Competitive Imperative: Choices for Pennsylvania’s Energy Future

From carbon pricing, to improving distribution system cybersecurity and resilience —here are choices to guide Pennsylvania’s energy future.

Introduction

No other state in the nation—besides Texas—produces more energy than Pennsylvania.1 In 2016, the commonwealth ranked second in the nation on natural gas production and nuclear power generation, ranked third on coal production2 and overall power generation, had a small (but growing) portfolio of renewable power assets, and was a net energy exporter (U.S. Energy Information Administration 2018). Critically, maintaining leadership in the energy sector is not a passive endeavor, especially given the dynamic nature of technologies, economics, and societal and investor expectations.

The goal of this report is to identify a portfolio of carefully weighed energy policy priorities for Pennsylvania policymakers and stakeholders to consider pursuing, based on critical needs and complicated tradeoffs.

General policy areas are identified as priorities, whereas policy details are provided as options or key questions to explore. The priority areas and options are broken down in the following three categories:

Advanced Energy Future. The advanced energy future priorities assume the energy sector will be carbon-constrained in the foreseeable future. Policy options identified aim to prepare and enable the state’s energy economy to manage uncertain, yet anticipated, greenhouse gas regulatory risks.

Carbon pricing policy in the power sector is consistent with competitive markets, will help preserve and grow the zero-carbon power resources critical to avoiding the worst impacts of climate change, and can generate revenues to disburse to affected individuals and industries (such as distressed coal communities, consumers, or energy-intensive industries).

No other state in the nation—besides Texas—produces more energy than Pennsylvania.

Pennsylvania’s shale gas resources have lowered gas and power prices for consumers, reduced power- sector emissions of air pollutants, and created new economic development opportunities. With these benefits also come complexities and concerns. Incentivizing best-in-class natural gas production will help solidify the fuel’s position as an environmentally and socially accepted low-carbon resource, which is critical to ensuring a long-term future for the industry. As a net electricity exporter, Pennsylvania is strategically positioned to lead on carbon reduction through transportation electrification. The commonwealth can also foster more accurate valuation and integration of distributed energy resources by disclosing distribution system conditions, authorizing certain utility investments, and partnering with grid operators. Lastly, the commonwealth could lead by example, by promoting long-term contracts for renewables-plus-storage to support government operations.

Energy System Security and Resilience. There are advancing human (i.e. cyber and physical) and natural- borne (i.e. extreme weather) threats Pennsylvania should address to ensure distribution grid and pipeline system security. Improved power system resilience to recover from human and natural disturbances can be pursued in tandem with efforts to modernize the distribution grid—through analysis, integrated planning, and strategic investments—to promote a more robust grid that can incorporate the technologies consumers increasingly demand.

Communities and Consumers. The rise of Pennsylvania’s shale gas industry has reduced demand for some of Pennsylvania’s other energy resources. Energy communities in transition—such as those dependent on coal mining or hosting economically at-risk nuclear power plants—require greater attention and transition assistance from policymakers, especially in response to rapidly changing industry dynamics. Increased consumer protection and regulatory transparency should be a prerequisite to embarking on much needed investments to modernize and improve the resilience and security of Pennsylvania’s power and gas distribution systems. This will help balance innovation for the future with affordability.

Advanced Energy Future

While not transformative, these modest policies will enable Pennsylvania to align itself with an advanced energy future, consistent with reasonable market, investor, and social expectations.

Power Sector Carbon Pricing

There is significant uncertainty for energy investors related to greenhouse gas regulatory risk. Although the current federal administration has moved away from— not towards—meaningful greenhouse gas regulations, many other states and nations are incorporating carbon mitigation strategies into regulatory regimes. In fact, the U.S. is now the international outlier in its efforts to withdraw from the Paris Agreement.3

Increasing the renewable energy (i.e. Tier I) requirements in Pennsylvania’s Alternative Energy Portfolio Standard (AEPS) law or establishing subsidies to prevent the premature retirement of zero carbon nuclear power resources would yield many benefits, including reducing power-sector greenhouse gas emissions, promoting fuel diversity, and supporting job creation/retention. However, significant policy, legal, and financial uncertainty exists regarding how AEPS-credited resources or nuclear subsidies will be treated by federal regulators and the regional grid operator (i.e. PJM Interconnection) in the future. Specifically, the Federal Energy Regulatory Commission may require PJM to mitigate the effects of state-level subsidies in wholesale markets, which could eventually require far greater state-level financial compensation and expanded state statutory authorities to promote or preserve preferred resources.4

A federal, economy-wide carbon pricing mechanism (e.g. cap-and-trade or carbon tax) is generally accepted to be the most economically efficient approach. A power- sector-only approach would best be implemented nationally, followed by a region-wide or sub-region-wide approach (e.g. via PJM). Pennsylvania could explore working with PJM and other PJM states that have established subsidies for zero-carbon resources in order to advance the RTO’s approach to carbon pricing.5 Correspondingly, Pennsylvania could re-examine joining the regional greenhouse gas initiative (RGGI).

In absence of these broader mechanisms, the commonwealth could consider a carbon tax or investigate state-level regulatory options. As one example, Pennsylvania could implement a state-based carbon price (e.g. a carbon fee on power production ranging from $5 to $20 per ton) to maintain fuel diversity, serving as a hedge against higher prices in a carbon-constrained future.6

To understand the hedge value, one must be aware of the fact that over 50% of the PJM queue (i.e. inventory of potential projects looking to interconnect to the grid) consists of combined cycle natural gas resources. Retirement of zero-carbon resources will predominately be backfilled by existing or new gas-fired resources, increasing Pennsylvania’s power sector emissions, and making the state’s power assets and consumers more vulnerable to stranded costs and higher prices associated with future carbon reduction efforts.

A state-level carbon price would help preserve low- carbon fuel diversity, provide a hedge against future gas price increases, and could reduce consumer and investor exposure to greenhouse gas regulatory risk (e.g. by avoiding an increase in power-sector GHG emissions). A lower per ton carbon price is less likely to meaningfully impact power prices, change dispatch orders, or harm economically healthy Pennsylvania-based power assets. A higher carbon price would most meaningfully disadvantage Pennsylvania’s coal resources.7

This carbon price would send a long-term signal to investors consistent with a carbon-constrained future. Carbon pricing is consistent with competitive market fundamentals, and could create a useful revenue stream. This revenue stream might be used to aid distressed coal or nuclear communities, low-income consumers, or energy-intensive industries.

Several zero-carbon nuclear plants in Pennsylvania are struggling to achieve revenue adequacy and at least two plants are preparing for premature retirement (i.e. prior to reactor license expiration). These two plants— Three Mile Island and Beaver Valley—represent about 2,700 megawatts of zero carbon capacity and operate at capacity factors generally over 92%. Loss of these units will reduce power exports, will predominately be backfilled by higher carbon resources, and may make Pennsylvania more vulnerable to cost impacts from impending carbon constraints and/or fuel price volatility.

Best-In-Class Natural Gas Development

It is in the best interest of Pennsylvania and its gas industry to ensure a long-term future for resource development and demand, which includes maintaining social license to operate (i.e. maximizing environmental sustainability) and solidifying the role of natural gas in reducing carbon emissions. For a capital intensive industry, a low commodity price environment may promote “short-cuts” and serve as an impediment to pursuing best practices. Over time, this may lead cash flow negative companies to precipitate a “race to the bottom” on environmental performance.

Pennsylvania’s mixed politics may require a mutual compromise that embraces the economic benefits of gas, while maximizing its environmental benefits and limiting its environmental harms. There is some evidence to suggest many natural gas production firms see value in achieving environmental standards beyond regulatory minimums.8

Over time, this may lead cash flow negative companies to precipitate a “race to the bottom” on environmental performance.

An incentive- or performance-based approach to environmental regulation could be pursued where Pennsylvania identifies voluntary best-in-class standards and practices with respect to key environmental issues (e.g. water use, wastewater disposal, methane leakage, air quality, bonding, etc.). Those operators demonstrating (e.g. application and certification) consistent implementation of best practices would qualify for preferential treatment (e.g. prioritization for permit review) and public recognition from the state for adherence to best-in-class standards.

Pennsylvania could also take steps to anticipate and address market, production, and environmental issues that may result as demand for gas increases (e.g. as new offtake pipeline capacity comes online and production increases). As a result of anti-trust issues, the gas industry may not be allowed to engage in such useful planning exercises. Anticipating cumulative, industry-wide water use and disposal needs, emissions impacts, sand and labor requirements, road traffic, land use impacts, and other industry-wide phenomena could help to better identify, prepare for, and address issues, therefore avoiding negative outcomes.

Transportation Electrification

Transportation electrification can provide a variety of environmental,9 economic, and societal benefits. As a net electricity exporter situated in the northeast U.S. corridor, Pennsylvania has a competitive advantage in supplying power to a robust transportation network. Pennsylvania has promoted transportation electrification through several policies, for example, through the Alternative Fuel Incentive Grant program and vehicle rebates, and a proposed policy statement from the PA PUC to reduce regulatory uncertainty over third-party charging (i.e. charging stations not owned by the vehicle owner or the local electric utility).10 In 2017, Pennsylvania ranked 19 out of 50 states on plug-in hybrid electric vehicle market share and 32nd in battery electric vehicle market share, and hosted about 540 publicly available charging stations (Meister Consultants Group 2018).

The 2018 Pennsylvania EV Roadmap (Roadmap) was developed by a coalition of government, industry, utility, municipal, and other stakeholders, and serves as a useful tool to explore light-duty car and truck transportation electrification policy options for the commonwealth (Meister Consultants Group 2018). The Roadmap outlined a series of strategies meant to boost consumer confidence in EVs, improve EV affordability, and rapidly expand charging infrastructure. Policies in the Roadmap include establishing a statewide goal for EV sales, instituting a utility transportation electrification directive, expanding EV rebates, promoting fleet electrification, strengthening statewide EV infrastructure planning, developing a variety of education and technical assistance initiatives, and other policies.

Developing the required EV charging infrastructure11 will enable Pennsylvania to capture the benefits of transportation electrification, a market expected to grow to 11% of all new U.S. car sales by 2025 (Bloomberg New Energy Finance 2018). Pennsylvania policymakers will need to explore a host of key issues when weighing EV infrastructure and vehicle expansion options, including but not limited to: ensuring EVs promote rather than inhibit grid reliability and resilience, defining the appropriate role of utilities and non-EV owning electricity ratepayers in contributing to EV infrastructure expansion, ensuring low- income populations can benefit from electrification (e.g. via mass transit), exploring the benefits and drawbacks of central coordination of infrastructure expansion, tracking alternative fuel tax remittance, developing rate structure options, and other issues.

Distributed Energy & Storage Resources

Maximizing the value of distributed energy resources (DERs) and minimizing system costs will require greater public transparency about distribution grid system data, and improved supply integration through situation awareness and coordination with the bulk power system. Energy consumers are increasingly interested in DERs (e.g. solar), but there are many debates about the costs or benefits to the distribution system of these assets (e.g. net metering policy). The DER value or cost is likely to depend on the location of interconnection (e.g. at the distribution feeder circuit level), as well as the time of day the resource operates.

Increased public transparency about distribution system data would enable customers and DER developers to better understand system value versus costs (e.g. hosting capacity analysis).12 In aggregate, DERs connected at the distribution system level have the potential to meaningfully impact the bulk power system, raising questions about the need for greater visibility and coordination between these systems. Pennsylvania regulators, utilities, and PJM could work together to explore strategies to beneficially facilitate DER growth.

In discrete situations, Pennsylvania might reconsider aspects of its restructuring law that prohibit utilities from owning certain generation resources. The prohibition was key to breaking apart the utility generation monopoly and opening the market to competition. Competitive, non-utility ownership of generation assets must be preserved. However, for some underserved populations, utilities may be the best or only entity willing to serve these customers. For example, utility ownership of community solar for the explicit purpose of solely and exclusively serving low-income consumers could ensure these often neglected populations enjoy the benefits of DERs.13 The role of utility ownership of electric storage investments to support the distribution system (e.g. substation upgrade deferral) could also be considered. These two discrete utility ownership prospects should be approached carefully, to ensure protection of competitive, non-utility investment opportunities.

Lead By Example

To promote continued progress towards carbon reduction and job growth, competitively solicited long-term contracts for clean resources to power commonwealth government operations could be explored. Ideally, these long-term contracts (i.e. ten years or longer) for power would support the development of new AEPS Tier 1-eligible resources paired with energy storage systems. In fiscal year 2016–2017, commonwealth government operations consumed approximately 113,866 MWh of power at a retail unit cost of $74.9/MWh (Penn State University Facilities Engineering Institute 2017). As a rough example, assuming a 20% capacity factor, this would require about 65 megawatts of new installed solar capacity, plus a quantity of storage capacity to ensure performance. Although these data may not be transferable to Pennsylvania (e.g. given comparatively lower insulation levels), it is worthwhile to mention long- term power purchase contracts for solar-plus-storage announced in 2017 were priced at $45/MWh (between NextEra and Tucson Electric Power) and $36/MWh (with Xcel Energy in Colorado) (U.S. Energy Information Administration 2018). The costs and benefits of these contracts for Pennsylvania could be investigated through a Request for Information (RFI) solicitation.

Energy System Security & Resilience

As a net energy producer and exporter, ensuring energy system security and resilience is important to Pennsylvania as well as other states dependent on its energy assets. Two things are clear, reliability concerns—from cyberattacks to extreme weather—are increasing, and current protection and recovery methods require improvements. On cyber threats, consider this except from a report of the Defense Science Board of the U.S. Department of Defense,

“Although progress is being made to reduce the pervasive cyber vulnerabilities of U.S. critical infrastructure, the unfortunate reality is that, for at least the next decade, the offensive cyber capabilities of our most capable adversaries are likely to far exceed the United States’ ability to defend key critical infrastructures.” (Defense Science Board, 2017)

On natural threats, the Pennsylvania Public Utility Commission’s (PA PUC) 2017 electric reliability report noted,

“It appears that if more frequent, severe weather patterns become the new norm, the Pennsylvania electrical distribution system will have difficulty in meeting the established {reliability} performance criterion.” (Pennsylvania Public Utility Commission, 2018)

Cyber & Physical Security

It is important that utility systems under state jurisdiction— and potentially those systems traditionally exempt from state regulation (e.g. cooperatives and small utilities)— continually evaluate defensive strategies against advancing human and natural threats. This section highlights a few gaps in power and gas system security, but broader exploration (including to other non-energy utilities) should also be considered.

The federal government has jurisdiction to develop and enforce cybersecurity regulations to protect the bulk power system (i.e. generation and high voltage transmission). Utilities (or other entities) with assets that if disrupted would impact the bulk power system are required to comply with federal critical infrastructure protection (CIP) standards developed by the North American Electric Reliability Corporation (NERC). Somewhat dated figures suggest only 10 to 20% of U.S. grid assets are covered by NERC CIP standards, with most non-covered assets likely falling under state jurisdiction (Phelan 2014).

Large, investor-owned utilities are more likely to be subject to NERC CIP compliance, whereas many assets connected to the low-voltage distribution system may have no applicable minimum cyber protection requirements. Many of these unprotected power assets may reside within rural cooperatives and municipal or publicly owned utilities, many of which are often exempted from traditional state public utility commission jurisdiction.14 States will also be in charge of ensuring the proliferation of DERs can be enabled without creating new threat vectors. As the 2015 Ukrainian power outage to more than 230,000 people showed, cyberattacks targeting distribution level assets can effectively result in large-scale impacts.

Some examples of actions already taken by the PA PUC to increase cyber protections include requiring jurisdictional utilities to develop cybersecurity plans and submit relevant self-certification;15 participating in tabletop and other training exercises, and developing best practice guidelines for non-jurisdictional utilities.16 Most recently, the PA PUC developed a new Office of Cybersecurity Compliance and Oversight and appointed an office director.17 While these are important accomplishments, given the nation’s trailing and defensive posture on cybersecurity, more work is needed.

Pennsylvania could model the approach of Connecticut, a leader in state-level cybersecurity policy.18 In addition to these actions, new authorities may be required to ensure traditionally non-jurisdictional utilities are implementing proper minimum protections. Some other items to address include maintaining sufficient regulatory staff expertise on cybersecurity, ensuring eligible consumer advocate interests have access to confidential utility data, enabling relevant officials to maintain security clearance to receive national security briefings, exploring cost recovery options that align with risk-based protection goals (e.g. capitalizing versus expensing, ensuring recoverable investments are used and useful), developing a cost effective distributed energy resource protection strategy, etc.

As the nation’s second largest producer of natural gas, Pennsylvania has a greater responsibility to ensure the cyber and physical security of its pipeline systems. Federal regulators have raised concern about the lack of security oversight for pipelines, especially as the role of natural gas increases in our power systems and economy (Sobczak 2018). The Transportation Security Administration (TSA) is tasked with ensuring the cyber and physical security of over 300,000 miles of interstate gas pipelines. A 2017 memo from the Congressional Research Service raised concerns about pipeline security given TSA only had 12 full-time staff dedicated to national pipeline protection, and the agency is reliant on industry-driven, voluntary standards (Parfomak 2017).

Apart from security, a discussion of gaps in Pennsylvania’s pipeline protections would be remiss to omit mention of the state’s lack of authority over pipeline siting and routing for projects not subject to FERC jurisdiction (i.e. intrastate gathering pipelines). This gap has been the subject of increased public and policymaker scrutiny, and deserves further exploration.19

Distribution Grid Resilience & Moderation

The term “resilience” generally recognizes that even the most reliably designed and operated system is exposed to outage risk, and there is great value in quickly recovering from such adverse events. “Grid modernization” generally refers to utility investments to update aging grid equipment, incorporate modern technologies that can help facilitate DER integration, harden the system to better withstand extreme weather events, and improve system security. Pennsylvania should explore ways to improve the resilience of its energy systems to both natural and human threats through strategically focused investments to strengthen and modernize the distribution grid.

Pennsylvania regulators should be empowered to identify vulnerabilities20 (e.g. physical, cyber, interdependency) in the low-voltage system in an effort to prioritize and approve utility improvement investments.21 Pennsylvania should explore enhanced utility planning and consumer communication efforts— especially for high-impact, low-frequency events (i.e. black swan events)—as well as approaches to identifying and addressing governance gaps.22 Integrating improved system resilience and grid modernization initiatives into comprehensive long-term infrastructure planning can help utilities, regulators, consumer advocates, and ratepayers better understand the importance and value of relevant utility investments.

Communities & Consumers

As the energy sector evolves, greater attention must be paid to the communities left behind and the ratepayers who are footing the bill to finance the future.

Energy Communities in Transition

Pennsylvania communities dependent on the coal industry have slowly experienced decades of economic decline, eclipsed recently by a more rapid downturn precipitated by the rise of shale-based natural gas. Domestic demand for thermal coal is expected to continue to decrease for the foreseeable future, causing continued strife for these populations.23 Pennsylvania should develop a strategy to assist individuals and communities impacted by the downturn in coal demand. Such a strategy could consider at least two paths. The first should focus on immediate to medium-term transitional needs of individuals most significantly impacted by coal’s downturn. The second would be a community-based approach focused on long-term economic diversification and recovery of communities formerly dependent on coal.24

Pennsylvania currently has five operating nuclear power plants with more high-level radioactive waste stored on-site at these plants than any other state in the nation (except Illinois). When a nuclear power plant retires, the plant equipment and soil can be decommissioned and decontaminated in as little as a few years, but the waste will remain on-site indefinitely. Although the remediated property may be attractive given transmission and other utility connections are in place, the waste will serve as a significant disincentive to redevelopment. Inability to re-enter the land into productive use will prevent the economic recovery of the surrounding community, contributing to prolonged financial depression (e.g. plummeting property values, eroding tax base, increased unemployment).

Pennsylvania should establish a statewide nuclear decommissioning advisory committee to help advise government officials and the public on decommissioning activities and economic redevelopment strategies. The statewide advisory committee could hold public meetings, provide education, and develop an action plan of recommendations to deal with issues identified by communities and the interested public. Although the federal government maintains primacy on issues related to high-level nuclear waste, the advisory committee could inform and develop federal outreach and advocacy priorities for Pennsylvania. Even if Pennsylvania avoids near-term, premature retirement of nuclear power plants, development of this advisory committee would be valuable to prepare for plant closures over the long-term.

Consumer Protection & Transparency

Securing, modernizing, and advancing Pennsylvania’s energy systems is in the best interest of all Pennsylvanians, businesses, and individuals alike. Utilities will have the opportunity to grow their rate base and may have greater revenue certainty, while consumers and businesses will enjoy improved services and system performance. These benefits will not be cheap, rather, they will represent significant costs that must constantly be monitored to ensure net benefits to applicable consumer classes, and affordability to low- income customers.

Pennsylvania should increase public transparency in the ratemaking process to ensure investments to secure, modernize, and advance the system provide net benefits to consumers. Strategies to explore include, but are not limited to, comprehensive integration of utility system investments into long-term infrastructure planning, disclosure of return on equity/rate or return on all rate case settlements (i.e. ending black box settlements), minimizing the use or avoiding proliferation of automatic adjustment clauses unrelated to weather or commodity fluctuations, enhancing staff resources for consumer and low-income advocates, and continually evaluating the adequacy of universal service program funding.

Conclusion

States like California are pursuing 100% carbon free energy policies that honor international commitments and will drive low-carbon innovations in America. While states like Texas are leading the nation in oil and gas development, providing energy resources both at home and abroad. But, Pennsylvania energy policies and politics do not resemble those of California or Texas; the commonwealth is unique. Energy policy progress in Pennsylvania will look and feel different compared to these states. However, this should not dissuade the pursuit of improvement. Rather, advancement in Pennsylvania requires mutual compromises that focus on long-term growth (advanced energy future), core competencies (security and resilience), and responsible protections (communities and consumers).

Christina Simeone

Kleinman Center Senior FellowChristina Simeone is a senior fellow at the Kleinman Center for Energy Policy and a doctoral student in advanced energy systems at the Colorado School of Mines and the National Renewable Energy Laboratory, a joint program.

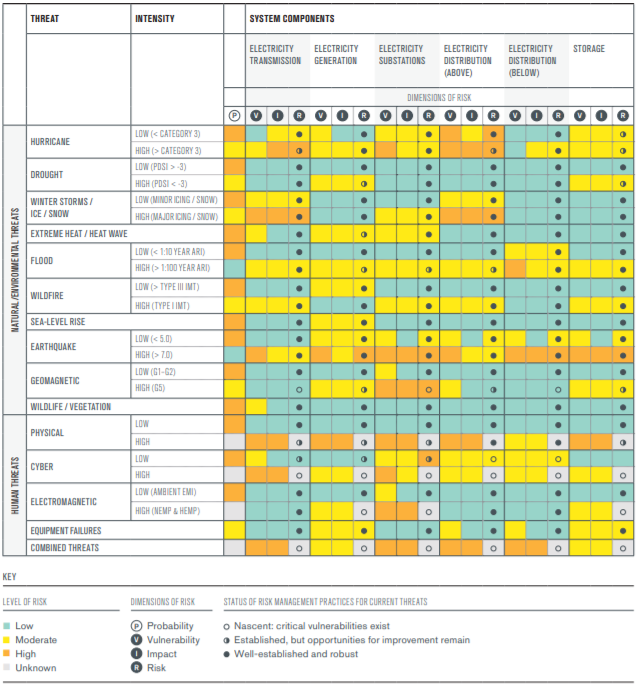

Table cells represent a qualitative assessment of risk by electric system component and threat. Some threats are divided into low or high intensity threats. Estimates of individual sub-components of risk are presented for each system component and threat: probability refers to the frequency or likelihood of a threat occurring vulnerability refers to the sensitivity of a system component to harm or damage; impact refers to the potential severity of damage in terms of financial costs, affected customers, and/or health and safety. (Preston, et al. 2016)

Bloomberg New Energy Finance. 2018. “Electric Vehicle Outlook 2018.” BNEF, 2018, https://about.bnef.com/electric-vehicle-outlook/#toc-download.

Defense Science Board. “Task Force on Cyber Defense.” U.S. Department of Defense, 2017. https://www.acq.osd.mil/dsb/reports/2010s/DSB- CyberDeterrenceReport_02-28-17_Final.pdf.

Meister Consultants Group. “DRAFT Pennsylvania Electric Vehicle Roadmap.” PA DEP, 2018. Parfomak, Paul. “Pipeline Security: Recent Attacks.” Federation of American Scientists. March 21, 2017. Accessed September 28, 2018. https://fas.org/sgp/crs/homesec/ IN10603.pdf.

Penn State University Facilities Engineering Institute. “Energy and Utility Usage Report: Fiscal Year 2016-2017.” Pennsylvania Department of General Services, 2017.

Pennsylvania Department of Environmental Protection.“2017 Pennsylvania Greenhouse Gas Inventory.” PA DEP, 2017. http://files.dep.state.pa.us/Air/AirQuality/AQPortalFiles/ Advisory%20Committees/CCAC/2018/4-24-18/PA%202017%20GHG%20Inventory.pdf.

Pennsylvania Public Utility Commission.“Electric Service Reliability in Pennsylvania: 2017.” David M. Washko, PA PUC, 2018. http://www.puc.state.pa.us/General/publications_ reports/pdf/Electric_Service_Reliability2017.pdf.

Phelan, Daniel. “A Summary of State Regulators’ Responsibilities Regarding Cybersecurity Issues.” National Regulatory Research Institute, 2014. http://nrri.org/download/nrri-14-12- cybersecurity-issues/.

Preston, Benjamin L., Scott N. Backhaus, Mary Ewers, and Julia A. Phillips.“Resilience of the U.S. Electricity System: A Multi-Hazard Perspective.” U.S. Department of Energy,

2016. https://www.energy.gov/sites/prod/files/2017/01/f34/Resilience%20of%20th… U.S.%20Electricity%20System%20A%20Multi-Hazard%20Perspective.pdf.

Sobczak, Blake.“FERC Commissioner Sounds ‘Call for Action’ on Pipelines.” E&E News. May 29, 2018. Accessed September 28, 2018. https://www.eenews.net/ energywire/2018/05/29/stories/1060082831.

U.S. Energy Information Administration. “Coal Data Browser: Aggregate coal mine production: all coal.” EIA.gov, 2016. Accessed October 2018. https://www.eia.gov/coal/ data/browser/#/topic/33?agg=0,2,1&rank=g&geo=g001qag9vvlpg&mntp=g&freq= A&start=2001&end=2016&ctype=map<ype=pin&rtype=s&pin=&rse=0&maptype=0.

—. 2018. “Pennsylvania State Profile and Energy Estimates.” EIA.gov. July 18, 2018. Accessed October 4, 2018. https://www.eia.gov/state/?sid=PA#tabs-1.

—. 2018. “U.S. Battery Storage Market Trends.” EIA.gov, 2018. https://www.eia.gov/ analysis/studies/electricity/batterystorage/pdf/battery _storage.pdf.

- According to the U.S. EIA, in 2016, Pennsylvania produced 7,888 trillion Btu, second only to Texas. This figure includes coal, natural gas, crude oil, nuclear power, biofuels, and other (wood, geothermal, hydro, solar, wind, and biomass waste to energy). https://www.eia.gov/state/rankings/?sid=PA#/series/101 [↩]

- It is important to note that while Pennsylvania’s national ranking on coal production increased in 2016, production decreased by 30% compared to levels a decade prior (2007 to 2016), and U.S. coal production dropped by over 36% in the same time period (U.S. Energy Information Administration 2016). [↩]

- Adopted in December 2015, the Paris Agreement within the United Nations Framework Convention on Climate Change (UNFCCC) commits signatories to keep global average temperatures well below 2°C (ideally below 1.5°C) above pre-industrial levels. In August 2017, the Trump administration notified the UNFCCC of its intent to withdrawal from the agreement. [↩]

- On June 29, 2018, the U.S. Federal Energy Regulatory Commission (FERC) declared PJM’s Tariff to be unjust and unreasonable and unduly discriminatory as, “It fails to protect the integrity of competition in the wholesale capacity market against unreasonable price distortion and cost shifts caused by out-of-market support to keep existing uneconomic resources in operation, or to support the uneconomic entry of new resources, regardless of the generation type or quantity…” FERC ordered PJM to submit a compliance filing, proposing that PJM mitigate (i.e. impose a minimum offer price rule, or MOPR) the effects of subsidies like the AEPS for renewables and zero emissions credits for existing nuclear generation units, and develop a fixed resource requirement alternative (FRRA). The FRRA could apply to state-subsidized units that fail to clear the PJM capacity market once the MOPR is applied, therefore requiring additional state-based compensation for capacity value (which would require new state statutory authority) in order to prevent the resource from retiring. A copy of FERC’s order in Docket EL18-178-000 is available at https://www.ferc.gov/CalendarFiles/20180629212349-EL16-49-000.pdf [↩]

- See PJM Interconnection’s carbon pricing white paper, “Advancing zero emissions objectives through PJM’s energy markets: A review of carbon-pricing frameworks”, April 23, 2017, located at https://www.pjm.com/~/media/ library/reports-notices/special-reports/20170502-advancing-zero-emission-objectives-through-pjms-energy-markets.ashx [↩]

- A hedge is almost like an insurance policy that serves to reduce the negative impact of a potential event. Like any insurance policy, there is a cost to every hedge. Investors often hedge one investment by making another investment (i.e. a cost) in a security that is negatively correlated (i.e. a loss in security X is offset by a gain in security Y). In this scenario, the carbon price supports zero-carbon resources that are a hedge against future gas price increases and also against an increase in power-sector GHG emission that would occur as zero-carbon resources are replaced by gas-fired resources. [↩]

- PJM’s generator deactivation list on October 17, 2018 identified 7,484 megawatts of coal capacity planning to retire between the end of 2018 and June, 2022, with approximately 2,660 MW located in Pennsylvania. [↩]

- See for example signatories to the One Future Coalition (https://onefuture.us/) of natural gas companies that have voluntarily committed to reduce methane emissions; and members of the Oil and Gas Climate Initiative to reduce greenhouse gas emissions (https://oilandgasclimateinitiative.com/) [↩]

- In 2018, the transportation sector became the largest source of U.S. greenhouse gas emissions. As of 2014, transportation was the third largest source—behind the electric power and industrial sectors—of GHG emissions in Pennsylvania (Pennsylvania Department of Environmental Protection 2017). [↩]

- See the PA PUC’s press release, “PUC advances proposed policy on third-party electric vehicle charging; seeks clarity, consistency among electric utilities,” March 15, 2018, Docket No. M-2017-2604382, http://www.puc. state.pa.us/about_puc/press_releases.aspx?ShowPR=3995 [↩]

- The Roadmap report references 275 public EV charging stations per million residents as a benchmark for leading EV markets, noting Pennsylvania is far below this benchmark at only 43 public plugs per million residents. (Meister Consultants Group 2018) [↩]

- Hosting capacity analysis, or similar methods, identify the limitations of distribution circuit feeders to accommodate (i.e. host) DERs without adversely impacting power quality or reliability, given existing controls and infrastructure. Such analysis can provide important details about DER interconnection value (e.g. no feeder issues) or cost (e.g. probable feeder issues) to the system. An example includes the solar PV hosting capacity map from Central Hudson Gas and Electric (of New York), located at https://gis.cenhud.com/gisportal/apps/webappviewer/index.html?id=01feb87… additional examples can be found at the Joint Utilities of New York webpage at https://jointutilitiesofny.org/utility-specific-pages/hosting-capacity/ [↩]

- Pennsylvania could also explore changes to its virtual net metering laws, to enable community solar development. [↩]

- Pennsylvania has at least 13 rural electric cooperatives (see the Pennsylvania Rural Electric Association members at www.prea.com) and at least 35 municipal electric utility members (see the Pennsylvania Municipal Electric Association at www.pmea.us) [↩]

- See Public Utility Security Planning and Readiness provisions in PA Code Title 52, Subpart E, Chapters 101 and 102, located at https://www.pacode.com/secure/data/052/subpartIEtoc.html [↩]

- See PA Public Utility Commission’s “Cybersecurity Best Practices for Small and Medium Pennsylvania Utilities,” located at http://www.puc.pa.gov/general/pdf/cybersecurity/Cybersecurity _Best_Practices_Booklet.pdf [↩]

- See PA Public Utility Commission’s press release, “PUC creates new office of cybersecurity compliance and oversight, appoints Michael C. Holko as Director,” September 20, 2018, located at http://www.puc.pa.gov/ about_puc/press_releases.aspx?ShowPR=4092 [↩]

- Some of Connecticut’s actions to improve cyber protections included: 1) Performing an assessment of utility (i.e. energy, water) cyber deterrence capabilities and recommending improvements. (In Pennsylvania, this assessment should extend to traditionally non-jurisdiction utilities.), 2) Developing cybersecurity compliance standards and oversight procedures through a series of collaborative stakeholder and technical meetings and task force deliberations, 3) Publishing a statewide cybersecurity strategy and action plan, 4) Issuing a statewide critical infrastructure annual review, 5) Providing exemptions from the public record for sensitive utility data. [↩]

- For example, the PA House Majority Policy Committee held a hearing on July 17, 2018 related to Safe Pipeline Development, in response to concerns over Sunoco’s Mariner pipelines. The siting authority gap in state law was explored by PA DEP Secretary Patrick McDonnell, (“As has been noted repeatedly, there is currently a gap in state law regarding siting and routing authority for projects that are not subject to FERC jurisdiction. Many other states have passed legislation to provide an enhanced role in siting decisions to their utility or public service commission.”) http://www.pagoppolicy.com/Display/SiteFiles/112/2018Hearings/Media/Patr… McDonnel,%20Department%20of%20Environmental%20Protection.pdf and PA PUC Vice Chairman Andrew Place http://www.pagoppolicy.com/Display/SiteFiles/112/2018Hearings/Media/Andr… Public%20Utility%20Commission.pdf [↩]

- One method to identify such vulnerabilities is through advanced interdiction analysis. Interdiction analysis identifies a subset of grid components that if disabled would maximize disruption to power customers. [↩]

- Analysis should recognize the relative risks (degree, probability, vulnerability, impact) and status of risk management practices for system components against a variety of threats. Threats to the bulk power systems (i.e. generation and high-voltage transmission assets) have the potential to negatively impact the greatest number of people, yet these assets enjoy greater protection through robust design and regulatory oversight. Disruption to distribution networks generally result in localized impacts, but may serve as a weak link in the overall system with the potential for impacts to the bulk power system. Appendix provides a graphic summarizing a risk and reliability analysis of the U.S. power system highlighting the relative risks to various system components, where significant opportunities for improvement exist at the distribution level. [↩]

- In this context, governance gaps, “…are defined as areas of shared risk where there is no clear identification or responsibility assigned to one or more entity.” (Preston, et al. 2016) [↩]

- Demand for Pennsylvania’s metallurgic coal (e.g. anthracite) shows greater promise. [↩]

- More specific recommendations can be found in the report, “Reimagining Pennsylvania’s Coal Communities” available at the Kleinman Center’s website at https://kleinmanenergy.upenn.edu/paper/reimaginingpennsylvanias-coal-com… [↩]