Should Pennsylvania join the Regional Greenhouse Gas Initiative? And what would happen to electricity prices?

Difficulty in coordinating regulations across different jurisdictions limits the scope and efficacy of market-based solutions to curb greenhouse gas emissions (GHG). While a global market that takes full advantage of gains from trade across different countries is ideal, it may not be feasible due to varying objectives and priorities of these sovereign countries. Even at the individual country-level, organizing a comprehensive national market may prove difficult. In the U.S. for example, attempts to federally regulate GHG emissions have failed and any further regulations are likely to arise from individual state effort.

Realizing the difficulty in having a federal-level regulation, individual states, either alone or together with neighboring states, have come up with their own solutions. Examples of these include the Regional Greenhouse Gas Initiative (RGGI), the Western Climate Initiative (WCI), and California’s AB-32. While these are important steps, one concern is that the impact of these initiatives may be quite limited. States that would readily implement such initiatives are more likely to have lower costs associated with reducing GHG emissions and have a smaller GHG footprint. The real challenge then is for states that are more significantly dependent on GHG to enact their own initiatives or to join existing ones.

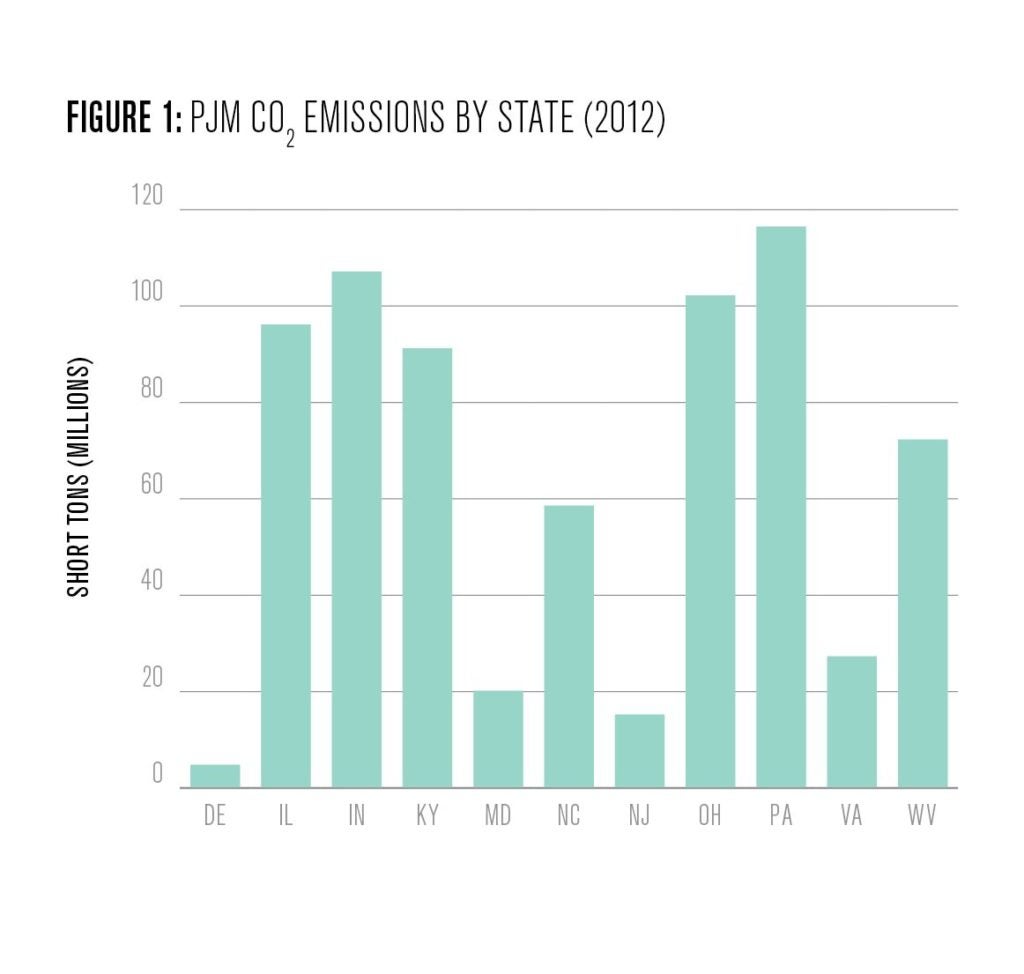

Pennsylvania1, New Jersey, and Virginia have announced their intention to join RGGI. Pennsylvania is of particular interest since, as can be seen in Figure 1, the state leads in terms of CO2 emissions among the group of states in the same interconnection, i.e. the Pennsylvania-New Jersey-Maryland interconnection (PJM). For this article, I provide some preliminary analysis of the impact of Pennsylvania joining RGGI on PJM.

RGGI and PJM

RGGI is a CO2 emissions allowance program that covers Connecticut, Delaware, Maine, Maryland, Massachusetts, New Hampshire, New York, Rhode Island, and Vermont. For these states, an annual cap on CO2 emissions is set, and this determines the number of allowances introduced in the market. Polluting sources in the power sector are required to surrender an allowance for each ton of CO2 they emit. Allowances are released via auctions (contrary to the Acid Rain Program where allowances were mostly allocated for free), and participants can also buy and sell in secondary markets.

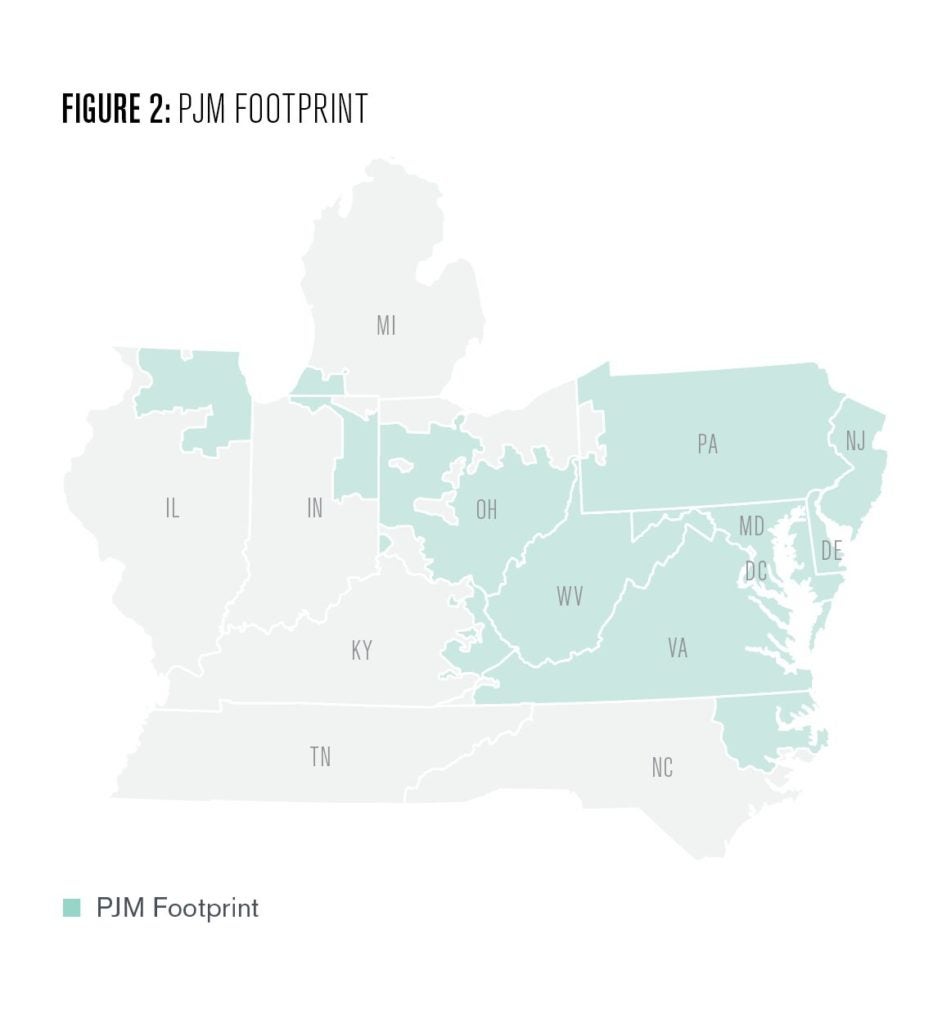

PJM operates one of the world’s largest wholesale markets as the regional transmission organization that covers 13 states. Figure 2 shows the PJM footprint. Electricity generating firms own plants scattered across these states. Plants generate electricity that is then sold in the PJM wholesale market and distributed across the region. Thus, the impact of Pennsylvania joining RGGI has to be measured through the lens of the overall PJM market.

For example, it is not immediately clear whether electricity prices in the PJM region will rise as a result of this move. If most of the plants in Pennsylvania are infra-marginal—that is, these plants are willing to supply at a price that is lower than the equilibrium price due to lower costs—then any increase in these plants’ cost will just eat up some of their profit margins without changing electricity prices.

Similarly, profits might not decrease significantly if most of the plants affected by inclusion in RGGI are marginal plants, i.e. plants that are indifferent between supplying or not sat the equilibrium price. In this case, we expect that the increase in costs are mostly passed on to consumers through higher electricity prices, given highly inelastic demand. Finally, in terms of emissions, plants in Pennsylvania will clearly emit less as a result of the move. However, overall emissions may still increase if the output that Pennsylvania plants used to produce is then produced by plants not subject to a CO2 price, a phenomenon known as emissions leakage.

Methodology

Because the direction of the overall effect of Pennsylvania’s move to join RGGI on electricity prices, consumer and producer welfare, and emissions depend on many factors, I simulate the PJM model under a range of CO2 prices that Pennsylvania plants may face.2 This simplifies the analysis, eliminating the need to explicitly model the RGGI market.

To perform the simulations, I use the model from my previous work (Abito et al., 2018).3

The model consists of a set of firms that own portfolios of plants across the different states in PJM. Differences in plant age, technology, and location affect the cost of electricity generation. In each period, firms produce electricity using their existing plants and sell it in the PJM wholesale electricity market. Firms also decide4 on how much to invest in coal- and gas-fired generation.5 Investment in new capacity allows firms to produce at a lower cost and, potentially, increase profits from electricity sales in subsequent periods. Abito et al. (2018) use cost and demand data until 2012 to estimate the parameters of our model.

Results

In this digest, I present results for electricity prices, operating cost, new capacity invested, profits, and CO2 emissions damages (assuming that the social cost of CO2 is equal to $40 per short ton). Since investment behavior depends on whether we assume firms are strategic or not, I simulate outcomes under two scenarios. The main analysis comes from a scenario where each firm takes electricity prices as given when deciding how much capacity to invest in. I label this scenario as the nonstrategic scenario. The second scenario is where all firms coordinate investment to maximize industry profits while taking into account the effect of new capacity on future prices. I refer to this scenario as the strategic scenario.6

For all scenarios, I simulate the model under the CO2 prices of $0, $25, $50, and $75 per short ton. The $0 simulation reflects the case where Pennsylvania, New Jersey, and Virginia do not join RGGI. Simulations with positive CO2 prices reflect cases when they all join.

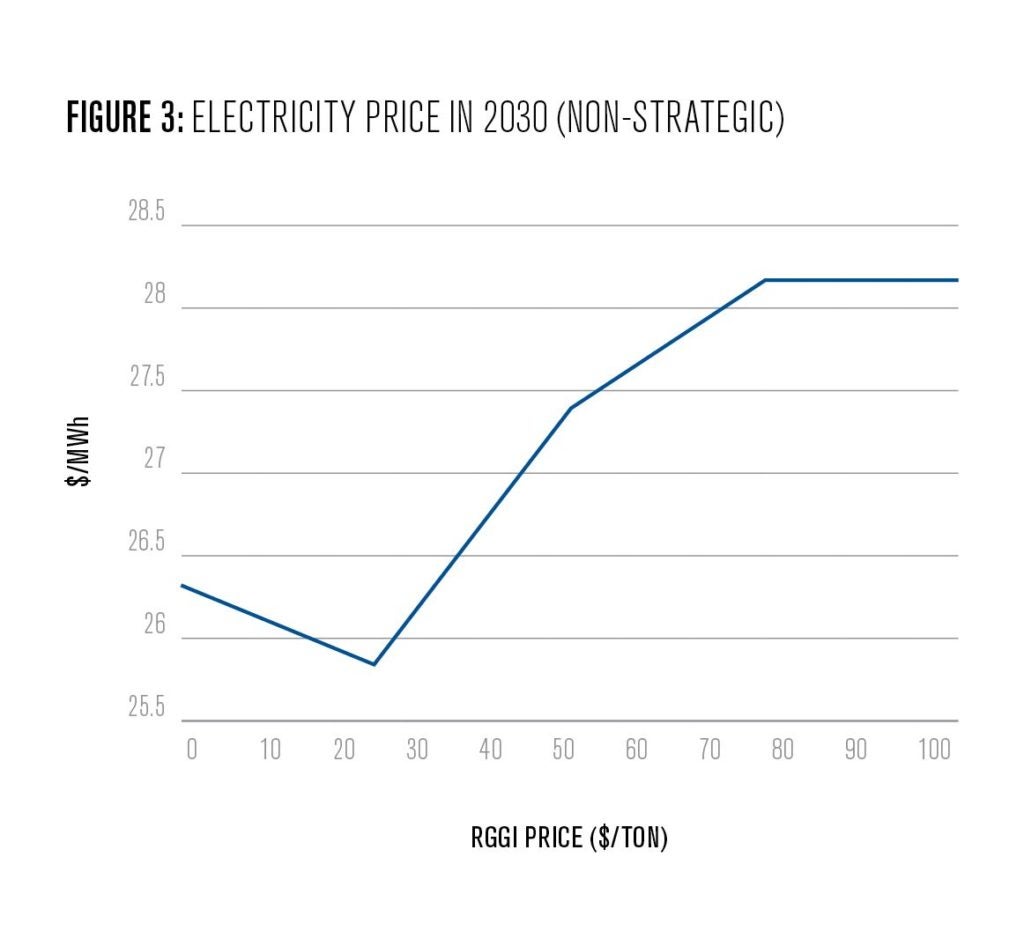

Figure 3 plots predicted 2030 electricity prices for the different RGGI CO2 prices. Interestingly, electricity price is lower by about 2% under a RGGI price of $25 per ton compared to the case where Pennsylvania does not join RGGI. Once the RGGI prices goes up to $50 per ton, electricity price increases by 4%. The largest increase in electricity prices occurs for both RGGI prices of $75 and $100 per ton. In both cases, the increase in electricity price is about 7%, the reason being that with such a high price most of the high-cost plants that are more sensitive to changes in CO2 prices no longer supply. Operating cost tracks the same behavior as electricity price, implying the important role of plants facing an RGGI price in determining equilibrium prices.

Greater investment is the primary reason for a decrease in electricity prices and operating costs observed in the $25 per ton case. Investment in more efficient capacity is about 5% higher with a $25 per ton RGGI price compared to the “No RGGI” case. The same phenomenon of higher investment under stricter CO2 regulations has been recognized and studied previously (Abito et al. 2018).

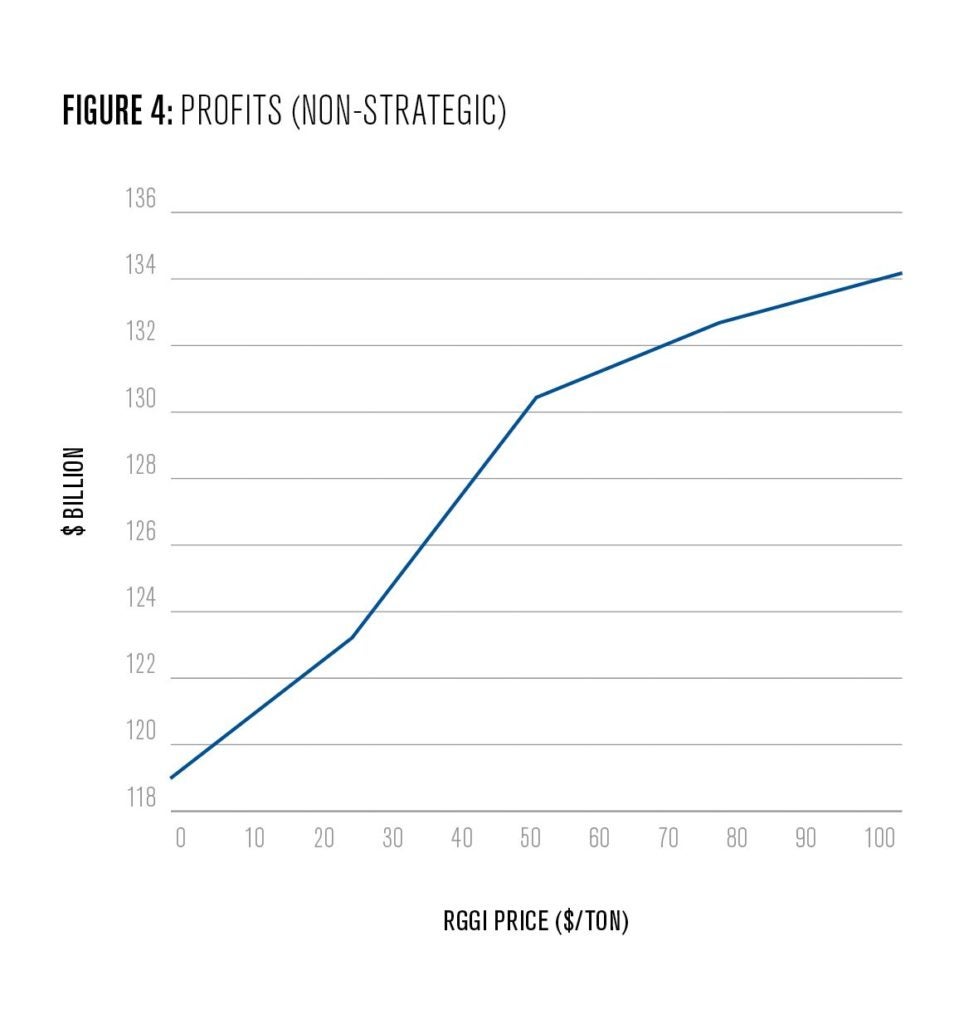

Moving to profits, we see from Figure 4 that industry profits actually rise as we look at higher RGGI prices. Note that this measure of profits includes all plants in PJM, not only in Pennsylvania. The increase in profits is driven by higher electricity prices to RGGI and the fact that plants not subject to RGGI simply increase their margins.7

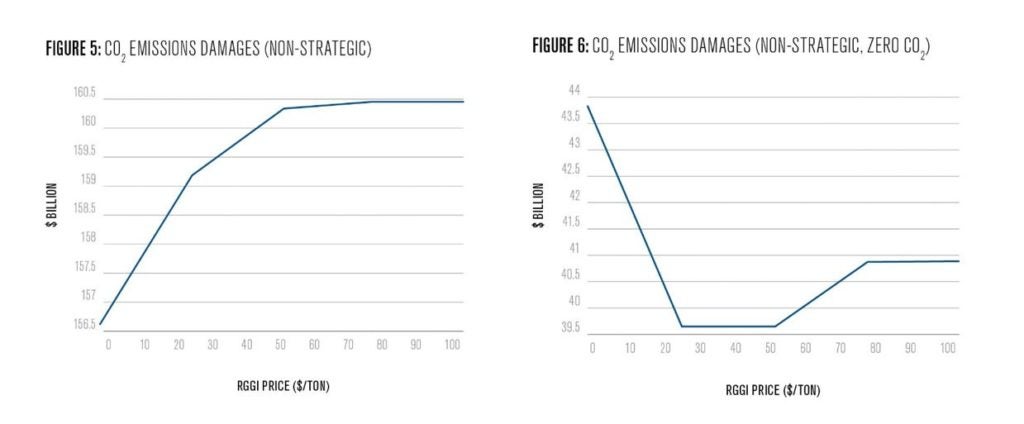

Figure 5 plots CO2 emissions damages as a function of RGGI price. We see an increase of about 2% in CO2 emissions damages. While emissions coming from Pennsylvania plants go down, the rise in emissions stems from two sources.

First, emissions basically leak to plants in non-RGGI states. Second, our model assumes that firms can only invest in new natural gas capacity not subject to RGGI (even if they are located in a RGGI state), so in this sense, emissions leak to new capacity. To determine the extent of these two sources, I recompute emissions assuming firms can only invest in zero carbon capacity. As can be seen in Figure 6, CO2 emission damages do go down relative to the No RGGI case. For RGGI prices of $25 and $50 per ton, emissions decrease by 10%. Interestingly, the decrease in emissions is a lower 7% for RGGI prices of $75 and $100 tons, reflecting greater emissions leakage to plants in non-RGGI states for these two prices.

The final part of the analysis compares outcomes under strategic and non-strategic investment. As expected, investment is much lower when firms strategically invest. What is a somewhat surprising is that the level of investment in the strategic scenario is not affected by the RGGI price. This means that the incentive to restrict capacity and strategically keep electricity prices high is so strong that it dominates any incentives to invest. With lower investment comes higher electricity price and operating cost. Finally, CO2 emissions decrease by about 7% compared to the No RGGI case when firms strategically invest.

Conclusion

This article provides some preliminary analysis on the effects of Pennsylvania’s move to join RGGI. The analysis suggests that for moderate RGGI CO2 prices, electricity prices (and operating cost) may actually go down as long as firms have enough incentives to invest in new capacity. Moreover, industry profits increase as a result of a subset of states joining RGGI. The fact that firms own plants located in both RGGI and non-RGGI states suggests that states that are deciding to join RGGI may not encounter that much pushback from firms due to an increase in profits from plants in non-RGGI states. Finally, the results suggest the importance of market structure and strategic behavior in analyzing the effects.

Mike Abito

Assistant Professor of Economics, Ohio State UniversityJose Miguel “Mike” Abito is an Assistant Professor of Economics at Ohio State University. He is a reviewer for the Kleinman Center and was previously an assistant professor of business economics and public policy at the Wharton School.

Abito, J.M., C. R. Knittel, K. Metaxoglou and A. Trindade (2018), “Coordinating Separate Markets for Externalities,” working paper, Univ. of Penn.

Bushnell, J., E. Mansur, and C. Saravia (2008): “Vertical Arrangements, Market

Structure, and Competition: An Analysis of Restructured U.S. Electricity Markets,” American Economic Review, 98, 237-266.

Dixon, H. (1985): “Strategic Investment in a Competitive Industry,” Journal of Industrial Economics, 33, 483-500.

- Although Pennsylvania Governor Tom Wolf’s 2014 campaign did seem to include a pledge to join RGGI, the governor denied this during his reelection bid. See https://stateimpact.npr.org/pennsylvania/2018/01/26/gov-wolf-doesnt-recall-campaign-pledge-to-join-climate-initiative/. Nevertheless, New Jersey and Virginia are still scheduled to join RGGI in 2020. [↩]

- I assume that New Jersey and Virginia are also part of RGGI and are subject to the same CO2 price. I simulate outcomes under the following CO2 prices (in $ per short ton): $0, $25, $50 and $75. Note that these prices are much higher compared to historical RGGI prices, i.e. less than $10. With the participation of Pennsylvania, New Jersey, and Virginia, RGGI prices are likely to rise if these states decide to bring in nontrivial emissions budgets into RGGI. In fact, Pennsylvania’s CO2 emissions in 2012 was 30% more than the whole RGGI region and was expected to reduce its emissions by about 25% under the Clean Power Plan. [↩]

- I received generous funding from the Kleinman Energy Policy Center at the University of Pennsylvania for Abito et al. (2018) [↩]

- Investment incentives in Abito et al. (2018) are created only in the energy market. However, PJM also operates a capacity market that is intended to encourage investment. Although we do not explicitly model a capacity market, our model can accommodate capacity payments. In the presence of capacity payments, investment cost should be interpreted as the net of the expected future value of capacity payments. Of course, this interpretation is valid only when all new investment receives capacity payments. It is also important to note that during 2003 to 2012, capacity payments have accounted for 6% of the total wholesale price per MWh while energy payments accounted for 82%. [↩]

- We assume investment in renewables is dictated by an individual state’s Renewable Portfolio Standard. [↩]

- Although firms coordinate their investment decisions, we still assume that the PJM energy market is competitive (e.g., Bushnell, Mansur and Saravia) conditional on capacity. This is similar to the model analyzed in Dixon (1985) [↩]

- Although the price of electricity in 2030 is lower under a RGGI price of $25 versus $0, this is a result of higher investment in more efficient capacity. Prior to 2030 when the investment has not been made, electricity price is higher under positive RGGI prices. The higher electricity price directly translates to higher profits for infra-marginal plants that are not in RGGI states since their revenue increases without an increase in cost. [↩]