An International Investment Treaty Could Jump-Start Sustainable Development

The Stockholm Treaty Lab contest has awarded prizes to two model investment treaties that could open new possibilities for international cooperation on renewable energy.

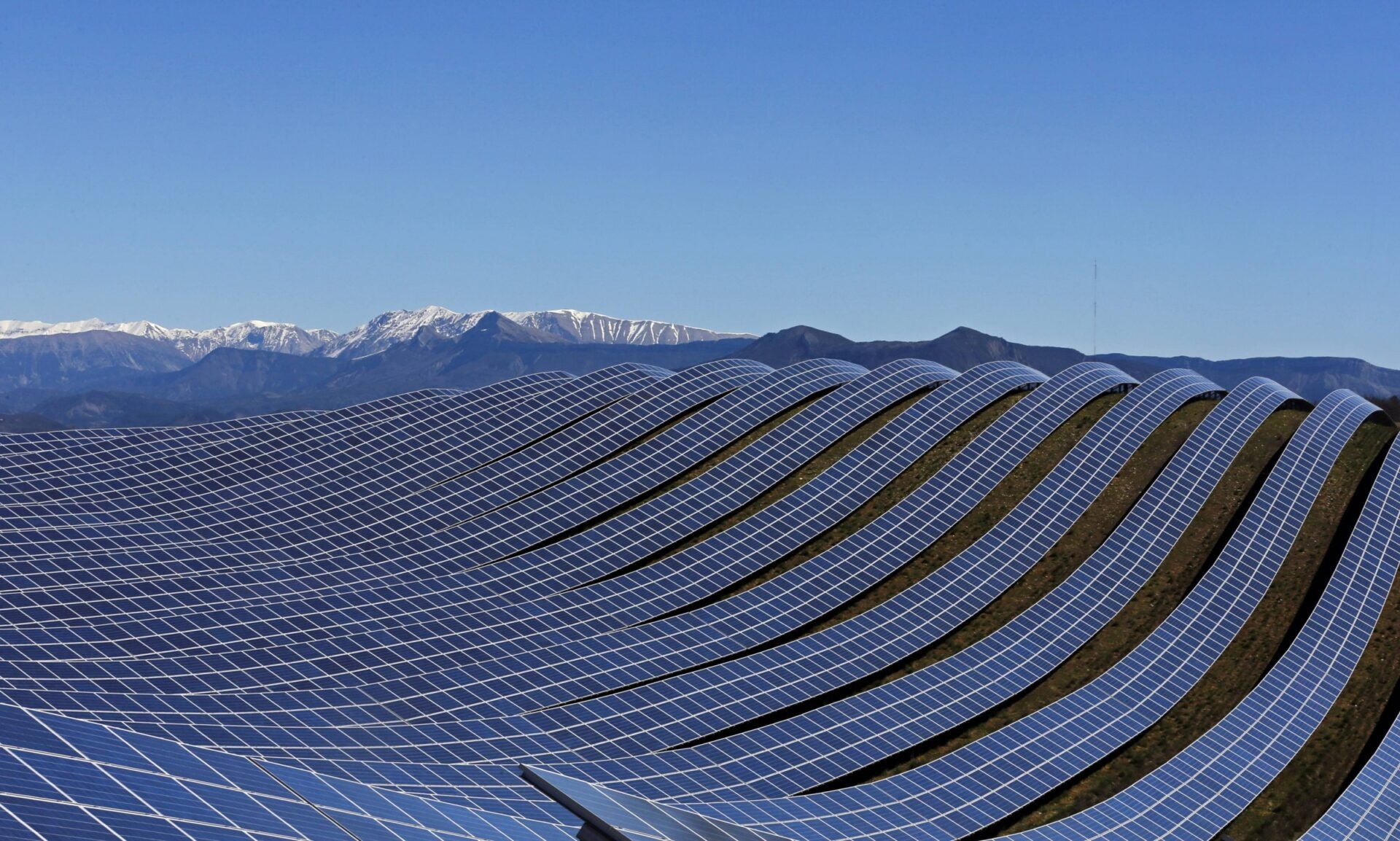

Achieving a global sustainability transition, as set forth by the 2015 Paris Climate Agreement and the Sustainable Development Goals, will require trillions of dollars in new investments between now and mid-century. Many nations—and cities—have committed to ambitious energy and climate mitigation targets, but in order to effectively catalyze these words into actions on a global scale, cooperative foreign investments will be needed. Despite the global commitment to sustainable development, there exists no international legal framework in place to specifically manage foreign investments in sustainable projects and programs. Without a transparent and neutrally enforced sustainable investment treaty, global development will struggle to meet future environmental targets.

In a commendable effort to fill this “policy gap,” the Arbitration Institute of the Stockholm Chamber of Commerce (SCC) recently concluded their Stockholm Treaty Lab contest. This contest required participating teams to draft a model treaty intended to incentivize sustainable foreign investments, especially in the areas of climate mitigation and adaptation. Over twenty teams consisting of international legal, energy, finance, and environmental professionals drafted what they saw as the best treaty framework to complement the goals and commitments of the Paris Agreement and the Sustainable Development Goals. Last month, the SCC announced the two winning teams, each of which took a somewhat different approach to addressing the policy challenge at hand.

Treaty on Sustainable Investment for Climate Change Mitigation and Adaptation

The first winning team designed a treaty that not only encourages sustainable investments but also outlines forceful steps for the signing parties to discourage unsustainable investments. This includes the elimination of subsidies and export privileges for the fossil fuel industry. Although the Stockholm Treaty Lab prompted teams to develop treaties that specifically addressed climate mitigation and adaptation investments, this team determined that climate investments are just one of many types of sustainable investments that could be covered by this treaty.

This team also included an article in the treaty acknowledging that the transition to a sustainable, renewables-based economy could have short- and long-term economic impact on communities, and that signing parties must commit to ensuring a just transition. Rather than having a universal definition of what is a “sustainable investment,” this treaty allows the host party to classify an investment as sustainable, unsustainable, or non-classified within 60 days of request by the investor.

The Green Protocol

The second winning treaty, abbreviated as the “Green Protocol” is designed to work as an amendment to existing international investment treaties such that an existing treaty “shall continue to apply only to the extent that its provisions are compatible with the provisions of this Green Investment Protocol.” A Green Investment in this treaty is defined very specifically as any project or program that contributes to the aims of the Paris Agreement or the Kyoto Protocol, or one that is made in an effort to reduce carbon emissions. As with the first winning treaty, this treaty allows parties to establish a framework for green investment certification, and to incentivize projects and programs that meet that certification.

Both of these winning treaties provide a legal framework with which foreign investors and host states can ensure that investment collaborations are reliably regulated by a neutral and transparent agreement. Both treaties include articles to ensure that signing parties will not discriminate against sustainable investment and that investors will be treated, and will behave, in accordance with international and domestic law regarding corruption, expropriation, transparency, and human rights. Host parties of both treaties reserve the right to regulate investments in accordance with domestic regulations, and agree to send unresolved disputes between investors or host states to an independent tribunal.

These kinds of protections for sustainable investments have never formally been agreed upon, and doing so would remove several financial and economic barriers to achieving global climate and sustainability targets. The Stockholm Treaty Lab Prize not only provides us with two impressive models of how to fill this policy gap, but also demonstrates the efficacy of crowd-sourcing international policy design.

The winning treaties will be presented on September 28th, 2018 in New York City at the 13thannual Columbia International Investment Conference.

Oscar Serpell

Deputy DirectorOscar Serpell oversees all student programming, alumni engagement, faculty and student grants, and visiting scholars. He is also a researcher, writer, and policy analyst working on research initiatives with students and Center partners.