Initial Questions on PJM’s Price Formation Proposal

After reading my last blog, you should have a general sense of PJM’s enhanced energy price formation proposal. Here, I’ll outline some preliminary and basic questions I have, upon initial proposal review.

In full disclosure, the complex mathematics and theoretical economics run well over my head. Therefore, most of these questions are relatively basic and focus on reforms to locational marginal pricing (LMP). Scarcity pricing, another part of PJM’s proposal, is not addressed.

How bad is the uplift problem?

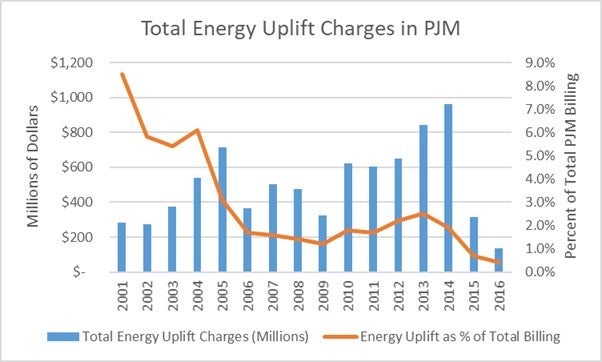

PJM promotes the move to extended LMP (eLMP) as a way to ensure the market prices accurately reflects the cost of providing power. The focus seems to be on reducing out of market payments, called “uplift”, to generators that respond to PJM’s administrative signals. However, according to data from Monitoring Analytics (2016 SOTM Vol 2, p. 185), uplift payments are trending down as a percent of total billings and have been drastically reduced in the past two years. According to the Q3 2017 SOTM, total uplift was $86.3M from Jan – Sept, trending down from the same time period last year. So, is this downward trend not expected to continue? Are uplift payments expected to increase?

Seems like an expensive solution?

Based on PJM’s cost analysis in appendix B of its proposal, it seems uplift is expected to continue even with eLMP. However, the cost of uplift would decrease from $190 million (M) to $110M, for a reduction of $80M.

However, annual cost increases (net of capacity market cost decreases) associated with eLMP would amount to $440M – $1,440M. Seems like an expensive solution given uplift costs, no? But, PJM notes these increase energy market revenues will prevent resources from retiring, therefore avoiding future increases to capacity prices.

How will FERC’s uplift transparency proposal help?

PJM has asserted zero uplift is not possible, and its proposal acknowledges that uplift payments will still be needed, but minimized, when using eLMP. Uplift is problematic because it lacks transparency, which in turn can inhibit investment in the market (if prices are suppressed) and the ability to hedge.

FERC proposed an “Uplift Cost Allocation and Transparency in Markets Operated by RTO/ISOs” in January 2017. How much will FERC’s uplift transparency proposal help? Given the magnitude of the costs of the proposed solution, is FERC’s transparency proposal a reasonable alternative?

Is it too soon to worry about resource adequacy?

PJM notes increasing energy market revenues will reduce capacity market costs and prevent certain resources from retiring, therefore avoiding future cost increases associated with new capacity. But, PJM had a near record-high reserve margin of 23.3% in the 2020/2021 base residual auction. In the price formation proposal PJM acknowledges this, but states, “…it is reasonable to assume that over time, this reserve margin could shrink to a value that approximates the minimum PJM installed reserve margin (IRM) of around 16.6 percent.” (p.50).

This raises a series of provocative questions. When is it too soon for an RTO to act on potential concerns about resource adequacy? Aren’t the dynamics of retirements leading to increasing prices leading to new investment exactly what is expected from these markets?

Is eLMP well understood enough to implement on a broad scale?

In 2016, a team of researchers working for ISO-NE and led by Dane Schiro published a study via IEEE, on “convex hull pricing” in electricity markets. Convex hull pricing is the fundamental principle underpinning PJM’s eLMP. The paper includes some interesting insights. While marginal cost pricing is a well-known economic concept, “Convex Hull Pricing, on the other hand, does not have an accepted economic justification” (p.4073). “Furthermore, short-term and long-term investment incentives remain unknown for Convex Hull Pricing” (p. 4074). “Convex Hull Pricing is an interesting mathematical pricing concept. However, it is not yet fully understood and the appropriateness of its variants is debatable” (p. 4075). While this is just one study, a quick review for additional analysis yields mostly papers on theory. There isn’t much in the way of empirical evidence of convex hull pricing implementation in real markets. Is enough known about eLMP to move towards market-wide implementation?

Why did PJM specifically not include a load-following product to reward flexibility?

PJM asserts that eLMP will promote flexibility by reflecting true cost of producing energy in the market price. Personally, I don’t understand this connection as it seems eLMP mostly benefits inflexible units. PJM outlines the potential to create a new competitively priced, load-following product that would compensate flexible units for ramping up and down as needed. The reward for flexibility with this product is clear. PJM states that perhaps inflexible units that can operate as a result of the flexible units would be allocated a portion of the market costs for the load following product. This is consistent with cost causation principles. Flexibility is also seen as a key generator reliability attribute, beneficial to a diverse and adaptable grid. So, why did PJM consider but fail to include a load-following product in the proposal?

These and many other questions will be raised as PJM continues to explore this proposal.

Christina Simeone

Kleinman Center Senior FellowChristina Simeone is a senior fellow at the Kleinman Center for Energy Policy and a doctoral student in advanced energy systems at the Colorado School of Mines and the National Renewable Energy Laboratory, a joint program.