Energy Transitions Are Brown Before They Go Green

Serial bankruptcies, terrifying explosions, and permanent closure at the largest oil refinery on the U.S. eastern seaboard preview the challenges of the energy transition in the real world, which often starts brown before it goes green.

This research was made possible through a generous gift from Carl Goldsmith (W’88).

The Atlantic Refinery was established near the confluence of the Schuylkill and Delaware Rivers in 1866, just seven years after Edwin Drake struck oil in Western Pennsylvania and effectively launched the beginning of the modern petroleum industry. The Atlantic Refinery was an ideal location far removed from the homes and small factories of a Philadelphia that was still a generation away from becoming the “Workshop of the World.”

But 150 years later, the refinery now encompasses 1,300 acres—equal to the size of Philadelphia’s central business district. It nestles among residential neighborhoods, the airport, three stadiums, and the revitalized Navy Yard office district containing iconic Philly brands like Urban Outfitters, GSK, and Tastykake. The refinery is just down river from three universities, four hospitals, and over $5 billion of office and lab development supporting 80,000 jobs defining the future of the life sciences and data analytics.

Juxtapositions of legacy and prospect are extreme in Philadelphia but also represent an often-overlooked truth about the energy transition: it starts brown before it goes green. The energy transition starts with legacy assets and incumbent actors whose profits and power derive from the hydrocarbon resources of wood, coal, oil, and gas that powered the Industrial Revolution.

These assets and actors are clearly being disrupted by efforts to contain the damages done by our use of these resources. But recognizing that these assets and actors constitute a set of powerful initial conditions—call it a “brown” energy system—is a key policy driver in accelerating a just and efficient transition.

In 2012, Philadelphia Energy Solutions (PES) purchased the refinery from Sunoco and reported several years of profitable operations conditioned on very specific circumstances1, which were sharply leveraged by PES’s primary investor The Carlyle Group. The investors borrowed heavily to finance their investment, which was economical for the investors but also greatly increased the chances of subsequent bankruptcy. And indeed, PES filed for bankruptcy in January 2018. PES reorganized and emerged from Chapter 11 protection in March 2018, with Carlyle largely exiting from ownership.

The University of Pennsylvania’s Kleinman Center for Energy Policy studied the PES Refinery for many years. In late 2018 we issued a report anticipating that the reorganization had done little to address the market fundamentals challenging PES’s viability and that the company would likely declare bankruptcy again before 2022 (Simeone 2018).

Explosion Aftermath

Then, in June 2019, the PES refinery in Philadelphia was rocked by three explosions and resulting fires. A section of pipe in one of the refinery’s two HF alkylation units had corroded to “half the thickness of a credit card” according to the preliminary report by the Chemical Safety and Hazard Investigation Board (CSB) (2019). When that pipe failed, the explosions vaporized about 3,000 pounds of deadly hydrofluoric acid into the atmosphere.

The CSB attributed the absence of fatalities to luck and in an interview the director noted, “The board remains concerned that the next time there is a major explosion at a refinery that uses HF for alkylation, workers and those living nearby will not be so lucky” (Maykuth 2019).

Five days after the explosions, PES announced it would shut down the refinery and then filed for bankruptcy a month later. More than a thousand refinery workers were given short notice, with bankruptcy protection allowing the company to end workers’ health benefits, including access to COBRA. One hundred thousand fence-line neighbors were left with health fears and ongoing doubts over who is liable for past and future exposure.

Mayor Jim Kenney and the city government responded to the incident with vigor, starting with the first responders and continuing with oversight by many agencies and departments in cooperation with state and federal officials. The City also formed an independent advisory group charged with gathering input from many perspectives.

I served on this advisory group and chaired the environment and science committee. The public meetings we attended gave voice to the conflicts, disruptions, and anxieties over the energy transition, exposed the limited capacity of cities to meet national goals, and demonstrated the importance of investment capital to make change. The effort led to an in-depth report produced independently by the City under the direction of the Managing Director and Fire Commissioner (City of Philadelphia 2019).2

The Philadelphia refinery closure provides an instructive test case of the U.S. energy transition in the real world (Hiar 2020). The scale of the energy transition facing the U.S. suggests that bankruptcy proceedings like PES will play a growing role. Hopefully, these will rarely be precipitated by explosions, but surely some concern is warranted over the strained finances of dozens of U.S. refineries that operate complex and dangerous facilities.

Even without explosions and fires and releases of toxic materials into air and water, bankruptcy is unlikely to ever be the optimal venue for aligning market signals with policy goals. Bankruptcy remains a complex process intended to maximize value for the creditors of distressed companies. That leaves an ambiguous role for those focused on the public good rather than the settling of private debts. On the other hand, as the refinery case demonstrates, bankruptcy court is a “court of equity” in which judges base their decisions on principles of fairness rather than rigid application of law (Federal Judicial Center 2019).

Even without explosions and fires and releases of toxic materials into air and water, bankruptcy is unlikely to ever be the optimal venue for aligning market signals with policy goals. Bankruptcy remains a complex process intended to maximize value for the creditors of distressed companies. That leaves an ambiguous role for those focused on the public good rather than the settling of private debts. On the other hand, as the refinery case demonstrates, bankruptcy court is a “court of equity” in which judges base their decisions on principles of fairness rather than rigid application of law (Federal Judicial Center 2019).

This policy digest describes the bankruptcy proceedings in the PES case, discusses the challenges of such proceedings for a just and efficient energy transition, and derives a set of policy drivers that might accelerate the brown to green transition.

Timeline of Bankruptcy Proceedings

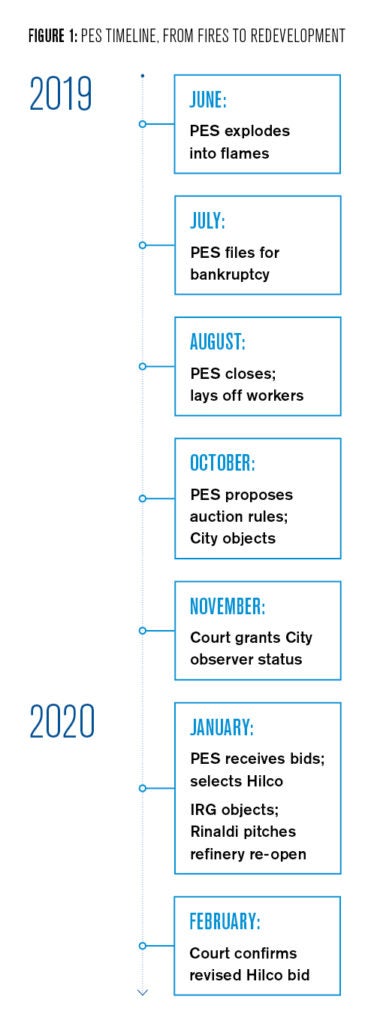

A brief timeline of events during the PES period of ownership follows.3

On 21 June 2019, the explosions and fires broke out at the PES Girard Point refinery. On 21 July 2019, PES entered Chapter 11 bankruptcy. On 15 August 2019, PES began permanently laying off workers as the complex completed the refining of remaining crude oil on the site and the shuttering of both refineries, Girard Point and Point Breeze. On 24 October 2019, PES filed proposed bidding procedures before U.S Bankruptcy Court Judge Kevin Gross. Several objections to these procedures were filed, including one by the City of Philadelphia asking for access to review the proposals before the auction. The city solicitor noted, “Whatever the outcome of the sale process and auction, development and operation of the site by any one of the variety of market players expressing interest in the debtors’ assets will not occur in a vacuum.”

On 14 November 2019, Judge Gross granted observer status to authorized City representatives at a hearing on the objections. Peter Winslow, head of a local non-profit, addressed the Court with a request that environmental remediation of the site receive a dedicated allocation of any insurance proceeds received by PES. While the Judge rejected this request, he did characterize residents’ concerns as “appropriate” and expressed hope that the City’s new participation in the approved process would be “sufficient.” On 22 January 2020, the auction proceedings narrowed to two finalists (37 potential bidders received access to confidential data on the refinery, 15 submitted written expressions of interest) and PES selected Hilco Redevelopment Partners, a Chicago-based real estate firm that has repurposed several former industrial sites on the U.S. East Coast.

At this point, we slow down the timeline in order to discuss subsequent events in more detail. On the day of the auction, The Philadelphia Inquirer reported, “Hilco Redevelopment Partners, a Chicago real estate firm that has acquired old power plant sites in Boston and New Jersey, and is building warehouses on a former steel mill site in Baltimore, agreed to pay $240 million to acquire the 1,300-acre refinery site during a closed-door auction Friday, according to a U.S. Bankruptcy Court filing” (Maykuth 2020) (In re PES Holdings, LLC. 2020a).

The same story reported that the most visible bidder since bankruptcy proceedings began—former PES president Phil Rinaldi who stated his intention to reopen the refinery—was unable to find sufficient financing to be a player in the auction. The City and many environmental and community advocates celebrated Hilco’s announced intention to not re-start refinery operations at the site and instead to convert the 1,300 acres over time to new uses focused around warehousing and logistics that leverage the site’s extensive multi-modal transportation infrastructure.

In the weeks following the auction, several objections were filed by various parties. First, it was revealed that another bidder, Industrial Realty Group (IRG), had presented a higher bid of $265 million to PES, $25 million more than Hilco’s bid. While the IRG presented only a $5 million deposit (compared to $30 million from Hilco4), the committee of unsecured creditors claimed that the openness of IRG to re-starting the refinery provided much more potential relief to these creditors, which included the unions—and their workers who had lost their jobs in the bankruptcy.

This objection gained some momentum when (a) the Rinaldi interests joined forces with IRG around a proposal that now centered on reopening the refinery and (b) the owner prior to PES, Sunoco Energy Transfer Partners, filed an objection to Hilco’s proposal based on deed restrictions placed into the 2012 sale of the site to PES. These restrictions appear to limit land use on the site to industrial uses that create minimal disturbance to the soils, which contain 150 years of contamination from various refining technologies and for which Sunoco is liable for pre-2012 contamination.

Throughout this series of developments, the City maintained its support of the Hilco bid on the basis of its environmental and economic benefits and contradicted objections, such as the deed restrictions, as irrelevant to the vision proposed by Hilco to convert the site from refinery operations to logistics. On 30 January 2020, The Philadelphia Inquirer quoted a City representative, “There is a deed restriction for the property underlying the refinery, but it most certainly does not limit the property’s use to refining, or to only industrial uses,” Mike Dunn, a city spokesman, said in an email (Maykuth 2020). “The current deed, in fact, permits use for most commercial and industrial uses. Use of the property for housing, recreational areas open to the public generally, nursing homes, and other similar sensitive uses are prohibited.”

After a marathon negotiating session precipitated by the expiration date of the Hilco offer, all outstanding issues were sufficiently resolved that on 13 February 2020, Judge Gross signed a confirmation order approving the sale of PES assets to Hilco for a final bid of $252 million which includes a new $5 million in severance for former workers at the refinery as part of a $29 million settlement with PES’s unsecured creditors (In re PES Holdings, LLC. 2020b). Several issues remain unresolved but are now treated as negotiations between the new owner Hilco and the various parties, including: Sunoco over its pipeline easements and deed restrictions on the property, and Point Breeze Renewable Energy and its lease to build a bio-gas plant on a parcel within the 1,300-acre PES site.

In a broad view of the court’s jurisdiction, Judge Kevin Gross was quoted by NPR affiliate WHYY as stating, “I’m very much satisfied that the sale to Hilco is the highest bid and the sale clearly is in the best interest of the community as well, given the risks that were attended to the prior operations with the refinery, and a refinery frankly that had numerous and repeated problems over the years. And I see no reason to think that that wouldn’t have continued” (Jaramillo 2020).

Policy Powering Transition

Stepping back from the dramatic specifics of the PES Refinery, this case illustrates many of the market and policy dynamics of the energy transition more generally. Because these dynamics played out in the form of a bankruptcy proceeding, we have a relatively transparent window into them in this case. In this final section of the digest, we present a policy research agenda derived from the refinery experience. It is an agenda we think will play a key role in accelerating a just and efficient energy transition.

Perhaps the most fundamental dynamic at play in the refinery case is the misalignment between markets and policies at the heart of environmental externalities. When markets fail to accurately value certain goods and services, because they have no market price mechanism for recognizing these accurate values, then the true costs of such goods and services fall on others without compensation. These others are “external” to the market activity and these uncompensated costs are labeled “externalities.” In the case of the PES Refinery, the health impacts from gasoline production on nearby neighbors was an externality. The cost of asthma and cancer in fence-line neighborhoods is neither factored into the market price of that gasoline nor compensated for by the sale of that gasoline.

“While it is well understood that pollution can negatively impact public health, it is difficult to attribute specific public health impacts to any specific industrial site when the public is also exposed to pollution (and other health risks) from other sources… However, data strongly suggests that Philadelphians suffer disproportionately adverse health effects, and many of these health effects are correlated to emissions like those generated from the refinery… The National Cancer Institute estimates that Philadelphia has the highest cancer rate of any large city in the U.S…. Philadelphia has an asthma hospitalization rate three times higher than the state average, according to the PA Department of Health” (Abernathy and Thiel 2019, 18).There are many externalities associated with the PES Refinery. First, as presented in the City’s refinery report, “the refinery was the largest single emitter of toxic pollutants in Philadelphia…toxic emissions attributed to the refinery represented 56.65% of total toxic emissions from larger sources in Philadelphia…These toxic emissions include benzene and other known carcinogens” (Abernathy and Thiel 2019, 17).

Second, the PES refinery was the single largest emitter of greenhouse gases (GHG) in Philadelphia, accounting for 20 percent of its annual carbon footprint, accounting for two and a half times the GHG of all other stationary sources in Philadelphia combined. Furthermore, the PES Refinery was the 8th largest stationary source of GHG in the entire state of Pennsylvania.

These externalities create concentrated uncompensated costs for nearby neighbors and diffused uncompensated costs for the whole City (as well as the region, state, nation, and ultimately the world.) These externalities contribute to the burdens that generate hundreds of millions of dollars each year in public health, climate mitigation and adaptation, fire and emergency management, and other efforts by the City of Philadelphia.

This nexus between the PES Refinery and so many public problems demonstrates the importance of accurately pricing carbon in order to overcome the market failures. Also, it is worth noting that even an accurately assessed carbon tax would not be sufficient to address all these externalities (e.g., a conventional price on carbon dioxide emissions would not account for all the uncompensated damages to respiratory illnesses due to collateral emissions of other chemical compounds).

Our external reviewer points out that $50 per ton is the social cost of carbon from a global perspective—not Philadelphia’s—and it is an appropriate evaluation only if Philadelphia adopts a global perspective. While it may or may not have been fully aware of it at the time, Philadelphia has effectively adopted this global perspective by embracing the “80 by 50” target developed as part of the United Nations Framework Convention on Climate Change on the global reductions in greenhouse gases needed (an 80 percent reduction from 1990 levels by 2050, “80 by 50”) to have a good chance of limiting global mean temperature increases to 2 degrees Celsius. Adopting the global target for emissions reductions is conceptually equivalent to adopting the global social cost of carbon.

Again, this is the essence of an externality: PES never paid that $150 million in annual damages. But more importantly now, no one is paying Hilco for avoiding the $150 million of annual carbon damages—a positive consequence of their ongoing decision to keep the refinery closed. Even just 10 to 20% of that annual value could produce a revenue stream able to finance hundreds of millions in investment capital.

Hilco’s final adversary in the bidding for PES assets had announced its intention to restart the refinery operations at the site. In this instance, with a supportive City government and a bankruptcy judge who was open to considering community interests, Hilco prevailed. But the bidding might have easily gone the other way.

Even with the Hilco ownership now settled, if suppressing the GHG at the site (as well as avoiding the public health and environmental damages) had bankable value, then Hilco’s project financing would allow for significantly accelerated and greener redevelopment of the site.

“We need to think not only of ‘green financing’ but also of ‘brown buyouts’—and how to pay for them.”

Cary Coglianese

Director, Penn Program on Regulation

It is unlikely that the Hilco proposal for the PES refinery that won in bankruptcy court will maximize local, state, and national policy goals. Normally, this is true of most market activity in which firms pursue profits rather than public policies. The urgency of climate change and the global response to it underway by governments at all levels and firms in all sectors, however, justify careful exceptions to the market norm.

Hilco’s proposal simply plays by market rules that have no means of pricing and therefore of valuing the full benefits of transitioning the site from brown to green. Given the urgency of that transition, and the continued absence of a sufficient carbon tax on polluters, a symmetrical subsidy for non-polluters seems like a warranted second-best approach.

More generally, how much more value is locked up in brown assets across the U.S. that could be transitioned into green with appropriate financial instruments? The real-world energy transition ongoing in urban and rural communities across the U.S. is a brown to green transition that needs new forms of finance designed to facilitate the shift of assets from brown and to green.

According to Bloomberg News, sustainable finance was the fastest growing investment sector in 2019 with over $460 million in new issues (Marsh 2020). Most of that came in the form of green bonds, where the proceeds must be used for projects that generate environmental returns. But the fastest growing sub-sector came in the form of green loans, which have variable interest rates linked to the borrower’s performance on measurable environmental impacts. This activity has been spurred by the development of new guidelines for green financing that set project standards for green or sustainable performance that give investors confidence in the environmental returns of their investments (Climate Bonds Initiative 2020).

Probably the most important form of this new green financing will be municipal bonds issued by cities and states. When issued as general obligation bonds, these instruments are secured by the issuer’s general fund and therefore the same credit rating applies as the issuer’s other bonds.

In this case, the issuer’s general purposes (such as avoiding future public health costs or reducing carbon emissions) could be funded with the proceeds. When issued as revenue bonds, these instruments are secured by new fees the issuer places on a salient activity. In this case, the issuer might exact a decarbonization fee on emitters (e.g., utilities or buildings with connections to the electric or gas grids) to back green bonds with proceeds that fund green energy operations and infrastructure. When issued as project bonds, these instruments are secured by the assets and revenues of the specific project or group of projects. In this case, the proceeds are ring-fenced to supporting only the specific underlying project(s) and these projects must produce a revenue stream for repayment.

These green financing mechanisms are only one way in which carbon can be priced to reflect its true social cost. Other ways include an economy-wide carbon tax, a cap-and-trade system, offset markets, and direct regulation. All of these can help if designed in ways that mutually reinforce rather than undermine each other.

Our focus here is been on green financing mechanisms that can leverage well-established government capacities for raising capital at favorable rates to support targeted investments that can create widespread (even global) benefits. Of course, it is worth emphasizing that this approach must be limited and specific, lest borrowing rates on all government debt rise unsustainably. In general, the borrowing envisioned here would be for very long-maturity loans aligned with the long-term effort of mitigating and adapting to climate change by transitioning the energy system from brown to green.

If more of this kind of capital were accessible, the PES auction would have been driven by the value of the enormous green returns available at the 1,300-acre site. If even more of this kind of capital were accessible, we could avoid the pain and disruption of future bankruptcies by financing the brown to green energy transition in a systematic and comprehensive way for the benefit of all. The Kleinman Center will issue a series of reports describing the design and deployment of these instruments and policies needed to support them.

The author is grateful to the Kleinman Center’s external reviewer, Dr. James R. Hines, Jr. of the University of Michigan, for insightful comments and key improvements to an initial draft.

Mark Alan Hughes

Director EmeritusMark Alan Hughes is director emeritus of the Kleinman Center. During his time as faculty director, he led the Center and wrote on topics ranging from deep decarbonization to the future of Philadelphia’s energy landscape.

Abernathy, Brian, and Adam Thiel. 2019. A Close Call and an Uncertain Future: An Assessment of the Past, Present, and Next Steps for Philadelphia’s Largest Refinery. Philadelphia, PA: City of Philadelphia. https://www.phila.gov/media/20191202091559/refineryreport12219.pdf.

Chemical Safety Board. 2019. “Chemical Safety Board Releases Factual Update and New Animation Detailing the Events of the Massive Explosion and Fire at the PES Refinery in Philadelphia, PA.” https://www.csb.gov/chemical-safety-board-releases-factual-update-and-ne….

City of Philadelphia. n.d. “Refinery Advisory Group.” https://www.phila.gov/programs/refinery-advisory-group/.

Climate Bonds Initiative. 2020. https://www.climatebonds.net/.

Federal Judicial Center. 2019. “Jurisdiction: Equity.” https://www.fjc.gov/history/courts/jurisdiction-equity.

Hiar, Corbin. 2020. “In Landmark Deal, Redeveloper to Buy Bankrupt Pa. Refinery.” E&E News. https://www.eenews.net/greenwire/stories/1062150167.

In re PES Holdings, LLC. 2020a. Plan Supplement for the First Amended Joint Chapter 11 Plan of PES Holdings, LLC. No. 19-11626 Docket entry No. 780 (Bankr. D. Del. Jan. 22, 2020).

–––––. 2020b. Order Confirming the Fourth Amended Joint Chapter 11 Plan of PES Holdings, LLC. Docket entry No. 1004 (Bankr. D. Del. Jan. 22, 2020).

International Capital Market Association. 2020. “Green Bond Principles.” https://www.icmagroup.org/green-social-and-sustainability-bonds/green-bo….

Jaramillo, Catalina. 2020. “Bankruptcy Judge Approves PES Refinery’s Sale to Hilco Redevelopment Partners.” WHYY News. https://whyy.org/articles/bankruptcy-judge-approves-pes-refinerys-sale-t….

Marsh, Alastair. 2020. “Climate Threat Spurs Record Sales of Sustainable Bonds and Loans.” Bloomberg News. https://www.bloomberg.com/news/articles/2020-01-08/climate-threat-spurs-….

Maykuth, Andrew. 2020. “Chicago Developer Hilco’s $240 Million Bid Wins Auction for Bankrupt Philadelphia Refinery.” The Philadelphia Inquirer. https://www.inquirer.com/business/energy/philadlephia-refinery-land-auct….

–––––. 2020. “Newly Revealed Restrictions Challenge Redevelopment of Bankrupt Philly Refinery’s Land.” The Philadelphia Inquirer. https://www.inquirer.com/business/pes-philadelphia-refinery-bankruptcy-a….

–––––. 2019. “S. Philly Refinery Blast Released 5,000 Pounds of a Deadly Chemical, Federal Investigators Say.” The Philadelphia Inquirer. https://www.inquirer.com/business/deadly-chemicals-philly-refinery-explo….

Prieto, Andres, and Lindsey Walter. 2020. “Carbon Pricing: One Piece of the Climate Puzzle.” Third Way. https://www.thirdway.org/memo/carbon-pricing-one-piece-of-the-climate-pu….

Simeone, Christina. 2018. Beyond Bankruptcy: The Outlook for Philadelphia’s Neighborhood Refinery. Kleinman Center for Energy Policy. https://kleinmanenergy.upenn.edu/paper/beyond-bankruptcy.

Wang, Pei, Xiangzheng Deng, Huimin Zhou, and Shangkun Yu. 2019. “Estimates of the Social Cost of Carbon: A Review Based on Meta-Analysis.” Journal of Cleaner Production 209: 1494-1507. doi:10.1016/j.jclepro.2018.11.058.

- The financially successful years at PES relied on access to relatively cheap Bakken crude transported via rail from North Dakota. But then prices changed. Domestic crude production decreased (due to OPEC market forces), the United States lifted the oil export ban, and the formerly stalled Dakota Access Pipeline came online—making it much cheaper to transport Bakken crude to the Gulf Coast instead of the East Coast. (Simeone 2018) [↩]

- There has been some confusion in otherwise excellent media coverage of the advisory group and the City’s report. The latter was produced by the City itself with no direct writing by the public members of the advisory group. Nor did the report make recommendations for the disposition of the refinery or the site. Rather the report summarizes input from the public as gathered by the advisory group and expresses the preferences of the City consistent with its stated policy goals: namely, that the future of the site be healthier, safer, more stable, and more productive than it was before the June incident. [↩]

- The public interest was well served by extensive media coverage of the PES explosion and bankruptcy, and the author wishes to acknowledge the detailed reporting of several local and national journalists covering the story: Andy Maykuth of The Philadelphia Inquirer, Catalina Jaramillo of NPR affiliate WHYY, Claire Sasko of Philadelphia Magazine, Corbin Hair of E&E News, and Laila Kearney of Reuters. [↩]

- It is unclear why the IRG deposit was so low (the auction rules required 10 percent of the bid.) It could have reflected difficulties IRG faced in getting financing or it might have reflected a bargaining strategy by IRG. [↩]