Fuel, Food, and Fertilizer: The Interwoven Impacts of the Russia-Ukraine War

The last three years have been a stark reminder of the correlation between energy and food prices. One year into the Ukraine war, and on the tail end of the COVID-19 pandemic, the data suggests that global trade disruptions have threatened global food security by increasing competition for critical mineral fertilizers.

One of the most important and overlooked drivers of global food security is the link between energy markets and fertilizer production. The global food system witnessed a steep rise in prices over the course of the COVID-19 pandemic, while energy markets faced an economic tightening in 2021. But this situation escalated drastically into a global energy crisis, as a result of Russia’s invasion of Ukraine in February 2022, exposing millions of people to a potential food security crisis.

The number of people facing acute food insecurity has more than tripled since 2017 and reached a record high of 345 million last year. One major contributing factor to this situation has been the grain export interruptions through the Black Sea, which have been a central component of Russia’s war strategy. The war has also impacted energy prices, which has had a spillover effect on the global food supply chain and rising fertilizer prices.

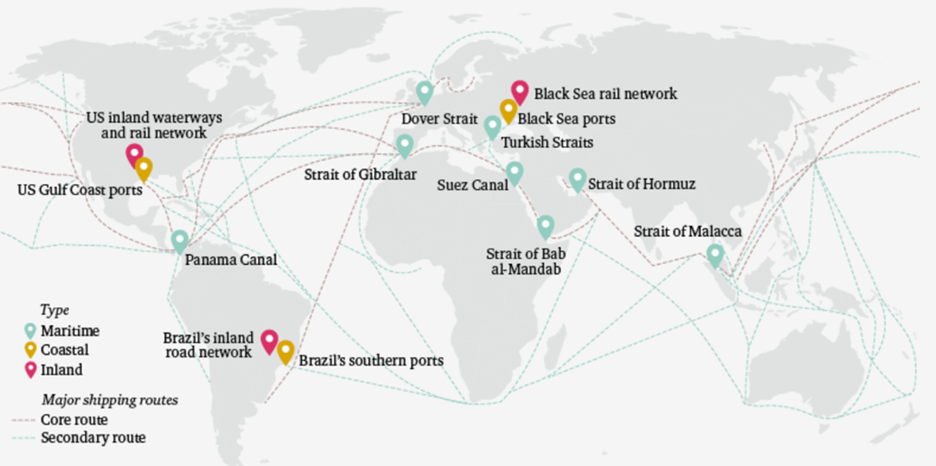

This isn’t the first time the global supply chain has experienced such chokepoints and delays in trade. In 2021, the multi-day shutdown of the Suez Canal exposed the vulnerability of global trade and the food system to even a temporary blockage of key trade routes. The growing global dependency on these chokepoints has increased in the past decade and the risks arising from even a minor disruption or closure of these transit points has never been greater.

The Linkages Between Fuel, Fertilizer and Food Security

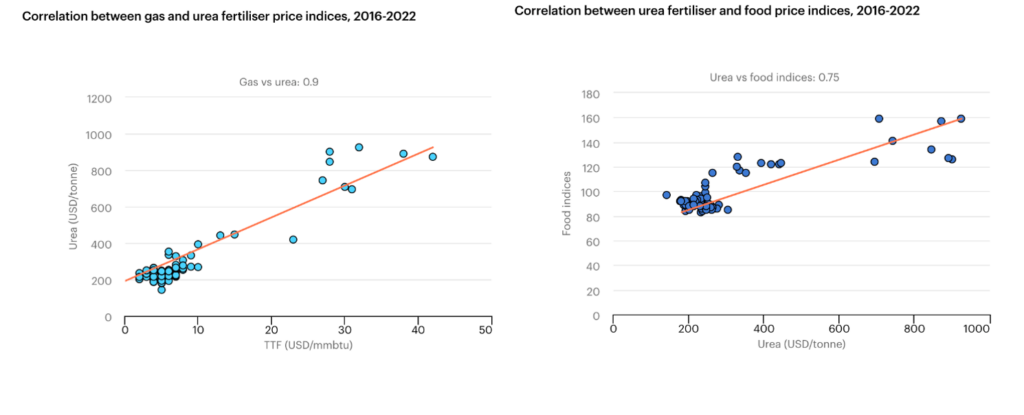

The agriculture industry uses direct and indirect energy for various purposes. Electricity and fuel are consumed directly for water irrigation, manufacturing, processing, and packaging, while use of mineral fertilizers to boost crop yields account for the sector’s indirect energy consumption. Natural gas is the key raw material used in the production of nitrogen fertilizers such as urea and ammonia, accounting for 75-90% of manufacturing costs. Therefore, higher energy prices nearly always translate to a higher cost of fertilizer, and ultimately contribute to higher food prices, as demonstrated in Figure 2.

The COVID pandemic, along with the energy disruptions caused by European geopolitical tensions caused the price of natural gas to rise steeply, with prices in Europe and Asia reaching their highest levels since the 1973 oil crisis. Owning to these high gas prices, fertilizer companies curtailed production, with some shutting down entirely.

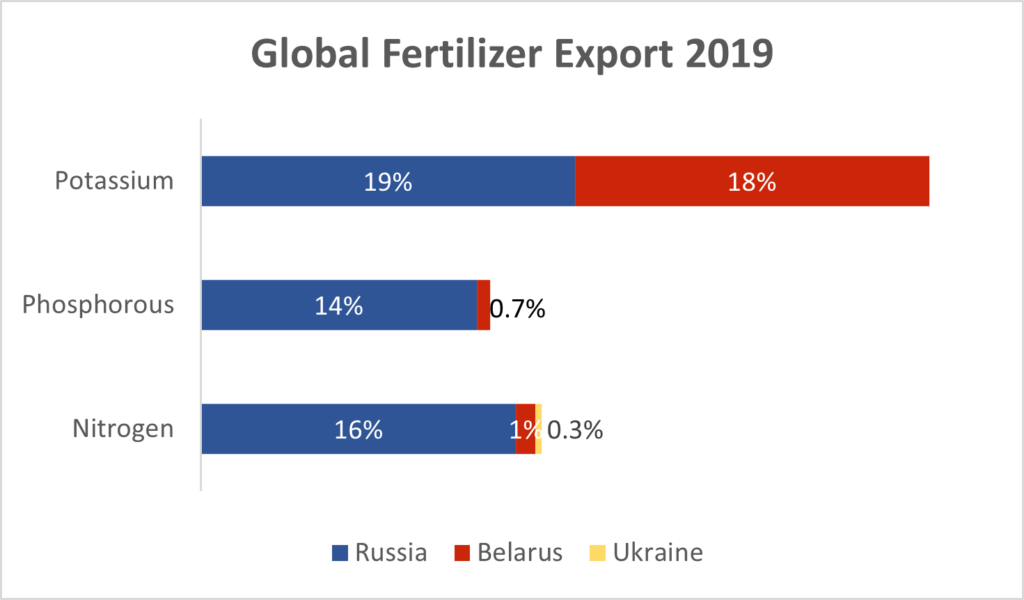

Russia and Ukraine are major exporters of food, together accounting for nearly 30% of global wheat exports, 15% of the world’s corn exports, and about 2.1% of the world’s soybean exports. The two countries are also significant players in the global fertilizer industry. Figure 3 showcases the global fertilizer export of Russia, Belarus, and Ukraine in 2019.

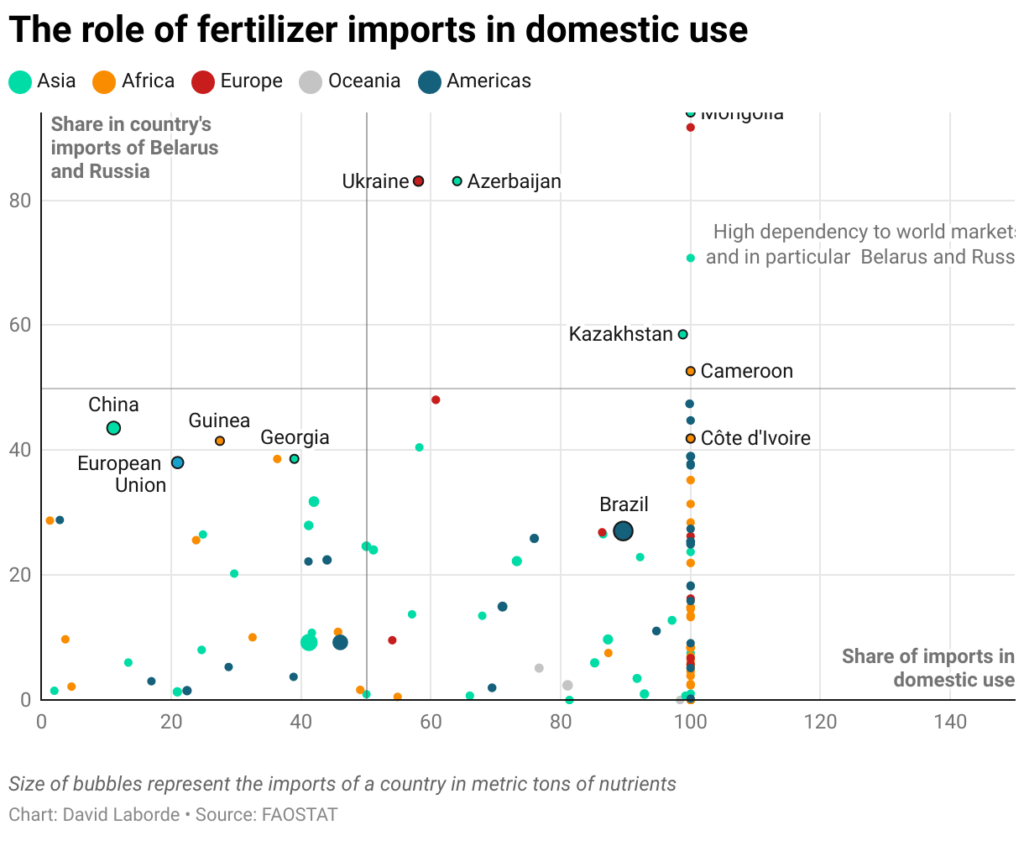

Sanctions on companies in Russia and curtailment of supplies from Belarus have restricted the global availability of these key fertilizers. Furthermore, Russia has refused to extend the “Black Sea Grain Initiative” deal beyond May 18, 2023, weaponizing food against low and middle-income countries. This initiative is aimed at providing safe transportation of grain, related food products, and fertilizer, including ammonia, from designated Ukrainian ports to global markets. Figure 4 shows that nearly three-quarters of all countries satisfy at least 50% of their fertilizer consumption from Russia and Belarus.

Examining the Aftermath: One Year since the Russia-Ukraine War

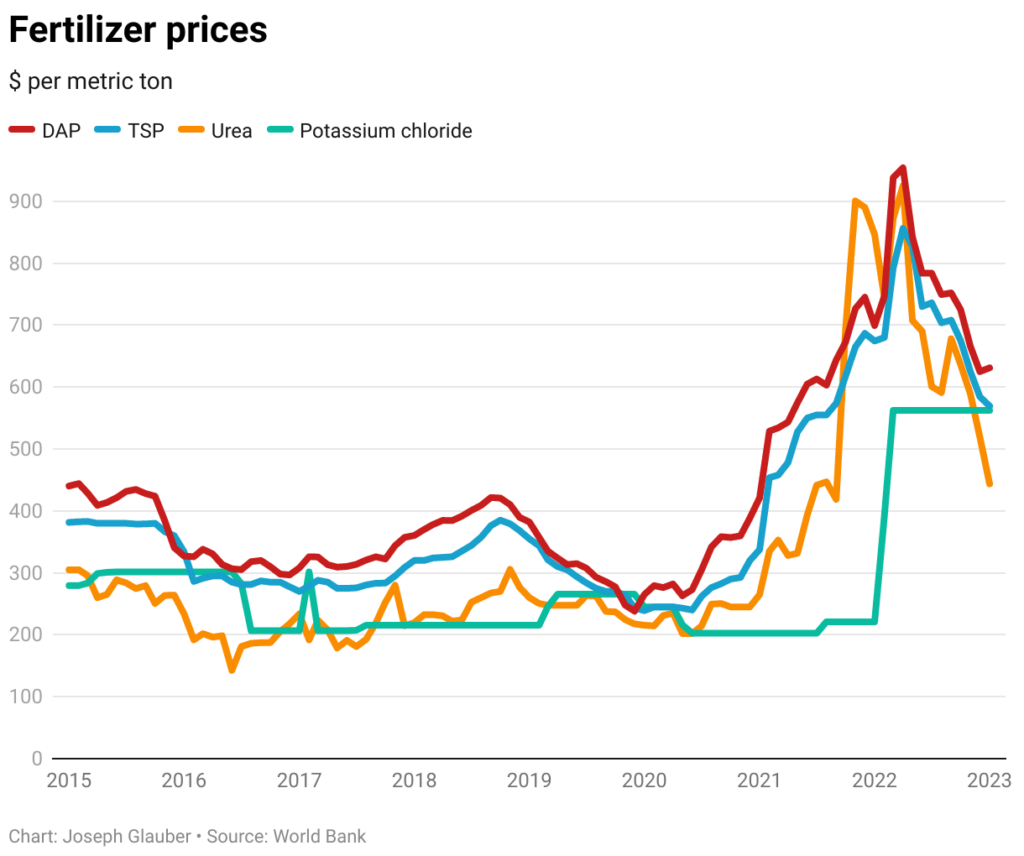

Throughout 2022 and into 2023, international fertilizer prices have eased but remain high by historical standards. For example, the price of urea reached a maximum of USD 925.00 per metric ton in April 2022 and fell significantly to USD 443.75 per metric ton in January 2023. Figure 5 shows the falling trend of fertilizer prices (in USD per metric ton) from their peaks in 2022.

Note: DAP = diammonium phosphate. MOP = muriate of potash.

Many farmers are responding to this imbalance by reducing their use of fertilizer and shifting to crops like soy which are less dependent on mineral supplements. These compounded distortions of the fertilizer market could continue to exacerbate the global food crisis, with staple crops like wheat and rice facing the brunt of the shortage.

Swift policy actions need to be taken to mitigate the exposure to such disruption by investing in trade infrastructure, strengthening trade deals, and developing emergency mechanisms for food and fuel distribution. It is also essential to leverage the present crisis by investing in new technologies and practices that focus on minimizing fertilizer demand while maintaining quality yield. For example, cutting-edge technologies are available that can monitor soil conditions in real time. This data can be used to adjust and optimize fertilizer usage. It is also the best time to introduce regenerative agricultural practices that can help build a more climate-resilient agriculture system, restoring environmental balance and helping avert future food crises. At an international level, free open trade must be encouraged, supported by the phasing out of export bans imposed by major food producers.

Naimat Chopra

2022 Kleinman Energia FellowNaimat Chopra is pursuing a master’s degree in social policy and data analytics at the School of Social Policy & Practice (SP2). She is the 2022 Kleinman Energia Fellow.