An Exploration of Solar Access: How Can Tenants Benefit from Solar Financing Policies?

The U.S. solar boom leaves renters behind, with current policies favoring homeowners. This digest explores the barriers that tenants face and potential pathways towards more equitable solar access for all.

At a Glance

Key Challenge

Renters face significant barriers to accessing solar energy, including homeownership bias, limited incentives for landlords, and gaps in current policies that exclude tenants from solar benefits.

Policy Insight

To ensure renters benefit from solar, policies must expand beyond homeownership. Offering landlord incentives, enabling community solar, and net metering can create more equitable access for all.

As the United States embarks on an economy-wide energy transition, there has been an unprecedented investment in the growth of renewable energy. With ambitious goals aimed at lowering carbon emissions, increasing energy access, and keeping up in a global economy, the federal government is striving towards rapid decarbonization.

Federal policies enabling wind, solar, and storage are changing how Americans build and consume power. Solar energy is a clear frontrunner in this race towards net zero, with more funding on the table than ever before. The current administration’s rapid deployment of solar infrastructure pushes the needle forward but has inadvertently built barriers in current policy that inequitably challenge tenant participation.

This digest will evaluate the current federal regulatory landscape of residential solar for renters and the feasibility of pathways forward. By exploring the unique net-metering challenges, administrative burdens, and policy roadblocks that tenants face, this digest will outline key barriers to access. It will then assess the potential for implementing various policy measures to better facilitate tenant access and how these actions could be deployed to ensure a more equitable solar market.

While the federal government is making great strides in growing the renewable energy market, it is imperative that policies are crafted with a holistic view of potential participants. The recommendations in this digest will serve as a roadmap toward a more sustainable and equitable residential solar landscape.

The Current Solar Policy Landscape

In the face of a changing climate, energy security threats, and domestic economic challenges, the U.S. is transitioning domestic energy markets towards renewable energy production. Major federal policies have positioned solar to grow as a leading part of the U.S. energy market, largely due to its scalability and potential to deliver “affordable, clean energy for homes, businesses, and communities” (Gazmararian et al., 2024). Two cornerstone initiatives are the federal Solar Investment Tax Credit (ITC) and the Solar for All Program, each addressing different aspects of solar energy adoption and renewable infrastructure development.

The Solar Investment Tax Credit (ITC) has been pivotal to scaling the U.S. solar industry. This initiative allows homeowners to deduct a substantial 30% of the installation costs for residential solar systems from their federal taxes (U.S. DOE 2024). This tax incentive catalyzed average annual solar industry growth of 33% over the past decade and proved highly successful in fostering solar adoption and technological investment across the country (SEIA 2024).

Following this wave of solar development, the federal government launched the Solar for All (SFA) initiative as part of the broader Greenhouse Gas Reduction Fund program within the Inflation Reduction Act. The SFA provides targeted funding for the solar energy sector aimed at promoting economic development, lower carbon emissions, and environmental justice.

Launched with a budget of $7 billion, the program seeks to enable more than 900,000 homeowners in low-to-moderate income (LMI) communities to access residential solar energy (U.S. EPA 2023a). By targeting LMI communities, the program will utilize electricity bill savings to help alleviate the energy burden on economically disadvantaged households and fund local workforce development programs. The SFA program builds upon the success of the Solar ITC by funneling funding directly to previously underrepresented economies.

In practice, SFA dollars are distributed at the state level to expand the solar market’s local reach and impact. For example, the Pennsylvania Energy Development Authority and the Philadelphia Green Capital Corp jointly manage Pennsylvania’s SFA program. This program focuses on deploying $156 million in solar, storage, and necessary upgrades within low-income and disadvantaged communities (U.S. EPA 2023b).

This targeted approach ensures that solar benefits are equally distributed while integrating a more on-the-ground community outreach strategy. By working in communities and alongside workforce development programs, this investment should lead to economic progress and sustainable solar market growth in the region.

Tenants and Energy Burden

While the current United States solar policy framework supports expanded solar energy adoption, it inadvertently marginalizes tenants. The Solar ITC and SFA programs channel incentives to homeowners, landlords of multifamily and residential housing units, and property owners (U.S. DOE 2024). This design is an equity and access issue as it limits the support tenants and low-to-moderate income (LMI) communities can receive.

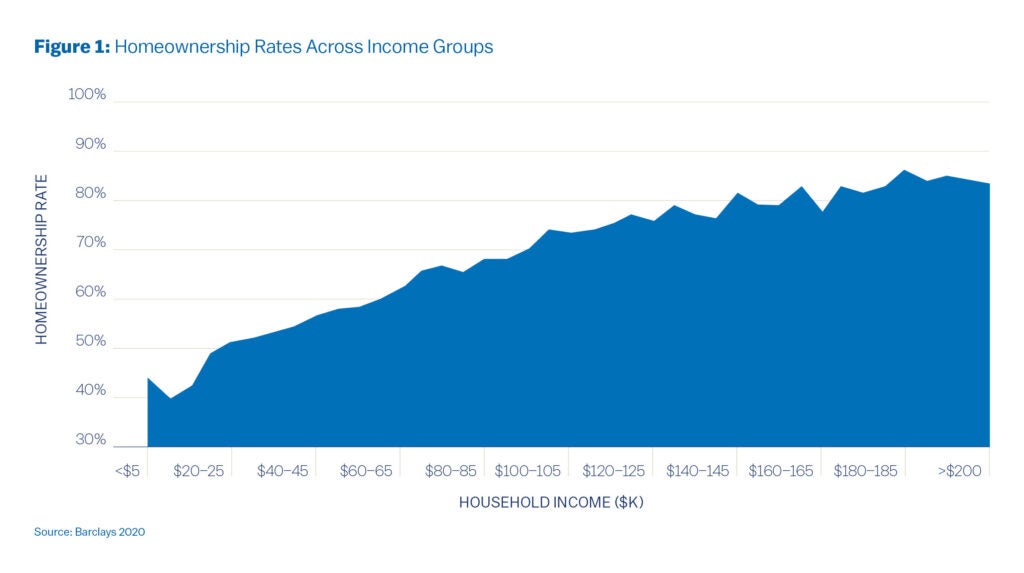

As depicted in Figure 1, the homeownership rate for households earning less than $25,000 annually is just 46%, nearly half the homeownership rate in the highest income bracket (Barclays 2020). Therefore, the dependence on homeownership creates a systematic barrier to participation.

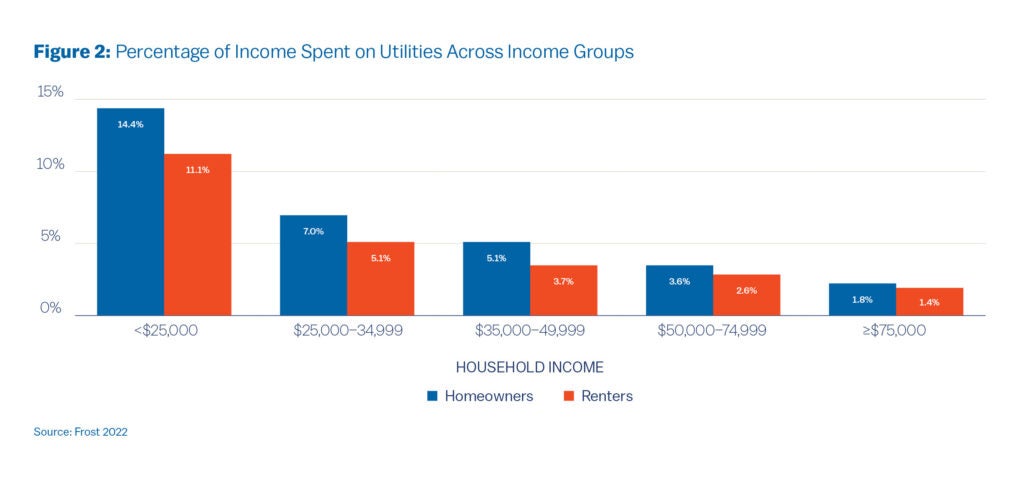

This disparity becomes highly apparent when considering the percentage of gross income a household spends on energy costs, also known as energy burden. A high energy burden is defined as 6%, while 10% is considered severe (Forrester et al., 2024). As depicted in Figure 2, the energy burden is felt most in LMI households that spend more than 8% of their gross income on energy, up to four times higher than high-income homeowners (NREL 2022). People living at or below the poverty line are more impacted by electric market fluctuations and service disruptions, as they pay a higher percentage of their income in utility bills.

Energy burden reduction through solar adoption offers a myriad of potential benefits. Rooftop solar “reduces the rate of high or severe energy burden from 67% for all LMI households before adoption to 52%,” demonstrating that solar energy can be a valuable tool in addressing energy equity (Forrester et al., 2024).

The current policy leaves this potential unmet and begs for reform. By removing barriers to entry, these policies could enable renters to benefit equally from renewable energy advancements and mitigate energy cost disparities across different socioeconomic groups, promoting environmental justice and economic development.

Barriers to Tenant Participation

Current federal policies to promote solar implementation often miss the mark for LMI communities. They fail to account for the lower rates of property ownership, limited advocacy around solar initiatives, and structural financial hurdles that low-income individuals face. While numerous financing mechanisms exist to facilitate solar installation for LMI homeowners, these do not translate equally across the socio-economic landscape. This often leaves renters and those without flexible capital at a pronounced disadvantage.

Administrative Barriers

The fundamental disparity between homeowners and renters stems from authority over building operations and management decisions. Property owners have the legal precedent to install and interact with residential solar systems. In contrast, renters are not empowered to make these types of decisions about the property they live in, limiting their opportunities to pursue residential solar.

For tenants to participate, a landlord must be involved and committed to sharing the economic benefits. Solar installation can create administrative burdens for landlords and potential disputes among tenants regarding the allocation and benefits of solar installations (Cook and Bird 2018). These complexities can deter landlords from opting into solar programs. Additionally, not all renters reside in homes suitable for solar installation because of older roofs, interconnection limitations, and building structure. These residents would require significant home upgrades prior to installation that landlords may not be interested in pursuing (Heeter et al., 2021). Without changes to lease terms that detail the use of solar, tenants remain dependent on landlords who lack adequate incentives to pursue solar.

Economic Barriers

In addition to decision-making and structural barriers, the financial challenges many LMI communities face are multifaceted. LMI households have less disposable income, making the high upfront costs associated with rooftop solar installations unfeasible. Even when initiatives aim to lower these upfront costs, they do not always yield equitable benefits due to their structure.

Many financial incentives for solar, such as direct cash incentives or loans, are predicated on credit scores or homeownership status (Cook and Bird 2018). Nearly 30% of low-income consumers are credit invisible, meaning they have no credit score or borrowing history (Heeter et al., 2021). This hinders their ability to access traditional financial products like loans or power purchase agreements. This disparity in low-income participation is exemplified by the fact that almost 90% of solar installations happen in high-income households with credit scores over 680 (Barbose et al., 2020). It is evident that these economic levers are structured to benefit more affluent households.

Policy Barriers

In the current U.S. policy landscape, there are a myriad of supportive solar policies that promote residential solar adoption; however, as established above, these policies primarily target homeowners in single-family or multi-family housing. This oversight is particularly apparent in the structure of the Solar ITC, which explicitly excludes renters unless they have ownership stakes, such as in cooperatives or condominiums (SEIA 2024).

From 2005 to 2013, tax credits totaled $3.5 billion in tax expenditures, 54% of which went to solar panels (Borenstein and Davis 2016). Renters were barred from participating in this program, missing out on substantial financial benefits. For the benefits of solar power to be felt by all of society, policy shifts must occur that open the door for expanded participation.

The Road to Tenant Solar Access

Despite the hurdles that block tenants from easily accessing the current tranche of federal solar funding, several promising financing structures and policy shifts could open the door for more equitable participation in these programs. Policies that incentivize landlord participation and allow for broad participation in community solar and net metering could create a dashboard of options for tenants. Paired with education and advocacy around participation, these shifts could reduce the energy burden on renters and cut carbon emissions.

Community Solar

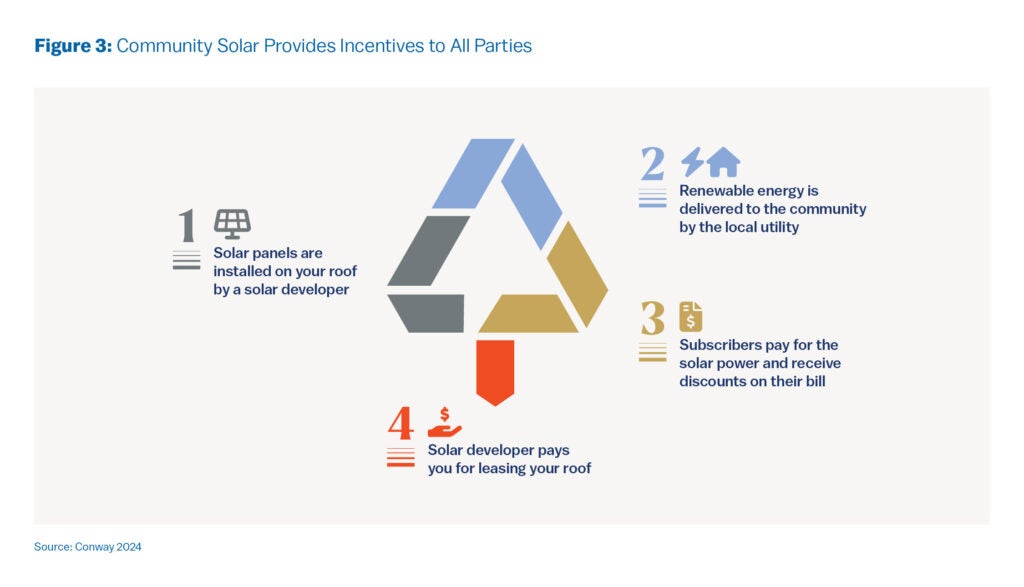

New options for tenant solar participation are emerging, with community solar as a clear frontrunner. Community solar projects allow individuals to lease a portion of a large offsite solar array, providing a pathway for renters to benefit from solar energy without requiring installations on their properties (as depicted in Figure 3).

Community solar projects create a pathway to bypass structural challenges like limited space, unsuitable roofs, the direct cost of installation, and a lack of supportive landlords (Gazmararian et al., 2024). This extends the benefits of solar energy, lower energy costs, and emissions reductions to those who would otherwise be excluded due to infrastructure limitations (Conway 2024).

However, community solar projects also have specific limitations that disproportionately affect LMI households. LMI households consume less energy on average compared to their high-income counterparts. As a result, third-party ownership models are skewed to provide them with less financial benefit (Heeter et al., 2021).

Additionally, the complexity of long-term commitments in community solar programs poses significant barriers to participation. These long-term contracts do not always guarantee savings; 73% require upfront payment and often include high exit fees upon a customer canceling the subscription (Cook and Bird 2018).

Another substantial barrier to community solar is a lack of broad enabling legislation, wherein many states do not allow for its implementation. Take, for example, Pennsylvania, where legislation mandates that to receive solar generated offsite, the electricity must be generated within two miles of one’s dwelling and list a common name on all utility bills (PECO 2024). Community solar could transform the tenant solar landscape, but enabling legislation remains in a stalemate in the Pennsylvania Senate (Conway 2024).

Despite these roadblocks, community solar continues to grow as an alternative to residential rooftop solar. As of 2020, upwards of “1,184 MWac of community solar has been deployed, and more states have been incentivizing low-income inclusion in community solar programs,” driving progress in scaling this structure (Heeter et al., 2021). As community solar scales, states are increasingly promoting incentives that support tenant inclusion, such as cutting upfront costs for LMI participants.

To continue this growth, there is a need to enable policies at the state level and consumer protection measures that allow for easy cancellation or transfer of subscriptions. Community solar offers great potential for tenant participation, but the opportunity remains on the shelf without a supportive government.

Net Metering

Net metering can also unlock doors for tenant participation in the solar market. Net metering is a billing mechanism that credits participants for their excess renewable electricity that is added back into the grid when unused (Lutz 2024). Effectively spinning the electricity meter backward, this incentive structure provides co-benefits to landlords and tenants via lower energy bills, credits back on existing bills, and decarbonization.

Similarly, virtual net metering allows multiple customers to receive solar generation credits against their electricity bills (CPCU 2019). Virtual net metering could be particularly beneficial for renters, as it does not require solar panels to be installed on their specific dwellings.

Net metering represents a very promising structure for tenant participation, but it is not without its challenges. The scalability of net metering is extremely varied, given the lack of uniform adoption across states. While 34 states have implemented net metering legislation, only a few have virtual net metering policies—vital to scaling tenant participation (DSIRE 2023).

Pennsylvania’s net metering policies exemplify these challenges. In Pennsylvania, customers are not credited the full retail price for over-generation, electricity cooperatives and municipal utilities are not guaranteed net metering, and there is a 50kW limit on residential systems (Solar United Neighbors 2024). Significantly, the Pennsylvania Public Utility Commission also only allows net metering for “eligible alternative energy resources” located on a customer’s property—effectively barring non-property owners from gaining benefits (PPUC 2022). This catchall of policy limitations compounds into an environment that deters tenants from participating.

In contrast, California is a strong example of how regulatory frameworks can enhance the accessibility of solar energy through tenant-friendly policies. The state has pioneered virtual net metering and provides a real-world example of tenants benefiting directly from residential solar installations on multifamily housing via the Multifamily Affordable Solar Housing (MASH) program (California Public Utilities Commission 2024).

MASH’s success showcases how net metering with thoughtful enabling policies can potentially deliver economic and climate benefits to tenants while also benefiting landlord energy efficiency goals. It highlights the importance of scaling supportive net metering policies across the U.S., where this accessibility mechanism could greatly benefit LMI communities.

Fair compensation and electricity rates are key factors that must be considered when scaling net metering policies. Without a fair compensation structure for excess generation, net metering programs may have limited impact on tenant solar participation. While electricity pricing is often based on the social marginal cost of production and the value to both the market and society, additional incentives may be needed to equitably engage LMI customers (Besser et al., 2023).

Net metering is fundamentally dependent on the underlying retail rate structure, which sets the relative value of the generated electricity in the market (Darghouth et al., 2011). This means that legislators must deploy net metering in tandem with other supporting rate policies and electricity rate mechanisms to be most effective.

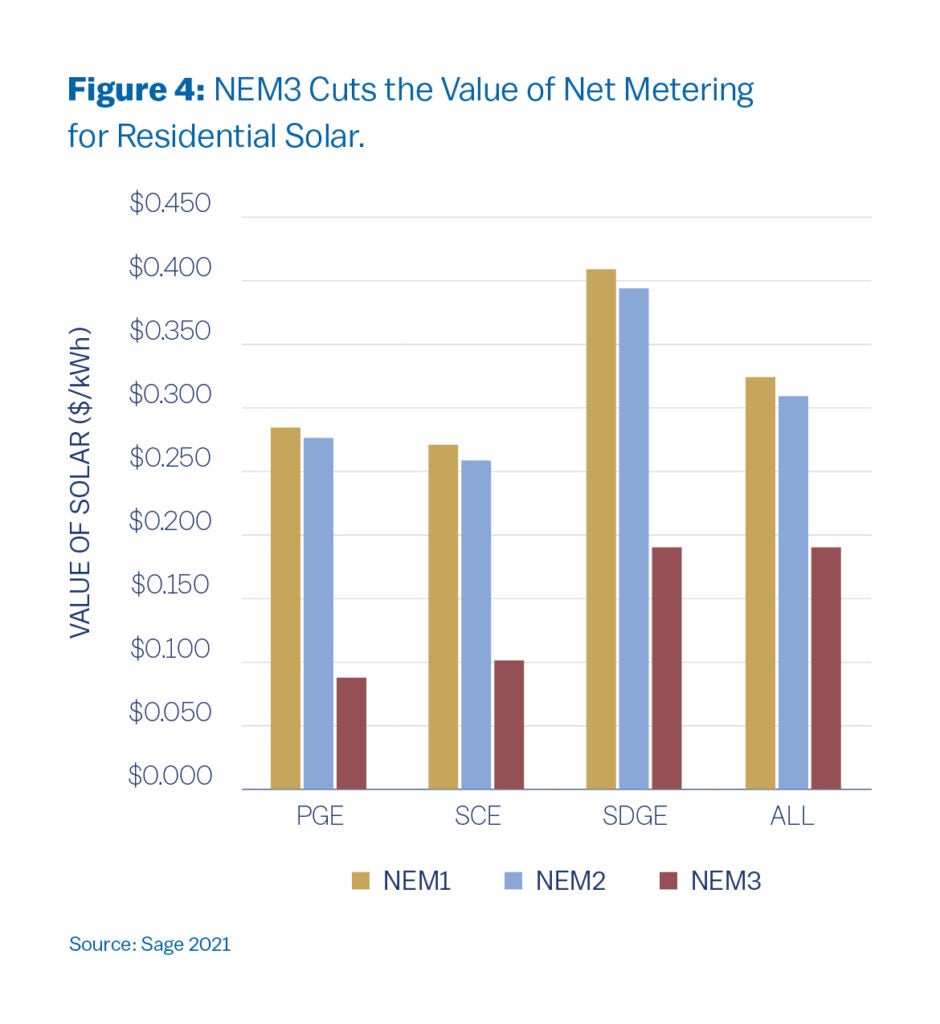

California provides an example of why LMI and tenant access to net metering require supportive policy frameworks to succeed. At the end of 2022, the California Public Utilities Commission cut net metering compensation rates for new California solar customers by about 75% (Thoubboron 2023).

The new Net Energy Metering 3.0 (NEM3) program incentivizes solar-plus-storage installations over solar-only projects. NEM3 reduces the value of energy exported rather than stored and consumed on-site (Sage Energy Consulting 2021). This aims to incentivize solar storage technology adoption, which is important for broader climate goals but comes at the expense of tenant participation.

As shown in Figure 4, across all four major energy distributors in California, there is a pronounced drop in the value of residential solar with the new legislation, negating any impact on energy burden reduction and disincentivizing tenant participation. This exemplifies that fair compensation structures are a precious tool for tenant solar participation.

Net metering is not fruitful for tenants and LMI communities without the necessary supportive legislation to enable tangible benefits, like competitive energy pricing. However, with enabling legislation, fair compensation structures, and the ability to pair net metering with community solar projects, these strategies could unlock multifamily renewable energy deployment and open the market to tenant participation.

Landlord / Tenant Corporation

Landlords play a crucial role in the deployment of residential solar. Landlords must spearhead the project approval process and can be easily deterred from participation by the administrative complexities of solar installations. Since landlords control the physical properties that tenants inhabit, their cooperation is essential for implementing solar energy solutions. The administrative burdens presented by the installation, tax credit management, tenant education, and, most importantly, the distribution of benefits could all stifle landlord participation (Gazmararian et al., 2024).

To combat these burdens, an array of emerging financial and policy mechanisms is designed to encourage landlord participation. These include capital refinancing, third-party leasing, energy service agreements, and low-income energy assistance programs (Cook and Bird 2018).

Energy service agreements permit a third party to finance, construct, and operate the solar array and then enlist participants. The benefits, such as energy generation, efficiency improvements, and cost reductions, are then distributed based on contractual terms between the provider and tenants. These agreements effectively mitigate the risk that a landlord incurs.

They are particularly beneficial when landlords aim to improve energy efficiency across their properties without bearing the initial capital (Nadel 2018). Another related strategy is a Power Purchase Agreement (PPA), where landlords pay a fixed amount to rent rather than own an onsite solar array. The third-party owner of the systems is responsible for maintenance while landlords improve efficiency and renters benefit from the energy produced, often at lower rates than the local utility (Posigen 2024).

It is important to note that some multi-family housing providers are run by public housing authorities or have limited tax liability. This affects their ability to benefit from tax credits associated with solar installations directly. In some cases, landlords can leverage these taxes and pass benefits directly to building owners and tenants.

For example, the Housing Authority of Denver partnered with third parties and successfully signed an agreement to install 2.5 MW of solar across 385 buildings (Cook and Bird 2018). These agreements help to incentivize landlord participation, serving to increase city wide solar capacity and provide benefits to renters.

In addition to direct solar installation models, there are innovative approaches like using solar renewable energy credits (SRECs) specifically targeted at LMI communities. SRECs are market-based financial instruments that represent the environmental and societal value of renewable energy generation (Cook and Bird 2018). Via community solar and policies that tie the net income from SRECs to community projects, SRECs can direct benefits to renters and local workforce development programs.

This drives funding to programs that invest in the communities they operate in, grow the local renewable energy workforce, and provide tenants with favorable energy rates. While promising, it is important to note that participation in SREC programs is again dependent on the landlord’s final say.

While the involvement of landlords in residential solar installations presents challenges, it also opens possibilities for facilitating solar in multi-family and rental housing sectors. By leveraging a mix of financial and administrative incentives, policymakers can enhance the uptake of residential solar by increasing landlord-tenant agreements for solar installation. In broadening policy to be more inclusive of tenant participation, renewable energy’s benefits will be extended to new and impactful sectors.

Recommendations

It is a pivotal time for deploying renewable energy infrastructure in the U.S., and solar plays a key role in reaching net zero goals. Current federal policies are ambitiously funding residential solar but lack essential functions to enable tenant participation. To address the disparities in solar energy access, comprehensive policy changes are needed to foster equitable participation.

The current solar residential landscape is predicated on homeownership, which presents numerous barriers deterring tenant participation. While we have seen solar adoption shift towards lower-income households over time, the lack of tenant representation underscores broader equity issues (Barbose et al., 2019). To address these barriers, policies must be adapted to be more inclusive of diverse housing structures.

Policymakers should consider enhancing landlord incentives by strengthening tax benefits, offering grants, and tailoring rebates to offset the costs of solar installations. Reforming technical and regulatory challenges for net metering in multi-family buildings will unlock shared solar benefits between landlords and tenants. These changes would make solar installations more attractive to landlords and create the foundation for an inclusive solar landscape for tenants.

Policymakers and advocates should also push for policies to enable community solar projects. By actioning community solar that requires little upfront investment and offers easy opt-out options, these projects become a viable option for renters. These policy shifts have the potential to broaden access to residential solar substantially. By opening the residential market to tenants, solar energy can alleviate disproportionate energy burden, grow local renewable energy workforces, and lower carbon emissions.

Policymakers hold the keys to unlock more equitable distribution of solar benefits, enhance energy security for vulnerable households, and contribute to a more just energy market. To be most effective, policymakers must work in tandem with financial institutions, landlords, and community members to shape supportive regulatory structures.

This calls for the active participation of advocates and widespread community efforts to reform current policy. Without solar policies that enable participation for all of society, including people who do not own homes, a large swath of our community cannot benefit from this renewable energy. By expanding solar access to tenants, the benefits of solar power will be felt more broadly and push the U.S. towards its net zero goals.

Gwendolyn K. Cochran

2024 Philadelphia Energy Authority FellowGwendolyn K. Cochran is the 2024 Kleinman PEA Fellow at the Philadelphia Green Capital Corps and a Master of Environmental Studies candidate at the University of Pennsylvania.

Barbose, Galen L., Sydney Forrester, Naïm R. Darghouth, and Ben Hoen. 2020. “Income Trends among US Residential Rooftop Solar Adopters.” Lawrence Berkeley National Laboratory. Accessed August 2024. https://emp.lbl.gov/publications/income-trends-among-us-residential.

Barclays. 2020. “A Growing Divide: How Income Inequality Affects U.S. Homeownership Rates.” Barclays Investment Bank. Accessed August 2024. https://www.ib.barclays/our-insights/a-growing-divide-how-income-inequality-affects-us-homeownership-rates.html.

Besser, Janet Gail, Brent Heard, K. John Holmes, Daniel Talmage, Rebecca DeBoer, Jasmine Bryant, Kaia Russell, and Eli Nass. 2023. Net Metering: Briefing Slides. Consensus Study, sponsored by the U.S. Department of Energy. Washington, DC: The National Academies Press. https://nap.nationalacademies.org/resource/26704/Net-Metering-Briefing-Slides.pdf.

Borenstein, Severin, and Lucas W. Davis. 2016. “The Distributional Effects of U.S. Clean Energy Tax Credits.” Tax Policy and the Economy 30 (1): 191–234. Accessed August 2024. https://doi.org/10.1086/685597.

California Public Utilities Commission. 2024. “CSI – Multifamily Affordable Solar Housing Program.” Accessed October 4, 2024. https://www.cpuc.ca.gov/industries-and-topics/electrical-energy/demand-side-management/california-solar-initiative/csi-multifamily-affordable-solar-housing-program.

California Public Utilities Commission. 2019. “HUD Solar Virtual Net Energy Metering (VNEM) Credits.” SOMAH. https://calsomah.org/sites/default/files/docs/SOMAH_HUD_Solar_VNEM_Credits_memo_2019-07-08.pdf.

Cook, Jeffery J., and Lori Bird. 2018. “Unlocking Solar for Low- and Moderate-Income Residents.” National Renewable Energy Laboratory. https://www.nrel.gov/docs/fy18osti/70477.pdf.

Conway, Michael. 2024. “Embracing the Sun: A Real Estate Owner’s Perspective on Community Solar.” SolarKal. Accessed August 2024. https://www.solarkal.com/blog/embracing-the-sun-a-real-estate-owners-perspective-on-community-solar.

Darghouth, Naïm R., Galen Barbose, and Ryan Wiser. 2011. “The Impact of Rate Design and Net Metering on the Bill Savings from Distributed PV for Residential Customers in California.” Energy Policy 39 (9): 5243–53. Accessed August 2024. https://doi.org/10.1016/j.enpol.2011.05.040.

Database of State Incentives for Renewables & Efficiency (DSIRE). 2023. Net Metering: State Policy Overview. N.C. Clean Energy Technology Center. Accessed September 2024. https://www.dsireusa.org/wp-content/uploads/2023/11/DSIRE_Net_Metering_Nov2023.pdf.

Forrester, S. P., C. C. Montañés, E. O’Shaughnessy, et al. 2024. “Modeling the Potential Effects of Rooftop Solar on Household Energy Burden in the United States.” Nature Communications 15: 4676. https://doi.org/10.1038/s41467-024-48967-x.

Frost, Riordan. 2022. “Energy Insecurity Threatens to Destabilize Households This Winter.” Joint Center for Housing Studies Harvard University. Accessed August 2024. https://www.jchs.harvard.edu/blog/energy-insecurity-threatens-destabilize-households-winter.

Gazmararian, Alexander F., and Dustin Tingley. 2024. “Reimagining Net Metering: A Polycentric Model for Equitable Solar Adoption in the United States.” Energy Research & Social Science 108 (February 2024): 103374. Accessed August 2024. https://doi.org/10.1016/j.erss.2023.103374.

Hammerle, Mara, V. Lee White, and Bjorn Sturmberg. 2023. “Solar for Renters: Investigating Investor Perspectives of Barriers and Policies.” Energy Policy 174: 113417. https://doi.org/10.1016/j.enpol.2023.113417.

Heeter, Jenny, Jeffrey J. Cook, Monisha Shah, Emily Fekete, Ashok Sekar, and Jenny Heeter. 2021. “Affordable and Accessible Solar for All: Barriers, Solutions, and on-Site Adoption Potential.” National Renewable Energy Laboratory. https://www.nrel.gov/docs/fy21osti/80532.pdf.

Lutz, Amanda. 2024. “Understanding Net Metering.” Architectural Digest. https://www.architecturaldigest.com/reviews/solar/net-metering#:~:text=The%20controversy%20with%20net%20meteringin%20.

Nadel, Steven. 2019. “Energy Service Agreements: Potential Big Kid in Town?” The American Council for an Energy-Efficient Economy. https://www.aceee.org/blog/2019/02/energy-service-agreements-potential.

National Renewable Energy Laboratory. 2022. “Low- and Moderate-Income Solar Flexible Financing Credit Agreement Rubric.” U.S. Department of Energy. Accessed August 2024. https://www.nrel.gov/docs/fy22osti/81816.pdf.

PECO. 2024. “Virtual Metering Aggregation.” Accessed October 2, 2024. https://peco.my.site.com/s/article/Virtual-Metering-Aggregation.

Pennsylvania Public Utility Commission. 2022. “Net Metering—Use of Third-Party Operators Withdrawal Order.” Public Meeting February 24, 2022. https://www.puc.pa.gov/pcdocs/1735185.docx.

Sage Energy Consulting. 2021. “The Latest on NEM 3.0 and How It Could Impact the Value of California Solar Projects.” Solar Builder Magazine. Accessed August 2024. https://solarbuildermag.com/featured/the-latest-on-nem-3-0-and-how-it-could-impact-the-value-of-california-solar-projects/.

Solar Energy Industries Association. 2024. “Solar Investment Tax Credit (ITC).” Accessed August 2024. https://www.seia.org/initiatives/solar-investment-tax-credit-itc.

PosiGen. 2024. “Solar Lease vs Power Purchase Agreement (PPA): What’s the Difference?” Accessed August 2024. https://www.posigen.com/blog/solar-lease-vs-power-purchase-agreement.

Solar United Neighbors. 2024. “Net Metering in Pennsylvania.” Accessed April 28, 2024. https://solarunitedneighbors.org/resources/net-metering-in-pennsylvania/.

Thoubboron, Kerry. 2023. “NEM 3.0 in California: What You Need to Know.” EnergySage. Accessed September 4, 2024. https://www.energysage.com/blog/net-metering-3-0/.

U.S. Department of Energy. 2024. “Homeowner’s Guide to the Federal Tax Credit for Solar Photovoltaics.” Accessed August 2024. https://www.energy.gov/eere/solar/homeowners-guide-federal-tax-credit-solar-photovoltaics.

U.S. Environmental Protection Agency. 2023a. “Biden-Harris Administration Launches $7 Billion Solar for All Grant Competition to Fund Residential Solar Programs that Lower Energy Costs for Families and Advance Environmental Justice Through Investing in America Agenda.” Accessed August 2024. https://www.epa.gov/newsreleases/biden-harris-administration-launches-7-billion-solar-all-grant-competition-fund.

U.S. Environmental Protection Agency. 2023b. “Biden-Harris Administration Announces Pennsylvania Energy Development Authority to Receive over $156 Million to Deliver Residential Solar Lowering Energy Costs and Advancing Environmental Justice Across PA.” Accessed August 2024. https://www.epa.gov/newsreleases/biden-harris-administration-announces-pennsylvania-energy-development-authority.