Part 2: Future Coal Retirements and a NOPR Disconnect

As explored in my last blog, significant coal-fired generation capacity retired between 2007 and 2016, and more of this retired coal capacity was cost-of-service compensated, compared to market (or merchant) compensated.

The U.S. DOE’s Notice of Proposed Rulemaking on Grid Resiliency focuses on subsidizing merchant coal and nuclear units in competitive markets (that also have capacity markets), fearing these power systems will become less resilient as resources with a 90-day supply of fuel on-site increasingly retire.

Assume for a minute DOE’s assertion that on-site fuel stockpiles are necessary for maintaining a resilient power grid (a highly contested assumption). If so, why isn’t there a complementary effort underway raising alarms about resiliency in regulated areas?

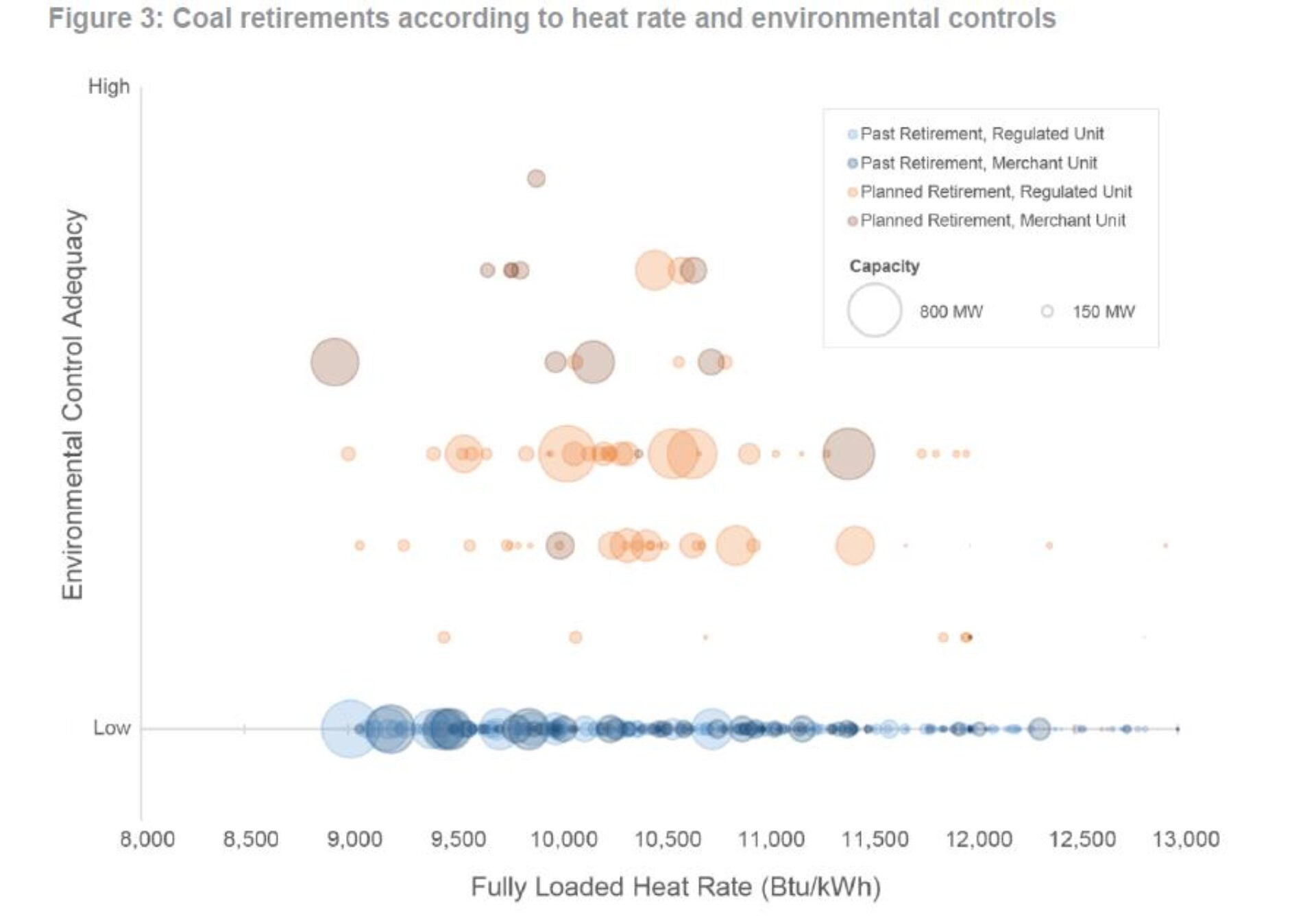

Looking forward, analysts predict greater coal capacity retirements in regulated areas, compared to retirements in competitive markets. For example, an April 2016 analysis by Charles Rivers Associates anticipates that most future coal plant retirements will be regulated units. Many of the units expected to retire are younger, cleaner, and more efficient compared to the coal plants that retired between 2007-2016. (See the figure 3 graphic in the blog intro)

Markets require resources to compete based on costs in near real-time. Winners and losers readily become apparent when exposed to competition, market price volatility, and in the absence of a ratepayer-funded safety net.

In regulated jurisdictions where state commissions, not markets, make choices about resource planning – typically through “Integrated Resource Planning” (IRP) processes – and ratepayers underwrite long-term investments, resource mix changes based on comparative economics of different technologies take a little longer to shake out.

At least 33 states require utilities to file IRPs. IRP processes typically incorporate a least-cost approach for meeting long-term forecasted energy demand that considers a variety of supply, transmission, and demand-side options. There may also be consideration of lifecycle costs, risks and uncertainties, and other factors such as environmental externalities and policy mandates (e.g. renewable portfolio standards). Stakeholders typically engage in the planning process too.

So, if markets move quicker, why have we seen and expect to continue to see more coal retirements in cost-of-service areas?

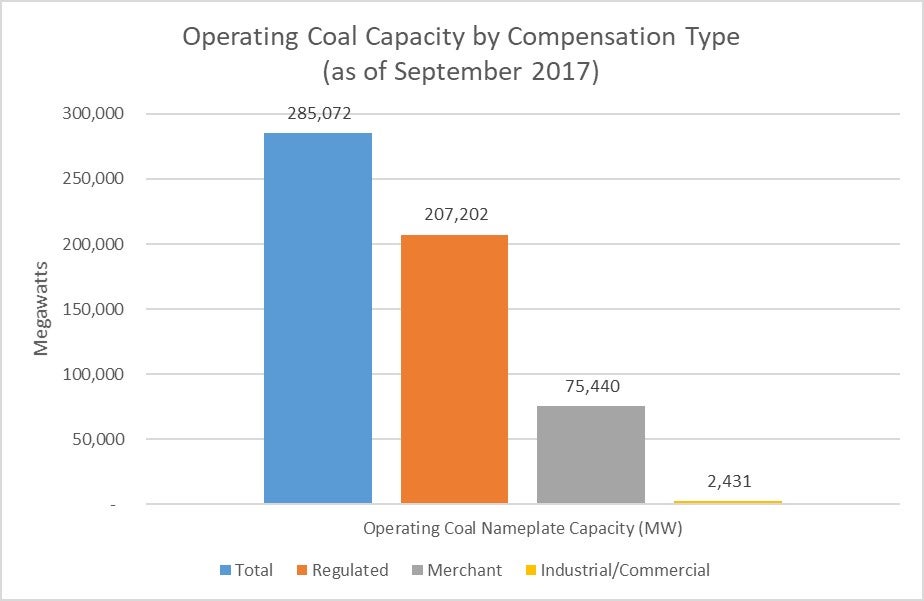

The fact is there is much more regulated coal capacity compared to merchant coal capacity.

According to EIA data, of the 285,072 MWs of operating coal nameplate capacity in September 2017, 73% were from regulated units and only 26% were from merchant units, while the remainder were owned by industrial and commercial energy users.

So, the DOE’s resiliency focus on protecting merchant coal may be related to rapid market-based outcomes, a smaller baseline denominator of merchant coal capacity, and various limits on DOE’s jurisdiction.

The disconnection in this situation is significant.

DOE’s NOPR would provide subsidies for merchant coal plants to avoid retirement before the end of their useful lives, with wholesale electricity market consumers footing the bill. Here consumers would in theory be paying for greater resiliency, a potential value proposition.

Meanwhile, a cost-of-service regulated coal plant that retires before the end of its useful life (for example, when expected costs exceed expected revenues over the remaining useful life of the plant) may potentially be entitled to ratepayer recovery for the unamortized book value of the asset. Ratepayers may also be on the hook to pay for remediation and dismantling costs for these coal plants.

So, assuming the DOE fuel stockpile/resiliency theory is accurate, these captive ratepayers would be paying more for a less resilient system.

Are regulated power states somehow dropping the resiliency ball? Do regulated states not perceive the same resiliency threat?

The next blog in this series take’s a look at what utilities in regulated states are planning for the future.

Christina Simeone

Kleinman Center Senior FellowChristina Simeone is a senior fellow at the Kleinman Center for Energy Policy and a doctoral student in advanced energy systems at the Colorado School of Mines and the National Renewable Energy Laboratory, a joint program.