The world’s stock of vehicles has recently surpassed one billion, and there are few signs that this trend will reverse anytime soon. Transportation is therefore an obvious and visible target for regulators, who want to reduce greenhouse gas emissions.

One of the most popular policy instruments around the world to achieve this laudable goal is a fuel-economy standard. Such a standard requires a minimum sales-weighted average miles-per-gallon (MPG) rating of new cars, which usually increases over time. In the United States, tightened fuel economy standards are a cornerstone policy of the Obama Administration aiming to meet the 2009 Climate Action Plan targets of reductions of 17 percent from 2005 levels by 2020. The Corporate Average Fuel Economy (CAFE) standard has been around since 1975, but, as of 2012, is slated to tighten dramatically over the next several years, with a goal of a fleet-wide average efficiency of 54.5 MPG by 2025. The U.S. is not alone in its interest in this policy instrument – fuel-economy standards have also been adopted in countries like China, India and Japan, who are all aiming for at least 55 MPG by 2020. Even the European Union, one of the few regions in the world with substantial fuel taxes that can add up to about three-quarters of the price at the pump, has recently implemented a fuel-economy standard on top of their hefty gasoline and diesel taxes.

There is little doubt that fuel-economy standards have been effective at reducing CO2 emissions from passenger cars. Manufacturers can comply with these rules in various ways. They can innovate on fuel-efficient technologies and make existing models more fuel efficient. They can also raise the price of their gas guzzlers and lower the price of their cleaner models, changing the mix of cars they sell. Both of these channels have been empirically demonstrated in several countries (Reynaert, 2015). In the U.S., some automakers also “comply” by paying fines to the U.S. government or producing “flex-fuel” vehicles, both of which allow the automakers to produce more thirsty cars. Politicians repeatedly emphasize how consumers save a lot of money on avoided gasoline expenses over the lifetime of their (now more efficient) car. Indeed, this logic often underpins regulatory analyses of further tightening standards. For example, the Obama Administration has calculated that the average middle class family who buys a middle-of-the-road family car in 2025 will save six thousand dollars at the pump, at only a modest increase of the price of their vehicle (about two thousand dollars).

One might ask, if consumers’ net-benefits from higher fuel economy are so large, why do automakers not voluntarily make these investments in the first place? This paradox comes from an important assumption made in regulatory analyses, which is highly debated among academics and policymakers: do consumers fully value gasoline savings from higher fuel economy in their purchase decision? Recent empirical evidence suggests that consumers value these savings almost fully (e.g., Busse et al., 2013), or only at about two-thirds of what regulatory analyses have typically assumed (e.g., Allcott and Wozny, 2014; Sallee, West and Fan, 2015). If consumers undervalue fuel savings, fuel-economy standards may be an attractive way to correct consumers’ miscalculations – an argument that might seem paternalistic to some, but is implicit in the assumptions that go into the regulatory analyses of standards.

In addition to saving consumers money, tightening standards are also touted as an important way to reduce reliance on imported oil, potentially from instable and hostile foreign regimes. What is rarely stated, but is perhaps the most important for the attractiveness of standards is that these benefits accrue without anyone paying a direct tax – the government regulates, but does not collect any payments from either consumers or automakers. So any costs are entirely hidden from voters.

In addition to saving consumers money, tightening standards are also touted as an important way to reduce reliance on imported oil, potentially from instable and hostile foreign regimes. What is rarely stated, but is perhaps the most important for the attractiveness of standards is that these benefits accrue without anyone paying a direct tax – the government regulates, but does not collect any payments from either consumers or automakers. So any costs are entirely hidden from voters.

All this explains why fuel-economy standards have been a favorite tool among policymakers. While they look reasonable and attractive at first glance, there are in fact strong reasons to believe that these standards are a more costly and problematic policy tool than they appear on the surface. They suffer from three fundamental problems, and – although this can be solved in principle – they may even be subject to strategic behavior or even manipulation by automakers.

First, they lead to some unintended consequences on driving behavior. To most effectively reduce greenhouse gases, we would want the policy to influence the amount of gasoline we burn. But the amount of gasoline we use is based on both the fuel economy of our cars – and the number of miles we drive. Unfortunately, fuel economy standards work in exactly the opposite direction than we would hope. When you increase the fuel economy of a car, it becomes cheaper to drive a mile. So it only follows that people will want to drive more after a fuel economy standard. Economists call this the “rebound effect”.

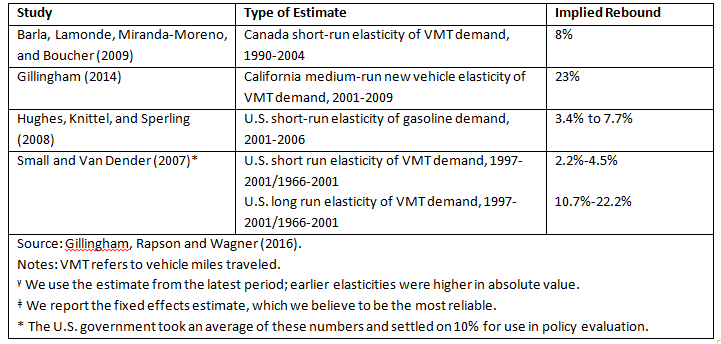

The rebound effect may allow people travel more, which provides benefits. But this comes with additional costs: more traffic congestion, more accidents, and the additional gasoline use and emissions. Economists have been working for decades to quantify the importance of this rebound. Economists Kenneth Gillingham, David Rapson, and Gernot Wagner surveyed the studies on rebound effects. They found that most recent estimates for the short-run or medium-run effect in the U.S. and Canada fall in the range of 5-25 percent (see Table 1 below). In other words, roughly 5 to 25 percent of the gasoline (and emissions) savings that would have been expected from the improved fuel economy alone. For its own analysis, the U.S. government assumes that the rebound effect cancels out 10% of expected CO2 savings, based on an influential study by Kenneth Small and Kurt Van Dender (2007).

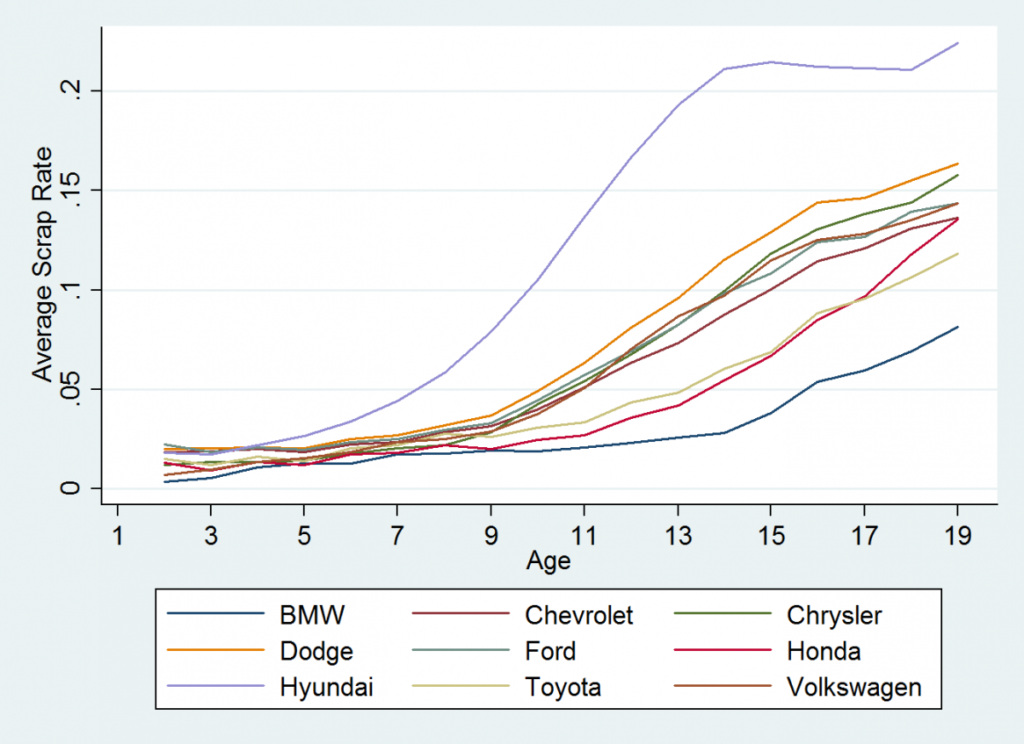

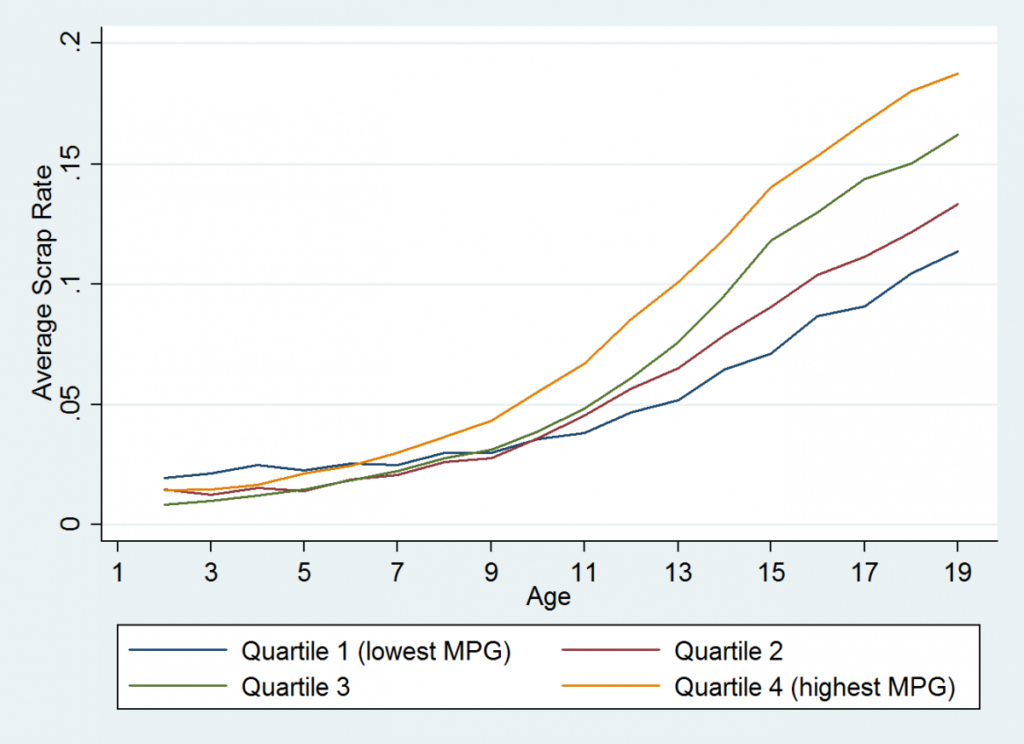

A second, and often overlooked, issue is that fuel-economy standards only apply to new vehicles. This means that they only indirectly affect the vast used car market; 94 percent of the vehicle fleet in the United States is more than one year old. It takes a very long time for the vehicle fleet to turn over, so the full CO2 savings of an increase in the stringency of a standard will not materialize until at least a decade or so afterwards. This is illustrated by the figures below, which indicate that annual rates of sending cars to the scrapyard are relatively low until cars reach about 10 years of age (Figure 1). Moreover, Figure 2 shows that scrap rates of old gas guzzlers (quartile 1) are much lower than scrap rates of old fuel-efficient cars (quartile 4). This is not due to differences in quality, but simply to the fact that fuel-efficient cars are usually small and less expensive. As a result, their resale values are low and when they become older, even small repair costs can be the death knell of the car.

There is a third unintended consequence from fuel-economy standards that also operates through the used fleet. Economists Mark Jacobsen and Arthur van Benthem studied the following phenomenon: Standards require new technologies which make new cars more expensive. This increases the demand for used cars and therefore their resale value. As used car prices increase, people tend to maintain them better. So old gas guzzlers stay on the road longer. This study finds that tightened standards for new vehicles cause about 15% of the expected fuel savings to leak away through the used vehicle market. This “leakage effect” on the overall effectiveness of policy is ignored by policymakers, even though its magnitude rivals the often-cited mileage “rebound” effect discussed above.

These three fundamental shortcomings of fuel-economy standards cannot be easily “fixed” without additional regulation and all serve to reduce the effectiveness of standards. To make matters worse, practical implementation of these standards in many countries has led to another suite of problems that are due to imperfect enforcement or policy design.

First, the standards require that each vehicle model’s fuel economy is tested. In both the United States and the European Union, this is done using dubious testing procedures. Tests take place under highly stylized driving conditions with all ancillary equipment turned off. Fuel-economy ratings used to be significantly higher than the true on-road fuel economy. While this gap narrowed substantially following an EPA revision to the reported MPG on the window stickers for new cars, there is growing evidence suggesting that the gap may be widening as a result of the tightening of the standards. Some manufacturers have been accused of overstating the fuel economy of a number of their models. In an ongoing class action suit against Fiat and Volkswagen in Italy, consumer rights groups claim that several vehicles have a fuel economy that is 20% to 50% lower than the official rating. And in the United States, Hyundai and Kia have paid refunds to consumers when the EPA determined that their MPG labels were inaccurate.

The effectiveness of standards has also been negatively impacted by a variety of loopholes or preferential treatments. For example, the United States has separate standards for “cars” and “light duty trucks” (which include SUVs and vans as well). The less stringent standards for light duty trucks explain at least partially why the market share of SUVs has risen so rapidly over the last several decades. The creation of these “favored” categories of vehicles has given rise to a continuous incentive for automakers to sell more cars that fall in the light duty truck segment, or even redesign existing models so that the EPA classifies them as light trucks. A famous example is the PT Cruiser, a small station wagon which Chrysler successfully marketed to the regulators as an SUV by making the rear seat removable.

Further loopholes abound. When the CAFE standards went into force in the 1970s, vehicles above 8500 pounds were exempted from the regulation, as these were classified as medium or heavy duty commercial trucks. Over time, manufacturers started producing vehicles that were meant for passenger use but so heavy that they avoided any fuel-economy rules. A famous example is the Hummer. The government had meant to discourage highly fuel-inefficient vehicles through the gas guzzlers tax, but ironically this tax only applies to passenger cars, not SUVs or pickup trucks.

With so many problems, one would think that there might be better policies to tackle the greenhouse gas emissions from cars. According to most economists, the answer is quite straightforward: we need a higher tax on gasoline. In a University of Chicago survey, 93% of economists responded that they favor a gasoline tax over a fuel-economy standard. Unfortunately, only 23% of non-economists agreed.

The reason why economists like a gasoline tax is that, in a world where consumers’ undervaluation of fuel economy is absent or modest, it has all the same benefits of a fuel-economy standard without suffering from any of its flaws. Like fuel-economy standards, a tax induces new car buyers to choose a more fuel-efficient car. This incentive is highest for those who drive the most. In turn, this increased demand for greener cars gives financial incentives to automakers to invest in technologies that enhance fuel economy. On top of that, a tax encourages drivers of all cars, new and used, to drive less and save fuel. A gas tax can therefore solve all three fundamental problems of fuel-economy standards.

A fuel tax is also likely to suffer less from cheating and distortive loopholes. It does not require fuel-economy testing. And there is no preferential treatment for light trucks, or cars in certain weight categories. Another highly attractive feature of gasoline taxes is that it raises government revenues, which, if used wisely, can produce economic gains elsewhere in the economy. For instance, the revenues could be used to reduce income or payroll taxes, or to subsidize much-needed innovation in green energy technologies.

The advantages of a gas tax vis-à-vis a fuel-economy standard are in fact very substantial. Several studies in leading economics journals have estimated that fuel-economy standards are between two and ten times as expensive per gallon of fuel saved as a fuel tax (e.g., Jacobsen, 2013). This makes standards so expensive that society would be better off without them, as the economic costs surpass the benefits of reduced greenhouse gas emissions.

While this would seem a convincing argument in favor of gasoline taxes, this route has proven an uphill battle in most countries. Voters in most countries have a particular distaste for new taxes, and gasoline taxes are particular salient to consumers every time they visit a gas station. Fuel-economy standards are much more expensive, yet their costs are largely invisible to consumers or at least hard to attribute to the policy. At a minimum, countries should eliminate all loopholes from their fuel-economy standards and increase enforcement of realistic fuel-economy testing procedures. They should keep the standards “plain vanilla” and avoid creative use of categories, weight cut-offs and the like: every vehicle, large or small, should be treated equally. The resulting single fleet-wide average standard will be much simpler and harder to manipulate than the CAFE design.

But why should we settle for “damage control” when the underlying policy instrument is flawed in the first place? We should let our aversion against gasoline taxes go and be transparent about how the revenues will be redistributed in an equitable and efficient manner. When raising one tax is paired with lowering another, this might offer some hope for meaningful green tax reform. And as an added bonus, we’ll have reduced greenhouse gas emissions at a much lower cost.

Sébastien Houde

Assistant Professor, University of MarylandSébastien Houde is an assistant professor in the Department of Agricultural and Resource Economics at the University of Maryland.

Arthur van Benthem

Associate Professor of Business Economics and Public PolicyArthur van Benthem is an expert in environmental and energy economics, exploring the economic efficiency of energy policy. He is a faculty fellow at the Kleinman Center and an associate professor of Business Economics and Public Policy at Wharton.

Mathias Reynaert, 2015, “Abatement Strategies and the Cost of Environmental Regulation: Emission Standards on the European Car Market”, available at https://sites.google.com/site/mathiasreynaert/research.

Meghan Busse, Christopher Knittel and Florian Zettelmeyer, 2013, “Are Consumers Myopic? Evidence from New and Used Car Purchases”, American Economic Review 103(1), pp. 1-41.

Hunt Allcott and Nathan Wozny, 2014, “Gasoline Prices, Fuel Economy, and the Energy Paradox”, Review of Economics and Statistics 96(10), pp. 779-795.

James Sallee, Sarah West and Wei Fan, 2015, “Do Consumers Recognize the Value of Fuel Economy? Evidence from Used Car Prices and Gasoline Price Fluctuations”, working paper, available at https://are.berkeley.edu/~sallee/swf_140127.pdf.

Kenneth Gillingham, David Rapson and Gernot Wagner, 2016, “The Rebound Effect and Energy Efficiency Policy”, Review of Environmental Economics & Policy, forthcoming, available at http://www.rff.org/RFF/Documents/RFF-DP-14-39.pdf.

Kenneth Small and Kurt Van Dender, 2007, “Fuel Efficiency and Motor Vehicle Travel”, Energy Journal 28(1), pp. 25-51.

Mark Jacobsen and Arthur van Benthem, 2015, “Vehicle Scrappage and Gasoline Policy”, American Economic Review 105(3), pp. 1312-1338.

Mark Jacobsen, 2013,”Evaluating U.S. Fuel Economy Standards in a Model with Producer and Household Heterogeneity”, American Economic Journal: Economic Policy 5(2), pp. 148-187.