Part 1: Cost-of-Service Retired More Coal

The U.S. Department of Energy’s (DOE) Notice of Proposed Rulemaking (NOPR) on Grid Resiliency promoted the idea of guaranteed cost-plus-profit returns to generators that store 90 days of fuel on-site (e.g. coal and nuclear plants) and operate in competitive power markets that have capacity markets.

The merits of DOE’s claims about resiliency and its proposed solutions have been widely contested. However, for the sake of argument, let’s assume for a minute that on-site fuel storage is the key to a resilient power grid.

If this is indeed the case, then the Trump administration is ignoring a huge vulnerability in the system, specifically, cost-of-service regulated coal and nuclear plants.

The Trump administration has been outspoken in its support to bring back coal use and coal jobs. And, the NOPR is certainly meant to help avoid additional coal and nuclear plant retirements in the future. But, the reality is, regulated markets have retired more coal and nuclear units and capacity than competitive markets.

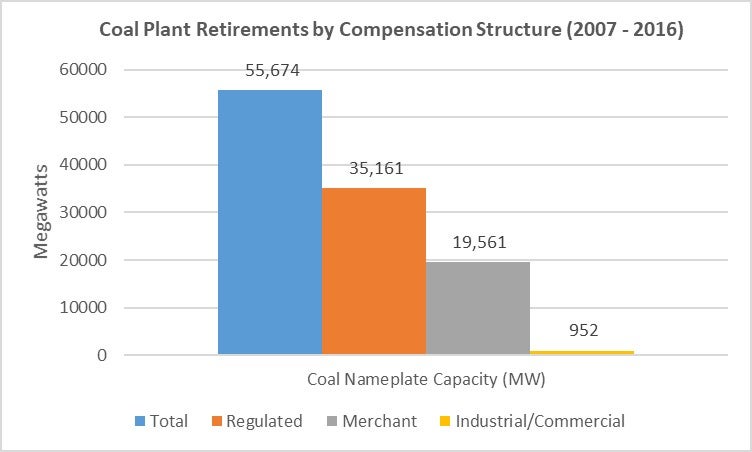

U.S. EIA data on power plant retirements from 2007 – the starting point of the U.S. shale gas revolution – through 2016, revealed a total of 531 coal units were retired representing 55,674 megawatts of nameplate coal capacity. And in fact, 63% of these retired coal megawatts were cost-of-service regulated, while 35% were merchant megawatts operating in competitive markets. The remainder was capacity owned by commercial and industrial entities, primarily for on-site power needs.

Using the same data source and time period (2007-2016) examined for coal, six nuclear units have retired representing 4,770 MW of nameplate capacity, with 76.4% of that capacity located in cost-of-service areas.

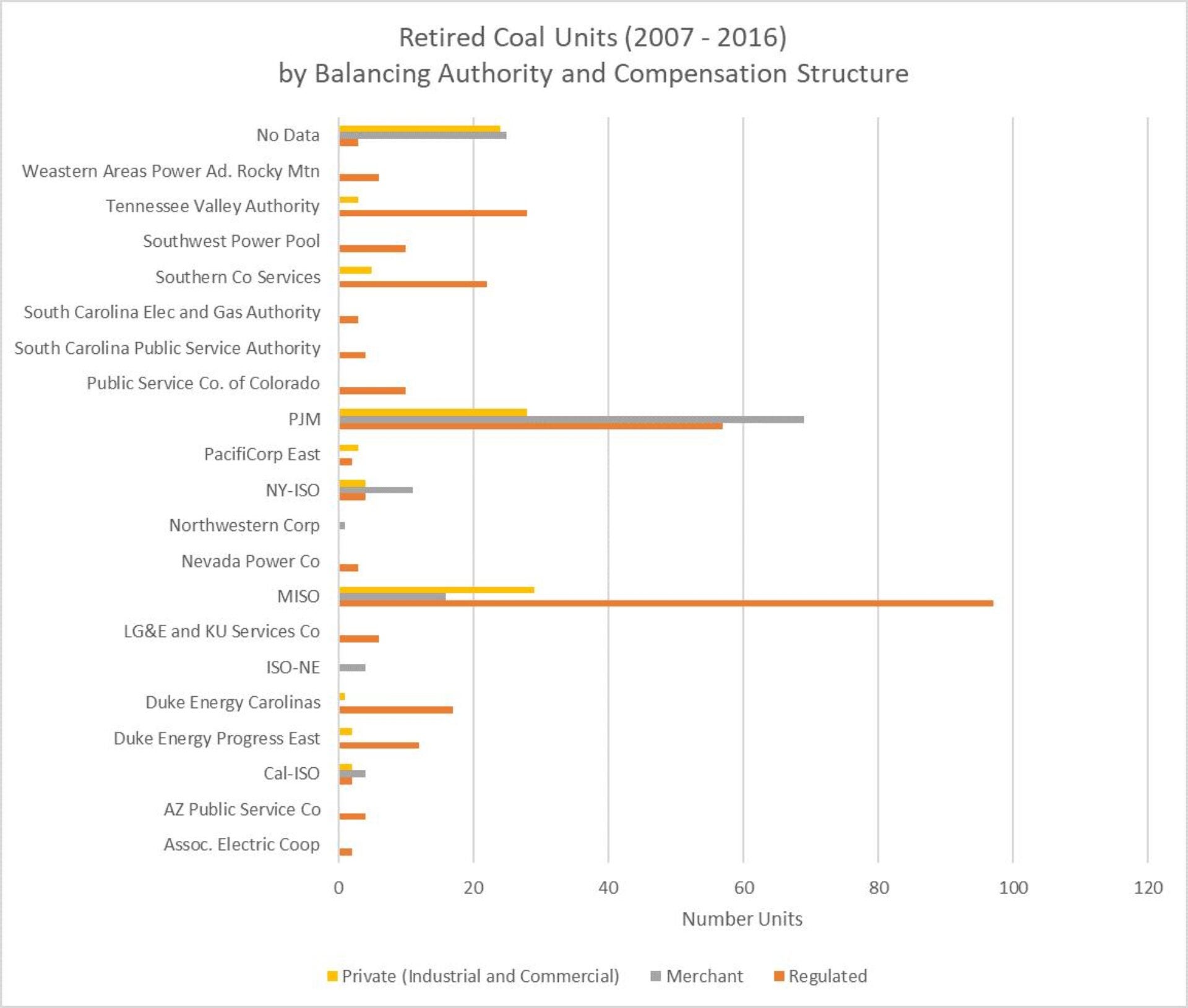

The graphic in the blog intro shows coal retirements (including combined heat and power) by compensation structure and balancing authority. Balancing authorities maintain the balance between power supply and demand. Regional transmission organizations and independent system operators that facilitate competitive markets also function as balancing authorities.

As you can see, the largest amount of coal capacity loss occurred through retirement of regulated units operating in MISO and PJM. PJM had the largest amount of merchant coal retirements. And indeed, DOE’s NOPR targets PJM most directly.

But, if grid resiliency is in imminent danger, why the focus just on competitive markets? And only those competitive markets that have capacity markets?

The authority DOE used in issuing its Resilience NOPR was tied to the agency’s historic relationship to the Federal Energy Regulatory Commission (FERC), the latter having jurisdiction over competitive wholesale power markets. Therefore, DOE’s concerns limited to insuring resilience in competitive markets is likely related to limits on jurisdiction.

However, this continues to beg a fundamental question. If losing “fuel-secure” capacity is such a big problem, and regulated markets have retired a greater amount of coal and nuclear plants that store fuel onsite, why isn’t the Trump administration doing more to ensure resilience in regulated markets?

In the absense of competitive wholesale markets, states have the ultimate say on resource decisions in regulated areas. So, the Trump administration doesn’t have the same tools at its disposal to direct state decisions. But, it could go to Congress for a solution, convene regulated states to explore resilience concerns, issue voluntary resiliency guidance to states, commission studies on resiliency in regulated markets, or take other actions.

DOE’s focus on competitive markets is perhaps forward looking.

Studies and analysis indicate that both coal and nuclear plants will continue to be challenged in competitive markets, as cheap shale gas, flat load growth and other conditions persist.

But, regulated markets are continuing to move towards cheaper natural gas, demand side, and renewable energy solutions. And with these plans, more coal (and perhaps nuclear) retirements can be explected in regulated areas.

Check out the next post in this blog series exploring planned coal plant retirements in regulated areas, which explores an interesting disconnect in DOE’s resiliency approach.

Christina Simeone

Kleinman Center Senior FellowChristina Simeone is a senior fellow at the Kleinman Center for Energy Policy and a doctoral student in advanced energy systems at the Colorado School of Mines and the National Renewable Energy Laboratory, a joint program.