Addressing Energy Insecurity in Philadelphia’s Affordable Multi-Family Housing with C-PACE Financing

Aging energy systems of Philadelphia's affordable multi-family homes contribute to pervasive energy insecurity. This digest explores using and tailoring the existing financing mechanism, C-PACE, for upgrades that lower utility expenditures of residents in affordable multi-family buildings.

At A Glance

Key Challenge

Aging energy infrastructure in conjunction with above national average electricity rates contribute to high energy insecurity among Philadelphia residents.

Policy Insight

Restructuring existing financing mechanisms, such as C-PACE loans, in addition to new policies will bring needed improvements to energy systems of Philadelphia buildings and lower energy insecurity among Philadelphia residents.

Introduction

On July 7, 2022, Governor Tom Wolf signed into Pennsylvania law Senate Bill 635, expanding the scope of the Commercial Property Assessed Clean Energy program (C-PACE) to encompass multi-family homes and cover indoor air-quality improvements (Yudichak 2022). The expansion has significant implications for the City of Philadelphia: C-PACE financing mechanisms can now be used to improve the energy systems of Philadelphia’s aging multi-family buildings and reduce Philadelphia’s carbon footprint. Prior to the passage of SB 635, C-PACE was reserved for non-residential commercial properties.

C-PACE is a low-cost loan program that finances energy efficiency and air-quality improvements in commercial buildings through creating a partnership between commercial property owners, municipal governments, and third-party capital providers. Because C-PACE requires active participation from state and municipal governments, the program requires legislative action at both levels.

Thirty-eight states, including Pennsylvania, have passed C-PACE enabling legislature (PACENation 2022). To date, C-PACE financing has been used to deploy over $3.4 billion in energy efficiency upgrades across the United States (PACENation 2022; PACENation 2019).

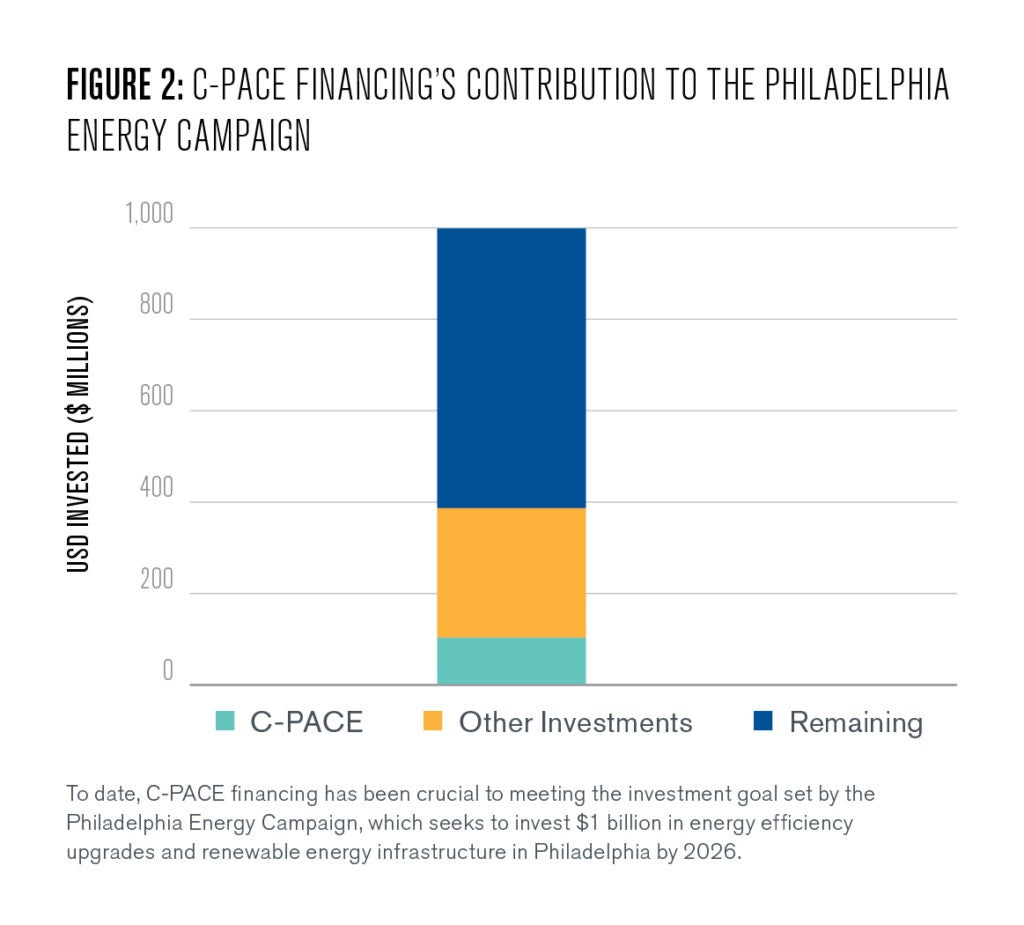

In Philadelphia, C-PACE has mobilized a cumulative total of $100 million towards energy efficiency and air quality upgrades for Philadelphia buildings (Philadelphia Energy Authority 2022). The five projects that closed in 2021 led to a cumulative forecasted carbon avoidance of 86,500 tCO2e over the next 25 years (Philadelphia C-PACE 2022). Most C-PACE deals in Philadelphia have been sponsored by large developing firms with an average C-PACE loan amount of $1.5 million.

According to Matt Stern, a senior director at the Philadelphia Energy Authority, interest in C-PACE financing has already skyrocketed among market-rate building owners and developers since the passage of multi-family expansion.

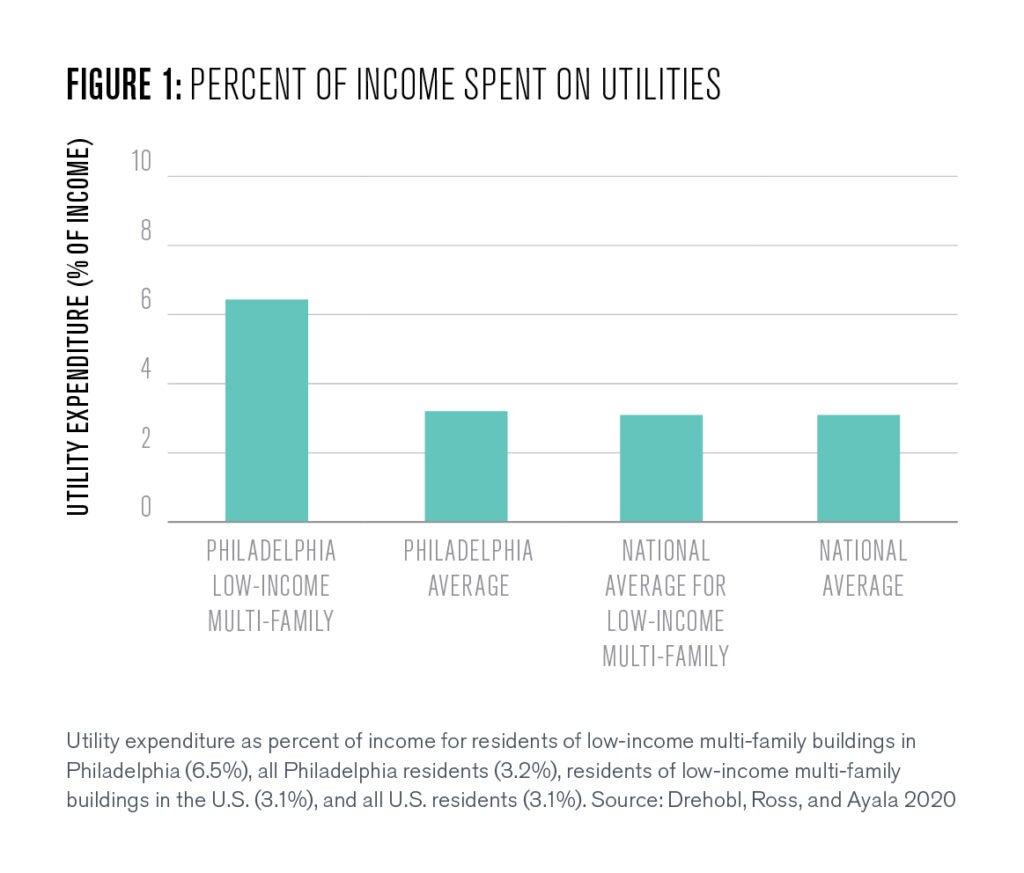

While C-PACE financing can reduce the carbon footprint of luxury multi-family buildings, C-PACE can also be leveraged to bring needed energy efficiency upgrades to affordable housing units in Philadelphia. The 2020 census revealed that 26% of Philadelphia residents live at or below the poverty line, compared to the national average of 13% (U.S. Census Bureau 2022). Compounding this, 1 in 7 Philadelphia residents spend over 10% of their income on utilities (Drehobl, Ross, and Ayala 2020).

C-PACE financing has been used to deploy over $3.4 billion in energy efficiency upgrades across the United States.

The high cost of electricity, aging appliances, and poor weatherization of the average city home contribute to pervasive energy insecurity in Philadelphia (U.S. Bureau of Labor Statistics 2022). The low-cost financing of C-PACE loans for energy efficiency upgrades offers a sustainable method to reduce utility payments among low- and moderate-income families and mitigate energy burden in Philadelphia.

Despite the potential of C-PACE, significant barriers prevent affordable housing building owners from seeking C-PACE financing to improve energy systems. First, building owners are not incentivized to improve the efficiency of their buildings, as any potential cost savings are experienced by tenants. Second, C-PACE has a complex application process, challenging capital securement, and stringent lien requirements. Herein, policy options are suggested which may mitigate each barrier.

Overcoming Split Incentives

Property owners have little incentive to finance energy efficiency upgrades that are beyond code to their buildings because the cost savings from such renovations are experienced by the building’s tenants. This is often referred to as the split incentive. The effect of the split incentive is that energy systems of affordable multi-family buildings are inefficient, dated, and barely meet minimum code requirements, leaving tenants burdened with higher-than-average utility costs.

State and local policy measures can overcome split incentives through policies that ensure regular and predictable increases to the energy code requirements for existing multi-family affordable housing buildings. Such policies have been enacted by California, where new energy efficiency targets are set every three years (Balaraman 2021). Property owners in California expect such increases to occur and proactively renovate buildings to meet future requirements.

Another tool vital to tackling split incentives is education initiatives for landlords of affordable multi-family properties. Jeaneen Zappa, executive director of the Energy Efficiency Alliance, points out that landlords are either unaware or skeptical of financing mechanisms for energy efficiency upgrades to multi-family properties. Additionally, education efforts should emphasize to landlords the human benefits such renovations will have on the individuals living in affordable multi-family units.

Many studies have linked health benefits to electrifying homes, including the decreased prevalence of asthma and acute myocarditis (Gruenwald et al. 2023; Olaniyan et al. 2022). Others suggest air conditioning in households and schools increases social mobility and productivity (Haverinen-Shaughnessy and Shaughnessy 2015; Jessel, Sawyer, and Hernández 2019).

Both municipal legislature and landlord buy-in are necessary to implement annual increases to energy code requirements. Through passing new efficiency requirements for existing buildings paired with landlord education initiatives, the Philadelphia government can increase C-PACE utilization in the multi-family sector and decrease utility expenditures of low- and moderate-income families.

Streamlining a Long and Complex Application Process

To receive C-PACE funding, property owners must navigate a time-intensive and complex application process with both the C-PACE program administrator and a third-party capital provider. The application process involves submitting a pre-application to the C-PACE program administrator, recruiting a third-party capital provider, and performing an intensive Energy Conservation Measure (ECM) survey.

Prior to obtaining C-PACE financing, property owners first submit a pre-application to the C-PACE program administrator, who is contracted by the municipal government. In Philadelphia, C-PACE is administered by Philadelphia C-PACE. Once the pre-application is approved, the property owner seeks sponsorship from third-party capital providers, such as Nuveen Green Capital or Petros PACE Finance.

At this point, proposals must undergo an extensive review process by the program administrator. In Philadelphia, an ECM survey is used to forecast utility bill savings from the proposed project. The ECM survey ensures that after renovations are complete, the annual utility bills are less than current utility expenditures.

The utility bill savings projected by the ECM surveys in conjunction with subsequent lien requirements secure the low interest rates characteristic of C-PACE loans. However, the surveys themselves are expensive and time consuming. Additionally, building owners are responsible for identifying and hiring qualified energy auditors.

After the ECM survey is complete, the third-party capital provider provides C-PACE funding to the property owner. C-PACE loans are secured via a priority lien on the property and paid off via annual savings on utilities over a fixed duration, usually 10 to 20 years. The subsequent billing and lien processes are managed by the program administrators, not the capital provider. The time between pre-application submission and financing can be up to a year.

This challenging application process is a particularly acute barrier for property owners of affordable multi-family properties, who neither have the time nor resources to apply for C-PACE funding. As such, many states and municipalities, including Philadelphia, are unable to recruit C-PACE financing applications from affordable multi-family housing building owners.

John D’Agostino, managing director at Inclusive Prosperity Capital, specializes in financing energy efficiency improvements for affordable multi-family housing units in Connecticut. According to D’Agostino, new heating and cooling systems are the most common loan application item he encounters from the affordable housing market.

D’Agostino finds that these owners often need to replace end-of-life systems immediately and lack both the extra capital to finance energy audits and the time to wait for proposal approval from the C-PACE administrator. As a result, affordable building owners end up using more expensive but readily available methods to finance end-of-life replacements.

Nevertheless, C-PACE financing can be restructured to address these shortcomings. For example, C-PACE in Michigan has a streamlined application process for certain upgrades, including the installation of efficient boilers and solar panels (Lean & Green Michigan 2023). Eligible upgrades for this application have well-known return on investments (ROIs) and require straightforward contracting work.

Moreover, with this system in place, only a simple energy audit is needed. Approval for funding can occur in as little as two weeks. Like Michigan, Philadelphia can do the same: identify the most common financing needs of affordable housing building owners and develop a streamlined application process.

Additionally, Philadelphia can provide bridge funding to cover the immediate needs of property owners in the interim period, from when a proposal is submitted to when it is approved for C-PACE. For instance, in Minnesota, the C-PACE administrator, MinnPACE, uses a $17-million Revolving Door Fund (RDF) to provide capital to property owners as soon as a proposal is submitted (City Energy 2018). This allows owners to start their project immediately.

Once approved for C-PACE, MinnPACE sells the loan to a third-party capital provider. This structure has allowed the RDF to revolve over three times in the past ten years. According to Peter Klein, the vice president of St. Paul Port Authority, MinnPACE’s success in closing over 300 deals to multi-family building owners resulted from its RDF’s ability to provide immediate capital.

By developing a straightforward application process and decreasing the time until funding is received, Philadelphia would make C-PACE financing accessible to affordable multi-family building owners. As in MinnPACE, Philadelphia should limit the expedited process to loans under $1 million and for specific upgrades to reduce the risk of investment default. Larger proposed C-PACE projects would use the existing pathway to be vetted and secured.

Aiding Capital Securement

Expensive underwriting processes pose additional barriers for property owners of affordable multi-family units seeking C-PACE funding as third-party capital providers often do not make C-PACE deals under $1 million. Specifically, underwriting for C-PACE deals occurs separately to the application process and the associated costs are incurred to the capital provider.

This dynamic makes C-PACE deals below $1 million unattractive to capital providers because smaller loans are as expensive to administer as larger loans but have smaller returns (Kramer 2021). For example, in Philadelphia, Nuveen Capital has closed the highest number of C-PACE deals compared to all other C-PACE third-party capital providers. Nuveen Capital’s average C-PACE deal is $15 million and they have not funded C-PACE projects smaller than $1 million (Philladelphia C-PACE 2022). Nationally, the average C-PACE deal is $1.25 million (PACENation 2022).

In contrast, the renovations and improvements that affordable multi-family housing owners seek on average range between $100,000 and $500,000. Thus, Philadelphia C-PACE loans are disproportionately going to large developing firms instead of individual building owners.

To make C-PACE financing obtainable to Philadelphia affordable multi-family building owners, C-PACE financing must offer smaller loans. One solution is to recruit credit unions and community banks to serve as third-party capital providers. Credit unions and community banks operate on smaller budgets potentially making them amenable to providing capital to C-PACE proposals in the $100,000 to $500,000 range.

Credit unions and community banks will benefit from their involvement as capital providers for C-PACE financing. The community financial institutions will be able to provide loans to C-PACE projects that are less risky (due to the extensive application process) and have known 25-year returns (due to loan the managing services from C-PACE program administrators).

Further, the smaller budgets and operating costs of credit unions and community banks make them amenable to underwriting projects under $1 million. Credit unions and community banks in Philadelphia already have relationships with affordable multi-family building owners and could direct them to C-PACE financing.

Despite these advantages, none of the closed C-PACE deals in Philadelphia have been underwritten by Pennsylvania-based community bank or credit union (Philadelphia C-PACE 2022). Collin Bishop, the CEO of Allectrify and previous president of PACENation, attributed the shortage of approved small third-party providers to lack of awareness about the program or lack the resources to gain approval from C-PACE program administrators. Bishop suggests intentional outreach and education to credit unions and community banks will aid their recruitment.

Another attractive option to fund energy efficiency projects under $1 million would be for Philadelphia C-PACE to package small projects into larger deals and sell the aggregated deals to capital providers. This would enable the capital provider to underwrite a collection of small projects, saving time while preserving high margins.

However, Know Your Customer (KYC) laws, which require lenders to certify the identity of each borrower, may be a barrier to this strategy (Lowe 2022). As required by KYC legislation, lenders may still have to invest substantial resources to verify each small project in an aggregated deal.

The potential advantages and cost-savings of aggerated deals warrant further research. In summary, smaller C-PACE loans, accessible to property owners of affordable multi-family units, can be financially feasible either through recruiting credit unions and community banks as capital providers or bundling small C-PACE deals into larger ones that would be attractive to larger banks.

Loosening Lien Requirements

C-PACE financing requires a priority lien on the property. A lien is the collateral to a loan, which in the case of C-PACE is the property (also seen with mortgages). Additionally, C-PACE loans have priority liens, meaning that in the event a property with multiple lines of debt fails, the C-PACE loan will be paid back first. To gain priority, all other lenders in a property’s capital stack must provide consent.

This is a particularly challenging requirement for affordable multi-family units, which often have outstanding mortgages (Gose 2019). Additionally, the C-PACE program guidelines in Philadelphia require that the collective loan-to-value ratio, including primary and secondary mortgages, of the property must be under 0.95, further complicating C-PACE’s ability to finance many properties (Philadelphia C-PACE 2022).

Ultimately, Philadelphia C-PACE needs to take an active role in helping property owners seek consent from their mortgage providers for the priority lien. By partnering with affordable housing Community Development Corporations (CDCs), Philadelphia C-PACE can identify mid-cycle properties and educate stakeholders on their options to finance energy efficiency upgrades though C-PACE.

In response to challenges posed by C-PACE lien requirements, Connecticut Green Bank launched Loans Improving Multi-Family Efficiency (LIME). Unlike C-PACE, LIME can be secured through a variety of methods ranging from property liens to assignment of renewable credits to personal guarantees (Connecticut Green Bank 2022). This flexibility has made LIME financing accessible to affordable housing building owners. LIME loans have been made to over 100 affordable multi-family buildings in Connecticut (Connecticut Green Bank 2021).

Following Connecticut’s lead, Philadelphia launched its own green bank, Philadelphia Green Capital Corp. (PGCC). PGGC’s mission is centered on alleviating energy insecurity and driving a just energy transition. PGCC offers Catalyst, a loan for energy efficiency upgrades which can be secured through personal guarantees or leverage on assets.

Unlike C-PACE, Catalyst loans do not need a priority position in a capital stack, allowing them to be easily deployed to finance energy upgrades on properties with existing debt (Philadelphia Green Capital Corp. 2022). Through working with affordable multi-family building owners, PGCC can provide capital for efficiency upgrades in a timely manner.

Engaging Local Green Banks

From its inception, PGCC has had a close relationship to Philadelphia C-PACE. Both organizations spun out from the Philadelphia Energy Authority, which is a municipal authority aimed at creating a robust, clean, and equitable energy market in Philadelphia.

To leverage this relationship and amplify C-PACE in Philadelphia, PGCC developed products complementary to C-PACE. For example, PGCC’s Navigator Loan covers pre-development costs, including ECM surveys and energy audits required by C-PACE financing. C-PACE and Catalyst can be layered to cover 100% of costs associated with energy upgrades.

The relationship between PGCC and Philadelphia C-PACE should continue to be leveraged to upgrade affordable multi-family housing units, reduce utility bills, and decrease Philadelphia’s carbon footprint. In other states, green banks are approved C-PACE capital providers. Similarly, PGCC could become a C-PACE approved capital provider and directly provide financing to affordable multi-family C-PACE projects.

While PGCC would be held to the strict lien and application requirements in the Philadelphia C-PACE program guidelines, it would enable the green bank to offer cheaper forms of capital. Further, PGCC could specifically fund projects that for-profit capital providers tend to shy away from, such those requiring under $1 million in capital.

Outlook on C-PACE and Beyond

C-PACE is one crucial tool for the success of Philadelphia Energy Campaign, which seeks to create 10,000 clean energy jobs and invest $1 billion in clean energy projects by 2026 (City Council Philadelphia 2016). C-PACE financing has already mobilized over $100 million towards energy efficiency upgrades leading to over 86,500 tCO2e of avoided emissions in Philadelphia.

The expansion of C-PACE financing to all multi-family properties—including affordable multi-family properties—will lead to new energy efficiency investments and countless additional tons of avoided carbon emissions. Through intentional restructuring, strong partnerships, and wider marketing, C-PACE financing can expand its reach and drive energy efficiency upgrades in Philadelphia’s affordable housing sector. Municipal policies and education initiatives are critical tools to increase utilization of C-PACE in Philadelphia and make low-cost financing accessible to affordable multi-family property owners.

In parallel, the Philadelphia government needs to take an active role to improve the energy efficiency of affordable multi-family homes. On an individual level, access to efficient, modern, and green energy systems will increase the quality of life for the individuals and families living in Philadelphia’s affordable multi-family units. New studies show that the beyond-end-of-life gas heating and cooking infrastructure—commonly found in Philadelphia affordable multi-family units—is responsible for the rising prevalence of asthma and acute myocarditis in children (Grunwald et al. 2023).

However, many Philadelphians who experience such energy insecurity live in single family homes ineligible for C-PACE funding. To serve this population, the city should increase access to the Low-Income Home Energy Assistance Program (LIHEAP) and other grants that immediately mitigate monthly energy expenditures of families with high energy burdens. LIHEAP’s impact could further be amplified and longer lasting if utilized on energy efficiency upgrades in addition to one-time grants covering utility expenditures.

For example, in 2021, Philadelphia Energy Authority launched its first pilot of the Built-to-Last initiative on 100 single family homes. Built-to-Last layers federal, state, municipal, and private grants to update the energy infrastructure and lower the utility costs of Philadelphia single family homes (Philadelphia Energy Authority, 2022). Through expansion of Built-to-Last, and a combination of city grants and C-PACE loans, Philadelphia can alleviate energy insecurity.

The expensive gas and electricity rates in Philadelphia hit those with poorly insulated homes the hardest—homes often occupied by individuals and families with low or moderate incomes. By improving the energy efficiency of its aging multi-family and single-family homes, the city can begin to remedy its high prevalence of energy insecurity. New policies and programs in addition to expanding existing tools – such as C-PACE – are necessary to create a decarbonized and equitable Philadelphia.

Walter Johnsen

Student Advisory Council MemberWalter Johnsen is a Ph.D. candidate in the department of chemistry and he was the 2022 Kleinman Philadelphia Energy Authority Fellow. He is also a member of the Kleinman Center’s Student Advisory Council.

Acknowledgments

Special thanks to the Kleinman Center for Energy Policy, the Stuart Weitzman School of Design, and the Kleinman family for funding the 2022 Kleinman PEA / PGCC fellowship. Thank you to Rishika Ghosh, Matt Stern, Zoe Getzin and the PEA / PGCC team for encouraging reseach on C-PACE. Finally, thanks to Sabina Maurer and Oscar Serpell for editing many versions of the manuscript.

An Act amending Title 12 (Commerce and Trade) of the Pennsylvania Consolidated Statutes, in property assessed clean energy program, further providing for purpose, for definitions, for establishment of a program, for notice to lien holder required for participation, for scope of work, for lien and for collection of assessments., Act No. 43 C.F.R. (2022).

Balaraman, K. 2021. “California Greenlights First-of-Its-Kind Energy Code to Encourage Electrified Buildings.” Utillity Dive. Retrieved from https://www.utilitydive.com/news/california-greenlights-first-of-its-kind-energy-code-to-encourage-electrifi/604863/

Clean Energy States Alliance 2021. Directory of State Low- and Moderate-Income Clean Energy Programs. Retrieved from https://www.cesa.org/projects/state-energy-strategies-project/directory-of-state-lmi-clean-energy-programs/

Connecticut Green Bank. 2022. LIME. Retrieved from https://www.ctgreenbank.com/building-solutions/multifamily-financing/lime/

City Council Philadelphia. 2016. “Philadelphia Energy Campaign.” [Press Release]. Retrieved from https://phlcouncil.com/pec/

City Energy Project. 2018. “Minnesota PACE: Partnerships and Financing Creativity.” [Press release]. Retrieved from https://www.cityenergyproject.org/wp-content/uploads/2018/12/City_Energy_Project_Resource_Library_Case_Study_Minnesota_PACE.pdf

Drehobl, A., L. Ross, and R. Ayala. 2020. “How High are Household Energy Burdens?” American Council for an Energy-Efficient Economy. Retrieved from https://www.aceee.org/research-report/u2006

Gose, J. 2019. “To Meet Demand for Green Buildings, Developers Get a Leg Up.” The New York Times. Retrieved from https://www.nytimes.com/2019/08/27/business/green-buildings-pace-loans.html

Gruenwald, T., B.A. Seals, L.D. Knibbs, and H. D. H. III. 2023. “Population Attributable Fraction of Gas Stoves and Childhood Asthma in the United States.” International Journal of Environmental Research and Public Health, 20(1). doi:https://doi.org/10.3390/ijerph20010075

Haverinen-Shaughnessy, U., and R. J. Shaughnessy. 2015. “Effects of Classroom Ventilation Rate and Temperature on Students’ Test Scores.” PLOS ONE, 10(8), e0136165. doi:10.1371/journal.pone.0136165

Jessel, S., S. Sawyer, and D. Hernández. 2019. “Energy, Poverty, and Health in Climate Change: A Comprehensive Review of an Emerging Literature.” Frontiers in Public Health, 7. doi:10.3389/fpubh.2019.00357

Kramer, S. (2021). Improving Access to C-PACE for Smaller Businesses. Retrieved from https://www.naseo.org/data/sites/1/documents/publications/FINAL_CPACE_smallbiz_brief%207%206%2021.pdf

Lean & Green Michigan. 2023. PACE Express. Retrieved from https://leanandgreenmi.com/about-pace/pace-express/

Lowe, J. 2022. “What is KYC? Financial Regulations to Reduce Fraud.” Retrieved from https://plaid.com/resources/banking/what-is-kyc/

Olaniyan, T., L. Pinault, C. Li, A. van Donkelaar, J. Meng, J., R.V. Martin,… H. Chen. 2022. “Ambient Air Pollution and the Risk of Acute Myocardial Infarction and Stroke: A National Cohort Study.” Environmental Research, 204, 111975. doi:https://doi.org/10.1016/j.envres.2021.111975

PACENation. 2022. Commercial PACE. Retrieved from https://www.pacenation.org/pace-market-data/

PACENation. 2022. PACE Market Data. Retrieved from https://www.pacenation.org/pace-market-data/

PACENation. 2019. PACE Programs. Retrieved from https://www.pacenation.org/pace-programs/

Philadelphia C-PACE. 2022. C-PACE FAQs. Retrieved from https://philadelphiacpace.org/resources/faqs/

Philadelphia C-PACE. 2022. Capital Providers. Retrieved from https://philadelphiacpace.org/wp-content/uploads/2022/10/C-PACE-Capital-Providers-List-20221012.pdf

Philadelphia C-PACE. 2022. “Year In Review 2021.” [Press release]. Retrieved from https://philadelphiacpace.org/wp-content/uploads/2022/01/Philly-CPACE-2021_YearInReview.pdf

Philadelphia Energy Authority. 2022. “Built to Last: An Initiative to Restore Safe, Healthy, and Affordable Homes. [Press release] . Retrieved from https://philaenergy.org/wp-content/uploads/2022/10/10-2022-PEA-Built-to-Last-summary.pdf

Philadelphia Energy Authority. 2022. “Philadelphia C-PACE hits $100MM in Clean Energy Financing.” [Press release]. Retrieved from https://philaenergy.org/philadelphia-c-pace-hits-100mm-in-clean-energy-financing/

Philadelphia Green Capital Corp. 2022. Catalyst Term Loan. Retrieved from https://phillygreencapital.org/catalyst/

United States Bureau of Labor Statistics. 2022. “Average Energy Prices, Philadelphia-Camden-Wilmington—November 2022.” Mid-Atlantic Information Office. Retrieved from https://www.bls.gov/regions/mid-atlantic/news-release/averageenergyprices_philadelphia.htm

United States Census Bureau. 2022. “QuickFacts: Philadelphia County, Pennsylvania (2022).” Retrieved from https://www.census.gov/quickfacts/philadelphiacountypennsylvania