Solar Industry Growth Set to Slow

After months of fingernail biting, President Trump approved "safeguard tariffs" on imported solar equipment. While the situation seems dark, the sun will rise again.

After months of fingernail biting, yesterday, President Trump approved “safeguard tariffs” on imported solar equipment (e.g. cells and modules). While the situation seems dark, the sun will rise again.

The Import Tariffs

The import tariffs will apply to all imported solar equipment for a four-year period. The first 2.5 gigawatts of imported solar cells are exempt from the tariffs each year, presumably in an effort to assist domestic solar module manufacturers that rely on imported cells. The tariff begins at 30% in year one, then drops to 25% in year 2, 20% in year 3, and ending in year four at 15%.

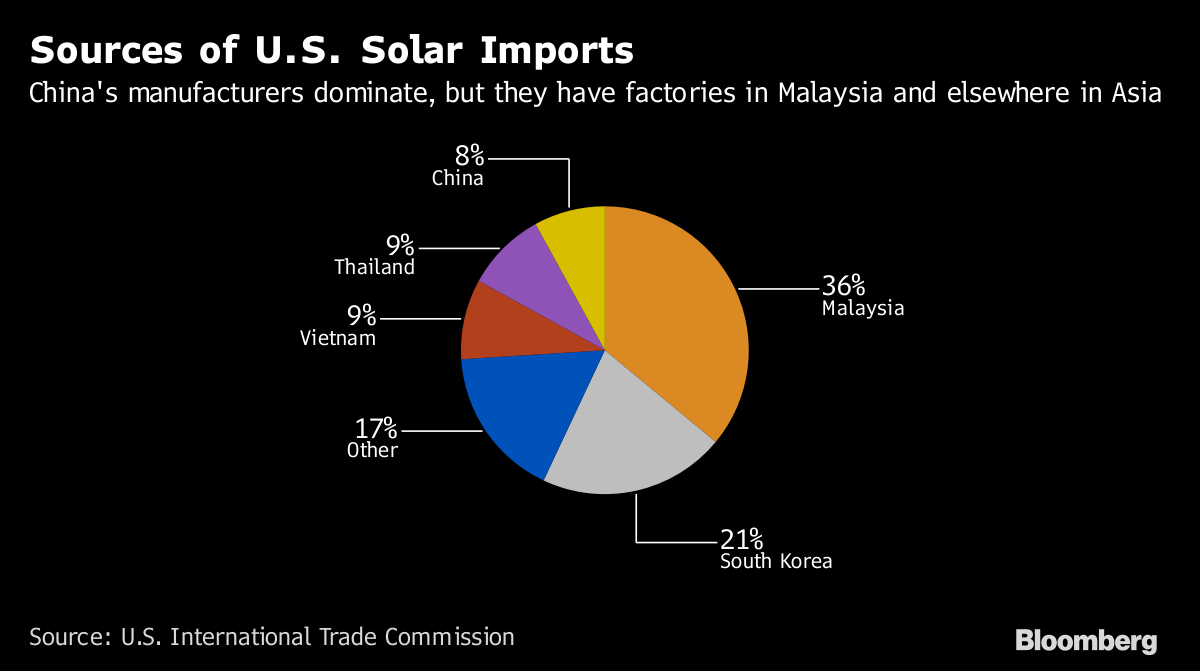

According to the International Trade Commission (ITC), China’s industrial central planning has focused on increasing China’s capacity to produce solar equipment through incentives, subsidies, and tariffs. As a result, China’s share of global solar cell production increased from 7% in 2005 to 61% in 2012. China currently produces 60% of the world’s solar cells, and 71% of solar modules.

The Chinese government’s investments into its domestic solar industry benefited U.S. solar project owners and developers, as the prices for solar cells and modules fell by 60% between 2012 and 2016, and imports increased by 500%. The ITC asserts these artificially low prices spurred a three-fold increase in domestic installed solar capacity between 2012 and 2016.

While domestic deployment of solar benefitted, the ITC found domestic solar manufacturers were harmed. The ITC noted that 25 solar manufacturing companies closed since 2012 and only two domestic solar cell and module manufacturers remain (one of these two declared bankruptcy in 2017). An additional 8 domestic firms remain that make solar modules using imported cells.

In the past, U.S. solar manufactures sought relief against China’s actions. However, China evaded 2012 U.S. anti-dumping and countervailing duties actions by exploiting loopholes and also relocating manufacturing plants to Taiwan. U.S. efforts in 2013 to address the loopholes resulted in China moving production to Malaysia, Singapore, Germany, and Korea. Hence, the new tariffs apply to all imports – including imports from Mexico, Canada, Korea, and several other countries that could have been excluded from tariff applicability.

Tariff Impacts Pile onto Other Policy Changes

It is complicated to understand the impacts of the import tariff, given there are many variables at play.

Bloomberg New Energy Finance estimates the tariffs will increase utility scale solar costs by 10%, and residential systems by just 3%. Clearview Energy Partners had similar estimates, pegging utility scale project impacts at a 10% cost increase, 6% increase for commercial projects, and 4% for residential rooftop installations. The Solar Energy Industry Association believes the tariffs will translate into 23,000 lost solar industry jobs and delay or cancelation of billions of dollars in solar investments.

Keep in mind, the tariffs are being imposed over the same years that the federal investment tax credit– a meaningful incentive for solar investment – is being phasing down.

Most recently, changes to the federal tax code established via the “Tax Cuts and Jobs Act of 2017”, could also reduce renewable energy capacity growth, including solar.

By reducing the corporate tax rate from 35% to 21%, it may be more difficult to close some types of renewable energy financing deals with corporations. In 2017, 43 corporations globally contracted for 5.4 gigawatts of clean energy in 10 different countries, a record amount with most of this activity (2.8 GW) occurring in the U.S.

While corporations procure renewables for a variety of reasons (e.g. social and environmental responsibility, hedge against energy price volatility, RE100 campaign), one reason is to reduce tax liabilities.

Many renewable energy projects are not profitable in the early years of operation, and therefore can’t take advantage of federal tax credits. Contractual arrangements can enable entities with tax liabilities – like banks, insurance companies, and other corporations – to monetize the value of these credits when they invest in the renewable energy projects. These are often called tax advantaged partnership or tax equity deals. Tax equity deals represented $12.2 billion in renewable energy financing agreements in 2016 across about 35 tax equity investors. Tax equity makes up about 40%-50% of financing for solar projects.

While the federal investment tax credit remains in place and can continue to be used to offset corporate tax liabilities, the tax law’s ‘base erosion anti-abuse tax’ (BEAT) provision will also reduce the value of renewable tax credits and create uncertainty for multinational companies hoping to use renewable energy tax credits to reduce their U.S. tax liabilities.

J.P. Morgan predicts an associated 3% drop in tax equity finance for solar projects in 2018.

The Silver Lining

In spite of these obstacles, many predict continued renewable energy growth. Fitch ratings found the outlook for renewables to be stable in 2018, in spite of the solar tariffs and changes in tax law. Fitch believes state-level policies may drive renewable energy demand as federal support weakens. Similarly, Deloitte’s 2018 outlook acknowledges the degree of short-term policy uncertainty facing the solar industry may be unprecedented, yet all the long-term signals are positive. Deloitte predicts the industry’s rate of growth will slow in the short-term, but the future is still bright for solar.

China and South Korea are preparing to appeal to the World Trade Organization, disputing Trump’s tariffs and many other countries are expressing dismay with the protectionist move. Apparently, the U.S. has lost every time the law allowing the president to impose import tariffs has been challenged at the WTO.

Let’s just hope a trade war doesn’t break out in the meantime.

Christina Simeone

Kleinman Center Senior FellowChristina Simeone is a senior fellow at the Kleinman Center for Energy Policy and a doctoral student in advanced energy systems at the Colorado School of Mines and the National Renewable Energy Laboratory, a joint program.