Challenges in Funding and Scaling Cleantech Innovations: Insights from the 2019 NREL Industry Growth Forum

MBA Student Sid Radhakrishna attended the NREL Industry Growth Forum and learned firsthand about some of the challenges facing the cleantech field.

For the last twenty years, National Renewable Energy Lab (NREL) has hosted an Industry Growth Forum where the nation’s leading cleantech entrepreneurs, investors, policy-makers, and ecosystem partners come together to build relationships and discuss the cutting-edge matters of the day. With the Kleinman Center’s support, I had the opportunity to attend this year’s forum and learn about the challenges that the field has faced.

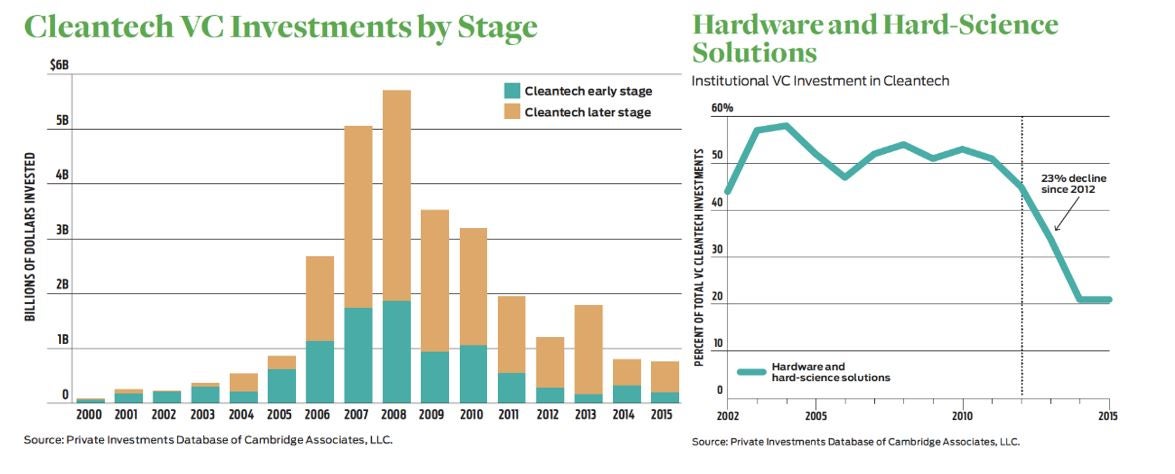

One theme was clear: cleantech investing has been a rocky road. A landmark report published by MIT’s Energy Initiative in 2016 detailed that over the course of the cleantech “boom” of the mid-2000s, venture capital (VC) investors deployed $25 billion into the sector and lost over half of it. These losses led capital flows to quickly dry up, slowing startup activity.

Data from Cambridge Associates reveals similar trends—VCs moving away from cleantech, resulting in less early-stage funding to support new cleantech ventures. Investors carried forward a negative perception of cleantech, which impeded political support as well.

At the forum, I connected with one of the authors of the MIT report, Dr. Ben Gaddy, currently chief technology officer and director of investments at the Clean Energy Trust. Dr. Gaddy shed light on why emerging cleantech startups encounter so much difficulty. These ventures have much more technology risk than typical VC investments. Clean tech companies are commercializing fundamentally new materials and processes that, in many instances, have only recently emerged from scientific labs.

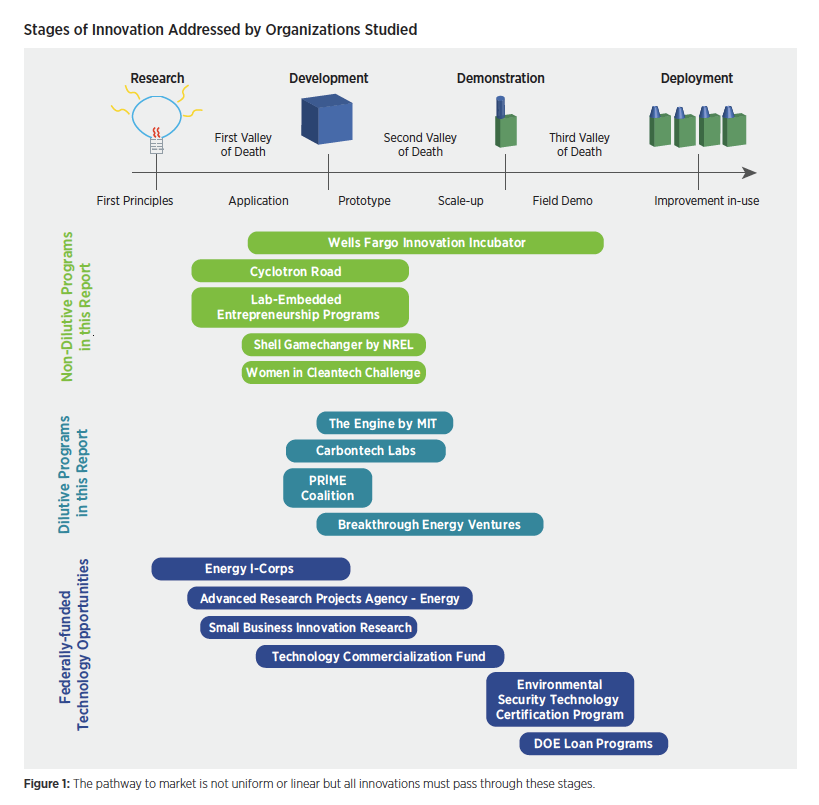

Cleantech firms face not one but up to three valleys of death. The first is creating a working prototype to validate with the market. The second is selling a functional, proven product. The third is scaled deployment that enables the company to reach financial sustainability and to gain mainstream commercial acceptance.

Innovations are also more expensive to scale, often requiring hundreds of millions of dollars of investment, sometimes even before the core technology has completed development. Unlike biotech—a similar sector where successful firms enjoy healthy profit margins—cleantech firms often operate in highly competitive commodity markets that require economies of scale for sustained profitability.

The forum provided the opportunity to connect with entrepreneurs like Philip Taynton, chief technology officer at Mallinda. Taynton described challenges of balancing technical risk and market risk and the multiple “valleys of death” that threaten to impede a venture’s progress towards commercialization.

“Technology is the easy part,” said Taynton, explaining its relative ease in comparison to figuring out the fundraising game. Fundraising creates daily challenges of who, when, and where to focus those conversations. Every funder has a different perspective on where they see themselves along the technical and market risk spectrum and their own set of constraints.

After hearing the entrepreneur persective, I wanted to understand this equation from the cleantech investors’ side of the table. So I sought out Penn alum Abe Yokell (C’03), managing director and founding partner at Congruent Ventures, a $92 million cleantech venture firm launched last year.

To be effective, Yokell said that cleantech investors need to be intimately familiar with scientific breakthroughs, emerging technologies, and their commercial potential. The best investors are often former cleantech entrepreneurs or applied scientists from places like ARPA-E.

However, since early-stage venture capital already takes five to eight years to prove out returns, Yokell attested that cleantech VCs still encounter difficulty obtaining capital commitments from limited partners such as pension funds and endowments. They tend to be risk-averse and focus on past performance of fund managers, which raises the bar given cleantech’s historical difficulties.

In recent years, however, investors are revisiting cleantech, with prior losses now rolling off their balance sheets along with widespread proliferation of ESG investing and climate finance mandates. According to Bloomberg New Energy Finance, global cleantech venture capital and private equity investment in 2018 jumped 127% to $9.2 billion, the highest since 2010. Global clean energy investment across asset classes exceeded $300 billion for the fifth year in a row.

Cleantech investing’s comeback has been promising news, but it still has a long way to go. The UN’s International Panel on Climate Change recommended that $2.4 trillion of investment is needed each year through 2035 to avoid catastrophic damage from climate change caused by global temperatures rising beyond 1.5°C from pre-industrial levels. Absent support from governments and international agencies, bold steps are necessary.

This is the first of a two-part blog series recapping the 2019 NREL Industry Growth Forum. Part two discusses several promising models highlighted at the Forum that look to bridge funding gaps for commercializing cleantech innovation.