Teeming with Carbon Taxes

There has been a flurry of carbon tax bills introduced in Congress this term from members on both sides of the aisle. How do these bills compare and will any of them become law?

There has been a flurry of carbon tax bills introduced in Congress this term from members on both sides of the aisle. Here is a summary of what has been proposed thus far:

- January 24: Energy Innovation and Carbon Dividend Act, Ted Deutch (D-FL)

- April 10: American Opportunity Carbon Fee Act, Senator Sheldon Whitehouse (D-RI)

- July 25: Climate Action Rebate Act, Senator Chris Coons (D-DE)

- July 25: Stemming Warming and Augmenting Pay (SWAP) Act, Congressman Francis Rooney (R-FL)

- July 26: Raise Wages, Cut Carbon Act, Congressman Dan Lipinski (D-IL)

- August 2: America Wins Act, John Larson (D-CT)

Before we dig into the similarities and differences between these plans, what is a carbon tax? Simply put, a carbon tax is a price put on each unit of carbon dioxide released into the atmosphere. This price creates an incentive for emitters to lower emissions.

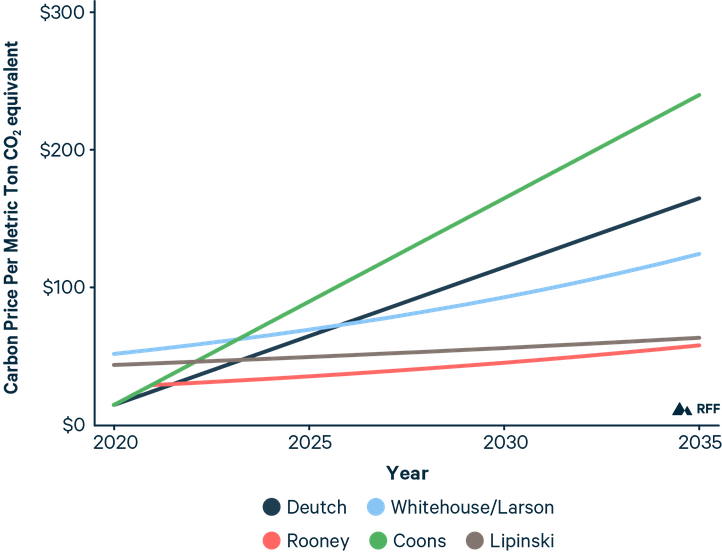

All of the proposed bills put a price on carbon across the energy system. Where they differ is primarily in the price path and revenue use. Resources for the Future created a thorough table that explains the details of each proposed bill and compares the bills to one another.

As you can see in the figure from Resources for the Future, some proposals are more ambitious, like Senator Coons bill that raises the price per ton of carbon dioxide to over $200 by 2035. Not surprisingly, Republican Congressman Rooney has the most moderate plan of the bunch.

And the members have different ideas about how the generated funds should be spent. Representative Deutch’s Energy Innovation and Carbon Dividend Act proposes using all the funds for taxable carbon dividends. The other bills include a variety of revenue uses including payroll tax cuts, social security beneficiary payments, energy efficiency research and development, infrastructure spending, and more.

While there are a lot of ideas floating through the halls of Congress, does any one of them have a chance of becoming law? The short answer is no. Congress has been notoriously deadlocked and divided, with a Republican controlled Senate and a Democratic controlled House. When Congress returns from August recess, there will only have a few weeks before we begin to move into an election year. And in an election year, a controversial bill tackling climate change is highly unlikely to see a vote.

Recent research from the Kleinman Center shows that a carbon tax vote is largely ideological. “While the carbon tax has the favor of economists and policy elites, American voters are not yet ready to jump on the bandwagon. Carbon taxes remain a highly ideological and polarizing issue,” writes the authors. Politicians are not expected to fight for an issue that doesn’t have the backing of their constituents.

While it is doubtful that any of the six proposed bills will become law in this Congress, it is exciting that these issues are being discussed and debated. And encouraging that perhaps sometime in the near future the needle will move even closer to a carbon tax becoming a reality.

Mollie Simon

Senior Communications SpecialistMollie Simon is the senior communications specialist at the Kleinman Center. She manages the center’s social media accounts, drafts newsletters and announcements, writes and publishes content for our website, and regularly posts to our blog.