaho National Laboratory, “Cybersecurity for energy delivery systems has emerged as one of the nation’s most serious grid modernization and infrastructure protection issues”.7 Approximately 82% of executives surveyed in 2015 by Utility Dive stated their utility’s investment in grid security is increasing and the Black & Veatch survey noted that in recent years cybersecurity has surged in the ranking of utility top 10 issues.8,9

- Distributed Energy Resources: Market driven technology advancements and cost reductions in DERs like solar, energy storage, and energy efficiency equipment raise challenges for distribution utilities related to 1) reduced sales (e.g. from greater customer-sited generation or increased efficiency), 2) shifting costs among consumers as DER owners reduce contributions to distribution system fixed costs (hence increasing the fixed cost burden on non-DER customers), and 3) the potential for challenges with grid management as DER penetration increases. In the 2015 Utility Dive survey, when asked “what is the biggest challenges you utility has with regard to distributed energy resources?” respondents noted grid operations (32%) and profitability (32%) as the top answers.10

- Public Policy Priorities: Public attitudes about environmental priorities have resulted in establishment of public policies such as renewable portfolio standards, energy efficiency resource standards, and regulations to reduce air pollution (e.g. mercury, ozone and carbon dioxide). Under certain regulatory frameworks, these public policy priorities have the potential to negatively impact distribution utility economics, for example by decreasing sales (e.g. increased DER or energy efficiency) and complicating grid operations. In addition, distribution utilities may find themselves having to comply with new regulatory requirements driven by environmental rules, adding administrative and compliance costs and legal liabilities. The Black & Veatch survey ranked environmental regulation as second among industry’s top 10 issues, with regulatory compliance costs serving as a primary driver for rate increase over the next five years.11

- Customer Transformation: : Over the past decade, utilities have observed significant changes in consumer expectations. The rapid expansion of connectivity and the emphasis on 24/7 , hand-held access to digital information, online shopping and other interactive customer experiences is changing expectations about utility customer service, data access, responsiveness and interactivity. Some consumers have converted to “prosumers” (e.g. DER owners), a type of utility customer that both draws from and delivers power to the grid, creating revenue and operational challenges. Technologies are developing to allow consumers to become more interactive with the grid and improve their energy management. These trends tend to drive the need for additional system investments by EDCs on both hardware and IT systems, increasing system operations costs. Although the utility has historically been the main point of contact between the customer and the grid, many new technology offerings are being provided by non-utility providers (e.g. cable, home security, software or technology vendors), raising new questions about the appropriate dividing line between competitive and regulated services and the appropriate approaches to ensure consumer protection.

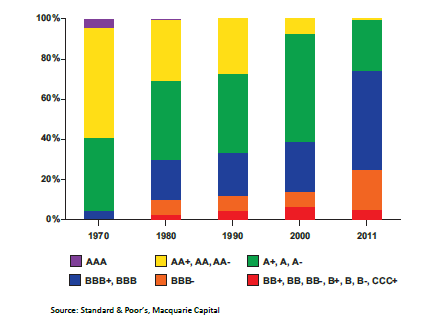

- Corporate Finance: The utility industry’s status as a natural monopoly has resulted in enjoyment of a guaranteed, fair rate of return of and on investment. This treatment has enabled utilities to enjoy access to relatively low-cost capital to finance business activities. Some industry advocates suggest that investor confidence in utility investments is being negatively impacted by risks related to business model changes, economic trends or regulatory policy changes.12 One potential measure of this erosion in utility investor confidence is the sectors credit rating, which seems to have steadily declined over the last few decades. Utility customer costs could increase (via increased revenue requirements) if utility company credit ratings declined to the point where significant rerating of capital, credit availability or broad based investor confidence is negatively impacted.

Source: EEI Disruptive Challenges (January 2013)

The aging of the utility workforce was cited in both surveys as a critical challenge for the utility sector. However, there were differences in how this issue was prioritized. Black & Veatch found that this issue is a slow-developing challenge (e.g. not all workers over retirement age will retire at once), whereas issues like regulatory compliance and cybersecurity have more immediate costs and deadlines.

Opportunities

Due to the highly regulated nature of electric utilities, significant investments in new technologies or innovative services generally require alignment of both utility business strategies and governmental policies. This tends slow the innovation cycle in the industry, as utilities seek assurances regarding cost recovery of prudent investments while regulators want demonstrations that new investments broadly serve the public interest. Many of the challenges listed above are seen as disruptive threats to a functioning system and require a proactive effort to achieve alignment between utilities and policymakers. Black & Veatch suggests that a company’s attitudes and acceptance of change, as well as recognizing the opportunity in disruption, can be key to developing a modern, thriving utility. Below is a sample list of potential opportunities that utilities are exploring to convert challenges into value:

- Combating Low Load Growth: The Utility Dive 2015 survey identified several ways for utilities to potentially manage the low load growth challenge. When asked “what is the best way for utilities to mitigate the impact of stagnant load growth”, utility executives responded, 1) develop new unregulated business models (23%), 2) develop new regulated business models (22%), 3) revenue decoupling (17%), 4) increased fixed bill charges (14%), 5) offer premium power options to customers (13%), and lost revenue adjustment mechanism (5%).13 However, the report specifically stated, “There is no clear solution for low electricity sales growth. Tellingly, the most common answer from utility executives was to develop new business models.”13 A recent report from GTM research indicates that utilities are beginning to examine their product service offerings to customers as a way to manage the low load growth challenge. For example, by leveraging existing customer service capacity (e.g. via call centers), expanding professional services based on expertise (e.g. with advanced metering infrastructure and interoperability), using fleet vehicle assets to perform field services beyond regulated operations and maintenance activities (e.g. tree trimming and landscaping), etc.14

- Revitalizing the Grid: Under the current regulatory model, distribution utilities can earn a rate of return on approved grid-related investments, providing an opportunity for increased profitability. Replacing outdated, critical infrastructure may provide a financial upside to utilities and create an opportunity to modernize the grid. However, regulators will judiciously evaluate these ratepayer supported infrastructure investments as they will likely be reflected in higher rates for customers. Some jurisdictions have put in place infrastructure replacement riders that allow for timely cost recovery for certain qualified infrastructure upgrades, usually related to maintaining safety and reliability. New infrastructure investment opportunities provide the utility with a chance to integrate newer technologies, address legacy issues, assess technologic obsolescence, and examine asset health and traditional views about useful life assumptions.

- Investing in Emerging Technologies: Although traditionally thought of as presenting revenue and operational challenges, energy storage, renewables, and DERs are seen as a significant value opportunity by many utility sector leaders. When Utility Dive asked what the top three emerging technologies that a utility should invest in, energy storage (53%), energy efficiency (41%), utility scale renewables (37%), demand response (37%) and distributed solar (32%) were the top answers.15 Utilities are also recognizing that market and regulatory drivers are likely to continue to promote the growth of these technologies. However, most utilities (56% in the Utility Dive survey) are uncertain as to how best to realize the DER opportunity.16 At the same time, both Black & Veatch and Utility Dive found that utilities are reviewing net metering policies in light of certain DER technologies, such as distributed solar, and the existence of cross-customer subsidies. Overall, Black & Veatch found that emerging technologies offer more opportunities than challenges, citing advanced metering infrastructure (AMI) as an example of a new technology that is being widely deployed by utilities, but where challenges exist to fully leverage the capabilities and opportunities (e.g. AMI data and analytics) provided by these investments.

- Enhanced Customer Engagement: The utility has a major branding advantage with respect to consumers. It is a recognized name with established connections to electricity customers in its territory. This advantage can be used in a variety of ways, such as better understanding and responding to customer needs (e.g. energy conservation tips, efficiency rebates, community outreach and education, service offerings) and enabling integration of customer-facing technologies (e.g. NEST thermostats, interactive apps). However, utilities may be at a disadvantage to non-regulated third party providers of these services. Therefore, utilities will need to examine customer interest and acquisition costs, and regulator perspectives carefully before developing innovative programming.

In many ways, the manner in which electric utilities are regulated creates significant challenges in responding to fast-paced changes. While the last transformational change – the introduction of wholesale and, in many markets, retail competition – primarily impacted the generation side of the industry, the emerging trends discussed above raise the potential of creating fundamental changes at the energy transmission and distribution system level. Technology innovation, evolving public policy priorities, changing customer expectations, and increasing levels of expectation with regard to reliability are forcing a re-thinking of how a sustainable grid can be maintained as these changes accelerate. The good news is there are many potential win-win opportunities that utilities can pursue while embracing emerging technologies and satisfying customer expectation. Changes to the traditional utility business model may enhance the ability of utilities to evolve and innovate, but the path forward is unknown and the stakes are high for a wide range of stakeholders, from consumers, to investors and beyond.

Please be sure to review “Part III – How States Are Exploring the Utility of the Future” in the PA Future Utility policy digest series.

Christina Simeone

Kleinman Center Senior FellowChristina Simeone is a senior fellow at the Kleinman Center for Energy Policy and a doctoral student in advanced energy systems at the Colorado School of Mines and the National Renewable Energy Laboratory, a joint program.

- Utility Dive, “State of the Electric Utility: 2015 Annual Survey Report”, 2015, http://app.assetdl.com/landingpage/utility-survey-2015/ [↩]

- Black & Veatch, “2014 Strategic Directions: U.S. Electric Industry”, 2014, http://bv.com/reports/2014/electric [↩]

- U.S. Department of Energy, “Quadrennial Energy Review: Energy Transmission, Storage, and Distribution Infrastructure”, (April 2015) p.1-8, http://energy.gov/sites/prod/files/2015/05/f22/QER%20Full%20Report_0.pdf [↩]

- Utility Dive 2015, Note: The percent totals for full results should add up to 300% [↩]

- American Society of Civil Engineers, “2013 Report Card for America’s Infrastructure” (March 2013) http://www.infrastructurereportcard.org/wp-content/uploads/2013ReportCardforAmericasInfrastructure.pdf [↩]

- The Brattle Group (for the Edison Foundation), “Transforming America’s Power Industry: The Investment Challenge 2010-2030”, (November 2008), http://www.eei.org/ourissues/finance/Documents/Transforming_Americas_Power_Industry_Exec_Summary.pdf [↩]

- Idaho National Laboratory, prepared for the U.S. Department of Energy Contract DE-AC07-05ID14517, “Vulnerability Analysis of Energy Delivery Control Systems”(September 2011) http://energy.gov/sites/prod/files/Vulnerability%20Analysis%20of%20Energy%20Delivery%20Control%20Systems%202011.pdf [↩]

- Utility Dive 2015, p. 19 [↩]

- Black & Veatch, p. 10 [↩]

- Utility Dive 2015, p. 17 [↩]

- Black & Veatch, p. 14 [↩]

- Kind, Peter, Energy Infrastructure Advocates, prepared for Edison Electric Institute, “Disruptive Challenges: Financial Implications and Strategic Responses to a Changing Retail Electric Business” (January 2013), p. 8, http://www.eei.org/ourissues/finance/documents/disruptivechallenges.pdf [↩]

- Utility Dive 2015, p. 13 [↩] [↩]

- Propper, Steven, “Alternate Utility Revenue Streams: Expanding Utility Business Models at the Grid Edge”, GTM Research, May 18, 2015, http://www.greentechmedia.com/research/report/alternate-utility-revenue-streams [↩]

- Utility Dive 2015, p. 7 [↩]

- Utility Dive 2015, p.17 [↩]