Introduction

Unanticipated energy price volatility can have quite significant macroeconomic impacts, adversely affecting business investment as well as household planning and consumption. As a result, such volatility can have important political implications. Energy price volatility has historically reflected geopolitical events around the world. But recently in the United States, natural disasters, policy design and implementation, and competition in markets have contributed to volatility in U.S. energy prices.

Environmental policy can influence the volatility of energy prices through a number of channels. For example, environmental regulations in markets characterized by little competition can reduce competitiveness. With fewer businesses participating in these markets, production shocks at one or more firms are likely to cause greater price swings.. Moreover, implementing environmental policy through cap-and-trade systems, tradable performance standards, and tradable credit programs—all of which could be subject to even greater volatility than the world oil market (Aldy and Viscusi 2014)—could exacerbate fuel and electricity price volatility in retail markets. When short-term supply disruptions occur, environmental regulations can be quite costly without government intervention to relax the regulatory constraint.

Concerns about energy price volatility, especially that resulting from negative supply shocks, have motivated an array of policy responses. In response to the restrictions on oil production that dramatically increased oil prices in the 1970s, the U.S. government created the Strategic Petroleum Reserve—a public inventory that has held 500 to 700 million barrels of crude oil over most of the past three decades. The President has the discretion to tap the Strategic Petroleum Reserve to address an unexpected and significant shock to U.S. oil supplies.

Many state programs mandate the supply of electricity from renewable sources and implement these so-called renewable portfolio standards (RPS) through tradable credit systems. Some RPS programs establish rules that cap the prices of the tradable credits by allowing utilities to make alternative compliance payments in lieu of generating or contracting for renewable power. This prevents negative supply shocks in renewable power markets from significantly increasing utility costs and consumer prices.

In these cases, there are important trade-offs in providing shock absorbers for energy markets. The Strategic Petroleum Reserve costs taxpayers for the crude oil inventory and facility maintenance to insure against the low-probability risk of a major supply disruption. In renewable power programs, the alternative compliance payments reduce the downside risk of unexpectedly high costs but at the expense of lower renewable power generation (and associated environmental benefits). Much of the discussion of legislative approaches to climate change over the past decade have considered discretionary and rules-based approaches to safety valves on greenhouse gas cap-and-trade programs that protect against unexpectedly costly emission abatement (Aldy and Pizer 2009; Murray et al. 2009; Aldy et al. 2010).

There is, however, an alternative way of implementing environmental policy when unexpected energy market shocks occur. This policy brief explores the application of temporary fuel regulation waivers.

In the next section, I describe how environmental regulation of gasoline and diesel fuels has contributed to the Balkanization of the U.S. fuels market. Such “regulatory islands” are more vulnerable to supply shocks, given the lack of economic competition and few nearby substitutes given the regulatory restrictions. I then describe how short-term waivers of these regulations have been quite common in response to hurricane-related disruptions of local fuel markets across the United States. I then conclude with a discussion of the trade-offs associated with such waivers and the implications of discretionary versus rules-based shock absorbers in environmental regulations affecting energy markets.

Balkanized Fuel Markets

Under the Clean Air Act, the Environmental Protection Agency (EPA) regulates the design of transportation fuels with the intent of reducing the emissions of volatile organic compounds (which facilitate the formation of ground-level ozone pollution), carbon monoxide, and hazardous air pollutants. The 1990 Clean Air Act Amendments granted EPA the authority to implement such fuel content regulations by targeting the most heavily polluted areas.

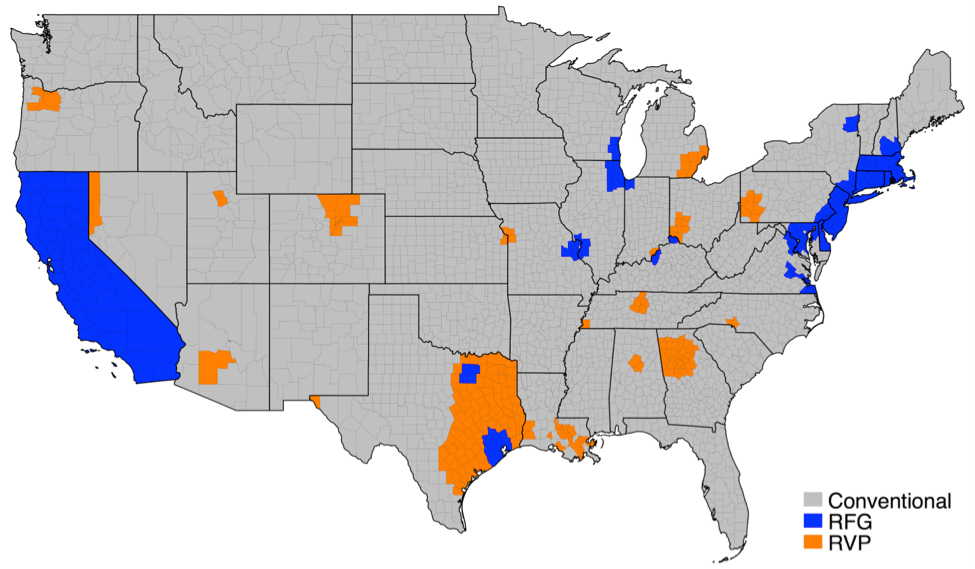

During the ensuing decade, EPA promulgated regulations on reformulated gasoline (RFG), Reid vapor pressure (RVP), oxygenated fuels, California cleaner burning gasoline, and the state boutique fuels the program. Each of these standards requires refiners to modify their gasoline—primarily by removing various volatile organic compounds—so that when it is used in cars and trucks, there are fewer pollutant emissions. The RFG standard imposes the greatest costs on fuel markets and is estimated to have the largest impact in reducing volatile organic compounds among this set of regulations. The RVP standard applies to the greatest number of counties among these regulatory instruments (see Figure 1).

Produced by the author based on EPA regulatory implementation in 2015 (Aldy 2017). California’s CARB gasoline satisfies the standards for the federal reformulated gasoline (RFG) standard, and is labeled RFG in the map. Counties required to meet the RFG standard must also satisfy requirements for Reid Vapor Pressure (RVP).

Implementing multiple, geographic-specific fuel content standards and providing state regulators the discretion to authorize specific fuel blends under the state boutique fuels program has resulted in more than 45 different gasoline fuel blends sold in America (Chakravorty et al 2008; Anderson and Elzinga 2014). This segmentation of U.S. gasoline markets through fuel content regulations has created what is typically referred to as “boutique fuel markets.”

The air quality regulations creating these boutique fuel markets are intended to improve air quality in those areas with the worst ozone and carbon monoxide pollution—the most serious “non-attainment” areas as designated by EPA under the Clean Air Act. However, these regulations have also Balkanized the American gasoline market, imposing significant and heterogeneous price impacts. For example, the reformulated gasoline standard increases gasoline prices on the order of about 7 cents per gallon, but this varies by more than a factor of two, reflecting both geographic isolation and imperfect competition in local fuel markets (Sweeney 2015; Brown et al 2008).

Market Balkanization effectively reduces the elasticity of supply to every Balkanized jurisdiction, thereby increasing the price effect of local supply shocks. If a given reformulated gasoline market suffers a supply shock, the neighboring non-RFG markets do not have regulation-compliant fuel to export to the disrupted market.

Fuel Market Shocks

The implementation of the second phase of the RFG standard in Chicago illustrates the vulnerability of these Balkanized markets to supply shocks. The reformulated gasoline program transitioned to the second and more stringent phase in 2000 in areas with the worst ozone pollution. During the first year of the second phase, Chicago did not have significant inventories of regulation-compliant fuel when an important pipeline serving its market went out of service that spring. With a short supply of RFG gasoline, Chicago gasoline prices in June 2000 were some 50 cents higher per gallon than fuel sold in areas that were not exposed to the supply shock (Bulow et al. 2003).

Local supply shocks can occur when pipelines or refineries serving those markets go out of service. Indeed, many local fuel markets have been adversely affected by supply shocks resulting from hurricane damage to the Gulf Coast states. As a leading tool to promote U.S. energy security, the Strategic Petroleum Reserve has been used more often—through Presidentially-directed releases and Department of Energy authorized exchanges— to address hurricane-related shocks than to mitigate the impacts of geopolitical events (Bingaman 2009; Department of Energy n.d.).

Reflecting the concerns about the economic costs borne by households and businesses as a result of such shocks, some politicians have advocated for regional product reserves as a part of the Strategic Petroleum Reserve (e.g., S. 1362, The Strategic Gasoline and Fuel Reserve Act of 2007). In the aftermath of a severe winter in 2000, Hurricane Sandy in 2012, and resulting public pressure for action in the aftermath, the Department of Energy created the Northeast Heating Oil Reserve and the Northeast Gasoline Supply Reserve.

But product strategic petroleum reserves are costly—the Northeast Gasoline Supply Reserve cost more than $200 million (Department of Energy 2016). For the price tag, these custom reserves seem under-utilized—The Northeast Heating Oil Reserve, for example, has not been tapped for an emergency in its more than 15 years of existence. Rather than investing in costly infrastructure, perhaps a more cost-effective solution lies in rethinking policy—particularly for low-frequency events.

Since many low-frequency supply shocks are a result of the Balkanization of U.S. fuel markets, it would be more effective to simply modify the fuel content regulations to mitigate the economic impacts of temporary supply shocks. Given the high cost of building a reserve—plus annual maintenance, inventory management, and administrative costs—fuel regulation waivers could be a lower-cost, more flexible policy approach to ensure U.S. energy security in product markets. This would especially be the case if regulatory flexibility delivers comparable price-dampening effects as deployment of the product reserves.

Waiving Environmental Regulations

Concerns about fuel market inflexibility in times of supply interruptions, such as refinery shutdowns or storm damage to pipelines, motivated members of Congress to grant EPA flexibility in implementing fuel content regulations. In the Energy Policy Act of 2005, EPA received the authority to temporarily waive fuel and fuel additive controls and prohibitions under any of the regulatory programs described above if significant supply interruptions occur.

An EPA regulatory waiver must meet three conditions: (1) “extreme and unusual . . . supply circumstances exist . . . which prevent the distribution of an adequate supply of the fuel or fuel additive to customers;” (2) these extreme circumstances “could not reasonably have been foreseen or prevented;” and (3) granting the waiver is “in the public interest.” The waiver is only effective for 20 days or less if EPA determines that a shorter waiver period is adequate. On several occasions, EPA granted second and third waivers for an area impacted by a shock that effectively extended the waiver period beyond three weeks.

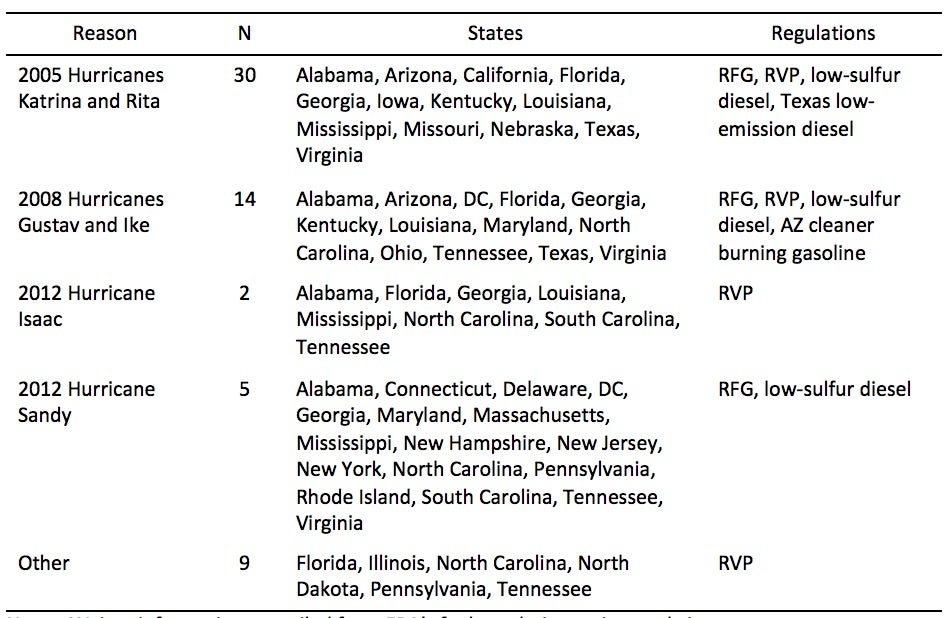

Since having the option to waive fuel standards in 2005, the EPA Administrator has waived regulations more than 60 times, with nearly 90% of these based on hurricane damage to refineries, pipelines, and/or storage terminals (Aldy 2017). Indeed, nearly half of all waivers to date occurred soon after President Bush signed the Energy Policy Act into law in the wake of Hurricanes Katrina and Rita. The waivers have primarily focused on reformulated gasoline and low-volatility gasoline and, generally, target narrow geographic areas. The introduction of this flexibility has made the boutique fuels regulations more adaptive to short-term shocks to the fuel supply system, and thus may have contributed to its durability, especially given the impacts of Hurricanes Katrina and Rita in 2005 and Hurricanes Gustav and Ike in 2008.

Waiver information compiled from EPA’s fuel regulation waiver website, https://www.epa.gov/enforcement/fuel-waivers, and presented in Aldy (2017). There were no waivers in 2015 and three waivers in the fall of 2016.

Waiving an environmental regulation in response to a fuel supply shock would appear to represent a trade-off between environmental benefits and economic costs. The waiver results in greater use of conventional gasoline—and hence greater emissions of ozone precursors such as volatile organic compounds—in order to prevent a price spike and potentially a physical shortage of regulation-compliant fuel. The 2000 price spike experienced in Chicago during the implementation of phase two of the RFG program illustrates that fuel price increases could be an order of magnitude greater than the estimated marginal costs of producing RFG in the absence of a supply shock. Unless the temporary conversion to conventional gasoline results in steep reductions in environmental and public health benefits, preventing fuel price spikes through regulatory waivers could meaningfully reduce economic costs while foregoing modest benefits.

Indeed, the environmental benefits foregone could be quite small. While the EPA estimates large reductions in volatile organic compound emissions under the RFG program, this has not translated into substantial improvements in ozone concentrations (Auffhammer and Kellogg 2011). Two factors may explain this result. First, ozone pollution reflects both volatile organic compound and nitrogen oxide emissions. In some parts of the country, the latter are much more important in influencing concentrations of ozone, which limits the effectiveness in reducing the former in order to lower ozone levels. Second, the RFG standard gave discretion to refineries on the types of volatile organic compounds they reduced and many complied with the standard by lowering those compounds that play a lesser role in ozone formation.

In contrast to the national RFG program, the State of California’s so-called CARB gasoline targets specific types of volatile organic compounds—those that are most reactive in the atmosphere and thus most prolific in producing ozone pollution. While CARB gasoline reduced ozone pollution by about 15 percent in southern California, RFG and RVP regulations outside of California have not produced statistically significant reductions in ozone pollution. Future research will investigate empirically the impacts of temporary regulatory waivers on environmental, public health, and fuel prices to enable a rigorous assessment of the benefits and costs of the waiver policy.

Given the nature of the costs and benefits of these standards, especially in light of the uncertainties associated with fuel shocks and regulatory compliance costs, a waiver policy strikes a balance that could minimize the social welfare losses that arise during infrequent supply shocks. This illustrates how discretionary policy implementation through the relaxation of a regulatory quantity constraint could mitigate the costs of unexpectedly high compliance costs (Weitzman 1974; Goulder and Parry 2008).

Predictability for Unpredictable Markets

The discretionary nature of the waiver policy under the Clean Air Act contrasts with rules-based approaches to policy shock absorbers. A rules-based approach may provide automatic relief in response to a shock, so long as the rules anticipated the shock in question. A discretionary policy may be more flexible in adapting to shocks, especially to those of a type that may not have been imaginable at the time an environmental regulation or energy policy was designed and implemented. Under either approach, the regulated community and those benefitting from the regulation will demand a predictable policy.

A well-designed waiver policy can be predictable in the face of unpredicted shocks. It is impossible to write down a complete set of non-discretionary rules for regulatory waivers that would be as effective and judicious as a well-managed discretionary regime. The extensive experience under the Clean Air Act waiver policy coupled with good communication among government and industry officials enables stakeholders to form expectations about the conditions likely to result under a waiver.

The extraordinary circumstances associated with hurricanes and other natural disasters wreak havoc with the production and supply of fuels. The judicious use of the waiver policy can mitigate the costs associated with these events. This policy may not provide certainty about the costs of complying with a regulation, but it does ensure that unexpectedly high costs will not be imposed on consumers of transportation fuels.

Much has been made of the trade-off between cost certainty and benefit certainty in energy and environmental policy—or put into the stakeholders’ perspectives, business certainty versus environmental certainty. Many policy instruments reflect a stark, zero-sum game between these two types of certainty—any gain in business certainty comes at the expense of environmental certainty, and vice versa.

Reframing the policy context in terms of predictable and sensible management can circumvent, to some extent, the uncertainty trade-offs. Predictable policy implementation—and adjustments in response to shocks—can inform the investment decisions by businesses. Such predictable policy implementation can also address the concerns of environmental stakeholders that policy adjustments in response to shocks will not fundamentally undermine the environmental integrity of the policy.

The challenge lies with the government employing its discretion in a clear, credible, and anticipated manner. Discretion leaves open the possibility that implementation of the waiver policy could change with the whims of political winds, but this will not deliver sound policy outcomes. Substantial variations over time in how the government evaluates the performance of energy markets and environmental regulations, and hence the conditions that merit regulatory waivers, could reduce social welfare as well as weaken support for the policy among both business and environmental stakeholders. Sensible and predictable policy will therefore not be the one that either Democrats or Republicans would choose by themselves, but instead lie somewhere near the middle.

The author wishes to acknowledge helpful comments from Cary Coglianese, Jim Hines, Howard Kunreuther, and seminar participants at the University of Pennsylvania. This is part of a larger project that has received financial support from the Alfred P. Sloan Foundation and the National Science Foundation, on which Blake Barr, Stu Iler, Carlos Paez, and Christi Zaleski provided excellent research assistance.

Joe Aldy

Professor of Public Policy, Harvard UniversityJoe Aldy is a professor of the practice of public policy at the John F. Kennedy School of Government at Harvard University. Aldy was a visiting scholar at the Kleinman Center in 2016-2017.

Aldy, Joseph E. 2017. Promoting Environmental Quality through Fuels Regulations: Lessons for a Durable Energy and Climate Policy. Working paper prepared under the American Academy of Arts & Sciences Durability and Adaptability in Energy Policy project, March Draft.

Aldy, Joseph E. and William A. Pizer. 2009. Issues in Designing U.S. Climate Change Policy. Energy Journal 30(3): 179-210.

Aldy, Joseph E., Alan J. Krupnick, Richard G. Newell, Ian W.H. Parry, and William A. Pizer. 2010. Designing Climate Mitigation Policy. Journal of Economic Literature 48(4): 903-934.

Aldy, Joseph E. and W. Kip Viscusi. 2014. Environmental Risk and Uncertainty. In: Handbook of the Economics of Risk and Uncertainty, Volume 1, Mark J. Machina and W. Kip Viscusi, eds., Elsevier, 601-649.

Anderson, Soren T. and Andrew Elzinga. 2014. A Ban on One is a Boon for the Other: Strict Gasoline Rules and Implicit Ethanol Blending Mandates. Journal of Environmental Economics and Management 67: 258-273.

Auffhammer, Maximilian and Ryan Kellogg. 2011. Clearing the Air? The Effects of Gasoline Content Regulation on Air Quality. American Economic Review 101(6): 2687-2722.

Bingaman, Jeff. 2009. Opening Statement, Strategic Petroleum Reserve Hearing before the Committee on Energy and Natural Resources, U.S. Senate, May 12.

Brown, Jennifer, Justine Hastings, Erin T. Mansur, and Sofia B. Villas-Boas. 2008. Reformulating Competition? Gasoline Content Regulation and Wholesale Gasoline Prices. Journal of Environmental Economics and Management 55: 1-19.

Bulow, Jeremy I., Jeffrey H. Fischer, Jay S. Creswell Jr., and Christopher T. Taylor. 2003. U.S. Midwest Gasoline Pricing and the Spring 2000 Price Spike. Energy Journal 24(3): 121-149.

Chakravorty, Ujjayant, Celine Nauges, and Alban Thomas. 2008. Clean Air Regulation and Heterogeneity in U.S. Gasoline Prices. Journal of Environmental Economics and Management 55: 106-122.

Department of Energy. n.d. History of SPR Releases. http://energy.gov/fe/services/petroleum-reserves/strategic-petroleum-reserve/releasing-oil-spr. Accessed November 1, 2015.

Department of Energy. 2016. FY 2017 Congressional Budget Request. Report DOE/CF-0121 Volume 3. February. https://energy.gov/sites/prod/files/2016/02/f29/FY2017BudgetVolume3_2.pdf. Accessed February 25, 2017.

Goulder, Lawrence H. and Ian W.H. Parry. 2008. Instrument Choice in Environmental Policy. Review of Environmental Economics and Policy 2(2): 152-174.

Murray, Brian C., Richard G. Newell, and William A. Pizer. 2009. Balancing Cost and Emissions Certainty: An Allowance Reserve for Cap-and-Trade. Review of Environmental Economics and Policy 3(1): 84-103.

Sweeney, Richard L. 2015. Environmental Regulation, Imperfect Competition, and Market Spillovers: The Impact of the 1990 Clean Air Act Amendments on the U.S. Oil Refining Industry. Working paper, Boston College.

Weitzman, Martin L. 1974. Prices vs. Quantities. Review of Economic Studies 41(4): 477-491.