Crisis to Cooperation: What Can Mineral Exporters Learn From OPEC?

This digest explores how resource-rich nations might draw lessons from OPEC in pursuing cooperative governance to enhance equity, stability, and strategic autonomy in critical mineral markets amid growing global reliance and geopolitical competition.

At A Glance

Key Challenge

China’s market dominance and use of export controls in critical minerals create price volatility and deter investment in higher-standard, locally beneficial mining operations elsewhere.

Policy Insight

Bilateral agreements that include infrastructure investment and community benefit-sharing can strengthen trust with resource-rich nations, supporting supply stability while avoiding exploitative power imbalances.

Introduction

The global transition to clean energy technologies is undeniably underway, and its success hinges on the availability of certain critical raw materials (CRMs). As countries race to reduce carbon emissions, the demand for resources like lithium, cobalt, and rare earth elements (REEs) has skyrocketed.

These materials are the backbone of crucial technologies and operations that are essential for achieving global decarbonization targets, yet the intense competition for these resources has led to a concentrated power structure, where a handful of nations—most notably China—dominate the global supply chain.

This situation raises complex questions about how the global market will adapt to meet growing demand, particularly as resource-rich nations find themselves balancing domestic needs with international pressures. The implications of this struggle for control over critical minerals are not just economic; they are geopolitical, environmental, and social, influencing the path forward for both developed and developing nations alike.

As demand for critical raw materials accelerates, resource-rich countries face an urgent choice: allow supply chains to remain dominated by a few major players or pursue new forms of international cooperation that strengthen local benefits, promote market stability, and support a resilient global transition to clean energy.

One of the major barriers to a smooth global transition is China’s overwhelming dominance in critical mineral markets. China’s deliberate choice to flood the market with surplus has driven the cost of minerals like cobalt and lithium down dramatically (Blas 2024), making it nearly impossible for new investors to compete.

For instance, the only cobalt mine in the United States (in Idaho’s Salmon River Mountains) was forced to close before it was even operational due to plummeting prices (Smith and Whitney 2023). While countries like the U.S. can provide much more stringent and sustainable environmental and social mining standards, manufacturers are left weighing this against their mandate to select the lowest cost option for materials.

CRMs, often moved across three or more continents before reaching their final destination, have become global commodities central to national and international policy agendas. Yet, the economic benefits of the supply chains remain significantly uneven. Despite immense profits derived by low-emission technologies (like electric vehicles), the actual extraction of critical minerals receives very little investment. This imbalance reinforces unequal value distribution and can worsen issues like corruption and local instability. These conditions, and the limited long-term benefits seen by communities, make volatility and unpredictable market conditions particularly difficult to weather.

Given these dynamics, under what conditions could these better-regulated mines, higher-cost mines compete? In what world could these mines, that offer greater local benefit, compete economically?

To explore this, it is useful to look beyond current market conditions and consider how geopolitical strategies have shaped resource control in the past. Since well before President Trump dramatically escalated tensions with recent import tariffs, China and the United States have been engaged in a tit-for-tat “trade war.” Even when these restrictions are largely symbolic (as they were with China’s restrictions on germanium or gallium exports, for example), they nonetheless influence broader market dynamics and investor behavior (Baskaran and Schwartz 2024).

This form of strategic resource control echoes the conditions of the 1950s and 1970s, when dissatisfaction with Western oil companies and geopolitical conflict spurred the creation of OPEC. As China’s role in the critical minerals market continues to expand, some analysts have begun to ask: could an “Organization of Mineral Exporting Countries” (OMEC) offer a path toward similar influence for resource-rich nations?

While a direct replication of OPEC is neither feasible nor desirable given the distinct characteristics of mineral markets, this paper argues that strategic international cooperation among resource-rich nations could provide stability, local benefits, and greater resilience in the face of China’s current dominance of the global supply chain.

This digest will begin by outlining the current landscape and China’s dominant role, including subsequent challenges. Then, it explores historical analogs between critical minerals and OPEC, weighing the viability of an international coordination effort. Finally, it offers strategic recommendations for U.S. policymakers to support a more equitable, diversified, and secure critical minerals future.

The Current Landscape

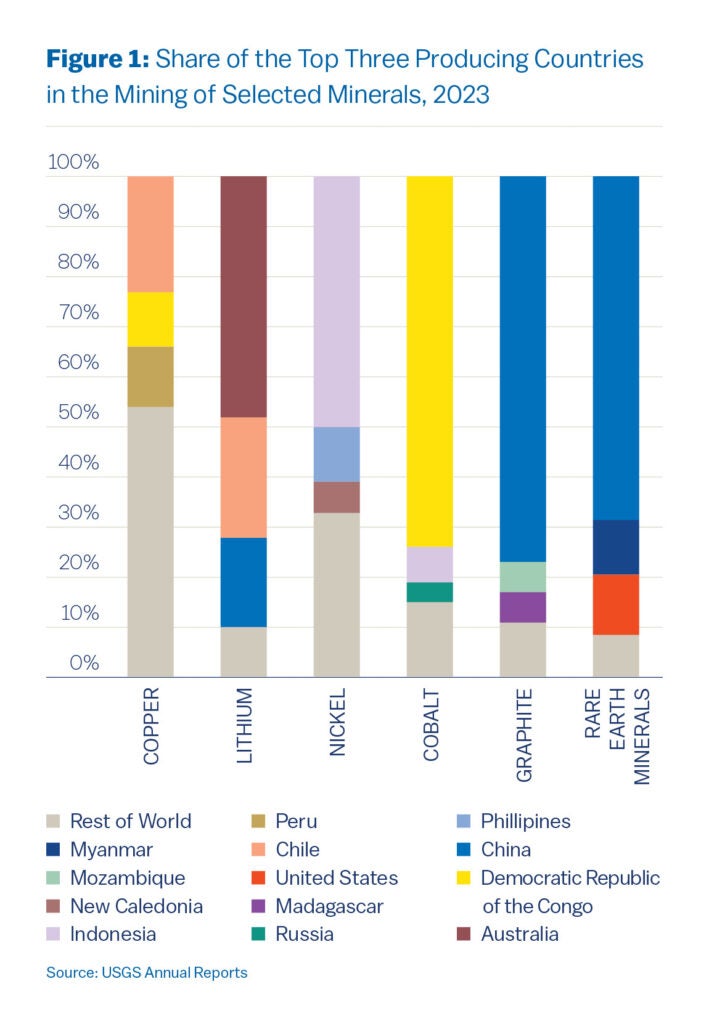

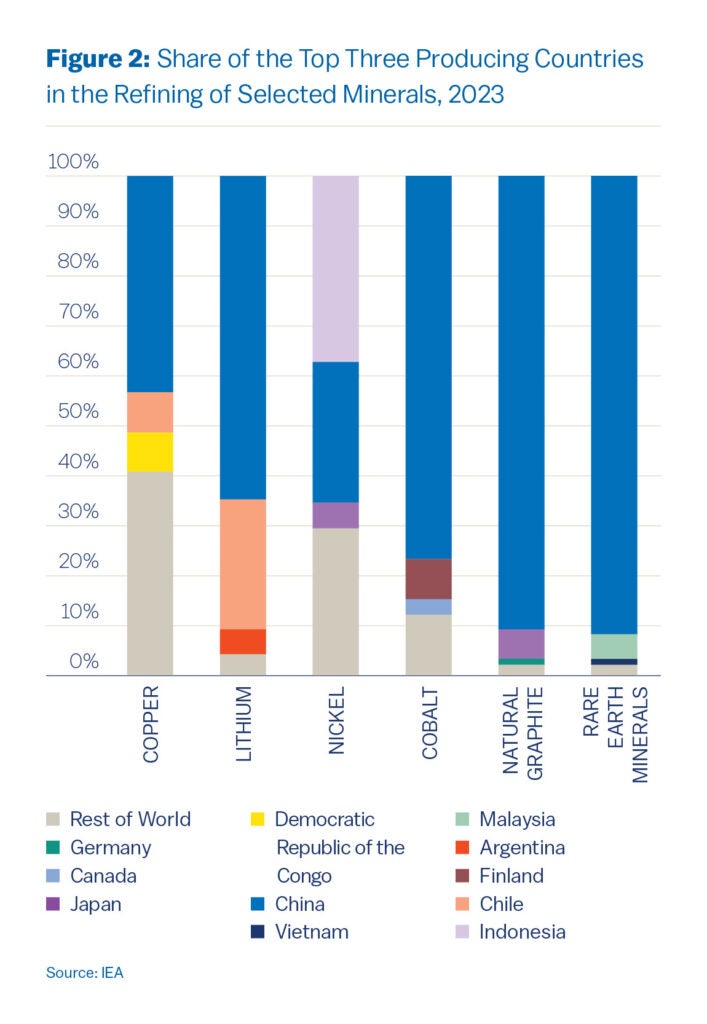

China has developed an impressively dominant role in raw mineral acquisition and refining. While there are significant resources within the borders of the country (particularly in rare earths), Chinese presence in global processing in refining is extremely outsized in comparison (Figures 1 and 2).

Through their investment in CRM extraction, they have provided local economic development, essential services, and jobs to local communities around the world. This has been championed by their Belt and Road Initiative, which often exchanges infrastructure projects for resource access (e.g., mines, roads, buildings, etc.).

China’s dominance has raised concerns about debt-trapping, corruption, and economic dependency, as exporting countries grow increasingly dependent on Chinese investment (Gregor and Milas, n.d.). As seen in Figure 1, Chinese dominance in the supply chain (whether from the mining of REEs, vital to so many modern technologies, or the refining/processing of almost every CRM) creates the possibility for salient economic disruption.

One example of China’s global impact is the use of export bans on REEs to Japan in 2010 in response to a maritime dispute (Evenett and Fritz 2023). This is often cited as a distinct example of economic sanctions as a political tool, yet nationalist policies regarding Chinese natural resources (and particularly REEs) can be seen developing before and beyond 2010 (Yang 2025).

In the months following the start of President Trump’s second term, the trade-war standoff between the United States and China is fluctuating every day. As of April 21, U.S. tariffs on Chinese imports were at 145%, and China had issued 125% of retaliatory tariffs on American goods. By mid-May, the tariffs had been temporarily slashed. The resulting volatility has been detrimental to diplomatic and economic policies alike.

Effectively, they have issued trade embargoes against one another (Lee and Chen 2025). China is no stranger to trade embargoes and restrictions—it alone has been responsible for 20% of the increase in export restrictions measures between 2009 and 2020 (Kowalski and Legendre 2023). Already, China’s dominance in CRM refining and processing is undeniable, creating significant leverage over global supply chains.

Navigating the Future: Strategic Coordination Without a Cartel

Against this backdrop of escalating trade tensions and market consolidation, nations must assess strategic responses. Clearly, most American politicians would like the United States to control more of the critical mineral supply. A historical parallel can be drawn from the 1950s, when increasing price control by the “Seven Sisters” oil companies and global dependence on Middle Eastern oil prompted the formation of OPEC. OPEC first exerted major influence in 1973, when Egypt and Syria invaded Israel in what we’ve come to know as the “Yom Kippur War” (Zeidan 2024).

During the resulting conflict, the U.S. provided military aid to Israel, and opposing OPEC countries led a retaliatory oil embargo against the U.S. and other Israeli allies. While the embargo’s economic impact was significant, its social and political consequences were even greater—cementing OPEC’s reputation as a formidable force in global markets (Colgan 2018). Today, understanding how dominant players can shape market behavior, local conditions, and global supply is crucial to informing any coordinated response in the mineral sector.

Perhaps the most convincing connection between the supply chains of oil and critical minerals/materials is the role of enterprises in the management of natural resources. Where establishing a domestic supply chain is not feasible due to the geographical distribution of resources, multinational corporations (MNCs) or state-owned enterprises (SOEs) will often invest in subsidiaries within countries that can source these materials.

Broadly speaking, when major multinational corporations control the upstream, midstream, and downstream parts of the supply chain, they exercise enormous control over how they distribute their taxable income among subsidiaries (Seth 2024). This internal transfer pricing can heavily influence the distribution of taxes and royalties paid by companies between parts of the supply chain.

With an international supply chain, this can have immense consequences on oil-exporting nations, which can lead to nationalization in an attempt to maintain sovereignty over resources (Nersesian 2010, 157). The lucrative nature of this approach for oil can be seen in state-owned companies like the National Iranian Oil Company or Saudi Aramco (Statista 2024; Murphy and Schifrin 2024).

At a foundational level, how an OMEC would be defined varies widely—most notably in its fundamental market presence and the countries that would be involved. Additionally, the comparison falters in a few immediately obvious places:

- As opposed to crude oil, OMEC encompasses not one, but many varied resources with various demand fluctuations, processing needs, and geographic concentrations. Determining price-fixing measures that encompass all of the necessary considerations would be counterproductive and at odds with the benefits of nationalizing a resource.

- Even if a unified market for all critical minerals were created, it would be virtually impossible to completely disentangle China from the supply chain. China would be both the aggravator and a key member of an OMEC.

- Demand for crude oil functions fundamentally differently from the demand for CRMs. Most CRM use takes place primarily during manufacturing (e.g. the creation of an EV’s battery), unlike the constant daily operational demand of oil that must be met with about a million barrels of oil a day (“Demand for Crude Oil Worldwide from 2005 to 2023, with a Forecast for 2024” 2024; David Victor and Joisa Saraiva 2024).

Markets where producers have the opportunity to restrict trade often face a push-and-pull between cooperation and competition. While organizations like OPEC demonstrate how coordination can emerge, such cooperation typically depends on strong, unifying agreements—something that’s difficult to achieve in other sectors. When it comes to critical raw materials, establishing a stable, cartel-style arrangement would demand significant trust among countries.

Given existing rivalries and the history of competitive actions—such as the use of export controls in the U.S.–China dynamic—it’s clear that competitive behavior is more the norm than the exception. At its core, a cartel-style framework for critical minerals would be vastly unpopular. In potentially limiting access to these minerals, even in the short term, the energy transition at large could also be threatened.

However, an OMEC alliance could emerge that operates differently from OPEC, while still promoting the benefits—namely market stability and economic and political benefits for member countries. It could incorporate:

- National control of natural resource reserves, via domestic ownership requirements or the expansion of domestic state-owned enterprises

- The use of strategic reserves or supply buffering

- Data transparency and sharing

- Longer-term contracts between the extracting and producing entities

- Flexible production agreements between countries with the same natural resources based on price changes

- Diversifying refining contracts to reduce dependency on single producing countries

Such policy tools are already beginning to take shape, particularly in South America, where we can find examples of increased state involvement in the management of mining lithium and copper across Argentina, Mexico, Peru, and Chile (Frankena and Bodnar 2024). While this can lead to better local conditions and increased economic value for local communities, it may also deter private investment, which potentially slows the development of projects altogether.

In these examples, and others, we find that state involvement in the management of critical minerals (CRMs) may offer local benefits, but it can also present significant challenges, particularly when it comes to governance and the distribution of wealth. Intensifying “land grabs” for mineral assets across the globe and a subsequent rush of mergers and acquisitions between mining companies could result in energy transition targets driving the formation of record-breaking multinational giants. This rapid consolidation could threaten competition, local benefits, and supply chain stability.

This mirrors the situation in OPEC countries, where oil revenues, though vast, often do not translate into equitable economic growth. Despite the immense control over global oil markets, many OPEC member states continue to grapple with corruption, inequality, and political instability (Cordesman and Markusen 2016).

Similarly, CRMs are frequently extracted from regions already struggling with political turbulence, and the supply chains involved present opportunities for further mismanagement and corruption. While the financial boom associated with the increasing demand for critical minerals could help stabilize these communities, the potential for misappropriation by governments or corporations remains a significant concern.

China’s outright dominance and increasing confidence and strength in the global market makes any deliberate takeover of the supply chain look unlikely. China’s control also limits the ability of resource-rich countries to secure local benefits and take full advantage of the economic opportunities their natural resources could afford them.

However, there is a potential future in which exporting countries can form an allegiance that promulgates some of the key benefits of an international allegiance (like OPEC), allowing them to take these advantages without simultaneously disrupting their own citizens and the global market.

If the United States were to give preferential treatment to resources coming from countries who operate in this manner, could resource-exporting countries be emboldened to move out from underneath the umbrella of Chinese production? Could the United States advance their own strategic goals by supporting local benefit, development, and markets? Establishing an international, non-cartel, coordination alliance for strategic mineral management could allow for de-risking price support, local benefit initiatives, and incentives for businesses operating in countries with national control.

The Need for Coordination

Historically, the distribution of oil resources had immense impact on global geopolitics, trade routes, and economies, particularly in the 20th century. Early dependence on Middle Eastern suppliers for oil can be seen in parallel to the high geographic concentration of different CRMs—for example, the extremely concentrated availability of cobalt in the DRC, the concentration of nickel in Indonesia, or the dominance of South Africa in platinum-group metals. However, the concentration of some CRMs is even more geographically focused than that of oil, leading to vulnerabilities and potentially catastrophic disruptions in the supply chain.

The exact countries that would be interested in any kind of coordination alliance depends not only on the resources available within its borders but on the political, economic, and social conditions that must support a large-scale diplomatic relationship. But we can look at some illustrative examples of raw materials that were identified as critical by the U.S. Department of Energy that were identified as having specified global reserves by the U.S. Geological Survey.1 To better understand which countries might form the foundation of such a coalition, we can examine the distribution of critical mineral reserves.

Table 1 illustrates several countries that emerge as potential candidates. While this list is not exhaustive, we can consider it a starting point for countries that may be particularly prone to seeking alliances that help them increase control of their natural resources.

Weighing the diplomatic, geopolitical, and economic benefits of joining such an organization with the opportunities for economic retaliation, corruption, or overexploitation of natural resources yields a complicated balancing act. There are some key concerns that should be raised that are relevant both to member states and the rest of the global market. These include:

- Price distortion

- Weaponization of prices or market control for geopolitical gain

- Unfair advantages (economically and politically) for member states

- Internal disputes between member states

Alliances have formed that aim to prioritize supply chain stability—such as the Minerals Security Partnership (MSP) or the Sustainable Critical Minerals Alliance (SCMA). However, these alliances do not include most key reserve-holding countries.

Supporting the sovereignty and self-determination of these countries that supply CRMs is vital to supply. Policy interventions can be designed to promote the goals of resource-exporting countries, with or without the establishment of a formal international alliance, allowing for maximum global benefit and limiting the potential for harm.

Conclusion: Policy Recommendations

As the global transition to clean energy accelerates, strategic coordination among resource-rich nations becomes not just a possibility but a necessity. Even if an international, OPEC-like diplomatic arrangement could be made, the extent to which any wider political benefits would translate into local socioeconomic mobility remains an open question. While OPEC has certainly amassed global influence, the extent of this influence and the actualized power of each member state is debated.

There is fear that applying a similar structure for CRMs would limit their availability in importing nations like the United States or have wider detrimental impacts on the global economy. Paired with the entrenched power structures that already challenge the CRM market with mismanagement and corruption, it seems particularly challenging to impose a mutually beneficial and equitable arrangement.

However, if an international coordination effort were established to manage strategic and critical minerals, particularly those of most use in the energy transition, countries could be empowered to move away from the existing consortium of refining and processing controlled by China. Not only could this increase the local value experienced by the exporting countries, but it could increase overall supply chain stability, particularly for the United States, as China increases its controls and subsequent use of export restrictions for critical materials.

The United States is well-positioned to support the formation of such an alliance. While there are American reserves of CRMs that can be developed, it is in the best interest of American policy to support a stable international supply chain. Not only can this help secure the minerals not available domestically, but it can reduce China’s dominance and heavy pull on American manufacturing. To support this, policymakers could engage the following tools while working abroad to move in this direction:

- Prioritize infrastructure investments. By putting concerted investment into local infrastructure, not only can the supply chain itself be strengthened on a practical level (for example, improved transportation infrastructure and labor organization centers, etc.), but it can lead to increased trust in long-term partnerships.

- Pursuing robust community benefit sharing agreements. Both on a federal and private level, pursuing equitable benefit sharing agreements (via royalties, development, social projects, etc.) can promote regional stability. This not only promotes robust governance and peace for local citizens but also supports a secure and stable supply.

- Support training for alternative livelihoods. Economic diversification can strengthen social resilience and sustainability, vital in communities that currently depend almost entirely on the extractive industry.

Even in the absence of a formal alliance among resource-rich countries, these tools could promote more stability and longevity in the CRM supply chain. For example, the recent critical minerals deal between the U.S. and Ukraine illustrates how bilateral deals can support infrastructure development and broader strategic goals. However, it also carries the risk

of replicating existing power imbalances—potentially positioning the U.S. as a dominant actor rather than an equal partner, mirroring some of the same dynamics that have drawn criticism in China’s approach.

To avoid reinforcing these imbalances and to mitigate the risks of global supply chain monopolization, increased awareness and proactive engagement are essential. Policies aimed at promoting secure, sustainable resource governance should also consider how they can:

- Pursue opportunities in nearshoring (relocating supply chains to within the United States) and friendshoring (relocating supply chains to countries considered political and economic allies). Strategic partnerships with allied nations, such as Canada, should be pursued to reduce supply chain vulnerability and strengthen international relations (Gravel 2025). This could reduce American reliance on Chinese production and refining, a stated goal of the new administration (Bloomberg 2025).

- Monitor and engage with multinational corporations. Establishing transparency requirements, strengthening due diligence requirements, and encouraging the development of cooperative agreements with host countries can help promote strong governance and avoid further monopolizing extractive markets.

- Foster international cooperation. By collaborating on global governance and strategically investing in emerging economies in resource-exporting host countries, sustainable practices can be promoted and supported. These practices can encourage competitive markets and promote efficiency in the supply chain.

The potential for organized allegiances to influence global supply and pricing for vital commodities is already unfolding—but this does not necessitate the emergence of a cartel. Rather than replicating OPEC’s structure, which has often prioritized producer power over broader equity or sustainability, resource-rich countries can chart a different path.

A strategic coordination alliance that is rooted in transparency, mutual benefit, and long-term development goals could help nations secure greater local value. With the support of other global players like the United States, this could stabilize global supply chains and reduce overreliance on dominant players like China. Whether or not such an alliance formalizes under a single name, the imperative remains clear: aligning policy, investment, and diplomacy to support a resilient, just, and cooperative minerals future.

Arwen Kozak

Senior Research CoordinatorArwen Kozak is senior research coordinator at the Kleinman Center. She assists with research and programming initiatives at Kleinman, working to support visiting scholars, students, and grant recipients.

Baskaran, Gracelin, and Meredith Schwartz. 2024. “China Imposes Its Most Stringent Critical Minerals Export Restrictions Yet Amidst Escalating U.S.-China Tech War,” December. https://www.csis.org/analysis/china-imposes-its-most-stringent-critical-minerals-export-restrictions-yet-amidst.

Blas, Javier. 2024. “China Has Broken the ‘Critical Minerals’ Market.” The Economic Times, September 30, 2024. https://economictimes.indiatimes.com/small-biz/trade/exports/insights/china-has-broken-the-critical-minerals-market/articleshow/113801939.cms?from=mdr.

Bloomberg. 2025. “China Faces Trump’s Return Just as Reliance on Exports Soars,” January 19, 2025. https://www.bloomberg.com/news/articles/2025-01-19/china-faces-trump-s-return-just-as-reliance-on-exports-soars.

Colgan, Jeff D. 2018. “Qatar Will Leave OPEC. Here’s What This Means.” Washington Post, December 6, 2018. https://www.washingtonpost.com/news/monkey-cage/wp/2018/12/06/qatar-will-leave-opec-heres-what-this-means/.

Cordesman, Anthony H., and Maxwell B. Markusen. 2016. “The ‘OPEC Disease’: Assessing the Impact of Lower Oil Export Revenues,” September. https://www.csis.org/analysis/opec-disease-assessing-impact-lower-oil-export-revenues.

Evenett, Simon, and Johannes Fritz. 2023. “Revisiting the China–Japan Rare Earths Dispute of 2010.” CEPR. July 19, 2023. https://cepr.org/voxeu/columns/revisiting-china-japan-rare-earths-dispute-2010.

Frankena, Greetje, and Dana Bodnar. 2024. “Critical Minerals in LAC Are Key for Energy Transition.” Atradius. February 27, 2024. https://group.atradius.com/publications/economic-research/lac-critical-minerals-february-2024.html.

Gravel, Steve. 2025. “Trade, Tariffs, and Minerals: The Need to Position Canada as an Indispensable Trading Partner.” Canadian Mining Journal. January 6, 2025. https://www.canadianminingjournal.com/featured-article/trade-tariffs-and-minerals/.

Gregor, Farrell, and Paul J. Milas. n.d. “China in the Democratic Republic of the Congo: A New Dynamic in Critical Mineral Procureme.” US Army War College – Strategic Studies Institute. Accessed February 17, 2025. https://ssi.armywarcollege.edu/SSI-Media/Recent-Publications/Article/3938204/china-in-the-democratic-republic-of-the-congo-a-new-dynamic-in-critical-mineral/https%3A%2F%2Fssi.armywarcollege.edu%2FSSI-Media%2FRecent-Publications%2FArticle%2F3938204%2Fchina-in-the-democratic-republic-of-the-congo-a-new-dynamic-in-critical-mineral%2F.

Kowalski, Przemyslaw, and Clarisse Legendre. 2023. “Raw Materials Critical for the Green Transition: Production, International Trade and Export Restrictions.” OECD Trade Policy Papers 269. Vol. 269. OECD Trade Policy Papers. https://doi.org/10.1787/c6bb598b-en.

Lee, Liz, and Laurie Chen. 2025. “China Warns Countries against Striking Trade Deals with US at Its Expense.” Reuters, April 21, 2025, sec. World. https://www.reuters.com/world/china-opposes-any-deals-between-us-other-nations-its-expense-2025-04-21/.

Murphy, Andrea, and Matt Schifrin. 2024. “Forbes 2024 Global 2000 List.” Forbes. June 6, 2024. https://www.forbes.com/lists/global2000/.

Nersesian, Roy. 2010. Energy for the 21st Century: A Comprehensive Guide to Conventional and Alternative Sources. Oxford, UNITED KINGDOM: Taylor & Francis Group. http://ebookcentral.proquest.com/lib/upenn-ebooks/detail.action?docID=1900031.

Seth, Shobhit. 2024. “Transfer Pricing: What It Is and How It Works, With Examples.” Investopedia. June 25, 2024. https://www.investopedia.com/terms/t/transfer-pricing.asp.

Smith, Stacey Vanek, and Eric Whitney. 2023. “Cobalt Is in Demand, so Why Did America’s Only Cobalt Mine Close?” NPR, December 14, 2023, sec. Economy. https://www.npr.org/2023/12/14/1219246964/cobalt-is-important-for-green-energy-so-why-has-americas-only-coablt-mine-closed.

Statista. 2024.“Largest State-Owned Oil Companies 2019.” 2024. Statista. April 29, 2024. https://www.statista.com/statistics/793389/largest-state-owned-oil-companies/.

Yang, Florence W. 2025. “Rare Earth and Resource Nationalism: What Happened Before and After China’s Embargo on Japan?” Journal of Contemporary China 34 (153): 383–400. https://doi.org/10.1080/10670564.2024.2335547.

Zeidan, Adam. 2024. “Yom Kippur War.” Britannica. September 20, 2024. https://www.britannica.com/event/Yom-Kippur-War.

- Aluminum, for example, is identified as critical by the U.S. DOE but is identified as having “met world demand for metal well into the future,” by USGS, focusing their attention on where production capacity is located rather than where natural reserves are found. [↩]