A Risky But Promising Solution for Battery Storage

The merchant model will always entail risk but innovative firms in the UK are using this risk to drive returns for batteries higher, potentially solving one of the central financial problems stymying the transition to a zero-carbon energy system.

Batteries have long been the presumed solution to the fundamental challenges introduced by the intermittency of solar and wind energy. However, despite the assiduous decline in the cost of storing a kilowatt-hour over the past decade, making enough financial return to justify batteries’ significant capital expenditures (CapEx) remains difficult. A solution to that problem—the merchant model (MM)—was one of the central topics of the New Energy Infrastructure & Energy Storage 2020 conference.

The MM generally holds that battery systems can best return value by freely arbitraging the price volatility inherent in any renewable-based power system. In its simplest version, batteries intake energy when there is a surplus (i.e. during the day) and sell it back to the grid when prices rise either due to demand spikes or supply shortages (i.e. at night).

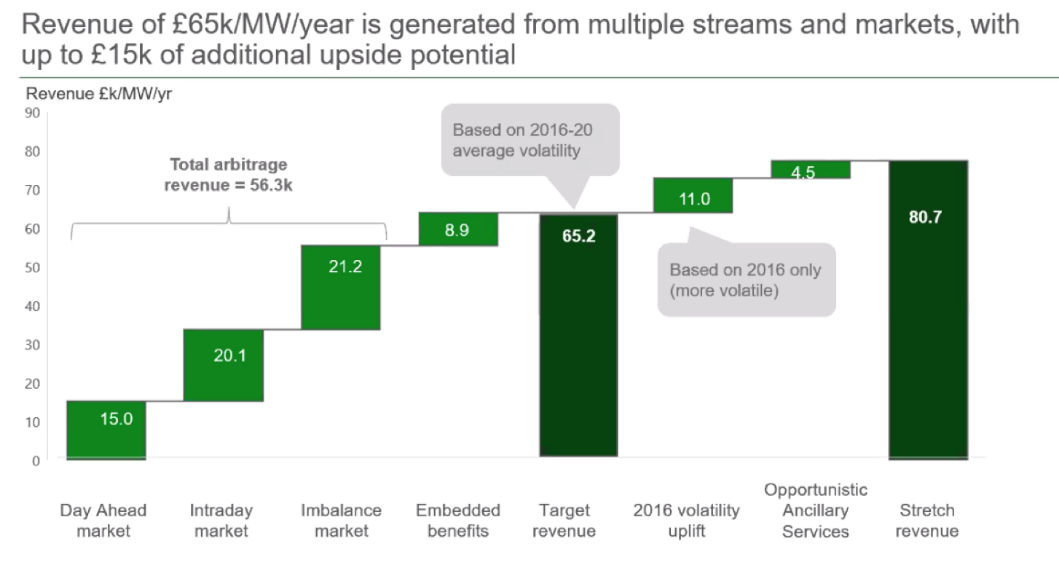

According to Mike Ryan, a keynote presenter and a Commercial Director at Habitat Energy total arbitrage under this model could approach £65,000 a Megawatt a year, taking advantage of three distinct power markets, each with their own level of volatility:

Traders—using powerful statistical models ingesting weather, asset degradation, and historical pricing data—can attempt to predict these markets’ fluctuations and sell energy stored in their assets at a profit. All told, the Internal Rate of Return (IRR) on batteries could reach as high as 18% under the MM and improve the return on conjoined solar projects by as much as 5%.

At the conference, the “Spotlight on Making the Merchant Model Work” panel highlighted that the MM has several winds at its back. First, it was born from a dearth of subsidies and does not require government intervention as other battery monetization strategies might. The UK government was scarred by its experience with solar subsidies and subsequently went light on incentivizing batteries.

As such, the MM has emerged most predominantly in the UK as battery developers had to create their own returns. Second, everyone agrees that the volatility that fuels the MM, will only increase as more and more renewables replace dispatchable, carbon-based sources. These promising forces, and the positive direction of financial returns for UK battery systems more broadly, have pulled in a variety of investors, both backing trading companies—such as Habitat and Vest—and battery developers, such as Pivot Power which was recently acquired by Électricité de France (EDF).

But headwinds remain. First, there are legacy systems—both in infrastructure and customs—that defy the perfections of a supposedly hyper-efficient market. Among these are:

- degradation concerns, as constantly charging and discharging a battery shortens its useful life

- utility concerns around things such as “inertia,” the frequency at which electrons move on a transmission line

- competition (in regions outside the UK) with other funding approaches, most centrally a grid services-based model.

Moreover, it is not clear whether the best approach is for asset owners to outsource the trading to focused firms or build an in-house operation.

But the central concept of the merchant model will always entail risk. The good news is that innovative firms in the UK are using this risk to drive returns for batteries higher, potentially solving one of the central financial problems stymying the transition to a zero-carbon energy system.

The author attended this conference through the Kleinman Center student grant program. Pursue your energy education with a student grant.

Avery Wendell

MBA Student, Wharton SchoolAvery Wendell is a master of business administration student at the Wharton School and is pursuing a dual master of public policy at Harvard University.