Tax Substitution as Climate Policy for Hard-to-Decarbonize Sectors

Reforming existing taxes offers an opportunity to start implementing decarbonization incentives without increasing the tax burden on industries.

The so-called hard-to-decarbonize sectors pose a challenge to climate policy. These sectors significantly contribute to the global economy but operate on carbon-based technologies for which there are no scalable alternatives in the near future. For this reason, any substantial reduction in emissions within these industries requires a proportional reduction in their economic activity and, consequently, faces strong resistance from current stakeholders.

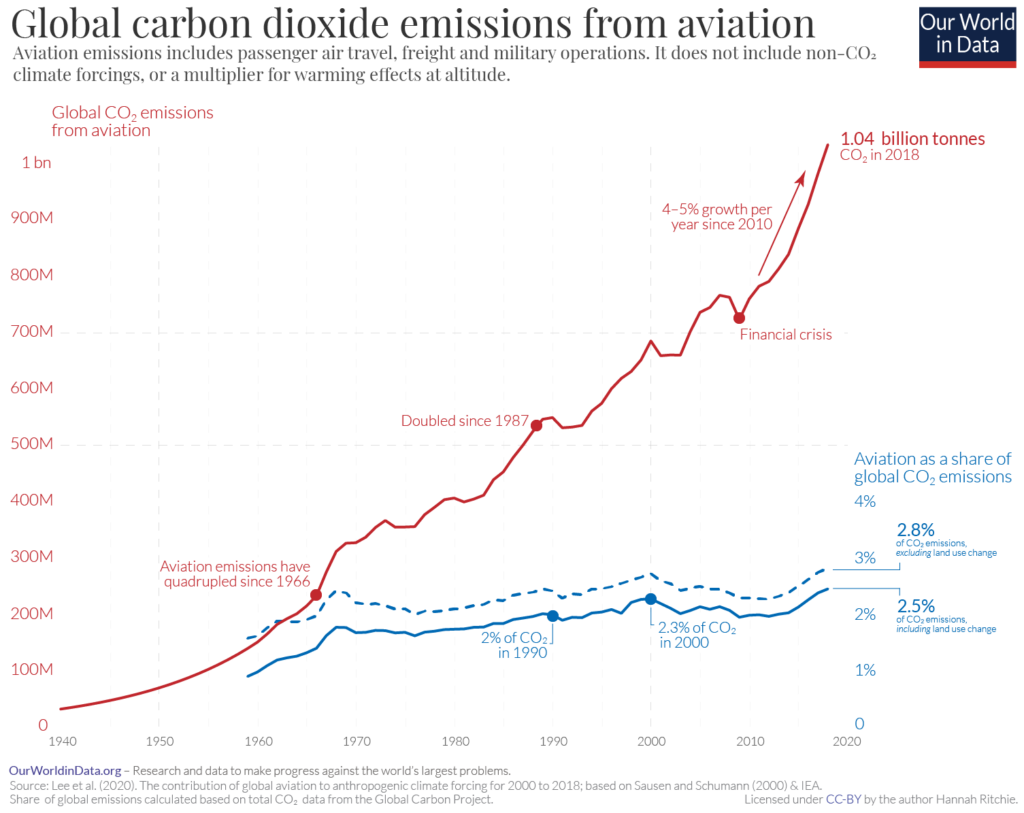

Aviation presents a clear example of these challenges. The sector accounts for 2.5% of CO2 emissions and 3.5% of the effects leading to climate change. Despite notable efficiency improvements since the 1980s —which have cut emissions per passenger-mile by more than half—total emissions from aviation have skyrocketed due to vigorous increase in demand and fast expansion of service networks. Still, alternative fuel technologies are either far from commercial viability or constrainted in scalability due to land-use change

During the last decade, governments and international organizations pushed policies to curb aviation emissions. In 2012, aviation was included in the European emissions trading scheme, though only covering flights within the European Union.

In addition, the Carbon Offsetting and Reduction Scheme for International Aviation (CORSIA) intends to halt the growth of CO2 emissions from international flights. By 2027, CORSIA will require airlines to offset any emissions that exceed 2019 levels. Nevertheless, large domestic aviation markets remain mostly unregulated—most notably, the United States, which accounts for over 45% of passenger-miles traveled in domestic flights worldwide.

The concept of carbon pricing is behind most policies to curb emissions. The economic principle underlying carbon pricing is that, by increasing the cost of a polluting service in proportion to the damages it causes to third parties, it establishes the incentives for market participants to cut emissions.

However, an often-overlooked part of the equation is that existing non-carbon-based taxes can have a similar impact, albeit in imperfect ways. For instance, consider the passenger ticket sales tax in the American aviation sector, currently set at 7.5% of the fare.

All else equal, longer flights burn more fuel, incur higher operating costs, and have a higher fare; thus, higher emissions pay a higher tax. In ongoing research, I estimate that, on average, a ton of CO2-equivalent emissions (this is, accounting for other aviation greenhouse gases) corresponds to about $70 paid in sales tax.

While a ticket sales tax might help reduce demand for air travel and its emissions, this taxation scheme introduces distorted incentives. For instance, connecting flights travel longer distances and, on average, burn more fuel per passenger than direct flights. However, passengers dislike waiting and are willing to pay more for direct flights. Consequently, fares for direct flights are higher— and so are the taxes collected. Hence, this scheme taxes the least polluting options proportionally more. Correcting these distorted incentives presents an opportunity for a first step to implement carbon pricing in taxed industries.

Excise aviation taxes collected in the United States are appropriated by the Airport and Airway Trust Fund and help fund the Federal Aviation Administration and its infrastructure investments. Taking as given that this tax revenue is necessary to maintain an operational sector infrastructure, it is possible to reform the way this revenue is collected to generate climate benefits.

One way is to switch the tax base from airfares to jet fuel volume, which is directly proportional to aviation emissions. In fact, such jet fuel tax already exists in the United States (currently set at 4.4 cents/gallon for commercial airlines, or about $3 per ton of CO2-equivalent), thus lowering the institutional requirements for a tax substitution.

This example of revenue-neutral tax substitution shows at least three positive features. First, in the short run, it puts in place incentives for consumers and airlines to switch to more efficient routes, resulting in lower emissions for the same traffic. Second, since this approach does not increase the total tax burden on the sector, it is bound to face lower opposition than the addition of a standard carbon tax. Third, considering how competition in this sector has traditionally driven airlines’ race for lower costs, cost incentives will also affect how the sector grows. Establishing the right incentives sooner will steer airlines towards more efficient technologies and help speed up the transition to a carbon-neutral aviation sector.

This post highlights research presented at the Northeast Workshop on Energy Policy and Environmental Economics, hosted this year at the University of Pennsylvania.

Diego Cardoso

Doctoral Student, University of GenevaDiego Cardoso is a postdoctoral researcher at the Institute of Economics and Econometrics, University of Geneva. His research focuses on the design and analysis of environmental policies for climate change and water.