California's Low Carbon Fuel Standard plays an important and increasingly controversial role in the state’s climate strategy. This report explores the debate over the program's reliance biofuels and its impact on retail fuel prices.

At a Glance

Key Challenge

Rapidly cutting transportation emissions requires more than just zero-emissions vehicles, but relying on life cycle analysis to pick clean fuels involves normative political judgments buried in technically dense methods.

Policy Insight

California policymakers need to clarify the state’s strategy for cutting transportation emissions and decide where biofuel subsidies fit among their priorities.

Executive Summary

California’s Low Carbon Fuel Standard (LCFS) is a prominent and increasingly controversial part of the state’s climate mitigation strategy. The LCFS requires the carbon intensity of transportation fuels sold in California to decline every year. To comply, bulk fuel sellers must either reduce emissions within their own supply chains or procure credits from companies that sell lower-carbon fuels—all based on life cycle carbon intensity calculations overseen by the state climate regulator.

The LCFS program mobilizes significant financial flows through private transactions, rather than by raising public funds from auctioning pollution rights. It has issued more than 22 billion dollars’ worth of credits for low-carbon fuels since 2013 and has transformed the market for diesel fuels, where since 2023 biofuels have accounted for more than half of statewide consumption. As the state climate regulator considers amendments to increase the LCFS program’s ambition, three prominent areas of debates have emerged.

- Prioritizing biofuels over electrification. The first issue concerns the program’s overall alignment with California’s strategy for decarbonizing transportation. Although the state’s primary objective is to replace combustion vehicles with zero-emitting alternatives, about 80% of the LCFS credits issued to date—worth more than $17.7 billion in 2023 USD—have instead gone to combustion-based biofuels.

The primary justification for supporting biofuels in the LCFS is that the state expects a “long tail” of diesel consumption, due to the slower turnover of heavy-duty vehicles. State regulations mandate a transition to zero-emission heavy-duty vehicles, but that transition needs investment in fast-charging infrastructure and vehicle rebates. The LCFS puts the state’s transition goals further at risk because it primarily funnels capital toward replacing fossil diesel with biofuels rather than toward electrification. - Environmental harms. The second area of concern is about the environmental harms of biofuels credited under the LCFS. The fastest-growing category, renewable diesel, is primarily made from food crops like soybean and canola oil. Crop-based biofuels compete with food production and increase land-use impacts, including deforestation, that may not be accurately captured by the LCFS program’s carbon intensity scores.

Meanwhile, the LCFS is likely leading to “resource shuffling” of renewable diesel made to comply with national production mandates. To the extent those fuels reduce pollution relative to fossil alternatives, they would do so with or without the LCFS—though perhaps in other states. And finally, there are growing technical and environmental justice concerns about biomethane projects credited under the LCFS that claim to avoid methane emissions from dairies, landfills, and other sources. Notably, biomethane projects earn LCFS credits even when they don’t deliver fuel to California. - Retail pricing impacts. The third issue is how much the program will increase retail fuel prices. Historical cost impacts have been modest because the program’s carbon price applies to only the fraction of a fuel’s carbon intensity score that is higher than the program’s policy target. To date, the program’s policy targets have only been incrementally lower than conventional fossil fuels, so the LCFS credit price has applied to only a small share of the emissions associated with a gallon of gasoline or diesel. In contrast, the proposed regulations contemplate both rapid reductions in policy targets and higher credit prices. These effects will combine to produce significantly higher fuel-cost impacts in the years ahead.

Rather than discuss these implications openly, the regulator has distanced itself from its own initial assessment and even suggested it is not possible to project cost impacts going forward. To fill the resulting analytical void, I update the regulator’s original cost calculations based on the latest regulatory proposal. If LCFS credit prices reach their maximum allowed levels, as has occurred in the past, then retail gasoline price impacts could be $0.65 per gallon in the near term, $0.85 per gallon by 2030, and nearly $1.50 per gallon by 2035.

These are upper-bound estimates of program impacts and depend on LCFS credit prices, which are fundamentally uncertain and could easily be lower. For example, if LCFS credit prices increase from their current levels of about $60 per credit to $100 per credit, then retail gasoline price impacts could be $0.26 per gallon in the near term, $0.34 per gallon by 2030, and almost $0.60 per gallon by 2035 (all units in 2023 USD.)

With a vote on the proposed LFCS regulations scheduled a few days after the presidential election in November 2024, California’s climate regulator is looking to finalize the future of the LCFS program in advance of upcoming discussions about the potential reform and extension of the state’s economy-wide cap-and-trade program.

This sequencing has important implications for the ambition of the cap-and-trade program, which is likely to be politically constrained by consumer price impacts that are directly affected by the LCFS program, as well as for who stands to benefit from state climate finance. By updating the LCFS program ahead of the cap-and-trade program, the state climate regulator is effectively privileging the LCFS program’s beneficiaries—primarily biofuel producers—above the current and potential future beneficiaries of state funding collected from auctioning allowances in the cap-and-trade program.

Introduction

The Low Carbon Fuel Standard (LCFS) is designed to decrease the carbon intensity of transportation fuels within California. It requires fuel providers to reduce the carbon intensity of their sales, either by decarbonizing their own supply chains or by buying credits from companies that produce lower carbon fuels or aggregate electric vehicle charging.

The LCFS plays an important and increasingly controversial role in California’s strategy for reducing greenhouse gas emissions from the transportation sector. This report introduces the program’s mechanics, the surprisingly large financial flows it creates, and some of the criticisms that have emerged, including estimates of retail fuel price impacts from a proposal to extend the LCFS through 2045.

Policy Context

The LCFS is implemented by the California Air Resources Board, which was initially required to reduce statewide greenhouse gas emissions below 1990 levels by 2020 (under Assembly Bill 32 from 2006). The board is also required by law to reduce statewide greenhouse gas emissions at least 40% below 1990 levels by 2030 (under Senate Bill 32 from 2016) and at least 85% below 1990 levels by 2045 (under Assembly Bill 1279 from 2022).

Although the state has made substantial progress in reducing its electricity sector emissions and met its 2020 target early (Mastrandrea, Inman, and Cullenward 2020), transportation emissions are the largest source of statewide greenhouse gas emissions and have proven more difficult to cut.

In the late 2000s, the board developed a three-pronged strategy to cut transportation emissions by (1) reducing the number of vehicle miles traveled, such as satisfying transportation demands through public transit, walking, or biking; (2) promoting zero-emissions vehicles, notably through mandatory emissions performance standards for light-, medium-, and heavy-duty vehicles; and (3) lowering the greenhouse gas intensity of transportation fuels through the LCFS (CARB 2022, 184–95; LAO 2018).

While California’s clean vehicle policies have helped promote zero-emitting vehicles, which now make up about 25% of new light-duty vehicle sales (CEC 2024), the state has struggled to reduce overall vehicle miles traveled. The lack of progress on reducing vehicle miles traveled places additional pressure on clean vehicle mandates and the LCFS to align the transportation sector with statewide emissions limits.

The LCFS is also notable for its relationship to the broader legal framework for state climate policy. Although many of California’s policies are authorized by legislation that expressly directs the board to enact certain programs or regulations—including policies for vehicle miles traveled and zero-emitting vehicles—the board characterizes the LCFS as an “early action” measure that was authorized in 2009 under its general authority to enact climate regulations in pursuit of statewide emission reduction requirements (CARB 2023b, 6). And while the LCFS program is regularly reviewed and updated every few years, it has not been guided by specific legislation since implementation—despite its evolution into a multi-billion-dollar market with substantial environmental and economic consequences.

How the Program Works

Under the LCFS, all transportation fuels sold in California are assigned a carbon intensity score, based on a life cycle analysis, and expressed in terms of greenhouse gas pollution per unit of useful energy (gCO₂e/MJ). The LCFS regulations establish a schedule of declining target carbon intensity scores and require that transportation fuel sellers meet these targets, either by decarbonizing their own supply chains and/or acquiring credits from other fuel producers.

The policy mechanics work as follows. Every fuel with a carbon intensity score above the target level incurs “deficits,” and every fuel with a carbon intensity score below the target earns “credits.” In practice, this means that sellers of conventional fossil gasoline and diesel fuels incur deficits,1 which they can match with credits to comply with policy targets. Credits are bankable, meaning parties can earn or purchase them and hold them for future compliance use as needed.

Most credits are issued to biofuel producers, parties that capture methane from agricultural and other sources, and electric vehicle charging operations. A smaller number of credits are awarded to low-carbon fossil fuel production in conventional petroleum refining processes. In the future, hydrogen producers are also likely to earn significant credit volumes as well.

The LCFS is notable for being one of the first energy or environmental policies rooted in life cycle analysis methods (Breetz 2017). Rather than looking just at how much pollution is emitted when an internal combustion engine consumes gasoline or diesel, for example, a life cycle analysis also looks at emissions from extracting crude oil, refining it, and distributing refined products to retailers. Similar programs have been adopted in Oregon, Washington, and Canada, and life cycle analysis methods are also used in the federal Renewable Fuel Standard in the United States and in multiple tax credits under the Inflation Reduction Act.

Life cycle analysis is particularly important for biofuels because their climate consequences span crop growth, biofuel refining, and final combustion. Because biofuel production competes with agriculture and other land uses, diverting production from fueling people to fueling vehicles raises food prices and causes additional greenhouse gas emissions from land use changes—as farmers shift their production choices and sometimes clear forested land (Lark et al. 2022; Searchinger et al. 2008; 2015). These land-use effects have substantial climate and environmental impacts, which are often incompletely represented in policy and modeling applications (Plevin et al. 2022).

In economic terms, the LCFS operates as an intensity-based cap-and-trade program for greenhouse gas emissions from transportation fuels. By design, this does not cap total emissions from transportation fuels but rather limits the average emissions of those fuels. Unlike other market-based climate policies that auction pollution rights that are paid for by private parties, the LCFS does not generate any government revenue.

The regulator’s role is essential but limited to setting policy targets and assigning carbon intensity scores according to the life cycle analysis framework it develops and oversees. Fuel sellers incur deficits and earn credits according to this framework; they transact in private markets to satisfy compliance with the LCFS program’s targets. Rather than paying the government for the right to pollute, fuel sellers with deficits purchase LCFS credits directly from other private parties, which in turn receive those LCFS credits from the government when they sell qualified low-carbon fuels.

Program Outcomes

Before discussing the program’s outlook and potential changes in a rulemaking process that is ongoing as of this writing, I will first review data on the program’s performance to date. To give context to the contemporary policy debate, this section focuses on credit issuance, market prices, the bank of surplus credits that has emerged, estimated financial flows caused by the program and ultimately paid for by California consumers, and the impact on state transportation emissions. All program data are from the California Air Resources Board (CARB 2024b) and are organized in a companion spreadsheet.

Credit Issuance

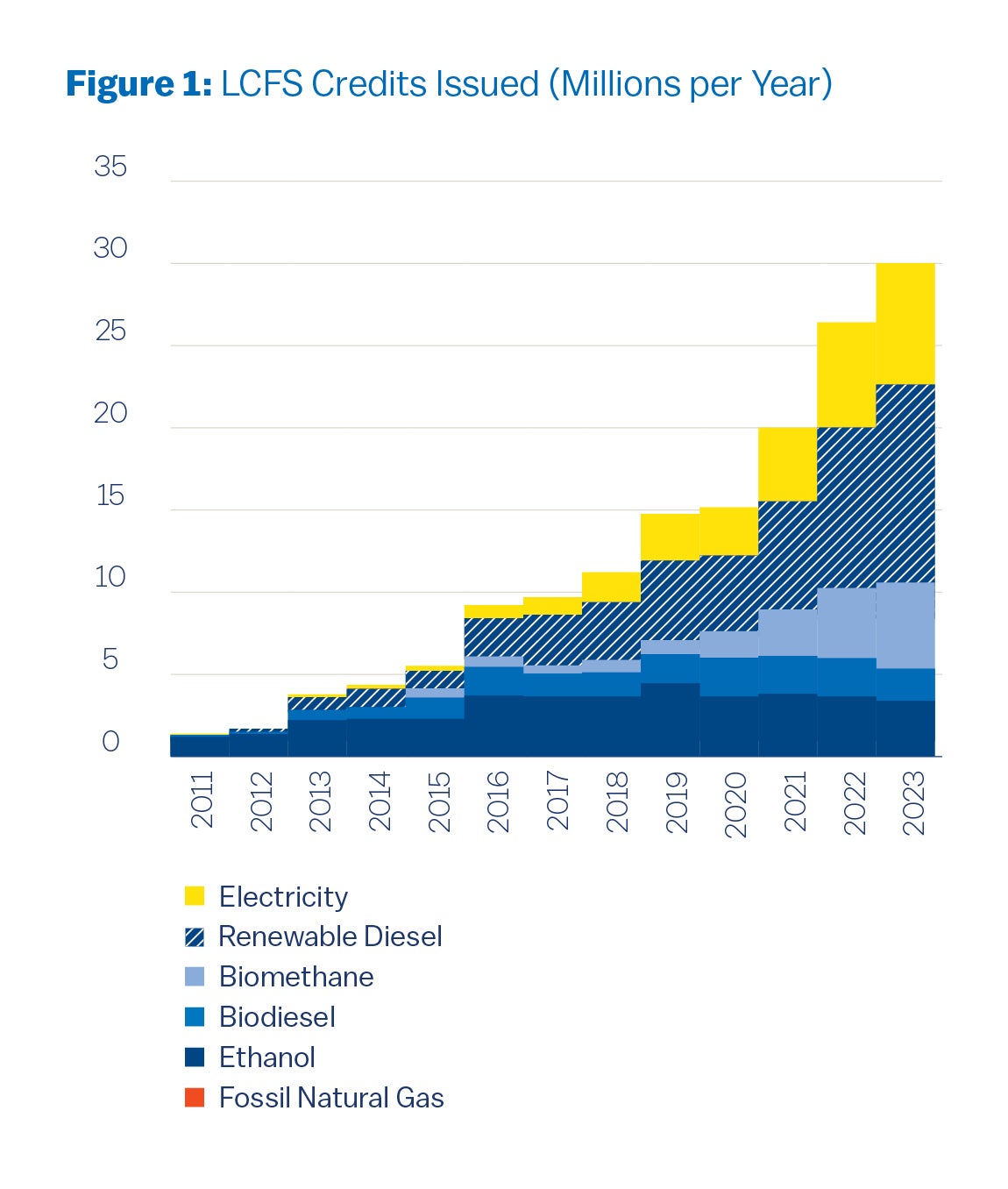

Given California’s emphasis on the electrification of transportation, it might come as a surprise that more than 80% of the total LCFS credits awarded to date have gone to biofuels. Electrification accounts for almost 19% of cumulative credit issuance, with less than 1% going to relatively low-carbon fossil fuels. Although the annual share of credits issued to electricity pathways has been growing over time, it remained at just under 25% as of 2023.

Figure 1 illustrates trends in annual LCFS credit issuance across four biofuel categories (renewable diesel, biomethane, biodiesel, and ethanol), electricity, and lower-carbon fossil fuels. Two biofuel categories (biodiesel and ethanol) generated most of the credit supply in the program’s early years but have not grown substantially since about 2016 because these fuels are blended into conventional diesel and gasoline supplies, which can only accommodate a certain percentage of biofuel blending before hitting the “blend wall” (Ro, Murphy, and Wang 2023, 13).

The substantial growth in credit issuance over the last eight years comes from two biofuel categories (renewable diesel and biomethane) as well as electricity-based pathways. All three involve fuels that do not face a blend-wall limit to their consumption.

- Renewable diesel is a “drop-in” fuel produced from vegetable oils, animal fats, and waste grease that can be substituted for diesel without blending.

- Biomethane captured from dairies or landfills, also known as renewable natural gas (RNG), is not currently required to be delivered to California and therefore is not subject to any infrastructure limits that would restrict credit issuance.2

- Electricity pathways are not constrained by statewide grid infrastructure limits, even if, for example, local grid conditions might constrain the deployment of individual electric vehicle charging stations.

As a result, the growth of renewable diesel, biomethane, and electricity-based fuels has not been constrained by physical infrastructure. The growth of these supplies is primarily driven by the economics of the program’s design, including the relatively low carbon intensity scores assigned to these fuels. Notably, the scale at which renewable diesel supplies have supplemented biodiesel blending resulted in California announcing that 50% of its overall diesel demand was met with biofuel alternatives (CARB 2023a).

Market Prices and Supply–Demand Balance

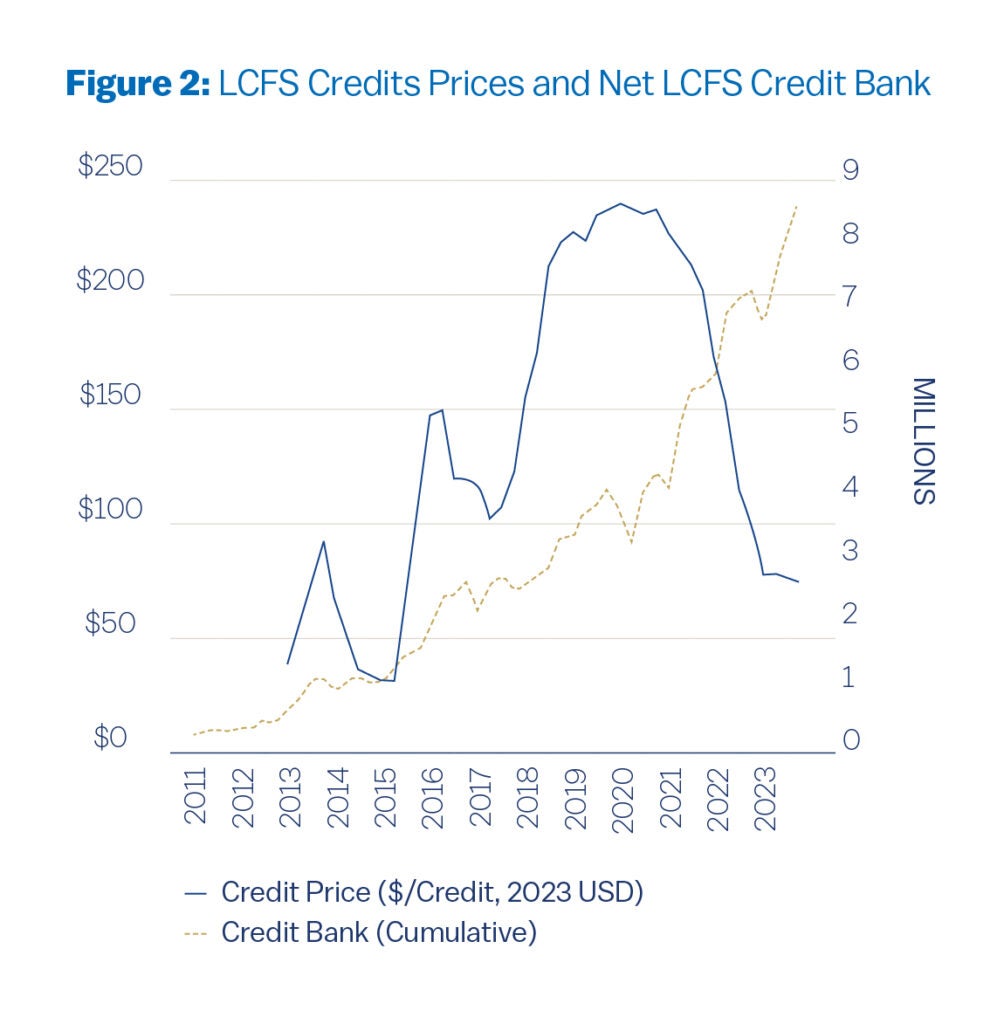

The LCFS program was designed to produce a higher carbon price than the state’s economy-wide cap-and-trade program for greenhouse gas emissions, with the explicit goal of promoting innovation in credited low-carbon fuels (CARB 2023b, 80–81).

As shown in Figure 2, prices in the LCFS program rose from initial levels near $60 to about $230 per credit before falling again below $80 per credit in 2023. For comparison, prices in the economy-wide cap-and-trade program have ranged from about $10 to $40 per credit (all units 2023 USD).

Prices and the pace of program target regulations in the early years of the LCFS program were affected by litigation3 and frequent regulatory amendments (the details of which are beyond the scope of this report). More recently, the decline in prices from peak levels was closely related to substantial increases in low-carbon fuels that have generated LCFS credits in excess of deficits. This program-wide outcome can be tracked by reporting the net bank of LCFS credits available in the market.

Figure 2 illustrates how the net LCFS credit bank has grown steadily. Although low market prices can be a sign of successful compliance, they can also reflect limited ambition in policy target-setting, unexpected supply-side outcomes, or both. In the case of the LCFS, the regulator has indicated that one of its explicit policy goals is to maintain higher prices in order to support investment in long-lived energy infrastructure, and therefore, one of the goals of the 2024 rulemaking process is to increase market prices (CARB 2023b, 80–81; Ro, Murphy, and Wang 2023, 47).

Financial Flows

Under the LCFS program regulations, money does not flow between regulated companies and the government. Rather, the program creates compliance obligations for companies that sell high-carbon fuels and issues LCFS credits to companies that sell low-carbon fuels. Money flows between private parties that change their production processes and/or transact in LCFS credits, rather than buying credits directly from the government. Although the transactions themselves are private, the government plays an essential, central role in establishing the program-wide carbon intensity targets and assigning fuel-specific carbon intensity scores.

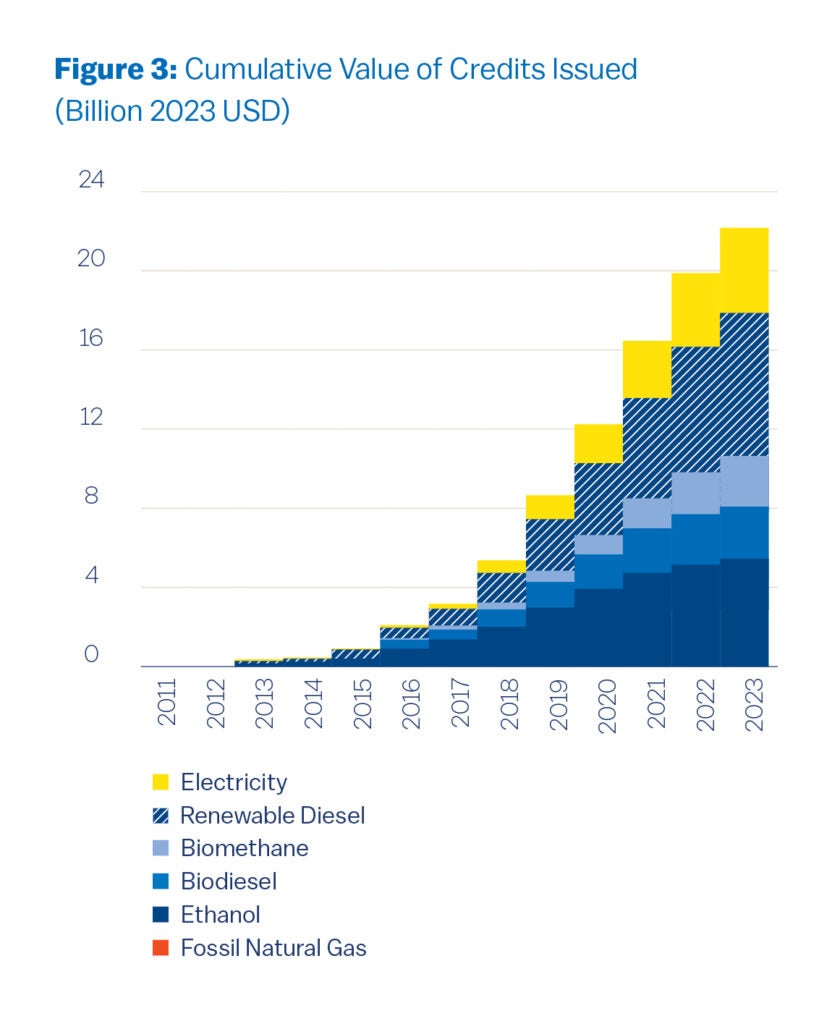

Perhaps because no LCFS-related funds move through state accounts, the extent of financial flows induced under the LCFS is not widely understood. These flows can be approximated using public credit issuance and market price data. Although the terms of real-world transactions likely differ by fuel pathway and across individual projects, their terms are not publicly disclosed. In any case, valuing credit issuance according to contemporary spot market prices is a reasonable proxy by which to assess program-wide financial flows.

Figure 3 combines the data shown in the earlier figures to report the cumulative value of credits issued. By the end of 2023, credits worth approximately $22.1 billion were issued to low-carbon fuel producers across all categories, with about $17.7 billion accruing to biofuels, $4.3 billion to electricity pathways, and about $90 million to low-carbon fossil fuels (2023 USD).

On an annual basis, the value of recent credit issuance ranged between about $3–4 billion per year during periods of high market prices, down to just over $2 billion per year in light of lower market prices in 2023. The value of credit issuance also depends on the market-wide carbon intensity reduction targets, which declined modestly over the historical period but (as discussed below) are slated to decline much more rapidly going forward. Lower emissions targets imply higher market prices because they have the practical effect of increasing demand for LCFS credits.

Impact on Transportation Sector Emissions

The impact of the LCFS program on transportation sector emissions is difficult to characterize for two critical reasons. The first is that the LCFS program and California’s official greenhouse gas inventory use fundamentally different accounting conventions. The LCFS uses a life cycle emissions accounting framework to capture emissions associated with the production, distribution, and consumption of transportation fuels, wherever they occur.

In contrast, the state’s official greenhouse gas inventory is focused on emissions that occur inside of California’s borders, with the additional inclusion of emissions from imported electricity (CARB 2024a). Although the LCFS program seeks to precisely quantify the life cycle emissions associated with transportation fuels sold in the state, the program’s reporting data do not distinguish where a fuel’s life cycle emissions occur, and as a result, one cannot readily reconcile the emissions reported under the two programs.

A second factor is that the statewide greenhouse gas inventory excludes biogenic CO2 emissions, which may give a misleading impression of the effect of the LCFS program on statewide emissions (IEMAC 2024, 7–9). As shown in Figure 1 above, the primary effect of the LCFS program has been to encourage the in-state consumption of biofuels to replace gasoline and diesel. While the board calculates that these fuels reduce emissions by about 40% for ethanol and approximately 60% for renewable diesel fuels on a life cycle basis (CARB 2024b Figure 5a), the combustion emissions of these fuels is excluded from the greenhouse gas inventory such that they show up as 100% reductions.

Separate reporting from the board indicates that emissions from light-duty vehicles are decreasing over time, even with the inclusion of biogenic CO2 emissions from ethanol (CARB 2024a Figure 8); however, the significant decline in heavy-duty vehicle emissions reported in the inventory appears to be an artifact of excluding biogenic CO2 emissions from bio-based diesel (CARB 2024a Figure 9).

Controversies and Outlook

The California Air Resources Board began a formal process to amend and extend the LCFS at the end of 2023. Although a vote on the proposed regulations (CARB 2023b) was initially planned for March 2024, substantial stakeholder concerns about the program’s design led the board to reschedule its vote for November 8, 2024, immediately after the presidential election.4

In addition, board staff released a set of “15-day changes” in August 2024 that modify the original regulatory proposal published in December 2023 (CARB 2024c). This section reviews some of the concerns that stakeholders have expressed: the alignment between the program’s reliance on biofuels and the state’s emphasis on electrification; questions about the climate benefits and local environmental impacts of fast-growing biofuel supplies; and the range of retail fuel price impacts that could result in the years ahead. It concludes with a brief discussion of how the 15-day changes respond to criticisms.

Strategic Alignment

One of the most notable features of the LCFS is its heavy reliance on biofuels, which contrasts with the state’s primary strategic focus on electrifying transportation services. In part, this may reflect the program’s origins. At the time the program was developed in the late 2000s, the cost of electric batteries had yet to begin the precipitous declines observed in recent years, and there was much more enthusiasm for second-generation biofuels made from lignocellulosic feedstocks than there is today (Kramer 2022). To date, however, little progress has been made in deploying cellulosic biofuels.

Although most analysts now believe that electric vehicles will be the primary technology for decarbonizing personal cars and trucks, even ambitious scenarios anticipate that it will take more time to deploy zero-emitting medium and heavy-duty vehicles that run on electricity or hydrogen fuel. This results in a “long tail” of diesel consumption that outlasts gasoline demand in many decarbonization scenarios, which is frequently cited to support the argument that lower-carbon alternatives to conventional diesel can play an important role in reducing cumulative emissions outcomes (Ro, Murphy, and Wang 2023).

Nevertheless, significant strategic tensions remain, even if one prioritizes providing alternative fuels to supply the “long tail” of diesel engine combustion needs. Substantially reducing demand for diesel and alternative liquid fuels, in the long run, requires a shift to zero-emitting medium- and heavy-duty vehicles—in other words, demand destruction through the promotion of new vehicle technologies rather than substitution of alternative fuels that work with incumbent combustion engines.

Consistent with this view, the board recently approved an ambitious regulation, known as the Advanced Clean Fleet rule, that requires a growing share of zero-emitting medium- and heavy-duty vehicle sales over time. Although these regulations provide a clear direction for demand destruction and a shift toward zero-emitting medium- and heavy-duty vehicles, proponents worry that politically sustainable implementation requires greater financial support from the LCFS program because of unfunded needs for infrastructure for electric vehicle charging (Browning 2023) and, potentially, hydrogen fueling.

In effect, the current LCFS primarily subsidizes fuel substitution over vehicle turnover. While one can reasonably argue that it is appropriate to have a policy dedicated to fuel substitution, particularly because California has multiple policy instruments focused on vehicle turnover, it might also be necessary to prioritize efforts if the overall strategy for reducing transportation emissions is falling short.

Recall that California’s climate strategy involves three interlocking elements: reductions in vehicle miles traveled, a shift to zero-emitting vehicles, and fuel substitution. The state’s policies for reducing vehicle miles traveled have not been effective, and as a result, the state is not remotely on track for achieving that element of its transportation strategy (CARB 2022, 192–95).

While zero-emitting vehicles now account for about 25% of light-duty vehicle sales, the cost differential between conventional and electric or hydrogen technologies for heavy-duty vehicles is substantially larger than it is for personal cars and trucks. Thus, optimism about the pace of light-duty electrification unfortunately does not resolve the problem of the slow turnover of diesel fuel vehicles nor the significant financial and infrastructure barriers to heavy-duty zero-emitting vehicles.

Environmental Harms

The LCFS has also been criticized for exacerbating local and global environmental harms. I review three issues here: food crop-based biofuels, resource shuffling of existing fuel supplies, and the climate and environmental justice consequences of biomethane crediting from dairies.

First, the rapidly expanding supply of renewable diesel fuels is primarily coming from crop-based production processes, such as the production of fuel from soy or canola, rather than the use of waste oils and other resources that do not compete with food use (Martin 2024a; 2024b). This is a problem because competition with food can raise food prices and drive substantial deforestation (Searchinger et al. 2015).

Although the LCFS includes an “indirect land use change” factor in assigning carbon intensity scores to crop-based biofuels, these factors were highly uncertain when they were first developed many years ago (Breetz 2015) and may substantially underestimate the results (Plevin et al. 2022).

Second, the LCFS is likely causing “resource shuffling” of transportation fuels, where existing production is diverted to California markets instead of being consumed elsewhere. This is particularly concerning for renewable diesel fuels because there is a national production mandate under the federal Renewable Fuel Standard. Renewable diesel that is simply diverted to California instead of being consumed in another state doesn’t create any new climate benefits; even if the carbon intensity scores accurately captured indirect land use change effects, the displacement of conventional diesel would have happened anyway—though likely in another state—due to the Renewable Fuel Standard, rather than the LCFS.

This effect turns out to be large: about 50% of national production volumes in 2022 were consumed in California (Martin 2024a) and the potential future supply under the federal program is large enough to affect the LCFS market’s supply-demand balance for years to come (Murphy and Ro 2024, iii). Similar effects may also be occurring in ethanol markets, as LCFS incentives encourage lower-carbon ethanol produced from Brazil to serve California markets—even if that fuel likely would displace others’ use of gasoline without the LCFS.

A third set of issues concerns the role of putatively negative-emissions biomethane fuels, which are also known as renewable natural gas (Lazenby 2024). Briefly, these pathways are assigned negative carbon intensity scores for claiming to avoid methane emissions from sources like dairy manure ponds at large-scale confined animal feedlots.

Because methane is a short-lived but potent greenhouse gas, its calculated carbon dioxide equivalence is so large that the imputed climate value of avoiding methane emissions more than makes up for the harms of creating new carbon dioxide emissions from combusting captured biomethane (Grubert and Cullenward 2024). This is effectively an offsetting practice that gives the transportation sector credits for avoiding methane emissions in the agricultural, fossil fuel, or waste sectors.

The distortionary effects led to surprising results: in the first three quarters of 2023, biomethane credits accounted for 17% of market-wide LCFS credit issuance while providing only about 1% of transportation fuel supply (Martin 2024c). When credit prices have been high, the combination of incentives from the LCFS program and several related state and federal programs have been sufficient to potentially encourage larger herd sizes, specifically to produce additional methane emissions to capture for profit (Smith 2024)—a perverse incentive that has been documented in other carbon offsetting programs (Schneider 2011).

The environmental justice and animal welfare implications of biomethane production from dairy manure waste are a significant part of the LCFS program debate (EJAC 2023). Local residents have accused dairy operations in places like Pixley, California, located in the southern heart of the state’s central valley, of significant air and water pollution impacts that are exacerbated by subsidized dairy digesters (Cantú 2023).

In contrast, the California Air Resources Board maintains that LCFS subsidies are necessary to achieve in-state methane emission reduction mandates. Because LCFS incentives aren’t limited to geography, however, more than half of the credits issued to dairy projects are going to out-of-state facilities (CARB 2024b Figure 10b; Pierce and Strong 2023).

Some stakeholders have advocated for the board to directly regulate in-state emitters as an alternative to an incentives-only policy (Smith 2024), including through a formal regulatory petition that was recently declined (Cliff and Ross 2024). While one can only speculate about the regulator’s political reasoning, one factor may be that if the board were to require methane pollution controls at in-state dairies, then those facilities might not be eligible to earn credits for the same activities.5 In other words, the regulator may be unable to pursue a combination of carrots and sticks for in-state facilities, and thus resorted to a carrots-only approach over a sticks-only alternative.

In response to concerns about the environmental impacts of crop-based biofuels and the distortionary effects of biomethane crediting, academics have published modeling that suggests that a cap on crop-based renewable diesel fuels and changes in biomethane crediting practices could support most of the board’s stated policy objectives (Wara et al. 2023). As discussed at the end of this section, however, board staff do not appear convinced and have largely proposed to retain their original vision for the LCFS.

Consumer Price Impacts

Perhaps the most politically consequential controversy about the future of the LCFS program is its impact on retail fuel prices. To date, program costs have generally been understood to be relatively modest, but due to the design of the program those costs are poised to rise substantially (LAO 2018, 30). As the California Air Resources Board has long recognized, including in the latest cost-benefit analysis its staff produced for the proposed LCFS amendments under consideration as of this writing, the impact of the LCFS program on retail fuel prices is a product of three factors (CARB 2023c, 55–59):

- The carbon deficit incurred per unit of fuel sold in California, which itself is a product of the carbon intensity of the fuel and the applicable LCFS program target for that year

- The LCFS credit price

- The extent to which conventional fuel producers pass along the overall program compliance cost in the form of higher retail fuel prices

To evaluate potential retail price impacts, I review each of the three factors as applied to the sale of gasoline. A similar exercise could be done for diesel, which is covered under the LCFS but not illustrated here.

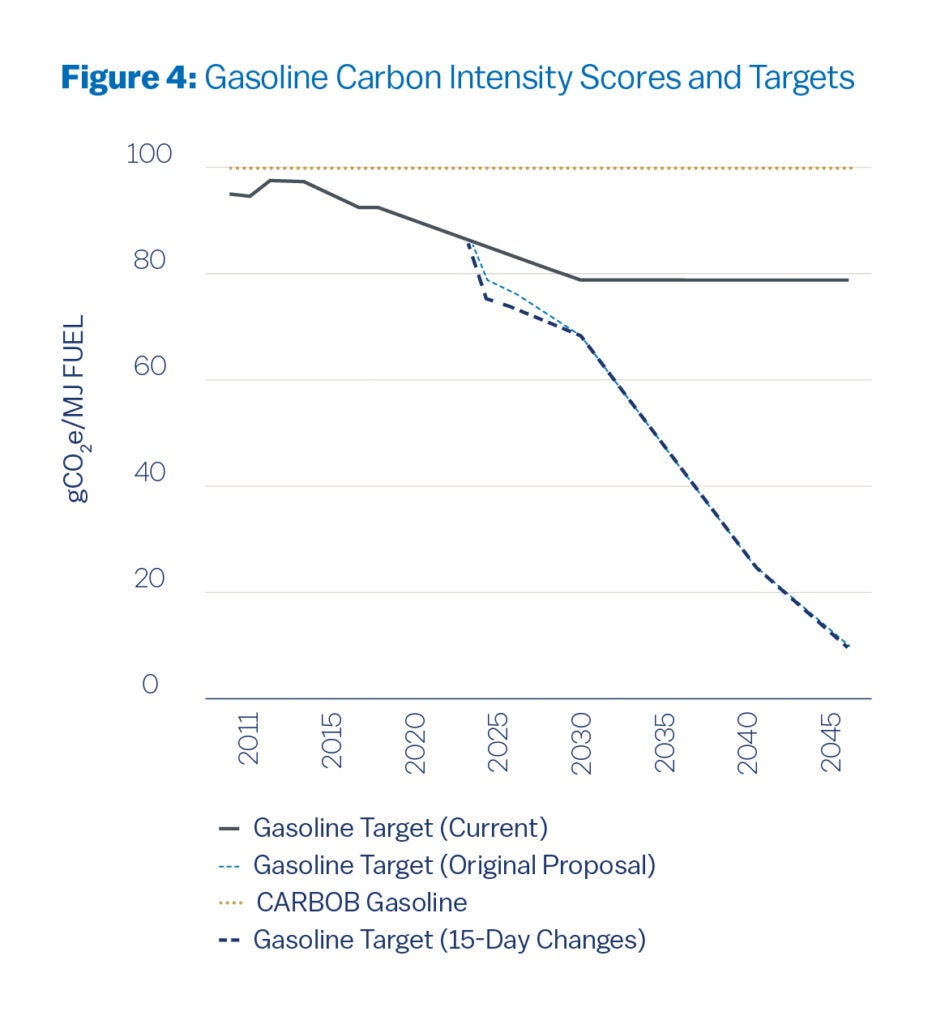

The first factor, the credit deficit incurred per unit of fuel sold, is given explicitly by the LCFS program regulations and the proposed amendments by board staff. California requires a special refining blend known as CARBOB gasoline, to which the regulator has assigned a carbon intensity score of 100.45 gCO₂e/MJ.

The credit deficit is the difference between the carbon intensity score of the fuel and the target carbon intensity score for the replacement fuel category. As Figure 4 illustrates, the target carbon intensity score for gasoline replacements was initially set slightly below the carbon intensity of CARBOB gasoline and is 87.01 gCO₂e/MJ as of 2024; it will decline to and remain at 79.55 gCO₂e/MJ beginning in 2030 under the current regulation.

Under the proposed amendments, however, the target would decline more rapidly beginning in 2025 and drop to 9.91 gCO₂e/MJ by 2045. Based on the current program regulations, the per-gallon credit deficit will grow in the years ahead—substantially so under the proposed regulations—and increase retail price impacts as a result.6

The second factor, the price of LCFS credits, is set by market forces in response to the program’s supply-demand balance. By substantially reducing carbon intensity targets, the proposed amendments will increase credit deficits and therefore should increase demand for LCFS credits. LCFS credit supplies could also increase as well, either because of higher LCFS credit prices and/or greater certainty about the program’s long-term trajectory; however, it would be unreasonable to speculate about the precise balance of outcomes from simple assumptions.

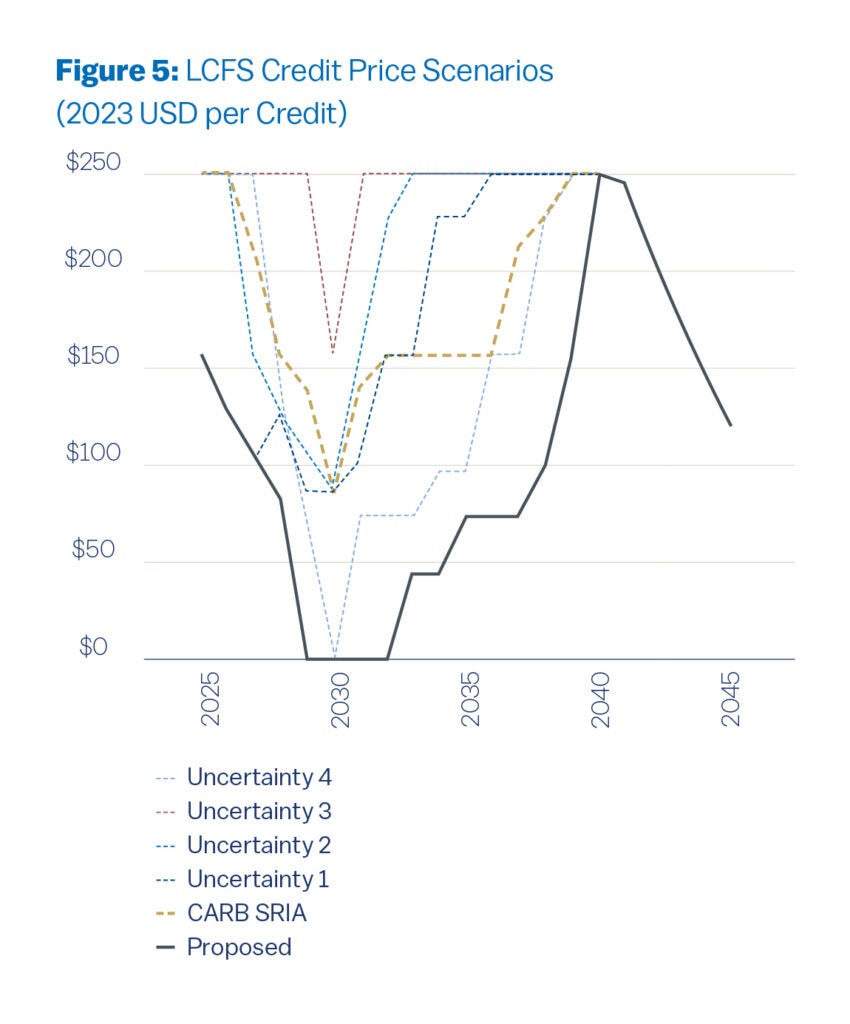

To bound the range of potential price impacts, Figure 5 looks at a range of credit price scenarios that include the maximum prices allowed by regulation. For comparison, I also include a price scenario that the California Air Resources Board developed for its latest cost-benefit analysis (known as a SRIA), which is based on an internal modeling analysis (CARB 2023c Table 22). In addition, I also depict a suite of modeling scenarios released as part of the August 2024 15-day changes, including the “proposed” scenario and four uncertainty scenarios (CARB 2024c Appendix C).

A full discussion of what data and modeling assumptions explain the results shown in Figure 5 is beyond the scope of this paper, although one notable feature of all scenarios is that they report relatively lower LCFS in benchmark years 2030 and 2045 than they do in between these years.

I cannot identify any structural feature of the program or the proposed regulatory changes that would explain this pattern but note that cost impacts are often summarized succinctly based on point estimates for years in which the state has a binding emission reduction requirement (2030 and 2045). This suggests that politics may help explain some of the modeling results depicted here beyond the substantial technical complexity involved in projecting possible price scenarios.

In any case, because the scenarios span a wide range of possible outcomes between a zero price and the maximum price allowed in the program, they offer a reasonable way of identifying potential price impacts—even if one is skeptical of the storyline or modeling results for a given scenario.

The third factor is the extent to which fuel producers pass along the total cost of covering their LCFS credit deficits in the form of higher retail prices. CARB has historically assumed that producers pass along 100% of total program costs in the form of higher retail prices as an “upper bound” analysis (CARB 2023c, 55–56); the nonpartisan Legislative Analyst’s Office also expects that “[m]ost or all” of these costs are passed on to consumers (LAO 2018, 32).

I therefore assume a 100% cost pass-through, which seems reasonable in light of concerns that the small number of fuel providers operating in California’s bespoke refined fuel markets may be capable of exercising market power.7 I note, however, that board staff object to this assumption, though they have not identified a preferred alternative (CARB 2024c Appendix C).

Figure 6 reports the range of retail gasoline price impacts that follow from these three factors, using the same LCFS credit price scenarios discussed in Figure 5. Near-term price impacts could be as high as $0.60 or $0.70 per gallon if market prices approach their maximum levels; maximum retail price impacts could reach $0.85 per gallon by 2030 and $1.34 per gallon by 2035, though board staff project lower prices by those timeframes.

Although this analysis does not estimate the likelihood of each possible LCFS credit price outcome, the potential retail price impacts are categorically and often substantially larger than the approximate 2023 retail price impact of about 10 cents per gallon of gasoline. The potential for substantially higher retail price impacts going forward reflects both the planned reductions in carbon intensity targets going forward (see Figure 4) and the expectation of higher LCFS credit prices going forward (see Figure 5).

One notable feature of potential retail gasoline price impacts is how quickly price impacts increase over time for each price scenario. As carbon intensity targets decline (see Figure 4), the larger the percentage of gasoline’s total carbon intensity is “exposed” to the market’s price signal and, therefore, the greater the resulting retail price impact for any given LCFS credit price, as noted previously by the nonpartisan Legislative Analyst’s Office (2018 Figure 17).

To be clear, the analysis presented here does not evaluate which price scenarios are more likely than others. Although the proposed regulations will raise market prices above their current levels near $50 to $60 per LCFS credit—an explicit goal of the proposed rules (CARB 2023b, 80–81)—it is difficult to project outcomes in environmental markets (Borenstein et al. 2019), particularly in light of different results from model-based studies of the LCFS (Wara et al. 2023; Murphy and Ro 2024; CARB 2023c; 2024c Appendix C).

These challenges are all the more difficult to resolve because of the proposed mechanism to automatically accelerate carbon intensity target reductions to push prices higher if market supplies exceed certain thresholds (Murphy and Ro 2024, iii).

Another limitation is that neither this report nor any of the analyses cited account for the fact that the LCFS is encouraging the conversion of in-state refineries to produce renewable diesel, such as at the Marathon/Tesoro facility in Martinez, California. Refinery conversions pull gasoline production capacity offline, potentially on a permanent basis, which further increases economic concentration among a handful of producers in California’s refining sector. Thus, beyond causing direct impacts in the form of higher retail fuel prices, the LCFS could also be contributing to higher prices that reflect producer market power.

Regulatory Response to Criticism

Although some board members have expressed concerns about the criticisms discussed above (St. John 2024), board staff have largely maintained course without major modifications to the original regulatory proposal. Instead of implementing a firm cap on crop-based biofuel crediting or eliminating the practice of crediting avoided methane emissions, two sets of 15-day regulatory changes released in August and October 2024 offer incremental alternatives. The regulatory updates also dispute the suggestion that LCFS program reforms will lead to significant retail fuel price impacts, and even the very notion that price impacts can be calculated by anyone in the first place.

The regulatory proposal would allow full crediting only for the first 20% of a regulated entity’s fuel mix (CARB 2024c Appendix A-1, § 95482(i)) for crop-based biofuels, including those produced from soybean, canola, and sunflower oils. Crop-based biofuels sold in excess of this limit will be assigned the program’s target intensity rather than a biofuel’s lower carbon intensity score.

In effect, this means that crop-based biofuels would earn LCFS credits as usual, up until the associated biofuel consumption constitutes 20% of a fuel seller’s overall fuel mix. At that point, further crop-based biofuel consumption would stop incurring either credits or deficits (because fuels assigned the carbon intensity of the policy target earn neither credits nor deficits under the program regulations). While this approach would be less generous to crop-based biofuels than the status quo, it would still provide an incentive to consume more crop-based biofuels because consuming regular fossil diesel would incur significant deficits (rather than none).

As a retired former CARB staff member wrote in technical comments to the board, this is not a hard “cap” on crop-based biofuel crediting and it may be inadequate to send long-term signals that limits the share of crop-based biofuels sold in California markets (Duffy 2024).

The proposed regulatory changes would also allow board staff to consider and adopt more conservative estimates of land-use change impacts from biofuel production (CARB 2024c Appendix A-1, § 95488.3(d)(2)), which is not required under the proposal but would—if enacted and applied using the best available science—reduce biofuel crediting in the future.

For biomethane crediting, the regulatory proposal would add some physical delivery requirements for biomethane while grandfathering all existing projects (CARB 2024c Appendix A-1, § 95488.8(i)(2)). These changes appear unlikely to constrain the growth of biomethane crediting going forward.

Specifically, the proposal would require biomethane suppliers to establish that they have a contractual arrangement that would result in physical delivery to the state of California, not just injection into the interstate pipeline network without geographic restriction. However, this requirement would be phased in for transportation fuel use and electricity generation by 2041 and for hydrogen production only by 2046, and in both cases, it would apply only to biomethane projects that break ground on or after January 1, 2030.

Thus, through 2040, no biomethane projects would have to demonstrate physical deliverability, and beginning in 2041 (and 2046 for hydrogen), biomethane fuel users would only need to do so for biomethane capture projects that break ground in 2030 or later. These deliverability requirements would be accelerated to apply in 2038, however, if the deployment of zero-emission medium- and heavy-duty vehicles exceeds target numbers by 2030. In either case, all existing biomethane supplies and projects that break ground before 2030 would be grandfathered into the program. The October 2024 update also changes the eligibility period for biomethane crediting, and would allow existing projects to earn credits for up to 30 years while reducing the maximum crediting period to 20 years for new projects (CARB 2024c Appendix A-1, § 95488.9(f)(3)).

With respect to retail price impacts, board staff have disputed both any correlation between LCFS credit prices and retail gasoline prices as well as the very notion that retail price impacts can be calculated in the first place. Despite publishing a set of modeling results that explore potential market scenarios and price outcomes (see Figure 5 above), board staff assert that “[n]o model currently available can accurately predict future credit prices for the LCFS, future transportation fuel prices, or pass-through cost for retail gasoline or diesel costs” (CARB 2024c Appendix C).

As board staff note, several other factors are likely responsible for explaining most of the variation in retail gasoline and diesel price impacts over the last decade. But that observation doesn’t change the fact that a regulatory proposal that is explicitly designed to increase LCFS credit prices and lower LCFS carbon intensity policy targets to encourage greater emission reductions will put upward pressure on retail fuel prices.

Nor does it address the fact that LCFS-related price impacts were small in the program’s initial years in part because the LCFS program targets were only modestly lower than conventional fossil fuels. The proposed regulations would require significantly greater reductions that would amplify the retail cost impact of a given LCFS credit price beyond historical outcomes.

Conclusion

California’s Low Carbon Fuel Standard is an important and increasingly controversial climate program. As an intensity-based cap-and-trade program based on the greenhouse gas emissions of transportation fuels, the program’s complexity can lead to opacity. However, thanks to detailed program data disclosures from the California Air Resources Board, it is nevertheless possible to explore the program’s function and performance.

At its core, the LCFS sets target carbon intensity levels for transportation fuels sold in California. Fuel providers that sell fuels that emit more than the target incur deficits and must cover those deficits by purchasing LCFS credits, which the regulator issues to fuel providers that sell fuels that emit less than the target.

The California Air Resources Board sets carbon intensity targets and assigns carbon intensity scores to transportation fuels sold in the state, but is not directly involved in private transactions in the LCFS credit market. Companies that sell conventional fuels earn deficits, while those that sell low-carbon alternatives—including biorefineries, biomethane producers, and electric vehicle charging aggregators—earn credits based on the carbon intensity scores assigned by the board.

Despite the program’s technical focus on life cycle greenhouse gas emissions accounting, it is perhaps best understood as a mechanism for moving dollars rather than managing tons (Green 2021). Through 2023, about $22.1 billion worth of LCFS credits have been issued to low-carbon fuels. About $17.7 billion (or 80%) of this value has gone to four categories of biofuels: two that have hit a “blend wall” in the fuel supply chain (ethanol and biodiesel) and two “drop-in” fuels that are unconstrained by fuel blending limits and growing rapidly (renewable diesel and biomethane).

While California has generally prioritized the electrification of transportation services, only about $4.3 billion (or 20%) has gone to electric fuel pathways thus far. That share is poised to grow over time as carbon intensity targets fall, but electricity-based LCFS credits are likely to remain a minority for many years to come. (All units in 2023 U.S. dollars.)

Meanwhile, several serious questions have been raised about whether crop-based biofuels and biomethane fuels are delivering the climate benefits their assigned carbon intensity scores promise. Environmental justice organizations have also raised concerns about the impact of LCFS credits from dairy digesters, which encourage intensive animal agriculture and can exacerbate pollution impacts in highly burdened communities.

So far, these concerns have generally not persuaded California Air Resources Board staff to make significant changes to the program, though a non-binding cap on crop-based biofuels could reduce the growth in credits issued to renewable diesel relative to the original and unconstrained proposal.

Of all the controversies over the program’s design, however, perhaps the most politically salient issue will be its impact on retail gasoline and diesel prices. The value of LCFS credits issued to low-carbon fuels comes from program costs that are largely, if not completely, passed along to retail consumers.

Those impacts have been relatively muted so far, particularly in the program’s early years and again when LCFS credit prices fell in 2022. But conditions are poised to change. Retail price impacts depend both on LCFS credit prices, which are expected to increase under the proposed amendments, and on the level of the program’s carbon intensity targets.

The proposed regulations contemplate significant reductions in those targets, which will amplify the expected increases in LCFS credit prices—though the extent of the ultimate impact on retail fuel prices depends on market forces, which are not easily predicted in environmental markets.

If LCFS credit prices reach their maximum allowed levels, as has occurred in the past, then near-term retail price impacts could be $0.65 per gallon, $0.85 per gallon by 2030, and nearly $1.50 per gallon by 2035. Actual market prices and retail price impacts could also be lower. For example, if LCFS credit prices increase only modestly above their current levels near $60 per credit to $100 per credit, then near-term price impacts could be $0.26 per gallon, $0.34 per gallon by 2030, and almost $0.60 per gallon by 2035. (All units in 2023 USD.)

Ultimately, California policymakers will need to determine what level of retail fuel price incidence is acceptable between the Low Carbon Fuel Standard and the state’s comprehensive cap-and-trade program for greenhouse gas emissions, as well as which funding recipients deserve to be the primary beneficiaries of many billions of dollars a year that that consumers ultimately pay.

By prioritizing a vote on the LCFS program in November 2024—ahead of any potential regulatory amendments and/or legislative negotiations to extend the state’s cap-and-trade program through 2045—the California Air Resources Board is effectively privileging its view of how to control LCFS program funding flows over the options California legislators might consider in the context of the statewide cap-and-trade program.

Both the LCFS and cap-and-trade programs move billions of dollars a year and impose higher consumer-facing energy prices that are designed to internalize some of the public costs of unconstrained climate and local air pollution. Still, the two have fundamentally different governance structures.

The California Legislature has provided extensive guidance on how the board should design its statewide cap-and-trade program, oversees the appropriation of billions of dollars a year, and is likely to consider program reauthorization soon (IEMAC 2023, 24–31). In contrast, the board controls billions of dollars a year in funding flows via the LCFS program regulations without the benefit of specific legislative instructions on how the program should operate.

Danny Cullenward

Senior FellowDanny Cullenward is a senior fellow at the Kleinman Center. He is an economist and lawyer focused on the scientific integrity of climate policy with additional appointments at the Institute for Responsible Carbon Removal at American University and Google.

Borenstein, Severin, James Bushnell, Frank A. Wolak, and Matthew Zaragoza-Watkins. 2019. “Expecting the Unexpected: Emissions Uncertainty and Environmental Market Design.” American Economic Review 109 (11): 3953–77. https://doi.org/10.1257/aer.20161218.

Breetz, Hanna L. 2015. “Science, Values, and the Political Framing of Indirect Land Use Change (ILUC).” In Science and the Law: How the Communication of Science Affects Policy Development in the Environment, Food, Health, and Transport Sectors, edited by William G. Town and Judith N. Currano, 1207: 95–122. ACS Symposium Series. Washington, DC: American Chemical Society. https://pubs.acs.org/doi/abs/10.1021/bk-2015-1207.ch007.

———. 2017. “Regulating Carbon Emissions from Indirect Land Use Change (ILUC): U.S. and California Case Studies.” Environmental Science & Policy 77 (November):25–31. https://doi.org/10.1016/j.envsci.2017.07.016.

Browning, Adam. 2023. “LCFS Reform Is Critical to ACF Success.” Presented at the California Air Resources Board Environmental Justice Advisory Committee, August 25. https://ww2.arb.ca.gov/events/ab-32-environmental-justice-advisory-committee-meeting-35.

Cantú, Aaron. 2023. “How a California Dairy Methane Project Threatens Residents’ Air and Water.” Capital & Main. April 20, 2023. https://capitalandmain.com/how-a-california-dairy-methane-project-threatens-residents-air-and-water.

CARB. 2022. “2022 Scoping Plan for Achieving Carbon Neutrality.” Sacramento, CA: California Air Resources Board. https://ww2.arb.ca.gov/our-work/programs/ab-32-climate-change-scoping-plan/2022-scoping-plan-documents.

———. 2023a. “For First Time 50% of California Diesel Fuel Is Replaced by Clean Fuels.” California Air Resources Board. August 23, 2023. https://ww2.arb.ca.gov/news/first-time-50-california-diesel-fuel-replaced-clean-fuels.

———. 2023b. “Staff Report: Initial Statement of Reasons, Proposed Amendments to the Low Carbon Fuel Standard.” California Air Resources Board. https://ww2.arb.ca.gov/rulemaking/2024/lcfs2024.

———. 2023c. “Standardized Regulatory Impact Analysis (SRIA), Low Carbon Fuel Standard 2023 Amendments.” California Air Resources Board. https://ww2.arb.ca.gov/resources/documents/low-carbon-fuel-standard-sria.

———. 2024a. “California Greenhouse Gas Emissions from 2000 to 2022: Trends of Emissions and Other Indicators.” California Air Resources Board. https://ww2.arb.ca.gov/ghg-inventory-data.

———. 2024b. “LCFS Data Dashboard.” California Air Resources Board. https://ww2.arb.ca.gov/resources/documents/lcfs-data-dashboard.

———. 2024c. “Low Carbon Fuel Standard 15-Day Changes.” California Air Resources Board. https://ww2.arb.ca.gov/rulemaking/2024/lcfs2024.

CEC. 2024. “New ZEV Sales in California.” California Energy Commission. https://www.energy.ca.gov/data-reports/energy-almanac/zero-emission-vehicle-and-infrastructure-statistics-collection/new-zev.

Cliff, Steven, and Karen Ross. 2024. “Response to Petition for Rulemaking to Regulate Methane and Other Air Pollutants from California Livestock,” May 30, 2024. https://ww2.arb.ca.gov/sites/default/files/2024-05/2024-05-30-CARB-CDFA-Response-to-Dairy-Rulemaking-Petition.pdf.

Duffy, Jim. 2024. “LCFS 15-Day Comments.” https://www.arb.ca.gov/lists/com-attach/7390-lcfs2024-VjJdLlUyAjdRLgNc.pdf.

EJAC. 2023. “2023 Low Carbon Fuel Standard Recommendations.” California Air Resources Board Environmental Justice Advisory Committee. https://ww2.arb.ca.gov/historical-documents.

Grubert, Emily, and Danny Cullenward. 2024. “The New Hydrogen Rules Risk Opening the Door to Methane Offsets.” Heatmap News. February 9, 2024. https://heatmap.news/climate/hydrogen-tax-credit-final-methane-offsets.

IEMAC. 2023. “2022 Annual Report of the Independent Emissions Market Advisory Committee.” Independent Emissions Market Advisory Committee, California Environmental Protection Agency. https://calepa.ca.gov/2022-iemac-annual-report/.

———. 2024. “2023 Annual Report of the Independent Emissions Market Advisory Committee.” Independent Emissions Market Advisory Committee, California Environmental Protection Agency. https://calepa.ca.gov/2023-iemac-annual-report/.

Kramer, David. 2022. “Whatever Happened to Cellulosic Ethanol?” Physics Today 75 (7): 22–24. https://doi.org/10.1063/PT.3.5036.

LAO. 2018. “Assessing California’s Climate Policies—Transportation.” California Legislative Analyst’s Office. https://lao.ca.gov/Publications/Report/3912.

Lark, Tyler J, Nathan P Hendricks, Aaron Smith, Nicholas Pates, Seth A Spawn-Lee, Matthew Bougie, Eric G Booth, Christopher J Kucharik, and Holly K Gibbs. 2022. “Environmental Outcomes of the US Renewable Fuel Standard.” Proceedings of the National Academy of Sciences 119 (9): e2101084119. https://doi.org/10.1073/pnas.2101084119.

Lazenby, Ruthie. 2024. “Mitigating Emissions from California’s Dairies.” UCLA Emmett Institute on Climate Change and the Environment. https://law.ucla.edu/news/mitigating-emissions-californias-dairies-considering-role-anaerobic-digesters.

Martin, Jeremy. 2024a. “A Cap on Vegetable Oil-Based Fuels Will Stabilize and Strengthen California’s Low Carbon Fuel Standard.” Union of Concerned Scientists. January 30, 2024. https://blog.ucsusa.org/jeremy-martin/a-cap-on-vegetable-oil-based-fuels-will-stabilize-and-strengthen-californias-low-carbon-fuel-standard/.

———. 2024b. “Everything You Wanted to Know About Biodiesel and Renewable Diesel. Charts and Graphs Included.” Union of Concerned Scientists. January 10, 2024. https://blog.ucsusa.org/jeremy-martin/all-about-biodiesel-and-renewable-diesel/.

———. 2024c. “Something Stinks: California Must End Manure Biomethane Accounting Gimmicks in Its Low Carbon Fuel Standard.” Union of Concerned Scientists. February 15, 2024. https://blog.ucsusa.org/jeremy-martin/something-stinks-california-must-end-manure-biomethane-accounting-gimmicks-in-its-low-carbon-fuel-standard/.

Mastrandrea, Michael D., Mason Inman, and Danny Cullenward. 2020. “Assessing California’s Progress toward Its 2020 Greenhouse Gas Emissions Limit.” Energy Policy 138 (March): 111219. https://doi.org/10.1016/j.enpol.2019.111219.

Murphy, Colin, and Jin W. Ro. 2024. “Updated Fuel Portfolio Scenario Modeling to Inform 2024 Low Carbon Fuel Standard Rulemaking.” UC Davis Policy Institute for Energy, Environment, and the Economy. https://escholarship.org/uc/item/5wf035p8.

Pierce, M. Hanna, and Aaron L. Strong. 2023. “An Evaluation of New York State Livestock Carbon Offset Projects under California’s Cap and Trade Program.” Carbon Management 14 (1): 2211946. https://doi.org/10.1080/17583004.2023.2211946.

Plevin, Richard J., Jason Jones, Page Kyle, Aaron W. Levy, Michael J. Shell, and Daniel J. Tanner. 2022. “Choices in Land Representation Materially Affect Modeled Biofuel Carbon Intensity Estimates.” Journal of Cleaner Production 349:131447. https://doi.org/10.1016/j.jclepro.2022.131477.

Ro, Jin W., Colin W. Murphy, and Qian Wang. 2023. “Fuel Portfolio Scenario Modeling (FPSM) of 2030 and 2035 Low Carbon Fuel Standard Targets in California.” University of California Institute of Transportation Studies, November. https://doi.org/10.7922/G2S46Q8C.

Schneider, Lambert. 2011. “Perverse Incentives under the CDM: An Evaluation of HFC-23 Destruction Projects.” Climate Policy 11 (2): 851–64. https://doi.org/10.3763/cpol.2010.0096.

Searchinger, Timothy, R. Edwards, D. Mulligan, R. Heimlich, and R. Plevin. 2015. “Do Biofuel Policies Seek to Cut Emissions by Cutting Food?” Science 347 (6229): 1420–22. https://doi.org/10.1126/science.1261221.

Searchinger, Timothy, Ralph Heimlich, R. A. Houghton, Fengxia Dong, Amani Elobeid, Jacinto Fabiosa, Simla Tokgoz, Dermot Hayes, and Tun-Hsiang Yu. 2008. “Use of U.S. Croplands for Biofuels Increases Greenhouse Gases Through Emissions from Land-Use Change.” Science 319 (5867): 1238–40. https://doi.org/10.1126/science.1151861.

Smith, Aaron. 2024. “Cow Poop Is Now a Big Part of California Fuel Policy.” Energy Institute at Haas. January 1, 2024. https://energyathaas.wordpress.com/2024/01/22/cow-poop-is-now-a-big-part-of-california-fuel-policy/.

St. John, Jeff. 2024. “California’s Biofuel Bias Is Hampering Its EV Future. Can That Change?” Canary Media. March 12, 2024. https://www.canarymedia.com/articles/food-and-farms/californias-biofuel-bias-is-hampering-its-ev-future-can-that-change.

Wara, M, M Ahumada-Paras, M Mastrandrea, H Zhu, C Morton, and R Chor. 2023. “Fact Sheet: California’s Low Carbon Fuel Standard: Simulating an EJ Scenario Using CARB’s CATS Model.” Stanford Climate and Energy Policy Program. https://woodsinstitute.stanford.edu/system/files/publications/LCFS_Factsheet_Final.pdf.

- LCFS compliance obligations are assigned to bulk fuel sellers, rather than retail providers. For gasoline and diesel fuels, this means that petroleum refineries and their associated fuel marketing companies face LCFS compliance obligations, rather than individual gasoline stations. [↩]

- To earn LCFS credits, biomethane must be injected into pipelines that are connected to an interstate pipeline network; however, there is no requirement to show that the biomethane in question is delivered to California or even that gas flows in the pipeline network from the point of injection into California. For example, LCFS credits are awarded to dairy methane capture projects in upstate New York (Pierce and Strong 2023). While the interstate pipeline network technically connects New York and California, gas does not flow on the network from New York to California. [↩]

- See POET, LLC v. State Air Resources Board, 218 Cal. App. 4th 681 (Cal. Ct. App. 2013). [↩]

- It is commonly understood that votes on complex policy matters that take place alongside or immediately after prominent political events, like presidential elections, are unlikely to receive significant media attention. [↩]

- While the board has the authority to regulate in-state methane emissions from dairies and other sources—and might conceivably be convinced to use that authority—most other states are not actively contemplating regulation. If in-state dairies were required to control their methane pollution but out-of-state dairies were not, then it is plausible that in-state dairies would be ineligible to earn LCFS credits for controlling methane pollution while out-of-state dairies would be eligible. Thus, a move to encourage regulation in California could have the practical effect of subsidizing out-of-state facilities to the detriment of in-state facilities. An outcome in which in-state facilities get sticks while out-of-state facilities gets carrots is unlikely to be politically sustainable. [↩]

- The proposed program amendments also include an “Automatic Acceleration Mechanism” that would automatically reduce policy targets beyond the scheduled amount if the LCFS credit bank exceeds certain metrics (CARB 2023b Appendix A-1, § 95484). If triggered, this mechanism would further increase the carbon deficit per unit of fuel sold. I do not model this mechanism here. [↩]

- These concerns led to the passage of a bill, called SB X1-2, that created a government office to investigate potential market power abuses. For additional context, see CEC and CDTFA (2024). [↩]