Pennsylvania’s ZEC Bill Reveal

Though outdated, an early draft of PA's nuclear subsidy bill looks to be expensive, and represents a telling evolution in zero emissions credit policy.

This blog was updated on March 8th with more accurate pricing data.

After much anticipation, a draft bill of Pennsylvania’s version of a zero emissions credit (ZEC) program for nuclear power plants has emerged, made public by media outlet StateImpact.

The bill sponsors maintain the version revealed by StateImpact is outdated, and the draft legislation has changed significantly.

But still, let’s take a look at the policymaker starting point in PA.

The bill is an amendment to the state’s Alternative Energy Portfolio Standard (AEPS)—a renewable energy portfolio standard that includes a renewable energy Tier I requirement of 8% by 2021 (0.5% must be solar) and a 10% by 2021 non-renewable Tier II requirement that includes things like waste coal and municipal waste to energy. Electric distribution companies and competitive generation suppliers (i.e. retail suppliers) are required to comply with the AEPS by supplying the applicable percentage of total sales via Tier 1 and Tier II supply.

The bill would create a new Tier III requirement, whereby electric distribution companies must purchase Tier III credits to cover 50% of the total power sold in their service territory, regardless if sold by the distribution company’s default supply or by a competitive retail supplier.

Resources eligible to generate Tier III credits include new or existing zero emissions power from solar, wind, low-impact hydro, geothermal, and nuclear fission, provided each resource meets all of the following: has capacity injection rights within PJM (i.e. likely excludes distribution system connected resources from qualifying); cessation of operations of the new or existing zero emissions resource would increase certain air pollutants that negatively impact Pennsylvania’s ability to achieve regulatory goals or standards; cannot be owned by a cooperative; cannot have received cost-based rate recovery by a state, or received subsidies from another state.

Tier III resource eligibility is determined once at the outset of the program through a written application and commitment period, and once again after six years. This means that all new resources built after the initial qualification period (i.e. 90 days after June 1, 2019) that could potentially meet the qualification criteria would not be eligible for credits until the second six-year period.

Once the applications are submitted, the PA Public Utility Commission (PUC) is then tasked with “ranking” the eligible applicants based on a very unclear set of criteria. For example, there are qualitative criteria for eligibility (i.e. yes or no requirements based on the eligibility criteria above), but no quantitative criteria to assist in ranking (perhaps other than first come, first serve).

The first compliance year would begin on June 1, 2019. The Tier III credit price would be determined by the PUC prior to each compliance year (with the exception of the first compliance year). The Tier III credit price would be set at the average of the Tier I futures price for the current year and the two subsequent years, based on the PA AEC Class I futures published by the Intercontinental Exchange. The Tier III price cap would be 115% of the Tier III price established for 2019-2020 and the price floor would be 85% of the Tier III price established in 2019-2020.

The alternative compliance payment for Tier III – meaning the compliance cost associated with credit shortfalls—will be twice the Tier III price for the applicable reporting year, times the number of outstanding credits needed to meet compliance. Unlike Tier I and Tier II ACP payment revenues that are paid to PA sustainable energy funds to support development of new alternative energy resources, 50 percent of the Tier III ACP payment revenues will go to the sustainable energy funds and 50 percent will go to Tier III alternative energy resources.

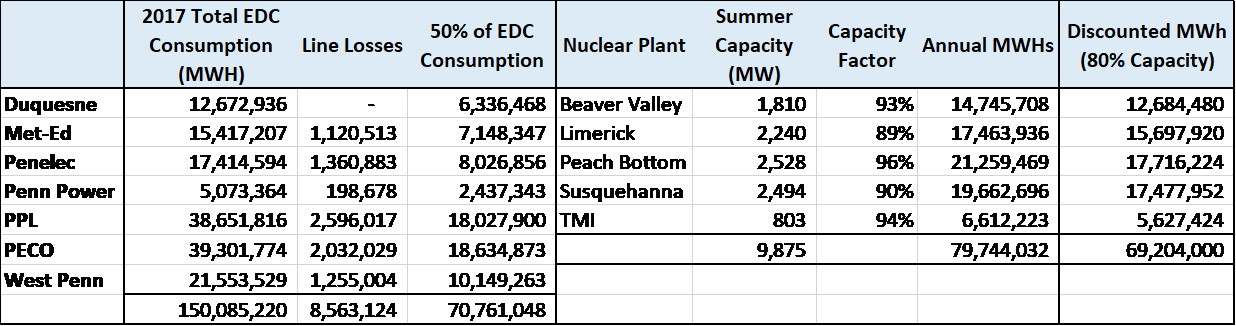

Based on data from the PUC’s most recent electric power outlook and nuclear power plant data from SNL Energy, the 50% Tier III requirement of 75 million MWh is roughly equivalent to the annual power output of PA’s nuclear fleet (see the table below). However, the bill seems to suggest a discounted nuclear capacity factor of 80%, reducing the target to 69 million MWh and potentially leaving a few million MWhs for non-nuclear Tier III resources (pending their ability to meet the eligibility criteria). However, this opportunity could disappear completely depending on the treatment of the “marginal applicant” that is likely to be a nuclear plant.

So if I have this right, assuming a 75 million MWh annual Tier III requirement (50% of 150 TWh in consumption) and a Tier III credit price of $13.08 (based on the three year average price of non-solar tier I RECs from 2015 to 2017, as reported by the PA PUC), the total cost of the Tier III requirement would be about $981 million annually (*updated to $500 million annually, see note below the table).

*When this blog was initially posted, I did not have access to ICE futures data for PA Tier I credits, so I used publicly available data on historic credit prices. Subsequently, I was provided with ICE futures data yielding a Tier III credit price of $7.05 (based on an average of 2018 annual average futures prices for 2020, 2021, and 2022 vintage years). Using these data, the resultant bill cost to the seven large EDCs in PA turns out to be about $500 million, after applying to 50% of 141.5 TWh (150 TWh in consumption, minus 8.5 TWh in line losses).

The draft bill includes “fixed resource requirement” language from FERC’s yet-to-be-finalized proposal of June 2018, essentially authorizing the state to charge PA ratepayers for capacity payments to Tier III subsidized resources that fail to clear PJM’s capacity auction as a result of FERC-required subsidy mitigation (i.e. minimum offer price rule). The annual Tier III cost does not include fixed resource requirement costs.

This Tier III cost also doesn’t account for market price increases associated with PJM’s subsequent recommendation to FERC’s June proposal, which would boost market prices to avoid price suppression from resources transitioning to the fixed resource requirement.

The Tier III program sunsets—provided an average carbon price of $15 per ton over a three-year period is put in place.

Beyond the considerable cost, this draft bill represents an interesting evolution in zero emission credit policy.

Christina Simeone

Kleinman Center Senior FellowChristina Simeone is a senior fellow at the Kleinman Center for Energy Policy and a doctoral student in advanced energy systems at the Colorado School of Mines and the National Renewable Energy Laboratory, a joint program.