This policy digest examines historic trends over a ten-year period (2005-2014) related to basic activity metrics of Pennsylvania electric distribution companies (EDCs). The Pennsylvania Public Utility Commission (PUC) annually publishes its Electric Power Outlook (EPO) for Pennsylvania Report.1 The EPO report compiles information submitted by PA EDCs and includes information about plans and projections for meeting future demand. This digest also relies on additional data from the U.S. Energy Information Administration.

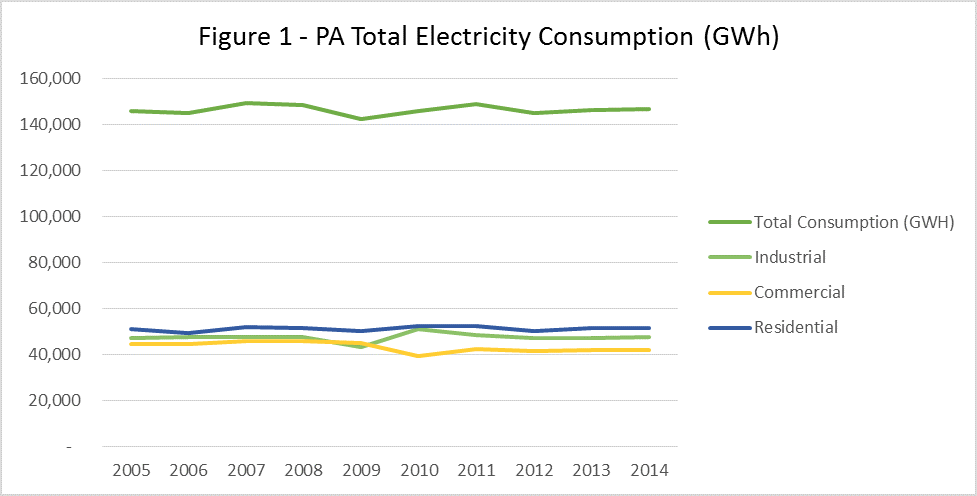

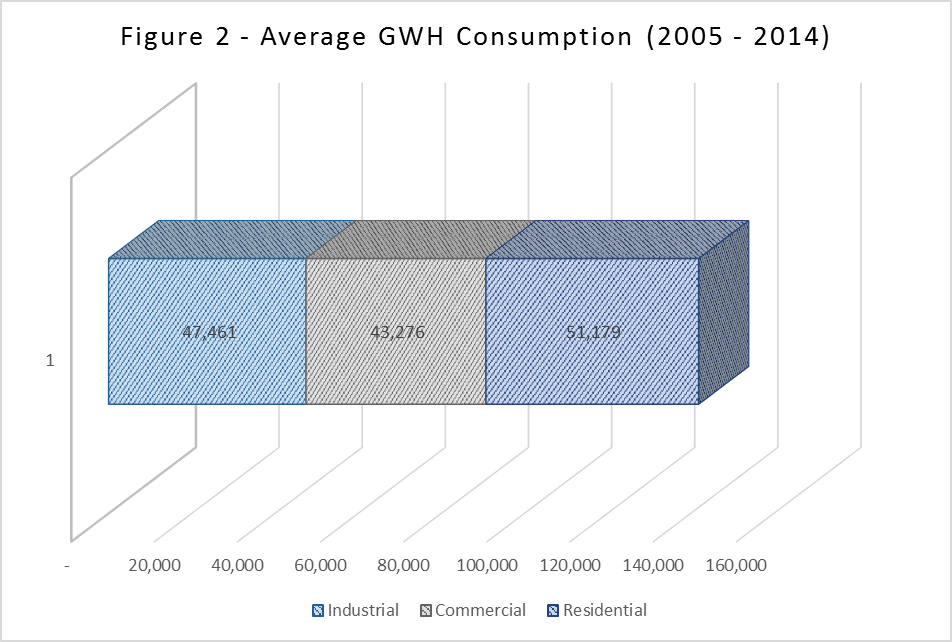

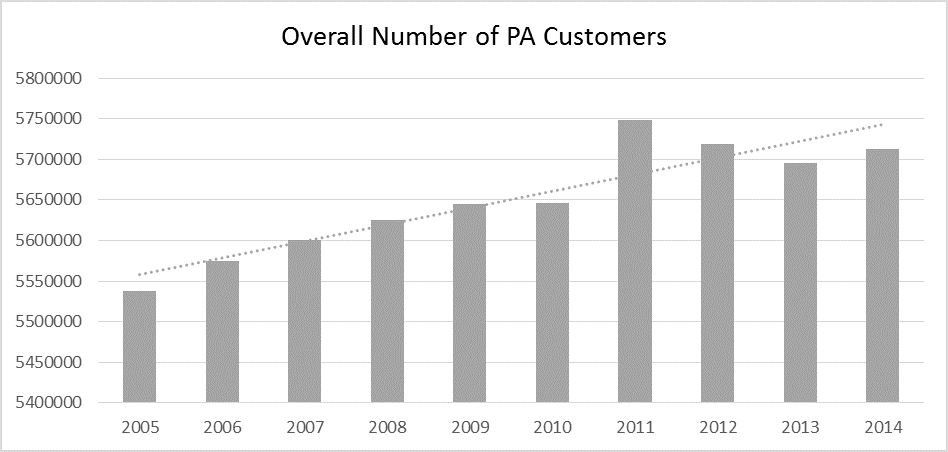

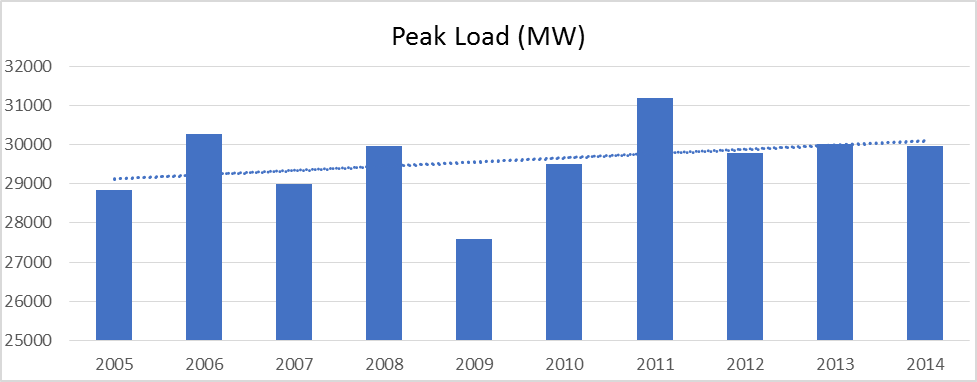

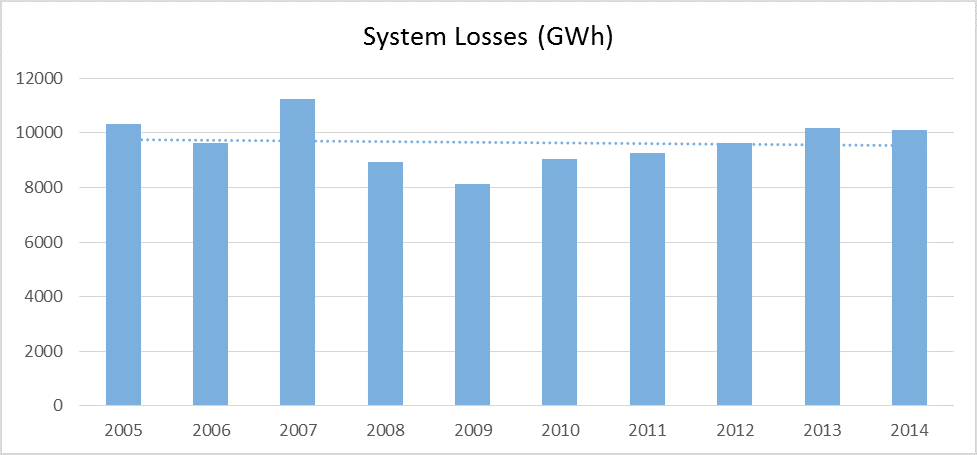

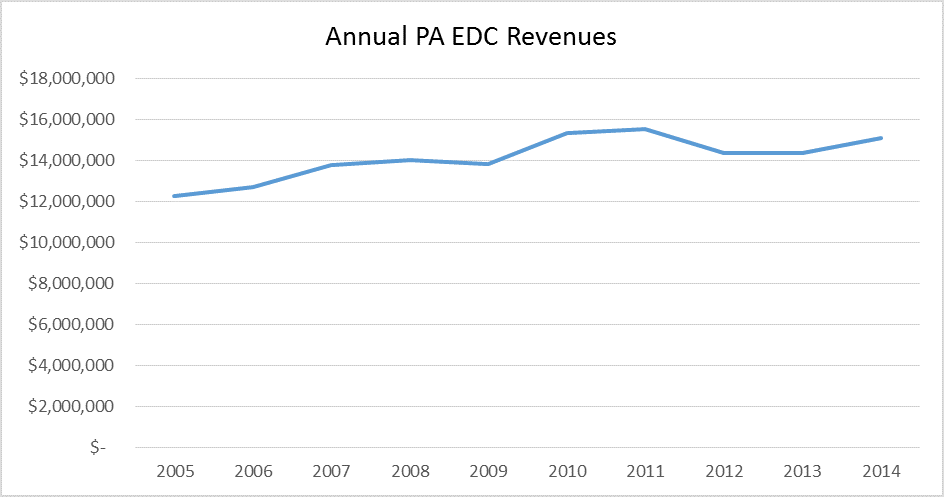

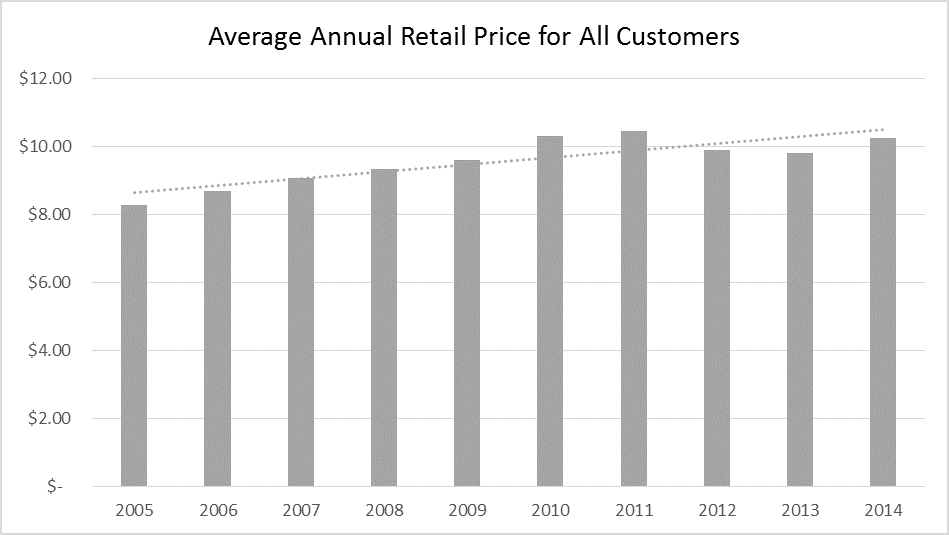

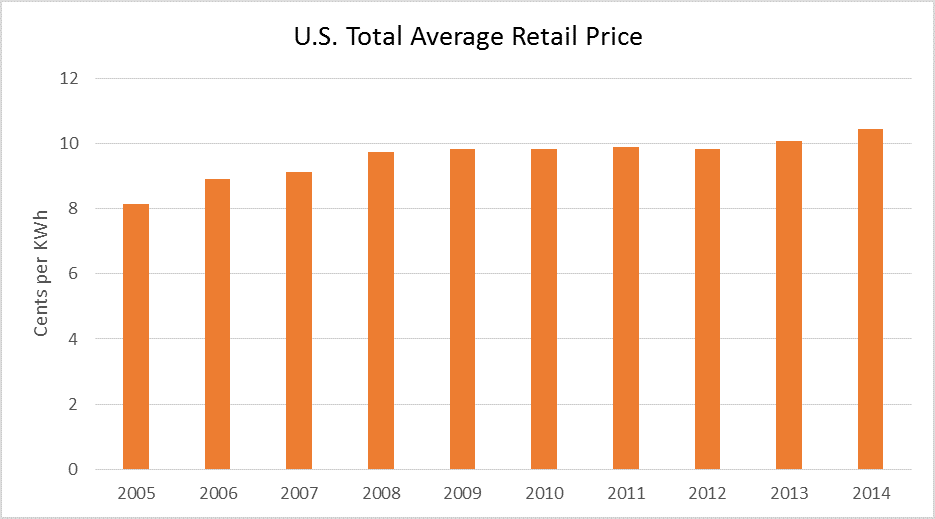

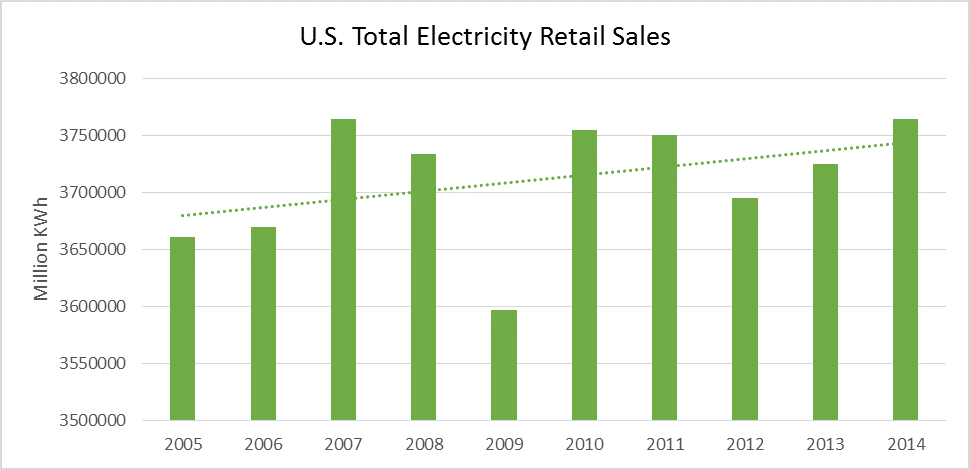

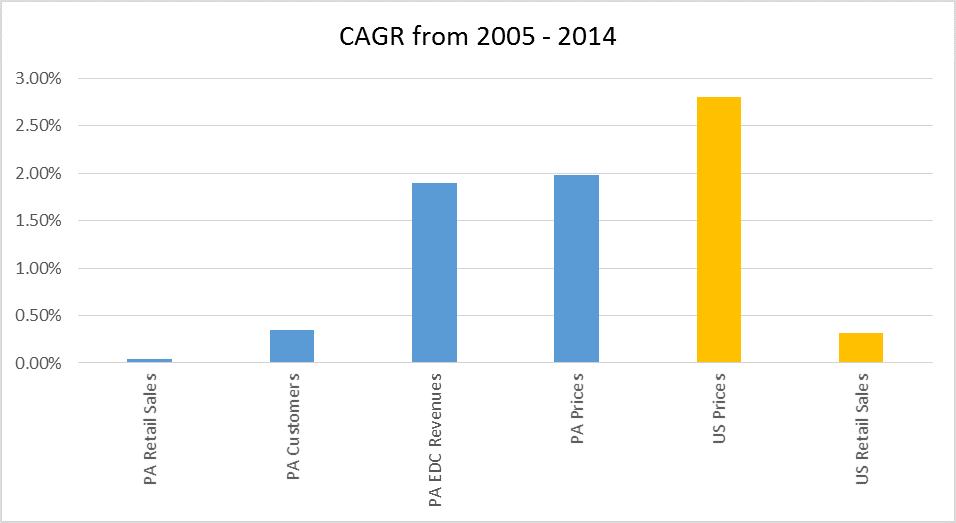

These data show that over the 2005-2014 period, Pennsylvania retail electricity sales and total consumers are growing at slower rates than Pennsylvania electricity prices and EDC revenues. However, Pennsylvania retail sales and prices are growing at a slower rate than U.S. retail sales and prices. Pennsylvania has experienced average annual customer growth rates of 0.35% and average annual increases in peak loads of 0.42%. Pennsylvania’s system losses have decreased over the period by an average of 0.24% per year.

Customer and Usage Trends

System Peak and Losses

Revenues and Prices

CAGR Comparisons

Christina Simeone

Kleinman Center Senior FellowChristina Simeone is a senior fellow at the Kleinman Center for Energy Policy and a doctoral student in advanced energy systems at the Colorado School of Mines and the National Renewable Energy Laboratory, a joint program.

- PA PUC Electric Power Outlook for Pennsylvania Report can be found at http://www.puc.state.pa.us/utility_industry/electricity/electric_reports.aspx [↩]

- Includes Duquesne Light, Met-Ed, Penelec, Penn Power, PPL, PECO, West Penn, UGI, Citizens’, Pike County and Wellsboro. [↩]

- Compound Annual Growth Rate (CAGR) is the mean annual growth rate of a series of values over a specific period of time longer than one year. Said another way, this calculation measures the annual rate to grow the beginning value to achieve the ending value over a period of time. Fluctuations in the values between time periods are not accounted for [↩]

- Electric Power Outlook for Pennsylvania 2010-2015, page 21, http://www.puc.state.pa.us/general/publications_reports/pdf/EPO_2011.pdf [↩]

- Form EIA-826 aggregated data on sales and revenues, available at http://www.eia.gov/electricity/data/eia826/ [↩]

- U.S. EIA’s Table 9.8 Average Retail Prices of Electricity from the January 2016 Monthly Energy Review released January 27, 2016 and available at http://www.eia.gov/totalenergy/data/annual/index.cfm#electricity [↩]

- U.S. EIA’s Table 7.6 Electricity End Use from the January 2016 Monthly Energy Review released January 27, 2016, available at http://www.eia.gov/totalenergy/data/annual/index.cfm#electricity [↩]