Try Harder, Gazprom. Why Poland Could Choose LNG

High prices that Poland and the CEE region paid in the past can make the switch to LNG and other non-Russian gas supplies easier.

This piece was first published in Forbes on December 21, 2018. It is reprinted with their permission.

This week PGNiG, the Polish state-owned energy company signed yet another long-term contract for delivery of U.S. LNG in early 2020s. The contracts have been part of Poland’s move away from Russian gas—a move predicated upon geopolitical considerations and comparatively high prices that Russia has charged Poland as the dominant market supplier.

Now those high prices may come back to haunt Russia. The European natural gas market has become more liquid and diversified thanks to the advent of large-scale LNG exports. High prices that Poland and the CEE region paid in the past can make the switch to LNG and other non-Russian gas supplies easier.

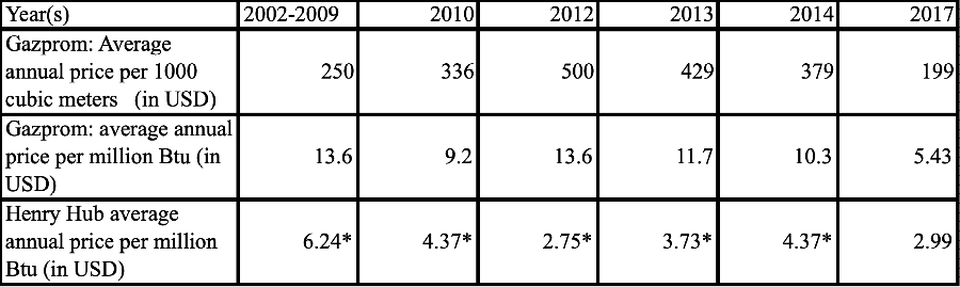

Under the Yamal Contract, signed with Gazprom for the period of 1996 to 2022, Poland has been buying Russian gas on the basis of a generally disadvantageous formula indexed to price of crude. As a result, Poland paid on average $13.6 per million Btu in the period between 2002 and 2009, and in excess of $9 per million Btu between 2010 and 2014 (Table1). Even in 2017, when crude prices were low, Russia charged Poland $7.99 per million Btu. This is a sizable markup over Russia’s reported cost of approximately $3.5 per million Btu, which includes production, transport, and export duties.

Table 1. Average Prices of Natural Gas Delivered to Poland under the Yamal Contract & at Henry Hub

* Henry Hub prices are provided for informational purposes. Competition potential between Russian gas and HH prices between 2002 and 2014 is only hypothetical since the U.S. did not start exporting LNG until 2016 and Poland had no infrastructure to accept LNG until 2015, when the LNG terminal in Swinoujscie began operating.

Thanks to its dominant position, Gazprom has also charged Poland higher gas prices compared to customers with a more diverse pool of suppliers. Reportedly, in 2012 Poland paid $1.64 more per million Btu of gas than Western European countries paid on average. When compared to its immediate neighbor, Germany, this difference was $1.77 per million Btu in 2010, $1.36 in 2013, and $1.53 in 2014. As oil prices fell, the spread became significantly smaller but has not disappeared completely (in 2017 Poland still paid $0.20 more per million Btu than Germany).

Once the Yamal contract expires, given a more liquid natural gas market and Poland’s diversification efforts, the price differential with Western Europe and high prices unrelated to market conditions should disappear. Gazprom will then need to compete. With the low cost of its gas, Gazprom is more than likely to win any price war with more expensive LNG.

But since geopolitical concerns have been at the forefront of Poland’s natural gas policy, the country is also likely to prefer to pay a certain premium for non-Russian gas over the hypothetical price that Gazprom would offer post-2022. Historically high prices can make paying such a premium more economically and politically palatable. In a way, the premium could be “invisible,” i.e. generate no price increases, since the price of LNG would be similar if not lower than the high prices of natural gas that Poland is accustomed to.

Take for example the Henry Hub (HH), the main pricing point in the United States for natural gas and the basis for U.S. LNG prices. Even if the price at HH rises to the upper bond of EIA predicted levels (approx. $5 per million Btu), U.S. LNG could still compete with prices that Gazprom charged Poland through most of the 2010s (see Table 1). Precisely this line of argumentation employed PGNiG’s CEO, Piotr Wozniak when he stated this October that U.S. LNG contracts for delivery in the early 2020s come at a 20% discount, relative to current prices of Russian gas.

Of course, this does not mean that Gazprom will disappear from CEE markets altogether. After all, it is the lowest cost supplier on the European market and it can effectively compete for the market if it offers lower prices. However, all else equal, countries like Poland that had to pay higher prices for Russian gas in the past are somewhat less economically and politically constrained in factoring geopolitical benefits into their decision. As a result, as long as alternative supplies are readily available, Gazprom would have to compete much harder for those markets than what a simple economic calculus would suggest.

Anna Mikulska

Senior FellowAnna Mikulska is an expert on European energy markets and energy policy. She is a senior fellow at the Kleinman Center and a fellow in energy studies at Rice University’s Baker Institute for Public Policy.