China’s long-awaited national emissions trading scheme is finally here. Together with the EU, these two markets now represent the largest cap-and-trade systems in the world. Learn what it would mean for the EU and China National ETS to merge, as well as what challenges the two jurisdictions might face in the process.

At a Glance

Key Challenge

More expansive carbon markets are needed to meet the global challenge of climate change.

Policy Insight

A linked China-EU market will decrease the overall cost of abatement and serve as a monumental step in global cooperation. Before this can happen, however, full preparation must entail fundamental structural changes, thorough transparency, and the early harmonization of goals.

Introduction

On February 1, 2021, China unveiled its new, fully formed national emissions trading scheme (ETS) to the world (Zhou 2021). The project, nearly ten years in the making, is already on track to overtake Europe as the largest emissions trading scheme to date (IEA 2020).

China’s long-awaited entrance into the global carbon trade comes as part of a global push to realize the cost of climate change through market-based reform, an effort led by Europe, South Korea, parts of the United States, and more than 20 other national and subnational jurisdictions since the launch of the EU ETS in 2005 (ICTSD 2016). Since 2005, cap-and-trade has become a quintessential policy tool in the effort to reduce universal carbon emissions and maintain global temperatures under critical thresholds.

Still, many Chinese officials agree that a new ETS will not be enough to reach the goals set by the Paris Climate Accord of 2015. As a result, internal advisors for China’s ETS have begun to draft long-term plans around the idea of linking China’s ETS with the rest of the world and, most notably, to its counterpart in Europe1.

Under a fully linked system, Chinese emissions generators would be able to trade across borders with emissions generators in the EU, thereby coordinating a joint carbon market between the two jurisdictions. If achieved, a linked China–EU ETS will represent a crucial milestone for international cooperation and climate change, the consequences and challenges of which will be detailed in the following analysis.

What Does It Mean to Link an ETS?

Emissions trading schemes (ETS), also known as cap-and-trade, are artificial markets in which carbon emitters are able to purchase emissions allowances in exchange for the right to pollute. Additionally, organizations responsible for overseeing the ETS—typically national, regional, or local governments—reserve the right to determine the total number of pollution credits available for trade under their respective markets.

However, while emissions trading markets are typically confined to the specific political regions in which their governments operate, some have established key trade linkages that allow previously unaffiliated stakeholders and market participants to interact amongst themselves.

In general, there are two types of ETS linkages: direct linkage and indirect linkage (Abrams 2013). Direct linkages open trade directly between the permit accounts of each jurisdiction, while indirect linkages prohibit the aforementioned free flow of allowances. For example, this may happen if two jurisdictions that cannot trade directly share a common trade partner, or if domestic polluters fulfill part of their abatement obligations through abatement actions taken in regions outside of their own.

While some ETS’s welcome indirect offsets2, very few direct linkages currently exist3. However, since many of the same principles that apply to indirect linkages apply similarly, albeit more markedly, to direct linkages, we will simplify our discussion to focus exclusively on the potential for a direct linkage between the EU and Chinese markets.

Rationale for Linking

The most compelling argument in favor of linking emissions trading schemes is that, by expanding the number of participants in an ETS, the market gains efficiency (Dellink et al. 2014; Kachi et al., 2015 ICAP; Sheni, Ying, and Feng 2017; Carbone et al., 2009). More specifically, increasing market size improves stability and liquidity, which reduces the ability of a single purchase or entity to influence prices at any given time.

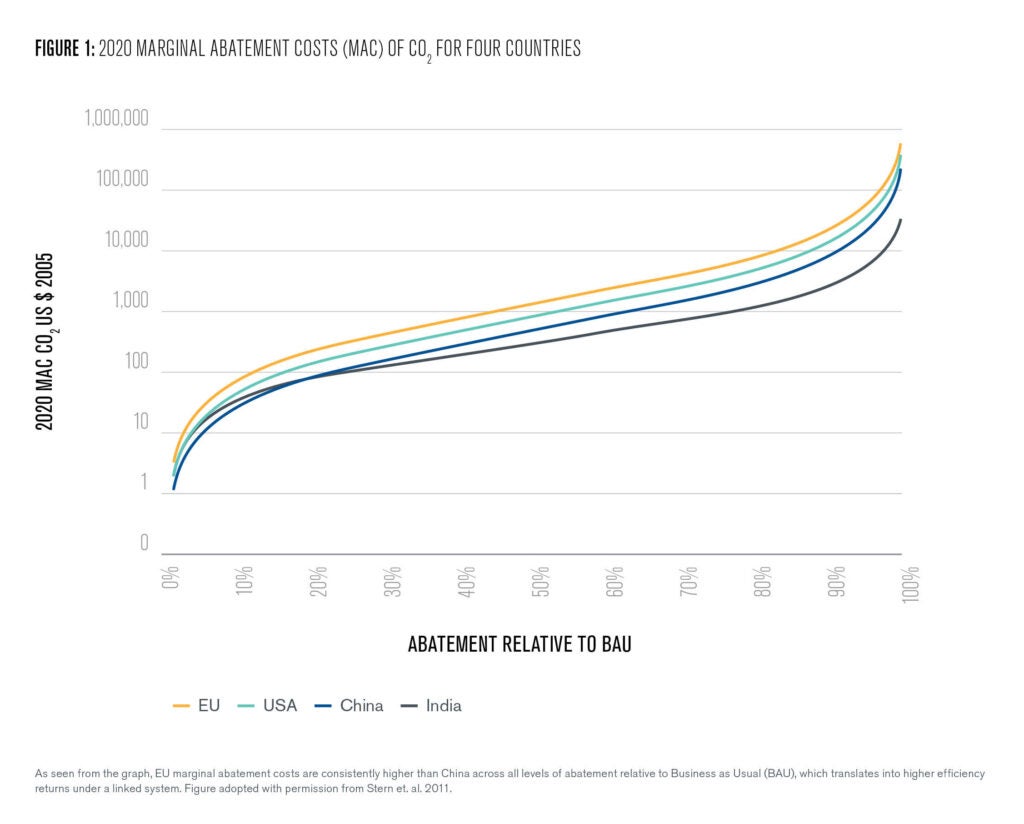

Furthermore, linking optimizes abatement across a greater diversity of territories and abatement options, which allows regions with unexploited abatement potential, such as China, to relieve cost pressures in regions that are already strained to capacity from mitigation, such as the EU (Figure 1).

In fact, as allowance prices in the EU reach an all-time high—close to $100 USD/mtCO2—pilot-based estimates for Chinese ETS prices still hover conservatively at around $11.00 USD/mtCO2 (“EU Carbon Permits”; Slater 2017). This drastic price difference suggests that there exists a potential for considerable efficiency gains under a linked system.

China, the predicted net exporter of allowances, would gain profit by selling allowances to the EU at a price higher than they would domestically, and Europe would gain by increasing production and purchasing permits at lower allowance prices.

Greater efficiency means that, even if China and the EU were to strengthen their caps by 3% and 12%, respectively, welfare in the EU can be expected to increase by 0.29%, with welfare in China remaining practically the same. In other words, both jurisdictions will be freed to pursue more aggressive changes under a linked system due to the significant cost reduction.

On a broader scale, linking emissions trading schemes serves as a powerful signal to the rest of the world and catalyzes international buy-in (“Agreement on Linking” 2019; Flachsland 2009). Essentially, emissions trading becomes more appealing as more countries sign on. This is because when a country decides to pursue an ETS, it inevitably chooses to sacrifice some of the competitiveness of its domestic industries relative to countries who do not have an ETS.

The ETS is also rendered less effective by a phenomenon known as carbon leakage, which occurs when domestic producers choose to move operations to another country with either lower ETS prices or no ETS at all. More uniform markets, as well as a more widespread acceptance of cap-and-trade in general, will reduce the competitiveness concerns of foreign countries and decrease the risk of carbon leakage, thereby promoting greater forces of collaboration.

Global cooperation will only grow more important as the world works to meet its abatement targets for the future. In fact, the Kyoto Protocol projected in 1999 that the closer we become to establishing a globally linked ETS network, the closer we are to achieving potential cost savings of over 70% (Weyant and Hill 1999). Although this goal may seem far off, figures such as these demonstrate that, if anything, economies stand to gain massive benefits from more cohesive global strategies. In this sense, the creation of a linked China-EU ETS would mark a critical inflection point in the path to cooperation.

A Tale of Two Schemes

China and the EU currently account for the first and second largest carbon trading systems in the world. A deeper review into the origins and characteristics of both systems will be crucial to understanding how the two schemes are, in some ways, already connected, as well as what routes are available towards achieving greater connections in the future.

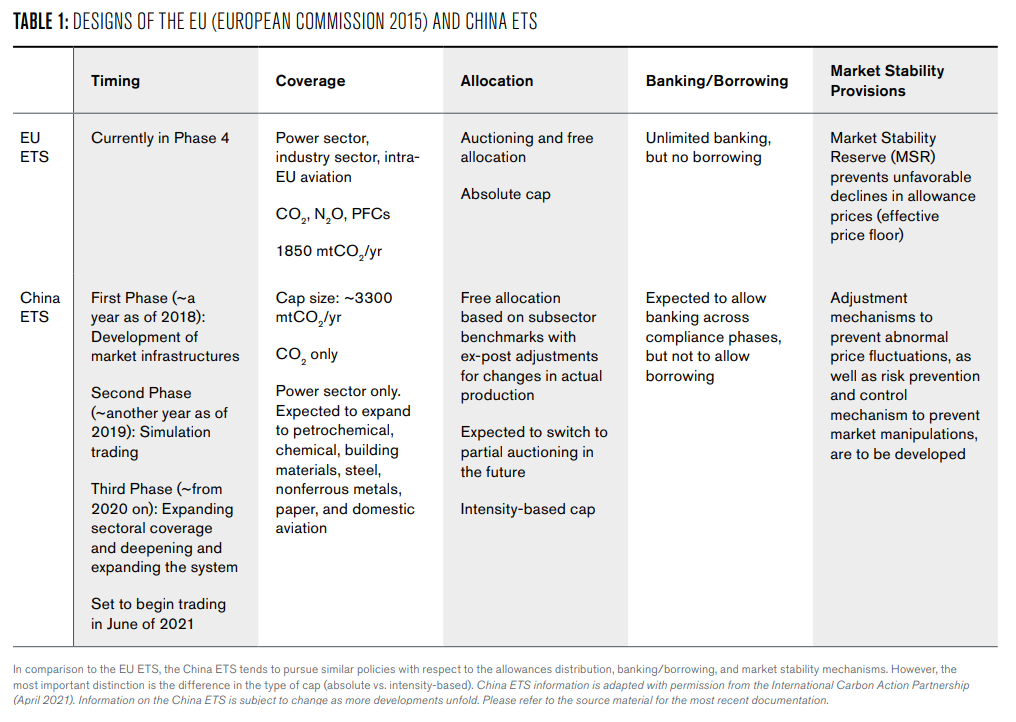

Table 1 provides a summary of the key components of each emissions trading system. A closer examination of the table reveals that the European Union played both a large indirect and direct role in shaping the outcome of the Chinese national ETS. For one, the early failures of the EU ETS provided valuable lessons regarding the proper structuring of an emissions trading scheme, including the need for auctioning, banking, and price control mechanisms—all of which China readily absorbed into its final model.

Besides careful observation, the EU and China maintained a close relationship as China embarked on the drafting and pilot stages of its ETS program. Most notably, China and the EU established a critical communication infrastructure through numerous EU-funded technical training programs as well as government forums, such as the EU-China Climate Programme (ICTSD 2016), which served to further strengthen China and the EU’s path towards parallel growth.

The convergent evolution of the China and EU ETS’s lends itself to two key takeaways: first, the EU and Chinese ETS’s, by nature of their shared history, already in some ways demonstrate structural compatibilities that will, in turn, affect the success of a joint market. To list a few previous examples, China is eventually expected to follow similar policies regarding the banking and borrowing of credits, allocation methods, and the establishment of price ceilings and floors. Second, high historical levels of interaction between the two jurisdictions gives positive indication that cooperation is possible, especially given the existence of pre-established communication networks. However, despite their early successes, the EU and China still face substantial hurdles that must be overcome before a linked China-EU ETS can fully materialize.

Barriers to Linking

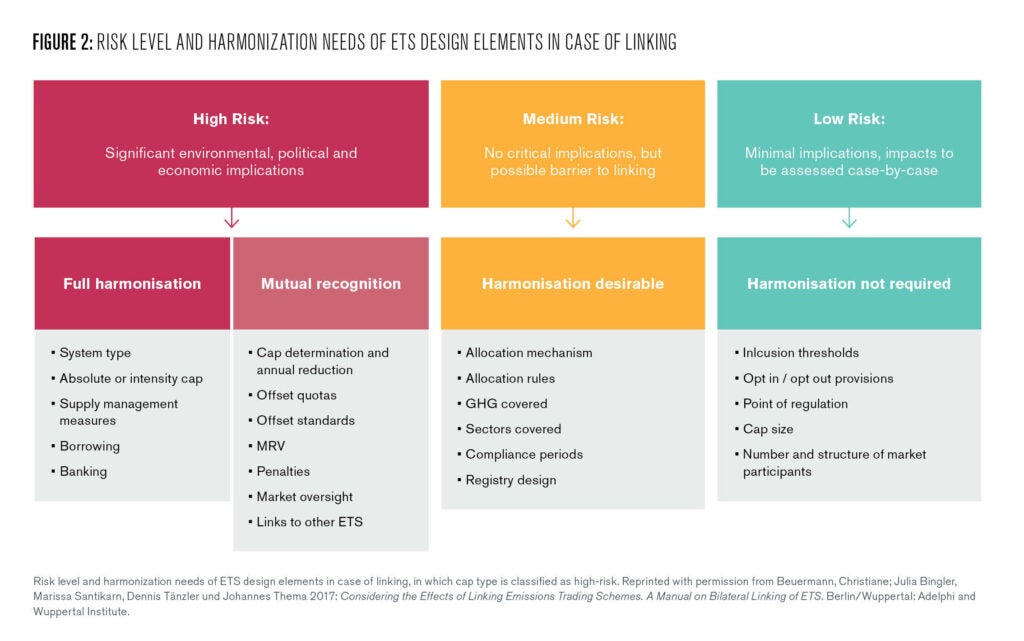

Generally speaking, the more similarities that two trade schemes share, the easier it is for them to link. Coincidentally, this discussion has already identified numerous potential compatibilities between the European and Chinese plans. However, the majority of these similarities represent only a minor factor in determining the success of linkage.

With the exception of banking/borrowing and market stability mechanisms, properties such as coverage level, size, allocation structure, and timing have relatively little influence over the political feasibility of linking (Figure 3). On the other hand, the greatest barriers that exist between the China and EU ETS’s are differences in the type of cap as well as the fundamental level of ambition between regions (Beuermann et al. 2017). All things considered, the EU and China will likely face significant barriers to linking in the future, and, in each instance, proper foresight will be key to addressing these issues as they arise.

Cap Type

To begin, a striking distinction between the China and EU ETS is that China has chosen to pursue an intensity-based cap, which directly conflicts with Europe’s longstanding absolute cap. While an absolute cap fixes carbon allowances at rigid and predetermined quantity (allowances in units of CO2), China’s intensity-based cap allows polluters to emit more or less depending on the anticipated input and GDP output in any given year (allowances in units of CO2/MWh, for example). This means that, while Europe commits to a strict maximum number of allowances, an intensity-based cap will act more like a moving target, losing stringency in years when economic production in China increases (Couwenberg 2016).

Essentially, an intensity-based cap is notably more unpredictable than an absolute cap, which would make the EU ETS more volatile and discourage long-term investment—a consequence the EU may not so willingly accept (Kachi et al. 2015; Couwenberg 2016). This rings especially true considering that the EU’s Climate and Energy Package explicitly mandated in 2009 that:

“Agreements may be made to provide for the recognition of allowances between the Community scheme and compatible mandatory greenhouse gas emissions trading systems with absolute emissions caps established in any other country or in sub-federal or regional entities,” (European Parliament 2009) which effectively excludes China from its list of linking candidates. Without significant progress in the area of cap adjustments, a linked ETS system may prove intensely difficult to achieve.

Ambition and Stringency

Along the same vein, differences in the ambition level of each policy poses a massive deterrent to linking from the perspective of the EU. As mentioned previously, Europe is currently in the process of rapidly tightening its cap and launching allowance prices to historical highs, even reaching records of nearly $100/mtCO2 in May of 2022. In contrast, China’s cautious approach has only managed to achieve prices less than half that of the current EU ETS.

Under an unlimited linkage, however, prices will fully equalize between the two regions as EU producers choose to buy cheaper pollution credits from China and Chinese producers sell more credits on the more lucrative EU market. In other words, linking the EU to a less ambitious ETS essentially allows Europe to pollute more at the expense of an equivalent amount of Chinese abatement.

As a result, it is predicted that China’s carbon price rises by 12% and emissions decrease by 4.7% relative to a non-linked scenario, while EU’s carbon price decreases by 67% and emissions increase by 18.7% (Mengyu et al. 2019).

Such a verdict does not bode well for European abatement goals, and, thus, it comes as no surprise that the EU has repeatedly asserted its own emissions agenda during past linkage negotiations. For example, the EU forced both Australia (AETS) and Switzerland to amend their non-compliance penalties in order to satisfy the EU’s request for greater stringency (Beuermann et al. 2017). Ultimately, a large part of why Europe has hesitated to establish many direct linkages to date derives from its compulsion to protect its environmental interests.

The Road to Compromise

Despite formidable challenges to a joint China-EU market, the possibility of linkage has been far from extinguished. For one, China must increase its allowance price and cap stringency to match the EU’s existing standards as closely as possible. This may include transitioning towards an annually adjusting absolute cap, which adjusts the cap to GDP on an annual, rather than continuous, basis.

Otherwise, Europe must modify its legal framework to recognize China as a viable trade candidate, and China, in turn, must pursue a cap that falls more in line with the EU’s goals—an action that lies fully within its realm of capability. In fact, surveys show that industry stakeholders expect Chinese ETS prices to rise substantially in the future, indicating that China already wields massive credibility and leeway in expanding the latent potential of its ETS (Slater et al. 2018).

Furthermore, the EU and China may also consider limited direct linkage as a viable alternative. In limited linkage, trade between two regions is restricted by any combination of transaction costs, quotas, discount rates, and/or limitations to the types of permits that can be exchanged.

Limited trade agreements hedge some of the negative consequences of full trade but also proportionally dampen any associated benefits (Gavard et al. 2016). As a substitute, the EU may choose to limit trade by pursuing a unilateral, rather than bilateral, trade deal, in which European producers may sell permits on the Chinese market but not vice versa. This would, in effect, increase domestic EU prices by lowering domestic supply and further lower Chinese prices by increasing the supply of foreign imports. Nonetheless, unilateral agreements have the potential to evolve further into a bilateral linkage (Hua et al. 2019), as was the plan for Australia and most other EU ETS agreements, and thus serve as a reasonable starting point.

Conclusion and Policy Recommendations

In this discussion, I have attempted to contextualize and evaluate the prospect of a directly linked China-EU ETS. China and the EU’s mutual history serves as a strong foundation for cooperation between their respective ETS’s. However, to assure full political agreement, the EU and China must address the inevitable result that, in the current state of affairs, re-distribution of abatement may be unfavorably one-sided. To this end, the following policy actions should be seriously considered by both parties:

- Prepare early with full transparency and discussion. Working the Chinese ETS up to the standard set by the EU ETS may take many years, and thus, if China wishes to strike a linkage agreement with the EU anytime in the future, it must begin to strive towards this goal from the very earliest stages of the ETS launch. Additionally, China must begin to disclose information on future plans and current market conditions to the EU in order to alleviate uncertainty between parties early on. Lastly, in the event of allowance auctioning, an agreement must be reached as to the distribution of auction revenues.

- Pay close attention to the unintended consequences of linkage. Policymakers must gain a comprehensive awareness of how each component of an ETS may help or hinder its performance. In a system with many moving parts, inadequate supervision may lead to unintended one-sided consequences for the EU especially, such as volatile prices, obstructions to renewable development, and environmental harm.

- Decide upon the degree of linkage. Although most existing linkages have full bilateral functionality, policymakers in reality have a choice over the extent to which two markets merge. A limited or unidirectional ETS linkage would curtail some damages that arise from full linkage, which may prove favorable between jurisdictions with divergent priorities.

All in all, a linked China and EU ETS holds exciting implications for international carbon policy. Not only will merging the China and EU ETS’s lead to better global cooperation and greater cost savings, but simply put, the linkage will represent the breakage of a monumental barrier in carbon mitigation on a comprehensive, global scale.

Angela Sun

Student Advisory Council MemberAngela Sun is a Kleinman Center Student Advisory Council Member. She was also a 2021 Kleinman Center Undergraduate Seminar Fellow.

Abrams, Joel. n.d. “Linking to Europe’s ETS: How to Make It Work.” The Conversation. Last modified March 5, 2013. https://theconversation.com/linking-to-europes-ets-how-to-make-it-work-12647. https://ec.europa.eu/commission/presscorner/detail/en/IP_19_6708.

Asian Development Bank. n.d. Emissions Trading Schemes and Linking: Challenges and Opportunities in Asia and the Pacific.

Baker, Jill. 2019. “All Eyes on China as National Carbon Market Plan Emerges from Haze.” Reuters Events.

Beuermann, Christiane, Julia Bingler, Marissa Santikarn, Dennis Tänzler, and Johannes Thema. 2017. “Considering the Effects of Linking Emissions Trading Schemes – A Manual on Bilateral Linking of ETS.” Adelphi.

Carbone, Jared & Helm, Carsten & Rutherford, Thomas. 2009. “The Case for International Emission Trade in the Absence of Cooperative Climate Policy.” Journal of Environmental Economics and Management. 58. 266-280. 10.1016/j.jeem.2009.01.001.

Couwenberg, Oscar. 2016. “Absolute Vs. Intensity-Based Caps for Carbon Emissions Target Setting.” European Journal of Risk Regulation: EJRR. 7, no. 4 (2016): 764–781.

Dellink, R., et al. 2014. “Towards Global Carbon Pricing: Direct and Indirect Linking of Carbon Markets.” OECD Journal: Economic Studies, vol. 2013/1, https://doi-org.proxy.library.upenn.edu/10.1787/eco_studies-2013-5k421kk9j3vb.

“EU Carbon Permits.” Trading Economics. Accessed May 11, 2022. https://tradingeconomics.com/commodity/carbon.

European Commission. 2015. EU ETS Handbook.

European Commission. 2019. “Agreement on Linking the Emissions Trading Systems of the EU and Switzerland.”

European Commission. n.d. “Use of International Credits.” Accessed April 8, 2022. https://ec.europa.eu/clima/eu-action/eu-emissions-trading-system-eu-ets/ use-international-credits_en.

European Parliament. 2009. Directive 2009/29/EC of the European Parliament and of the Council of 23 April 2009 amending Directive 2003/87/EC so as to improve and extend the greenhouse gas emission allowance trading scheme of the Community.

Flachsland, Christian, Robert Marschinski, and Ottmar Edenhofer. 2009. “To Link or Not to Link: Benefits and Disadvantages of Linking Cap-and-Trade Systems.” Climate Policy 9 (4): 358-372. doi: http://dx.doi.org.proxy.library.upenn.edu/10.3763/cpol.2009.0626.

Gavard, Claire, Niven Winchester, and Sergey Paltsev. 2016. “Limited Trading of Emissions Permits as a Climate Cooperation Mechanism? US–China and EU–China Examples.” Energy Economics 58 (August 2016): 94-104.

Hua, Yifei; Dong, Feng. 2019. “China’s Carbon Market Development and Carbon Market Connection: A Literature Review” Energies 12, no. 9: 1663. https://doi.org/10.3390/en12091663

IEA. 2020. China’s Emissions Trading Scheme, IEA, Paris. https://www.iea.org/reports/chinas-emissions-trading-scheme

International Centre for Trade and Sustainable Development (ICTSD). 2016. China’s National Emissions Trading System. By Jeff Swartz.

Kachi, Aki, Charlotte Unger, Niels Böhm, Kateryna Stelmakh, Constanze Haug, and Michel Frerk. 2015. “Linking Emissions Trading Systems: A Summary of Current Research.” International Carbon Action Partnership.

Federal Office for the Environment (FOEN). 2019. “Linking the Swiss and EU Emissions Trading Systems.”

Mengyu Li, Yuyan Weng, and Maosheng Duan. “Emissions, energy and economic impacts of linking China’s national ETS with the EU ETS.” Applied Energy, no. 235 (2019): 1235–1244.

Sheni, Ying and Jinheng Feng. 2017. “Linking China’s ETS with the EU ETS: Possibilities and Institutional Challenges.” Environmental Policy and Law 47 (3) (06): 127-133.

Slater, Huw. 2017. “China’s Carbon Market Needs Ambition.” China Dialogue, December 29, 2017. https://chinadialogue.net/en/energy/10330-china-s-carbon-market-needs-ambition/.

Slater, H., De Boer, D., Shu, W., and Qian, G. 2018. The 2018 China Carbon Pricing Survey, July 2018, China Carbon Forum, Beijing.

Stern, David I., John C. V. Pezzey, and N. Ross Lambie. 2011. “Where in the World Is It Cheapest to Cut Carbon Emissions?” Agricultural and Resource Economics, December 18, 2011. Accessed April 28, 2021. https://doi-org.proxy.library.upenn.edu/10.1111/j.1467-8489.2011.00576.x

UNFCCC. 2021. “The Clean Development Mechanism.” Accessed April 28, 2021. https://unfccc.int/process-and-meetings/the-kyoto-protocol/mechanisms-under-the-kyoto-protocol/the-clean-development-mechanism.

Welfens, P.J.J., Yu, N., Hanrahan, D. et al. The ETS in China and Europe: dynamics, policy options and global sustainability perspectives. Int Econ Econ Policy 14, 517–535 (2017). https://doi-org.proxy.library.upenn.edu/10.1007/s10368-017-0392-4

Weyant, J.P., Hill, J.N., 1999. “Introduction and Overview.” Energy Journal (special issue) The Costs of the Kyoto Protocol: A Multi-Model Evaluation, vii–xliv.

Zhou, Oceana. 2021. “China to Launch National Carbon Emissions Trading Scheme on Feb 1.” S&P Global Platts (Singapore), January 6. https://www.spglobal.com/platts/en/market-insights/latest-news/coal/010621-china-to-launch-national-carbon-emissions-trading-scheme-on-feb-1.

- In a statement made on behalf of the pilot and national programs, Professor Maosheng Duan of Tsinghua University wrote, “It is clear in the construction/development plan that in the long run, China wishes to develop a national system with great international influence and hopes to link its system with others” (Reuters Events 2019). [↩]

- The EU ETS and New Zealand ETS, for example, are linked indirectly by the Kyoto Protocol’s Clean Development Mechanism (CDM), which allows countries to use foreign projects in order to fulfill UN reduction requirements (UNFCCC; Asian Development Bank). However, beginning in 2020, the EU has announced that it will no longer be accepting international credits as a valid form of compliance (European Commission). [↩]

- Notable exceptions include the direct linkage between the EU and Norway, Iceland and Liechtenstein, the EU and Australia, and California and Quebec (Hua et al. 2019; Welfens, Yu, Hanrahan et al. 2017). [↩]