The Not-So-Rare Earth Elements: A Question of Supply and Demand

Rare earth elements are critical to several key industries and technologies, but 80% of their global supply is dominated by China. This report addresses the economic, geopolitical, environmental, and technological policy options for managing their future supply and demand.

At a Glance

Key Challenge

Adequate supplies of rare earth elements critical to clean energy and optoelectronic technologies must continue to be available, but the current imbalance in the global trade of these resources does not guarantee this.

Policy Insight

Policies should seek geopolitically stable supply chains and enforce sustainable mining and refining of REE, while encouraging flexibility and innovation where the use of REE fosters technological supremacy.

Executive Summary

Rare earth elements (REEs) are crucial ingredients for a range of energy and information technologies. They are an indispensable part of strong magnets for electric power generation to rechargeable battery components as well as for optical devices such as lasers. In recent years, the global supply, mining and distribution of REEs has come under intense pressure for a variety of reasons, including high demand, geopolitical tensions, lack of sustainable sources, and poor recovery efforts.

Addressing climate change is the need of the hour which demands advanced technologies in multiple spheres that critically depend on REEs. At the same time procurement of REEs must also remain an ecologically sustainable and economically viable process. This presents multifaceted challenges in terms of policy-making both at the scientific as well as geo-political level.

This report summarizes the key challenges and outlines targeted policy suggestions for key technologies and elements to secure their long-term supply and procurement in a peaceful and sustainable way.

Introduction

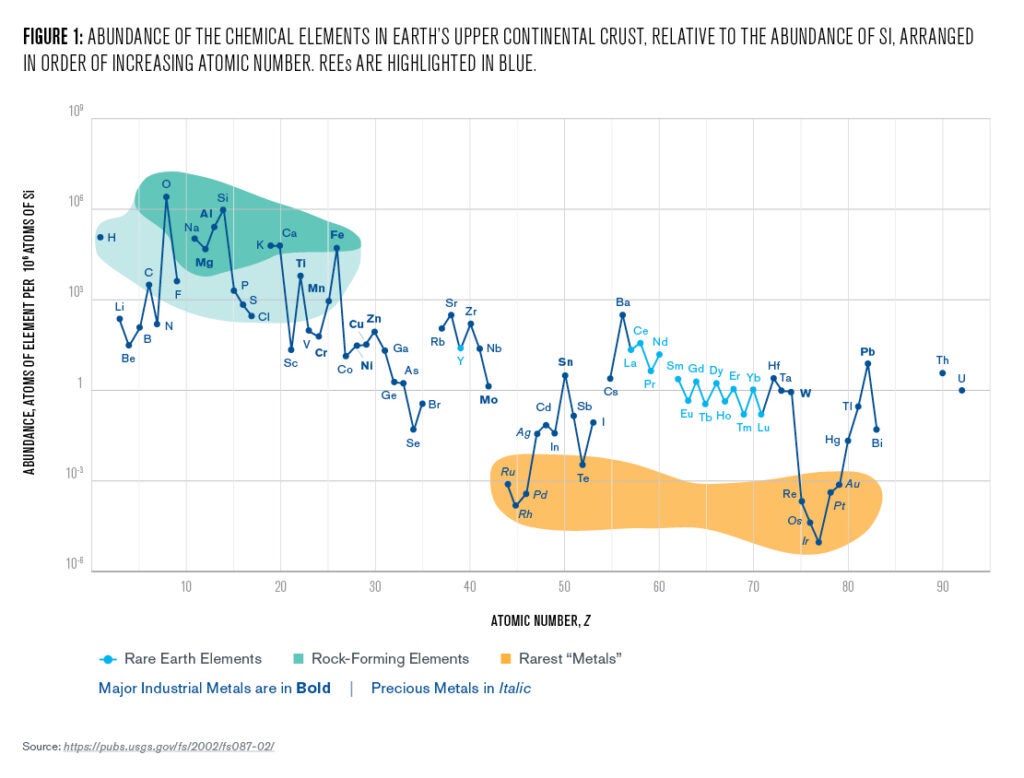

Rare earth elements (hereafter referred to as REEs) is a collective term for seventeen chemical elements in the periodic table consisting of yttrium (Y), scandium (Sc), and the 15 elements of the lanthanide series (IUPAC 2005). Despite the name, REEs are not very rare and found far more commonly in the Earth’s continental upper crust than most precious metals such as gold (Au) and platinum (Pt). Some REEs such as Cerium (Ce) are as abundant as industrial metals like Copper (Cu) and Nickel (Ni), as shown in Figure 1.

However, this abundance is distributed throughout the crust and is rarely found in concentrated deposits. REEs are therefore costly and energy intensive to extract. The four lightest REEs—lanthanum (La), cerium (Ce), praseodymium (Pr), and neodymium (Nd)—typically constitute more than 80% of these deposits, and heavier REEs such as europium (Eu), terbium (Tb), and dysprosium (Dy) are much more difficult to find (USGS 2021).

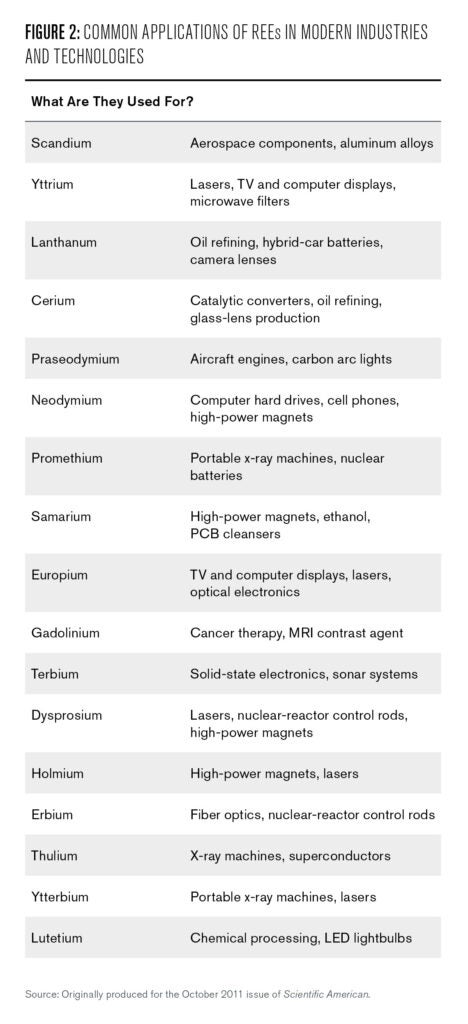

Materials that contain REEs are crucial in several critical industries, notably in the manufacturing of electronic and optoelectronic devices as well as high-power magnets for electrical power generation (Figure 2). Many of these industries have expanded tremendously in the past few decades, underscoring the sudden and recent attention bestowed upon REEs by politicians and scientists alike.

For instance, mobile phones have evolved from a rare novelty twenty years ago to an essential tool for some five billion people in 2019 (Silver 2019). With the continual expansion of the electronics industry and the explosive demand for ubiquitous renewable energy technologies, global demand for REEs is only expected to rise. Be it for national defense or for sustaining electric car assembly lines, it is in the best interests of both corporations and governments to ensure a stable supply of REEs.

Breaking the Chinese Monopoly

Currently, China holds a near monopoly in the global market for both the mining and refining of REEs, and most nations and industries of the world are dependent upon Chinese exports. In the past decade, the United States has continually imported above 80% of its REE supplies from China (USGS 2010-2021).

The difficulty of breaking the Chinese monopoly is that China not only has the world’s largest reserves of REEs but is also home to some 80% of REE refining facilities (Bhutada 2021). REE refining is a costly process with considerable environmental impacts, and many countries that mine REE ores from their own territories choose to have these processed in China rather than undertaking domestic refining.

China demonstrated its willingness to use its REE monopoly as a diplomatic tool in 2010 when it severely limited REE exports to Japan during arguments over disputed territory. The incident heralded to the world that China had begun to see its REE monopoly as a strategic tool in foreign policy.

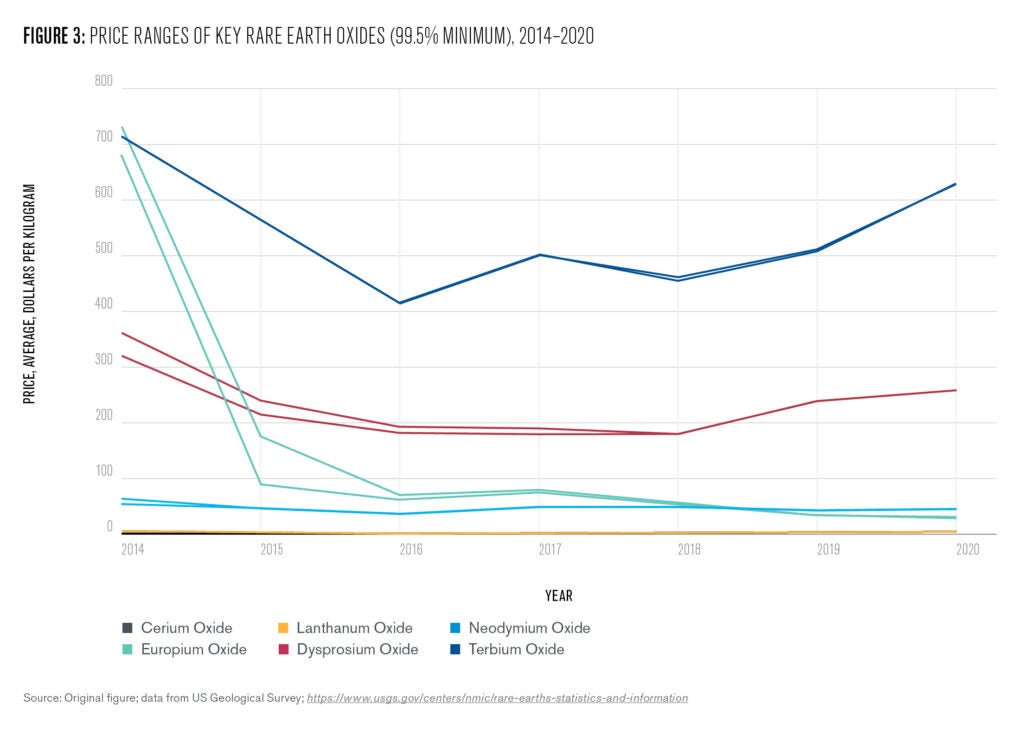

Even after the incident, the Chinese government maintained an REE export quota for the next four years; during this period REE prices remained high and were held in check only by occasional illegal mining and smuggling. Prices were somewhat restored in 2015 when the World Trade Organization declared China’s REE export quotas unlawful (Bohlsen 2019).

With recent tensions in U.S.–China relations, it has been suggested that China may use REE exports as a trump card in its trade war with the U.S. These concerns took a step closer to becoming reality in May 2019 with Chinese overtures of a potential embargo on REE exports to the U.S. President Xi Jinping visited an REE company in Jiangxi Province and made a televised speech later in the day calling for renewed efforts to address “challenges from abroad.” Nine days later, Xinhua Net, a Chinese state-run news agency, published an editorial titled “U.S. Risks Losing Rare Earth Supply in Trade War.”

Just these two incidents caused prices of most REEs in the global market to temporarily spike up by as much as 50% (Chang 2019; Xuequan 2019; Johnson and Groll 2019), most likely due to speculators buying up stocks in anticipation of the impending devitalization of Chinese supplies.

Although this incident did not leave as severe marks the REE market like the 2010 crisis, it left in its wake the notion that the REE market is highly volatile and highly dependent on Chinese foreign policy. Prices of some key REE such as Tb and Dy have begun rising again in view of such insecurities (Figure 3).

If China were to abruptly deny its REE supply chains to the U.S., both the U.S. government and private ventures would likely turn to stockpiles of REEs in order to stabilize the market and keep industries running (Hsu 2019). However, the U.S. National Defense Stockpile largely consists of unprocessed REE ores that still require Chinese refining, and a recent legislation prohibited the Pentagon from using REE-based magnets from China, Russia, or North Korea (Hansen 2020)—meaning that the U.S. is ill prepared for windfalls in the REE market in the near future. In review of China’s overwhelming dominance in global REE supply chains and its history of using it as political leverage, it is critical that the U.S. escapes dependency on Chinese REE supplies.

Policy Options

In the short term, the U.S. should seek a closer REE trade partnership with Australia, currently the only significant producer of REE ores outside of China. Australia is a close ally of the U.S. and has aligned itself economically and politically with the U.S. in combating Chinese monopoly in REEs, notably preventing a Chinese state-run company from acquiring Australian REE mining company Lynas Corp in 2009 (Matsumoto 2019).

Breaking this Chinese monopoly should happen in both mining and refining, and the current Australian supply chain achieves just that. Ores mined by Lynas in Australia are refined into industry-grade compounds (usually Rare Earth Oxides, or REOs) in Estonia, Japan, and Malaysia before being sold to companies in the United States.

REEs mined from Australia and China but refined in these three countries accounted for 12% of U.S. REE imports in 2015-2018 (USGS 2020). Any U.S. partnerships with these countries should ensure that their ore refining industries implement best practices and maintain their vital role in the non-Chinese REE supply chain.

In the long term, the U.S. should look beyond Australia in terms of REE mining and refining. In September 2019, the U.S. convened a Multilateral Meeting on Energy Resource Governance Initiative (ERGI) with several other nations with confirmed or potential reserves of critical minerals including REEs (US DS 2019). Some, such as Australia, Canada, and Argentina, have vast tracts of land measured and indicated to include considerable reserves of REEs. Most of these member nations have a track record of resource management and trade with the U.S. and are expected to be able to exploit their reserves responsibly and efficiently. From the United States’ perspective, the ERGI is intended to ensure responsible mining and trading of critical minerals in each country and, in the long run, become reliable (and potentially exclusive) suppliers of those minerals for the US.

However, the presence of exploitable REE reserves cannot be the sole indicator in selecting REE suppliers for the U.S. For example, efforts to secure and negotiate REE supplies in Afghanistan are challenged by the country’s civil unrest and discouraged by the sheer cost of general development that should precede profitable exploitation of any mineral reserve (Schewe 2017). With the recent Taliban occupation of the nation’s capital, Kabul, and the withdrawal of US assets from the region, it is probable that these dilemmas will continue.

Future U.S. efforts in breaking Chinese monopoly and diversifying foreign REE supplies then, should continue in the vein of seeking and working with geopolitically stable suppliers while being wary of China’s parallel efforts at buying up shares in foreign mining projects and their involvement in the refining of REE supplies from other countries.

Mountain Pass Mine and More

The Mountain Pass Mine in California is one of the largest REE reserves in the world and, between 1952 and 1990, was the only major source of REEs worldwide. However, prohibitive regulations for mining practices and the environmental ramifications of refining ores gradually undermined the profitability of domestic REE production.

Mountain Pass lost its unique attraction in the 2000s as outsourcing REE mining and processing to China became more meritorious in the eyes of businessmen and the public alike. The last-ditch attempt by Molycorp, the corporation owning Mountain Pass Mine, to compete with Chinese REE supplies was effectively over by 2014 when the company filed for bankruptcy (Green 2019).

The Mountain Pass Mine was put on care-and-maintenance status in 2015 and resumed operation in 2018. This had a discernible effect on U.S. production of REE ores, which netted 26,000 tons in 2020, a 44% increase from 2018 (USGS 2020). However, Mountain Pass is still the only commercially active REE mine in the US, and in the status quo a reduction in the Mine’s ore output—whether temporarily due to repair projects or permanently due to depletion—will concern investors and counteract U.S. efforts to expand domestic REE supply chains. Furthermore, Mountain Pass is partially owned by a consortium of Chinese corporations and nearly all the REE ores from the mine are sent to China for refining, meaning that the U.S. is technically not producing any REEs that can be fed directly into U.S. industries. The construction and operation of domestic refining facilities, however, remains at the infant phase, with several under construction or in pilot phase (Green 2019; Matsumoto 2019; Stutt 2020).

In addition to Mountain Pass, trace amounts of REEs have been found in phosphate minerals, which are mined as an essential ingredient for phosphoric acid that is critical to the fertilizer industry. It is estimated that about 250 million tons of these phosphate minerals are mined worldwide and none of the 100,000 tons of REEs in them are claimed (Rutgers University 2019).

Recent research results suggest a number of efficient and environmentally benign methods of extracting REEs from phosphogypsum, a byproduct of phosphoric acid production, by using organic, bacterial-induced acids such as gluconic acids as opposed to strong industrial acids such as sulfuric acid. However, these methods were tested on lab-synthesized phosphogypsum with controlled and known composition, and similar tests on industrial waste are yet to follow (Antonick 2019).

Policy Options

To meet growing REE demands, future U.S. policies should aim at locating and tapping into other promising REE reserves in the nation so that Mountain Pass Mine no longer constitutes the entirety of domestic REE mining. The United States Geological Survey has recently entered a joint venture with the respective geological survey functions of Australia and Canada in pooling data and best practices, called the Critical Minerals Mapping Initiative (USGS 2020).

All three nations have vast tracts of land with potentially tremendous reserves of critical minerals, and an accurate understanding of the distribution and concentration of these reserves should precede any major prospecting and development of mining facilities. The Round Top Mountain in Texas, Bear Lodge Range in Wyoming, and the Bokan-Dotson Ridge in Alaska have all been identified as promising deposits of REEs in the United States, and projects to develop and exploit these sites are underway (Borzykowski 2019; Goyal 2020). The former is expected to begin commercial production of refined REE in 2021.

Deep sea mining for polymetallic nodules with exploitable concentrations of REE may be considered if its drastic environmental ramifications can be justified for value of REEs extractable. Sustainable development implementation of best practices may be encouraged with a combination of government funding and environmental regulations, e.g. by putting these mines under pilot programs in joint venture with the Department of Energy. Regulations may further ensure that ores mined from these mines are refined in the U.S. and fed into the domestic supply chain as opposed to being refined overseas.

Policies regarding domestic mining and refining should keep in mind that, while multiple REEs are found in the same deposit, the most critical REEs are the few that are extensively used in permanent magnets—notably Nd and Dy. Relative concentrations of these elements could certainly be an important criterion in future mapping and prospecting of deposits. Future government funding and incentivization may encourage the priority purification of elements that are in high demand. For example, the Wheat Ridge refining facility was funded by the U.S. Department of Defense and the latter will determine the specific elements to be purified, ostensibly those that are essential to the defense enterprise (Stutt 2020).

REEs in Permanent Magnet Technologies

Replacing REEs with other more widely available materials can reduce general global demand for REEs as well as making various technology sectors more resilient to supply disruptions and price fluctuations of REEs. Unfortunately, REEs play crucial and exclusive roles in many industries and cannot be easily substituted. As of 2020, the U.S. National Minerals Information Center maintains that “substitutes [for REEs] are available for many applications but generally are less effective” (USGS 2020), which is true especially for cutting-edge technologies.

One of the most important applications of REEs is as constituent elements in permanent magnets used in electric vehicles, wind turbines, as well as computer hard disk drives. The most used composition, NdFeB, contains about 30% Nd; alternating layers of iron and Nd-B to create a dense distribution of unpaired electrons with aligned spins to form a strong magnetic field. Other trace REEs such as Pr and Dy are also added to make the magnet stable at high temperatures. In 2008, some 26,300 tons of Rare Earth Oxides were fed into the permanent magnets industry, 69% of which was NdO (Stanford Magnets n.d.).

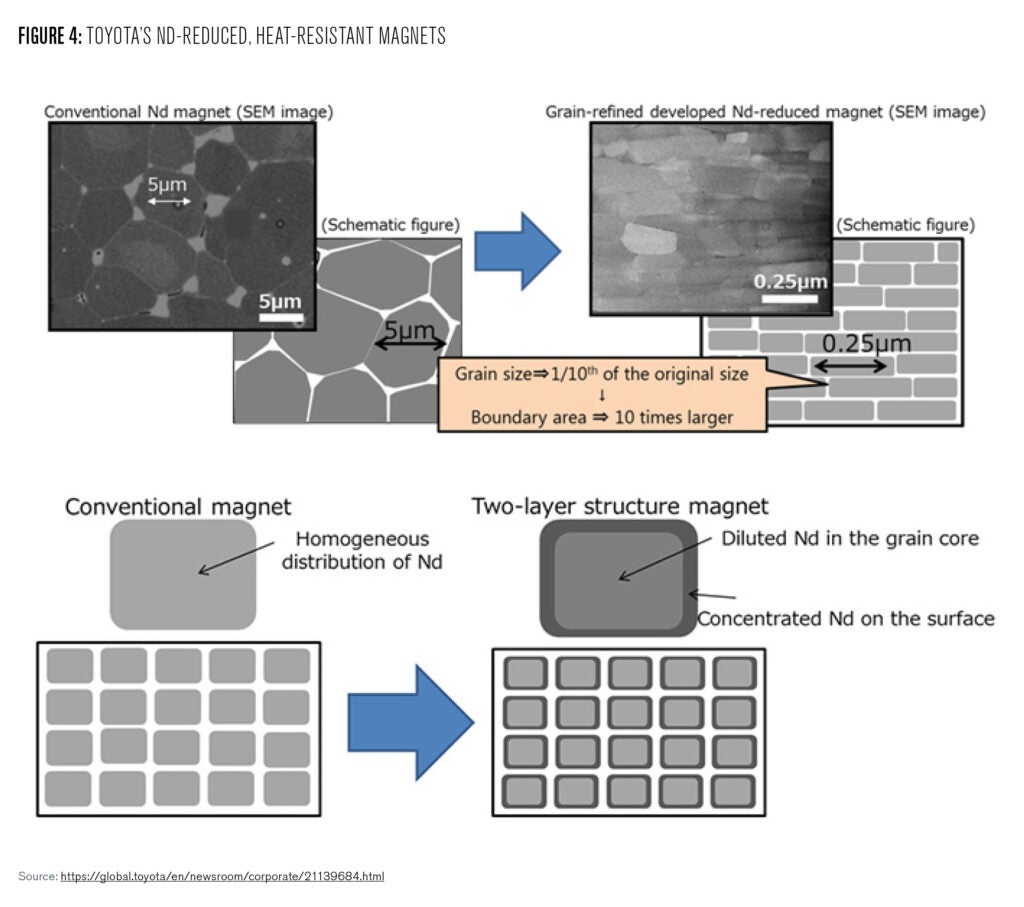

Several producers of electric vehicles have already taken steps to reduce REE consumption in their products to become more resistant to market fluctuations. Toyota, one of the biggest players in the market, has stopped using Tb and Dy in its products since 2016 (Bombgardner 2018). The company then announced an entirely new model of NdFeB magnets in 2018, which drastically reduces the amount of REEs needed through two facets: 1) a ten-fold reduction of the magnet’s grain size to increase grain boundary area and 2) concentration of Nd on the grain surface rather than using a homogeneous composition for the entire grain.

Toyota expects that these two measures will allow its next generation of electric motors to require just 50% of the Nd that the current generation of motors require. The trace REEs that will replace Nd in the magnet grain’s core will be La and Ce, which are much cheaper and more widely available than Nd, Tb, or Dy (Toyota Motor Corporation 2018).

On the other hand, Tesla takes an entirely different approach for most of its models: induction motors that use electromagnets instead of permanent magnets and hence do not require REEs (Rippel 2007). This makes a Tesla arguably more resistant to instabilities in the REE market than the competition (which relies on permanent magnets) and allows for more tunability in power output. However, electromagnets-based motors are generally less powerful and require a larger rechargeable battery forged from a composite of other critical elements such as nickel (Els 2021).

Wind turbines convert rotational momentum of an axle into electrical energy using the same principle of Faraday Induction as electric motors. This technology, again, favors permanent magnets. In 2011, the wind energy industry began shifting from REE-consuming permanent magnet synchronous generators (PMSG) to other electromagnet-based systems, wary of future REE market fluctuations like that witnessed in 2010.

However, PMSG are lighter, produce more power, use fewer parts, and require less maintenance. As new wind turbines are installed in offshore platforms and other remote locations, it is projected that the use of permanent magnets in the wind energy industry will once again increase. The EU’s Joint Research Centre (JRC) estimates that by 2030, permanent magnets will be found in more than 70% of the wind turbines in use (Dodd 2018).

If the use of permanent magnets is the preferable choice in the clean energy industry, their use in the realm of data storage is non-optional. Hard disk drives (HDD) store information in rotating platters coated with magnetic material, the bits of information (0 or 1) represented by the polarity of individual grains. For this manner of data storage to be non-volatile, permanent magnets that do not require power should be used (Munchen 2018). Because spin magnetic moment is an intrinsic and indestructible property, it does not “disappear”—and to compromise the stored data by reversing these moments requires a large external magnetic field that is not typically encountered in everyday life.

Therefore, magnetic memories are robust and reliable for long-term data storage in contrast with optical memory devices such as CD-ROM and flash (transistor-based) memory devices such as USB. Optical storage is less dense, bulkier, and read-only compared to magnetic memory, while flash has endurance limitations thereby reducing them to temporary storage applications. Therefore, unless flash memory evolves to have a semi-infinite lifespan and its price-per-bit can be greatly reduced, HDD using REE-based permanent magnets will remain the mainstream.

Policy Options

Future policies should acknowledge that REEs will remain critical components of permanent magnets, and that the latter will continue to play significant roles in several cutting-edge technologies. It is difficult to drastically reduce the proportions of REEs present in NdFeB magnets without forfeiting their unique advantages, and permanent magnets are generally the favorable choice over REE-free electromagnets in most applications.

For these reasons, Nd will remain in high demand in the short and medium term (Binnemans 2018). The decision to trade off reduced consumption of REEs for reduced performance and increased consumption of other critical elements should not be made lightly, and policies should be flexible in allowing industries to develop in the direction of compromise between good performance and dependence on various critical elements. Other REEs that are present in permanent magnets in trace amounts, such as Pr and Dy, will be in demand to different extents based on how technologies to reduce their use in permanent magnets progress.

REEs in Optoelectronics Technologies

REEs also play critical roles in the optoelectronics industry. Most solid-state lasers today are based on REE ions embedded in substrates that serve as gain centers, i.e. sites where an incoming signal is amplified and emitted as a high-intensity, phase-coherent, laser light. The unique electron configuration of REEs (outer 6s shells completely filled and inner 4f shells partially filled) permit a wide range of laser wavelengths. The most common solid state laser is the Nd:YAG laser, in which the gain centers are Nd3+ ions (Extavour 2011).

These lasers themselves have important medical, military, and scientific usage. REEs are equally important in optical fibers because of excellent amplification in wavelength ranges ideal for telecommunications applications (Poole 1986). For instance, Er-doped fiber has a huge gain bandwidth and is the ideal choice for amplifying multiple incoming data channels to different extents. REE-based phosphors are coated inside fluorescent light bulbs to apply color to the emitted light in a mechanism similar to solid state lasers. Finally, manufacturing and preparing various optical systems is yet another key application of REEs: CeO2 is the most effective and popular polishing agent for high-precision lenses and mirrors. While Cerium is one of the cheaper REEs, polishing agents account for the lion’s share of REE consumption within the realm of optoelectronics technology.

Policy Options

The practical advantages of using REEs in cutting-edge optical technologies cannot be easily forfeited, and complete substitution will not be feasible in many cases. Some substitutions that may happen in the short term include the use of Ce in optical polishing agents, for which competent and REE-free substitutes such as ZrO2 exist (Ichinoho 2009); and fluorescent lights, which are being phased out and replaced by LED lights that do not use REEs. Finally, cost-benefit analysis and policies in reducing REE usage should consider relative magnitudes of consumption in each technological sector.

The gain medium (rod) in a solid-state laser contains milligrams of REEs, whereas a Toyota Prius uses about a kilogram of REEs, and a typical wind turbine uses about half a ton (Harler 2018). The optoelectronics industry’s annual REE consumption is measured in kilograms, whereas the alloy industry that produces permanent magnets consumes tons of REEs annually (Extavour 2011).

Use, Reuse, and Recycle

On the eve of an increasing shortage of critical minerals, the U.S. Government is eagerly investing in projects and institutions for recycling them, and REEs are no exception. As is the case with many other materials, the importance of recovering REEs from end-user products is clear: the more we recycle, the less we need to newly mine to meet our needs. Successful programs and institutions for recycling aluminum cans is largely what makes the aluminum industry successful and economically feasible (Aluminum Association. n.d.).

Unfortunately, in the status quo, the vast majority of electronic waste is not properly recycled, and the high-value metals inside them are simply lost. According to the international Solid Waste Association, only 17.4% of 2019’s electronic waste worldwide was collected and recycled (Forti 2020). This is usually because precious metals such as Gold and Platinum are present in electronics in small quantities and even distribution; extracting these trace elements from used electronics is usually not feasible or economical. This is also the case for REEs in many electronic and optical devices such as fluorescent lights (Extavour 2011).

On the other hand, Nd makes up 30% of a typical permanent magnet, the rest being mostly iron. This means that potentially 1,000 tons of magnetic material can be recovered annually from used hard drives alone, many of them shredded and not reused due to data security concerns (Harler 2018). The current method of extracting REEs from permanent magnets, called Countercurrent Solvent Extraction, entails repetitively passing used magnets through parallel streams of organic and aqueous fluids flowing in opposite directions. Over time, the REEs dissolve and accumulate between the two streams. This process is not only time and energy consuming but also generates large amounts of chemicals harmful to the environment. This further disincentivizes the recycling of electronics to reclaim REEs (Penn Today 2016).

Corporations and researchers alike have attempted to develop superior methods of recycling REEs, some with promising results. A group of researchers from the University of Pennsylvania recently developed a new organic compound, H3TriNOx, that readily bonds to lighter REEs such as Eu but not to heavier REEs such as Y. This method can easily separate a light-heavy pair of REEs, such as Nd and Pr in permanent magnets (US DOE 2021; Schelter 2016).

Recycling REEs does not necessarily require completely separating each element, especially with the understanding that similar compositions of REEs are commonly used in permanent magnets. The recycling method developed through a collaboration between Momentum Technologies and Oak Ridge National Laboratory in 2018 takes this approach and can extract ~97% of REEs present in permanent magnets (Harler 2018).

Policy Options

As REE recycling methods are further optimized and institutionalized widely, we should continue to focus on permanent magnets and be mindful of both their environmental ramifications and economic competence in comparison to mining. An eco-friendly but expensive and small-scale extraction is not necessarily better than Countercurrent Solvent Extraction. While recovery rate for REEs may never be as high as that for aluminum, a sustainable and efficient recovery of REEs from used permanent magnets could make up a respectable portion of domestic supplies for certain REEs in the long term.

Outlook

In the near future, Nd will remain the most critical REE due to its indispensable need and function in permanent magnets. Industries such as electric vehicles and wind energy are continually expanding and becoming increasingly dependent on permanent magnets due to their superior performance over electromagnets. Demand for other REE may not be as critical, as these elements are used in trace amounts or may be partially substituted.

Mining and refining of REEs within the United States are still largely in the pilot phase, and Australia remains the only major producer of REEs besides China. Hence, the Chinese REE monopoly will continue in the short term, and gradually abate as both the United States and other countries develop their own REE supply chains, likely by pooling data and best practices.

The current Chinese REE monopoly is a vestige of both the mining and refining of ores being concentrated in China primarily due to economic and political factors, with the relative abundance of REE reserves in China proper being secondary. Large reserves of REE on par with those in China are found in the United States, Canada, and Australia, and plans to exploit these are well under way. Motivated by restrictive Chinese trade policies and rising demand for REE, there is a high potential for these programs to develop into stable domestic supply chains that will internationalize the REE market.

U.S. policies for the time being should accept that Chinese supplies will remain the most lucrative option for most industries, and punitive policies to discourage their use would not be advisable. Both the U.S. and other countries, through stockpiling of key REEs at both governmental and corporate levels, should ensure that domestic industries are relatively unimpacted by future fluctuations in the REE market for a reasonable period of a year or more. In the long run, incentivizing the use of American REE supplies should be considered, both to reduce dependency on Chinese supplies and to help vitalize the domestic REE market.

Finally, we should remember that REEs are just one class of materials that deserves attention as critical assets for the future. Other elements (notably Li, Co, Ni, and Mn used in battery applications; and Ga, In, As, Ce, and Cd used in semiconductor applications) are under increasingly higher demand for their extensive use in growing industries and technologies.

While the geopolitical stability of international supply chains and the science behind the mining and refining of these elements can be understood separately from those for REEs, these elements are often used in close conjunction—and sometimes have trade-off relationships—with REEs in several key applications. Policies aimed at managing REE demand and fostering sustainability should, therefore, be shaped with consideration of supply-demand and cost-benefit dynamics extending to other critical elements as well.

Aluminum Association. n.d. “Recycling.” Aluminum Association. Accessed April 19, 2021, https://www.aluminum.org/industries/production/recycling.

Alvin, Mary Ann. 2019. “Overview of DOE-NETL’s REE & CM Program.” National Energy Technology Laboratory. Accessed March 2, 2021, https://usea.org/sites/default/files/event-/MAAlvin_Workshop%20on%20REE%20and%20CM%20Production%20from%20Domestic%20Coal-Based%20Resources%20-%20DC.pdf.

Antonick, Paul J. et al. 2019. “Bio- and Mineral Acid Leaching of Rare Earth Elements from Synthetic Phosphogypsum.” The Journal of Chemical Thermodynamics 132: 491–96. doi:10.1016/j.jct.2018.12.034.

Bazilian, Morgan D. 2019. “We Need to Get Serious about ‘Critical Materials.’” Scientific American. Accessed January 10, 2021, https://blogs.scientificamerican.com/observations/we-need-to-get-serious-about-critical-materials/.

Bhutada, Govind. 2021. “Visualizing China’s Dominance in Rare Earth Metals.” Visual Capitalist. Accessed January 16, 2021, https://www.visualcapitalist.com/chinas-dominance-in-rare-earth-metals/?fbclid=IwAR1FGDI0ZAZBSZhSsX2YeA3b7oSqlr5YpfzI6qYxNvyxNQXsTBJJf6j3Kiw.

Binnemans, Koen et al. 2018. “Rare Earths and the Balance Problem: How to Deal with Changing Markets?” Journal of Sustainable Metallurgy 4 (1): 126–46. doi:10.1007/s40831-018-0162-8.

Schelter, Eric J. et al. 2016. “Accomplishing Simple, Solubility-Based Separations of Rare Earth Elements with Complexes Bearing Size-Sensitive Molecular Apertures.” Proceedings of the National Academy of Sciences 113 (52): 14887–92. doi:10.1073/pnas.1612628113.

Bolhsen, Matthew. 2019. “The U.S. Rare Earths Saga Continues…” Investor Intel. Accessed July 22, 2021, https://investorintel.com/markets/technology-metals/technology-metals-intel/the-rare-earths-state-of-the-market-july-2019/

Bombgardner, Melody M. 2018. “New Toyota Magnet Cuts Rare-Earth Use.” Chemical & Engineering News. Accessed February 26, 2021, https://cen.acs.org/content/cen/articles/96/i9/New-Toyota-magnet-cuts-rare.html

Borzykowski, Bryan. 2019. “Wyoming May Hold the Key to the Rare Earth Minerals Trade War with China.” CNBC. Accessed January 13, 2021,

https://www.cnbc.com/2019/07/10/wyoming-may-hold-key-to-the-rare-earth-minerals-trade-war-with-china.html#:~:text=Wyoming%20may%20hold%20the%20key,minerals%20trade%20war%20with%20China&text=America%20depends%20on%20China%20for,cellphones%20and%20other%20products%20rise.

Chang, Felix K. 2019. “Digging Deeper: Rare Earth Metals and the U.S.-China Trade War.” Foreign Policy Research Institute. Accessed January 21, 2021,

https://www.fpri.org/article/2019/06/digging-deeper-rare-earth-metals-and-the-u-s-china-trade-war/.

Dodd, Jan. 2018. “Rethinking the Use of Rare-Earth Elements.” Windpower Monthly. Windpower Monthly. Accessed May 13, 2021,

https://www.windpowermonthly.com/article/1519221/rethinking-use-rare-earth-elements.

Els, Frik. 2021. “Cobalt, Nickel Free Electric Car Batteries Are a Runaway Success.” Mining.com. Accessed March 11, 2021,

https://www.mining.com/cobalt-nickel-free-electric-car-batteries-are-a-runaway-success/.

Extavour, Marcius. 2011. “Rare Earth Elements: High Demand, Uncertain Supply.” Optics & Photonics News. Optics & Photonics News. Accessed May 17, 2021,

https://www.osa-opn.org/home/articles/volume_22/issue_7/features/rare_earth_elements_high_demand,_uncertain_supply/.

Forti, Vanessa et al. 2020. “The Global E-Waste Monitor 2020 .” Ewaste Monitor. Accessed May 19, 2021, http://ewastemonitor.info/.

Goyal, Radhika. 2020. “Controversial Alaskan Mine Receives a Push From the Trump Administration.” State of the Planet. Columbia Climate School. Accessed January 18, 2021, https://blogs.ei.columbia.edu/2020/09/30/alaskan-mine-trump-administration/.

Green, Jeffery A. 2019. “The Collapse of American Rare Earth Mining – and Lessons Learned.” Defense News. Defense News. Accessed January 18, 2021, https://www.defensenews.com/opinion/commentary/2019/11/12/the-collapse-of-american-rare-earth-mining-and-lessons-learned/.

Hansen, Tobin. 2020. “Securing U.S. Access to Rare Earth Elements.” Defense 360. Accessed July 21, 2021, http://defense360.csis.org/wp-content/uploads/2020/03/Hansen_Rare-Earth_v1.pdf

Harler, Curt. 2018. “Rare Opportunity to Recycle Rare Earths.” Recycling Today. Recycling Today. Accessed April 29, 2021, https://www.recyclingtoday.com/article/rare-earth-metals-recycling/.

Hsu, Jeremy. 2019. “Don’t Panic about Rare Earth Elements.” Scientific American. Accessed January 5, 2021, https://www.scientificamerican.com/article/dont-panic-about-rare-earth-elements/.

Ichinoho, N, et al, 2009. “Development of Cerium Oxide Composite Abrasives for Improvement of Cleanability and Dispersibility.” Proc of 3rd Int. Conf. of ASPEN (2009) 1B9-1-4

International Union of Pure and Applied Chemistry, 2005. “Nomenclature of Inorganic Chemistry.” Accessed January 19, 2021.

Johnson, Keith, and Elias Groll. 2019. “China Raises Threat of Rare-Earths Cutoff to U.S.” Foreign Policy. Accessed January 5, 2021, https://foreignpolicy.com/2019/05/21/china-raises-threat-of-rare-earth-mineral-cutoff-to-us/.

Matsumoto, Fumi. 2019. “US and Australia Team up against China’s Dominance in Rare Earths.” Nikkei Asia. Accessed January 6, 2021, https://asia.nikkei.com/Business/Markets/Commodities/US-and-Australia-team-up-against-China-s-dominance-in-rare-earths.

Mining.com editor. 2020. “Rare Earths Processing Facility Opens in Colorado.” Mining.com. Accessed January 29, 2021, https://www.mining.com/rare-earths-processing-facility-opens-in-colorado/.

München, Daniel Dotto, and Hugo Marcelo Veit. 2017. “Neodymium as the Main Feature of Permanent Magnets from Hard Disk Drives (HDDs).” Waste Management 61: 372–76. doi:10.1016/j.wasman.2017.01.032.

National Energy Technology Laboratory. n.d. “Critical Minerals Sustainability Program.” National Energy Technology Laboratory. Accessed December 28, 2020, https://netl.doe.gov/coal/rare-earth-elements/program-overview/background.

Paschotta, Rudiger. n.d. “Erbium-Doped Fiber Amplifiers.” RP Photonics Encyclopedia. RP Photonics Encyclopedia. Accessed May 20, 2021, https://www.rp-photonics.com/erbium_doped_fiber_amplifiers.html.

Paschotta, Rudiger. n.d. “Shortages of Rare Earth Materials – A Problem for Photonics?” The Photonics Spotlight. RP Photonics Encyclopedia. Accessed May 18, 2021, https://www.rp-photonics.com/spotlight_2014_06_27.html.

Penn Today. 2016. “Penn Researchers Expand Research on Simplifying Recycling of Rare-Earth Metals.” Penn Today. Accessed March 19, 2021, https://penntoday.upenn.edu/news/penn-researchers-expand-research-simplifying-recycling-rare-earth-metals.

Poole, S. 1986. “Fabrication and Characterization of Low-Loss Optical Fibers Containing Rare-Earth Ions.” Journal of Lightwave Technology 4 (7): 870–76. doi:10.1109/jlt.1986.1074811.

Rippel, Wally. 2007. “Induction Versus DC Brushless Motors.” Tesla, Inc. Accessed May 18, 2021, https://www.tesla.com/blog/induction-versus-dc-brushless-motors.

Rutgers University. 2019. “Researchers Find Potential New Source of Rare Earth Elements.” Phys.org.Accessed March 9, 2021, https://phys.org/news/2019-03-potential-source-rare-earth-elements.html.

Schewe, Eric. 2017. “War Has Made Afghanistan’s $1 Trillion in Minerals Worthless.” Daily JSTOR. Accessed February 2, 2021. https://daily.jstor.org/war-has-made-afghanistans-1-trillion-in-minerals-worthless/

Silver, Laura. 2019. “Smartphone Ownership Is Growing Rapidly Around the World, but Not Always Equally.” Pew Research Center’s Global Attitudes Project. Pew Research Center. Accessed February 5, 2021, https://www.pewresearch.org/global/2019/02/05/smartphone-ownership-is-growing-rapidly-around-the-world-but-not-always-equally/.

Stanford Magnets. n.d. “Rare-Earth Consumption and the Uses in Neodymium Magnets.” Stanford Magnets. Accessed May 21, 2021, https://www.stanfordmagnets.com/rare-earth-consumption-and-the-uses-in-neodymium-magnets.html.

Stutt, Amanda. 2020. “USA Rare Earth’s Ambitious Plans for Domestic Supply Chain.” Mining.com. Accessed January 26, 2021, https://www.mining.com/round-top-to-establish-us-rare-earths-supply-chain/.

Toyota Motor Corporation. 2018. “Toyota Develops New Magnet for Electric Motors Aiming to Reduce Use of Critical Rare-Earth Element by up to 50%: Corporate: Global Newsroom.” Toyota Motor Corporation. Accessed May 20, 2021, https://global.toyota/en/newsroom/corporate/21139684.html.

United States Department of Energy. 2021. “Rare Earth Recycling.” Office of Science. United States Department of Energy. Accessed May 22, 2021, https://science.osti.gov/bes/Highlights/2017/BES-2017-03-c.

United States Department of Energy. 2017. “Report on Rare Earth Elements from Coal and Coal Byproducts.” United States Department of Energy. Accessed December 27, 2021, https://www.energy.gov/sites/prod/files/2018/01/f47/EXEC-2014-000442%20-%20for%20Conrad%20Regis%202.2.17.pdf.

United States Department of State. 2019. “U.S. Convenes a Multilateral Meeting on Energy Resource Governance Initiative (ERGI).” United States Department of State. Accessed January 17, 2021, https://2017-2021.state.gov/u-s-convenes-a-multilateral-meeting-on-energy-resource-governance-initiative-ergi/index.html.

United States Geological Survey. 2020. “Critical Cooperation: How Australia, Canada and the United States Are Working Together to Support Critical Mineral Discovery.” United States Geological Survey. Accessed January 17, 2021, https://www.usgs.gov/news/critical-cooperation-how-australia-canada-and-united-states-are-working-together-support.

United States Geological Survey. n.d. “National Minerals Information Center.” Rare Earths Statistics and Information. United States Geological Survey. Accessed January 12, 2021, https://www.usgs.gov/centers/nmic/rare-earths-statistics-and-information.

United States Geological Survey. 2021. “Rare Earth Elements – Critical Resources for High Technology.” United States Geological Survey. Accessed January 11, 2021, https://pubs.usgs.gov/fs/2002/fs087-02/.

United States President Executive Order, 2017. “A Federal Strategy to Ensure Secure and Reliable Supplies of Critical Minerals, Executive Order 13817 of December 20, 2017.” Federal Register Vol.82, no. 246 (December 26, 2017): Page 60835-60837. https://www.federalregister.gov/documents/2017/12/26/2017-27899/a-federal-strategy-to-ensure-secure-and-reliable-supplies-of-critical-minerals

Xuequan, Mu. 2019. “Commentary: U.S. Risks Losing Rare Earth Supply in Trade War.” Xinhua Net. Accessed January 21, 2021. http://www.xinhuanet.com/english/2019-05/29/c_138097845.htm.

Hyong-Min Kim

Undergraduate StudentHyong Min Kim is a senior majoring in electrical engineering and minoring in history at Penn. His research interests lie in the fabrication and characterization of electronic and optoelectronic devices using transition metal dichalcogenides and other novel 2D materials.

Deep Jariwala

Associate Professor of Electrical and Systems EngineeringDeep Jariwala is an associate professor of electrical systems engineering in the School of Engineering and Applied Science.