Wharton MBA Team competes in the 2017 National Energy Finance Case Competition held at University of Texas at Austin

This fall, the Kleinman Center was excited to send a team of Wharton MBA students to compete in the UT Austin McCombs Energy Finance Case Competition. The Case Competition challenged teams from the country’s top MBA programs to apply real-world finance issues to today’s dynamic energy industry. The Wharton team presented to a panel of senior executives representing multiple stakeholders across the energy finance landscape. The team developed a comprehensive multi-pronged strategy, addressing the upstream, midstream, hedging, and environmental social, and governance dimensions of the business.

Key case question: “how should Falchion Energy—a small Marcellus shale natural gas operator—adapt its business strategy going forward?”

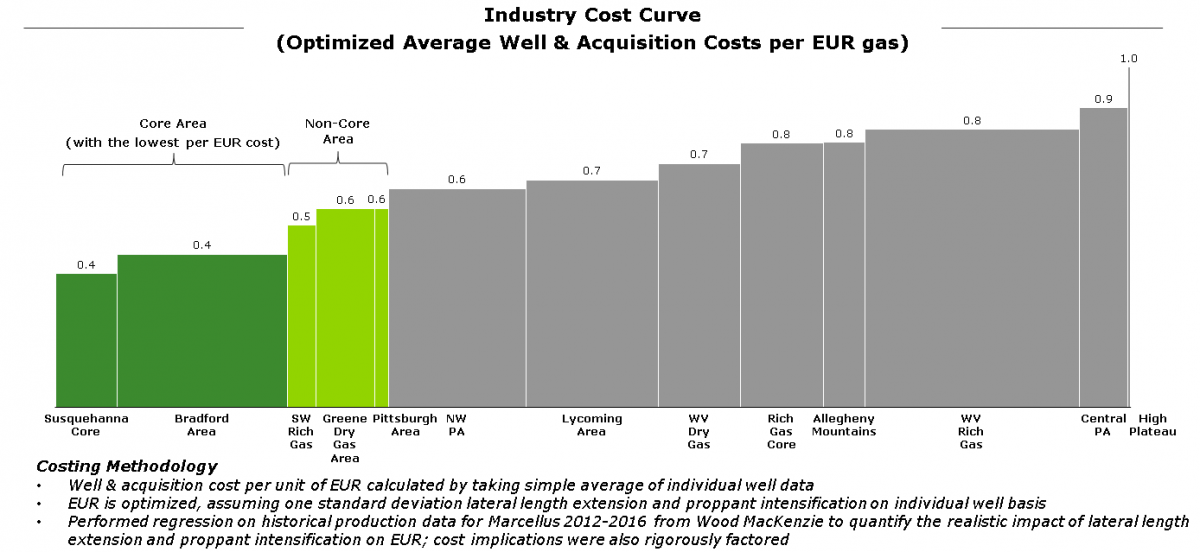

In the upstream, the Wharton team advised the target company to develop a transformational ‘3D strategy’: develop the core Northeast acreage, diversify to Southwest Pennsylvania to achieve major market position in Marcellus, and digitize operations to optimize asset portfolio. This was based on the team’s highly quantitative analysis, including multiple regression on the reservoir characteristics of different sub-plays in the Marcellus.

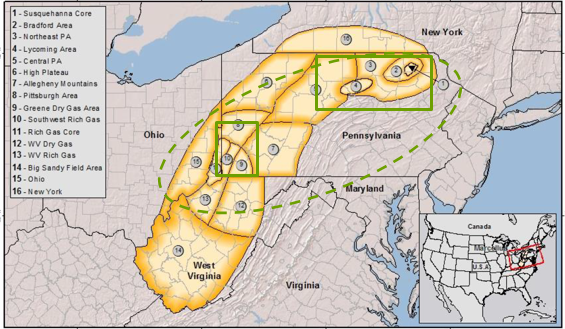

Specifically, the team recommended that Falchion should build a sizeable footprint in 2 selected clusters of sub-plays (denoted in different shades of green). It should first ‘core up’ its existing position in the Northeast, as this area contains the best sub-plays from a well & acquisition unit cost perspective. Further, Falchion would realize significant operating synergies with its currently owned assets and supporting infrastructure in this region. Next, the team recommended that Falchion should expand to the Southwest area of the Marcellus. This area provides access to more valuable wet-gas and the second-best cluster of sub-plays from a well and acquisition cost perspective.

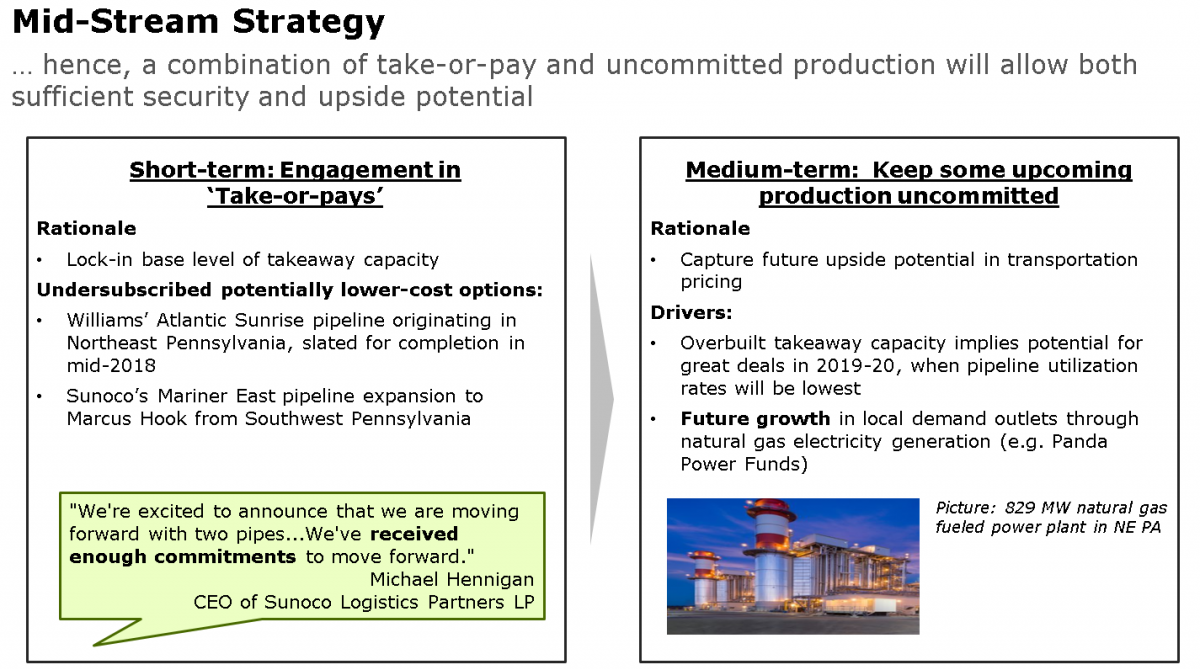

This approach would lead to a well-positioned asset portfolio and one best positioned for cost leadership in Pennsylvania. Regarding the midstream sector, the team recommended a combination of take-or-pay and uncommitted production–allowing both sufficient security and upside potential from (forecast) surplus takeaway capacity.

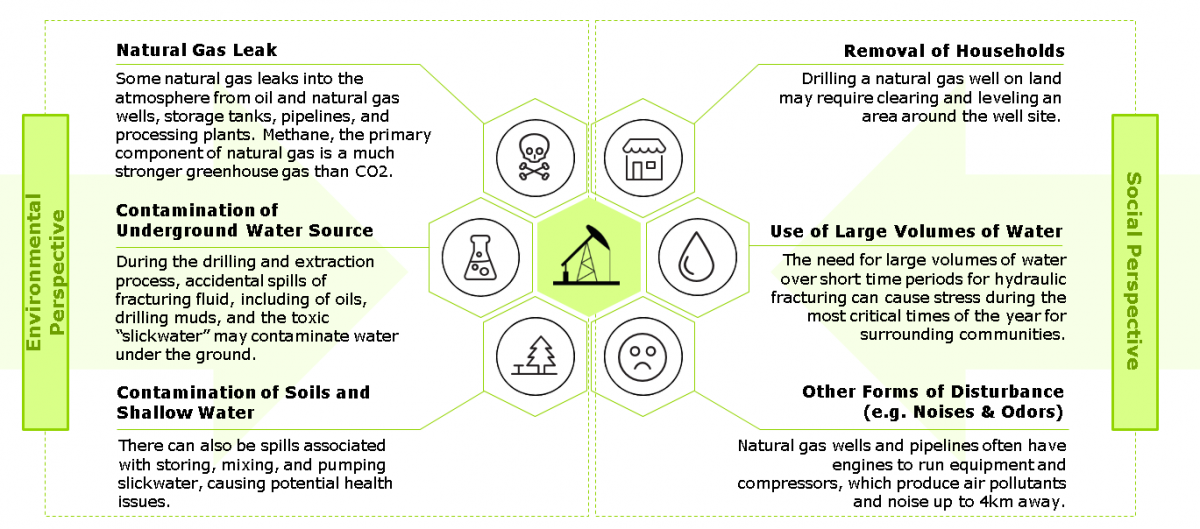

Finally, the team addressed the various aspects of environmental social, and governance that Falchion should consider as it scaled rapidly.

While among the finalists in Austin the Wharton team did not win, the students thoroughly enjoyed the opportunity to take a deep-dive into the challenges of natural gas drilling in the Marcellus. “We loved the challenge of tackling this multi-dimensional and highly quantitative business case. None of us came in with significant petroleum engineering experience so this case really enabled us to explore a part of the energy industry we had never seen before,” said team-member Huy Le. The team also received encouraging feedback regarding its core thesis of coring up existing acreage and diversifying to Southwestern Pennsylvania longer-term.

Interested in attending a conference or participating in a case competition? Learn more about Kleinman Center student grants.

The Wharton team supported by the Kleinman Center:

- Miguel Cebrian, MBA, Wharton

- Karl Chan, MBA, Wharton

- Huy Le, MBA, Wharton

- Michael Alexander, MBA, Wharton

- Thomas Witmer, MBA, Wharton

The Wharton team thanks The Kleinman Center at the University of Pennsylvania for its generous support, which enabled the student team to explore this multi-faceted energy issue.