Introduction

The People’s Republic of China (PRC) is a country of mosts: the most people, the most energy demand, the most energy generation, and the most greenhouse gas emissions. Interesting, and to some surprising, however, is another ‘most’ for China: the country investing the most in renewable energy.

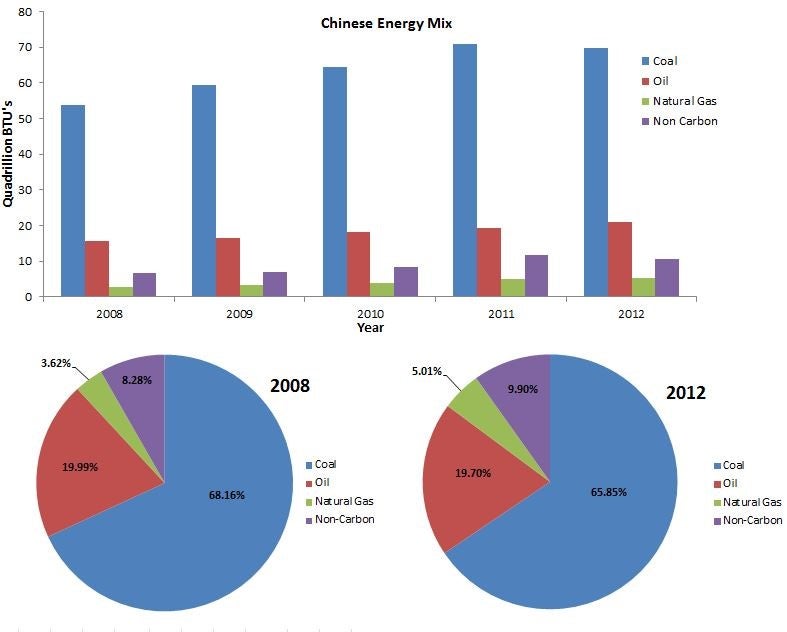

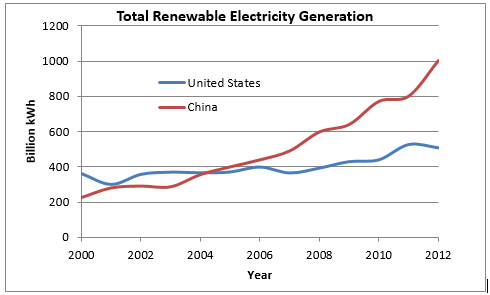

When it comes to energy and the PRC, many jump immediately to thoughts of smog-filled cities and huge numbers of coal-fired power-plants. While China is certainly still dependent on coal—it accounted for two-thirds of primary energy generation in 2012—the paradigm is beginning to shift from a coal-based energy mix to one with a large renewable segment. Between 2008 and 2012, PRC built renewable capacity to generate over 400 billion kilowatt hours (kWh) of new electricity capacity from renewable sources. This included 130 billion kWh of non-hydroelectric capacity, such as solar and wind power1. In comparison, the United States added approximately 120 billion kWh of renewable generating capacity in the same timeframe, 95 of which came from non-hydroelectric sources1.

This has not been a one-time boost. The Politburo’s 12th Five-Year Plan, which ends this year, had set a goal of 11.4% of primary energy consumption coming from non-fossil fuel power sources by 20152. The anticipated target set for 2020 is 15%3. Unlike in the United States, where energy consumption has been relatively constant over the past decade, China’s energy consumption is growing rapidly; this means efforts to increase renewable’s share of consumption require new renewable capacity to be installed at a faster rate than other types of power such as coal. How China meets such ambitious targets is of great interest to policy-makers around the world, and poses unique challenges and opportunities for innovation. This digest will explore the current state of renewable energy in the PRC, how the country has sought to expand renewable capacity, and the challenges associated with meeting the proposed targets.

Source: http://www.eia.gov/cfapps/ipdbproject/iedindex3.cfm?tid=2&pid=29&aid=12&cid=r1,r7,&syid=2000&eyid=2012&unit=BKWH

The Goal Setters in-Chief

Unlike the United States and many other Western nations, the close, regulatory relationship between China’s government and its economy allows the country to set – and meet – ambitious goals around clean power implementation. The government’s unique ability to lay out energy goals in the Five-Year Plan and rigorously follow through has been a major factor in China’s outpacing the world.

In most of the Western world, development of renewable energy has proven difficult due to the abundance of cheap fossil fuels, the cost of renewable technologies (despite an unprecedented decline in the cost of large-scale solar and wind projects) and, especially, uncertainty around public funding and regulation. According to Ben Droz, an analyst in GE Capital’s renewable energy group, “renewable projects’ investments decisions in the US are driven significantly by considerations of tax benefits. The expiration and renewal of the benefits can play havoc with industry investment decision-making.” Beyond renewable energy investment groups, large, institutional funds are particularly reluctant to put money toward policies that might be reversed after the next election4. The PRC, on the other hand, has consistently ranked as the most attractive country for renewable investments, according to Ernst and Young’s Investment Attractiveness Index5. Investor confidence in the direction of Chinese energy policy, given the centralized government decision-making, is a reasonable explanation for such a preference.

Having established that the PRC can and will follow through on the renewable energy goals it sets for itself, it is relevant to ask: what are those goals? As noted previously, the 13th Five-Year Plan will stipulate that 15% of primary energy consumption comes from renewable sources by 2020. In the run-up to the 2015 United Nations Climate Change Conference, the country pledged to reach peak emissions in 2030 or earlier, and to reach 20% of primary energy consumption from non-carbon energy sources by this time. In addition, China pledged to decouple its economic growth from its carbon emissions by reducing the CO2 intensity of its economy by 60% from 2005 levels, by 20306. Reaching these goals will require massive investment in renewable energy, beyond the significant efforts the country has already taken.

The direct effects of emissions reductions are only part of the global benefit from the switch to solar, wind, and other renewables. A second key benefit is improvements to renewable power construction and implementation. If the country can successfully build and integrate massive renewable capacity it will have proved to investors, engineers, and policy-makers that renewable power is real and feasible, potentially erasing much of the doubt and skepticism surrounding the industry’s viability.

New Policies, a Breath of Fresh Air

Much of the rationale behind these targets is China’s effort to do its part in combatting global climate change. The international community has pushed China to do more to control its emissions, and the country certainly seems to have heard the message. Investments in solar power, for example, avoided nearly 3.7 billion tons of CO2 emissions from 2007 to 2012. But of course, there are national security and health concerns that motivate the PRC as well.

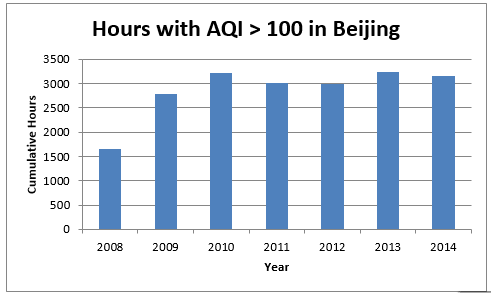

Incessant coal burning in the country has wreaked havoc on the air quality in major cities; this was a source of embarrassment during the 2008 Beijing Olympics, when air quality became a topic for international criticism in the run-up to the event7. To mitigate the problem, coal-fired power plants were shut down and vehicular travel was restricted in the weeks before the games.

But the harmful air did not disappear with the Olympic Village and public scrutiny. Today, China’s major cities still have severe air quality issues, with Beijing, Guangzhoue, and Chengdu all regularly achieving Air Quality Index (AQI) ratings above 100 (see figure 3), labelled as “unhealthy.” Researchers have equated breathing Beijing’s air with smoking dozens of cigarettes per day, and attribute thousands of premature deaths each day to the country’s air pollution8. In transitioning to renewable energy, the PRC hopes to achieve a permanent solution to this growing problem.

Source: http://www.stateair.net/web/historical/1/1.html

Harnessing the Sun

Part of that transition will be through solar power. Photovoltaic (PV) solar power has been a huge area for renewable growth in China. In 2014, the country installed 10.6 GW of solar electricity capacity, nearly 30% of total world-added capacity9. Multiple projects, including a 200 Mega Watt (MW), 10 square mile solar field in the Gobi desert, are currently underway10. Such projects are representative of the renewable growth in the PRC, which has focused more on large-scale power plants as opposed to the distributed generation seen in the United States; think wind farms and solar fields instead of individual solar panels atop homes. This impressive growth has come from the top, with the Chinese government subsidizing $42 billion in loans for solar panel manufacturers between 2010 and 201211. Under the IEA roadmap for solar power, China could supply over a third of the world’s total solar generation capacity by 2050.

This windfall for the solar industry has not come without its challenges. Both the United States and the European Union have imposed anti-dumping tariffs on Chinese solar panels in an effort to protect domestic manufacturers from what they deem as unfair competition from subsidized Chinese manufacturers. The U.S. recently reduced this tariff from 30% to 18%12.

Despite the tariffs, China has continued to churn out massive quantities of PV panels, many of which are now installed domestically. The solar energy industry in China is the country’s fastest-growing power segment; generation capacity in 2014 was 35 times that of 2010 capacity9. Such growth is expected to continue so China can meet its climate targets.

The Answer is Blowin’ in the Wind

The other side of the renewable coin has been a far larger player than solar generation, however. Wind power—a more developed and understood technology—has far outstripped the solar industry in generation capacity. This is true for the world generally and for China specifically, with the country’s installed capacity at nearly 115 GW in 2014 according to the Wind Energy Council, with three-quarters of that capacity built since 201013.

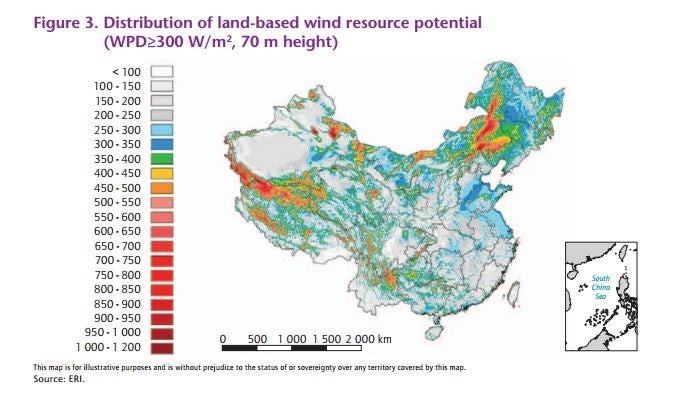

China’s wind power expansions present challenges that, if overcome, will again provide an example for the rest of the world. The primary concern, as is often the case with renewables, is location. The most abundant wind sources are concentrated in the western and northern parts of the country, while much of the population and industrial demand is concentrated in the east along the coast (Figure 4).

To solve this problem, China has begun to build various Ultra High Voltage (UHV) transmission lines to connect what were provincial-based electricity grids14. Not only does this allow for wind resources in low-demand areas to be connected to high demand areas along the coast, it also enables grid operators to perform what is called ‘grid balancing’14. By ‘balancing’ China’s national electricity grid to cover both more producers and consumers, the grid becomes inherently more flexible from a demand-response perspective, smoothing out the demand curve’s troughs and partially reducing the impact of renewable intermittency. Here again is an example of China’s push for renewable solutions translating to benefits for the rest of the world. Having successfully constructed and operated UHV lines in China, the PRC’s Grid Commission is now seeking to export its technological expertise by building an UHV line in Brazil to connect the country’s remote hydropower to demand centers15. With success in this venture, China could soon be building UHV lines to connect renewable energy supply to demand throughout the world—paving a path for renewable energy to become a powerful player in the energy industry globally.

Priceless Energy?

China’s commitment to, and implementation of, renewable energy is impressive. However, the question must be asked: how much has (and will) it cost? The short answer is hundreds of billions of dollars. In 2014, China invested $83.3 billion in renewable energy projects. Since 2010, the total stands at $287.7 billion. When one also factors in the cost of projects to absorb new renewable generation, such as the previously mentioned UHV transmission lines, the total investment easily clears $300 billion, $100 billion more than the United States’ total renewable investment in the same timeframe16.

Additionally, to meet these ambitious targets, this level of investment must continue or even increase. Ernst & Young, in a report on renewable investment in China, predicts a minimum investment of $258 billion is needed from 2014-2017 for China to remain on track to meet its renewable goals17. To raise so much capital, EY argues, China needs to adopt new and innovative financing models and move beyond the limited corporate debt financing options currently available. Among potential new avenues, EY lists yield companies and institutional investment as attractive options to increase financing not only for large-scale projects, but also for distributed generation of the type more commonly seen in the United States.

Reform and Liberalization

The PRC has recognized that its current grid system and electricity market are outdated, complicating a transition to greater renewable generation capacity. Currently, the grid is controlled by two grid operating companies and fed by five generation companies, all State-Owned Enterprises (SOEs). The grid companies buy power from generators at a price determined by the government and then act as retailers, often making huge profits18. Provinces and generators enter into long-term contracts that set electricity prices and purchase agreements. This has caused particular concern as the push to install renewable capacity has increased; provinces have little incentive to build new generation capacity if they are locked in to purchasing electricity for years in to the future. Furthermore, consumers are not incentivized to adjust consumption for demand-response management because prices do not reflect market conditions.

In order to free the country’s electricity markets to allow a more dynamic and competitive environment, the government has announced broad reforms. The most notable reform is transitioning electricity generation and retail to a competitive marketplace, and to change grid operators into middlemen. The grid operators’ main task would become facilitating power transmission from independent generators to independent power retailers19. This would allow for private generation companies and private retail companies to compete in the market.

Such a transition is essential for the country to continue expanding its renewable base and to allow it to meet emissions targets. Market incentives, in particular pricing mechanisms, for demand-side management will aid in the reduction of total demand and reduce wasteful or unneeded power consumption. However, with liberalized markets also comes the concern that, with prices dictating investment, the commitment to renewables could lessen and an emphasis on less expensive forms of generation such as coal could return. The national government, perhaps at odds with provincial governments more directly concerned with electricity prices in their regions, will have to do its best to strike a balance between allowing the market to dictate investment and meeting its set emissions and generation goals.

Lasting and Significant

From building new capacity to opening power markets through reform, it is clear China has made a lasting and significant commitment to renewable energy generation and use. In the run-up to climate talks this year in Paris, China’s commitments will certainly put pressure on other nations, both developed and developing economies, to follow suit. With the government spending billions of dollars on expanding capacity, connecting the grid, and implementing reform, it has set a global example for the potential scale and speed of renewable integration.

More opportunities to set an example are sure to follow. In recent months, the PRC has committed to implementing a cap and trade system for carbon throughout the country, having already implemented pilot operations in several provinces

For nearly a decade China has been considered a bad actor when it comes to greenhouse emissions, or cited as an excuse for developed nations to demur on renewable or emission reduction strategies. That paradigm, much like the smog over the eastern cities, seems sure to be lifted soon.

Dillon Weber

Research AssistantDillon Weber was a research fellow at the Kleinman Center and a graduate of the University of Pennsylvania majoring in chemical and biomolecular engineering and economics.

- Total Renewable Energy Net Generation. Washington, D.C.: U.S. Energy Information Administration. [↩] [↩]

- China’s 12th Five Year Plan (2011-2015) 2011. [↩]

- Gronholt-Pedersen, Jacob and David Stanway. “China’s Coal use Falling Faster than Expected.” Reuters (March 26, 2015). [↩]

- Hormann, Jasper. “Institutional Investors are Hesitant to Invest in Renewable Energy.” Greenzone.Co (Nov. 27, 2013). [↩]

- Renewable Energy Country Attractiveness Index: Ernst & Young, 2015. [↩]

- Chenxi, Li. Enhanced Actions on Climate Change: China’s Intended Nationally Determined Contributions (Translation), 2015. [↩]

- Takeuchi, Seiichiro and Takahiro Suzuki. “Beijing Failing to Clear the Air.” Daily Yomuiri Online, July 27, 2008. [↩]

- Ferris, Robert. “China Air Pollution Far Worse than Thought.” Cnbc. [↩]

- Masson, Gaeton and Mary Brunisholz. 2014 Snapshot of Global PV Markets: International Energy Agency PVPS, 2015. [↩] [↩]

- Sims, Alexandra. “China Builds Huge Solar Power Station which could Power a Millions Homes.” Independent (August 8, 2015). [↩]

- Yang, Yingzhi. “Why Millions of Chinese-made Solar Panels Sat Unused in Southern California Wareshouses for Years.” Pacific Standard (June 30, 2015). [↩]

- Bloomberg News. “U.S. Revises Tariffs and Duties on Chinese Solar Imports.” Bloomberg (July 9, 2015). [↩]

- Global Wind Statistics 2014. Brussels, Belgium: Global Wind Energy Council, 2015. [↩]

- Cheung, Kat. Integration of Renewables: Status and Challenges in China. Paris, France: International Energy Agency, 2011. [↩] [↩]

- Kemp, John. “Super-Grid: China Masters Long-Distance Power Transmission.” Reuters (June 19, 2014). [↩]

- Global Trends in Renewable Energy Investment 2014. Frankfurt, Germany: Frankfurt School & Bloomberg Energy Finance, 2015. [↩]

- “Capitalizing on China’s Renewable Energy Opportunities.” EY Publications (2014). [↩]

- Xinhua. “China Lowers Electricity Price for Grid, Enterprise Users.” China Daily (April 20, 2015). [↩]

- “China’s New Electricity System Reforms.” China Energy Storage Alliance (May 11, 2015). [↩]