Coordinated Policy and Targeted Investment for an Orderly and Reliable Energy Transition

In the United States, there is no national electricity policy. Reaching nationally defined decarbonization targets in the electricity sector, without a national electricity policy, while maintaining grid reliability, is a growing challenge.

At a Glance

Key Challenge

No one setting decarbonization targets at either the federal or state level is responsible for both setting decarbonization targets and maintaining grid reliability in the United States. This is an enormous policy gap.

Policy Insight

Creating a reliable, decarbonized, climate-resilient electricity sector requires a coordinated policy that de-risks investment in both the resources and infrastructure needed to ensure the reliable transition of the electricity sector.

Policies that support the clean energy transition must ensure grid reliability. Getting it right in electricity is essential to meeting decarbonization targets in other sectors, like heating and transportation, and reliable bulk grid operations is a public good. Creating a reliable, decarbonized, climate resilient electricity sector requires coordinated policy that de-risks investment in both the resources and infrastructure needed to ensure the reliable transition of the electricity sector.

Focused policy is critical for ensuring the reliable and orderly transition of the electricity sector, in support of Paris Agreement targets. State and federal policy can, and must, play an important role in the orderly transition of the electricity sector by focusing investment and shaping technology innovation.

The United States Does Not Have a National Electricity Policy

The lack of a national electricity policy creates reliability and investment risks for the clean energy transition in the United States. Reaching nationally defined decarbonization targets in the electricity sector, without a national electricity policy, while maintaining grid reliability, is a growing challenge.

There is a clear federal focus on industrial policy to help shape a decarbonized electricity sector, and individual states have set their own decarbonization targets. The problem is that no one setting decarbonization targets at either the federal or state level is responsible for both setting decarbonization targets and maintaining grid reliability in the United States (Joseph 2023). This is an enormous policy gap.

A lack of policy coordination puts the reliable transition of the electricity sector, critical for reaching any economy-side decarbonization targets, at risk. Indeed, the North American Electric Reliability Corporation (NERC), responsible for setting reliability standards across the United States and conducting risk assessments, identified policy as a reliability risk in its most recent electric sector risk evaluation (NERC 2023).

The Inflation Reduction Act (IRA) provides technology-neutral incentives for various types of clean energy technologies, but a specific technical mix of resources is required to meet operating reliability in daily grid operations (Joseph 2023). A lack of coordinated policy makes it hard to direct investment toward the kinds of resources that are needed and makes it hard to invest in the ecosystem of infrastructure required to scale new technology that can transition the sector.

In addition, much of the focus in the investment community is on de-risking new technology through the initial deployment of pilot plants. To deploy and scale, some of these technologies need associated infrastructure (like pipelines), and not all of these technologies (like geothermal) are, or will be, available in all locations.

Bridging the policy coordination gap can help mitigate the reliability challenges associated with the energy transition and de-risk investment in innovative technologies. In addition, focused policy that drives growth and innovation can help lower the costs of adopting new and innovative technological solutions (Zenghelis 2016).

The way to do this in the electricity sector is through targeted incentives that focus investment in the technology and infrastructure needed. The entities responsible for reliable grid operations do not determine decarbonization policy, and the United States does not have a national electricity policy. So, states play a crucial role in determining how federal incentives, intended to support decarbonization of the electricity sector, will be used in support of the reliable transition of the electricity sector. Coordinated state and RTO planning can help.

Specifically, coordinated, regional planning can do two things: (1) enable states and regional grid operators to fill a policy gap that creates reliability risk; and (2) help de-risk public investment in the high-capital, not-yet-commercial resources that are critical to enabling the reliable transition of the electricity sector.

The good news is that we have institutions that can enable the kind of coordinated, reliability-informed planning needed. The challenge is recognizing the importance of policy in the electricity sector, beyond fixing market gaps, to enable coordination, planning, and investment efficiencies for a moonshot mission to reliably decarbonize the electricity sector

Bridging the Policy Coordination Gap

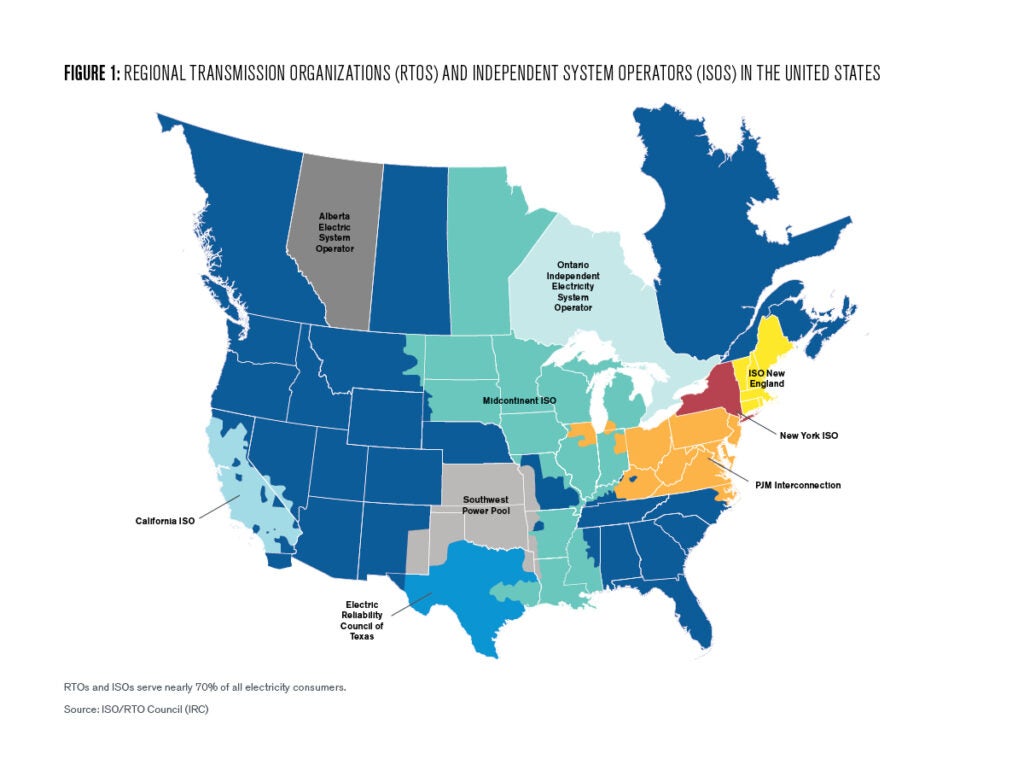

In the United States, regional reliability coordinators, called Regional Transmission Organizations (RTOs), are responsible for maintaining grid reliability across a wide footprint, and across a number of states, by meeting NERC-defined mandatory and enforceable reliability standards.

The seven RTOs in the United States serve nearly 70% of all electricity consumers (IRC 2024). These regional organizations manage a critical public good: Grid reliability on the bulk electric system.1 While not all parts of the country have RTOs, all regions of the country have reliability coordinators.2

As regional reliability coordinators, the RTOs conduct regional system planning and are the entities responsible for meeting mandatory and enforceable reliability standards. As the “supplier of last resort” (FERC 1999) for the resources needed to maintain reliability and prevent network system collapse (a blackout) the RTOs play a crucial role in managing bulk electric system reliability, a critical public good.

Importantly, the RTOs do not set electricity policy and do not set decarbonization targets, but must maintain operating reliability with the resources that enter and exit in response to state and federal policy incentives (Joseph 2023). Right now, state and federal policymakers are setting decarbonization targets without input from entities responsible for maintaining reliable grid operations and this creates reliability and investment risks.

An orderly transition, in support of Paris Agreement targets (UNFCCC 2023 COP), requires that clean energy targets and decarbonization policies support changing grid reliability needs. System operators need resources that can respond to dispatch signals, provide energy whenever called upon, and provide specific kinds of grid services as the grid transitions. As the resource mix changes, the types, or combinations of, generation resources needed to maintain reliable grid operations also changes (see Joseph 2023).

While renewable resources can provide some reliability services, unless and until sufficient battery storage, including long duration storage available over a multi-day period, is available at scale, or a new technology, like hydrogen, is available at scale, some fossil resources are needed (Robb Testimony Reliability 2021). In fact, electric system modeling demonstrates the need for dispatchable gas assets throughout the energy transition (NYISO 2022; CAISO 2022; ISO-NE 2023; MISO 2023; NREL 2023) to provide critical reliability services and balance intermittent renewable generation, and gas is expected to play a critical role until there is some other technology to replace it (NERC 2022; NERC 2023; NAESB 2023; FERC 2023).

Today, the natural gas system is planned, developed, and regulated separately from the electric system, exacerbating reliability challenges during extreme winter weather events (NERC 2023; NAESB 2023; FERC 2023). The reality is that individual states participate in regional electricity markets. This means that their individual policy choices for a particular resource mix have a wider, regional impact. So, states need to make sure their decarbonization and clean energy targets also support grid reliability needs.

Transitioning away from fossil fuels, while ensuring a robust and reliable natural gas system that meets electric system needs, is a complex challenge that requires focused and coordinated policy. Disparate state and federal policy, that is not reliability coordinator informed, makes it difficult to plan a future, reliable decarbonized, regional electric system. It also makes it hard to invest in needed technologies that may not run as often as the resource mix changes (see Mallapragada et al 2021; Gagnon et al 2023), but provide critical energy and reliability services when they do.

For states in regional electricity markets (i.e. RTOs), there are ways to de-risk public investment for the kinds of resources that can enable a reliable, decarbonized electricity system. States should rely on the RTOs to provide planning studies that help inform their policy planning and shape targeted investment incentives for the resources needed to maintain grid reliability, because bulk electric system reliability, a critical public good, requires an orderly transition.

RTOs can analyze various state policy targets for renewable resources and help states understand the types of technologies needed now to enable their integration, including transmission, natural gas, or batteries, and the locations and types of zero-emission resources needed over the longer-term to enable a reliable, decarbonized grid.

The RTOs can play an important role informing states about the reliability needs corresponding to various policy options. This could help focus and target investment into the mix of resources needed along with the existing and new infrastructure required to meet state policy targets.

Many of the RTOs already conduct these kinds of studies, but states need to use them to inform their policy, in support of changing grid reliability requirements. This kind of analysis, considering individual state policy targets alongside regional and local reliability needs, could enable dynamic policy that is focused on strategic and deliberate actions that can define which directions are possible now and how states can enable a particular future direction – steps that are needed in order to enable a moonshot mission (Mazzucato 2021).

How Focused Policy Shapes Technology Innovation

Policy plays an important role in enabling technological innovation. By taking on risk, defining the direction of change, and ensuring committed capital beyond research and development and into deployment, focused policy plays a critical role in shaping and creating technological innovation (Mazzucato 2015, 2016, 2018; Zeghelis 2016; Mazzucato and Semieniuk 2018; Deleidi et al 2019). Through investments in a portfolio of projects, with uncertain outcomes, strong policy can enable a variety of pathways and options that can enable a dynamic response, should some of these options fail (Mazzucato 2015, 2018).

Specifically, technology innovation benefits from policy that defines a direction, shapes a variety of pathways, and invests in what otherwise would not happen (Mazzucato 2015). In electricity, however, it also requires policy that considers electric system planning and the realities of what it takes to maintain reliable grid operations.

At the federal level, the IRA offers financial incentives for various clean technologies, so there is already a recognition that the public sector has an important role to play in “tilting” and shaping technology innovation through focused investment (Zenghlis 2016; Mazzucato 2016; Mazzucato and Perez 2015). The challenge in electricity, however, where federal incentives focus on a technology-neutral approach in order to enable a portfolio of possible solutions, is that not all resources provide the same kinds of reliability services and not all clean energy solutions are possible in all locations. To support grid reliability, technology neutral federal incentives need to be focused and directed.

Most of the technology that could fully decarbonize the electricity sector is not yet commercially available, and some requires investment in additional infrastructure to enable its use in electricity. In order to enable a hydrogen ecosystem, a geothermal ecosystem, a natural gas ecosystem with captured emissions or natural gas with bioenergy inputs, carbon capture and sequestration, direct air capture, advanced nuclear, or long-duration storage, more than de-risking technology through pilot demonstrations is required. Some of these technologies only work in some geological locations. And many of these technologies require additional infrastructure, like newly designed pipelines, in order to enable their production and delivery at scale.

Public investment that goes beyond de-risking technology to focus on deployment (see Mazzucato and Semieniuk 2018) is needed in electricity. The idea that public investment in specific technology types is “picking winners” ignores the reality that innovation is not something that happens only through the private sector, or is driven only by exogenous technological solutions (Mazzucato 2016; Zenghlis 2016). Further, it ignores the reality of what it takes to reliably transition the electricity sector.

Meeting Grid Reliability in Real-Time System Operations

The physics of electricity production and delivery through wires requires that supply and demand are matched in real-time system operations. Small disturbances on the grid can quickly cascade and have a much larger, regional impact. The constant balance of supply and demand, while operating transmission lines within their defined (“loading security”) limits, helps ensure that grid frequency, the flow of electrons through wires, remains within a specific range. Changes in grid frequency can impact power flows, which impact transient and voltage stability, and, if not managed, could lead to a cascading blackout.

The North American Electric Reliability Corporation (NERC) sets mandatory and enforceable standards for the reliable operation of the bulk electricity system.3 These mandatory reliability standards ensure reliable bulk grid operations for what is called “operating reliability,” or the ability to withstand sudden disturbances in system operations.

For example, in normal system operations, transmission line limits are determined not by the amount of power flowing, but by how much additional power would flow on a transmission line if another system element, like transmission or generation, failed (a “contingency”). Grid operators manage to contingencies in order to operate the bulk electric system to withstand sudden disturbances. This helps ensure reliable operations even with the unexpected loss of a transmission line, or the unexpected loss of a generation resource.

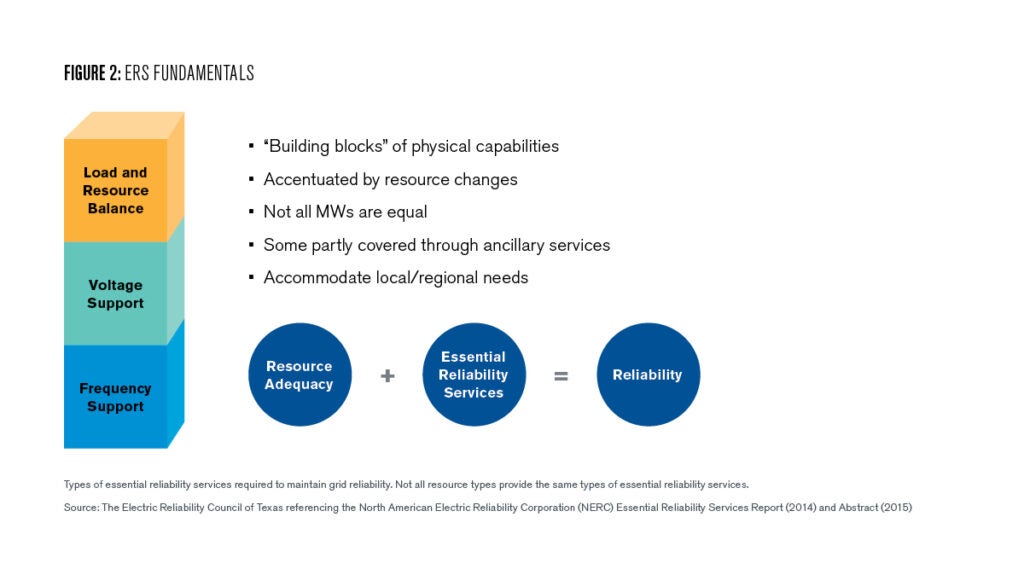

An important part of managing the physics of power flow across transmission lines, meeting reliability standards, and maintaining reliable grid operations is having generation resources that provide what are called ancillary services, or essential reliability services (ERS). These are resources that enable system operators to:

- respond to changes in grid frequency or voltage stability

- keep supply and demand in balance

- maintain transmission line limits

- meet mandatory and enforceable reliability standards

In addition, NERC Reliability Standards require that grid operators have access to specific kinds of generation resources, called operating reserves, that can be dispatched within 10-30 minutes in response to a contingency event.

In grids made up of mostly renewables, quick-start, fast-ramping generators provide critical ancillary services that help maintain operating reliability when renewable resources are not available (Joseph 2023). Today, batteries and natural gas-fired generators are commercially available technologies that meet this need.

Zero-emission resources that could meet this need include geothermal, hydrogen, advanced nuclear, long-duration (multi-day) storage, or fossil with carbon removal. These are high capital cost technologies that are not commercial today, may run infrequently as the resource mix changes, but provide critical services when they do, and some require additional infrastructure to scale.

Why Focused and Coordinated Policy Is Key

In the United States, technology neutral incentives at the federal level shape a variety of pathways that could help decarbonize the electricity sector, but targeted incentives are needed to scale and deploy new technology that can meet grid reliability needs.

Completely shifting the electricity sector toward zero-emission, clean energy resources is a moonshot mission. In electricity, it is not just a matter of incentivizing a portfolio of clean resources, finding a few technologies that become commercial, and switching those out for existing fossil assets. Reliable grid operations require certain kinds of resources that provide very specific, and sometimes very local, services. Not all resources can provide these services and for those that can, it matters where they are located and how quickly they can respond to operator dispatch signals.

Lessening reliance on natural gas in heating, in support of state decarbonization policy targets, while simultaneously increasing the need for a natural gas system capable of supporting the electricity sector through the transition requires focused and directed policy. Transitioning the electricity sector away from natural gas altogether requires a focus on the kinds of technology that can replace the reliability services it provides. Scaling batteries, geothermal, advanced nuclear, long duration storage, hydrogen, or captured emissions/removal technologies, along with the infrastructure needed, requires committed capital beyond research and development and into deployment.

A better way to enable individual state policy that has regional grid impacts, is to assess individual state policy targets collectively. Reimagining how we use existing institutions can help. Particularly, reimaging the role of the RTOs in helping states direct investment, fill a policy gap that creates reliability risk, and mitigate investment risk associated with new technology options.

This kind of coordinated planning could enable states, as the “innovator of first resort” (Mazzucato 2015) to focus investment on the types of zero-emission resources that provide the essential reliability services required for RTOs to be the ancillary services “supplier of last resort” (FERC Order 2000) throughout the energy transition.

| Entity | Role | Activities |

|---|---|---|

| States | Provide study assumptions | Study assumptions based on integrated Resource Plans (IRPs), state policy targets, and/or possible federal policy requirements (e.g. EPA). |

| RTO | Consensus Building | Regional system planning study (with agreed upon scenarios) based on state and federal policy (e.g. types of generation, timing, locations, electrification targets, EPA regulations, etc.). |

| RTO | Provide regional reliability assessments. These studies would identify reliability needs (Resource Adequacy and Operating Reliability) over a defined time period.4 | Timelines: Short-Term (1-5 years) Medium-Term (5-10 years) Longer-Term (10-20 years) |

| States | Consider studies and scenarios for reliability-informed policy planning. | Targeted incentives for technology types that meet policy and system reliability needs. |

| States | Coordinated regional planning for generation, and infrastructure, that meet identified reliability needs. | This could include mechanisms to consider regional planning and/or coordinated procurement of needed resources and/or infrastructure. |

The Limits of Electricity Markets

A task force set up to consider electricity market competition in the United States reported to Congress nearly twenty years ago that “system reliability, the prevention of network collapse, is a public good” (Task Force to Congress 2007). As the resource mix changes, preventing network system collapse requires that power system operators have access not just to a sufficient amount of generation resources, but the right technical mix of resources.

While prices in RTO wholesale markets help enable efficient generation dispatch and use of transmission lines within their reliability (“loading and security”) limits, relying on prices alone to ensure sufficient investment in the resources needed to maintain reliable grid operations and prevent network system collapse has always been insufficient (Joskow and Tirole 2007; Joskow 2008; Keppler et. al 2022).

In electricity markets, known limitations make it difficult to rely on prices alone as the investment signal for new generation resources. For example, because of the need to meet reliability targets, price caps to prevent the exercise market power, a mostly inelastic demand side with inefficient retail rates, and insufficient markets for risk in the sector, electricity market

prices alone cannot ensure sufficient investment in generation. As a result, electricity markets require acceptable (from the perspective of an economist) regulatory interventions that correct for what are called “missing money” or “missing incentives” in the sector.5 That is, there are inefficiencies that make it difficult to rely on prices alone, and fixing these inefficiencies, in order to then let the markets work, is an acceptable form of policy in electricity markets.

But markets are always imperfect and incomplete, and the constant focus on which market gap or market failure to solve, in order to get back to relying solely on market prices distracts from the need to ensure markets meet public purpose (Mazzucato 2021). Instead of focusing only on the market gaps that need fixing in markets for electricity, or new products that need pricing, a better focus would be: how do we enable the orderly transition of the sector? Asking specifically: “what needs to be done?” (Mazzucato 2021).

In reality, bulk electric system reliability is a public good. Everyone gets the benefit of the actions grid operators take, including deploying resources needed to provide essential reliability services and operating reserves, to avoid a catastrophic blackout. Fundamentally, there is no price mechanism in short-term power markets that can represent the “value” of grid reliability through price signals alone, because electric grid reliability cannot be represented in any individual consumer price or supplier payment (Joskow and Tirole 2008; Joskow 2019; Gorman 2022).

There is a role for policy in the electricity sector that goes beyond fixing market problems. A moonshot mission requires deliberate policy action that shapes and directs investment. Markets and electricity market prices alone cannot solve the decarbonization policy coordination challenges that create reliability risk, nor the need for coordinated planning, operations, and reliability standards that support both the gas and electricity sectors as the resource mix changes.

Markets alone will not ensure sufficient infrastructure is available to scale and deploy zero-emission technologies that meet grid reliability needs. Relying on prices alone to manage the reliable transition of the electricity sector also ignores the important role of policy in shaping technology innovation.

Conclusion

The scale of investment required to enable the energy transition, changes required in how the grid is planned and operated, specific types of technologies needed to enable grid reliability, and the infrastructure ecosystem required to enable the deployment of many high-capital zero-emission technologies, requires a fundamental rethinking of the role of policy in the electricity sector.

The policy coordination gap between those setting decarbonization targets at either the federal or state level, and those responsible for reliable grid operations, creates reliability risks. Regulatory silos make it challenging to plan across interdependent sectors (like natural gas and electricity). Policy that is uninformed by reliability needs makes it difficult to focus research and development on needed technology solutions, direct financial investment (both private and public), and scale new technology that can meet reliability needs and replace fossil assets.

Policy coordination is critical to enabling the reliable and orderly transition of the electricity sector. There is an important role for policy in the electricity sector that goes beyond fixing known problems that impact investment incentives in electricity markets. Electricity is too important, too essential, and too critical to reaching decarbonization targets to get this wrong.

States already share a commitment to ensure the reliability of the electricity system. As the resource mix changes states also have the responsibility to ensure that their decarbonization policies support grid reliability.

Not every clean technology is needed everywhere, or even possible in all locations, and not every clean technology solves operating reliability challenges in real-time system operations. Depending on the amount of transmission, types of renewable resources, weather, and state electrification targets, the mix of resources that meet policy targets and meet grid reliability requirements may look different in different places and may change over time.

A state policy framework that supports technology innovation, and is flexible enough to enable learning as new technologies are deployed, can help lower the costs of scaling new technologies. The way to do this in the United States is for states to rely on the system planning capability of the RTOs to inform state policy incentives. Not only would this fill a policy coordination gap that creates reliability risks, but focused policy can also help de-risk investment in the technology and infrastructure needed to decarbonize the sector.

Kelli Joseph

Senior Fellow, Kleinman CenterKelli Joseph is a Kleinman Center Senior Fellow. She works at the intersection of policy and markets, with a focus on transitioning the electricity sector to support a decarbonized, climate resilient economy.

California Independent System Operator (CAISO). 2022. “20-Year Transmission Outlook.” CAISO. https://www.caiso.com/InitiativeDocuments/Draft20-YearTransmissionOutlook.pdf.

California SB 100 Joint Agency Report. 2021. “Achieving 100 Percent Clean Energy in California: An Initial Assessment.”

Deleidi, Matteo, Mazzucato, Mariana, and Semieniuk, Gregor. 2019. “Neither crowding in nor out: Public direct investment mobilizing private investment into renewable electricity projects.” UCL Institute for Innovation and Public Purpose Working Paper Series (IIPP WP 2019-10).

FERC (U.S. Federal Energy Regulatory Commission), North American Electric Reliability Corporation (NERC), Regional Entity Joint Inquiry into Winter Storm Elliott. 2023.

Federal Energy Regulatory Commission (FERC). 1999. Order No. 2000: Regional Transmission Organizations.

Gagnon, Pieter, An Pham, Wesley Cole, Sarah Awara, Anne Barlas, Maxwell Brown, Patrick Brown, Vincent Carag, Stuart Cohen, Anne Hamilton, Jonathan Ho, Sarah Inskeep, Akash Karmakar, Luke Lavin, Trieu Mai, Joseph Mowers, Matthew Mowers, Caitlin Murphy, Paul Pinchuk, Anna Schleifer, Brian Sergi, Daniel Steinberg, and Travis Williams. 2023. “2023 Standard Scenarios Report: A U.S. Electricity Sector Outlook.” Golden, CO: National Renewable Energy Laboratory. NREL/TP-6A40-87724. https://www.nrel.gov/docs/fy24osti/87724.pdf

Gorman, Will. 2022. “The quest to quantify the value of lost load: A critical review of the economics of power outages.” The Electricity Journal, 35(8).

ISO/RTO Council (IRC). 2024. www.isorto.org. Accessed January 2024

Joseph, Kelli. 2022. “Coordinating Markets for Reliability: Resource Adequacy as a Public Good.” The Electricity Journal, 35(3).

Joseph, Kelli. 2023. “Meeting the Reliability Challenges of the Energy Transition.” World Resources Institute.

Joskow, Paul. 2019. “Challenges for wholesale electricity markets with intermittent renewable generation at scale: the US experience.” Oxford Review of Economic Policy, Volume 35, Issue 2, Summer 2019, Pages 291–331

Joskow, Paul. 2008. “Capacity Payments in Imperfect Electricity Markets: Need and Design.” Utilities Policy, 16(3), 159-170

Joskow, Paul. and Tirole, Jean. 2008. “Reliability and Competitive Electricity Markets.” The RAND Journal of Economics, 38(1), 60-84.

Keppler, Jon Horst, Quemin, Simon, and Saguan, Marcelo. 2022. “Why the Sustainable Provision of Low-Carbon Electricity Needs Hybrid Markets.” Energy Policy, 171.

Mallapragada, Dharik, Junge, Christian, Wang, Cathy, Pfeifenberger, Hannes, Joskow, Paul, and Schmalensee, Richard. 2021. Electricity Pricing Problems in Future Renewables-Dominant Power Systems. MIT Center for Energy and Environmental Policy Research (CEEPR). NBER Working Paper.

Mazzucato, Mariana, and Perez, Carlota. 2015. “Innovation as Growth Policy” in J.Fagerberg, S.Laestadius and B.R. Martin (eds), The Triple Challenge for Europe: Economic Development, Climate Change, and Governance. Oxford University Press: Oxford, UK ,pp. 229–264.

Mazzucato, Mariana. 2015. The Entrepreneurial State. New York: Hachette Book Group.

Mazzucato, Mariana. 2016. “From Market Fixing to Market-Creating: A New Framework for Innovation Policy.” Version 1. University of Sussex.

Mazzucato, Mariana. 2018. “Mission-Oriented Policies: Challenges and Opportunities.” Industrial and Corporate Change, 27(5): 803-815.

Mazzucato, Mariana. 2021. Mission Economy: A Moonshot Guide to Changing Capitalism. New York: Harper Collins.

Mazzucato, Mariana and Semieniuk, Gregor. 2018. “Financing Renewable Energy: Who Is Financing What and Why It Matters.” Technological Forecasting and Social Change, 127(C), 8-22.

Midcontinent Independent System Operator (MISO). 2023. “MISO Futures Report: Future 2A Energy Adequacy & Siting.” Initial Draft. LRTP Workshop Presentation. https://cdn.misoenergy.org/20230428%20LRTP%20Workshop%20Item%2003b%20Future%202A%20Siting%20Presentation628726.pdf.

New England Independent System Operator (ISO-NE). 2023. “2023 Regional System Plan.” https://www.iso-ne.com/static-assets/documents/100005/20231114_rsp_final.pdf

New York Independent System Operator (NYISO). 2022. 2021-2040 System & Resource Outlook (“The Outlook”).

North American Electric Reliability Corporation (NERC). 2023. ERO Reliability Risk Priorities Report.

North American Electric Reliability Corporation (NERC). 2022. Long-Term Reliability Assessment. https://www.nerc.com/pa/RAPA/ra/Reliability%20Assessments%20DL/NERC_LTRA_2022.pdf

North American Electric Reliability Corporation (NERC). 2021. Balancing and Frequency Control Reference Document. Prepared by the NERC Resources Subcommittee.

North American Electric Reliability Corporation (NERC). 2018. Bulk Electric System Definition Reference Document.

North American Electric Reliability Corporation (NERC). 2016. Essential Reliability Services: Whitepaper on Sufficiency Guidelines.

North American Electric Reliability Corporation (NERC). 2015. Essential Reliability Services Abstract.

North American Energy Standards Board (NAESB). 2023. Gas Electric Harmonization Forum Report. July 28.

Report to Congress on Competition in Wholesale and Retail Electricity Markets for Electric Energy Pursuant to Section 1815 of the Energy Policy Act of 2005. 2007. Task Force included the Department of Justice (DOJ), Federal Energy Regulatory Commission (FERC), Federal Trade Commission (FTC). Department of Energy (DOE), and Department of Agriculture (DOA).

Reliability, Resiliency, and Affordability of Electric Service in the United States Amid the Changing Energy Mix and Extreme Weather Events: Testimony Before the Committee on Energy and Natural Resources, 117th Cong. (2) (2021) (statement of James Robb, President and CEO North American Electric Reliability Corporation)

United Nations Framework Convention on Climate Change (UNFCCC) Conference of the Parties Serving the as the Meeting of the Parties to the Paris Agreement. 2023. “Outcome of the First Global Stocktake.” United Arab Emirates.

Zenghelis, Dimitri. 2016. “Decarbonisation, Innovation and the Economics of Climate Change.” In Jacobs, Michael and Mazzucato, Mariana, (eds.) Rethinking Capitalism: Economics and Policy for Sustainable and Inclusive Growth. Political Quarterly Monograph Series. Wiley-Blackwell, Chichester.

- The bulk electric system (“the grid”) includes load served on transmission lines that are not included in local (utility) electricity distribution (NERC 2018). These are typically higher voltage lines used in interstate transmission. [↩]

- See Joseph 2023 for a description of the different reliability coordinators in the United States. This paper refers to Regional Transmission Organizations (RTOs) and Independent System Operators (ISOs) interchangeably. [↩]

- Following the 2005 Energy Policy Act, NERC is the FERC-certified Electric Reliability Organization (ERO) responsible for developing and enforcing mandatory reliability standards. NERC (2018) defines reliability as consisting of two parts: (1) Resource Adequacy, or enough generation resources to meet expected demand; and (2) Operating Reliability, the ability to withstand sudden disturbances. While the electricity sector has focused mostly on Resource Adequacy, as sources of uncertainty on the electricity system change the reliability risk profile, including extreme weather and increased reliance on the natural gas system, there is an increased focus on operating reliability. [↩]

- RTO reliability assessments would consider both Resource Adequacy and Operating Reliability assessments. California, through its Joint Agency Study, is beginning this type of coordinated, reliability-informed planning (see Joint Agency Report 2021), but this analysis considers the state of California only.

[1]These “fixes” include capacity markets, or pricing adders that reflect reserve shortages, called an “operating reserve demand curve” (ORDC). [↩] - These “fixes” include capacity markets, or pricing adders that reflect reserve shortages, called an “operating reserve demand curve” (ORDC). [↩]