New nuclear technologies could help power the future of Africa and build a bridge to sustainable energy. The challenge, however, lies in financing and regulating nuclear deployment.

Introduction

The world is undergoing a period of technological advancement that is unrivaled by that of any era in history. Concurrently, there are increasing levels of concern raised by the global need to transition to clean energy; however, in many parts of Sub-Saharan Africa there is also a need for electrification to fuel development (International Energy Agency 2014). This digest examines how nuclear energy might be able to solve the issue of electrification, or lack thereof, while minimizing Africa’s carbon footprint.

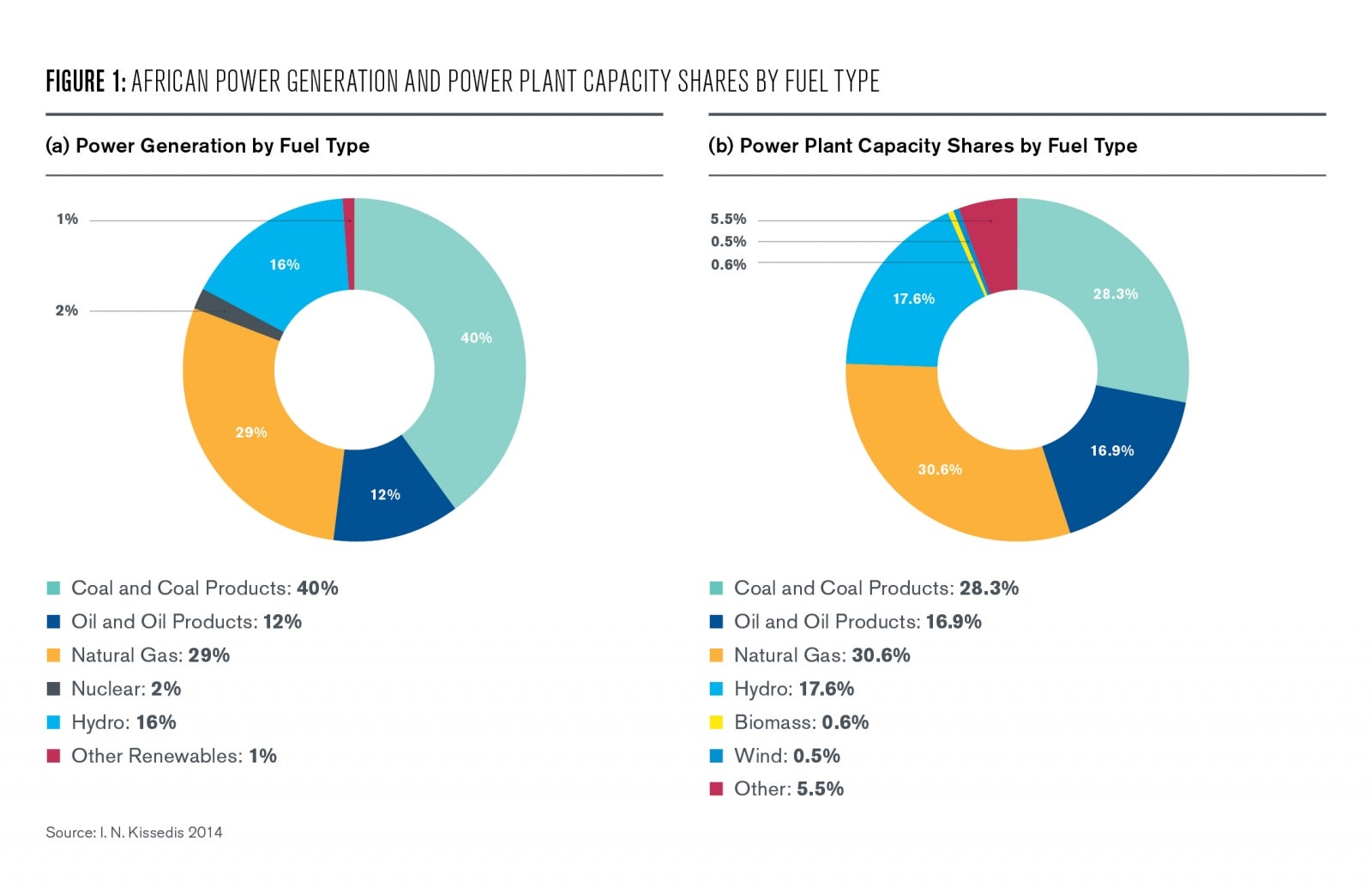

While Africa is home to many energy resources such as oil, gas, and limited hydro-electric power, most African countries still have vastly underdeveloped power sectors. The cumulative energy demand of 48 countries in Sub-Saharan Africa is roughly equal to that of Spain, even though the region is home to approximately 18 times the number of people and over 3 times the GDP on a PPP basis (International Energy Agency 2014).

In 2012, the region was home to only 83 GW of grid connected generation with South Africa accounting for approximately half. In 2012, it was estimated that 625 million people do not have access to electricity; however, over the past 25 years, less than $50 billion has been invested in power infrastructure (Sah et al. 2018). With a rapidly growing population, energy innovation is desperately needed.

In times of economic and population growth, many countries have turned to nuclear power to satiate energy needs. There appears to be potential for nuclear to supply Africa with clean baseline energy and bypass coal, oil, and natural gas generation—these fuel sources pose issues not only environmentally, but also logistically due to a need for constant fuel supply.

Nuclear has tremendous potential in Africa due to its energy dense fuel as well as its potential for use in desalination and steam generation (Ahmed et al. 2014). However, there are several challenges in moving towards nuclear given that traditional plants often have power ratings of 1,000 MW or larger, which often exceeds the safe capacity of many African countries’ power grids (I. N. Kessides 2014).

The Status of Nuclear in Africa

Presently, South Africa is the only country with commercial nuclear power; however, there is increasing government interest throughout the continent in developing commercial programs (IAEA 2011). In addition, there are currently ten operational research reactors in eight countries across Africa, which were all built by foreign countries such as China, the former Soviet Union, Argentina, and the United States (Gil 2018).

Though these reactors are strictly used for environmental and medical research—the development of research reactors has symbolled a first move towards commercial nuclear power projects for various other countries due to their ability to train students in maintenance and management. For example, Nigeria recently began a master’s program in nuclear engineering that graduated its first class in 2014. In addition, foreign countries often bridge the educational gap in exchange for government contracts. For instance, Russian Rosatom is offering scholarships for Sub-Saharan African students to pursue nuclear engineering degrees in Russia (Sah et al. 2018).

Domestic Regulatory Progress

In advance of building commercial nuclear generation plants, countries must develop policies to support nuclear development. These policies are often instituted through the creation of an energy agency, or incorporation within the energy ministry. The International Atomic Energy Agency (IAEA) has provided an outline that segments development plans into phases and key elements:

- Considerations prior to launching a nuclear power program: Ready to make a commitment to a program

- Initial work to construct a nuclear power plant following policy decisions: Negotiate contracts for a country’s first plant

- Implement the plant: Commission and operate the country’s first plant

During all steps, a government must consider issues that fall under a defined list ranging from national position and radiation protection, to stakeholder investments. Presently, South Africa and Ghana have both gone through this process, while Nigeria has made significant progress towards regulatory approval (Jewell 2011).

International Safety and Security Plans

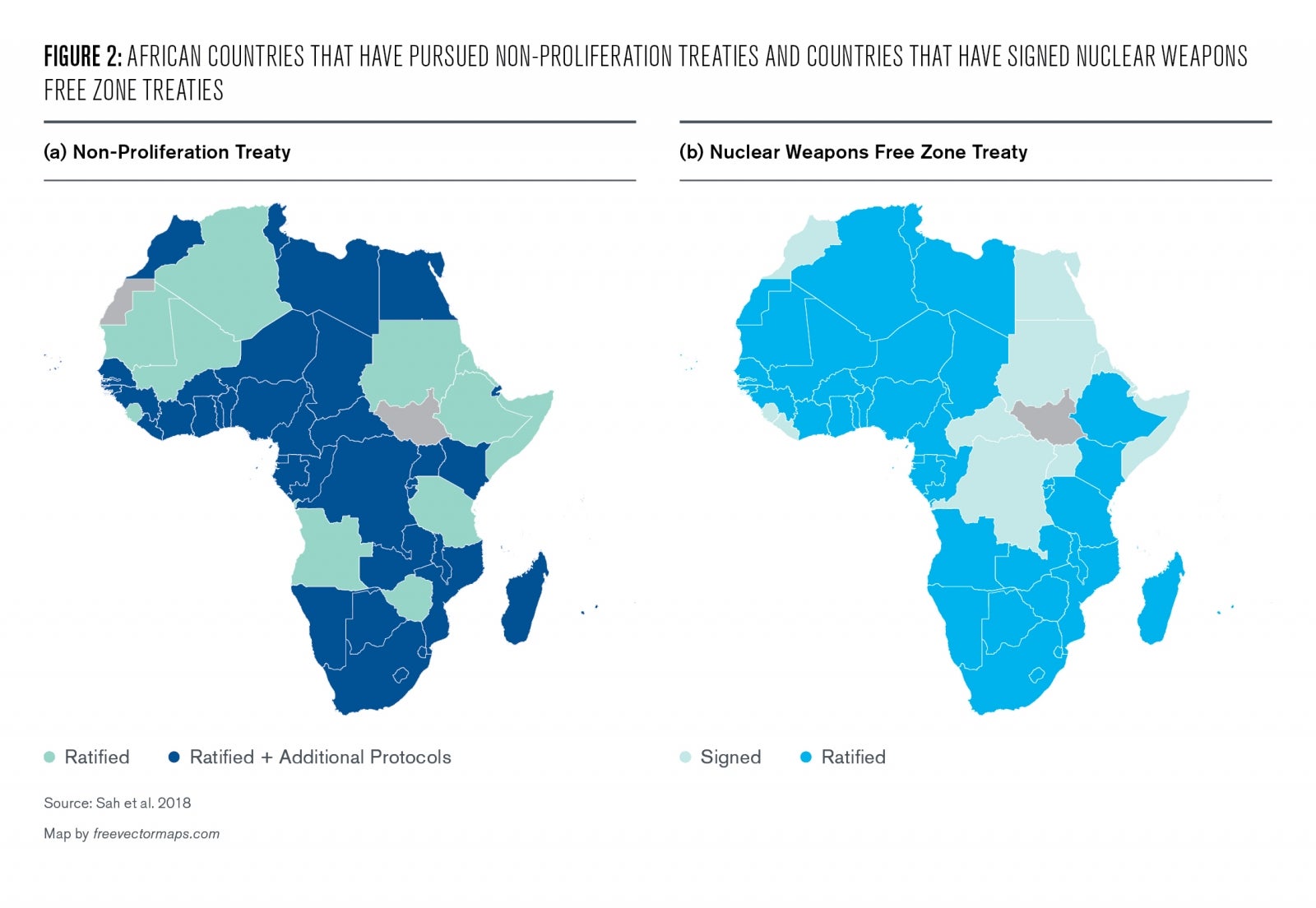

African countries have made significant progress towards non-proliferation treaties, which all countries but South Sudan have ratified. Further, nearly 60% have also moved towards additional supervision that allows the IAEA to verify compliance (Jewell 2011).

In addition, all but South Sudan have signed the African Nuclear Weapon Free Zone Treaty, which disallows the use and development of nuclear weapons. The United States also requires countries to have a Section 123 agreement before the U.S. can share nuclear technologies to any of these countries. Presently, three countries in Africa have such agreements with the U.S. while South Africa is the only country that meets the standards for nuclear exporters (Sah et al. 2018).

National Strides Towards Nuclear Power

There have been substantial interests from numerous countries in Africa—with several banding together to form the African Network for Enhancing Nuclear Power Programme Development in 2015 (Gil 2018). Further, many countries have signed agreements with international power developers to cover aspects of deploying nuclear power. These range from providing technology and training, to assisting in regulatory development. For instance, Rosatom from Russia has agreements with Ghana, Kenya, Nigeria, Tanzania, Uganda and Zambia while Chinese entities have partnerships with Kenya, Sudan, Uganda, and Namibia (Sah et al. 2018).

Fuel Sources on the Continent

Of particular interest are natural resources on the African continent. Namibia’s largest Uranium (fuel commonly used in present nuclear technologies) mine is owned and operated by China General Nuclear (CGN), where nearly all of the raw metal is exported to China before it is refined (Jewell 2011). The following outlines the position of selected countries and their strides towards commercial nuclear power.

South Africa is the only African nation with an operational nuclear power plant. The project began in 1984 with the Koeberg Power Station which has two 900 MW Pressurized Water Reactors (PWR) each. The plant is owned by the electricity utility and accounts for 5% of the annual electricity. The country has an off-site storage site for low-grade waste while high level waste is kept on premises for eventual fuel recycling. The country is looking to expand its nuclear capacity to nearly 10 000 MW and is examining new generation technologies.

Tanzania plans to build a research reactor with the goal of bringing commercial nuclear power to the country by 2025. The development will be done through a subsidy from Rosatom. Rosatom’s involvements in Tanzania were motivated by the discovery of uranium deposits where it commenced extraction in 2018 from the Mkuju River. Further, the prospect of locally occurring uranium is promising for the generation capabilities of Tanzania.

Uganda aims to have two 1 000 MW reactors by 2031. In order to achieve these development goals, the Ministry of Energy has entered agreements with both Chinese and Russian power technology developers. Presently, sites are being considered in Aswa, Kyoga, and Kagera.

Nigeria is looking to install 4 000 MW of capacity by 2025. In 2010, the Nigerian Atomic Energy Commission (NAEC) selected four sites for evaluation. A preference for two of the sites was declared in 2015 where Rosatom disclosed plans to build two reactors at each site. NAEC and Rosatom have entered an agreement for a comprehensive nuclear program under a Build-Own-Operate model (a type of Public-Private Partnership) in which the majority of equity would be from Rosatom.

Challenges in Deploying Nuclear

Numerous different factors play against the development of the nuclear power segment in Africa. However, all of these challenges can be traced back to a fear that the challenges and risks associated with the African continent are unbearable. A sentiment that has been overcome in other sectors, and will likely be overcome here. These concerns include:

- Timelines. In addition to the large capital investments that nuclear plants require, these are usually accompanied by five- to ten-year-long periods of construction and testing. In potentially unstable regions, projects with long time horizons are often unattractive for investors. Although over the lifetime of a plant, costs are on par when weighted against fossil fuel plants (especially with local nuclear fuel resources) (World Nuclear Association 2020), the significant period between investment and revenue returns is often enough to sour investors. On top of this is a legacy of over-budget projects—another uncertainty negatively affecting the prospects of investment in traditional nuclear plants.

- Regulatory Frameworks. Further, fears surround the potential inability for Sub-Sharan African countries to provide clear regulatory and financial frameworks with adequate risk provisions in case of extended construction periods and uncertain electricity demand growth. This leaves investors without a degree of project life-cycle clarity, nor a sense of urgency from governments to accelerate nuclear projects. Historically, these countries tend to lag in schedules of project development.

- Infrastructure. Additionally, lack of transmission infrastructure and trained personnel leads to a decreased perception of prosperity for new generation projects. The success of generation projects is dependent on additional infrastructure including electricity transmission. If a legacy grid is not built to transmit a sufficient multiple (generally 10x) of the production capacity of the nuclear plant, further investment will have to be made into grid upgrades and renewal (International Energy Agency 2014).

- Maintenance. There is also the necessity for local maintenance expertise. For contracts where construction and operation are managed by one corporate partner, a degree of cultural understanding must also be taken into consideration. Thus, the importance of training locals cannot be understated. New energy sources are only likely to be accepted if they cost less than current methods. While long-term returns might outweigh those of other fossil-fuel generation methods, short-term barriers such as these often cloud future benefits and lead to project resistance.

- Safety. Finally, safety concerns are ever present when considering the idea of nuclear technologies. This is exacerbated by potentially unstable political situations, as well as by a lack of local expertise. Internationally, concerns of events such as Three Mile Island, Chernobyl, and Fukushima have been cited as reasons that Germany is rolling off of nuclear power.

However, irrespective of these issues, there are many good examples that can serve as fundraising models to the nuclear industry. Hydropower plants in Africa are broadly comparable to nuclear power projects, as they present similar elements of complexity. These projects have both been financed by tax payers and by international organizations. However, large hydro projects present similar issues of scale and long payback horizons (Sah et al. 2018).

The Potential for Aid from Major Nuclear Vendors

Given that the costs and resources associated with a nuclear program can be burdensome on a developing country, many countries have and will choose to partner with a foreign vendor. These vendors are able to alleviate challenges in financing, fuel supplies, training and overall deployment. While Russian companies have sponsored numerous African projects, some prominent alternative sources of aid follow:

France was the first country to build a nuclear plant in Africa with French Areva building South Africa’s Koeberg nuclear plant. At the moment, there are no plans between France and any African nation; however, France does obtain 40% of its Uranium supply for French generation from Niger. France hasn’t secured any export contracts since 2007, partly due to their relatively expensive designs; however, France was in talks to build further capacity in South Africa before talks stalled.

Canada has been dominant in exporting power generation equipment. With a unique heavy-water reactor design that runs on unrefined uranium, these plants take less processing and produce less waste. Additionally, with smaller capacity (100-500 MW) their designs are suitable for smaller grids. Through the latter half of the 20th century, exports were made to Pakistan, Taiwan, Argentina and China among others – however, exports have dropped.

International Financial Institutions (IFIs)—like the World Bank or African Development Bank—don’t have a strong interest in nuclear investment at the moment, largely due to previously cited reasons. However, due to evolving nuclear technologies along with other factors, it is certainly possible that many factors could lead to IFIs financing nuclear projects.

Next Generation Nuclear in Africa

To date, nearly 85% of commercial nuclear power plants have been either pressurized-water reactors (PWR) or boiling-water reactors (BWR) (World Nuclear Association 2020). Additionally, pressurized heavy-water reactors (PHWR) have also been installed, which use unenriched uranium and Deuterium Oxide (D2O), or heavy water, as a moderator in place of ordinary water. PWHRs have intrinsic advantages as efficiency is higher and refinement of raw, naturally occurring, nuclear fuel is not needed; however, proliferation is a concern given that natural uranium is transformed into enriched plutonium in PWHR processes.

Advanced Nuclear Technology

Traditional reactor types such as the PWR, BWR, and PHWR all have power outputs that are too large for a Sub-Saharan African grid—as such, traditional reactor designs might not be most appealing for these nations. However, there are many novel nuclear technologies that have the potential to avoid many potential challenges with the region including smaller and modular reactors that are less capital intensive and to a maximum production rate are on-par with larger nuclear plants. Further, next-generation designs have enhanced capabilities, and require fewer on-site operators. Finally, new technologies allow for the usage of less water for cooling, thus enabling nuclear for inland regions.

Sealed Micro-Reactors are small reactors with capacities of 10 MW or less that have the potential to operate for up to a decade without refueling. Designs allow for the movement of heat through heat tubes to produce electricity without the need for active processes, thus reducing costs. In a modular scheme, a 2 MW reactor would fit in the footprint of only two shipping containers. The reactors require minimal operational expertise, and spent fuel can often be recycled to find use for another decade.

High-Temperature Gas Reactors, or HTGRs, use CO2 gas as a coolant, which allows the reactor to operate at temperatures of up to 1000 degrees Celsius. This provides a great nuclear alternative for inland regions. HTGR units typically are 200 to 300 MW in capacity and use TRISO fuel pebbles, which only degrade in excess of 2000 degrees C – higher than the failure point of the reactor. Spent TRISO also doesn’t need to be stored in cooling pools, and can be sent to storage immediately. Further, due to the high temperatures achieved in these processes, the HTGR also can be utilized in cogeneration processes.

Pebbled Bed Modular Reactors, or PBMRs, are a subset of HTGR reactors that have a capacity of 100-200 MW and has the added safety of being able to autonomously shut down by releasing core heat without a meltdown in case of failure. The PBMR also uses unenriched fuels and as such eases proliferation concerns. Further, the reactor is designed for active refueling which allows for reduced downtime.

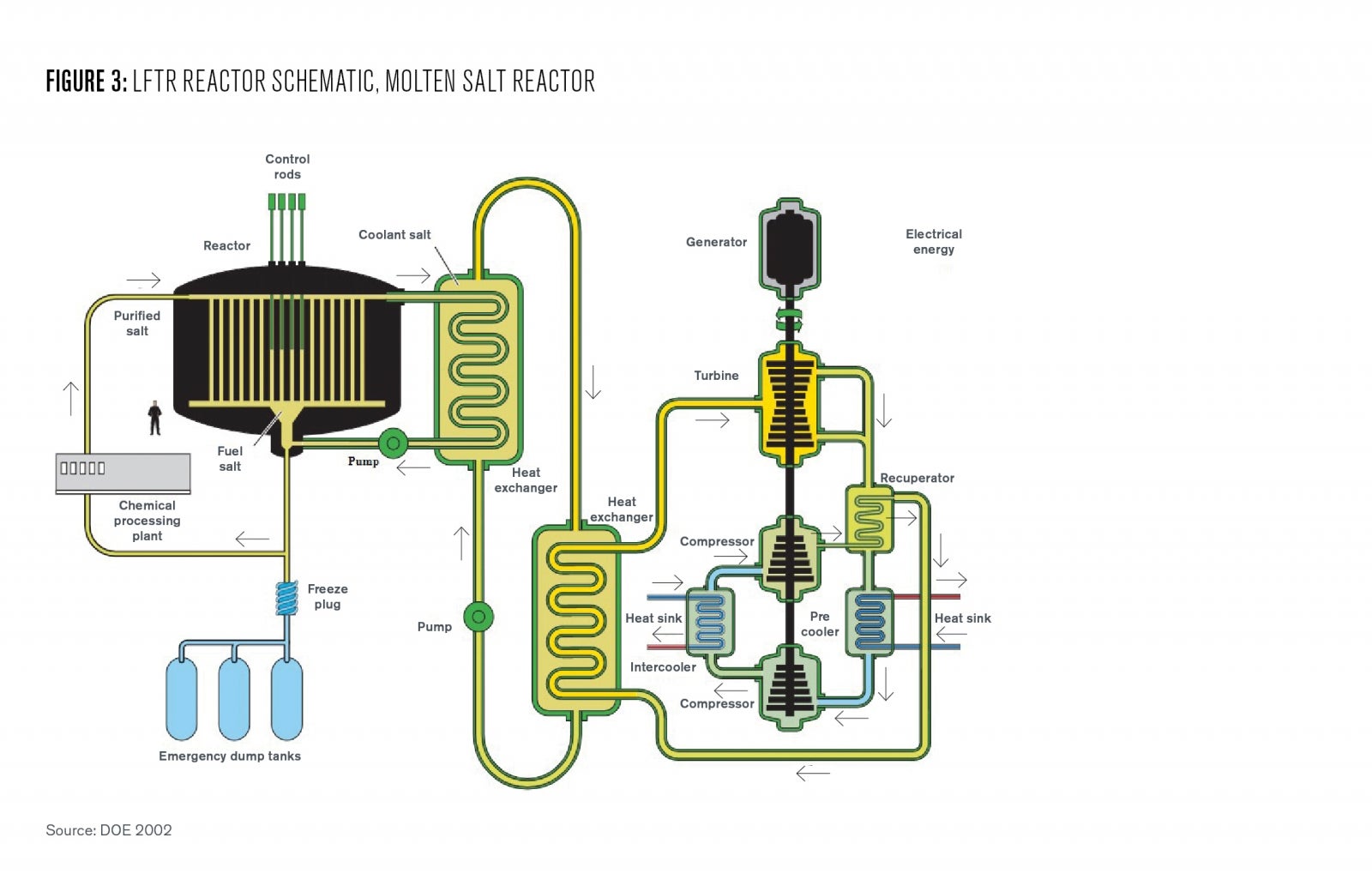

Small Modular Reactors, or SMRs, have capacity of up to 300 MW and are often built off site, lowering construction times and costs. By nature of their modularity, units can be combined as demand increases. This design allows for flexibility in placement of areas with or without robust grid infrastructure given their relatively limited capacity. SMRs utilize a range of fuels and coolants; however, one technology that is particularly exciting for countries is the liquid fluoride thorium reactor, or LFTR (Kessides and Kuznetsov 2012).

Liquid Fluoride Thorium Reactors, or LFTRs, use thorium and fluoride salts to power the generation process. Thorium-232 and Uranium-233 are added to fluoride salts in the reactor’s core. The salt melts, which runs in a heat exchanger and ultimately heats helium to drive a turbine. These reactors generate less radioactive waste and are able to re-use uranium making reactors essentially self-sufficient once started. Further, fluoride salts have much higher boiling points than traditional coolants thus limiting the chance of an explosion. Further, LFTRs only require air-cooling and have complex underground fail-safe containment chambers. Additionally, the spent fuel is at such a low level of enrichment, that it is inadequate for proliferation. Finally, thorium is 500 times more abundant than uranium-235 (fissile material), and LFTRs operate at a near 50% thermal efficiency, up to 20% more than that of a traditional PWR (Hargraves and Moir 2010) (Galperin, Reichert and Radkowsky 2007).

While LFTRs are not in widespread production to date, scientists suggest that with sufficient investment (public and private), a viable solution with great promise for the African market could be developed in less than five years (Surampalli 2019).

Conclusion

Advanced nuclear technologies have the power to address challenges initially posed to nuclear developers and investors in Africa. Not only do they address safety and proliferation fears but require less skilled oversight and do not require frequent refueling. Perhaps most importantly, SMRs and LFTRs in particular provide nearly every sub-Saharan African country the ability to provide safe nuclear power without modification to existing grids.

However, it is evident that no sub-Saharan country is able to build commercial nuclear within the next five years from a financial or regulatory standpoint. Nevertheless, there is great promise and interest for nuclear across Africa with substantial competition between vendors in Russia and China. Many nuclear cooperation agreements have been signed and the number of these will only grow in the future.

It is important that countries evaluate which technological advancements are right for their unique circumstances. Further, new operational models such as Build-Own-Operate and foreign-financed projects can help catalyze development. LFTRs have the potential to create safe, affordable nuclear in the foreseeable future—but still, nothing can be done without the supervision of provisions in place by the IAEA.

In the next decade, we can expect an increase in regulatory agreements, and the signing of many non-competition agreements with major vendors from across the globe depending on individual needs. However, given the necessity of energy in developing nations, and rising concerns around fossil fuels, scrutiny placed on nuclear projects by large development banks should be relaxed in order to allow for cooperative financing models. In place of these entities, countries turn to foreign companies that often may not have the African nation’s best interest as first priority. As such, development banks are an invaluable asset in facilitating transparency and sound governance. They have the ability to standardize practices around emerging nuclear technologies and negotiate industry standard contracts. Lastly, it is crucial that sub-Saharan African countries engage in real conversations with their citizens about the benefits and potential risks of nuclear energy, so all are educated and able to participate in full discourse.

William Deo

Undergraduate Seminar FellowWilliam Deo is a graduate student studying mechanical engineering at the School of Engineering and Applied Sciences. Deo was previously a 2020 Undergraduate Student Fellow with the Kleinman Center.

Ahmed, S A, H A Hani, G A Al Bazedi, M M H El-Sayed, and A M G Abulnour. 2014. “Small/Medium Nuclear Reactors for Potential Desalination Applications: Mini review.” Korean Journal of Chemical Engineering 924-929.

Baeten, Peter. 2017. The Development of Small Modular Reactors for Emerging Nuclear Countries in Africa. Slides, Mol, Belgium: SCK CEN.

Cho, Adrian. 2019. Smaller, safer, cheaper: One company aims to reinvent the nuclear reactor and save a warming planet. Feb 21. Accessed 4 3, 2020. https://www.sciencemag.org/news/2019/02/smaller-safer-cheaper-one-compan….

Cooper, Mark. 2014. “Small modular reactors and the future of nuclear power in the United States.” Energy Research & Social Science 161-177.

Galperin, Alex, Paul Reichert, and Alvin Radkowsky. 2007. “Thorium fuel for light water reactors—reducing proliferation potential of nuclear power fuel cycle.” Science & Global Security 265-290.

Gil, Laura. 2018. Is Africa Ready for Nuclear Energy? Sep 03. Accessed 4 3, 2020. https://www.iaea.org/newscenter/news/is-africa-ready-for-nuclear-energy.

Hargraves, Robert, and Ralph Moir. 2010. “Liquid Fluoride Thorium Reactors.” American Scientist 304-313.

IAEA. 2011. Research Reactors in Africa. Paper, IAEA.

International Energy Agency . 2014. Africa Energy Outlook: A Focus on Prospects in Sub-Saharan Africa. Paper, IEA.

Jewell, J. 2011. “A nuclear-powered Africa: Just a desert mirage or is there something on the horizon?” Energy Policy 4445-4457.

Kenny, A. 2008. “Prospects for nuclear power in Sub-Saharan Africa in the 21st Century.” International journal on Global Energy Issues 177.

Kessides, I N, and V Kuznetsov. 2012. “Small modular reactors for enhancing energy security in developing countries.” Sustainability 1806-1832.

Kessides, I N. 2012. “The future of the nuclear industry reconsidered: Risks, uncertainties, and continued promise.” Energy Policy 185-208.

Kessides, Ioannis N. 2014. “Powering Africa’s sustainable development: The potential role of nuclear energy.” Energy Policy S57-S70.

Lapp, Christopher W, and Michael W Golay. 1997. “Modular design and construction techniques for nuclear power plants.” Nuclear Engineering and Design 327-349.

Sah, Abigal, Jessica Lovering , Omaro Maseli, and Aishwarya Sacena. 2018. Atoms for Africa: Is There a Future for Civil Nuclear Energy in Sub-Saharan Africa? Paper, Washington DC: Center for Global Development.

Surampalli, Sameer. 2019. Is Thorium the Fuel of the Future to Revitalize Nuclear? 8 13. Accessed 4 2, 2020. https://www.power-eng.com/2019/08/13/is-thorium-the-fuel-of-the-future-t….

World Nuclear Association. 2020. Economics of Nuclear Power. March. Accessed April 2020. https://www.world-nuclear.org/information-library/economic-aspects/econo….

—. 2020. Small Nuclear Power Reactors. March. Accessed 4 4, 2020. https://www.world-nuclear.org/information-library/nuclear-fuel-cycle/nuc….

—. 2017. Thorium. Feb. Accessed 4 2, 2020. https://www.world-nuclear.org/information-library/current-and-future-gen….