Climate Tech for Real Estate: The Elephant in the Room

Why the real estate community must consider investing more capital into the climate tech ecosystem—and how some companies are paving the way.

At a Glance

Key Challenge

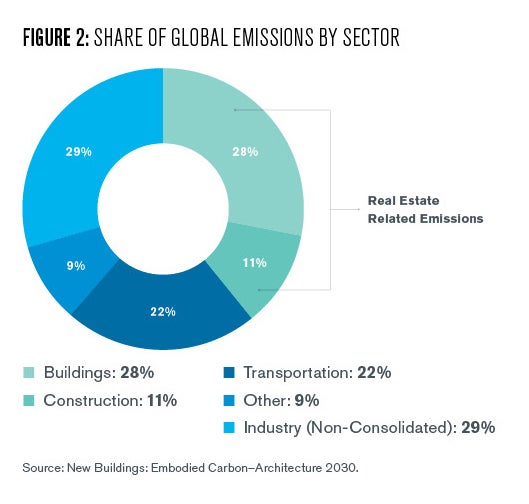

Real estate is the largest contributor to climate change at 40% of global emissions.

Policy Insight

Real estate owners should invest more into climate tech R&D and policy should better incentivize this by reinvesting carbon taxes into climate tech R&D, a long-term positive to real estate owners.

Introduction

It is not an exaggeration to suggest that eliminating real estate’s 40% share (EIA Outlook 2017) of global emissions will spawn the most significant technological shift in the history of modern buildings. And yet, this fact is gravely underappreciated by both traditional real estate investors as well as prop-tech investors, the two pools of financial capital that not only have the greatest power to directly catalyze the inevitable transition to net zero buildings, but also to most directly profit from its realization.

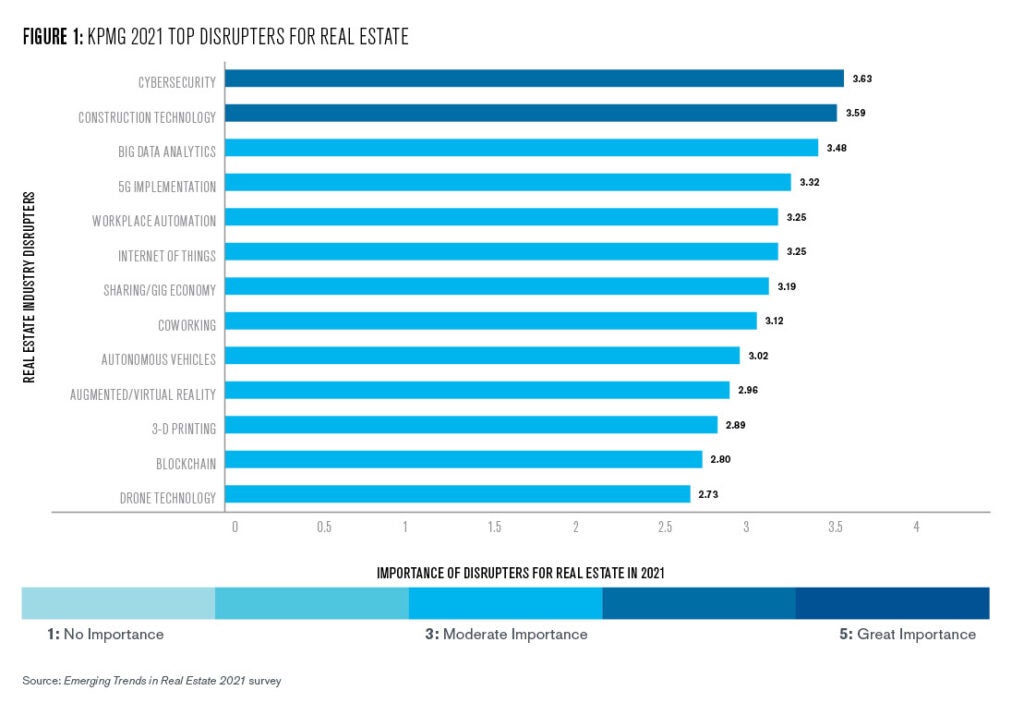

And it is not just the investment community that is under-indexing climate tech for buildings in their portfolio of investments or priorities. PWC recently listed the top 13 disrupters to the real estate industry in its annual 2021 Disrupters for Real Estate report. Climate tech for real estate was nowhere on the list (PWC 2021), a tremendous oversight if we consider how rapidly the building decarbonization policy landscape is evolving, how costly it will be to building owners, and how much new venture funding is being raised to hasten the decarbonization transition.

In Q4 2020, the European Union passed its “Renovation Wave” regulations—requiring a 60% reduction of carbon emissions in buildings over the next decade, along with an 18% reduction in heating and cooling demand. Building owners that do not comply will pay substantial fines.

Bloomberg New Energy Finance estimates that in Europe alone, this will cost more than $3 trillion (Coker & Champion 2021). The European Renovation Wave, which followed policy precedents from Los Angeles’s 2019 Green New Deal and New York’s Local Law 97, pulled the real estate community into the the epicenter of the climate change conversation.

This digest analyzes why the real estate community should consider investing more capital into the Climate Tech for Real Estate ecosystem, and where current policy may be falling short in promoting this capital influx. Furthermore, we will map out the eight largest categories emerging in the Climate Tech for Real Estate subsector, and develop a framework for assessing how participants across the real estate ecosystem could profit from this once in a generation wealth creation opportunity.

Real Estate Owners Should Be Climate Tech Investors

Existing “low hanging fruit” climate technologies and energy services such as LED lighting, on-site solar and storage, and HVAC upgrades can help landlords reduce part of their emissions and offer positive return on investment. In fact, in 2019 the best performing public REIT, Hannon Armstrong (HASI), was not a traditional real estate owner/operator, but a lender on such energy efficiency projects. The explosive growth outlook in the energy retrofit market for real estate caused its stock price to appreciate 2.5x since 2019, outpacing any traditional public real estate company since that time. Such preferential capital allocation toward greener real estate is only beginning.

Fully meeting the regulated decarbonization targets however, in addition to getting to net zero—are not yet economic— and require greater reductions in technology costs. The opportunity for continued cost reductions, combined with the scale of the problem and the political urgency to solve it – make this an enormously compelling investment opportunity. Counterintuitively, real estate owner/operators, are the most highly incentivized source of capital in the financial system to participate in such investments—not only traditional energy efficiency retrofits—but also high risk, high reward technology R&D.

The notion of real estate owners investing capital into technology R&D sounds strange, but in truth, it is the highest and best use of a landlords capital expenditures when a longer term time investment horizon is taken. Let’s examine a practical example. If for instance a solid-state battery storage venture announces that it has successfully doubled the storage capacity of residential or commercial batteries, and real estate investors had invested in such a venture, the landlord wins in three ways: 1) from its venture investment, which is now significantly higher in value 2) from its ability to drive energy cost reductions within its portfolio via deployment of the improved battery technology and 3) from the avoidance of taxes on carbon emissions that governments are increasingly imposing.

No other capital provider in the world outside of real estate owners has this many synergistic value creation opportunities for such a clean energy technology. Other examples of R&D investment opportunities which drive immense value to real estate owners include electric and geothermal heat pumps, next-generation distributed solar and storage, and next generation insulation and building materials.

Just as there is opportunity to invest in asset heavy, deep technology R&D, there is opportunity to invest in asset light, software solutions to help facilitate net zero buildings. Such investment opportunities span across categories including demand response, energy analytics, renewable energy trading, and carbon measurement. Real estate venture investors are in a unique position to accelerate new software adoption given their expertise and strategic LP relationships with building owners.

Many climate tech investors are betting on a future world where large office buildings with on site power and storage can sell excess power back to the grid or to nearby buildings—turning what was previously an operating expense into a revenue source.

Such a fundamental change to the nature of the office asset for example, is a unique instance of technology disruption actually improving the economics of a legacy real estate asset. As revenue within office buildings become increasingly pressured by work from home trends, landlords should find new ways to drive growth in their buildings, with reducing operating expenses being the most compelling option.

There is a strong argument to be made that a better policy framework is needed to align real estate owners and municipalities in the joint mission to decarbonize buildings. One such policy solution is to mandate climate tech R&D in proportion to an owners emissions, rather than a flat tax which will go into the pocket of the local government and spent on unrelated issues which do not accelerate the transition to carbon zero buildings.

I’ve argued for that here in this post. The more landlords unify in their approach to prioritize capex into climate tech R&D, over say cosmetic upgrades, the larger the pie for the entire real estate community. Solving this collective action problem is challenging but doable, so long as policy is improved.

Famed technology investor Chamath Palipatiya recently went on record tweeting “The world’s first trillionaire will be made in climate change.” Building owners and venture investors would be wise to be part of the capital stack of that future trillionaire.

How We Got Here

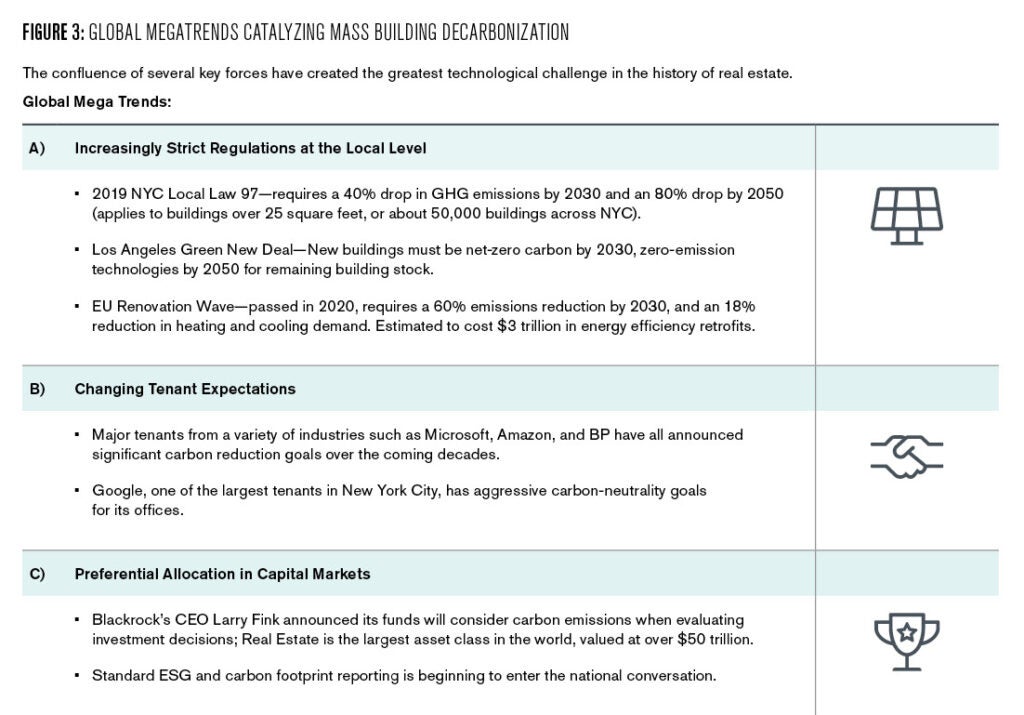

Before jumping into the quickly evolving landscape of climate technology for real estate, it’s important to briefly reflect on how we got to this point—in order to appreciate how early this opportunity is. If 2019 has been heralded as “the year that the world woke up to climate change,” it is perhaps even more so, the year that real estate, the worlds largest asset class, became thrown into the mix. Several forces including 1) new regulation 2) changing tenant preferences and 3) preferential allocation in capital markets towards “greener” real estate all combined in 2019 to create what one real estate technology investor, Fifth Wall, described as a “watershed moment for the industry.”

Amidst this sea change, Fifth Wall was one of the first to articulate why the convergence of these forces is the most significant event to ever affect the commercial real estate industry. In response they announced the first ever climate venture fund for real estate, and dubbed the mission to decarbonize real estate as the “moonshot of our time.” The below graphic summarizes the three unique mega-trends that combined in 2019 to catalyze the beginning of such an unprecedented moment for real estate.

The Investable Universe

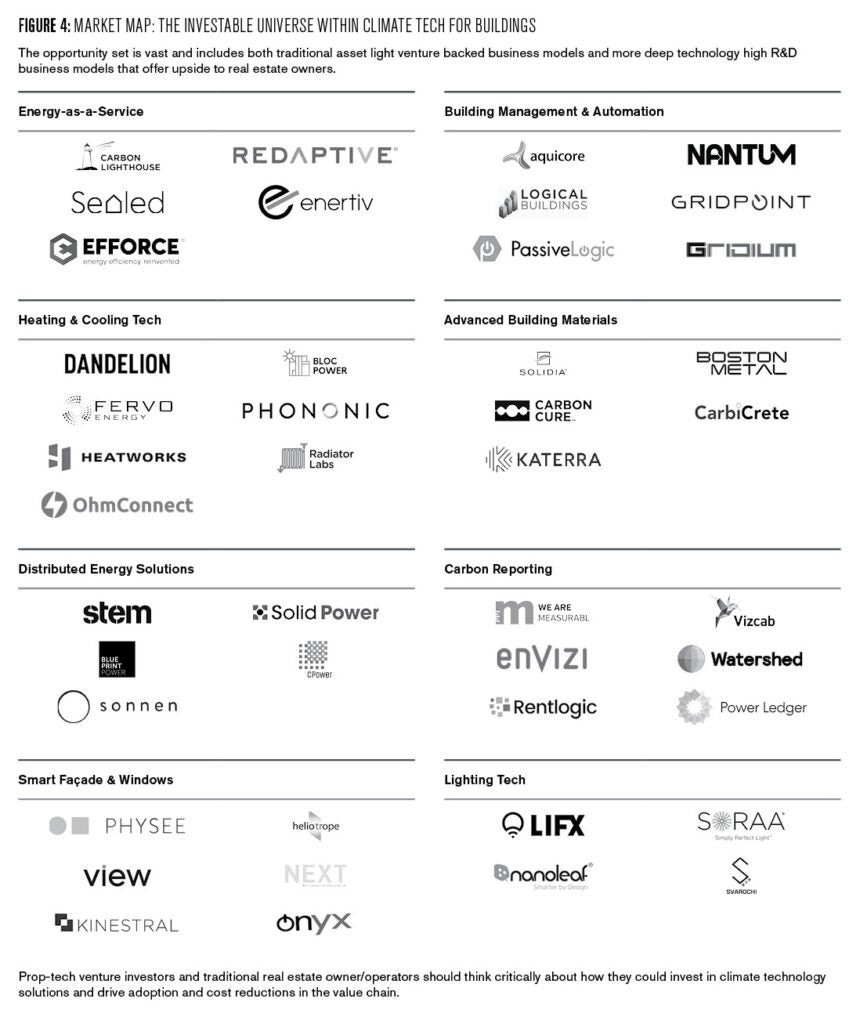

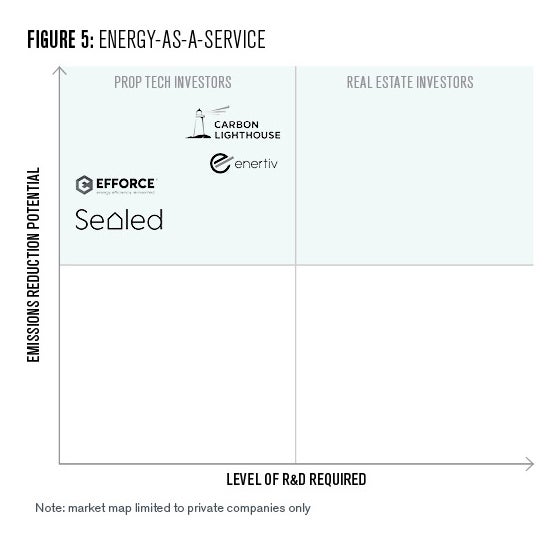

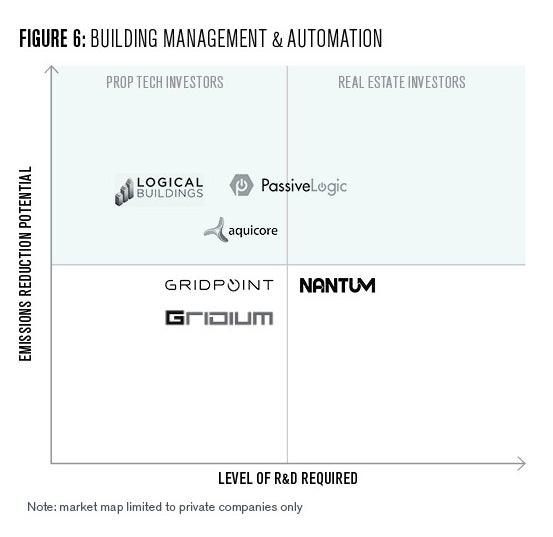

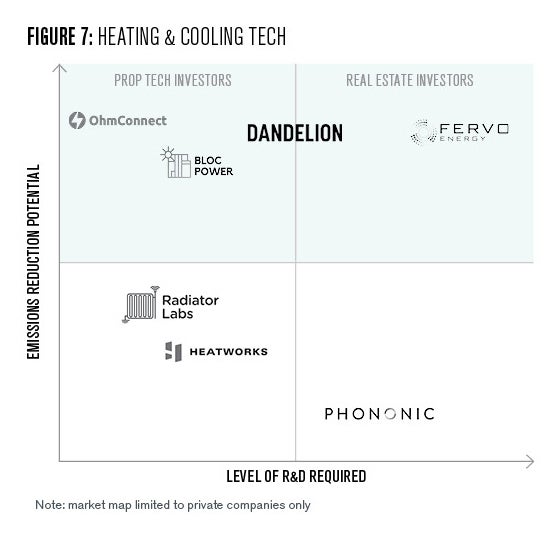

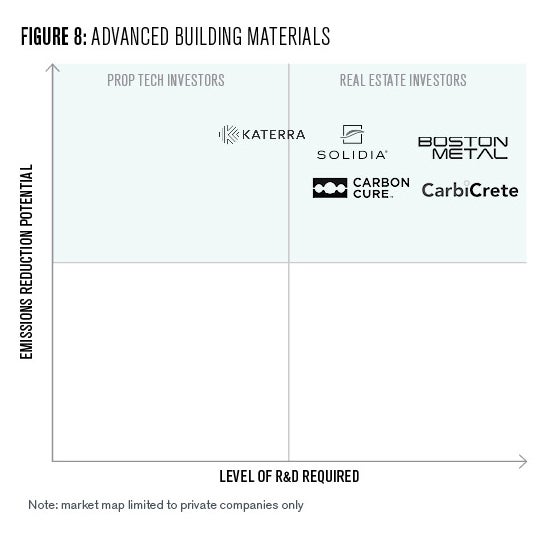

The investment opportunities within the intersection of real estate and climate tech are vast. Furthermore, the technologies and underlying companies paving the way in each of these subsectors range drastically along the spectrum of R&D and technology risk. Accordingly, this paper has bifurcated the universe of real estate and climate technology into eight distinct categories, and then overlaid each segment with a two-dimensional matrix plotting the most promising companies in each sector based on its level of deep technology exposure (i.e. asset heavy vs. asset light) by its overall potential to reduce emissions (a direct proxy for the size of the market opportunity).

We believe that real estate investors should commit more capital into upstream, high R&D companies with the highest emissions reduction potential while prop tech VCs should focus on the more traditional venture backed businesses, the asset light, low R&D software enabled models that offer the most potential to reduce emissions.

Energy-as-a-Service

Generally speaking, the Energy-as-a-Service (EAAS) market consists of companies that are reducing a building’s energy footprint through some combination of automation, internet of things, sensors, and software management tools. It is estimated to be a $58 billion market and is currently serving on the front lines of the building decarbonization mission, with sources estimating a 15% compounded annual growth rate over the next decade (Grand View Research 2020) .

While this segment has traditionally been dominated by large energy service companies (ESCO’s) such as Siemens or Ameresco, Silicon Valley is making a push to bring the industry into the next generation. Carbon Lighthouse is one such example. They’ve raised $70 million in venture funding from notable investors Cox Enterprises and Tesla co-founder JB Straubel. They also have a $65 million project finance balance sheet from Generate Capital, which they use to make upfront investments in energy efficiency projects so that their customers (building owners) can have zero upfront investment. Carbon Lighthouse is developing cutting edge technology to improve their ability to underwrite and implement energy efficiency projects, their business model predicated on taking a percentage of the utility savings (St. John 2019).

Building Management and Automation

Within the overarching energy services category we find companies specializing in energy efficiency and distributed energy and storage, as well as a host of other products which we have grouped into the subtopic “Building Management & Automation.” In our market map, this category includes: demand response; property and equipment management, energy auditing, forecasting, billing, and overall systems automation.

Of course, separating out the pure energy efficiency retrofit companies from the startups focusing on more general building management is more art than science, and there is overlap. Enertiv, Acquicore, and Logical Buildings are some of the leaders in this space. PassiveLogic is newer to the scene and just raised $16 million in their series A from RET Ventures—they are generating attention for their differentiated “physics based approach,” which relies on replicating the physical building in the virtual world in order to simulate more precise building management systems.

Heating and Cooling Tech

Fossil fuel based space and water heating in buildings constitutes 10% of global emissions, and nearly one third of all real estate emissions (excluding construction). As a result, this investment category is drawing significant attention (Billmoria 2018). Air-sourced heat pumps and ground-sourced geothermal heat pumps are two technologies that are expected to lead the charge in helping buildings electrify, and eliminate their fossil fuel usage (assuming concurrent growth in clean energy penetration to the electric grid). Heat pump technology is well positioned for rapid growth and adoption.

Currently, just 10% of existing residential homes in the Unites States use heat pumps for space and water heating, whereas 43% of new construction installed heat pumps in 2017. There is opportunity to invest in new business models that are helping buildings convert their existing equipment to heat pumps, and there is also opportunity to invest upstream in the company’s manufacturing heat pumps in order to expedite cost reductions (Electric Power Research Institute 2018).

Two technology startups in this space are Bloc Power, backed by Andreesen Horowitz, which offers no money down heat pumps to multifamily buildings in the U.S., and Dandelion, an X (formerly Google X) spinout innovating within geothermal that is backed by the largest single-family homebuilder Lennar, as well as Google Ventures.

Expect geothermal heat pumps to be a prime beneficent of further cost reductions and innovations in tunneling coming from Elon Musk’s Boring Company. Fervo Energy is a Breakthrough Energy Ventures backed company, that is advancing the drilling technologies and other key components of the geothermal heat pump technology, and would be a good opportunity for real estate investors to invest long term capital.

Advance Building Materials

Concrete and steel, the two most widely used building materials, together account for roughly 8% of global emissions. There are a handful of technology startups using lower carbon input and higher carbon utilization processes in order to reduce emissions in the production of these materials. Bringing the costs down for these technologies is necessary to achieve net zero buildings for new construction. A few names leading the pack in this space include Boston Metal, CarbiCrete, Carbon Cure, and Solidia. Katerra is building a factory to assemble pre-fab mass timber buildings, a far more sustainable building frame than concrete and steel.

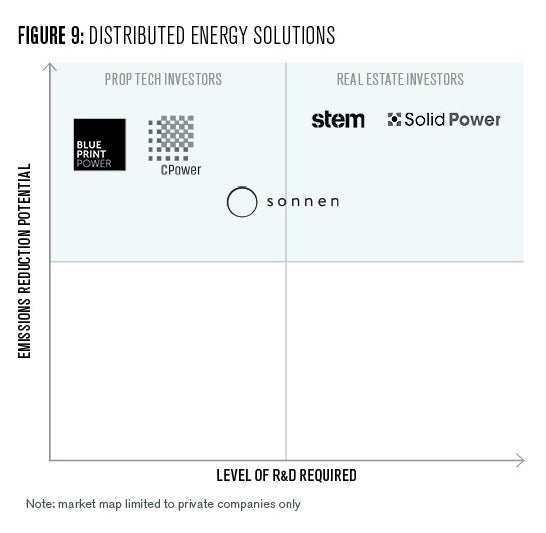

Distributed Energy Solutions

Distributed energy essentially refers to electrical generation or storage at the local building level, such as solar panels or lithium ion batteries. While this hardware has come down dramatically in costs over the last decade, there is still ample white space to invest upstream in the next generation of battery and solar technology such as Solid Power—a startup working on solid-state batteries (an order of magnitude improvement from lithium ion), and Stem—one of the original and largest private companies in the energy storage market.

There is also a plethora of venture backable software solutions that are being designed to help usher in an era where buildings are generating, storing, and often selling their own energy such as Blueprint Power and Power Ledger.

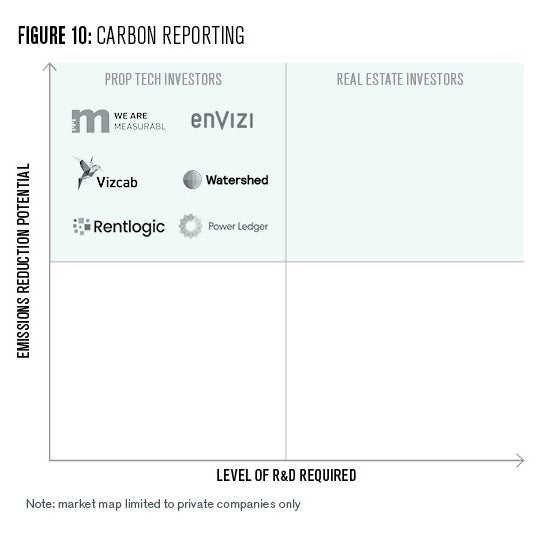

Carbon Reporting

Fast forward ten years and it is hard to imagine a world where public real estate companies are not required to file their audited carbon emission scoring, much like the way they are required to file accounting financials with the SEC. The go-to carbon auditor and reporting company is going to reap immense rewards (however it’s worth pointing out that such auditors should work for citizens and not private businesses, where there may be incentivized to to be generous in their emissions audits).

In September 2020, a leading sustainable infrastructure REIT Hannon Armstrong became the first REIT to join the partnership for Carbon Accounting Financials (PCAF). PCAF is a consultancy helping to create a coalition of companies to agree on consistent carbon accounting frameworks. There is ample white space for technology companies to create platforms to aggregate and synthesize the data that will determine a real estate company’s carbon score.

One such company that has jumped to an early lead is San Diego based Measurabl, who recently completed their series B with notable investors Salesforce and Camber Creek. Measurabl is a Software as a service platform that allows building owners and tenants to collect emissions data, set targets, and generate emissions reports.

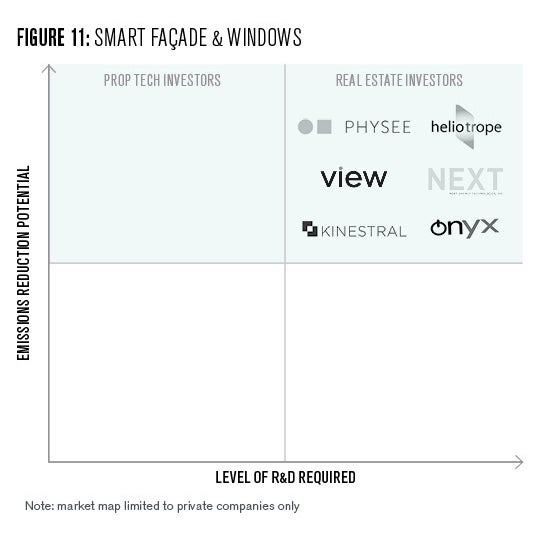

Smart Façade and Windows

Some of the more frontier hardware and building material technologies for maximizing energy efficiency include the use of photovoltaic glass façade (Onyx, Physee), smart windows that feature automated tinting and blinds controls, and windows with the ability to communicate with indoor building lighting in order to reduce lighting demand during peak sunlight hours (View, Heliotrope, Kinestral). Danish companies are also experimenting with prefabricated insulation improvements for existing buildings.

Many of these technologies are still in their early development but offer significant upside to real estate owners if the cost to manufacture improves.

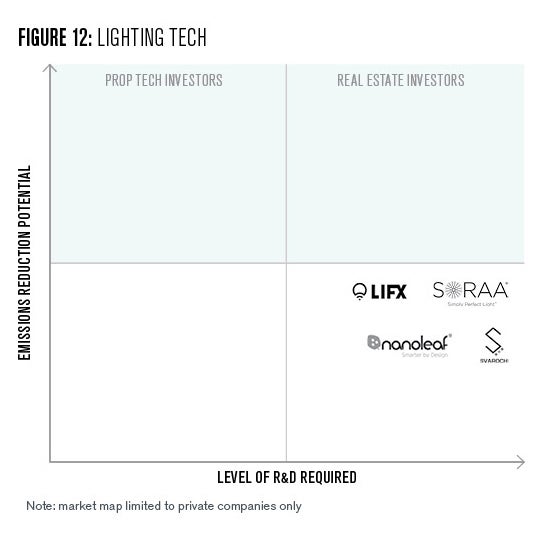

Lighting Tech

According to the most recent Commercial Buildings Energy Consumption Survey (CBECS), 17% of all building electricity in the U.S. is consumed by light bulbs. The good news is that since lighting is almost entirely electricity based for both commercial and residential buildings, it will inherently become more carbon free as clean energy penetration on the electric grid increases.

But, as the single most consumptive user of electricity in buildings, it’s worth highlighting a few of the names developing lower energy intensive, next generation lightbulbs such as Lifx, SORAA, Nanoleaf, and Svarochi. Given the nature of lighting as already being electrified, we would consider these to be relatively lower emission reduction potential technologies, though still extremely relevant in the context of climate tech for real estate.

Closing Thoughts

2019 in many ways marked the first inning in the real estate community’s push toward decarbonization. Despite being responsible for 40% of global emissions, the industry was under the radar and not taking demonstrable steps to lower its collective footprint. Governor Gavin Newsom called emissions from homes and buildings “a blindspot in California’s climate policy.” Not only that, but the issue has been getting worse. Building emissions spiked 10% nationally in 2018, the largest national emissions increase in decades (Building Decarb Coalition 2020).

In this paper we have laid out the distinct sub-categories that are the most directly at the intersection of real estate tech and climate tech. We have tried to articulate why capital from both real estate venture investors as well as real estate owner/operators are highly incentivized financially to invest in the coming decade.

The decarbonization challenge for buildings is immense, but not impossible so long as the capital is spent in the right quantities and by the right parties. Furthermore, because such an outsized share of emissions stems from the real estate community, small improvements can make a large difference. It is clear that as consumers and businesses become more aware of the fact that their largest personal carbon footprints come from their real estate needs, the market will demand more efficient solutions.

At that point, it will be too late for real estate owners to compete, as the most coveted, credit-worth tenants will no longer seek space in their buildings. The economic case for massive economic spending from real estate owners in both energy efficiency projects and R&D is highly apparent, and the sooner the action, the more all participants in the real estate community will profit.

Stephen Rothstein

MBA/MSE Student, Wharton School and Penn EngineeringStephen Rothstein is a dual-degree MBA / MSE candidate at The Wharton School and Penn Engineering. He has extensive experience in both the real estate and sustainable infrastructure and technology investment industries.

Billimoria, Guccione, Henchen, Louis-Prescott. 2018. “The Economics of Electrifying Buildings.” Rocky Mountain Institute.

Building Decarbonization Coalition. 2020. “A Roadmap to Decarboniza California Buildings.” https://www.buildingdecarb.org/archived/a-roadmap-to-decarbonize-californias-buildings

Coker, Emma and Emma Champion. 2020. “EU to Slash Building Emissions with Renovation Wave.” Bloomberg New Energy Finance.

EIA. 2017. International Energy Outlook. “New Buildings: Embodied Carbon.” https://architecture2030.org/new-buildings-embodied/

Electric Power Research Institute. 2018. “U.S. National Electrification Assessment.” http://mydocs.epri.com/docs/PublicMeetingMaterials/ee/000000003002013582.pdf

Energy as a Service Market Size, Share & Trends Analysis Report by Service (Supply, Demand, Energy Optimization). 2020 – 2027 / By End Use (Commercial, Industrial), By Region, And Segment Forecasts, https://www.grandviewresearch.com/industry-analysis/energy-as-a-service-market.

PWC. 2020. “Emerging Trends in Real Estate 2021.” https://www.pwc.com/us/en/asset-management/real-estate/assets/pwc-emerging-trends-in-real-estate-2021.pdf

St. John, Jeff. 2019. “Carbon Lighthouse $32.6M to Expand Sensor and Software-Driven Building Efficiency.” https://www.greentechmedia.com/articles/read/carbon-lighthouse-raises-20m-to-expand-sensor-and-software-driven-building

Woeste, Tyson. 2019. “Why Decarbonization is Not Optional for Real Estate Leaders.” https://medium.com/fifth-wall-insights/sustainability-real-estate-explained-b89cab66929d