Robust Carbon Markets: Rethinking Quantities and Prices in Carbon Pricing

If markets operated perfectly well and operated in a vacuum, putting a price on carbon would solve our emissions problems. But markets are imperfect and are affected by other policy levers. And that’s why RGGI’s approach is groundbreaking.

Carbon pricing represents the most important application of economic ideas to environmental problems that we have seen, and most economists feel this is happening just in time. Carbon pricing is imperative to address climate change because it is expected to be more efficient than other forms of regulation. This is important because the costs of addressing climate change will be substantial. If costs of achieving a given outcome can be reduced, this makes more ambitious policies possible.

Nonetheless, carbon pricing will never realistically provide the only policy to address climate change. The climate crisis is urgent; but unless the carbon price is very high, carbon pricing takes time to have its effect. A very high carbon price is not politically sustainable for a jurisdiction acting alone because it will face unfair competition from jurisdictions that have not acted to reduce their own emissions. Consequently, one finds companion policies such as performance standards and support for new technology applied broadly, including wherever one finds carbon pricing.

Although these policies are often less efficient than carbon pricing, which will reveal itself over time, they tend to suppress the change in product prices associated with carbon pricing, helping to maintain market share in the near term. Moreover, some companion policies have a strong independent justification. This complicated policy setting creates challenges to the naïve classroom description of carbon pricing, for reasons described below. In response, the design of carbon pricing has necessarily evolved away from its classroom portrayal in order to coexist with other policies. The result of this evolution will increase the influence of carbon pricing within the overall portfolio of climate policies.

These developments are nowhere more evident than in the Regional Greenhouse Gas Initiative (RGGI), which introduced carbon pricing through an emissions cap-and-trade program launched in 2009 to regulate emissions from electricity generators. RGGI covers eleven Northeast and Mid-Atlantic states including New Jersey, a charter member of RGGI that left the program and is now rejoining, and Virginia, a coal state that finalized regulations to join and is still awaiting approval from the legislature. Virginia state elections in November 2019 resulted in a new majority that favors joining RGGI, and the process is likely to be restarted when the new legislature takes it seats.

Potentially most important of all, in October of 2019 Governor Wolf of Pennsylvania directed the state’s Department of Environmental Protection to initiate regulations to join RGGI. In a separate development, the RGGI states, Virginia and Pennsylvania are involved in a new commitment to introduce carbon pricing for transportation, named the Transportation Climate Initiative.

The Challenge for RGGI

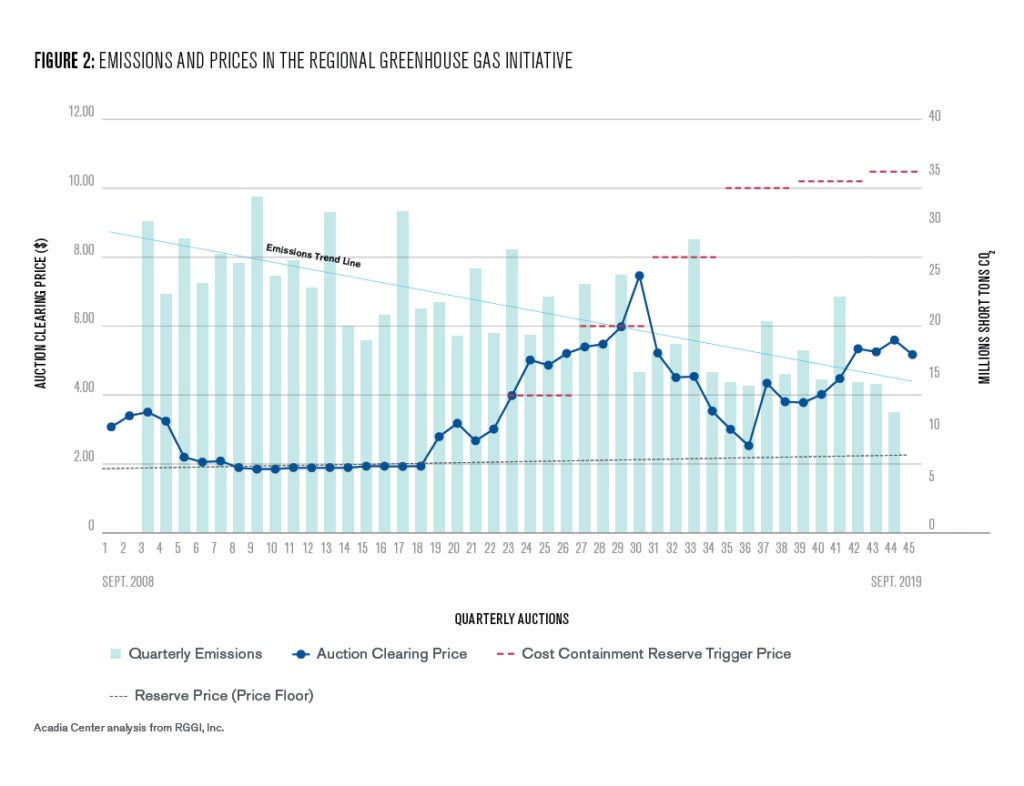

The RGGI region has observed emissions reductions of about 40 percent in the electricity sector since the start of the program. Without doubt, the program deserves substantial credit for coordinating a commitment among a diverse set of states to address climate change. The effort dramatically changed the investment climate in the region’s electricity sector, influencing an expansion in natural gas, renewables, and energy efficiency measures as well as a move away from coal. The program also raised $2.4 billion in revenue through 2017 from the auction of emissions allowances, and these dollars have been reinvested primarily in energy efficiency, accelerating emissions reductions and creating new employment opportunities with net benefits to the region.

Despite the decline in emissions, the performance of the RGGI program as well as other emissions markets have been questioned because they have consistently yielded prices that are lower than anticipated. Low prices have undermined the faith of some environmental advocates that carbon pricing would spark the innovation and investment necessary to enable deep decarbonization.

Some observers have asserted that low prices in carbon markets are counter-productive, by detracting from more ambitious policies that might achieve greater emissions reductions or directly force investments at specific facilities to reduce their emissions.

At the crux of the issue is the policy choice about whether to introduce a carbon price by limiting the quantity of emissions and enabling firms to trade emissions allowances in a market, or to enforce a price directly through a carbon tax. In fact, we witness an evolution in carbon pricing that has moved toward a hybrid of cap and trade and an emissions tax, resulting in approaches to carbon pricing that are increasingly robust and able to amplify the emissions reductions that might be achieved by other regulatory policies.

Economic Theory Meets Real World

Forty-five years ago, Professor Martin Weitzman formalized the policy choice that has framed the teaching of environmental economics ever since (1974).

Would it be better for policy to fixate on the environmental goal—the acceptable level of emissions—and enable firms to buy and sell the right to pollute? The market would identify a price for tradable emissions allowances and provide an economic incentive to reduce emissions; but the price level would vary and would be uncertain ex ante.

Or, would it be better to set a specific price by introducing an emissions tax, perhaps set to equal the marginal environmental damages of pollution? This would also provide an economic incentive to reduce emissions; but the quantity of emissions would vary and would be uncertain ex ante.

In a world with no uncertainty, these two approaches generate the same marginal incentives and relative prices. Although depending on how the pollution rights are allocated they can differ greatly in their income effects.

From an environmental perspective, the quantity under an emissions cap that enables firms to trade allowances would lead to a specific price, while setting a tax at that price would lead to a specific quantity of emissions. The same outcome—the quantity of emissions and the price per unit of emission—would be pretty much expected using either approach (not accounting for income effects).

Professor Weitzman recognized that environmental and economic outcomes are inherently uncertain. One cannot be sure what the price would be under an emissions cap or what the emissions would be under an emissions tax.

Weitzman clarified that in choosing between them, one should ask whether it is more important to overall economic welfare to limit the level of pollution or to limit the (marginal) cost of the policy. If an environmental problem had a pollution threshold at which severe damages might occur, then a quantity approach would be preferable because it would prevent that outcome. However, if environmental damages were the same for each ton of emissions, while the cost of reducing emissions might become increasingly expensive, then setting a price would be preferable.

In practice the most important applications of carbon pricing use a quantity approach with cap and trade. For policymakers, advantages of cap and trade are that it makes the environmental goal more salient. In early emissions markets, a political advantage of cap and trade was that emissions allowances could be given away for free, avoiding the public’s enormous resistance to new taxes. However, in recent markets the majority of allowances are distributed through auctions, yielding proceeds similar to a tax.

Where necessary, free allocation of allowances can be used to mollify industry resistance. Exempting industry from a carbon tax can also mollify industry resistance. Sources that receive allowances for free nonetheless retain an incentive to reduce their emissions. Over time, it is perhaps easier to reduce free allocation in favor of an auction than it is to reverse exemptions under a tax.

Moreover, emissions allowances are typically bankable. Because they can be saved for use in future years, allowances are fungible assets that encourage firms to take early action when it is cost effective to do so. This helps support program durability. Cap and trade also provides opportunities for linking markets. Perhaps most relevant at the state level in the United States, implementation of cap and trade often does not require legislation, whereas legislation is always required and often a super majority is required to implement a tax.

Low Prices Have Hampered Emissions Markets

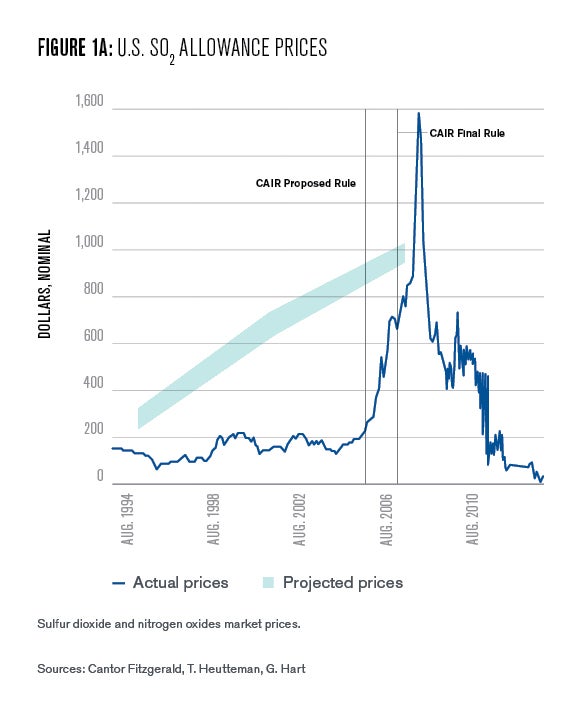

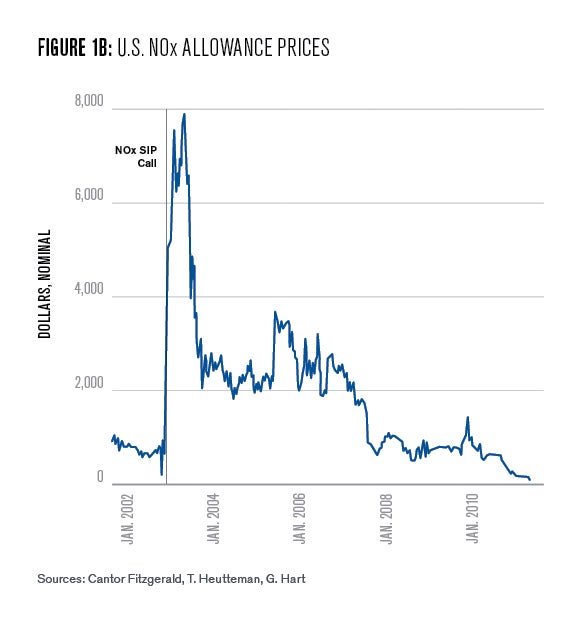

Policy makers have nearly three decades of experience using cap and trade to address emissions of sulfur dioxide and nitrogen oxides, and more recently carbon dioxide. At the outset of each of these programs, a prominent concern—especially of industry—has been that prices might spike to unacceptable levels.

In fact, allowance prices in emissions trading markets have been lower than anticipated in every market, often falling in real terms (Burtraw and Keyes 2018). Paradoxically, this outcome of low prices presents a significant threat to the success of these emissions markets. Why? Shouldn’t low prices be a good thing?

Ultimately, low prices for emissions allowances are the result of reduced demand for emissions allowances with a cap that fails to adjust. These lower-than-expected prices pose several challenges. One is that falling prices erode the payoff to early investments aimed at reducing emissions. Prices that fall over time undermine confidence in the role of the market as a policy instrument.

Environmental advocates, who may be distrustful of economic approaches to environmental regulation at the outset, see a failure to incentivize innovation. Some advocates interpret low prices as an indication of the need for additional prescriptive policies to force new technologies, which in turn create additional downward pressure on prices, creating a vicious cycle.

Another challenge stems from what’s called the waterbed effect. An emissions cap behaves like a waterbed—if you push emissions down in one place emissions go up somewhere else. Emissions might go down because of a technical advance, or they might go down because of a companion regulation that affects emissions at a facility that is also regulated under the cap. Under the waterbed effect, if the cap fails to adjust, other policies or actions aimed to reduce emissions have no effect on total emissions, an outcome that offends many. However, other policies do reduce the demand for emissions allowances, which causes allowance prices to fall.

The early years of the EU’s Emissions Trading System provided stark evidence that influenced the design of RGGI. In 2005, inexperience with environmental markets caused prices in the EU to rise at first, causing an increase in electricity prices that resulted in windfall profits for electricity generators because they were compensated for the cost of allowances they had received for free.

Then, in 2007 prices fell precipitously. This “pilot phase” of the EU program was followed by multiple reforms aimed at strengthening the market, but until late 2017 prices remained much lower than most observers expected or felt necessary to achieve the EU’s long-run goals.

Why Low Prices in Emissions Markets?

In policy negotiations at the creation of emissions markets, industry representatives understandably argue for enough allowances to ensure prices do not go too high. In addition, emissions pricing is always accompanied by companion policies that, for example, promote technological innovation and investments in renewable energy and energy efficiency, provide tax breaks for electric vehicles, or improve air quality. These additional policies indirectly lead to less use of coal, but have the ancillary effect of reducing the demand for emissions allowances and pushing down the allowance price.

In fact, by design cap-and-trade programs such as RGGI often enhance the trend of falling prices by directing allowance proceeds to investments in energy efficiency, which reduces the demand for allowances even further.

Economists also like to point out that markets work as intended: they provide an incentive to find low-cost opportunities to reduce emissions. The regulated facilities have information about the design and workings of their operations that is not available to the government, so it makes sense that they may be able to find ways to reduce emissions at less cost than the government can anticipate.

Whatever the reason for falling prices, some carbon markets have responded by adjusting their caps over time, but this process is politically challenging and uncertain, for both the environment and for regulated firms.

An Evolution of Market Design for Emissions Trading

Around the time when the EU was witnessing windfall profits due to very high prices, quickly followed by a sharp decline in prices to near zero, the mid-Atlantic and Northeast states were designing RGGI. This became the first carbon market in North America. Those states took two lessons from the EU.

First, because the Northeast electricity sector, like much of Europe, was deregulated—free allocation of emissions allowances could result in windfall profits here as well. Consequently, the states chose auctions instead of free allowances.

Second, low and falling prices could undermine the multi-state efforts at regional cooperation. In response, the states implemented a price floor as a minimum acceptable price in the auction. This works just like a minimum bid on eBay. In the auction, if demand is low and supply does not adjust, the price will fall. However, the price floor ensures that allowances will not sell at a price below the minimum acceptable bid, which constrains supply.

Fewer allowances in the market causes the price to be higher than it otherwise would and to remain at or above the price floor. If the price stays at the floor, then the carbon market becomes equivalent to a tax. An auction coupled with a price floor was the most significant new idea in applying economics to emissions problems in a decade, since the advent of the very first emissions market for sulfur dioxide under the Clean Air Act in the 1990s.

RGGI’s program design has been crucial to its durability. By its second year in 2010, prices fell to the price floor and remained there for eleven straight quarterly auctions until a program review permanently reduced the supply of allowances. Without the price floor, prices would have certainly fallen to zero because the demand for allowances would have been less than the supply (the cap) and there would have been no scarcity in the carbon market, thus ending the market experiment.

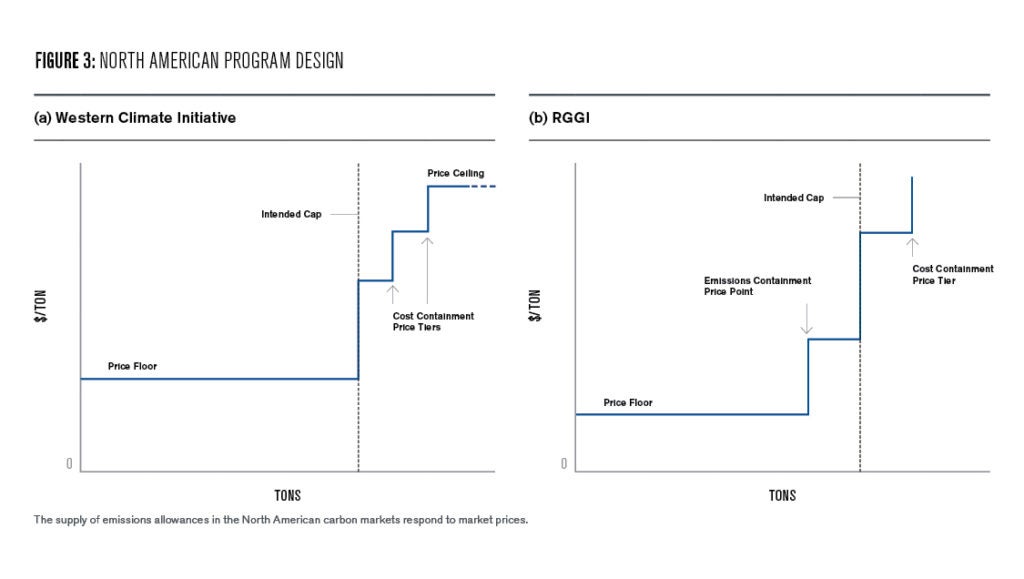

RGGI’s auction model was adopted in the Waxman-Markey proposal to introduce a federal cap-and-trade program that passed the House of Representatives in 2009. The model was also adopted in the California and Quebec economy-wide cap-and-trade programs that constitute the Western Climate Initiative (WCI). In both RGGI and WCI, the price floor is coupled with a cost containment provision that introduces additional allowances if the allowance price rises above a threshold level.

A key characteristic of the North America carbon markets is they depart from the classroom portrayal of an emissions cap. The price floor could reduce emissions below the anticipated cap level, and the cost containment reserve could lead to additional emissions.

Further Innovation in RGGI

RGGI now is evolving further with the introduction in 2021 of an additional price step. The price floor described previously remains in effect and provides a minimum price for the sale of about 90 percent of allowances in the auction.

The new price step is above the price floor and is called the “emissions containment reserve” and applies to 10 percent of the emissions allowances. This feature is especially valuable, because many of the states in RGGI are enacting policies that accelerate emissions reductions at facilities covered under the cap.

The emissions containment reserve helps to reduce the waterbed effect because when the demand for allowances falls, if the price falls to the emissions containment reserve price trigger, the supply of allowances is reduced, ensuring that state-level actions result in net reductions region wide.

With the price floor, the emissions containment reserve, and cost containment reserve, the emissions “cap” begins to resemble a staircase with steps that indicate the quantity of allowances to be sold at various prices. Soon California will introduce another feature—a price ceiling at which an unlimited supply of allowances would become available.

The price ceiling is analogous to the price floor and together they create a “collar” of minimum and maximum prices in the market, with price steps in between. An illustration of the supply schedules for the RGGI and California markets as they will take effect in 2021 are illustrated in Figure XX.

The price-responsive supply of allowances emerges as a hybrid of the choices described by Professor Weitzman, and is an outgrowth of an approach described by Michael Spence in 1977. Indeed, environmental markets are starting to look like other commodity markets which they are intended to emulate.

In markets for oranges or natural gas, if prices rise one would expect to see more orchards planted or more wells drilled and more of the commodity eventually coming into the market. Conversely, if the price falls, the supply will contract. The typical price-responsive nature of supply in a market contributes to price stability, and usefully it also contributes to the stability of auction revenues which is important to maintain funding for related programs.

Important in the mind of this author, this approach to cap-and-trade preserves also an incentive for firms and civil society groups to take voluntary individual actions to help the environment without necessarily triggering a waterbed effect. Deep decarbonization requires innovation not only in technology but also in social infrastructure, relationships, and norms. The ability for individuals to innovate in their social behavior, and to have those efforts affect emissions outcomes seems essential to achieving deep decarbonization goals. One could expect successful allowance markets to feed back into additional social innovation.

The EU Finds a Different Path

On the other side of the Atlantic, various program reforms in the second phase (2008-2012) and third phase (2013-2020) of the cap-and-trade program have sparked optimism about market prices, but they were subsequently deflated. However, in late 2017 the EU accelerated the annual reduction in new allowances that would be available and introduced a market stability reserve that adjusts the quantity of new allowances to be auctioned each year according to the quantity of allowances held in private banks.

Beginning in 2023, if the allowances being held in the market stability reserve grows large, some will be permanently cancelled, thereby reducing allowance supply permanently. This reform has coincided with a four-fold increase in the allowance price in the EU since late 2017.

Changes in the allowance supply in the EU are triggered by the quantity of allowances in circulation, while changes in the supply in the North American programs are triggered by the price of allowances in the auction, although the EU mechanism triggers adjustments to supply that are implemented over multiple years. Both of these approaches lead to the new characteristic in emissions markets where we see allowance supply adjust to enable the program to achieve long-run goals.

A Tax Approach Can Adjust Also

Advocates of carbon taxes have recently proposed analogous methods to automatically adjust tax levels in response to the emissions path achieved by carbon pricing (Aldy 2019). For example, if emissions are above a specified cumulative emissions pathway at a point in time, the tax level could ratchet up automatically.

Three of the six proposals for a carbon tax introduced in Congress this year include this type of adjustment mechanism. The assumption in this case, as in the carbon market approach, is that emissions goals are not set at a Pigouvian level initially, due to a complex political economy, and that emissions reductions at an accelerated pace are socially beneficial.

The takeaway is that carbon pricing has evolved from theory to practice. Its implementation has become dynamically responsive to market conditions. This is especially important because carbon pricing is important to achieving efficiency in emissions reductions, but it is not likely to be sufficient as a single policy instrument.

Since policymakers appear unlikely to give up on the use of other policy instruments that put downward pressure on allowance prices, market design must accommodate and complement companion efforts to maximize effective and influential results. Innovation in carbon pricing through features like RGGI’s price floor and emissions and cost containment reserves make these markets more robust and cast carbon pricing in a more effective role.

Dallas Burtraw

Darius Gaskins Senior Fellow, Resources for the FutureDallas Burtraw is the Darius Gaskins Senior Fellow at Resources for the Future. Burtraw was a 2018-2019 visiting scholar at the Kleinman Center.

Aldy, Joseph E. 2019. “Carbon Tax Review and Updating: Institutionalizing an Act-Learn-Act Approach to U.S. Climate Policy.” Review of Environmental Economics and Policy, rez019, https://doi.org/10.1093/reep/rez019.