Investment Horizons: Capitalizing on Energy and Infrastructure in Colombia and Venezuela

At a recent conference, panelists discussed sanctions and how Colombia and Venezuela can approach the energy transition while maintaining economic development.

This insight was the result of attendance at a Baker McKenzie-sponsored event by the Association for International Energy Negotiators

Colombia and Venezuela, two neighboring nations in Latin America, have both been affected by United States energy policy over the past decade. The United States Agency for International Development (USAID) has played a key role in supporting the delivery of “cleaner, more affordable, and more reliable electricity to homes and business” in Colombia, and there is a robust history of U.S. economic sanctions against Venezuela and the country’s oil sector.

The attention that both countries receive in relation to energy matters is understandable given their status as major oil exporters, with Colombia being the fifth-largest oil exporter to the United States in 2021, and Venezuela, despite its struggles under U.S. economic sanctions, sitting on the largest oil reserves in the world. These characteristics make both countries attractive for investment on a pure natural resource basis, but a combination of regional and international policy amongst other factors has led to lackluster involvement from foreign investors, with foreign direct investment (FDI) currently coming mainly from players with high-risk appetites. U.S. foreign policy directly contributes to the ease at which both countries can electrify and decarbonize their grids and utilize their natural resources to boost their local economies.

In regard to the energy transition, both countries face challenges given the local abundance of fossil fuels. Hydropower does represent a significant portion of power generation in both regions, with hydropower accounting for up to 77% of Colombia’s electricity supply, despite lackluster solar and wind deployment. For instance, wind and solar made up 1.5% of installed capacity in Colombia in 2022 and limited generation in 2021 in Venezuela. In the case of Venezuela’s energy transition, U.S. economic sanctions have been particularly detrimental to the decarbonization of oil and gas and the deployment of renewables.

On October 18, 2023, the United States Office of Foreign Asset Control (OFAC) lifted sanctions on Venezuela’s oil and gas sector—more specifically General License 44 (GL 44), “Authorizing Transactions Related to Oil or Gas Sector Operations in Venezuela”—until it expires on April 18, 2024. Previously, transactions allowed by GL 44 would be prohibited by the “Venezuela Sanctions Regulations, 31 CFR part 591.”

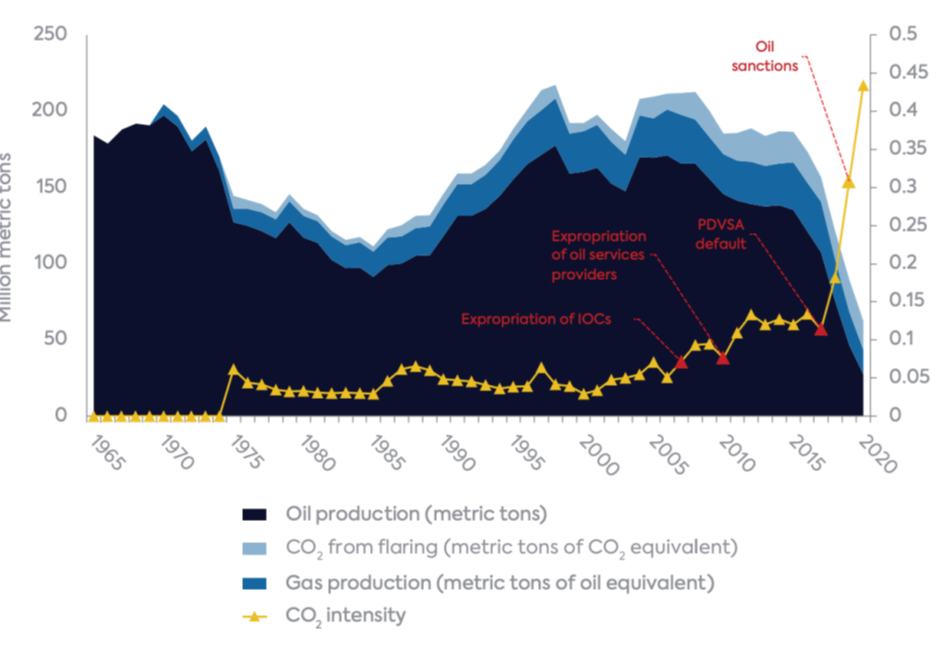

These actions by OFAC follow a history of sanctions against Venezuela’s oil industry beginning in August of 2017. In “Assessing ESG Risks in National Oil Companies: Transcending ESG Ratings with a Better Understanding of Governance,” authors Dr. Luisa Palacios and Caraina Vidotto Caricati show the effect of oil and gas sanctions on CO 2 emissions per barrel of oil produced.

As highlighted in “Investment Horizons: Capitalizing on Energy and Infrastructure in Colombia and Venezuela,” a Baker McKenzie-sponsored event by the Association for International Energy Negotiators that took place this February in Houston, Texas, the sanctions paradigm creates major challenges to the decarbonization of Venezuela as uncertainty around sanctions bars investments in climate outside of investors with extraordinary risk tolerance or unique regional knowledge.

Panelists also noted the current uncertainty around the magnitude of collaboration between Colombia and Venezuela given their complex political environments. Ultimately, the United States can help Colombia and Venezuela achieve their National Determined Contributions (NDCs) as per the Paris Agreement and accelerate their energy transitions by crafting creative policy solutions that protect investments in decarbonization specifically. This not only aids economic development in the region but also serves American interests by enhancing the nation’s financing role in Latin America, especially considering countries like Russia and China are also actively seeking to obtain greater influence in Latin America.

Lukas von Koch

Wharton Undergraduate StudentLukas von Koch is a Wharton student, concentrating in finance and minoring in energy engineering, and founding team member at Green Swan Capital, a project-finance investment firm focused on oil and gas decarbonization in emerging markets.