Independent Monitor’s View of PJM Markets

On March 8, Monitoring Analytics, the independent market monitor for PJM Interconnection, released its 2017 "State of the Market" report. Here's a summary of some of its key findings.

On March 8, Monitoring Analytics (MA), the independent market monitor for PJM Interconnection, released its annual “State of the Market” (SOTM) report covering calendar year 2017.

Monitoring of wholesale power markets is required by the Federal Energy Regulatory Commission (FERC)—by Order No. 2000 of 1999—as one of several key functions regional transmission organizations like PJM must maintain. Among other things, the market monitor identifies market power concerns and, through analytics, helps ensure markets are competitive.

MA’s 2017 SOTM report is a must-read for those interested in PJM markets, as it provides a well-informed, data-intensive, and often divergent set of perspectives on PJM markets and policies. This blog will summarize a few highlights from the report.

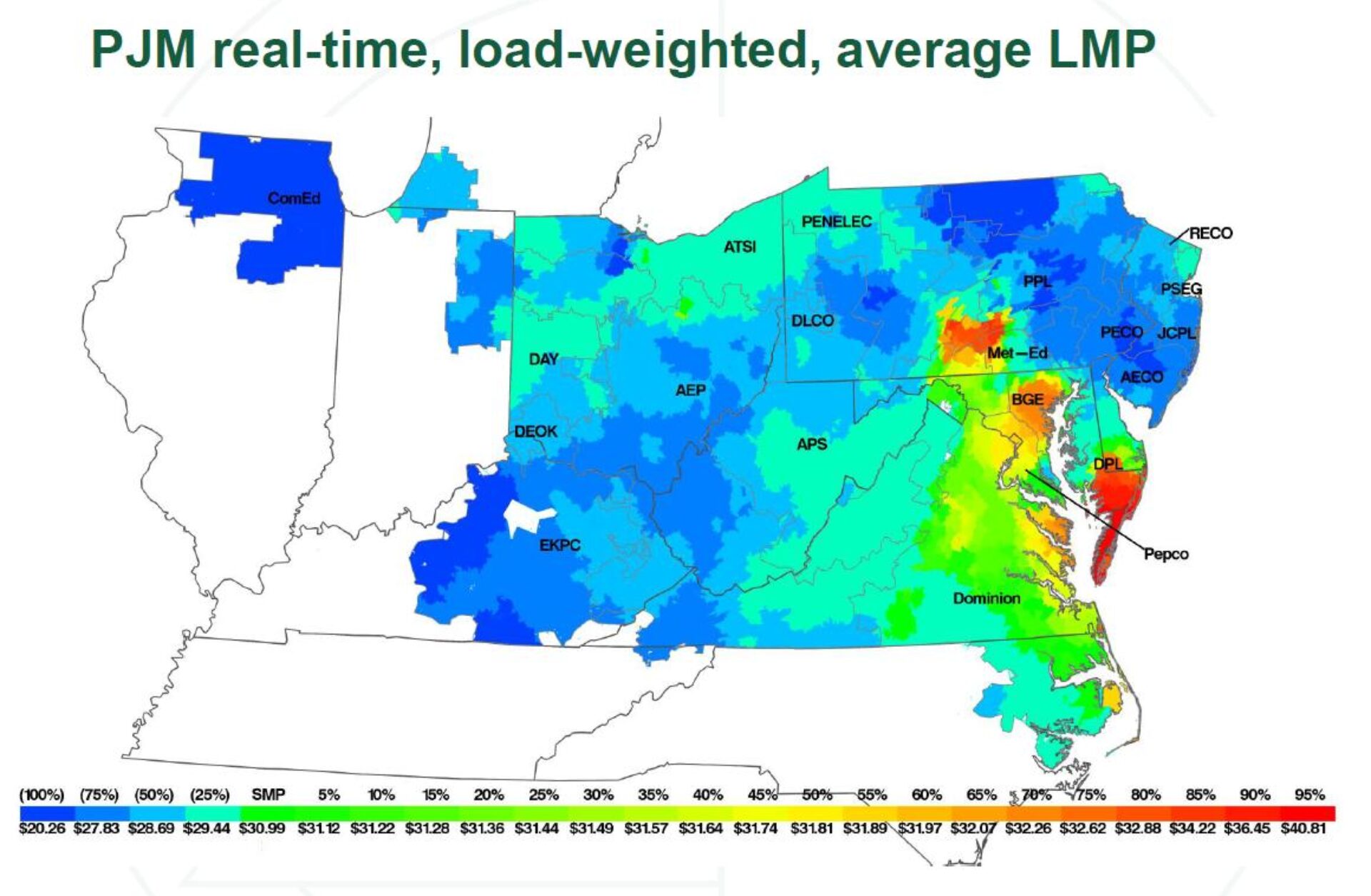

Markets are Competitive. The report asserts PJM’s energy and capacity markets are competitive, and reiterates the goal of competition is to provide wholesale power to consumers at the lowest possible price, but no lower. MA found real-time load-weighted energy market prices in 2017 were lower than in all but two years of PJM’s history, but maintains prices are not too low.

Generation Resources. MA shows in 2017, nuclear resources provided 35.6% of the power mix, followed by coal (31.8%), natural gas (27.1%), wind (2.6%), hydro (1.8%), biofuels (0.2%), and solar (0.2%). However, by the end of 2017 installed capacity was led by gas (36.8%), coal (35.4%), nuclear (18%), hydro (4.8%), oil (3.6%), wind (0.6%), solid waste (0.4%), and solar (0.2%)

Entry

Reserves. PJM had 10 gigawatts (GW) of excess reserves (24.1% reserve margin) in June 2017, which will grow to 17 GW of excess reserves (28.7% margin) by June 2018.

New Generation. Of the additional 24.8 GW cleared in capacity auctions covering delivery years 2007/2008 through 2016/2017, 72.9% were based on market funding (the rest being cost-of-service supported). Of the additional 18 GW cleared in capacity auctions for years 2017/2018 through 2020/2021, 85% were market funded. There are over 99.4 GW of generation in the PJM queue through 2024, of which over 59.9 GW are combined cycle natural gas projects, 18.4 GW are wind, and 0.199 GW are coal. About 68% of projects in the queue withdraw prior to completion.

Exit

Revenue Adequacy. The load-weighted average real-time locational marginal price (LMP) of energy was up 6% in 2017, due to higher fuel prices. Most units did not recover avoidable costs through energy market revenues, but majority of units (except some coal and nuclear units) covered the shortfall with capacity market revenues.

Retirement Risks. In addition to units currently planning to retire in 2018 or later (about 6.9 GW; 67% coal, 20% nuclear), there are between 108 and 118 units representing 22.9 to 30.7 GW of capacity at risk of retirement. These are mostly coal (38 to 46 units at 17.3 to 21 GW) and nuclear (3 to 5 plants at 2.9 to 7 GW) resources. The average steam coal capacity factor was 46%, combined cycle gas was 58%, and nuclear was 93.3%.

Nuclear Net Revenue Analysis. The report reviews publicly available data on energy and capacity prices and nuclear unit costs from the Nuclear Energy Institute for 2013 through 2017. It found nine nuclear plants (Braidwood, Byron, Davis Besse, Dresden, LaSalle, Oyster Creek, Quad Cities, Perry, and Three Mile Island) representing over 14 GW of capacity did not recover their avoidable costs in two of the last three years. A forward looking analysis for 2018 to 2020 found all but four plants (Davis Besse, Oyster Creek, Perry, and Three Mile Island) would cover their annual avoidable costs on average over the three-year period.

Other Details

Demand Response. Payments to demand response programs were down 23.5% (or $154.4 million), mostly resulting from reduced capacity market payments.

Congestion Costs. Congestion costs decreased 31.9% (or $326.1 million) in 2017.

Uplift. Total uplift charges were down 5.6% in 2017.

Policy

Threat of External Subsidies Persists and Evolves. The 2016 SOTM report included a blistering missive about the contagious nature of subsidies to uneconomic units, which could result in the undoing of competitive markets. This year’s report confirms the threat remains, but has expanded (e.g. OH, NJ, PA) and evolved to include federal subsidy proposals (i.e. the DOE Resilience NOPR). The report notes subsidizing uneconomic existing units ignores the opportunity cost associated with displacing new resources or technologies that would be economic, and asserts broader social goals (e.g. carbon reductions) can be achieved through competitive market mechanisms. However, it also acknowledges a quasi-market approach is possible where states can subsidize units and markets can be competitive, but only if there is a long-term state commitment to a cost of service regulatory model and PJM rules in place to mitigate associated market impacts. The report recommends mitigating certain state subsidies (via the MOPR-ex proposal) to maintain competitive market outcomes.

Enhanced Price Formation. The language in the report is unequivocal in its objections to proposed policy changes that would modify LMP calculations (e.g. fast start pricing, extended LMP), and the stated goal of minimizing uplift. Instead, the report argues the goal should be minimizing system production costs and supports policy improvements to scarcity pricing, pricing improvements when transmission constrains are violated, enhanced incentives for flexible units (e.g. by ceasing uplift payments to units with inflexible operating characteristics). In addition, an interesting list of provocative questions are posed about what causes inflexibility and how to promote enhanced flexibility for new and existing units.

Fuel Security. Current fuel diversity is higher than ever in PJM. MA believes concerns about fuel diversity (e.g. DOE Resilience NOPR) are being confused with fuel security. Fuel security is associated with the availability, delivery, or common mode issues of certain energy infrastructure. The report recommends PJM continue evaluating reliability risks associated with these critical infrastructure networks and systems.

Definition of a Competitive Offer. The report asserts PJM’s definition of a competitive offer in the energy market is not correct because some unit owners are including long-term maintenance costs into their bids, rather than just short-run marginal costs. A definition change and clarification is recommended to limit bids to short-run marginal costs.

These SOTM reports are treasure troves of data and information on PJM markets and trends. Be sure to dig in!

Christina Simeone

Kleinman Center Senior FellowChristina Simeone is a senior fellow at the Kleinman Center for Energy Policy and a doctoral student in advanced energy systems at the Colorado School of Mines and the National Renewable Energy Laboratory, a joint program.