Part 1: Philadelphia Energy Solutions Bankruptcy Basics

The East Coast's oldest and largest refinery filed for bankruptcy last week after a long history of being unprofitable. Find out why.

As you’ve probably heard, the Philadelphia Energy Solutions (PES) neighborhood refinery—the oldest and largest refinery on the East Coast — filed for Chapter 11 bankruptcy restructuring last week.

The bankruptcy plan intends to allow PES to continue uninterrupted operations while shedding or converting debt, extending debt maturities, and gaining $260 million in new capital. One of the many critical parts of the plan assumes that the bankruptcy court will relieve PES of $350 million in RIN obligations. (54)

If the bankruptcy plan is unsuccessful, PES may be forced to enter into Chapter 7 liquidation. The refining and marketing segment is estimated to be worth $643 to $708 million upon liquidation, while the logistics segment is estimated at $77 to $100 million. (Exhibit C)

Background on the Business

The PES refining complex includes two separate refineries with a total of 335,000 barrels per day (bpd) of crude oil distillation capacity, situated near Center City, Philadelphia. The refining business employs 1,100 people and represents 28% of the U.S. East Coast’s refining capacity. The PES refineries rely on light, sweet crude oil feedstocks, delivered by rail and ship, which it primarily sells into the New York Harbor market (19)

Stated Reasons for Bankruptcy

In its filing to the U.S. Bankruptcy Court for the District of Delaware, PES primarily blamed regulatory compliance costs associated with the federal Renewable Fuels Standard (RFS) policy for its economic woes.

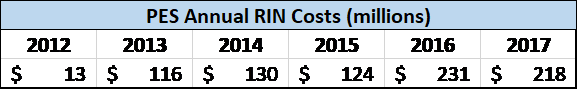

PES asserts it cannot blend biofuels onsite because the pipeline owners that distribute its product will not accept blended gasoline. PES also notes it is disadvantaged compared to its integrated oil company competitors that comply with the RFS through their fuel blending operations. As a result, PES has relied on buying RFS compliance credits (called renewable identification numbers, or RINs), which cumulatively cost PES $832 million between 2012 and 2017 (see the annual RIN cost break down to the right). PES asserts its 2017 RIN expenses were twice its annual payroll and represent its largest expense after crude oil. (17)

PES blames the elimination of affordable access to domestic crude (namely from the Bakken formation) as the second reason pushing it into Ch. 11. Next, PES cited industry-wide reduced gross refining margins—a measure of the profitability of converting crude oil to refined products—as another critical factor driving bankruptcy.

We will kick the tires on these claims in the next blog of the series. For now, let’s review a little history.

A Distressed Asset

PES has a long history of being unprofitable. Back in 2011, former refinery owner, Sunoco, announced it was exiting the refinery business in order to focus on its more profitable segments, like retail operations.

Sunoco intended to shut down its last two remaining refineries—in South Philly and Marcus Hook—by July 2012, if a new buyer couldn’t be found. Management claimed the company’s northeast refinery operations lost $772 million between 2009 and 2011, and the company could not justify the new investments needed to make the two refineries sustainable. Sunoco was acquired by Energy Transfer Partners in April 2012.

A combination of political will, public subsidies (e.g. $10 M for rail terminal expansion, $15 M for catalytic cracker turnaround, and the creation of Keystone Opportunity Zone tax benefits), private capital from the Carlyle Group, and continued participation from Sunoco coalesced to save the refinery—creating PES.

Currently, Carlyle owns 65% of PES, followed by PES Equity Holdings (successor-in-interest to Sunoco) at 32.5%, and current and former PES senior management owns 2.5%.

So, PES was in bad shape to begin with, but did the business fall victim to unforeseen events and bad government policy (like the RFS) as PES claims, or could its challenges be predicted and managed? Check out the next blog in this series to learn more.

Note: A more detailed publication on the Philadelphia Energy Solutions bankruptcy is in development.

Christina Simeone

Kleinman Center Senior FellowChristina Simeone is a senior fellow at the Kleinman Center for Energy Policy and a doctoral student in advanced energy systems at the Colorado School of Mines and the National Renewable Energy Laboratory, a joint program.