New research between the Kleinman Center and Resources for the Future finds that if Pennsylvania were to adopt the Regional Greenhouse Gas Initiative (RGGI), the state could potentially reduce its emissions, generate additional revenue, and see minimal to no impact on electricity rates.

At a Glance

Key Challenge

Despite fierce opposition, in 2022 Pennsylvania joined the Regional Greenhouse Gas Initiative (RGGI), a cap-and-trade program designed to reduce carbon emissions from Northeastern and Mid-Atlantic power plants. Ongoing lawsuits have so far prevented the program from going into effect.

Policy Insight

By adopting RGGI, Pennsylvania could potentially reduce its emissions, generate additional revenue, decreases coal generation and increases renewable generation, and see minimal to no impact on electricity rates and overall employment in the state.

This report was written in collaboration with Resources for the Future. You can also find the report on their website.

Executive Summary

In 2022, Pennsylvania joined RGGI by an executive order of Governor Wolf despite the fierce opposition of elected Republican legislators, some Democrats, fossil fuel lobbies, industry representatives, and unions. The order was challenged in the Commonwealth Court, whose ruling is pending.

Because recent developments, like the war in Ukraine and the Inflation Reduction Act, have affected energy prices, the Kleinman Center for Energy Policy at the University of Pennsylvania and Resources for the Future (RFF) have collaborated to produce a fresh, independent analysis of the effects should Pennsylvania join RGGI. We hope our findings inform Governor Shapiro’s decision concerning RGGI.

The report begins by discussing Pennsylvania’s history with RGGI and the arguments for and against participation. Section 2 then reviews Pennsylvania’s energy mix and emissions profile and the climate policies that affect the electricity sector. We find that market conditions at PJM (the regional transmission organization) and enforcement of stringent regulations from the Environmental Protection Agency have accelerated the trend away from coal generation in the past year.

Section 3 describes previous studies that assessed the effect of Pennsylvania’s joining RGGI. These studies generally found that joining RGGI reduces Pennsylvania coal and gas generation and emissions but has differing effects on renewable generation, retail prices, and customer bills, depending on the use of auction proceeds.

The world has changed since the publication of those reports, most notably because of the Inflation Reduction Act (IRA). Section 4 therefore describes a new modeling effort, in which we use the RFF Haiku electricity sector model, updated to include gas price changes and IRA subsidies. We examine four scenarios: Pennsylvania is in RGGI or not, and the RGGI emissions budget declines at 3 percent (relative to 2020) per year indefinitely or declines at a faster rate starting in 2026, reaching zero by 2040.

Section 5 presents the modeling results, summarized as follows:

- Joining RGGI lowers emissions. In 2030, joining RGGI lowers Pennsylvania’s electricity sector emissions by 25 million to 28 million tons below what emissions would have been if the state had not joined. This means that in 2030, Pennsylvania goes from being 52 to 49 percent below 2020 levels to 84 percent below 2020 levels. Joining RGGI leads to lower emissions in Pennsylvania, the 12-state RGGI region, and the nation under both rates of decline in the RGGI emissions cap. The reduction in emissions results from a decrease in coal and, to a lesser extent, gas generation. The tighter cap scenarios yield slightly higher national emissions than the 3 percent cap scenarios because higher coal generation outside the RGGI region replaces some generation inside the region. This leakage may be less likely, however, as regulations on coal plants become more stringent.

- The emissions reductions are achieved at low marginal costs. If Pennsylvania joins RGGI, the allowance price in 2030 drops from $8.59 (the emissions containment reserve price) to $2.26 (the floor price). Our model identifies allowance prices that are lower than current market prices. Current RGGI prices are not necessarily a good predictor of RGGI prices when Pennsylvania is in the market because the state will have a large allowance budget (compared with the rest of RGGI) and has a different generation mix (with more coal and thus more opportunities for abatement).

- Emissions reductions are achieved at small or negative changes in retail electricity prices. Low allowance prices translate into a small increase (1 percent) in Pennsylvania’s retail electricity prices in 2030 under a 3 percent declining cap and a small decrease (–0.6 percent) when the cap declines to zero by 2040. The electricity price projected for Pennsylvania in 2030 in all scenarios is higher than recently observed prices in the state.1

- Joining RGGI decreases coal generation and increases renewable generation. Coal generation and—to a lesser extent—gas generation decline in Pennsylvania. Wind and solar capacity and generation increase. These changes are on top of a substantial projected increase in renewable capacity and generation due to the IRA.

- Pennsylvania remains an electricity exporter across all scenarios, but joining RGGI decreases exports. The expected increase in renewable generation is not as large as the decrease in fossil generation, leading to a reduction in exports. Nonetheless, the state remains a major regional electricity exporter.

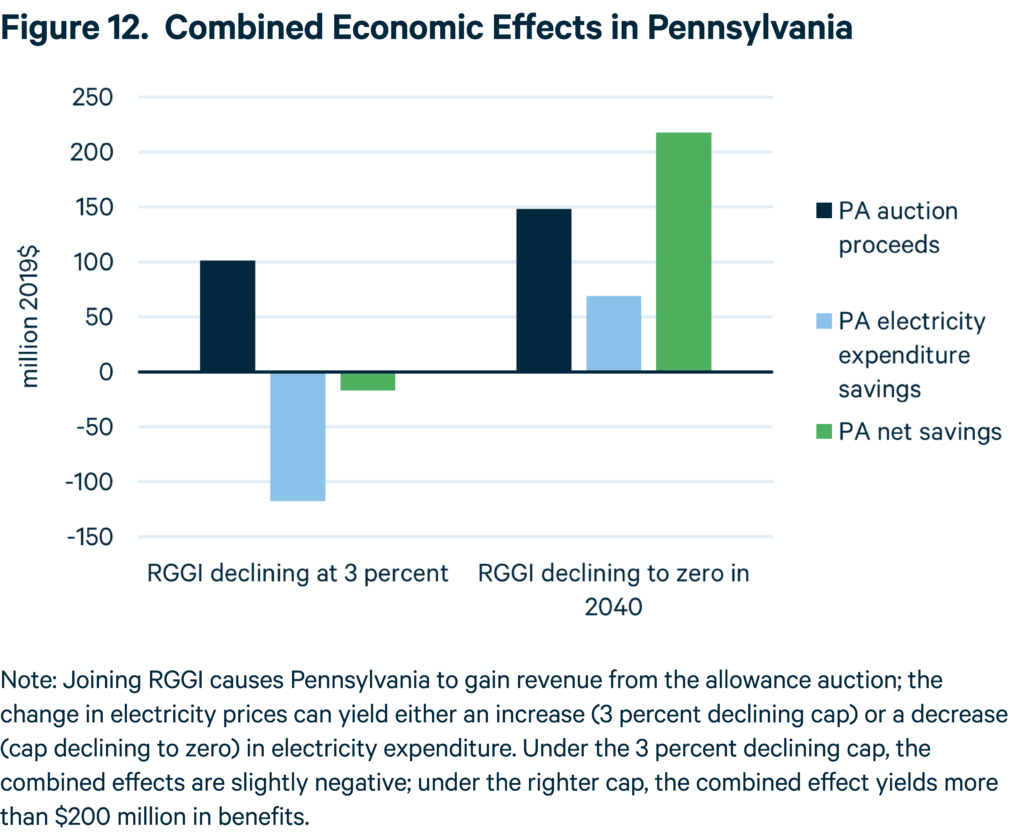

- Pennsylvania gains substantial revenue from joining RGGI. Despite low allowance prices, the state still gains $101 million to $148 million from the auction of emissions allowances in 2030. A large portion of this revenue (71 percent) comes from the purchase of allowances by generators in other RGGI states. The net effect for Pennsylvania consumers, combining auction proceeds and the change in electricity prices, is slightly negative under the 3 percent cap and beneficial under the tighter cap. Pennsylvania may decide to direct some or all of this revenue to program-related purposes that could directly reduce electricity bills or accelerate decarbonization.2

Section 6 compares our model results with the results of previous modeling. Our main difference is that emissions reductions are achieved at lower cost, partly because of the IRA; this also means lower allowance revenue. We then discuss the uncertainties that affect the analysis, including IRA implementation, electricity demand, and environmental regulations.

Section 7 considers perhaps the largest source of uncertainty, uses of allowance auction proceeds. We do not model any options for these funds, but the state’s decisions about revenue use will have important consequences.

Finally, Section 8 comments on RGGI’s possible effects on jobs. We foresee job reductions in coal-fired generation and coal mining. While RGGI will likely reduce generation at gas facilities and this may ultimately yield job losses at gas plants, there should be very little effect on upstream gas supply and employment because Pennsylvania gas power plants are not the main consumer of gas extracted in Pennsylvania. As jobs in coal power generation disappear, more jobs are created in the renewable and nuclear industries by 2030. With participation in RGGI, the state has an opportunity to use the auction proceeds to ensure that the transition to clean power is just and equitable and that the communities most affected by the job losses benefit not only from air quality improvements but also from job creation and economic welfare. If Pennsylvania remains outside RGGI, coal plants will likely continue to shut down but the state will not have the extra revenues to provide options to the affected communities.

1. Introduction

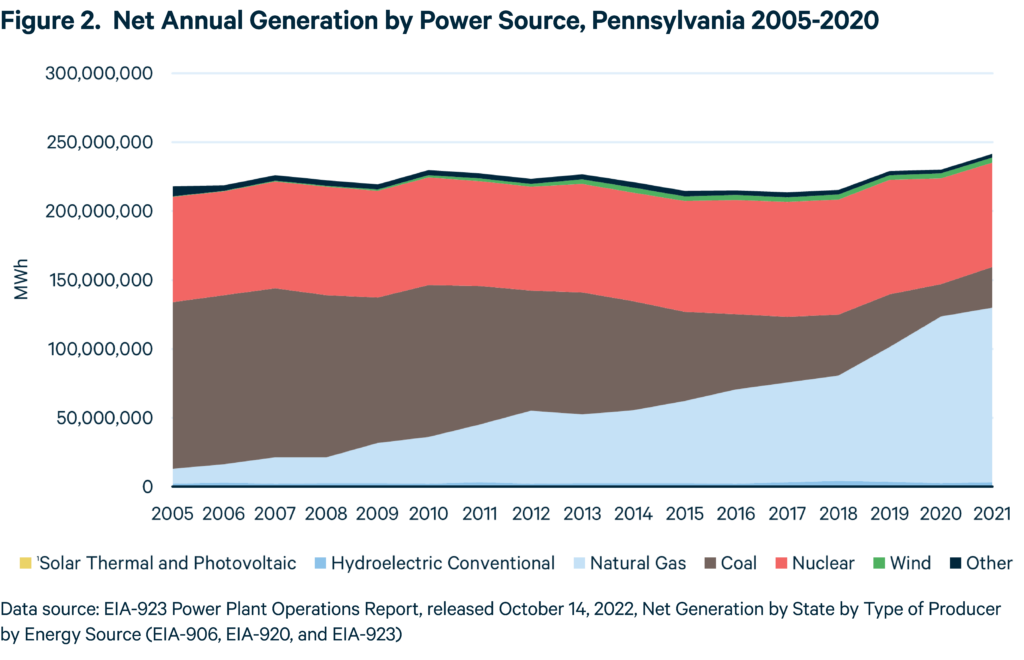

The participation of Pennsylvania in the Regional Greenhouse Gas Initiative (RGGI), the market-based cap-and-trade program for reducing carbon dioxide (CO2) emissions from power plants in the Northeast and Mid-Atlantic, has long been the subject of debate. In 2005, when some northeastern states started the initiative, Pennsylvania declined the invitation to participate. At the time, participation in RGGI implied high costs for Pennsylvania’s electricity sector, which was a large exporter of low-cost, high-emissions power generated by coal—the predominant fuel in Pennsylvania’s generation mix for many years. Since then, however, the electricity mix has evolved: as of 2021, only 12 percent of the state’s electricity was produced from coal; 52 percent came from natural gas, and 31 percent from nuclear power. CO2 emissions have been decreasing since 2014.

During his second term, in 2019, Governor Wolf signed Executive Order 2019-07, directing the Pennsylvania Department of Environmental Protection (PA DEP) to propose a regulatory rulemaking to abate, control, or limit carbon dioxide emissions from fossil fuel–fired electric power generators (Wolf 2020). The order was controversial and debated across parties in the state House and Senate. In July 2021, the House Environmental Resources and Energy Committee voted to reject RGGI (Flax 2021), but in April 2022, a vote to reject RGGI failed in the Senate. Subsequently, on April 23, 2022, the CO2 Budget Trading Program regulation (Commonwealth of Pennsylvania 2022a) was published in the Pennsylvania Bulletin, enabling participation in RGGI. Soon afterward, two lawsuits were filed (one led by companies with interests in coal plants, and the other by gas-fired generators), and the Commonwealth Court issued an order blocking efforts to join RGGI until the court ruled on its constitutionality (Morris 2023). In November 2022, the court heard oral arguments, and the ruling in both cases is pending.

Governor Shapiro was skeptical of RGGI during his campaign (Caruso 2021). More recently, his first budget proposal included funds to implement it in case the program moves forward. According to his administration, this does not imply a change in the governor’s stance on RGGI (McDevitt 2023). It is expected that the governor will shortly decide whether he supports the rule or not.

1.1 The Case for Joining RGGI

Governor Wolf’s executive order followed the recommendations of a study prepared for PA DEP (2020) by the consulting firm ICF. The study analyzes several scenarios of gas and coal prices and the price of allowances in RGGI and concludes that participation would bring environmental, health, and economic benefits.

Among the environmental benefits, the study estimates that joining RGGI could lower Pennsylvania’s CO2 emissions by 225 million tons between 2020 and 2030. Emissions of other harmful pollutants and particulate matter would also drop significantly. Nitrogen oxides could be reduced by 112,000 tons and sulfur dioxide by 67,000 tons. These reductions would bring significant health benefits, preventing up to 639 premature deaths from respiratory illnesses, 30,000 hospital visits for respiratory diseases like asthma for children and adults, and more than 83,000 lost workdays.

The study also finds that from 2022 to 2030, participating in RGGI would lead to an increase in gross state product of nearly $2 billion and a net increase of more than 30,000 jobs if the state uses the revenues from the allowances to fund energy efficiency or renewable energy projects.

Besides delivering health and economic benefits, participation in RGGI would help the state meet its climate goals of reducing greenhouse gas (GHG) emissions—26 percent below 2005 levels by 2025 and 80 percent below 2005 levels by 2050—established in the 2021 Pennsylvania Climate Action Plan.

Addressing the legality of joining RGGI by regulation and not by legislation, supporters of the initiative argue that the fees collected for the carbon allowances under RGGI are not comparable to state taxes. They also refer to a study by the Penn State Center for Energy Law and Policy, which concludes that RGGI does not conflict with other energy policy portfolios in Pennsylvania, and that PA DEP and the Environmental Quality Board have the authority to create and implement rules for joining RGGI (Blumsack et al. 2020).

1.2 The Case against Joining RGGI

Opponents of Wolf’s executive order include fossil fuel lobbies, coal and gas generators, and unions, elected Republican legislators, three Allegheny County Democratic senators (Jim Brewster, Lindsey Williams, and Wayne Fontana), and one Independent senator (John Yudichak) (Parish 2022). They make legal, economic, and environmental arguments.

They question the legality of the mandate, considering participation in RGGI equivalent to a tax on fossil fuel-fired generators and noting that a state tax can be imposed only through legislation (Miller 2023). And they say that participation in RGGI would harm electricity ratepayers because gas and coal generators would pass on the cost of paying for carbon allowances to consumers.

The assertions about costs are based on the Independent Fiscal Office’s review of the assumptions of the PA DEP study (Knittel 2022). That office finds that the PA DEP study underestimates the auction prices at RGGI for 2022 by assuming a nominal price of $3.57, when the actual price was around $13. The higher auction price could increase monthly residential electricity bills from $4.45 to $6.27 instead of $1.17 to $1.65, as presented by PA DEP. (A higher auction price could bring $781 million in proceeds from the sale of allowances, instead of $207 million.) In a recent letter to Governor Shapiro, the Senate Republican Caucus quotes the study from the Penn State Center for Energy and Law Policy and says that residential electricity rates would increase by 7.8 percent annually between 2022 and 2030: “That [increase in electricity rates] translates into devastating bills for low-income residents who already spend about 15 percent of their household budgets on energy costs. Studies also indicate the State’s employers will be crippled by the skyrocketing energy costs, meaning the costs of goods will increase, or employers will relocate” (Senate Republican Caucus 2023).

The harm to the state’s economy has been another recurrent charge against RGGI. Because RGGI would make coal and gas generators less competitive, opponents foresee job losses in the electricity generation sector and the coal and gas industries. They also raise concerns about energy security, suggesting that the “destruction” of the energy sector would leave Pennsylvania reliant “on foreign oil and gas for decades to come” (Rives 2022).

The generators suing PA DEP (Calpine Corporation, Tenaska Westmoreland Management, and Fairless Energy) argue (Commonwealth Court of Pennsylvania 2022) that RGGI rules would fail to minimize leakage and therefore cause carbon emissions to increase within the eastern electric grid, since fossil fuel generators in neighboring states not subject to RGGI rules would increase production while those in Pennsylvania would decrease production, thereby not achieving the desired effect of reducing CO2 emissions.

Finally, opponents observe that in the previous 10 years, Pennsylvania considerably reduced its CO2 emissions without participating in RGGI. The state, they say, could continue this trend without incurring the costs that RGGI imposes (Allegheny Institute for Public Policy 2021).

1.3 The Objective of This Report

Many of the factors influencing Pennsylvania’s decision have changed in the past two years. The war in Ukraine has put pressure on gas prices, and international demand for Pennsylvania gas has increased. President Biden signed the Inflation Reduction Act (IRA), which allocates hundreds of billions of dollars for renewable energy development, making electricity from renewable sources more competitive. Meanwhile, the electricity sector continues to be the second-highest emitter of GHG emissions in Pennsylvania. The urgency of addressing climate change and its consequences requires policies that minimize the costs of the energy transition and maximize the benefits for Pennsylvanians.

To inform the decision that Governor Shapiro will make concerning RGGI, the Kleinman Center for Energy Policy at the University of Pennsylvania and Resources for the Future (RFF) have produced an updated, independent analysis and evaluation of the effects should Pennsylvania join RGGI. Section 2 of this report reviews energy trends and climate policies in Pennsylvania over the past 20 years. Section 3 explains how RGGI works and recaps the studies prepared in 2019 and 2020 to assess the effects of joining RGGI. Section 4 describes the RFF Haiku electricity sector model, updated to include gas price changes and subsidies from the IRA. Section 5 examines the effect of Pennsylvania joining RGGI on emissions, emissions leakage, electricity and allowance prices, electricity production, revenues, and air pollution, under two levels of the RGGI cap. Section 6 compares our results with those of the prior studies and considers uncertainties that might affect the results. Section 7 briefly discusses how the allowance revenues might be used—something not modeled in our study. The report concludes in Section 8 by discussing the effect of RGGI on employment.

2. Background

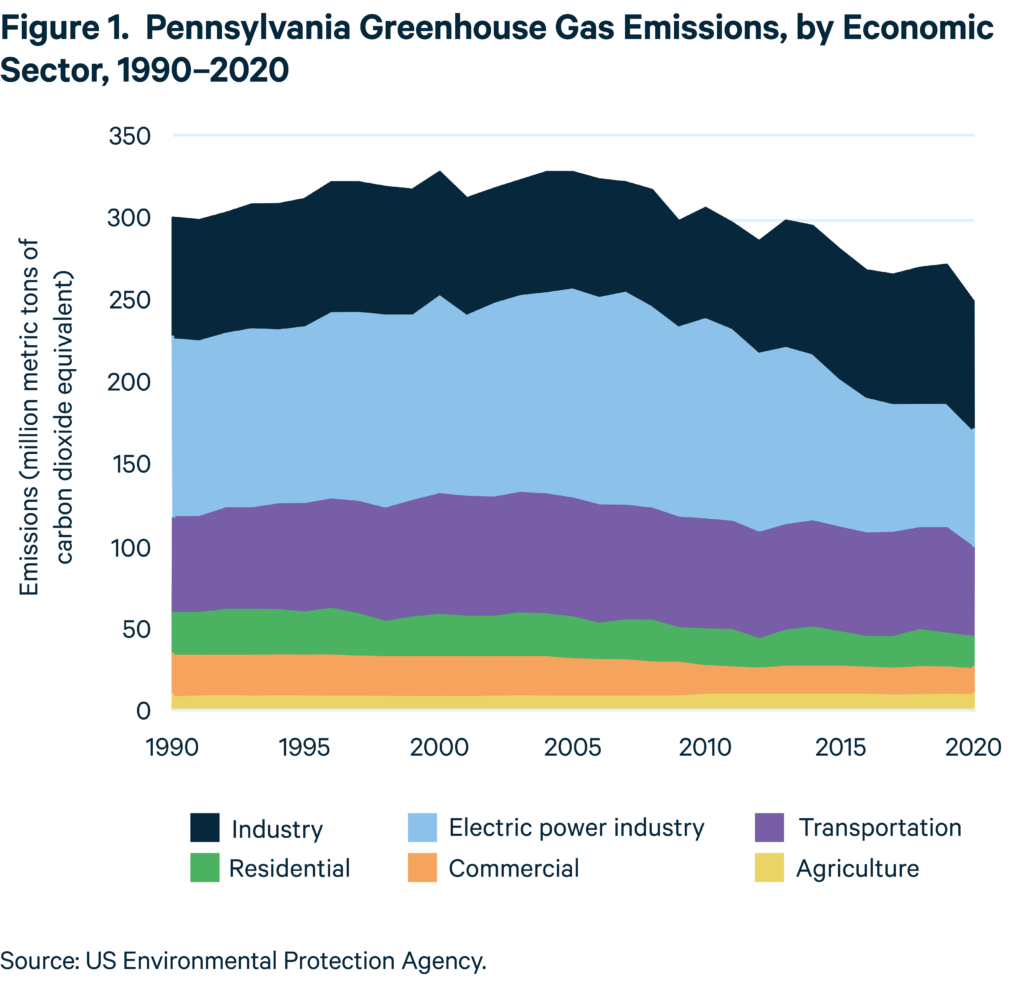

Producing more than 200 million metric tons of carbon dioxide equivalent, Pennsylvania is among the top carbon emitter states in the country. The industrial and electricity sectors are the state’s largest emitters (Figure 1). Pennsylvania is also an exporter of energy resources.

2.1 Trends in Pennsylvania’s Energy Usage

Since 2005, GHG emissions have been decreasing, mainly because of emissions reductions in the electricity sector. The main driver of this reduction was the substitution of natural gas for coal in electricity production due to the availability of shale gas (Figure 2).

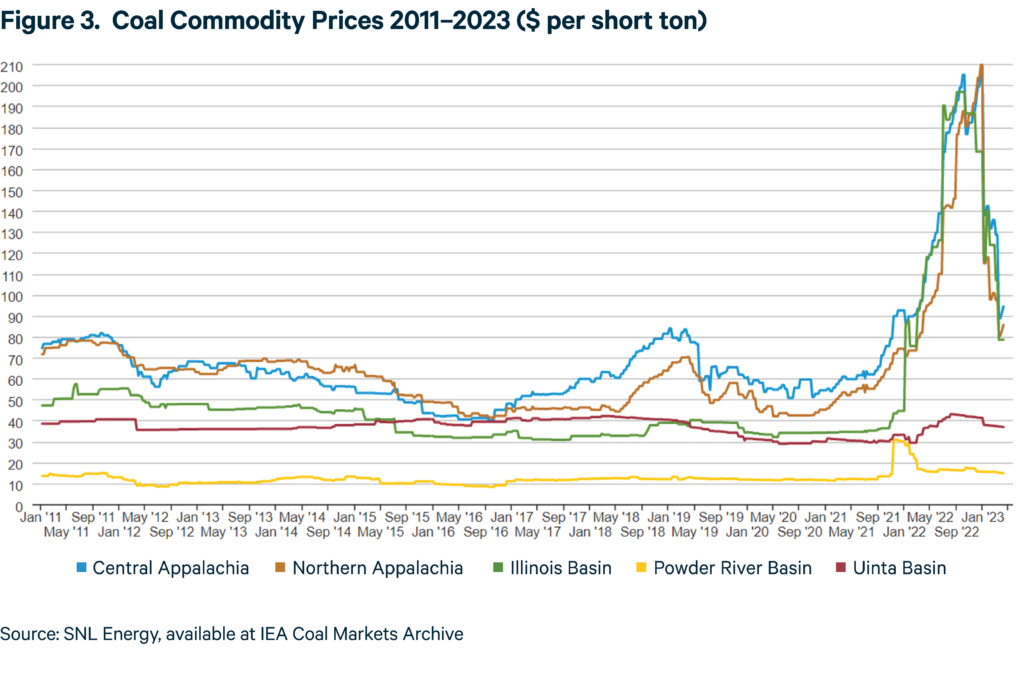

The decreasing share of coal in the energy mix is not exclusive to Pennsylvania. A study by the Institute for Energy Economics and Financial Analysis found that the United States is on track to close half its coal capacity by 2026 based on the announced retirements (Feaster 2023). In PJM, coal power generators have requested the deactivation of 7,374 MW of installed capacity in the next four years (PJM 2023). Those retirements have been accelerated by market and regulatory conditions in the past year, when an unprecedented increase in coal prices in 2021 and 2022 (see Figure 3) raised fuel costs for coal generators. At the same time, the capacity auction in PJM for 2023–2024, which determined an essential source of revenue for coal generators, resulted in the lowest price of the past decade: $34.13/MW-day (PJM 2022). Meanwhile, the Environmental Protection Agency (EPA) has proposed to strengthen the wastewater discharge standards that apply to coal-fired power plants and is planning to deny permits to six facilities to continue disposing of coal ash into unlined surface impoundments (EPA 2023a).

Under such market and regulatory conditions, the prospects for coal power generators in Pennsylvania are grim, even without RGGI. The share of coal generation in PJM, the state, and the country is likely to continue to shrink. Homer City, Pennsylvania’s largest coal plant, whose installed capacity of 1915 MW represented 15 percent of the state’s total installed coal generation capacity, just recently announced its closure. The plant was already in financial distress in 2016 (Brickley 2017) and filed for bankruptcy in 2017 (Nair 2017). Similarly, because the Conemaugh Generating Station in New Florence is one of the six facilities facing denial of its permit to dispose of coal ash, EPA’s rule may hasten the plant’s planned retirement, currently set for 2028.

According to EPA’s Greenhouse Gas Inventory (EPA 2023b), the move away from coal led to a 43.5 percent drop in emissions from 2005 to 2020 in the electric power sector, even as power generation rose by 5.5 percent overall, according to the U.S. Energy Information Administration. Despite this progress, the electricity sector remains the second-largest emitter in Pennsylvania, after industry. The latest Pennsylvania Greenhouse Gas Inventory Report (PA DEP 2022) shows that in 2019, coal still contributed 50.7 percent of GHG emissions in the electricity sector, and natural gas, 49.1 percent.

2.2 Climate Policies and Targets

In addition to joining RGGI, Pennsylvania has adopted several policies for the mitigation of greenhouse gases. Below we summarize key policies and programs for the transition of the electricity sector.3

- Act 213: Alternative Energy Portfolio Standards (AEPS) (2004)

- Act 70: Pennsylvania Climate Change Act (2008)

- Act 129: Energy Efficiency and Conservation Program (2008, Pennsylvania Public Utility Commission 2008)

- Act 30: Commercial Property Assessed Clean Energy Program (C-PACE) (2017)

- Act 40: Solar Renewable Energy Credits (2017)

- The Medium- and Heavy-Duty Zero Emission Vehicle MOU (2020)

- Governor’s Executive Order 2019-01, which set GHG reduction goals for Pennsylvania and sustainability goals for Commonwealth agencies (2019)

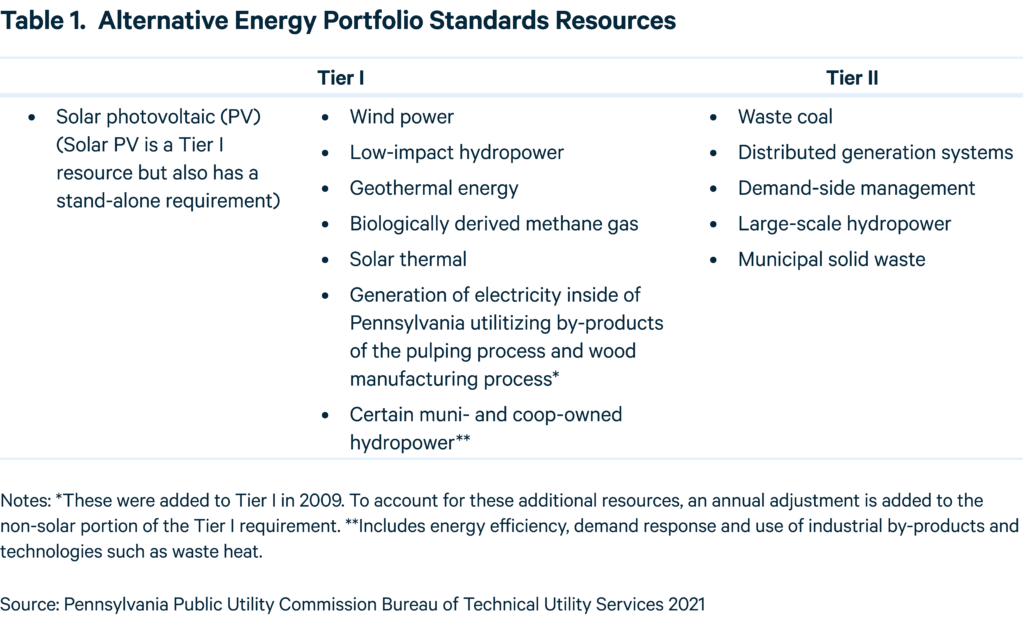

Pennsylvania Act 213 of 2004 established the Alternative Energy Portfolio Standards (AEPS) and also contributed to the reduction of emissions in the electricity sector by providing incentives for alternative energy sources, including renewable energy. AEPS requires electricity distribution companies and retail suppliers to procure a percentage of their electricity from qualified alternative energy resources. Those resources are divided into two tiers (Table 1). Currently, the Tier I requirement is 8 percent, of which at least 0.5 percent of all retail sales must come from solar photovoltaic (PV) sources in Pennsylvania. The requirement for Tier II resources is 10 percent of all retail sales. In our analysis, these requirements are projected to remain constant through 2050.

2.3 Alternative Energy Portfolio Standards

From the policy side, the enactment of the Pennsylvania Act 213 of 2004 which established the Alternative Energy Portfolio Standards (AEPS) also contributed to the reduction of emissions in the electricity sector by providing the incentives for the penetration of alternative energy sources including renewable energy. AEPS requires electric distribution companies and electric generator suppliers to retail customers to procure a percentage of the electricity they sell from qualified alternative energy resources. Those resources are divided into two Tiers (Table 1). Currently, the Tier I requirement is 8 percent of which at least 0.5 percent of all retail sales should come from solar photovoltaic (PV) sources located within Pennsylvania. The requirement for Tier II resources is 10 percent of all retail sales. In this analysis, these requirements are projected to remain constant through 2050.

The 2021 Pennsylvania Climate Action Plan aims to achieve the state’s emissions reduction goals: a 26 percent reduction in net GHG emissions statewide by 2025 and an 80 percent reduction by 2050, from 2005 levels.

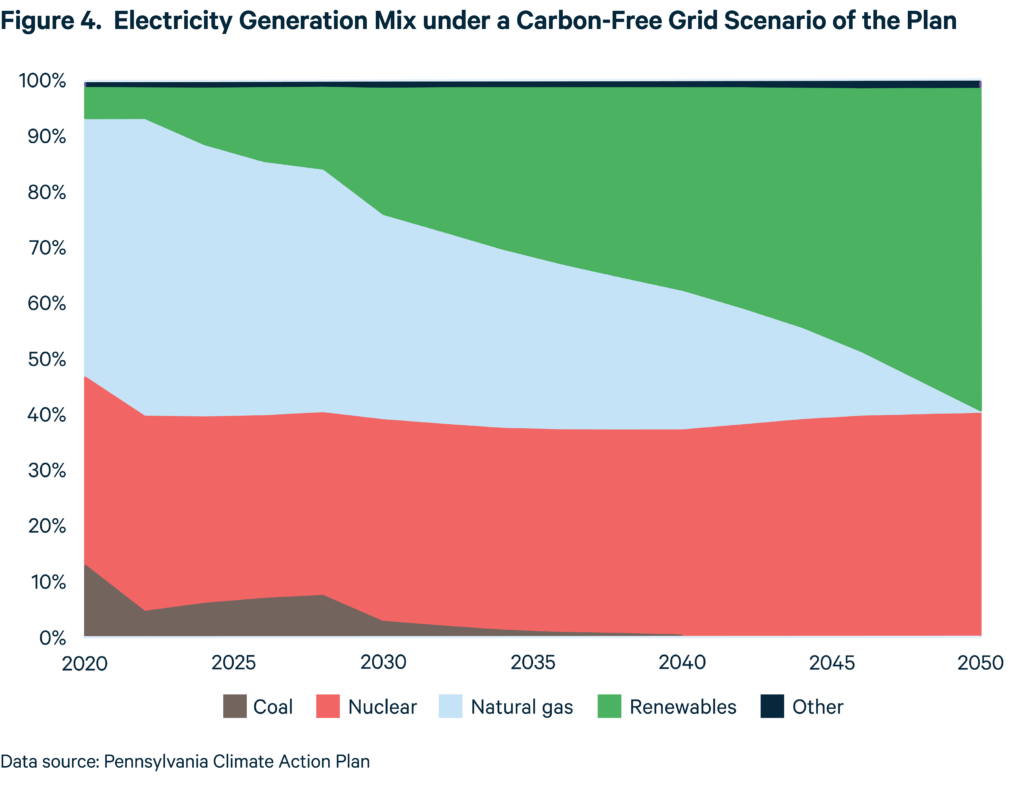

For the electricity sector, the plan proposes a carbon-free grid by 2050, with 60 percent renewables and 40 percent nuclear power. This implies the phaseout of coal generators by 2035 and gas generators by 2050 (Figure 4). In addition to joining RGGI, the 2021 Climate Action Plan outlines two strategies to achieve a carbon-free electricity grid.

First, it recommends extending the life of nuclear generation facilities to 80 years and, if necessary, pass legislation to create and administer a zero-emissions credit program to subsidize uncompetitive nuclear plants at risk of retirement (as New Jersey, New York, and Illinois have done).

Second, it recommends amending and increasing the AEPS to an in-state requirement for non-emitting generation or fossil fuels with carbon capture and storage of 100 percent by 2050. Tier I requirements would reach 100 percent by 2050 by increasing the solar threshold to 10 percent by 2030. The Tier II requirement, which includes the eligibility of waste coal, would be maintained at the current level of 10 percent through 2050. The plan also proposes amending AEPS such that in-state grid-scale and distributed solar resources are eligible for the solar threshold; nuclear, fossil energy with carbon capture and sequestration, and energy storage would be added to the eligible energy sources for Tier I.

2.4 The 2021 Climate Action Plan

The 2021 Pennsylvania Climate Action Plan aims to achieve the state’s emissions reduction goals: a 26 percent reduction in net GHG emissions statewide by 2025 and an 80 percent reduction by 2050, from 2005 levels.

For the electricity sector, the plan proposes a carbon-free grid by 2050, with 60 percent renewables and 40 percent nuclear power. This implies the phaseout of coal generators by 2035 and gas generators by 2050 (Figure 4). In addition to joining RGGI, the 2021 Climate Action Plan outlines two strategies to achieve a carbon-free electricity grid.

First, it recommends extending the life of nuclear generation facilities to 80 years and, if necessary, pass legislation to create and administer a zero-emissions credit program to subsidize uncompetitive nuclear plants at risk of retirement (as New Jersey, New York, and Illinois have done).

Second, it recommends amending and increasing the AEPS to an in-state requirement for non-emitting generation or fossil fuels with carbon capture and storage of 100 percent by 2050. Tier I requirements would reach 100 percent by 2050 by increasing the solar threshold to 10 percent by 2030. The Tier II requirement, which includes the eligibility of waste coal, would be maintained at the current level of 10 percent through 2050. The plan also proposes amending AEPS such that in-state grid-scale and distributed solar resources are eligible for the solar threshold; nuclear, fossil energy with carbon capture and sequestration, and energy storage would be added to the eligible energy sources for Tier I.

3. RGGI and Prior Modeling of Pennsylvania’s Participation

Started in 2009, RGGI is a cap-and-trade program for electricity sector emissions on the East Coast. The program currently operates in Maine, Vermont, Massachusetts, Rhode Island, Connecticut, New York, New Jersey, Delaware, Maryland, the District of Columbia, and Virginia. Pennsylvania would be the 12th jurisdiction to join.

The states collectively set an emissions cap and a trajectory of decline for that cap. Each state then issues a portion of the allowances that make up the cap and is entitled to the proceeds from the allowances it issues. Should it join, Pennsylvania has proposed that its cap be based on a 2020 emissions level of 83 million short tons and decline by 3 percent each year thereafter.

The RGGI program allows the banking of emissions allowances, meaning that entities can purchase allowances in the present to use in future years. This may encourage early emissions reductions and smooth allowance prices.

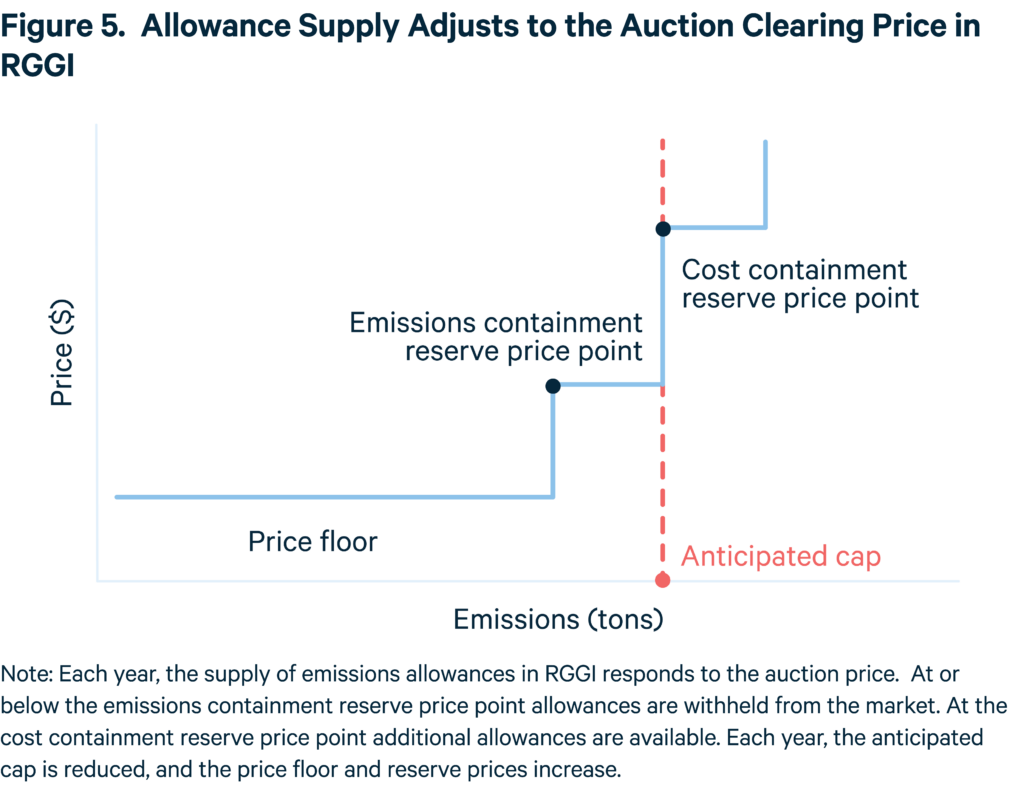

Another feature of RGGI is its price-responsive allowance supply. The simplest illustration is the price floor in the auction, which limits the issuance of allowances when demand is low. Generally, the number of allowances issued each year will differ from the anticipated emissions cap if the auction price is on or below the emissions containment reserve price step, or on or above the cost containment reserve price level. The price floor in RGGI is $2.50 in 2023; it is adjusted annually for inflation. The emissions containment reserve trigger price in RGGI is $6.87 per ton, and the cost containment reserve trigger price is $14.88; these prices rise at 7 percent per year. These mechanisms are illustrated in Figure 5 and discussed thoroughly in Burtraw et al. (2017).

RGGI’s price-responsive allowance supply converts what otherwise would be a static emissions cap into a dynamic supply, making the carbon market more like other commodity markets where supply generally adjusts to equilibrium prices. Historically in RGGI (and in California, which also has a price floor and similar cost containment features), these mechanisms have been most important when prices are low, which can result if, for example, sector-specific policies such as energy efficiency standards or clean technology subsidies reduce emissions and the demand for allowances. The likelihood of low prices can be enhanced through program-related investments made with auction proceeds, as occurs in RGGI. In the case of low allowance prices, the price-responsive allowance supply will reduce the number of allowances entering the market and harvest accelerated low-cost emissions reductions. Conversely, if the price is above a range of expected prices, the cost containment reserve expands supply. These dynamic adjustments to supply reduce price volatility and improve the stability of auction proceeds.

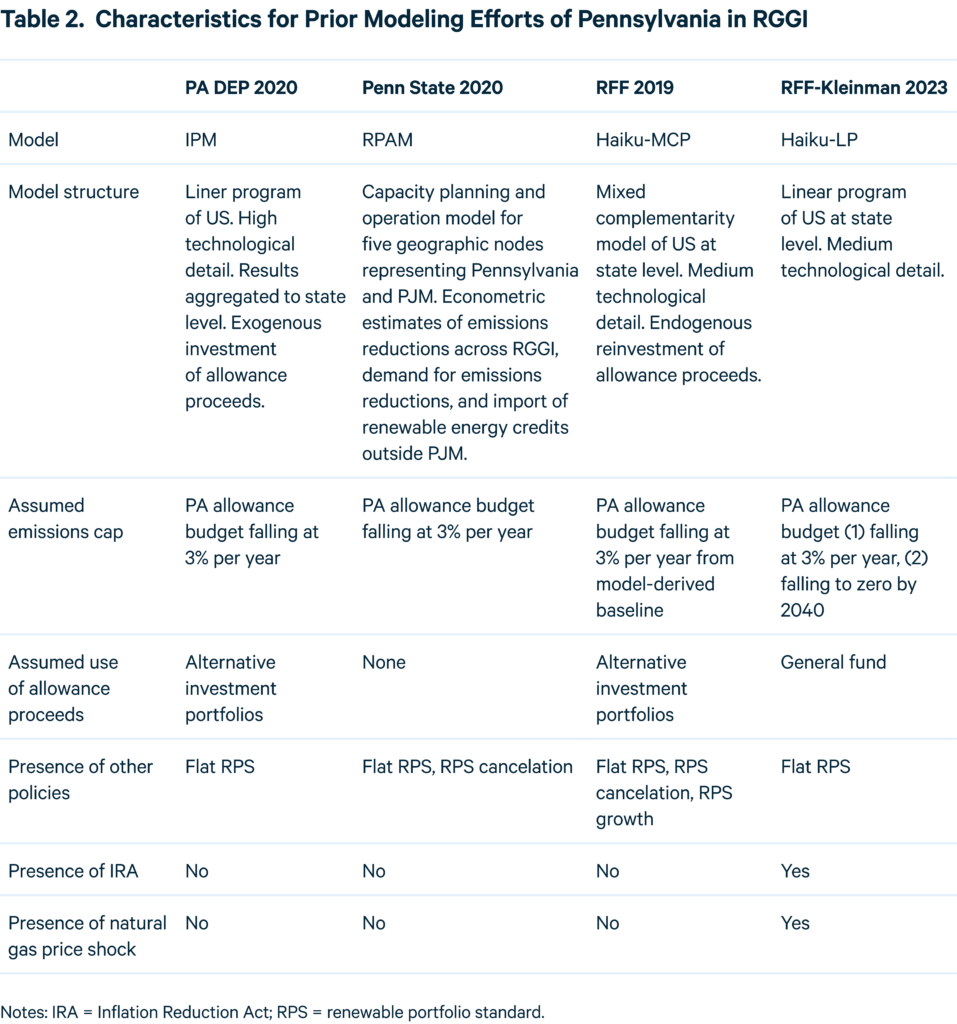

Three prior modeling efforts have considered the effect of Pennsylvania’s joining RGGI, conducted by the Pennsylvania Department of Environmental Protection (2020), Penn State University (2020), and RFF (2019).4 Table 2 summarizes the characteristics of those modeling efforts in comparison with, alongside those of the current effort (RFF-Kleinman 2023).

3.1 PA DEP Modeling 2020

To assess the effect of joining RGGI, PA DEP requested a study from ICF using the IPM electricity model. Researchers first ran a baseline with Pennsylvania outside RGGI (No Policy Scenario), then with Pennsylvania as a member (Policy Scenario). They considered three approaches to investing the allowance revenue from the Policy Scenario. One was splitting the money among energy efficiency programs to reduce electricity demand, renewable projects, and other projects for GHG reductions, principally electric vehicle deployment and carbon capture, utilization, and storage–related research. In the second, most of the revenue was designated to help customers pay electricity bills, and in the third, the money was deposited in the general fund.

The PA DEP study finds that RGGI alone, without investment, causes emissions in Pennsylvania to stop rising and begin falling, mostly by decreasing coal and gas generation relative to the baseline (though gas generation does rise from 2020 levels). Reducing coal generation leads to SO2 and NOx reductions, which in turn means public health benefits. Pennsylvania joining RGGI leads to an increase in wholesale prices, relative to the baseline, and a small increase in RGGI allowance prices. But when allowance revenue is spent on demand reduction or electricity bill rebates, customer bills may go down. Both the Policy and the Policy + Investment scenarios predict less generation in Pennsylvania than the No Policy scenario, which means that Pennsylvania exports less energy, and some generation shifts to other PJM states. The authors describe this as 54 percent leakage: 54 percent of emissions reductions in Pennsylvania are offset by a rise in emissions elsewhere in PJM. This metric does not account for changes that may be occurring in the parts of RGGI that aren’t in PJM, so our preferred measure of the program’s environmental integrity is leakage between Pennsylvania and the rest of the U.S. (see Section 6). Interestingly, according to the results of this model, joining RGGI alone isn’t enough to increase renewable generation in Pennsylvania; it is the investment of allowance auction proceeds that does that.

3.2 Penn State Modeling 2020

Penn State’s analysis used a model called RPAM, which does capacity planning and system operation for five nodes representing Pennsylvania and PJM. To represent interactions of Pennsylvania, PJM, and the rest of the region, researchers created econometric estimates of the supply and demand of emissions reductions across RGGI, and the availability of renewable energy credits from outside PJM. They modeled a baseline and a scenario in which Pennsylvania joins RGGI, but unlike the PA DEP study, they did not model investments from program revenue or economic effects. They included scenarios in which Pennsylvania ends its Alternative Energy Portfolio Standards on joining RGGI or keeps it through 2030 while being part of RGGI.

Like the PA DEP study, Penn State finds that joining RGGI leads to less coal generation and more gas. The researchers downscaled the generation changes predicted by the model to existing power plants to get a spatially detailed look at the public health benefits of RGGI. They see greater health benefits of the policy than does the PA DEP study because they assume fewer coal retirements in the baseline, therefore leaving a greater opportunity for emissions reductions and health benefits. The Penn State study finds that joining RGGI raises wholesale prices in PJM, which leads to higher profits for generators. The authors point out that these higher wholesale prices might or might not translate into higher customer bills, depending on revenue use.

As in the PA DEP study, overall generation falls in Pennsylvania and rises in other parts of PJM. This implies emissions leakage to the rest of PJM. Penn State uses a different leakage metric than the PA DEP report, stating that 86 percent of emissions reductions in Pennsylvania are offset by emissions increases elsewhere in PJM and RGGI. This measure does not take into account interactions between the PJM and RGGI region and the rest of the US, so, we prefer a leakage metric that looks at decreases in emissions in Pennsylvania relative to increases in emissions in the entire rest of the U.S. (see Section 6). However, if one assumes little interaction between the PJM/RGGI region and the rest of the US, the Penn State metric should be similar to ours. The Penn State study argues that leakage leads to higher costs outside RGGI. A similar finding of higher costs outside RGGI appears in Burtraw et al. (2006), who find that changes in the multistate wholesale energy price stemming from state-level policies affect other states in the market. This also suggests that some costs of achieving emissions reductions in Pennsylvania are paid for by consumers or producers outside the state. Burtraw et al. argue that this effect would be observed even in the absence of emissions leakage, and that it is likely to lead to indirect emissions reductions out of state through reductions in electricity demand. Also like the PA DEP report, the Penn State report finds that few renewables built in Pennsylvania can be attributed to participation in RGGI. Although the report does not include detailed outputs for the no-AEPS case, it does indicate higher air pollution if, having joined RGGI, the state eliminates the AEPS than if it maintains the AEPS. This finding implies higher quantities of fossil generation in the no-AEPS case (see Table 10 of the Penn State report).

3.3 RFF Modeling 2019

In 2019, RFF modeled the effect of Pennsylvania’s joining RGGI using its Haiku electricity model in two studies.5 Burtraw et al. (2019a) presented a comprehensive study of the prospects for the introduction of carbon pricing in six states, including Pennsylvania. In a second study (Burtraw et al. 2019b), the investigation was extended to consider several approaches to distributing emissions allowances in Pennsylvania and the consequences for investments, consumer prices, and leakage. The second study is the basis of the results summarized here.

At the time, the Haiku model was formulated as a mixed complementarity problem: the model could place a cap on emissions in RGGI while simultaneously directing allowance value—through investing auction proceeds, rebating auction proceeds to consumers, or distributing emissions allowances to producers to provide a production incentive— in ways that affect the allowance price.6 The model also could represent changes in electricity and natural gas demand in response to changes in electricity and natural gas prices. The scenarios included (1) allocation of Pennsylvania auction proceeds to the general fund; (2) allocation to consumers divided evenly between spending on energy efficiency (which reduces electricity consumption) and rate relief (which may cause a rebound in consumption); (3) allocation as a production incentive to producers to accelerate a move toward lower-emitting generation and to mitigate leakage— specifically, allocation to generators covered by the regulation, except coal, and to all non-emitting sources, including existing nuclear but excluding existing hydro, wind, and solar facilities; and (4) a scenario with a mix of the consumer and producer allocations. These scenarios were motivated by previous findings that channeling auction proceeds on behalf of consumers or producers can affect market outcomes. Using auction proceeds to provide a production incentive for generators covered by the program (including gas and nuclear generators) can mitigate leakage (Palmer et al. 2017) and potentially lead to negative leakage by drawing in generation from neighboring jurisdictions (Burtraw et al. 2015).

Like the PA DEP and Penn State studies, the 2019 RFF study finds that emissions in Pennsylvania fall when the state joins RGGI because coal and gas generation decrease relative to baseline. Electricity prices are estimated to change by less than +/–0.5 percent, and total electricity expenditures range from +0.4% to –1.8% as demand varies with prices. Allocating auction proceeds to benefit consumers lowers expenditures even further. The status of Pennsylvania as an electricity exporter depends on the use of allowance value. When allowances are allocated to producers to provide a generation incentive, exports from Pennsylvania increase. This is consistent with prior RFF work on the use of production incentives in emissions markets (Palmer et al. 2017) and the effect of allowance allocation and firm profits (see Burtraw et al. 2006). Pennsylvania’s joining RGGI results in an overall drop in U.S. emissions, which is our preferred measure of leakage (see Section 6). The study also looked at RGGI with the existing AEPS, without the AEPS, and with an increasing AEPS and finds that RGGI + AEPS (with allocation of allowance value to producers) leads to more renewables than the AEPS alone, but that RGGI cannot replace the AEPS, since it does not incentivize the same amount of wind and solar. In fact, ending the AEPS has a ripple effect on renewables in the region: it may free up credits from renewables in Pennsylvania, making them eligible to help neighboring states meet their renewable portfolio standard goals and lowering investments in those states.

4. RFF-Kleinman Modeling 2023

4.1 Methods

The electricity system is undergoing substantial change with the declining cost of renewable energy and storage technologies; challenges in the siting of facilities, transmission lines, and pipelines; the anticipated electrification of transportation, buildings, and industry; and increasingly stringent emissions standards governing the combustion of fossil fuels. The most important regulatory change in the past few years is the Inflation Reduction Act of 2022, which makes hundreds of billions of dollars available to support clean generation and electrification of the economy. These changes motivate a reexamination of the prospects for Pennsylvania in RGGI.

We use the Haiku electricity model, a capacity expansion model with 49 nodes for the contiguous states and the District of Columbia. The model has perfect foresight over a 26-year time horizon and a detailed representation of state and national policies, including the IRA, as well as technology types. It solves for the minimum-cost operation of the electricity system over 24-time blocks representing three seasons, day and night, at four load levels (baseload, shoulder, peak, and superpeak), with average solar and wind availability for each state and time block. It has been used in many analyses of federal and state policy, including a 2019 investigation of expanded carbon pricing using the RGGI architecture in Pennsylvania and North Carolina, which are contiguous to RGGI states and thus potential electricity trading partners, as well as a group of four Upper Midwest states: Minnesota, Wisconsin, Illinois, and Michigan (Burtraw et al. 2019a). Most recently, the Haiku model has been used to analyze the potential effect of the IRA (Roy et al. 2022). It represents the main provisions that affect the electricity sector: the production tax credit, the investment tax credit, the carbon capture utilization and storage tax credit, and support for nuclear.

For this modeling exercise, RGGI is represented as an annual cap with price steps, so there is no banking of allowances over time and emissions in each year equal the number of allowances issued. The modeling does not designate the allowance auction proceeds to any particular use, so the proceeds have no effect on emissions, electricity rates, electricity bills, or generator profits within the model. If Pennsylvania implements RGGI, it will have the opportunity to direct proceeds to uses that could help the state meet its decarbonization goals.

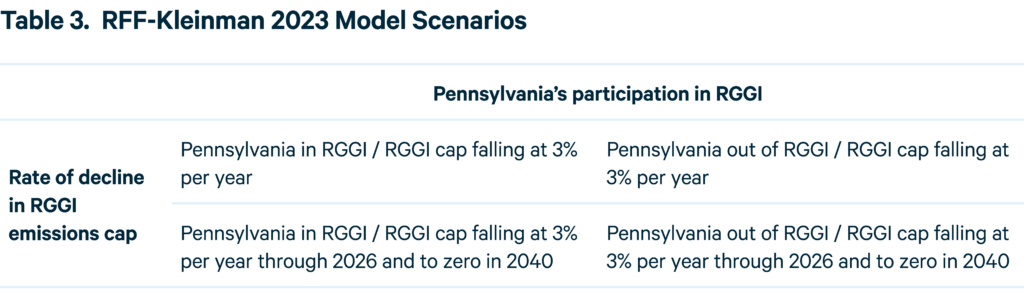

4.2 Scenarios

For this analysis, we focus on results in 2030 and investigate four scenarios (Table 3), involving Pennsylvania in or out of RGGI, and an emissions budget in RGGI that declines at 3 percent per year indefinitely or declines at a faster rate starting in 2026 and reaching zero by 2040. The 3 percent annual reduction in the emissions cap is relative to 2020 levels and represents the current trajectory of the emissions cap in RGGI. The accelerated rate of decline beginning in 2026 represents a view taken by many RGGI observers that additional low-cost emissions reductions are newly available because of the IRA; it also reflects increasing attention to climate change in general. Both scenarios resemble modeling scenarios that RGGI has commissioned as part of its ongoing program review.

5. Model Results

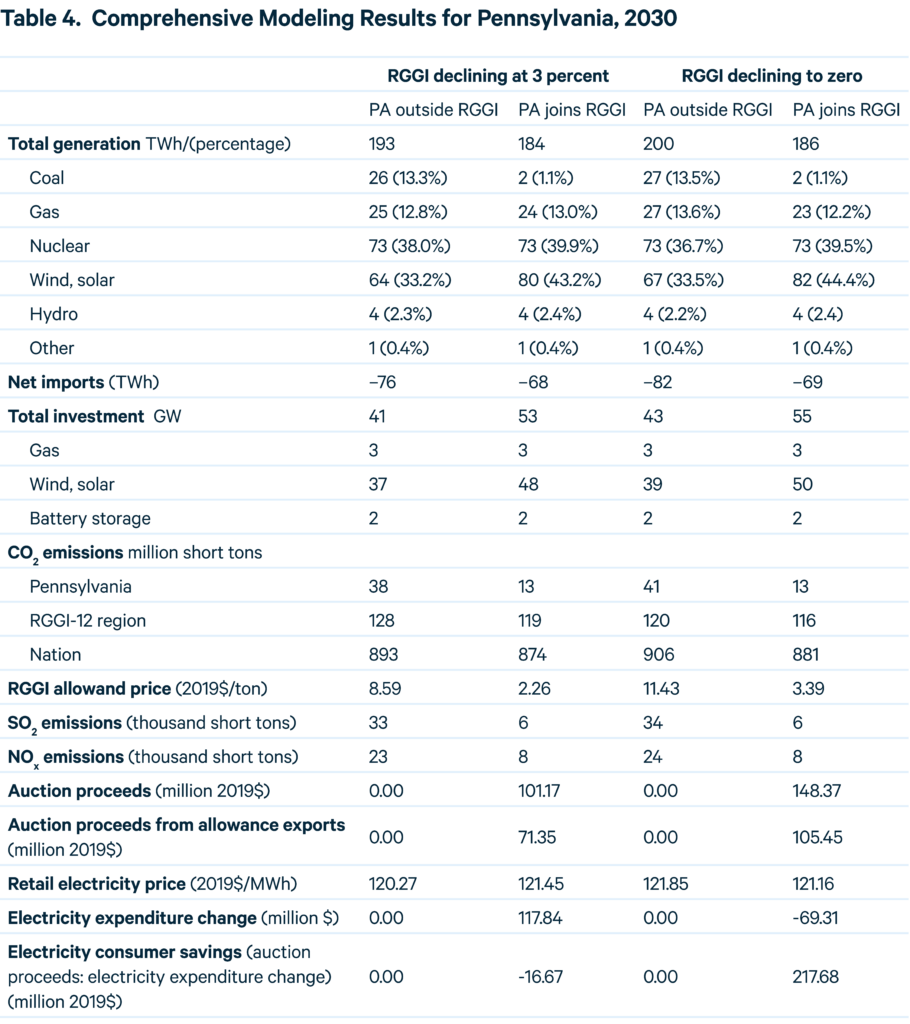

We focus on several outcomes of interest: emissions and leakage, allowance prices, electricity prices, generation, revenues, and air pollution. Comprehensive results are presented in Table 4.

5.1 Emissions Trends and Leakage

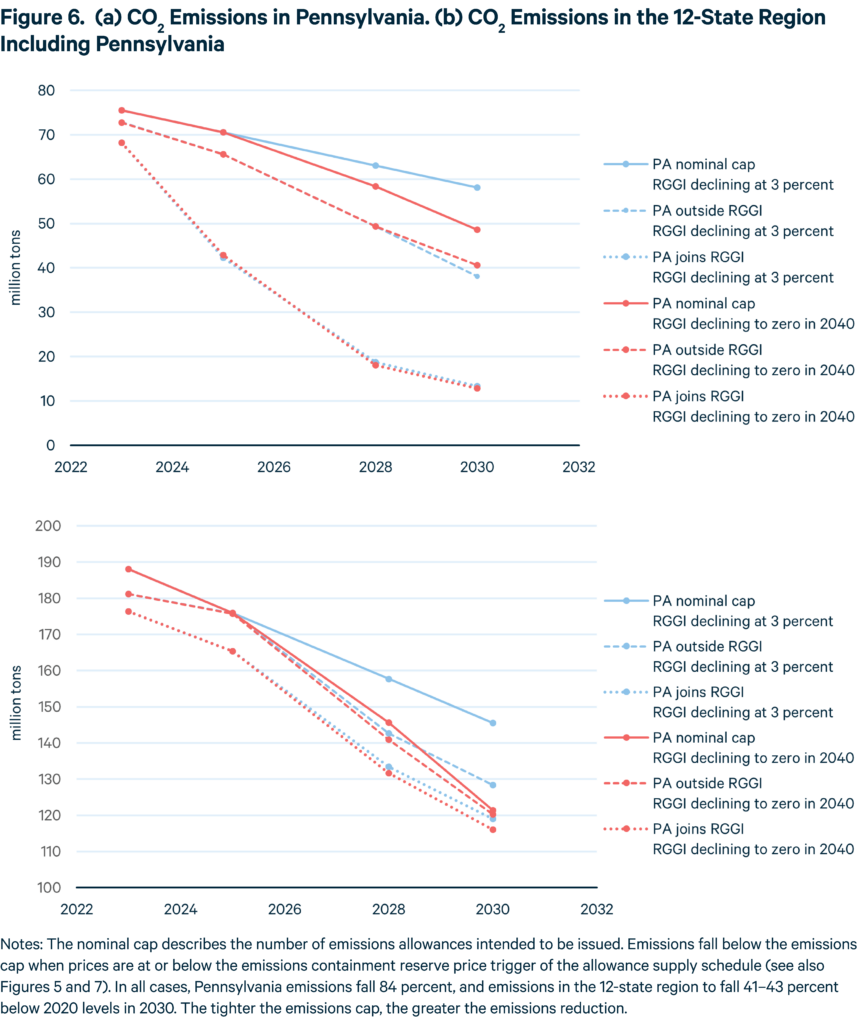

Joining RGGI lowers emissions. Joining RGGI leads to lower emissions in Pennsylvania, the 12-state RGGI region, and the nation under both rates of decline in the emissions cap (Figure 6).

In 2030, joining RGGI lowers Pennsylvania’s emissions by 25 million to 28 million tons below what emissions would have been if Pennsylvania were outside RGGI. This means that Pennsylvania goes from being 52–49 percent below 2020 levels in 2030 to 84 percent below 2020 levels in 2030. The more stringent cap aiming at zero in 2040 yields slightly lower Pennsylvania and RGGI emissions than the 3 percent cap, but the difference is small because the price steps in the allowance supply (price floor and emissions containment reserve) withhold allowances from the market at the observed low prices. Consequently, actual emissions are significantly below the nominal cap in both cases (i.e., the “anticipated cap” as labeled in Figure 5). This reduction in emissions results from a decrease in coal and, to a lesser extent, gas generation.

Within the 12-state RGGI region, emissions fall in 2030 from 37–41 percent below 2020 levels with Pennsylvania outside RGGI to 41–43 percent below 2020 levels with Pennsylvania in RGGI. The model finds that the tighter cap scenarios yield slightly higher national emissions than the 3 percent cap scenarios because higher coal generation outside the RGGI region replaces some generation inside the region. This substitution to out-of-state coal generation is made less likely given recent (Cross State Air Pollution Rule) and expected (Section 111) Clean Air Act regulatory actions on coal plants, as we discuss below.

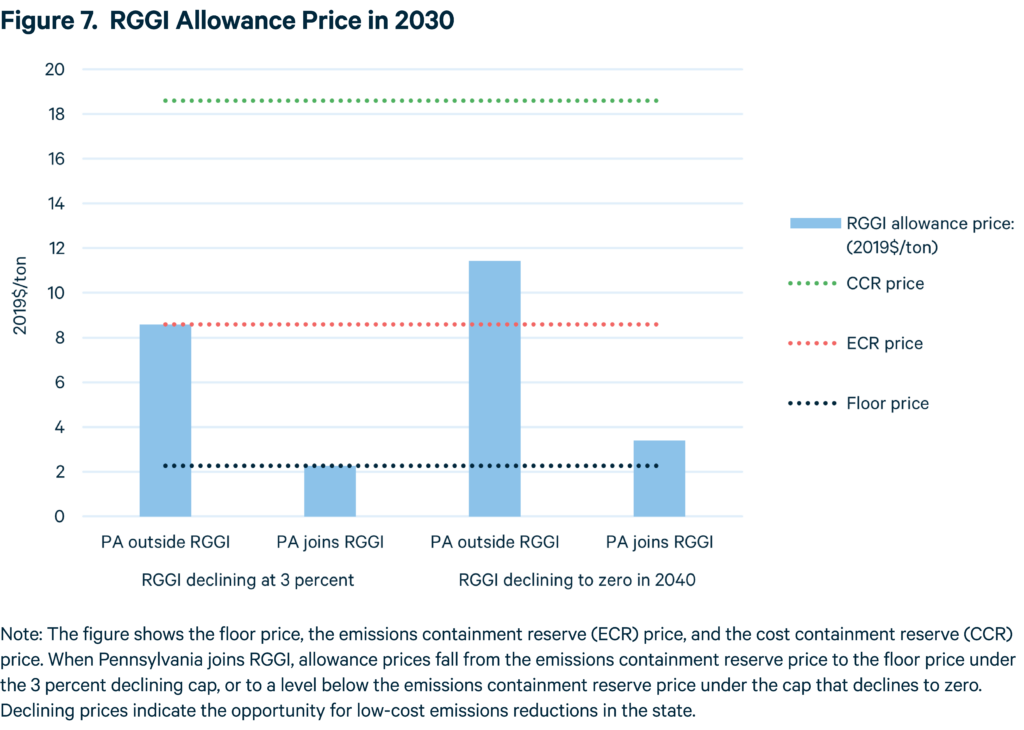

5.2 Allowance Prices

The emissions reductions in Pennsylvania are achieved at low marginal costs. In our scenarios, having Pennsylvania join RGGI causes the allowance price to drop from $8.59 (the emissions containment reserve price in 2030) to $2.26 (the floor price) (Figure 7). This reduction indicates that Pennsylvania has many low-marginal-cost emissions reduction opportunities, largely because, compared with other states, it has more coal production that could be abated at a low marginal cost and because the IRA provides substantial incentives for investment in renewable generation. These low allowance prices also demonstrate the importance of the RGGI’s supply adjustment mechanisms (the emissions containment reserve and the floor price). When allowance prices are low, indicating the availability of low-marginal-cost emissions reductions, these mechanisms reduce allowance supply to achieve greater emissions reductions and prevent the allowance price from falling to zero. This supply adjustment helps maintain the value of investments to reduce emissions and stabilizes auction proceeds.

Like the PA DEP model, our 2023 modeling finds that the allowance prices are lower than currently observed market prices. Current RGGI market prices are not necessarily a good predictor of RGGI prices when Pennsylvania is in the market because compared with other RGGI states, Pennsylvania will have a large allowance budget and has a different generation mix (with more coal and thus more opportunities for abatement).

Further, two prominent reasons explain why short-term allowance prices may not be a good predictor of long-term allowance prices in RGGI in general.

One reason is the volatility of natural gas prices. When natural gas prices are high, the cost of substituting from coal to natural gas is greater, driving up allowance prices and making the marginal opportunity for emissions reductions likely to be between coal and renewables. When natural gas prices are low, the substitution from coal to natural gas is less costly, pulling down allowance prices, and making a strategy to reduce emissions more likely. Since 2019–2020, natural gas prices have risen substantially—at one point to a fourfold increase above their previous level. This price rise was triggered by global energy supply disruptions associated with the war in Ukraine; prices are expected to return rapidly to long-term trends as new gas supply enters the market and the war is resolved. Futures market prices (NYMEX) have already fallen by 70 percent since September 2022. Our modeling carefully accounts for the recent spike in gas prices and anticipates a return to long-run forecasts (EIA 2019) by 2025.

A second reason that allowance prices identified by the model may differ from observed prices is the temporary period of market transition when Pennsylvania is expected to join RGGI. Observed market prices incorporate investors’ expectations about market behavior as well as market fundamentals. Compliance entities commonly exhibit risk-averse behavior when they assume new obligations associated with their participation in an emissions market. New entities enter the program with no market experience or allowance bank. Consequently, every previous emissions market (including markets for sulfur dioxide and nitrogen oxides) has seen initially high levels of demand and temporarily high prices as firms acquire allowances to build up a bank (Burtraw and Keyes 2018). This market behavior is typically followed by a return to expected prices over the longer term as the generation mix has time to adjust.

5.3 Electricity Prices

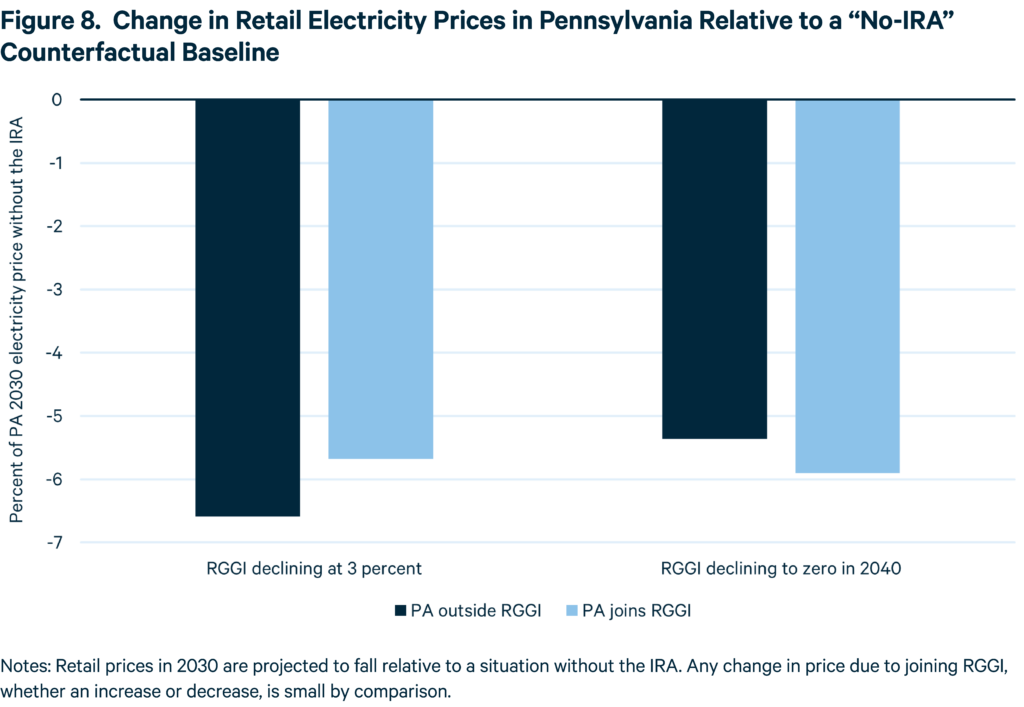

Emissions reductions in Pennsylvania are achieved at small or negative changes in retail electricity prices. Low allowance prices translate into a small increase (1 percent) in Pennsylvania’s retail electricity prices in 2030 under a 3 percent declining cap and a small decrease (–0.6 percent) in retail prices when the cap falls to zero by 2040 (see full results in Table 4). Initially, one might anticipate that introducing a carbon price in the electricity sector would raise the wholesale price (and thus retail price) by the allowance price times the emissions rate of the marginal generator. However, a Pennsylvania generator may not be the marginal generator in PJM. Furthermore, the price may be lower because even in the first year after a carbon price is introduced, there may be an opportunity to change the dispatch order of generation resources, including hydro or battery storage, such that the marginal plant changes to a lower-emissions plant, or for the marginal plant in the regional market to become a plant outside the state. In later years, newly built capacity yields a lower emissions generation mix. These multifaceted potential effects provide motivation for modeling to understand the influence of each factor.

The electricity price projected for Pennsylvania in 2030 in all scenarios is higher than recently observed prices in the state (before the current spike in natural gas prices).7 The higher prices are attributable in part to the current natural gas market disruption and to rising electricity demand over the decade. However, the projected price in every scenario is lower than it would be in the absence of the IRA. Figure 8 shows the change in the Pennsylvania retail price in 2030 under each scenario. The reference point (0 percent) describes the anticipated retail electricity price without the IRA. The bars represent the reduction in electricity price anticipated in the model due to the interaction of the IRA and the RGGI-related scenarios. The changes in retail prices projected when Pennsylvania joins RGGI are small in absolute terms and small compared with the reductions in retail prices expected from the implementation of the IRA.

Finally, although outside the scope of this study, changes in retail prices do not automatically translate into changes in household bills. In part, this is because price changes can induce behavioral changes to reduce consumption. But more importantly, Pennsylvania can use revenue from the program to promote energy efficiency or for direct bill relief. This study does not designate the revenue for such uses, since it does not make any decisions about what to do with revenue. The PA DEP and RFF 2019 studies both consider ways that revenue can be used to reduce bills.

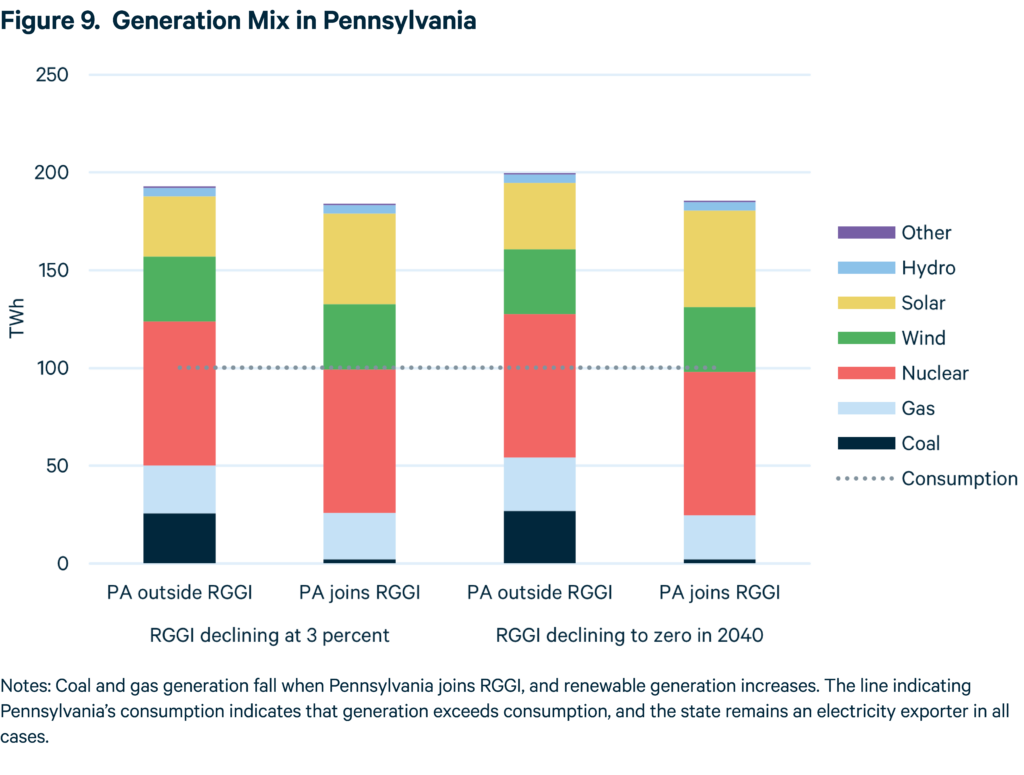

5.4 Generation

Joining RGGI decreases coal generation and increases renewable generation in Pennsylvania. Coal generation and—to a lesser extent—gas generation fall in Pennsylvania, and wind and solar capacity and generation increase (Figure 9). These changes are on top of a substantial increase in projected renewable capacity and generation due to the IRA. Wind and solar capacity and generation are also expected to be higher under the more stringent cap aimed at zero emissions by 2040 than under the 3 percent declining cap. The model predicts lower total generation in Pennsylvania in 2030 than in 2020 across all scenarios, whether Pennsylvania joins RGGI or not. This is likely because the analysis relies on consumption projections that grow slowly over the decade (AEO 2021). Below, we discuss uncertainty in demand levels due to investments in energy efficiency, electrification, and changes in economic activity.

5.5 Exports

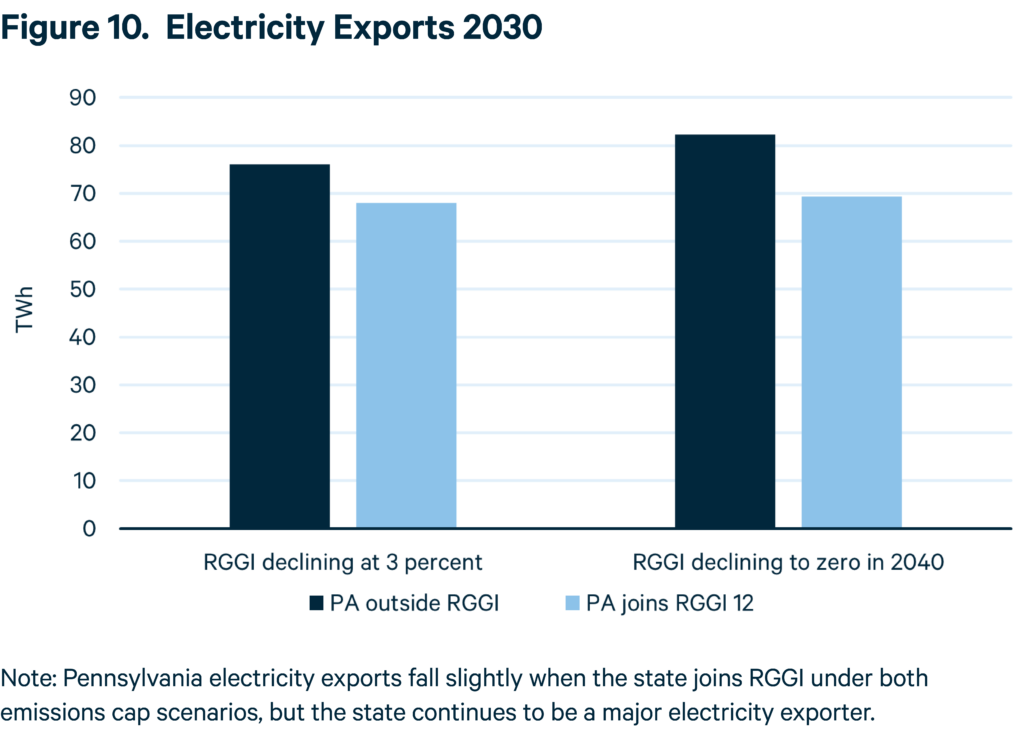

Joining RGGI lowers Pennsylvania emissions by lowering coal and to a lesser extent gas generation and increasing renewable generation. The increase in renewable generation is not as large as the decrease in fossil generation (Figure 9), leading to a reduction in exports. Nonetheless, the state remains a major regional electricity exporter (Figure 10).

5.6 Revenue

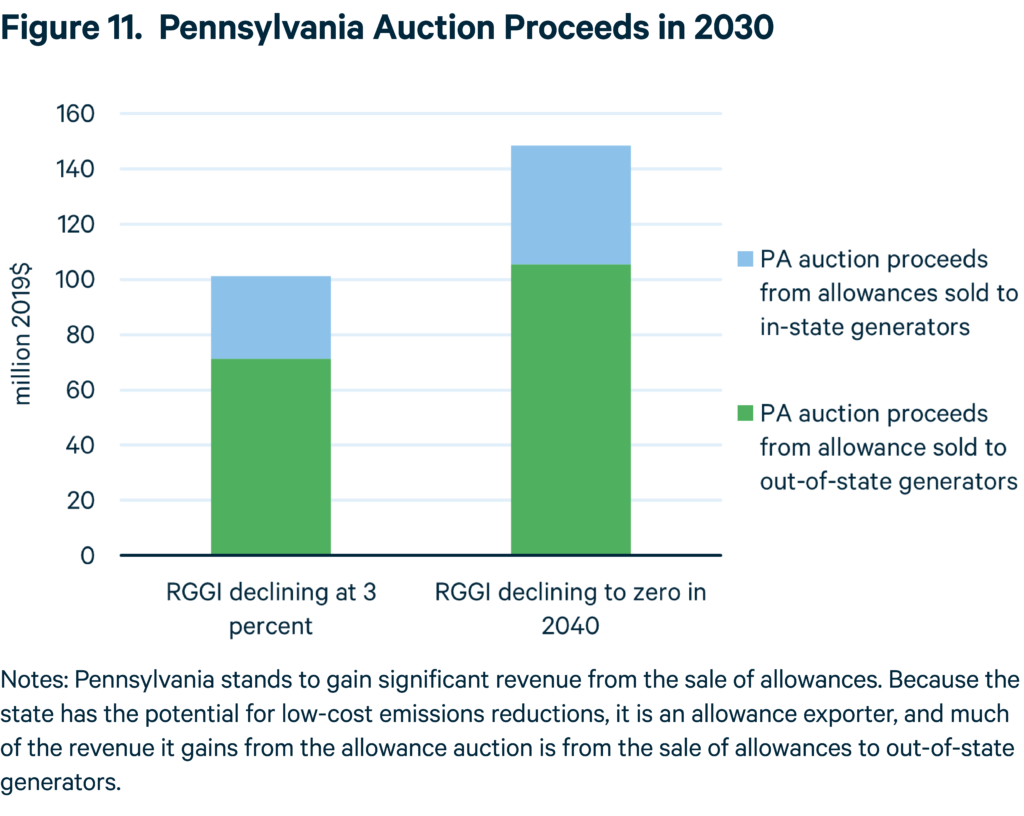

Pennsylvania gains substantial revenue from joining RGGI. Although allowance prices are low in 2030 if Pennsylvania joins RGGI, the state still gains $101 million to $148 million from the auction of emissions allowances in that year. A large portion of this revenue (71 percent) comes from the purchase of allowances by generators in other RGGI states (Figure 11). The ability to receive out-of-state revenues when low-cost emissions reduction opportunities can be realized in Pennsylvania is one of many reasons why RGGI cannot be compared to a carbon tax. Under a carbon tax, Pennsylvania would not be able to collect revenues from out-of-state generators.

As noted previously, the change in electricity prices is shared with other PJM states through exchanges in the regional wholesale power market, and therefore the revenue from the auction of emissions allowances is not all paid for by generators or consumers in Pennsylvania. The net effect for Pennsylvania consumers, combining auction proceeds and the change in electricity prices, is slightly negative under the 3 percent declining cap (allowance prices are on the floor and electricity prices rise a small amount), and beneficial under the tighter cap (allowance prices are off the price floor and electricity prices fall a little bit) (See Figure 5). Although the model does not designate revenue for any particular purpose, when comparing auction revenue with the change in electricity expenditures in Figure 12, we account for the auction revenue as a benefit flowing to consumers. In fact, Pennsylvania may decide to direct some or all of this revenue to program-related purposes that could directly reduce electricity bills or accelerate decarbonization.8

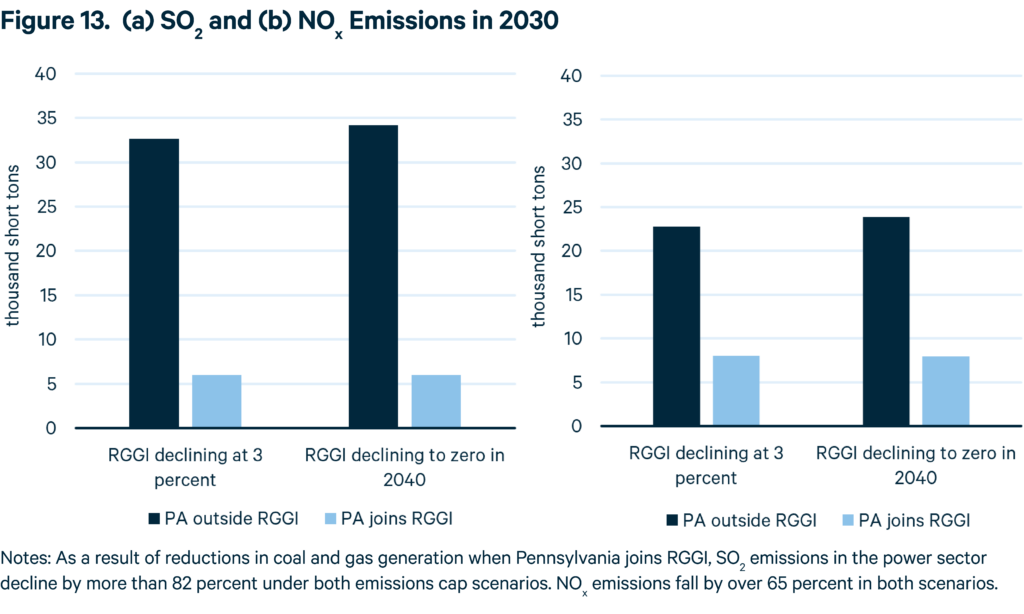

5.7 Air Pollution

Joining RGGI will decrease SO2 and NOx emissions in Pennsylvania, yielding important air quality benefits. Coal-fired electricity generation is the main source of SO2 emissions. Joining RGGI leads to the elimination of most SO2 emissions from Pennsylvania’s coal-fired power plants. Coal and gas are both sources of NOx emissions, and the decrease in coal and gas generation leads to a substantial decrease in NOx emissions (Figure 13). SO2 and NOx are both contributors to the formation of secondary fine particulate matter, which is the source of the majority of health harms associated with air pollution in the electricity sector. Reducing SO2 and NOx will deliver important health benefits for Pennsylvanians.

6. Discussion

In this section, we compare our model results (Table 4) with those of prior modeling studies and highlight several differences, summarized in Table 5. We also discuss major sources of uncertainty.

6.1 Comparison with Previous Modeling

We find directional agreement about changes in generation. Our modeling exercise indicates that joining RGGI will lead to a decrease in coal and gas generation and an increase in renewable generation in Pennsylvania. The prior modeling exercises also have indicated that RGGI would decrease coal and gas generation but have expected the AEPS to have more effect on renewable generation than RGGI. The responsiveness of renewable generation to RGGI in the present analysis is likely due to the introduction of renewable subsidies under the IRA. But this result should not be interpreted to mean that the AEPS is not also influential. Our results do not distinguish the influence of the policies that we model.

Prior work has also indicated that RGGI could play an important role in supporting nuclear generation in Pennsylvania. This is not a prominent result in our modeling because of the support for nuclear energy provided by the IRA and the Infrastructure Investment and Jobs Act of 2021. We assume these mechanisms maintain nuclear generation at current levels.

Total generation varies across prior modeling based on projected consumption in Pennsylvania. However, the models agree that the state will remain a major exporter of electricity.

We find directional agreement about changes in emissions. Prior modeling efforts agree that joining RGGI will reduce CO2 emissions in Pennsylvania. Each study takes a somewhat different approach to measuring the integrity of those reductions. PA DEP adopts a measure of leakage within the PJM region and finds 54 percent leakage (Table 5). The Penn State study measures leakage from Pennsylvania to RGGI and the rest of PJM and finds 81 percent leakage. Our study compares emissions in Pennsylvania and the rest of the country and finds 12–22 percent leakage. The approaches are thus not fully comparable.

If we consider only how emissions move between Pennsylvania and PJM, as in the PA DEP study, we ignore Pennsylvania’s power exports to RGGI, so there is less emissions leakage from the other RGGI states to the rest of the country. Considering leakage from Pennsylvania to RGGI and PJM, as in the Penn State study, may miss interactions between the edges of RGGI and PJM and the remainder of the United States. The large quantity of leakage found in that study likely comes from the drop in exports that occurs in Pennsylvania, made up for by a rise in generation elsewhere in the region. Although we find only a small amount of leakage when comparing Pennsylvania emissions with those in the rest of the country, under the scenario with an emissions cap declining to zero and Pennsylvania joining RGGI, we find leakage due to increased utilization of coal-fired plants in the PJM region. As we note below (in the next subsection), this outcome may be less likely because of anticipated Clean Air Act regulations that will affect coal plants.

Allowance prices and revenue estimates vary. Prior modeling has indicated that allowance prices in the RGGI region may rise if Pennsylvania joins RGGI, suggesting that emissions reductions would be more difficult to achieve in the state than in the existing RGGI region. These higher allowance prices also yield higher revenue estimates. In contrast, we find emissions reductions have a lower marginal cost than in the existing RGGI region, leading to lower revenue estimates.

One criticism of the PA DEP modeling, made by Pennsylvania’s Independent Fiscal Office, was that it used allowance prices that did not reflect the current observed allowance prices at RGGI. As explained above (Section 5), current prices at RGGI are not necessarily a good predictor of prices when Pennsylvania is in the market. Pennsylvania’s large allowance budget (compared with the rest of RGGI), the volatility of gas prices, and expected market behavior could result in a difference between expected and current prices; the latter were particularly high last year because of abnormal gas prices.

6.2 Uncertainties

Uncertainties in the modeling and their likely potential bias in the results include the following:

- Implementation of the IRA. Our implementation of the IRA is constrained by modest transmission growth and generous limits on the speed at which capacity can be added. Real-world delays to the siting and interconnection of renewable facilities may mean our representation of investments in renewable energy before 2030 is optimistic. Similarly, there is uncertainty about how the U.S. Treasury will implement the bonus credit provisions of the IRA for the investment and production tax credit provisions. Our implementation of the bonus credits is on the generous side, which may also lead to optimism about the renewable capacity that can be built before 2030.

- Electricity demand. Our demand scenario follows the Annual Energy Outlook 2021 (EIA 2021) and is low compared with the PJM demand projections used by the PA DEP and Penn State modeling teams. It may also be low compared with the demand growth that may result from electrification. One goal of the IRA is to promote electrification, and doing so will be increasingly important to decarbonizing the economy near the end of the decade through investments in transportation and buildings. A conservative (low) demand scenario may yield lower generation in Pennsylvania and imply depressed electricity and allowance prices. On the other hand, as mentioned under Methods (Section 4), this modeling effort does not consider the possible effects of the use of auction proceeds. States in RGGI previously have invested billions of dollars of auction proceeds in energy efficiency measures that have lowered electricity prices and consumer expenditures. Investments in energy efficiency could benefit electricity consumers similarly by reducing demand.

- Environmental regulations. EPA is rolling out regulations for air pollution through the Cross State Air Pollution Rule and Section 111 efficiency standards as well as for water pollution, such as the new coal combustion residual rule. These rules are expected to lead to the retirement of coal capacity and increased operational costs at surviving capacity. We do not represent these rules in the model and hence we may overstate the role of coal generation. A reduction in coal generation will bring Pennsylvania and RGGI closer to any emissions reduction target.

7. Revenue and Allowance Value Use

The modeling in this study does not consider uses of the revenue that Pennsylvania stands to gain from RGGI. Because the choice of revenue use is a critical question, we include here a brief description of ways that revenue can be used.

A carbon cap with tradable emissions allowances creates substantial economic value. In early environmental markets, emissions allowances were not sold but instead freely allocated to incumbent firms. This “grandfathering” meant that the economic value created by the carbon cap accrued to firms as allowance value rather than to the government as revenue. A large literature criticized both the efficiency and the distributional aspects of this approach, and now the general trend in emissions markets is to auction emissions allowances.

Today, the proceeds from allowance auctions are used by emissions trading programs in three general ways. One is to direct the value to the public, usually for spending on environmental programs. Programs that reduce emissions or energy demand can create a positive feedback loop that lowers future allowance prices. For example, in RGGI, roughly two-thirds of auction proceeds have been directed to energy efficiency investments, providing direct savings to households and businesses and reducing electricity demand, which then reduces emissions and electricity prices. A second approach is to direct the value to benefit consumers. Distributing the value to local distribution companies, for example, lowers electricity prices and improves affordability. This might be beneficial when expanding electricity use is a central strategy to reduce GHGs throughout the economy. Another way to benefit consumers is through climate credits (dividends) paid directly to households; this is how California uses most of the value from allowances in the utility sector. A third approach would direct the value back to producers, not for their incumbency but as a strategic incentive to preserve generation in the state and fight leakage. This “output-based” allocation can preferentially support clean technologies to accelerate an energy transformation. Each approach has advantages, and a mixed strategy can be useful.

In 2019, RFF used the Haiku model to examine 15 approaches to distributing emissions allowances or auction proceeds in Pennsylvania if it were to join RGGI, including combinations of the three general approaches described above and in combination with potential modifications to the AEPS. The results from that study are less relevant since the passage of the Inflation Reduction Act, but two lessons remain valid. The first is that allocation to producers increases generation and emissions within Pennsylvania. National emissions largely remain constant because the increased generation and emissions in Pennsylvania are shifts from other states. This makes an allocation to producers a potential leakage reduction measure. The second lesson is that allocation to consumers (primarily though energy efficiency or bill rebates) can lower electricity bills even when electricity rates increase.

The PA DEP study looked at how the state might consider spending the allowance revenue and imagined three representative investment portfolios: one with money split evenly among demand reductions, renewables, and GHG reductions (electric vehicles and carbon capture research), one with money going primarily to bill assistance, and one with money going primarily to the general fund. Although only the first portfolio—the mix of demand reductions, renewables, and GHG reductions—received a full treatment with the IPM model, the study did consider the economic benefits of each portfolio of investments using the REMI model. We recommend that readers refer to the PA DEP study for a summary of the results.

Rather than model investment portfolios, the Penn State study summarized the investments that other cap-and-trade programs have funded and considered a range of possible investments and their consistency with the Pennsylvania Air Pollution Control Act. We recommend that readers refer to that study for a comprehensive list.

8. Jobs

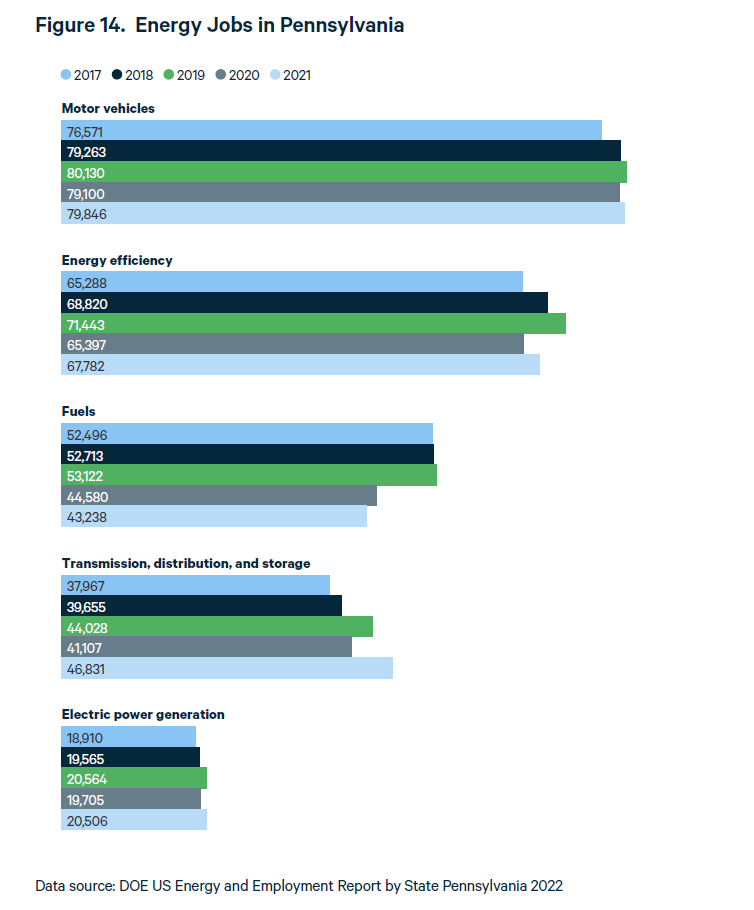

A major concern of stakeholders about joining RGGI has been the fear of losing jobs, given the effect of RGGI on the gas and coal industries. Our modeling did not include employment, but given the current market conditions and model results showing changes in electricity prices and generation, it is worthwhile to point to several factors that could cause job creation or job reduction.

How jobs could be affected depends on future electricity production for each type of energy. Joining RGGI causes coal generation and—to a lesser extent—gas generation to fall in Pennsylvania while wind and solar capacity and generation increase (Figure 9). This has three implications: (1) with present-day technologies and productivity; the number of direct jobs from fossil-fueled electricity generation would decline; (2) within the electricity sector, the distribution of jobs would change because the renewable industry, whose share of production could increase to 43 or 44 percent by 2030 if Pennsylvania joins RGGI, will need many new workers; and (3) we could see minor job losses in upstream gas supply, and job gains from potential investments of auction proceeds.

8.1 Fossil Fuel Generation Jobs

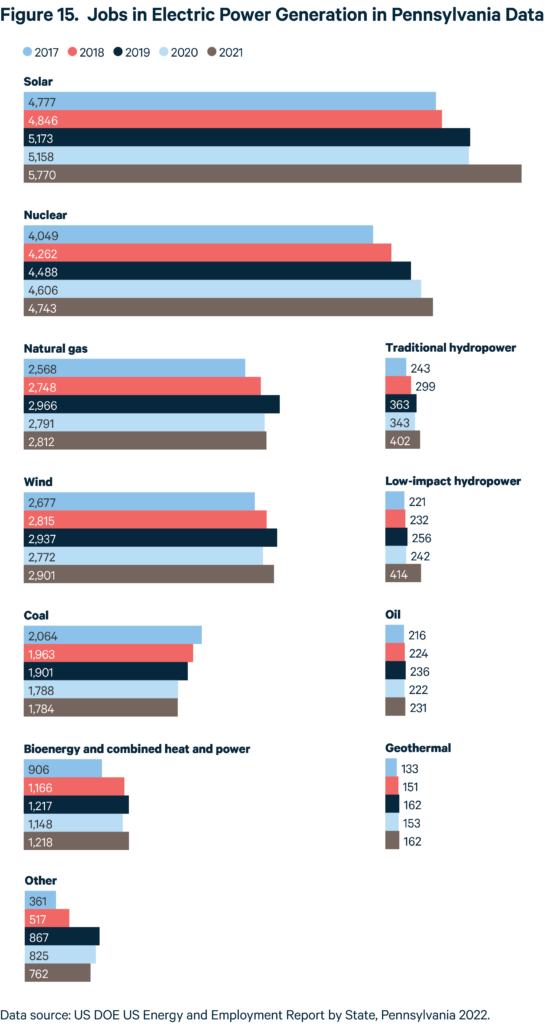

According to the U.S. Energy and Employment Report, Pennsylvania had 258,202 energy workers statewide in 2021, representing 4.6 percent of total state employment. Of these energy jobs, 20,506 were in the electric power generation sector (Figure 14). And of these 20,506 jobs, 2,812 are in gas generation and 1,784 are in coal generation (Figure 15). Direct jobs in the fossil fuel generation sector represent only 0.08 percent of total state jobs. The potential job reduction in this sector would have a minimal effect on state employment numbers, given its small share of direct jobs for the state economy and the creation of new jobs in the renewable and nuclear sectors. Moreover, the number of jobs in coal power plants has declined in the past 20 years: more than 60 coal-fired generating units have already closed. Only 14 coal power stations remain open; one, Homer City, was recently scheduled to close in June 2023. As explained in Section 2, this trend is likely to continue because coal power stations are not competitive under current market and regulatory conditions, even without state participation in RGGI.

Nevertheless, the job losses from a reduction in fossil fuel generation, especially the closure of coal power stations, will hurt the communities where the plants are located. Therefore, any state efforts to create new jobs should be directed to these communities.

8.2 Renewable Energy Jobs

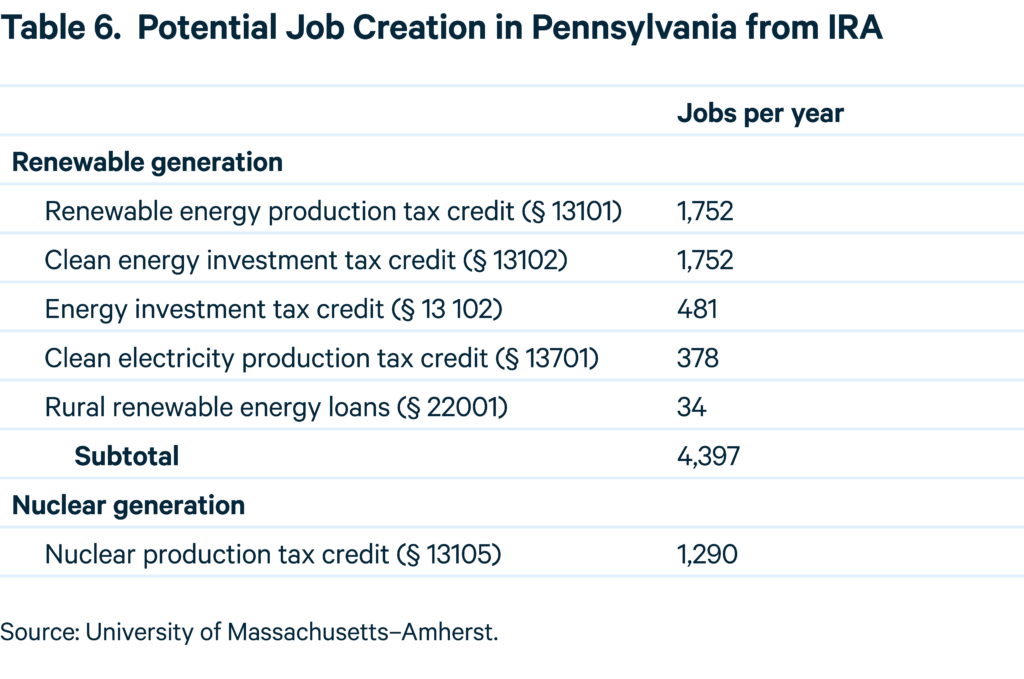

Redistribution of jobs within the electricity generation sector is not new. As seen in Figure 15, solar and wind generation already make up, without RGGI, the largest segment of employment related to electric power generation. Moreover, with the IRA and the public and private investment that the act will drive for renewable and nuclear power generation, a substantial increase in employment in these sectors is expected for the next 10 years. The Political Economy Research Institute at the University of Massachusetts– Amherst (Pollin et al. 2022) estimated that over the next decade in Pennsylvania, the IRA and associated private investment could add more than 4,000 jobs annually for the renewable energy industry and around 1,200 jobs annually for the nuclear power industry (Table 6). These additions could compensate for any direct losses in the fossil fuel generation sector.

8.3 Indirect Job Losses from Reduced Gas and Coal Demand

RGGI could also affect the gas and coal extraction industries in Pennsylvania by lowering the demand for these fuels in electricity production.

Only a small portion of the gas produced in Pennsylvania is used for electricity generation in the state, however. According to the EIA, Pennsylvania produced 7,626,504 million cubic feet in 2021 but consumed only 852,000 million cubic feet (11 percent) for electricity generation (EIA 2022). Reductions in electricity generation at gas plants in the state are therefore unlikely to have a large effect on employment in the state’s gas extraction sector. In fact, because 76 percent of gas produced in Pennsylvania is exported out of state to supply American and international markets, the main drivers of demand will continue to be the demand for natural plant Gas Liquids (including propane, natural gasoline, butane, ethane, isobutane, and refinery olefins), the speed of the electrification in the United States, and global demand for LNG even if Pennsylvania joins RGGI.

With or without RGGI, the likely closure of coal power plants, for the reasons explained in Section 2, would reduce demand for coal, since 38 percent of Pennsylvania’s coal is used for electricity generation. This reduction could affect coal mining jobs and coal communities.

8.4 Use of Allowance Revenues to Create Jobs

Even without RGGI, the renewable generation sector will expand because of environmental regulations, investments in clean energy, and Pennsylvania’s AEPS provisions. It is very likely that job growth in this sector could fully offset job losses in the coal generation sector. Although RGGI would accelerate this ongoing redistribution of employment from coal to renewables and nuclear, opponents to RGGI have mainly focused on fossil fuel generation job losses. This reflects Pennsylvania politics and the influence of the fossil fuel industry and unions on state legislators.

Because participation in RGGI generates revenues from the auction proceeds (as explained in Section 5, “Revenue” subsection), Pennsylvania would have funds to help ensure that the transition to clean power generation is just and equitable and that coal communities—the ones most affected by job losses—will benefit not only from cleaner air but also from the job creation and economic welfare that RGGI will bring. If the state remains outside RGGI, coal plants would continue to shut down but the state would not have RGGI revenues to address the job losses.

A study by The Analysis Group (Hibbard et al. 2018) has shown that spending of RGGI allowance revenue has generated billions of dollars in net benefits in the Northeast and Mid-Atlantic. For example, researchers found that RGGI-funded expenditures on energy efficiency reduced electricity demand, power prices, and energy bills. The state can also use the revenues from RGGI to address unemployment: in the PA DEP model, spending revenues on energy efficiency and renewable energy projects was the main factor in offsetting job losses.

Energy efficiency projects can be particularly labor intensive and require more workers. According to the International Energy Agency, every $1 million spent on energy efficiency is estimated to generate six to 15 jobs on average, depending on the sector (IEA 2020). Such projects could be mobilized quickly. Therefore, spending allowance revenues on energy efficiency projects targeted to low-income communities or the communities affected by power station closures may be a good option. Another approach is to invest in job training programs where workers can gain the skills for employment in new clean industries (e.g., clean energy manufacturing, critical minerals processing, solar installation). Retrained workers can ease labor shortages and inflationary pressures while making former coal communities attractive to investors seeking to take advantage of the Qualifying Advanced Energy Project Credit or the Low-Income Communities Bonus Credit—federal credits that encourage clean energy businesses to make targeted investments in underserved and hard-hit coal communities.

Dallas Burtraw

Darius Gaskins Senior Fellow, Resources for the FutureDallas Burtraw is the Darius Gaskins Senior Fellow at Resources for the Future. Burtraw was a 2018-2019 visiting scholar at the Kleinman Center.

Angela Pachon

Special AdvisorAngela Pachon is a special advisor the Kleinman Center and was previously the Center’s research director. She advises on the research agenda, research grants and the visitor scholar programs, as well as developing scholarship and research collaborations.

Maya Domeshek

Research Associate, Resources for the FutureMaya Domeshek is a research associate at Resources for the Future. Her research focuses on decarbonizing the electricity sector and the distributional effects of environmental policy. She works with RFF’s Haiku electricity sector model and the Social Welfare Incidence Model.

Acknowledgments

Thanks to Lucy Corlett for terrific research assistance. We acknowledge the financial support for model development from Resources for the Future’s Electric Power Program and Carbon Pricing Initiative, as well as the Environmental Defense Fund. The authors appreciate helpful comments from Marc Hafstead and John Quigley and assistance in model development from Nicholas Roy.

Allegheny Institute for Public Policy. 2021. Why the Regional Greenhouse Gas Initiative Is Wrong for Pennsylvania. Testimony before the Pennsylvania House Environmental Resources and Energy Committee. https://www.legis.state.pa.us/WU01/LI/TR/ Transcripts/2020_0082H.pdf.

Blumsack, Seth, et al. 2020. Prospects for Pennsylvania in the Regional Greenhouse Gas Initiative. Working Paper, Center for Energy Law and Policy, Penn State.

Brickley, Peg, 2017. Electric Plant Operator Homer City files for Bankruptcy, Wall Street Journal, January 11. https://www.wsj.com/articles/electric-plant-operator-homer- city-files-for-bankruptcy-1484142134.

Burtraw, Dallas, and Amelia Keyes. 2018. Recognizing Gravity as a Strong Force in Atmosphere Emissions Markets. Agricultural and Resource Economics Review 47(2): 201–19.

Burtraw, Dallas, Danny Kahn, and Karen Palmer. 2006. CO2 allowance allocation in the Regional Greenhouse Gas Initiative and the effect on electricity investors. Electricity Journal 19: 79–90.

Burtraw, Dallas, Karen Palmer, Anthony Paul, and Sophie Pan. 2015. A Proximate Mirror: Greenhouse Gas Rules and Strategic Behavior under the US Clean Air Act. Environmental Resource Economics 62: 217–41.

Burtraw, Dallas, Charles Holt, Karen Palmer, Anthony Paul, and William Shobe. 2017. Expanding the Toolkit: The Potential Role for an Emissions Containment Reserve in RGGI. Report. Washington, DC: Resources for the Future.

Burtraw, Dallas, Karen Palmer, Anthony Paul, and Paul Picciano. 2019a. State Policy Options to Price Carbon from Electricity. Report. Washington, DC: Resources for the Future.

Burtraw, Dallas, Maya Domeshek, Anthony Paul, and Paul Picciano. 2019b. Options for Issuing Emissions Allowances in a Pennsylvania Carbon Pricing Policy. Issue Brief. Washington, DC: Resources for the Future.

Caruso, Stephen. 2021. Gov. Candidate Shapiro Is skeptical of RGGI. It’s Unclear if AG Shapiro Will Do Something about It. Pennsylvania Capital Star. https://www.

penncapital-star.com/energy-environment/gov-candidate-shapiro-is-skeptical-of- rggi-its-unclear-if-ag-shapiro-will-do-something-about-it/.

Commonwealth of Pennsylvania. 2022a. CO2 Budget Trading Program. https://www. pacodeandbulletin.gov/Display/pabull?file=/secure/pabulletin/data/vol52/52- 17/625.html.

Commonwealth Court of Pennsylvania. 2022. Petition for Review. http://climatecasechart.com/wp-content/uploads/sites/16/case- documents/2022/20220712_docket-357-MD-2022_petition-for-review.pdf.

Department of Energy. 2022. Energy Employment by State 2022, United States Energy and Employment Report https://www.energy.gov/sites/default/files/2022-06/USEER%202022%20State%20Report_0.pdf

Energy Information Administration (EIA). 2019. Pennsylvania Electricity Profile 2019. Table 8 Retail Sales. https://www.eia.gov/electricity/state/archive/2019/ pennsylvania/.

———. 2021. Annual Energy Outlook 2021. https://www.eia.gov/outlooks/aeo/.

———. 2022. Pennsylvania Energy Profile. Table F18: Natural Gas Consumption Estimates, 2021. https://www.eia.gov/state/seds/data.php?incfile=/state/seds/sep_ fuel/html/fuel_use_ng.html&sid=US&sid=PA.

Environmental Protection Administration (EPA). 2023a. EPA Announces Latest Actions to Protect Groundwater and Communities from Coal Ash Contamination. https://www. epa.gov/newsreleases/epa-announces-latest-actions-protect-groundwater-and- communities-coal-ash.

———. 2023b. Greenhouse Gas Inventory Data Explorer. https://cfpub.epa.gov/ ghgdata/inventoryexplorer/.

Feaster, Seth. 2023. US on Track to Close Half of Coal Capacity by 2026. Institute for Energy Economics and Financial Analysis. https://ieefa.org/resources/us-track-close- half-coal-capacity-2026.

Flax, Debra. 2021. House Committee Votes to Reject Gov. Wolf’s RGGI Proposal. Pennsylvania Business Report. https://pennbizreport.com/news/20642-house- committee-votes-to-reject-gov-wolfs-rggi-proposal/.

Hibbard, Paul J., Susan F. Tierney, Pavel G. Darling, and Sarah Cullinan. 2018. The Economic Impacts of the Regional Greenhouse Gas Initiative on Nine Northeast and Mid-Atlantic States. Analysis Group.

International Energy Agency. 2020. Energy Efficiency Jobs and the Recovery. https:// www.iea.org/reports/energy-efficiency-2020/energy-efficiency-jobs-and-the- recovery.

Knittel, Matthew. 2022. Testimony on RGGI Modeling Assumptions. Independent Fiscal Office. http://www.ifo.state.pa.us/download.cfm?file=Resources/Documents/IFO_ Testimony_RGGI_Nov_4_2022.pdf.

McDevitt, Rachel. 2023. Pa. Gov. Josh Shapiro’s Budget Proposal Includes Regional Greenhouse Gas Initiative. State Impact Pennsylvania. https://stateimpact.npr.org/ pennsylvania/2023/03/07/josh-shapiros-budget-proposal-includes-regional- greenhouse-gas-initiative/.

Miller, Cassie. 2023. GOP Lawmaker Plans to Introduce Bill to “Eliminate” RGGI Regulation. Pennsylvania Capital Star, February 22. https://www.penncapital-star. com/blog/gop-lawmaker-plans-to-introduce-bill-to-eliminate-rggi-regulation/.

Morris, Jackson, and Mark Szybist. 2023. RGGI Is PA’s Path Forward on Climate in 2023. Expert Blog, Natural Resources Defense Council, January 10. https://www.nrdc.org/ bio/mark-szybist/rggi-pas-path-forward-climate-2023.