Exploring Exelon’s Microgrid Efforts

Exelon, through its regulated and competitive affiliates, is spearheading proposals in multiple states to build and pilot microgrid projects.

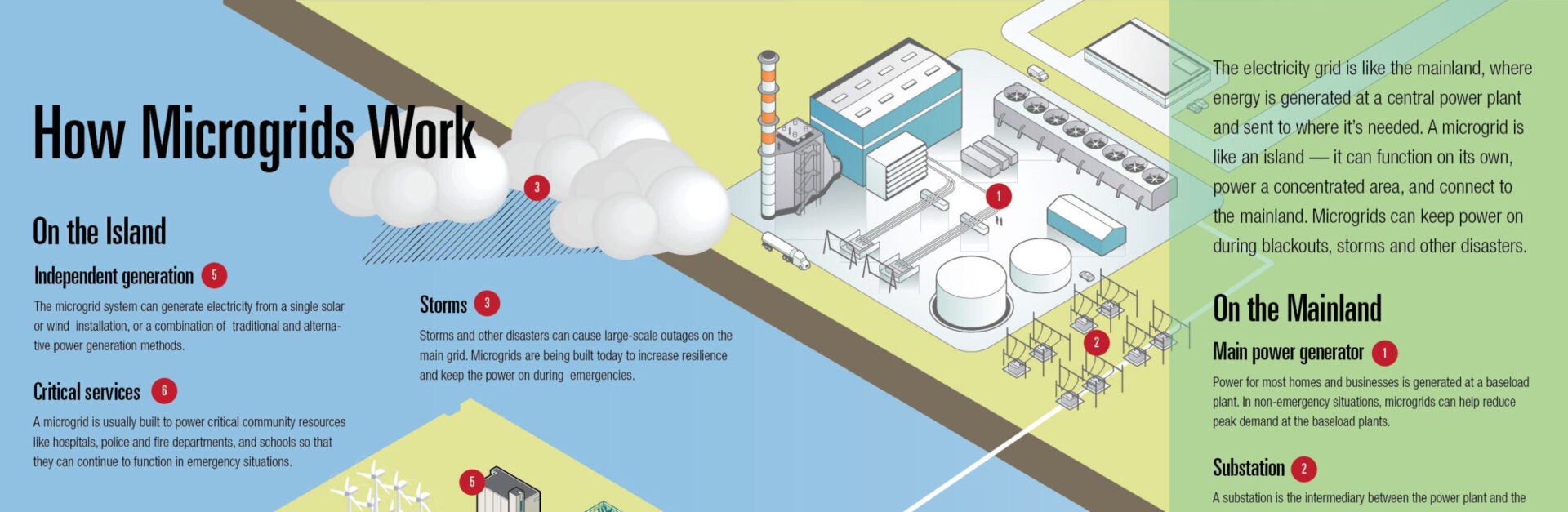

Microgrids are mini-electric grids complete with generation and distribution capabilities that can connect and disconnect from the larger electricity grid. Since microgrids can operating independently from the grid, for example during extreme weather events or grid power outages, they increase local electricity reliability. The reliability benefits of “customer-specific” microgrids are especially valuable to entities like hospitals, universities, industrial and commercial facilities, emergency responders, military bases, and others willing to pay a premium for dependable power supply.

Increasingly, “public purpose or community microgrids” that serve a broad set of diverse consumers in a municipality, for example, with a focus on key commercial and governmental services, are also being explored to meet enhanced resiliency objectives. The public benefits of these community microgrids are cited as justification for utility ownership of certain assets and associated ratepayer cost recovery.

Exelon has proposed microgrid projects hoping to improve storm-related resiliency, advance understanding of policy and technical issues, and to develop a blue-print for broader microgrid deployment. Of course, utility-ownership of these assets could be a powerful growth opportunity in an otherwise stagnant load environment. But, Exelon has also partnered with transmission developer Anbaric to advance a new business model to competitively deploy independent microgrids, starting in New York.

The projects below are all being developed in deregulated generation markets, meaning for projects that envision utility ownership of generation assets, there could be complications. Some projects have been successful, others have fallen short, and some are yet to be tested.

The Winners (Rely on Grant Funding and Innovative Finance)

Constellation (in Connecticut) – In April 2016, Constellation began construction on a microgrid project in Hartford’s Parkville neighborhood. The project will use natural gas-powered fuel cells by Bloom Energy, with Constellation providing the construction and operating services. The project will not be utility-owned, rather, a unique partnership between Constellation and Bloom Energy is enabling economies of scale to develop 40 MW of fuel cell projects at more than 170 locations in California, Connecticut, New Jersey, and New York. Constellation is providing equity financing and will own majority equity interest in the Bloom Energy fuel cells deployed through the partnership. The Hartford microgrid project is also being supported by a 15-year power purchase agreement with the City of Hartford, over $2 million in state grant funds, and revenues from state low emission renewable energy credits.

Commonwealth Edison (Illinois) – In 2015, ComEd proposed legislation that would provide $300 million to fund development of six microgrid projects in the state. With the legislation stalled, ComEd is planning to move forward with its Bronzeville solar-storage microgrid project on the south side of Chicago, thanks in part to $4 million in DOE funding. The project would install microgrid integrated solar-storage technology, and would be part of a microgrid cluster near the Illinois Institute of Technology. In 2014, ComEd also received $1.2 million in DOE funding to develop microgrid inverter technology.

The Disappointment

Baltimore Gas & Electric (Maryland) – In December 2015, BG&E proposed two community microgrid projects using natural gas and diesel generation to power various community facilities (e.g. groceries, public buildings, gas stations, clinics) in Baltimore City and Howard County, at a combined cost of $16.2 million. This was after a 2014 Maryland “Resiliency Through Microgrids Task Force” report concluded that, among other things, electric distribution companies should incorporate public purpose microgrids into their grid upgrade planning processes and endorsed utility ownership of public purpose microgrids in the short-term. However, in July, MD PSC rejected the BG&E microgrid proposal due to concerns, for example, that ratepayer funding for the microgrids would run counter to the state’s retail competition laws. Stakeholders claimed that customers switching over to microgrid power during an outage would be deprived of the ability to pick their electricity supplier. The MD PSC also took issue with failure to consider cleaner types of generation, opposed cost recovery through a surcharge on all customers instead of through a rate case, and encouraged third-party ownership of generation.

The Unknowns

PECO (Pennsylvania) – In October 2015, the PA PUC approved PECO’s Long Term Infrastructure Improvement Plan that included speculative language about a potential $50 million to $100 million microgrid investment in the 2017-2020 timeframe, for which PECO would have to refile for recovery. In May 2016, PECO filed a request with the PA PUC for rate recovery to construct, own, and operate a community microgrid integrated technology pilot project in Concord Township, Delaware County. PECO has requested approval to recover costs of microgrid distributed generation assets from its customer base. The $35 million project would include two community microgrids incorporating natural gas engines, utility scale solar, two batteries, and four electric vehicle charging stations. PECO’s entire rate base would contribute to recovery through a combination of automatic rate adjustments and recovery through subsequent rate case. A hearing on the case is scheduled for mid-September.

PEPCO (Washington, DC) – As part of the initial settlement agreement approving the merger of Exelon and Pepco Holdings, Exelon would agree to build four ratepayer-recovered microgrids in DC. However, this requirement was later stripped from the agreement, for example, over anti-competitiveness concerns with utility-owned generation. Instead, the DC PSC opted to investigate the microgrid issue in a broader grid modernization proceeding.

No matter what you think of Exelon’s proposals, you have to give this company credit for pushing the envelope and implementing a diversified strategy. They are raising the bar on the technology (inverters), using competitive models (NY, CT), leveraging subsidies where possible (IL), incorporating a community focus (public purpose microgrid), and not shying away from contentious ratepayer and regulatory issues (MD, PA, DC).

If more distributed power, improved technology integration, and greater system resiliency are going to be needed for the future – which they are – then finding a pathway for feasible, sustainable, investment worthy success is critically important.

Christina Simeone

Kleinman Center Senior FellowChristina Simeone is a senior fellow at the Kleinman Center for Energy Policy and a doctoral student in advanced energy systems at the Colorado School of Mines and the National Renewable Energy Laboratory, a joint program.